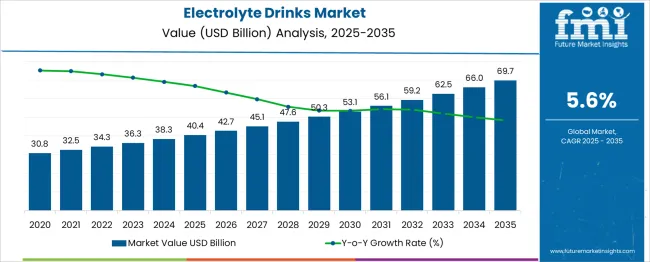

The Electrolyte Drinks Market is estimated to be valued at USD 40.4 billion in 2025 and is projected to reach USD 69.7 billion by 2035, registering a compound annual growth rate (CAGR) of 5.6% over the forecast period. The growth curve shape indicates a steady and consistent upward trajectory without major fluctuations, reflecting stable demand and gradual market expansion. Between 2025 and 2030, the market increases from USD 40.4 billion to USD 53.1 billion, representing a growth of USD 12.7 billion. This period marks consistent consumer adoption and expanding product availability, contributing to healthy growth rates each year.

The annual increments remain relatively uniform, reflecting steady acceptance across key regions. From 2030 to 2035, the market value grows further from USD 53.1 billion to USD 69.7 billion, adding USD 16.6 billion. This phase shows slightly larger absolute increments compared to the previous five years, indicating accelerating growth momentum as market penetration deepens and new product innovations are introduced. The growth pattern is characterized by a smooth curve with no signs of saturation or decline, suggesting strong underlying demand drivers. Industry stakeholders can expect a predictable market expansion that supports long-term investment and innovation in electrolyte drink formulations and marketing strategies. The steady growth profile makes this market attractive for sustained development efforts.

| Metric | Value |

|---|---|

| Electrolyte Drinks Market Estimated Value in (2025 E) | USD 40.4 billion |

| Electrolyte Drinks Market Forecast Value in (2035 F) | USD 69.7 billion |

| Forecast CAGR (2025 to 2035) | 5.6% |

The electrolyte drinks market is expanding steadily as consumers increasingly prioritize hydration, physical performance, and recovery in daily routines. The rise of fitness-conscious lifestyles, accelerated by pandemic-era health awareness, has elevated demand for functional beverages that replenish minerals and maintain fluid balance.

Product innovation in formulation, including the use of natural sweeteners, low-calorie variants, and added vitamins, is improving consumer appeal across both athletic and general wellness segments. Packaging sustainability and convenience continue to influence brand strategy, while marketing through social media and influencer channels has significantly amplified brand reach.

Furthermore, rising demand in emerging economies, where lifestyle shifts are underway, is broadening the market’s global footprint. As clean-label preferences and lifestyle customization trends gain ground, the market is poised to evolve toward more tailored hydration solutions across age and activity levels.

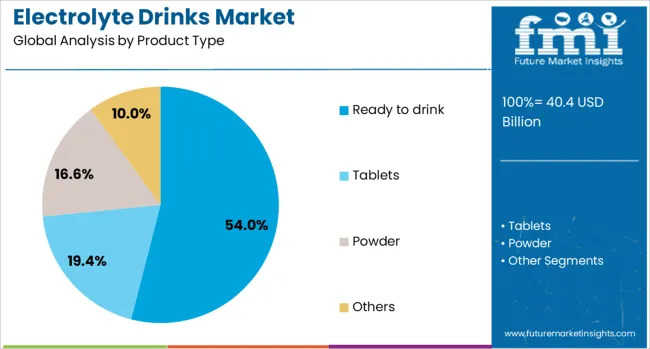

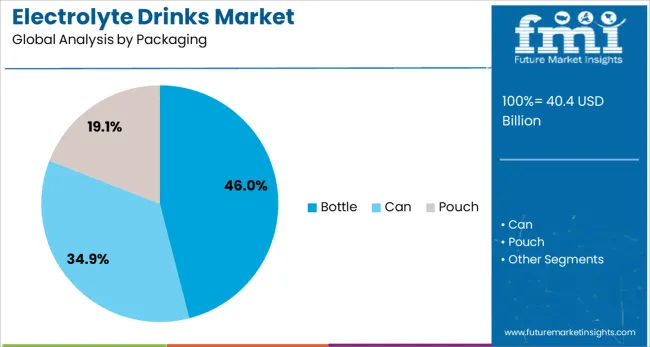

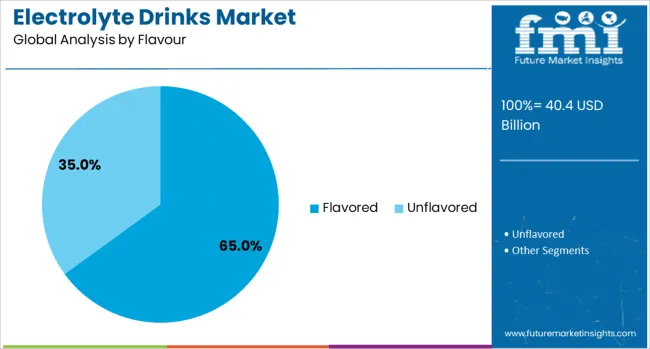

The electrolyte drinks market is segmented by product type, packaging, flavor, distribution channel, and geographic regions. By product type, the electrolyte drinks market is divided into Ready-to-Drink, Tablets, Powder, and Others. In terms of packaging, the electrolyte drinks market is classified into bottles, cans, and pouches. Based on the flavour, the electrolyte drinks market is segmented into Flavored and Unflavored. The distribution channel of the electrolyte drinks market is segmented into offline and online. Regionally, the electrolyte drinks industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Ready-to-drink (RTD) products are projected to dominate the market with a 54.00% revenue share in 2025. This segment’s growth is being driven by consumer demand for convenience, immediate hydration, and portability.

RTD electrolyte drinks eliminate the need for preparation, making them ideal for on-the-go lifestyles, sports activities, and everyday health routines. Their extended shelf life and ease of storage support broader retail availability across supermarkets, gyms, and online platforms.

The format has also become a focal point for product innovation, with brands introducing organic, zero-sugar, and energy-boosting variants that align with evolving nutritional expectations. Strategic collaborations with fitness influencers and increased visibility in e-commerce platforms have further accelerated RTD adoption, positioning it as the most accessible and widely accepted format in the hydration category.

Bottle packaging is expected to account for 46.00% of market revenue by 2025, making it the leading packaging format. Its dominance is linked to functionality, portability, and widespread compatibility with RTD formats.

Bottles offer resealability, portion control, and ease of use, key features preferred by athletes, travelers, and daily users alike. They also provide a robust branding canvas, allowing for clear nutritional labeling and attractive shelf presence.

The growing use of recyclable PET and sustainable materials in bottle production has helped address environmental concerns while maintaining production efficiency. Advances in lightweight design and tamper-evident features are further supporting its popularity among manufacturers aiming fora balance between convenience and compliance.

Flavored electrolyte drinks are anticipated to hold a dominant 65.00% share of the market in 2025. This segment’s lead is being fueled by taste enhancement, increased consumer trial, and higher repeat purchase rates. Flavoring not only masks the natural saltiness of electrolytes but also offers a sensory appeal that encourages consistent hydration.

A wide variety of fruit-inspired, herbal, and exotic blends has broadened the segment’s demographic reach from athletes to casual health-conscious consumers. Functional flavors that promote energy, relaxation, or immunity are gaining traction, contributing to value-added differentiation.

Brands are leveraging seasonal and limited-edition flavors to maintain consumer interest and create urgency-driven purchases. The emphasis on natural and sugar-free flavoring agents is also helping meet health standards while keeping palatability high.

The electrolyte drinks market has expanded significantly due to increasing consumer focus on hydration, physical performance, and wellness. These drinks are formulated to replenish essential minerals such as sodium, potassium, magnesium, and calcium lost through sweating and physical activity. Their adoption has been fueled by rising participation in sports, fitness activities, and outdoor recreation. Moreover, growing awareness of dehydration risks among various age groups has expanded the consumer base. Product innovation has introduced options tailored to different needs, including low-calorie, natural ingredient, and functional formulations that support energy, recovery, and immune health. Distribution channels have diversified, with strong presence in convenience stores, gyms, pharmacies, and online platforms. The market continues to evolve with the integration of clean-label trends and consumer demand for transparency in ingredient sourcing.

Athletes and fitness enthusiasts have been primary consumers of electrolyte drinks, utilizing them to maintain optimal hydration and electrolyte balance during and after exercise. The development of scientifically backed formulations has enhanced consumer trust and product efficacy. Electrolyte drinks have been designed to improve endurance, prevent cramps, and accelerate recovery, making them integral to sports nutrition regimes. Marketing efforts targeting active lifestyles and performance enhancement have increased product visibility and acceptance. Sponsorship of sporting events and collaborations with fitness influencers have also contributed to market expansion. Additionally, customized hydration solutions for endurance sports such as running, cycling, and triathlons have emerged, catering to specific electrolyte replenishment needs during prolonged physical exertion.

Innovations in formulation and packaging have broadened the appeal of electrolyte drinks beyond traditional sports consumers. Natural and organic ingredients, reduced sugar content, and added vitamins or adaptogens have addressed growing health-consciousness among consumers. Ready-to-drink formats, powders, and concentrates have provided convenience and dosing flexibility. Some products have been developed to support immune function, digestive health, and mental clarity, expanding their usage occasions. Flavor variety and clean-label claims have attracted a wider demographic, including older adults and individuals with active daily routines. Sustainability efforts, such as eco-friendly packaging and responsibly sourced ingredients, have also influenced purchasing decisions. These innovations have enabled electrolyte drinks to compete with other functional beverages in the broader health and wellness category.

The availability of electrolyte drinks across multiple retail channels has supported market growth. Traditional outlets such as supermarkets, convenience stores, and specialty health shops have maintained strong sales. Increasing presence in gyms, sports facilities, and vending machines has enhanced product accessibility to target consumers. The rise of e-commerce platforms has allowed direct-to-consumer sales, subscription models, and personalized product offerings. Online marketing strategies, including social media campaigns and influencer partnerships, have increased brand engagement and consumer education. Geographic expansion into emerging markets has been facilitated by digital distribution channels, overcoming limitations of physical retail infrastructure. As a result, market reach and consumer convenience have been significantly enhanced, driving broader adoption across diverse populations.

Regulations governing ingredient safety, labeling, and health claims have influenced product development and marketing strategies within the electrolyte drinks market. Compliance with food and beverage standards in different regions has required rigorous quality control and accurate nutrient profiling. Consumer demand for transparency has pushed manufacturers to disclose ingredient sources, nutritional content, and manufacturing practices. Third-party certifications, such as organic, non-GMO, and allergen-free labels, have been utilized to build consumer confidence. However, discrepancies in regulatory frameworks across countries have posed challenges for global product launches. Continued emphasis on clean-label formulations and transparent communication is expected to shape competitive positioning and consumer loyalty within the electrolyte drinks sector.

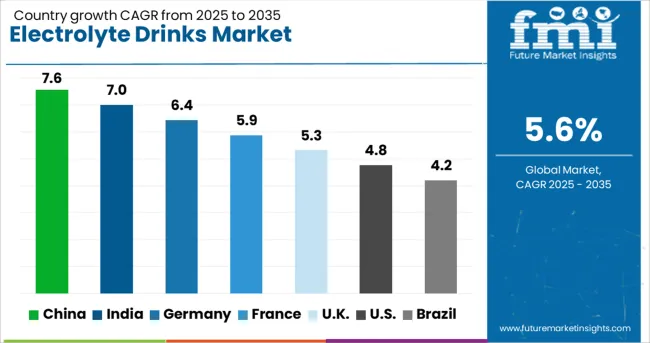

| Country | CAGR |

|---|---|

| China | 7.6% |

| India | 7.0% |

| Germany | 6.4% |

| France | 5.9% |

| UK | 5.3% |

| USA | 4.8% |

| Brazil | 4.2% |

The market is expected to grow at a CAGR of 5.6% from 2025 to 2035, driven by rising health consciousness, increasing sports participation, and demand for hydration solutions. China leads with a 7.6% CAGR, supported by expanding sports nutrition segments and beverage innovations. India follows at 7.0%, fueled by growing fitness trends and urban consumer adoption. Germany, with a 6.4% growth rate, benefits from health-focused formulations and expanding retail penetration. The UK, growing at 5.3%, experiences steady demand from athletes and wellness enthusiasts. The USA, with 4.8% CAGR, is influenced by functional beverage trends and growing consumption in active lifestyle segments. This report includes insights on 40+ countries; the top markets are shown here for reference.

China is anticipated to expand at a CAGR of 7.6% between 2025 and 2035 in the electrolyte drinks market, driven by rising health awareness and increased participation in fitness and endurance sports. Local beverage companies are launching enhanced hydration products formulated with vitamins and minerals tailored to regional preferences. Distribution through convenience stores, gyms, and e-commerce platforms has widened significantly. The demand for functional beverages with natural ingredients is shaping product development strategies. Key players such as Wahaha and Nongfu Spring are investing in product innovation and marketing campaigns targeting younger consumers.

India is forecasted to grow at a CAGR of 7.0% in the electrolyte drinks market, supported by growing interest in sports nutrition and physical fitness. Local brands and international entrants are introducing affordable electrolyte formulations targeting athletes and active youth. Distribution expansion in tier two and tier three cities is increasing availability. Partnerships with sports events and fitness centers are enhancing brand visibility. Rising demand for sugar-free and low-calorie variants is influencing product portfolios.

Germany is expected to grow at a CAGR of 6.4% in the electrolyte drinks market, driven by consumer preference for natural and organic ingredients. Beverage manufacturers are focusing on clean label formulations free from artificial additives and preservatives. Functional claims such as improved recovery and immune support are increasingly highlighted in marketing. Health food stores and organic supermarkets are key distribution channels. Collaborations between ingredient suppliers and beverage producers are fostering innovation.

The United Kingdom is projected to grow at a CAGR of 5.3% in the electrolyte drinks market, driven by premiumization trends and consumer demand for innovative flavors and packaging. High-end sports nutrition brands are introducing customized electrolyte blends targeting endurance athletes and active professionals. Online direct-to-consumer sales and specialty sports retailers are key growth channels. Focus on sustainability in packaging and ingredient sourcing is becoming important for consumer acceptance.

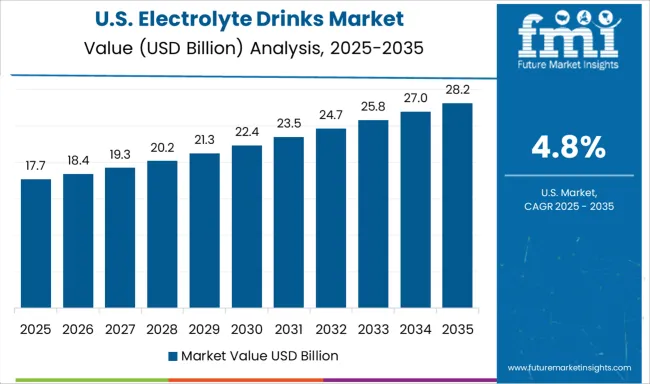

The United States is anticipated to grow at a CAGR of 4.8% in the electrolyte drinks market, with innovation in functional ingredients such as adaptogens and antioxidants enhancing product appeal. Sports endorsements and partnerships with professional athletes are increasing brand credibility. Retail expansion in health and convenience stores is supporting availability. The trend toward low-sugar and clean label formulations continues to influence product development.

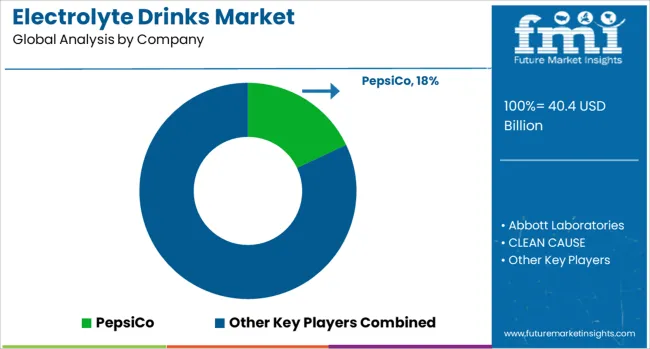

The market caters to consumers seeking hydration solutions that replenish essential minerals lost through sweat during physical activity or illness. Demand is driven by increasing health awareness, fitness trends, and the need for rapid rehydration in sports, medical, and wellness contexts. Product differentiation hinges on formulation accuracy, taste profiles, ingredient transparency, and convenience of consumption formats such as powders, ready-to-drink bottles, and tablets. PepsiCo and Coca-Cola leverage their extensive beverage portfolios and distribution networks to promote electrolyte-enhanced products targeting mainstream and sports consumers. Abbott Laboratories focuses on scientifically formulated medical-grade hydration solutions designed for clinical and recovery applications.

Kraft Heinz integrates electrolyte formulations into functional beverages emphasizing natural ingredients and flavor variety. Brands like Liquid IV, Nuun, and Nooma emphasize clean-label ingredients and innovative delivery systems that appeal to lifestyle consumers seeking plant-based or low-sugar options. Hydralyte specializes in oral rehydration solutions backed by clinical research to treat dehydration caused by illness. CLEAN CAUSE combines social impact with health products, offering electrolyte drinks that support addiction recovery programs. PURE Sports Nutrition targets professional athletes with performance-driven hydration formulations. Market growth is supported by product innovation, expanded retail channels including e-commerce, and increasing consumer preference for healthier alternatives to traditional sports drinks. Companies investing in clinical validation and transparent marketing are poised to build consumer trust and capture expanding demand across diverse demographics.

| Item | Value |

|---|---|

| Quantitative Units | USD 40.4 Billion |

| Product Type | Ready to drink, Tablets, Powder, and Others |

| Packaging | Bottle, Can, and Pouch |

| Flavour | Flavored and Unflavored |

| Distribution Channel | Offline and Online |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | PepsiCo, Abbott Laboratories, CLEAN CAUSE, Coca-Cola, Hydralyte, Kraft Heinz, Liquid IV, Nooma, Nuun, and PURE Sports Nutrition |

| Additional Attributes | Dollar sales by formulation type and distribution channel, demand dynamics across sports nutrition, healthcare hydration, and functional beverages, regional trends in consumption across North America, Europe, and Asia-Pacific, innovation in natural ingredient blends, sugar-free and electrolyte-enhanced water products, and smart packaging with hydration tracking, environmental impact of packaging waste, water usage, and production energy, and emerging use cases in personalized hydration, clinical nutrition support, and endurance athlete performance optimization. |

The global electrolyte drinks market is estimated to be valued at USD 40.4 billion in 2025.

The market size for the electrolyte drinks market is projected to reach USD 69.7 billion by 2035.

The electrolyte drinks market is expected to grow at a 5.6% CAGR between 2025 and 2035.

The key product types in electrolyte drinks market are ready to drink, tablets, powder and others.

In terms of packaging, bottle segment to command 46.0% share in the electrolyte drinks market in 2025.

Explore Similar Insights

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA