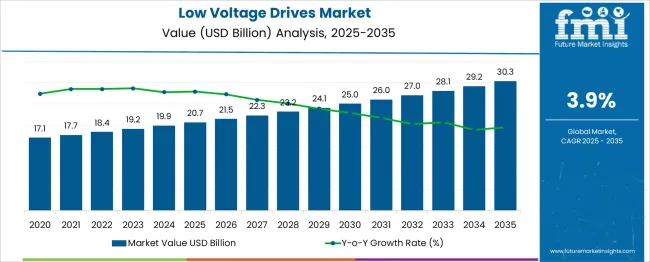

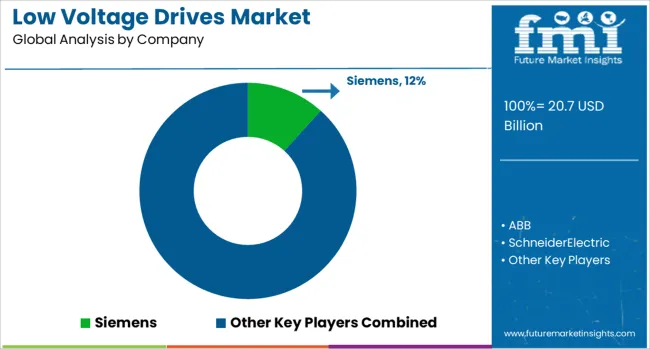

The Low Voltage Drives Market is estimated to be valued at USD 20.7 billion in 2025 and is projected to reach USD 30.3 billion by 2035, registering a compound annual growth rate (CAGR) of 3.9% over the forecast period.

The low voltage drives market demonstrates a steady growth trajectory throughout the decade, increasing from USD 17.1 billion in 2021 to USD 24.1 billion by 2030, resulting in an absolute dollar opportunity of USD 7.0 billion over this period. This growth translates to an approximate CAGR of 3.9%, indicating consistent but moderate expansion driven by energy efficiency initiatives, industrial automation, and modernization of motor control systems across various sectors. Year-on-year progression showcases incremental increases, starting from USD 17.1 billion in 2021, rising to USD 17.7 billion in 2022, and reaching USD 18.4 billion in 2023. By 2024, the market climbs to USD 19.2 billion, followed by USD 19.9 billion in 2025, reflecting growing adoption in HVAC systems, pumps, and conveyor applications. In the second half of the decade, acceleration is observed as demand for energy-saving solutions intensifies, supported by stringent efficiency regulations.

The market achieves USD 20.7 billion in 2026, USD 21.5 billion in 2027, and USD 22.3 billion by 2028, driven by automation investments in manufacturing and process industries. This upward trend continues as the market expands to USD 23.2 billion in 2029 and ultimately reaches USD 24.1 billion by 2030, signaling sustained demand across industries like oil and gas, water treatment, and building automation. The growth reflects increasing emphasis on reducing operational costs, integrating smart drive systems, and enhancing process control. Manufacturers offering IoT-enabled drives, predictive maintenance features, and advanced energy monitoring solutions are likely to capture a competitive edge as industrial sectors prioritize efficiency and digital transformation.

| Metric | Value |

|---|---|

| Low Voltage Drives Market Estimated Value in (2025 E) | USD 20.7 billion |

| Low Voltage Drives Market Forecast Value in (2035 F) | USD 30.3 billion |

| Forecast CAGR (2025 to 2035) | 3.9% |

The industry accounts for a relatively small yet significant share within these broader markets. In the overall industrial automation market, low voltage drives hold an estimated share of around 12-14%, as they play a crucial role in controlling motor speed and enhancing energy efficiency across manufacturing systems. Within the power electronics market, their contribution is moderate, likely 8-10%, since drives are essential for efficient power conversion and motor operations. In the renewable energy systems market, the share remains relatively smaller, around 3-4%, as they are mainly applied in wind and solar power integration for optimizing motor-driven components.

Within the HVAC systems market, low voltage drives capture approximately 6-7%, driven by their use in pumps, fans, and compressors to reduce energy consumption. In the broader electrical equipment market, their share is near 5-6%, considering the dominance of other components like switchgear, transformers, and wiring devices. Despite their modest share in these markets, low voltage drives continue to expand rapidly due to rising energy efficiency mandates, industrial modernization, and adoption of variable speed control in multiple sectors. With smart manufacturing, digital connectivity, and predictive maintenance gaining traction, their relevance is increasing, positioning them as a critical component in improving operational reliability and energy optimization across diverse applications worldwide.

The low voltage drives market is witnessing robust growth, supported by rising industrial automation, increasing demand for energy-efficient motor operations, and stricter regulatory mandates related to energy consumption. Low voltage drives are being increasingly integrated into various industrial systems to optimize motor speed, reduce energy loss, and enhance process control.

Technological advancements in variable frequency drives and digital control systems have further contributed to market growth, offering precision, scalability, and seamless integration with modern industrial platforms. The expansion of manufacturing activities, especially in sectors such as automotive, chemicals, and water treatment, has encouraged the deployment of low voltage drives for better operational efficiency.

Additionally, the shift toward Industry 4.0 and smart factory infrastructure is enhancing the relevance of software-configurable drives with real-time monitoring and predictive maintenance features. Global electrification trends and retrofitting initiatives in aging industrial facilities are also creating substantial opportunities for market expansion, particularly in regions focused on sustainable and cost-effective energy solutions.

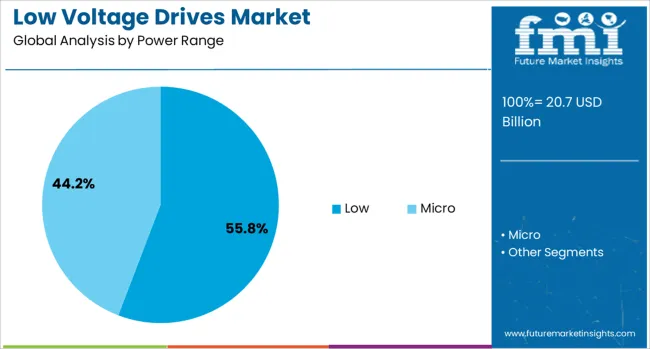

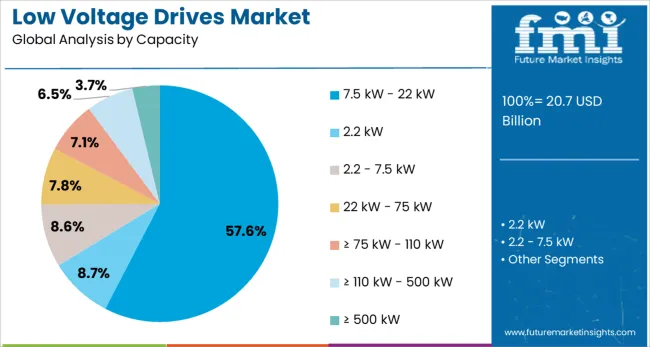

The low voltage drives market is segmented by power range, capacity, drive, technology, system, application, and geographic regions. The power range of the low voltage drives market is divided into Low and Micro. The low voltage drives market is classified into 7.5 kW - 22 kW, 2.2 kW, 2.2 - 7.5 kW, 22 kW - 75 kW, ≥ 75 kW - 110 kW, ≥ 110 kW - 500 kW, and ≥ 500 kW.

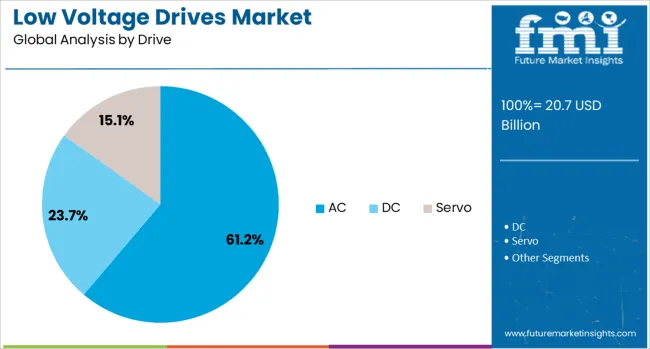

Based on the drive of the low voltage drives market, it is segmented into AC, DC, and Servo. The low voltage drives market is segmented into Standard and Regenerative. The low voltage drives market is segmented into closed-loop and open-loop systems. By application, the low voltage drives market is segmented into Pump, Fan, Conveyor, Compressor, Extruder, and Others. Regionally, the low voltage drives industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The low power range segment is projected to account for 55.8% of the revenue share in the low voltage drives market in 2025, reflecting its critical role in supporting small-scale industrial and commercial operations. This segment's leadership is driven by the extensive use of low-power drives in applications such as HVAC systems, small pumps, conveyors, and fans, where energy optimization and motor control are essential.

The growing adoption of compact and modular automation systems in industries has increased the demand for drives that support precise speed regulation and torque control at lower power capacities. These drives also offer lower installation costs, higher operational flexibility, and easier integration with programmable logic controllers and industrial communication protocols.

Their role in improving equipment life cycle and energy usage efficiency has further reinforced their presence in cost-sensitive environments. With an emphasis on reducing carbon footprints and operational overhead, low power drives are being widely preferred across facilities seeking agile and scalable motor control solutions.

The 7.5 kW to 22 kW capacity segment is expected to contribute 57.6% of the total revenue share in the low voltage drives market in 2025. This segment’s growth has been fueled by its versatility and suitability across a wide range of medium-duty industrial applications such as compressors, elevators, material handling systems, and irrigation pumps.

The increasing preference for mid-capacity drives stems from their ability to deliver stable performance, improved thermal management, and high energy savings in diverse operational environments. Enhanced compatibility with digital interfaces and cloud-enabled diagnostics has allowed these drives to meet the demands of modern industrial automation setups.

Their widespread adoption in commercial and municipal installations has also been influenced by their compact design and ease of retrofitting. As industries prioritize performance optimization and downtime reduction, the 7.5 kW to 22 kW segment is likely to maintain its dominance due to its balance between power efficiency, control precision, and integration capabilities.

The AC drive segment is anticipated to represent 61.2% of the low voltage drives market revenue share in 2025, maintaining its dominance due to its proven efficiency and applicability across numerous motor-driven systems. The strong presence of AC drives is attributed to their ability to regulate motor speed, minimize energy loss, and support variable torque loads in both constant and dynamic environments.

AC drives are extensively utilized in industries such as oil and gas, manufacturing, and building automation due to their robust design, operational flexibility, and adaptability to harsh working conditions. Advances in power electronics and control algorithms have further enhanced their capability to deliver stable and responsive motor control across various load profiles.

Their contribution to improving equipment life, lowering maintenance requirements, and complying with energy efficiency standards has led to widespread deployment. As industrial operations continue to demand scalable, intelligent, and efficient motor control technologies, AC drives are positioned to remain the preferred choice across global applications.

Low voltage drives are gaining traction for improving energy efficiency and reducing operational costs in industrial processes. Their integration into infrastructure and transportation projects ensures precise motor control, enhanced reliability, and compatibility with automated systems.

The demand for low voltage drives is increasing, necessitating the reduction of operational costs and improving process efficiency across diverse industries. Manufacturing and processing plants have adopted these systems to control motor speed, which optimizes power consumption and minimizes wastage. These drives are being implemented in HVAC systems, conveyors, pumps, and compressors to ensure better performance and reduced energy bills. The global focus on reducing operational inefficiencies and improving energy utilization has positioned low voltage drives as a preferred choice in industrial automation. This technology is being considered critical for sectors where continuous production and reduced downtime are required to maintain competitive advantages.

Significant adoption of low voltage drives is being seen in infrastructure development and transportation sectors due to increasing requirements for precise motor control and energy optimization. Rail networks, airport systems, and building automation projects are integrating these drives to ensure reliable operations and extended equipment life. The construction sector has acknowledged its role in maintaining energy-efficient systems for ventilation and water pumping applications. Advanced monitoring and control features incorporated in these drives allow seamless integration with smart grids and automated systems. This adaptability has positioned low voltage drives as an essential component in modern infrastructure frameworks, strengthening their demand across both developed and emerging economies.

The adoption of low voltage drives is being accelerated by the shift toward Industry 4.0 and smart manufacturing practices. These drives are now designed with digital connectivity features, enabling integration with Industrial Internet of Things (IIoT) platforms for real-time monitoring and predictive maintenance. Manufacturers are leveraging data analytics and cloud-based systems to optimize energy consumption, reduce downtime, and enhance equipment lifecycle management. This trend is particularly evident in sectors like automotive, food processing, and chemical manufacturing, where process optimization is critical. The ability of low voltage drives to deliver variable speed control, combined with embedded diagnostics, has positioned them as a key enabler in digital transformation initiatives across industrial plants.

Energy efficiency mandates and rising electricity costs have pushed industries to adopt low voltage drives in high-energy applications such as compressors, pumps, and fans. Governments worldwide are promoting efficiency standards, creating strong demand in markets like Asia-Pacific, where industrialization and infrastructure development are rapidly increasing. Emerging economies are witnessing large-scale adoption due to expanding manufacturing sectors and the availability of cost-effective drive solutions. Additionally, OEM partnerships and localized production strategies are supporting market penetration in these regions. By reducing operational energy consumption and offering flexible control, low voltage drives have become an indispensable component in energy optimization strategies, aligning with sustainability-driven production models and cost-sensitive industrial operations.

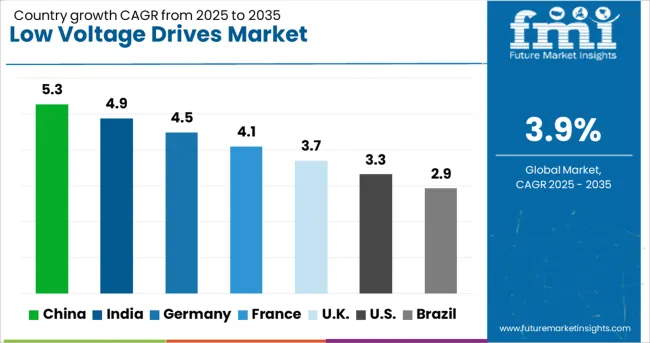

| Country | CAGR |

|---|---|

| China | 5.3% |

| India | 4.9% |

| Germany | 4.5% |

| France | 4.1% |

| UK | 3.7% |

| USA | 3.3% |

| Brazil | 2.9% |

The low voltage drives sector, projected to expand at a global CAGR of 3.9% from 2025 to 2035, demonstrates contrasting growth trends among leading nations. China, a BRICS member, is anticipated to grow at 5.3%, supported by large-scale industrial automation and power efficiency measures in heavy industries. India, another BRICS member, is estimated at 4.9%, fueled by increasing investments in manufacturing hubs and infrastructure upgrades. Germany, an OECD member, records 4.5%, strong adoption within the automotive and process industries for precision control and energy savings.

Slower yet steady growth is being observed in the United Kingdom and the United States, with 3.7% and 3.3% CAGRs respectively, attributed to established industrial bases and gradual integration of advanced drive systems in modernization projects. High-value opportunities are being highlighted in emerging economies like China and India due to aggressive industrialization and policy-driven efficiency programs, whereas OECD nations maintain stable demand through replacement and upgrade cycles. The report evaluates over 40 countries, and the five leading markets have been presented for reference.

The CAGR for the low voltage drives market in China moved from about 4.4% during 2020–2024 to 5.3% between 2025 and 2035, supported by the surge in automation investments and the integration of energy-optimized motor control systems in heavy industries. Government initiatives focusing on reducing industrial energy consumption played a central role in shaping adoption trends. China’s expansion in manufacturing clusters, combined with growing penetration of advanced drives in HVAC, pumping, and material handling systems, further strengthened this growth trajectory. Domestic companies enhanced local production capacity to meet escalating demand, while global players invested in joint ventures to gain a stronger foothold.

The CAGR for India’s low voltage drives segment improved from 4.1% during 2020–2024 to 4.9% across 2025–2035, supported by consistent investments in automotive and infrastructure sectors. Industrial corridors and government-backed programs emphasizing process optimization accelerated implementation in manufacturing hubs. Increased adoption of energy-efficient drives in pumps, compressors, and HVAC systems for large-scale industrial projects elevated demand. A growing trend in retrofitting older systems with new-generation drives was evident, aimed at reducing operational inefficiencies and extending equipment life. Local manufacturing of electronic components further reduced procurement costs for Indian buyers, fostering steady expansion across multiple sectors.

Germany witnessed a CAGR increase from 3.9% during 2020–2024 to 4.5% for 2025–2035, driven by a strong focus on process optimization within automotive, chemicals, and industrial machinery sectors. Widespread modernization of factory floors and automation lines required enhanced motor control solutions, positioning low voltage drives as an essential component. Regulatory frameworks favoring energy-efficient solutions contributed to market maturity. The demand was further bolstered by significant retrofitting activity across legacy systems. German engineering firms prioritized integration of digital controls with low voltage drives to achieve predictive maintenance and production reliability, amplifying adoption rates during the forecast period.

The CAGR in the United Kingdom shifted from 3.2% during 2020–2024 to 3.7% through 2025–2035, supported by modernization projects within established industrial bases and infrastructure developments. Increased retrofitting of aging systems with energy-optimized solutions played a pivotal role in steady demand growth. Integration of low voltage drives into building automation and transportation systems provided additional momentum. British engineering firms actively collaborated with technology suppliers for advanced drive solutions, enhancing adaptability for high-precision operations. The expansion of smart building initiatives across commercial spaces encouraged the procurement of drives for HVAC and water pumping systems, reinforcing market relevance.

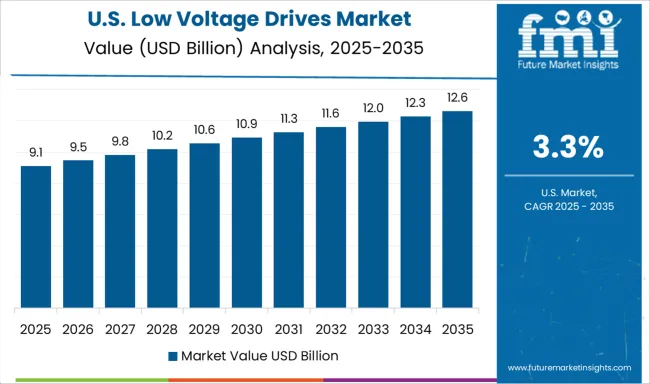

The CAGR in the United States advanced from 2.9% during 2020–2024 to 3.3% across 2025–2035, backed by investments in modernizing industrial infrastructure and gradual adoption in process control applications. Demand was largely driven by heavy industries seeking improved efficiency and cost reductions. Government-led initiatives promoting energy optimization in industrial and commercial segments created favorable conditions for manufacturers. Technological advancements in drive interfaces and enhanced diagnostic capabilities influenced adoption among large-scale enterprises. However, growth remained moderate compared to emerging economies due to an already mature industrial landscape.

The low voltage drives industry is witnessing strategic advancements as global players intensify efforts to deliver energy-efficient, digitally integrated solutions across industrial and commercial applications. Siemens, ABB, and Schneider Electric lead the sector with portfolios that cater to automation, HVAC, and infrastructure projects, leveraging drives optimized for precise motor control and reduced operational costs.

These companies have prioritized scalable platforms compatible with smart factory systems, enabling real-time data exchange and analytics-driven performance enhancement. Rockwell Automation, Mitsubishi Electric, and Danfoss are pushing innovation through IoT-ready drive systems with embedded monitoring capabilities, facilitating predictive maintenance, improved uptime, and compliance with energy efficiency standards.

Yaskawa Electric, Emerson Electric, and Fuji Electric are diversifying into renewable energy domains, delivering advanced drives for wind turbines, solar tracking systems, and energy storage operations. Nidec Corporation, Johnson Controls, and Hitachi are focusing on regionalized production strategies and modular designs, ensuring flexibility for industries facing dynamic operational requirements.

Strategic investments in R&D are fueling developments in sensor integration, adaptive control algorithms, and cloud-based connectivity, positioning these companies to meet growing demands for automation, sustainability, and digital transformation in manufacturing, water management, and smart infrastructure. This evolving competitive landscape underscores a transition from conventional drive systems to intelligent, software-driven platforms that deliver measurable performance and energy savings globally.

In 2024, the low voltage drives market strategies center on IoT-enabled solutions, predictive maintenance, and cloud connectivity to optimize efficiency and reduce downtime, while partnerships with OEMs and regional distributors ensure stronger supply networks. Modular and scalable designs are prioritized for diverse industrial applications.

In 2025, focus shifts toward AI-driven control systems, real-time analytics, and adaptive drives to meet the rising demand for smart factories and energy optimization. Companies are also expanding offerings for renewable energy integration and HVAC systems, while enhancing regional manufacturing capabilities to address cost sensitivity and compliance with evolving global efficiency standards.

| Item | Value |

|---|---|

| Quantitative Units | USD 20.7 Billion |

| Power Range | Low and Micro |

| Capacity | 7.5 kW - 22 kW, 2.2 kW, 2.2 - 7.5 kW, 22 kW - 75 kW, ≥ 75 kW - 110 kW, ≥ 110 kW - 500 kW, and ≥ 500 kW |

| Drive | AC, DC, and Servo |

| Technology | Standard and Regenerative |

| System | Closed loop and Open loop |

| Application | Pump, Fan, Conveyor, Compressor, Extruder, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Siemens, ABB, SchneiderElectric, RockwellAutomation, MitsubishiElectric, Danfoss, YaskawaElectric, EmersonElectric, FujiElectric, GE, NidecCorporation, JohnsonControls, Eaton, BoschRexroth, HoneywellInternational, BeckhoffAutomation, CGPowerandIndustrialSolutions, WEG, Hitachi, and HiconicsEco-energyTechnology |

| Additional Attributes | Dollar sales by region, market share by product type, competitive landscape, pricing trends, demand from industrial automation, OEM partnerships, regulatory standards, and opportunities in infrastructure and renewable integration. |

The global low voltage drives market is estimated to be valued at USD 20.7 billion in 2025.

The market size for the low voltage drives market is projected to reach USD 30.3 billion by 2035.

The low voltage drives market is expected to grow at a 3.9% CAGR between 2025 and 2035.

The key product types in low voltage drives market are low and micro.

In terms of capacity, 7.5 kw - 22 kw segment to command 57.6% share in the low voltage drives market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Low Alloy Steels Powder Market Size and Share Forecast Outlook 2025 to 2035

Low Alkali Cement Market Size and Share Forecast Outlook 2025 to 2035

Low Vibration Thermostat Market Size and Share Forecast Outlook 2025 to 2035

Low-Level Order Picker Pallet Truck Market Size and Share Forecast Outlook 2025 to 2035

Low Temperature Flexible Tester Market Size and Share Forecast Outlook 2025 to 2035

Low Light Imaging Market Forecast Outlook 2025 to 2035

Low Density Polyethylene Market Forecast and Outlook 2025 to 2035

Low-Temperature Cable Market Size and Share Forecast Outlook 2025 to 2035

Low Molecular Weight Chondroitin Sulfate Sodium Market Size and Share Forecast Outlook 2025 to 2035

Low Temperature Radiators Market Size and Share Forecast Outlook 2025 to 2035

Low Rolling Resistance Tire Market Size and Share Forecast Outlook 2025 to 2035

Low Temperature Commercial Boiler Market Size and Share Forecast Outlook 2025 to 2035

Low Emissivity Film Market Size and Share Forecast Outlook 2025 to 2035

Low Migration Inks Market Size and Share Forecast Outlook 2025 to 2035

Low Density Polyethylene Packaging Market Size and Share Forecast Outlook 2025 to 2035

Low Temperature Insulation Materials Market Size and Share Forecast Outlook 2025 to 2035

Low Clearance Loaders Market Size and Share Forecast Outlook 2025 to 2035

Low Calorie Desserts Market Size and Share Forecast Outlook 2025 to 2035

Low-Grade Glioma Therapeutics Market Size and Share Forecast Outlook 2025 to 2035

Low Power Wide Area Network (LPWAN) Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA