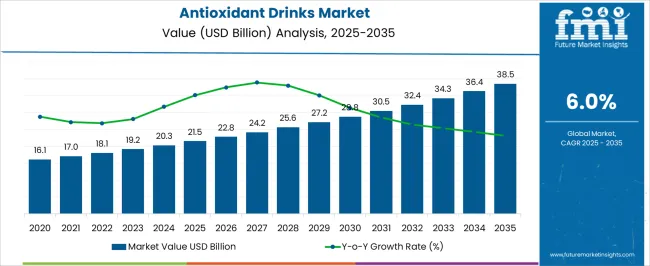

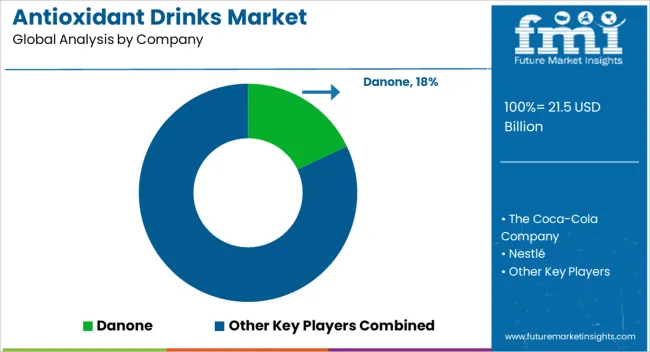

The antioxidant drinks market is estimated to be valued at USD 21.5 billion in 2025 and is projected to reach USD 38.5 billion by 2035, registering a compound annual growth rate (CAGR) of 6.0% over the forecast period.

Between 2021 and 2025, the market demonstrates steady expansion, rising from USD 16.1 billion in 2021 to USD 21.5 billion in 2025. This growth reflects increasing consumer preference for functional beverages that provide health benefits, particularly immunity support, anti-aging properties, and enhanced wellness. The early growth phase is supported by rising awareness of natural ingredients such as vitamins, polyphenols, and plant extracts, along with broader availability in retail and online channels. From 2021 to 2025, incremental increases are observed, with the market reaching USD 17.0 billion in 2022, USD 18.1 billion in 2023, USD 19.2 billion in 2024, and USD 20.3 billion prior to reaching USD 21.5 billion in 2025.

This phase reflects consistent compound growth as product innovations, convenient packaging formats, and expanded distribution channels gain traction among health-conscious consumers. Between 2025 and 2035, the market continues its upward trajectory, growing to USD 38.5 billion by 2035. Incremental annual growth from USD 22.8 billion in 2026 to USD 36.4 billion in 2034 underscores the sustained adoption of antioxidant beverages across diverse age groups and geographic regions.

| Metric | Value |

|---|---|

| Antioxidant Drinks Market Estimated Value in (2025 E) | USD 21.5 billion |

| Antioxidant Drinks Market Forecast Value in (2035 F) | USD 38.5 billion |

| Forecast CAGR (2025 to 2035) | 6.0% |

The antioxidant drinks market is influenced by several parent markets that collectively shape its growth and reach across consumer categories. The functional beverages market plays the most prominent role, with antioxidant drinks accounting for around 15-18% of this segment. Positioned as health-enhancing products, these beverages appeal to consumers seeking benefits beyond hydration, including improved immunity and reduced oxidative stress. The health and wellness food and beverages market contributes approximately 10-12% of the share, as more consumers incorporate antioxidant-enriched drinks into their wellness routines, reflecting rising interest in preventive health. The juice and flavored water market also supports demand, with antioxidant drinks representing about 8-10%.

Fruit-based beverages such as pomegranate juice, berry blends, and vitamin-infused waters fall into this category, increasing consumer accessibility and product visibility. The nutraceuticals market accounts for nearly 6-8% of the antioxidant drinks sector, since many of these beverages are fortified with vitamins, bioactive compounds, and botanical extracts, blurring the line between dietary supplements and conventional drinks. Finally, the sports and energy drinks market contributes around 5-7%, with athletes and fitness-oriented consumers embracing antioxidant drinks for recovery, muscle fatigue reduction, and enhanced endurance. Together, these parent markets underscore the multifaceted role of antioxidant drinks, combining elements of functionality, wellness, and performance.

The market is experiencing notable expansion as consumers increasingly prioritize beverages that deliver both hydration and functional health benefits. Rising awareness about oxidative stress and its link to chronic diseases has elevated the demand for products rich in natural antioxidants. This trend is being reinforced by growing interest in clean-label, plant-based, and nutrient-dense formulations, particularly among health-conscious demographics.

Advances in food processing technologies are enabling manufacturers to preserve bioactive compounds more effectively, ensuring that beverages retain their nutritional value throughout distribution. The market is further supported by the increasing adoption of preventive health approaches, where functional drinks play a prominent role in daily dietary routines.

With continuous product innovation, diversified flavor profiles, and strategic marketing around wellness benefits, the category is expected to expand its consumer base Regulatory encouragement for healthier food and beverage options is also contributing to the sector’s upward trajectory, paving the way for sustained growth across both mature and emerging markets.

The antioxidant drinks market is segmented by product type, source, product category, distribution channel, and geographic regions. By product type, antioxidant drinks market is divided into natural and fortified. In terms of source, antioxidant drinks market is classified into fruits, vegetable, herbs & botanicals, and others. Based on product category, antioxidant drinks market is segmented into RTD teas, fruits & vegetables, enhanced water, energy and sports drinks, functional coffee and cocoa beverages, Kombucha and fermented drinks, and others. By distribution channel, antioxidant drinks market is segmented into supermarkets & hypermarkets, cconvenience stores, speciality stores, online retail, food service, and others. Regionally, the antioxidant drinks industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

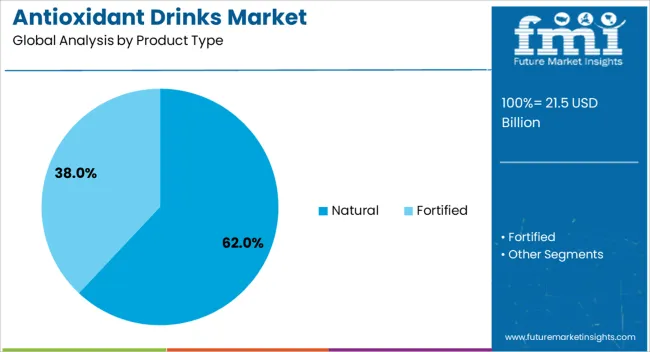

The natural product type segment is projected to hold 62% of the antioxidant drinks market revenue share in 2025, making it the leading category. Growth in this segment has been supported by consumer preference for beverages free from synthetic additives and artificial preservatives. Products formulated with natural ingredients are perceived as safer and more beneficial for long-term health, which has reinforced brand loyalty and repeat purchases. The availability of diverse raw materials from botanical, fruit, and herbal sources has provided manufacturers with flexibility to develop appealing flavors while maintaining clean-label standards. Furthermore, the growing influence of sustainability trends has driven interest in naturally sourced products that align with environmentally responsible production practices. The segment’s dominance has been strengthened by premium positioning, strategic retail placement, and effective communication of antioxidant benefits As demand for transparency in ingredient sourcing continues to rise, natural product types are expected to retain their competitive advantage in the market.

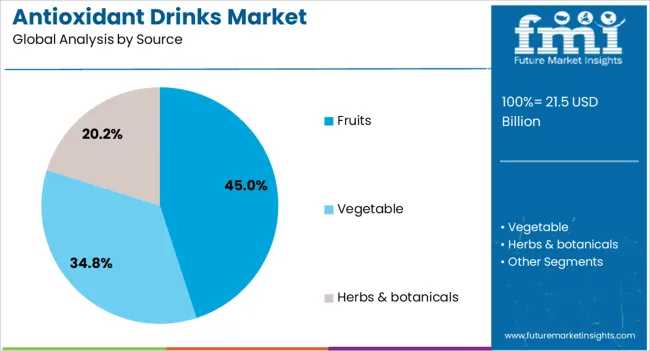

The fruits source segment is anticipated to account for 45% of the market revenue share in 2025, securing its position as the leading source category. This prominence has been achieved through the high concentration of naturally occurring antioxidants present in fruits, including vitamins, polyphenols, and flavonoids. The segment has benefited from consumer familiarity and trust in fruit-based beverages, which are associated with freshness, nutrition, and natural sweetness. Manufacturers have leveraged this perception by incorporating exotic and seasonal fruits to diversify portfolios and cater to evolving taste preferences. The ability of fruit-based drinks to be marketed as both indulgent and health-enhancing has further broadened their appeal across demographic groups. Technological advancements in cold-pressing, pasteurization, and packaging have ensured product stability without compromising nutritional integrity With growing emphasis on preventive health and immunity, fruit-derived antioxidant drinks are expected to maintain strong market leadership.

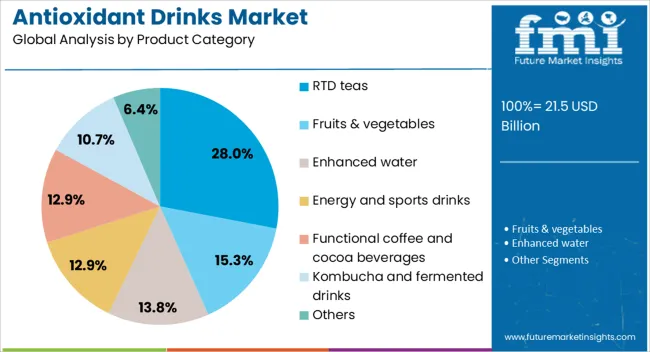

The RTD teas product category segment is projected to hold 28% of the market revenue share in 2025, establishing itself as a key growth driver. This leadership has been attributed to the natural antioxidant properties of tea, including catechins and polyphenols, which have been linked to numerous health benefits. The convenience of ready-to-drink formats has expanded accessibility, catering to busy lifestyles and on-the-go consumption patterns. The segment’s growth has also been reinforced by rising consumer interest in low-calorie, low-sugar beverage options that still deliver functional benefits. Innovation in flavors, including blends with herbs, spices, and fruits, has enhanced the appeal of RTD teas to a wider audience. Additionally, premium and specialty tea products have gained traction among consumers seeking both taste sophistication and health functionality Strong distribution through retail, e-commerce, and foodservice channels has supported this segment’s sustained performance in the competitive beverage market.

The antioxidant drinks market is gaining momentum as consumers increasingly seek functional beverages that support wellness and immunity. Natural extracts, botanicals, and fruit-based antioxidants are being integrated into a wide range of drink formats, supported by lifestyle-driven consumption patterns. While high production costs and ingredient sourcing challenges limit rapid penetration in some regions, innovation in flavors, sugar-free formulations, and convenient packaging are strengthening market potential. Expanding retail distribution, coupled with rising health awareness, is positioning antioxidant drinks as a preferred alternative to conventional beverages across global consumer bases.

Consumer lifestyles are shifting toward preventive health and wellness, creating strong demand for antioxidant drinks. These beverages, enriched with compounds from fruits, teas, herbs, and botanicals, are now widely consumed in daily routines as alternatives to traditional soft drinks. The association of antioxidants with improved immunity, detoxification, and vitality has made them appealing across age groups. In developed regions, high disposable incomes and greater awareness of nutritional benefits have accelerated adoption, while in developing areas, the growing middle class is embracing these drinks as part of healthier consumption habits. Functional beverages are replacing carbonated options, with antioxidant-based products being perceived as cleaner, more beneficial choices. This preference is strengthened by rising fitness culture, interest in weight management, and the expansion of wellness-focused lifestyles, positioning antioxidant drinks as key players within the broader functional beverage category.

Although consumer preference for antioxidant beverages is rising, manufacturers continue to face obstacles that restrain widespread market penetration. Production costs remain elevated due to the complexity of sourcing high-quality natural ingredients, such as herbal extracts, superfruits, and botanicals, which often depend on seasonal cycles and specific geographies. Fluctuations in agricultural yields and global supply disruptions can affect both availability and pricing, creating uncertainty for producers. Retaining the nutritional integrity of sensitive antioxidants during processing requires specialized technologies, which further increase expenses. Shelf life management of natural formulations also presents concerns, as these beverages often lack synthetic stabilizers, making them more vulnerable to spoilage. At the same time, regulatory authorities impose stricter scrutiny on health claims, which limits how aggressively brands can market benefits. Together, these factors raise challenges for affordability, creating barriers for smaller players and limiting growth in price-sensitive regions.

Innovation has emerged as a major force behind the expanding application of antioxidant drinks across multiple beverage categories. Beyond traditional juices, antioxidant compounds are increasingly integrated into ready-to-drink teas, sparkling waters, plant-based formulations, and functional wellness beverages. Flavor experimentation has gained momentum, with exotic blends and herbal infusions enhancing consumer appeal. Sugar-free, reduced-calorie, and clean-label options are particularly popular among health-conscious consumers who want convenience without compromising on taste. Portable packaging formats, such as cans, tetra packs, and single-serve bottles, are enabling on-the-go consumption, which fits well with busy modern lifestyles. Companies are also investing in research to improve the bioavailability of antioxidants, ensuring that health benefits are maximized. Opportunities are being created for innovative product positioning as multifunctional beverages, addressing hydration, immunity, and detoxification simultaneously. This diversification is expanding the consumer base and making antioxidant drinks relevant across multiple demographic and lifestyle segments.

Changing lifestyles and evolving retail strategies are critical trends shaping the antioxidant drinks market. Urban professionals, students, and younger demographics are particularly drawn to functional beverages that provide health benefits while fitting seamlessly into active daily routines. Online sales platforms have made antioxidant drinks widely accessible, while health-focused retail chains, supermarkets, and cafes are serving as key distribution hubs. Direct-to-consumer models and specialty wellness stores are also expanding brand visibility and creating stronger consumer engagement. Marketing strategies that emphasize natural origins, clean ingredients, and wellness benefits are resonating strongly with buyers. Social media campaigns and influencer-driven promotions further enhance consumer awareness and loyalty. The expansion of retail channels ensures that antioxidant drinks are not limited to niche outlets but are increasingly available across mainstream markets. This growing accessibility and lifestyle alignment are expected to reinforce demand and sustain long-term momentum for the category.

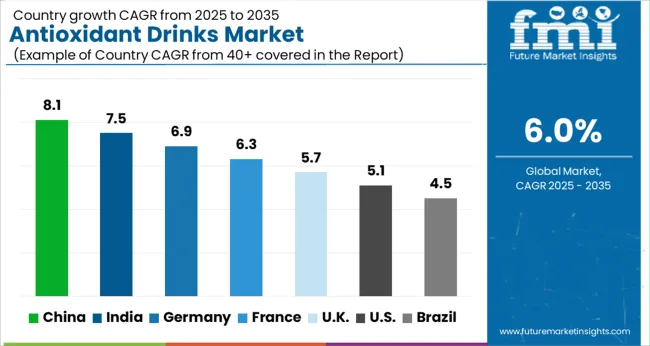

| Country | CAGR |

|---|---|

| China | 8.1% |

| India | 7.5% |

| Germany | 6.9% |

| France | 6.3% |

| UK | 5.7% |

| USA | 5.1% |

| Brazil | 4.5% |

The global antioxidant drinks market is projected to grow at a CAGR of 6.0% from 2025 to 2035. China leads with a growth rate of 8.1%, followed by India at 7.5%, and Germany at 6.9%. The United Kingdom and the United States show moderate growth at 5.7% and 5.1%, respectively. Growth across these regions is driven by consumer focus on health, innovation in beverage formulations, and the expansion of retail and online channels. The rising popularity of functional and premium beverages continues to shape the trajectory of antioxidant drinks worldwide. The analysis includes over 40+ countries, with the leading markets detailed below.

China is forecast to dominate the antioxidant drinks market with a CAGR of 8.1% from 2025 to 2035. Rising consumer focus on health and wellness is driving demand for functional beverages enriched with antioxidants. The expansion of middle-class income levels and growing awareness about dietary benefits are strengthening this market. E-commerce and modern retail outlets are playing a pivotal role in increasing access to these products across urban and semi-urban areas. Local manufacturers are investing in fruit-based formulations and herbal infusions to meet consumer preferences, while international brands are expanding their presence to capture this fast-growing segment.

The antioxidant drinks market in India is projected to expand at a CAGR of 7.5% between 2025 and 2035. The surge in demand is being supported by urbanization, changing dietary habits, and an increasing preference for functional drinks that offer health benefits. Local brands are introducing affordable formulations, while multinational players are investing in marketing campaigns targeting young consumers and working professionals. The rising penetration of modern retail formats and online grocery platforms enhances accessibility. Festivals and seasonal consumption trends also support the expansion of antioxidant beverage sales. India’s large youth population and growing awareness about immunity-boosting foods and drinks continue to drive demand.

Germany is projected to grow at a CAGR of 6.9% in the antioxidant drinks market from 2025 to 2035. The demand is driven by health-conscious consumers seeking beverages with natural ingredients and scientifically proven benefits. Germany’s well-established retail infrastructure supports wide availability of antioxidant drinks in supermarkets, hypermarkets, and specialty stores. Functional beverages enriched with vitamins, plant extracts, and superfruits are gaining popularity. Innovation in packaging formats and the rise of premium product categories are also shaping consumer choices. Germany’s aging population is another factor encouraging the consumption of beverages that promote vitality and wellbeing.

The United Kingdom’s antioxidant drinks market is expected to expand at a CAGR of 5.7% from 2025 to 2035. Growing consumer interest in wellness-focused beverages is boosting demand. Retailers are expanding their offerings in supermarkets and online platforms to cater to rising demand. The popularity of ready-to-drink formats and herbal teas enriched with antioxidants is contributing to sales. UK consumers are increasingly experimenting with new flavors and premium options, which has led to greater innovation among beverage companies. Marketing campaigns highlighting functional benefits such as energy-boosting, detoxification, and improved immunity are further accelerating growth.

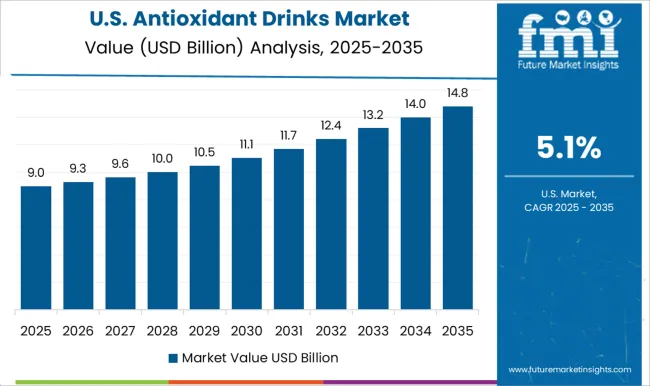

The USA antioxidant drinks market is forecast to grow at a CAGR of 5.1% from 2025 to 2035. Consumers are increasingly seeking beverages that offer functional health benefits beyond hydration, which supports growth in this segment. Demand for antioxidant-rich drinks is influenced by rising awareness of immunity and lifestyle-related health conditions. The presence of major beverage companies investing in marketing and product innovation is shaping the competitive landscape. Online grocery platforms, health stores, and supermarkets are expanding product visibility. Customizable drinks with added vitamins and plant-based ingredients are gaining traction among younger demographics and fitness enthusiasts.

In the antioxidant drinks market, competition is framed around product formulation, branding strength, and consumer health positioning. Danone leverages its expertise in functional beverages, offering antioxidant-rich drinks under its health-focused portfolio, particularly targeting markets where wellness trends drive consumption. The Coca-Cola Company competes through established brands and strategic extensions, introducing teas, juices, and functional water lines enriched with antioxidants to attract health-conscious consumers. Nestlé emphasizes science-backed formulations, incorporating natural extracts, vitamins, and plant-based ingredients in its beverage range, ensuring strong appeal among consumers seeking trusted nutritional benefits. Suntory Holdings differentiates through innovation in tea-based antioxidant drinks, with a focus on catechin-rich green tea products marketed heavily in Asia and increasingly in global markets.

Tata Consumer Products expands its competitive presence through herbal and fruit-based drinks, focusing on affordability and local adaptation to strengthen its share in emerging economies. Strategies emphasize portfolio diversification, targeted marketing, and partnerships with distribution networks to expand consumer reach. Danone prioritizes innovation in dairy-based and plant-derived antioxidant drinks, ensuring functional health claims resonate with diverse demographics. Coca-Cola utilizes its global bottling and retail network to position antioxidant drinks alongside mainstream beverages, driving volume growth through visibility. Nestlé invests in R&D to develop beverages with clean-label attributes, reduced sugar, and clinically validated antioxidant content.

Suntory continues to scale its green tea dominance, with global expansion aimed at leveraging Japanese tea expertise. Tata Consumer Products employs regionalized strategies, delivering cost-effective antioxidant beverages adapted to local flavor preferences. Product brochures highlight these approaches clearly. Danone presents probiotic and antioxidant-infused drinkable yogurts. Coca-Cola promotes antioxidant-enhanced teas and flavored waters. Nestlé emphasizes fortified drinks enriched with vitamins and botanicals. Suntory showcases catechin-focused green teas with strong functional claims. Tata highlights fruit-based antioxidant beverages tailored for affordability and daily consumption.

| Item | Value |

|---|---|

| Quantitative Units | USD 21.5 billion |

| Product Type | Natural and Fortified |

| Source | Fruits, Vegetable, Herbs & botanicals, and Others |

| Product Category | RTD teas, Fruits & vegetables, Enhanced water, Energy and sports drinks, Functional coffee and cocoa beverages, Kombucha and fermented drinks, and Others |

| Distribution Channel | Supermarkets & hypermarkets, Convenience stores, Speciality stores, Online retail, Food service, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Danone, The Coca-Cola Company, Nestlé, Suntory Holdings, and Tata Consumer Products |

| Additional Attributes | Dollar sales by product type (ready-to-drink, powdered mixes), ingredient type (fruit-based, botanical, herbal), and packaging (bottle, carton, pouch). Demand dynamics are driven by rising health awareness, increasing interest in functional beverages, and consumer preference for natural ingredients. Regional trends highlight strong growth in North America, Europe, and Asia-Pacific, supported by lifestyle shifts, retail expansion, and product innovation in antioxidant formulations. |

The global antioxidant drinks market is estimated to be valued at USD 21.5 billion in 2025.

The market size for the antioxidant drinks market is projected to reach USD 38.5 billion by 2035.

The antioxidant drinks market is expected to grow at a 6.0% CAGR between 2025 and 2035.

The key product types in antioxidant drinks market are natural, _natural (subcategory), fortified and _fortified (subcategory).

In terms of source, fruits segment to command 45.0% share in the antioxidant drinks market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Antioxidant Skincare Market Forecast Outlook 2025 to 2035

Antioxidant and Stabilizer Agents Market Size and Share Forecast Outlook 2025 to 2035

Antioxidant-Rich Skincare Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Antioxidants Cosmetic Market (Personal Care Actives) Analysis - Size and Share Forecast Outlook 2025 to 2035

Antioxidant-Rich Fruit Oils Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Antioxidant Premix Market Size and Share Forecast Outlook 2025 to 2035

Antioxidant-Rich Sea Buckthorn Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Antioxidants Market Size, Growth, and Forecast for 2025 to 2035

Antioxidants Reagent Market Analysis – Trends & Future Outlook 2024-2034

Food Antioxidant Market Size and Share Forecast Outlook 2025 to 2035

Food Antioxidants Market Analysis by Product, Application and Form Through 2035

Super Antioxidant Supplement Market Size and Share Forecast Outlook 2025 to 2035

Natural Antioxidant Market Size and Share Forecast Outlook 2025 to 2035

Phenolic Antioxidants Market Size and Share Forecast Outlook 2025 to 2035

Pet Food Antioxidants Market Size and Share Forecast Outlook 2025 to 2035

Vitamin E Antioxidant Creams Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Moringa Oil Antioxidants Market Size and Share Forecast Outlook 2025 to 2035

Animal Feed Antioxidants Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Tocopherol-Rich Antioxidants Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Blueberry Extract Antioxidants Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA