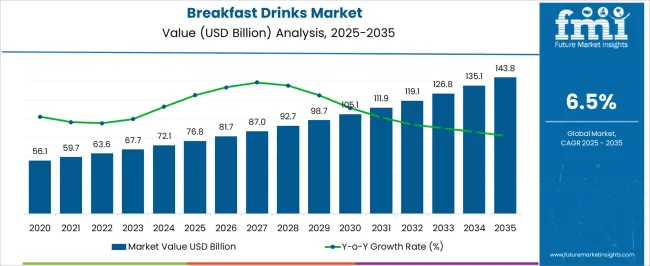

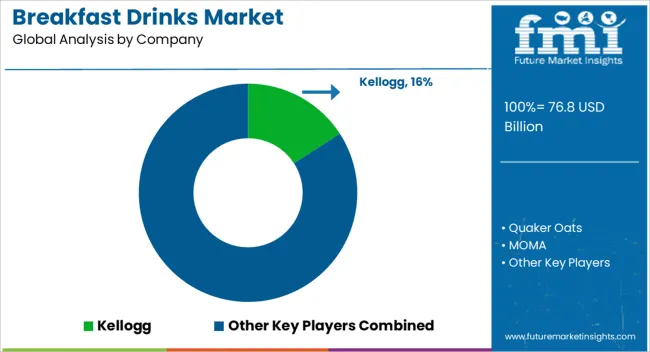

The Breakfast Drinks Market is estimated to be valued at USD 76.8 billion in 2025 and is projected to reach USD 143.8 billion by 2035, registering a compound annual growth rate (CAGR) of 6.5% over the forecast period.

| Metric | Value |

|---|---|

| Breakfast Drinks Market Estimated Value in (2025 E) | USD 76.8 billion |

| Breakfast Drinks Market Forecast Value in (2035 F) | USD 143.8 billion |

| Forecast CAGR (2025 to 2035) | 6.5% |

The Breakfast Drinks market is experiencing steady growth, driven by increasing consumer demand for convenient, nutritious, and on-the-go breakfast alternatives. Rising health consciousness, busy lifestyles, and a growing preference for functional beverages are supporting adoption. High protein formulations, fortified with vitamins and minerals, are being increasingly preferred for their ability to provide sustained energy and support daily nutritional requirements.

Packaging innovations, particularly carton-based formats, enhance product shelf life, portability, and ease of consumption, further boosting market appeal. Flavor innovation, including popular options like chocolate, is attracting a broader consumer base and enhancing repeat purchase rates. The market is also benefiting from the expansion of retail distribution channels, e-commerce platforms, and direct-to-consumer models, which improve accessibility and convenience.

As awareness of balanced nutrition and functional foods grows, manufacturers are increasingly focusing on product differentiation through protein content, flavor variety, and sustainable packaging solutions Continued research and development in formulation, taste, and packaging is expected to drive long-term market growth, making breakfast drinks an integral part of modern dietary habits.

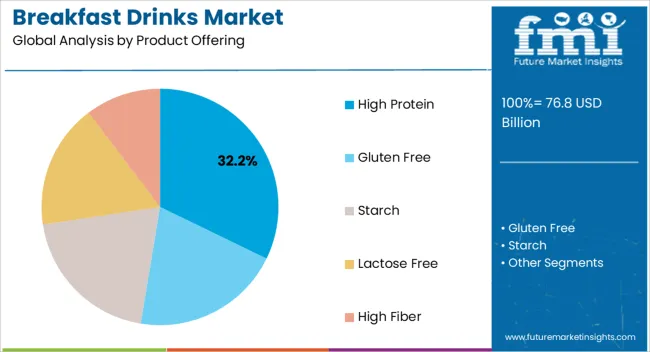

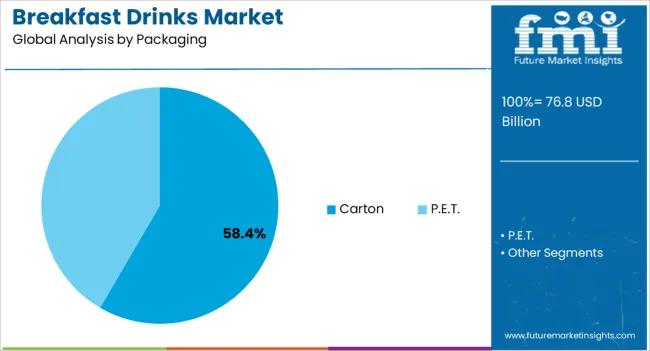

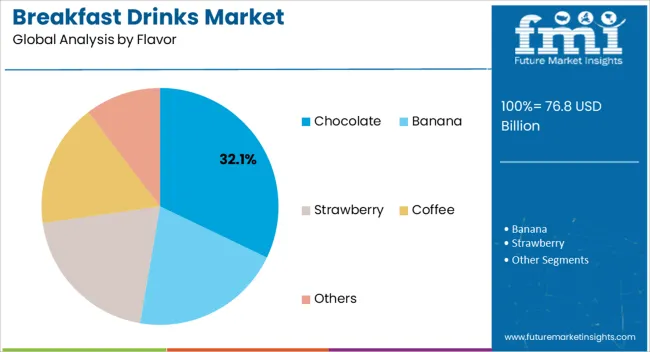

The breakfast drinks market is segmented by product offering, packaging, flavor, and geographic regions. By product offering, breakfast drinks market is divided into High Protein, Gluten Free, Starch, Lactose Free, and High Fiber. In terms of packaging, breakfast drinks market is classified into Carton and P.E.T.. Based on flavor, breakfast drinks market is segmented into Chocolate, Banana, Strawberry, Coffee, and Others. Regionally, the breakfast drinks industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The high protein segment is projected to hold 32.2% of the market revenue in 2025, establishing it as the leading product offering. Growth in this segment is being driven by increasing consumer focus on health, fitness, and weight management. High protein breakfast drinks provide essential nutrients that support muscle recovery, satiety, and sustained energy, making them highly attractive to active consumers and working professionals.

Manufacturers are leveraging advanced formulation technologies to ensure optimal protein content, smooth texture, and palatable taste, which enhances adoption. The segment’s popularity is further reinforced by growing awareness of dietary supplementation and functional food benefits.

Integration of natural protein sources, such as whey, soy, or plant-based alternatives, supports consumer demand for clean-label products With rising interest in convenient nutrition and meal replacement solutions, the high protein product offering segment is expected to maintain its leading position, driven by its ability to meet evolving health and wellness needs.

The carton packaging segment is anticipated to account for 58.4% of the market revenue in 2025, making it the largest packaging category. Growth is being driven by the convenience, portability, and extended shelf life offered by carton formats. Cartons provide protection against light, oxygen, and external contaminants, preserving nutritional content and flavor integrity.

Their lightweight and recyclable nature aligns with sustainability goals, which is increasingly important to environmentally conscious consumers. Easy-to-use designs, including single-serve and resealable formats, enhance consumer convenience for on-the-go consumption. Manufacturers are increasingly adopting carton packaging to differentiate products, improve brand visibility, and reduce transportation costs.

The ability to combine functionality with attractive design and sustainability has strengthened market preference for cartons As demand for ready-to-consume, nutritious breakfast beverages continues to rise, the carton packaging segment is expected to remain the dominant choice, supporting both consumer satisfaction and environmental responsibility.

The chocolate flavor segment is projected to hold 32.1% of the market revenue in 2025, establishing it as the leading flavor category. Growth is being driven by consumer preference for indulgent yet nutritious breakfast options that combine taste with health benefits. Chocolate-flavored breakfast drinks appeal to both children and adults, providing a familiar and enjoyable taste experience while delivering essential nutrients such as protein, vitamins, and minerals.

Manufacturers are leveraging flavor enhancement technologies to ensure consistent taste and aroma without compromising nutritional quality. The segment benefits from strong brand loyalty, repeat purchases, and cross-promotional marketing with other chocolate-based products.

The popularity of chocolate flavor is further reinforced by its versatility, compatibility with dairy, plant-based, and fortified formulations As consumer demand for flavorful, functional, and convenient breakfast solutions continues to rise, the chocolate flavor segment is expected to maintain its leadership, supported by continued innovation in formulation, taste, and nutritional profile.

Breakfast drinks are defined as a food products that are formulated through processing cereals with milk or other liquid ingredient. It is marketed as a supplementary food and positioned as a healthy, fast and convenient option for breakfast.

Breakfast drinks must be shelf stable and liquid or dairy based. It must contain added minerals and vitamins and should be packed in on-the-go format. Growing number of single individuals along with rising number of working women across the globe is leading to changing lifestyle, improving living standards and increasing urbanization are some of the factors which are expected to drive the market of breakfast drinks over the forecast period.

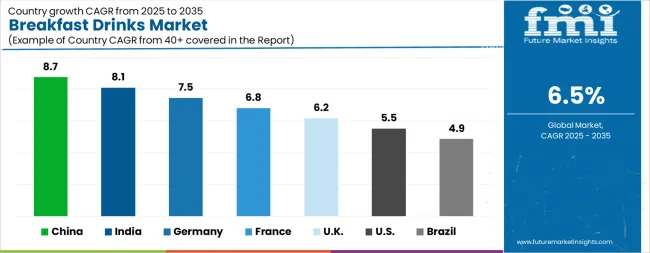

| Country | CAGR |

|---|---|

| China | 8.7% |

| India | 8.1% |

| Germany | 7.5% |

| France | 6.8% |

| UK | 6.2% |

| USA | 5.5% |

| Brazil | 4.9% |

The Breakfast Drinks Market is expected to register a CAGR of 6.5% during the forecast period, exhibiting varied country level momentum. China leads with the highest CAGR of 8.7%, followed by India at 8.1%. Developed markets such as Germany, France, and the UK continue to expand steadily, while the USA is likely to grow at consistent rates. Brazil posts the lowest CAGR at 4.9%, yet still underscores a broadly positive trajectory for the global Breakfast Drinks Market. In 2024, Germany held a dominant revenue in the Western Europe market and is expected to grow with a CAGR of 7.5%. The USA Breakfast Drinks Market is estimated to be valued at USD 27.6 billion in 2025 and is anticipated to reach a valuation of USD 47.2 billion by 2035. Sales are projected to rise at a CAGR of 5.5% over the forecast period between 2025 and 2035. While Japan and South Korea markets are estimated to be valued at USD 3.6 billion and USD 2.5 billion respectively in 2025.

| Item | Value |

|---|---|

| Quantitative Units | USD 76.8 Billion |

| Product Offering | High Protein, Gluten Free, Starch, Lactose Free, and High Fiber |

| Packaging | Carton and P.E.T. |

| Flavor | Chocolate, Banana, Strawberry, Coffee, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Kellogg, Quaker Oats, MOMA, General Mills, Sanitarium, Anchor, Nosh Drinks, Arla Foods, Whole Foods Market, and SmithKline Beecham |

The global breakfast drinks market is estimated to be valued at USD 76.8 billion in 2025.

The market size for the breakfast drinks market is projected to reach USD 143.8 billion by 2035.

The breakfast drinks market is expected to grow at a 6.5% CAGR between 2025 and 2035.

The key product types in breakfast drinks market are high protein, gluten free, starch, lactose free and high fiber.

In terms of packaging, carton segment to command 58.4% share in the breakfast drinks market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Breakfast Cereal Market Trends – Healthy & Indulgent Options Driving Growth 2025 to 2035

Breakfast Takeout Market Growth – Morning Convenience & Market Expansion 2025 to 2035

Soft Drinks Packaging Market Size and Share Forecast Outlook 2025 to 2035

Soft Drinks Concentrates Market Trends - Growth & Forecast

Beauty Drinks Market Size and Share Forecast Outlook 2025 to 2035

Liquid Breakfast Products Market Size and Share Forecast Outlook 2025 to 2035

Organic Drinks Market Size and Share Forecast Outlook 2025 to 2035

Low Fat Drinks Market Size and Share Forecast Outlook 2025 to 2035

Cannabis Drinks Market Size and Share Forecast Outlook 2025 to 2035

Collagen Drinks Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Alcoholic Drinks Packaging Market Size and Share Forecast Outlook 2025 to 2035

Aloe Vera Drinks Market Outlook – Growth, Size & Demand 2025-2035

On-the-go Breakfast Products Market Trends & Forecast 2020-2030

Demand for Breakfast Cereal in Japan Size and Share Forecast Outlook 2025 to 2035

Demand for Breakfast Takeout in Japan Size and Share Forecast Outlook 2025 to 2035

Antioxidant Drinks Market Size and Share Forecast Outlook 2025 to 2035

Electrolyte Drinks Market Size and Share Forecast Outlook 2025 to 2035

GABA-Infused Drinks Market Size and Share Forecast Outlook 2025 to 2035

Powdered Soft Drinks Market Size and Share Forecast Outlook 2025 to 2035

Digestive Health Drinks Market Analysis by Ingredient Type, Sales Channel, Region Through 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA