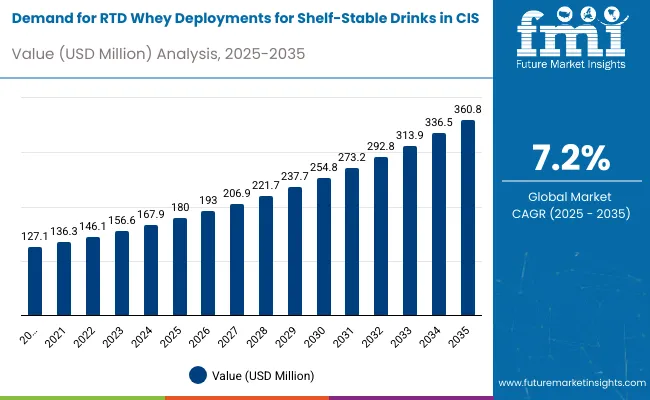

Sales of RTD whey shelf-stable drinks in the Commonwealth of Independent States are estimated at USD 180 million in 2025, with projections indicating a rise to USD 360.8 million by 2035, reflecting a CAGR of approximately 7.2% over the forecast period.

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 180 million |

| Industry Value (2035F) | USD 360.8 million |

| CAGR (2025 to 2035) | 7.2% |

This growth reflects both expanding fitness consciousness and increased per capita consumption in key urban centers. The rise in demand is linked to shifting lifestyle preferences, growing awareness of protein nutrition, and evolving convenience trends. By 2025, per capita consumption in leading CIS countries such as Russia, Kazakhstan, and Ukraine averages between 0.8 to 1.1 kilograms, with projections reaching 1.4 kilograms by 2035. Moscow leads among metropolitan areas, expected to generate USD 187 million in RTD whey shelf-stable drink sales by 2035, followed by St. Petersburg (USD 89 million), Almaty (USD 52 million), Kiev (USD 41 million), and Minsk (USD 28 million).

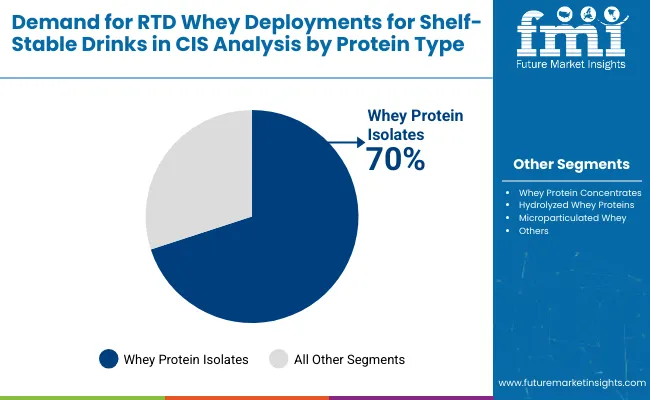

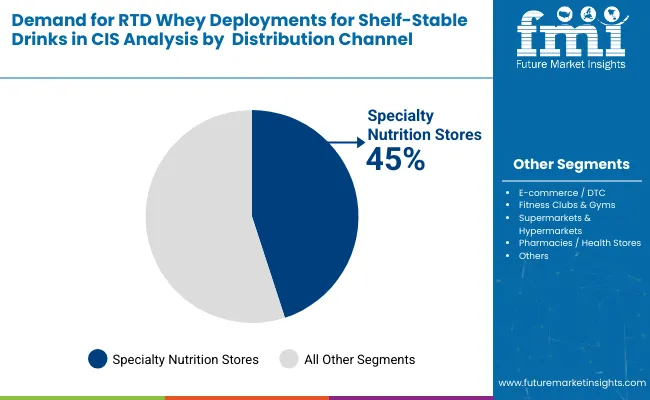

The largest contribution to demand continues to come from whey protein isolates, which are expected to account for 70% of total sales in 2025, owing to strong shelf presence, extended storage life, and retailer support. By distribution channel, specialty nutrition stores represent the dominant retail format, responsible for 45% of all sales, while e-commerce and fitness clubs are expanding rapidly.

Consumer adoption is particularly concentrated among young urban professionals and fitness-conscious millennials, with income and urban density emerging as significant drivers of demand. While price remains a limiting factor, the average price premium over conventional dairy drinks has declined from 28% in 2020 to 19% in 2025. Continued improvements in manufacturing scale and local production are expected to accelerate affordability and access across mid-income households. Regional disparities persist, but per capita demand in high-growth Central Asian cities is narrowing the gap with traditionally strong Russian urban hubs.

The RTD whey shelf-stable drinks segment in the CIS is classified across several segments. By product, the key categories include whey protein isolates, whey protein concentrates, hydrolyzed whey proteins, and microparticulated whey. By distribution channel, the segment spans specialty nutrition stores, e-commerce platforms, fitness clubs and gyms, supermarkets and hypermarkets, and pharmacies and health stores.

By protein concentration, formulations include standard whey (15-20g), high-protein (25-30g), concentrated whey (35g+), and blended protein combinations. By consumer profile, the segment covers young urban professionals, fitness enthusiasts, health-conscious millennials, active seniors, and weight management seekers. By region, countries such as Russia, Kazakhstan, Ukraine, Belarus, and Uzbekistan are included, along with coverage across all 12 CIS member states. By city, key metro areas analyzed include Moscow, St. Petersburg, Almaty, Kiev, and Minsk.

Whey protein isolates are projected to dominate sales in 2025, supported by superior bioavailability, clean taste profile, and category familiarity. Other formats such as concentrates, hydrolyzed variants, and microparticulated forms are growing steadily, each serving distinct consumption needs.

RTD whey shelf-stable drinks in the CIS are distributed through a mix of specialized retail and mainstream sales channels. Specialty nutrition stores are expected to remain the primary point of sale in 2025, followed by e-commerce platforms and fitness facilities. Distribution strategies are evolving to match consumer shopping behavior, with growth coming from both specialized and digital formats.

RTD whey shelf-stable drinks in the CIS utilize varying protein concentrations, selected for cost, bioavailability, taste profile, and nutritional positioning. Standard whey protein (15-20g per serving) remains the most widely used formulation, though high-protein and concentrated variants are gaining momentum. Product developers are increasingly exploring hybrid proteins to meet evolving fitness and dietary demands.

The RTD whey shelf-stable drinks category appeals to a diverse consumer base across age groups, income levels, and lifestyle preferences. While motivations vary from fitness to convenience to health optimization, demand is concentrated among five key demographic clusters. Each group brings distinct purchase behaviors, channel preferences, and product expectations.

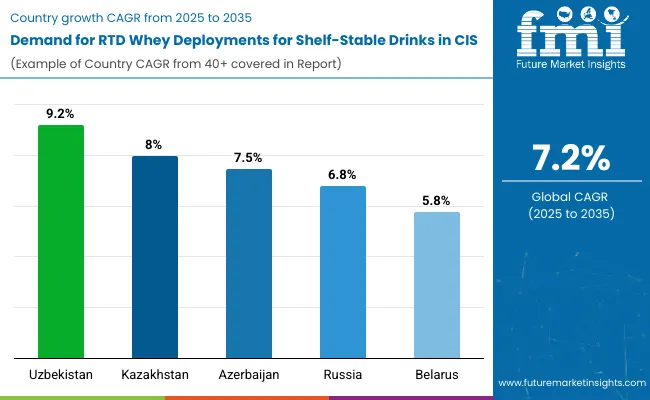

| Countries | CAGR (2025 to 2035) |

|---|---|

| Uzbekistan | 9.2% |

| Kazakhstan | 8.0% |

| Azerbaijan | 7.5% |

| Russia | 6.8% |

| Belarus | 5.8% |

RTD whey shelf-stable drink sales will not grow uniformly across every country. Rising disposable income and faster fitness culture adoption in Central Asian republics give Uzbekistan and Kazakhstan a measurable edge, while mature Russian centers expand more steadily from a higher base. The table below shows the compound annual growth rate (CAGR) each of the five key countries is expected to record between 2025 and 2035.

Between 2025 and 2035, demand for RTD whey shelf-stable drinks is projected to expand across all major CIS countries, but the pace of growth will vary based on economic development, fitness infrastructure, and baseline consumption levels. Among the top five countries analyzed, Uzbekistan and Kazakhstan are expected to register the fastest compound annual growth rates of 9.2% and 8.0% respectively, outpacing more established Russian consumption patterns.

This acceleration is underpinned by a combination of factors: growing middle class, expanding gym culture, and increasing availability of international protein brands across modern retail formats. In both countries, per capita consumption is projected to rise from 0.7 kg in 2025 to 1.1 kg by 2035, closing the gap with higher-consumption regions such as Russia and Belarus. Retail penetration is also expanding faster in these markets, with new specialty nutrition and online formats gaining traction in shopping centers and urban areas.

Azerbaijan and Russia are each forecast to grow at CAGRs of 7.5% and 6.8% respectively over the same period. Both countries already maintain established fitness retail ecosystems, with widespread access to international and domestic RTD whey products in specialty stores, hypermarkets, and fitness centers.

In Azerbaijan, growth is supported by increasing oil revenues, infrastructure development, and rising health consciousness among urban populations. Russia reflects similar dynamics, particularly among professional athletes and gym members seeking premium nutrition solutions, though growth is moderated by the mature baseline. In both countries, per capita consumption is projected to increase from 1.0 kg in 2025 to 1.4 kg by 2035, reflecting mainstreaming of protein supplementation.

Belarus, while maintaining steady growth, is expected to expand at a CAGR of 5.8%, reflecting its smaller economic scale but consistent health trends. The country already exhibits moderate per capita intake (0.9 kg in 2025), with growth coming from urban professionals and fitness enthusiasts rather than mass adoption.

Collectively, these five countries represent the core of demand for RTD whey shelf-stable drinks in the CIS, but their individual growth paths highlight the importance of economic development, retail modernization, and fitness culture expansion in driving category performance.

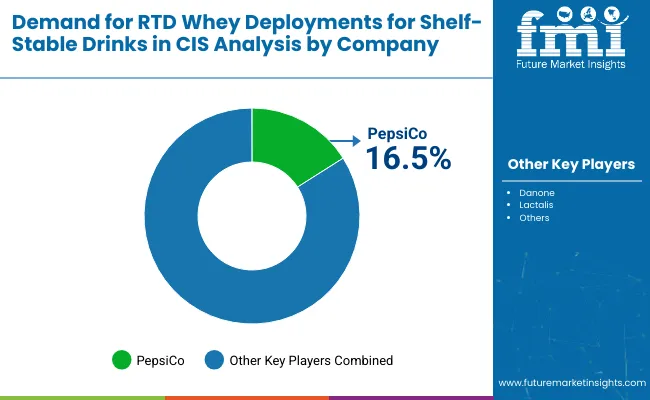

The competitive environment is characterized by a mix of multinational nutrition companies and regional specialty players. Distribution reach rather than product variety remains the decisive success factor: the leading suppliers collectively access thousands of specialty nutrition outlets across the CIS and account for a majority of shelf facings in the category.

PepsiCo leads with a 16.5% share through its specialized nutrition portfolio, leveraging established distribution networks and partnerships with regional fitness chains. The company's focus on mainstream retail penetration enables competitive pricing while maintaining quality standards across urban and suburban locations.

Danone operates through its specialized nutrition division, focusing on premium RTD whey products with European formulations and clinical backing. The company's emphasis on health credentials and scientific positioning has enabled market penetration in pharmacy and medical nutrition channels.

Lactalis competes through its sports nutrition subsidiary, offering cost-effective whey formulations targeting price-sensitive consumer segments. Recent expansions into private label manufacturing have strengthened its position with regional retail chains.

The competitive landscape includes numerous smaller players specializing in specific protein formulations, flavor innovations, or regional distribution. Private-label programs at major specialty nutrition retailers are expanding assortments at price points 15-25% below branded equivalents, putting margin pressure on smaller suppliers while supporting category trial.

Consolidation is likely to continue as cold chain logistics, regulatory compliance, and omnichannel presence become critical for maintaining shelf visibility and promotional support in this specialized but rapidly developing category.

Key Developments

| Attribute | Details |

|---|---|

| Study Coverage | CIS sales and consumption of RTD whey shelf-stable drinks from 2020 to 2035 |

| Base Year | 2025 |

| Historical Data | 2020 |

| Forecast Period | 2025-2035 |

| Units of Measurement | USD (sales), Metric Tonnes (volume), Kilograms per capita (consumption) |

| Geography Covered | All 12 CIS member states; country-level and city-level granularity |

| Top Countries Analyzed | Russia, Kazakhstan, Ukraine, Belarus, Uzbekistan, 12+ |

| Top Cities Analyzed | Moscow, St. Petersburg, Almaty, Kiev, Minsk and 50+ |

| By Product Format | Whey protein isolates, Concentrates, Hydrolyzed variants, Microparticulated forms |

| By Distribution Channel | Specialty nutrition stores, E-commerce, Fitness clubs, Supermarkets, Pharmacies |

| By Protein Concentration | Standard whey (15-20g), High-protein (25-30g), Concentrated (35g+), Blended proteins |

| By Consumer Profile | Young urban professionals, Fitness enthusiasts, Health-conscious millennials, Active seniors, Weight management seekers |

| Metrics Provided | Sales (USD), Volume (MT), Per capita consumption (kg), CAGR (2025-2035), Share by segment |

| Price Analysis | Average unit prices by product format and region |

| Competitive Landscape | Company profiles, private label strategies, multinational vs. regional presence |

| Forecast Drivers | Per capita demand trends, fitness culture expansion, income growth, retail modernization |

By 2035, total CIS sales of RTD whey shelf-stable drinks are projected to reach USD 360.8 million, up from USD 180 million in 2025, reflecting a CAGR of approximately 7.2%.

Whey protein isolates hold the leading share, accounting for approximately 70% of total sales in 2025, followed by whey protein concentrates and hydrolyzed variants.

Uzbekistan and Kazakhstan lead in projected growth, registering CAGRs of 9.2% and 8.0% respectively between 2025 and 2035, due to expanding fitness culture and rising disposable income.

Specialty nutrition stores are the dominant sales channel (45% share in 2025), but e-commerce platforms and fitness clubs are growing rapidly, especially in urban regions.

Major players include PepsiCo (16.5% share), Danone, Lactalis, and various regional specialists, with growing competition from private label brands at specialty nutrition retailers.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Demand Signal Repository Solutions Market Size and Share Forecast Outlook 2025 to 2035

Demand Side Management Market Size and Share Forecast Outlook 2025 to 2035

Demand Response Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

North America Shipping Supplies Market Trends – Innovations & Growth 2024-2034

Demand of Kozani Saffron in Greece Analysis - Size, Share & Forecast 2025 to 2035

Demand for Bronte Pistachio in Italy Analysis - Size, Share & Forecast 2025 to 2035

Demand and Trend Analysis of Gaming Monitor in Western Europe Size and Share Forecast Outlook 2025 to 2035

Demand and Trend Analysis of Gaming Monitor in Japan Size and Share Forecast Outlook 2025 to 2035

Demand and Trend Analysis of Gaming Monitor in Korea Size and Share Forecast Outlook 2025 to 2035

Glycine Soja (Soybean) Seed Extract Market Size and Share Forecast Outlook 2025 to 2035

Demand and Trend Analysis of Yeast in Japan - Size, Share, and Forecast Outlook 2025 to 2035

Demand and Trends Analysis of Stevia in Japan Size and Share Forecast Outlook 2025 to 2035

Demand of Pistachio-based desserts & ingredients in France Analysis - Size, Share & Forecast 2025 to 2035

Japan Women’s Intimate Care Market Trends – Growth & Forecast 2024-2034

Western Europe Men’s Skincare Market Analysis – Forecast 2023-2033

Demand and Trend Analysis of Fabric Stain Remover in Korea Size and Share Forecast Outlook 2025 to 2035

Demand and Sales Analysis of Paper Cup in Japan Size and Share Forecast Outlook 2025 to 2035

Demand and Sales Analysis of Paper Cup in Korea Size and Share Forecast Outlook 2025 to 2035

Demand and Sales Analysis of Paper Cup in Western Europe Size and Share Forecast Outlook 2025 to 2035

Demand and Trend Analysis of Avocado Oil in Western europe Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA