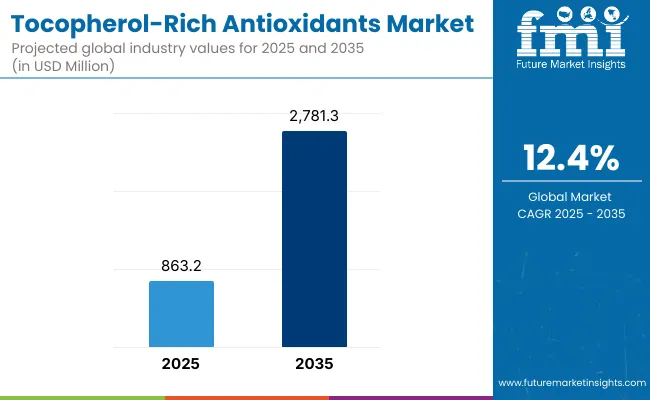

The Tocopherol-Rich Antioxidants Market is expected to record a valuation of USD 863.2 million in 2025 and USD 2,781.3 million in 2035, with an increase of USD 1,918.1 million, which equals a growth of nearly 222% over the decade. The overall expansion represents a CAGR of 12.4% and more than a 3X increase in market size.

Tocopherol-Rich Antioxidants Market Key Takeaways

| Metric | Value |

|---|---|

| Market Estimated Value in (2025E) | USD 863.2 million |

| Market Forecast Value in (2035F) | USD 2,781.3 million |

| Forecast CAGR (2025 to 2035) | 12.4% |

During the first five-year period from 2025 to 2030, the market increases from USD 863.2 million to USD 1,549.5 million, adding USD 686.3 million, which accounts for about 36% of the total decade growth. This phase records steady adoption in anti-aging skincare, dermatologist-tested antioxidant serums, and clean-label creams, driven by consumer concerns around photoaging, oxidative stress, and lifestyle-induced skin damage. Serums dominate this period as they cater to over 40% of consumer applications, offering lightweight delivery systems that maximize tocopherol absorption and efficacy.

The second half from 2030 to 2035 contributes USD 1,231.8 million, equal to 64% of total growth, as the market jumps from USD 1,549.5 million to USD 2,781.3 million. This acceleration is powered by widespread deployment of multifunctional antioxidant complexes, hybrid tocopherol-rich formulations combining vitamin C and ferulic acid, and personalized solutions via e-commerce channels. Oils and masks, once niche categories, capture greater attention due to demand for natural/organic and vegan claims. Subscription-driven e-commerce and AI-based skin diagnostics increase digital channel penetration, elevating e-commerce share to nearly 40% of the total market value by 2035.

From 2020 to 2024, the Tocopherol-Rich Antioxidants Market grew from a smaller niche category to a USD 800+ million market, driven by function-focused claims in anti-aging and free radical protection. During this period, the competitive landscape was dominated by prestige skincare brands controlling nearly 70% of revenue, with leaders such as SkinCeuticals, Estée Lauder, and L’Oréal focusing on science-backed tocopherol formulations for dermatology and premium consumers. Competitive differentiation relied on concentration levels, delivery technology, and packaging innovation, while mass retail brands leveraged price positioning and clean-label storytelling. Subscription services and online-exclusive launches had minimal traction, contributing less than 10% of the total market value.

Demand for tocopherol-rich antioxidants will expand beyond USD 860 million in 2025, and the revenue mix will shift as e-commerce and natural/vegan formulations grow to over 40% share. Traditional prestige leaders face rising competition from digital-first players offering dermatologist-tested formulations, eco-friendly sourcing, and algorithm-driven personalization. Major skincare conglomerates are pivoting to hybrid models, integrating refillable packaging, omni-channel retail strategies, and biotech-driven tocopherol derivatives to retain relevance. Emerging entrants specializing in clean-label serums, vitamin E oils with sustainable sourcing, and AR-powered beauty retail are gaining share. The competitive advantage is moving away from single-product innovation to ecosystem strength, authenticity, and digital channel agility.

Advances in skincare formulations have improved delivery of vitamin E (tocopherol) into dermal layers, allowing for more efficient antioxidant activity across diverse applications. Serums have gained popularity due to their ability to provide targeted treatment, enhanced absorption, and consumer trust in science-driven results. The rise of dermatologist-tested and clean-label claims has contributed to enhanced consumer acceptance, particularly in mature markets like the USA and Europe. Functional drivers such as anti-aging and UV damage repair are propelling adoption, especially among millennials and Gen Z consumers seeking preventative skincare.

Expansion of vegan and natural/organic formulations has fueled global demand, as consumers increasingly scrutinize ingredient sourcing and sustainability practices. Innovations in oils, lightweight creams, and brightening-focused masks are expected to open new application areas. Segment growth is expected to be led by anti-aging function, serum-based product types, and e-commerce channels, due to their ability to deliver transparency, efficacy, and convenience to end users.

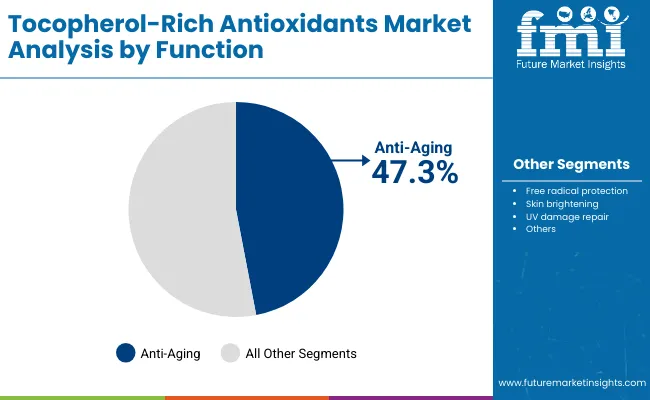

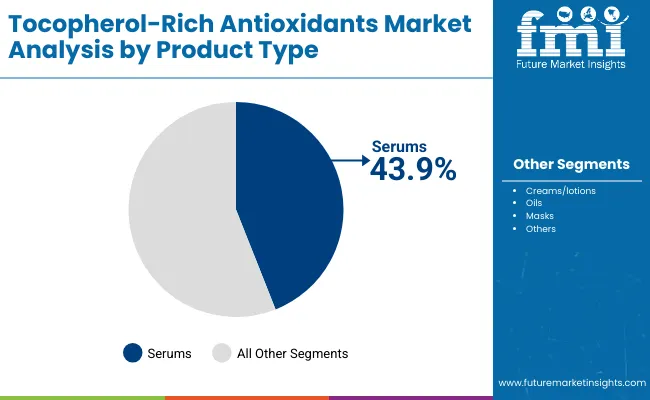

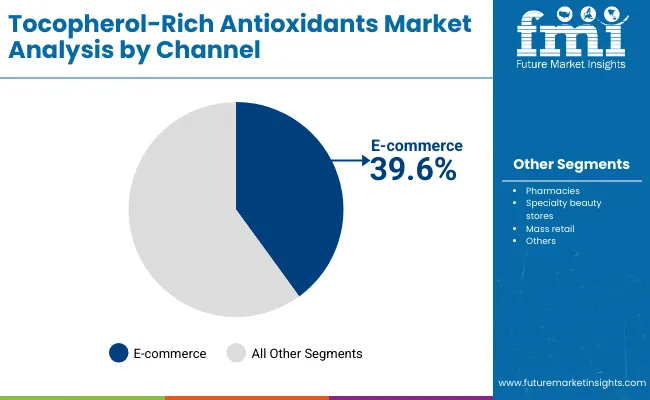

The market is segmented by function, product type, channel, claim, and geography. Functional segmentation includes anti-aging, free radical protection, skin brightening, and UV damage repair, reflecting diverse consumer needs. Product types span creams/lotions, serums, oils, and masks, capturing both mainstream and niche preferences. Distribution channels are divided into e-commerce, pharmacies, specialty beauty stores, and mass retail, with online growth outpacing offline formats. Claims such as natural/organic, vegan, dermatologist-tested, and clean-label form the core marketing narratives shaping consumer purchase decisions. Regionally, the scope spans North America, Europe, East Asia, South Asia & Pacific, Latin America, and the Middle East & Africa.

| Function Segment | Market Value Share, 2025 |

|---|---|

| Anti-aging | 47.3% |

| Others | 52.7% |

The anti-aging segment is projected to contribute 47.3% of the Tocopherol-Rich Antioxidants Market revenue in 2025, maintaining its lead as the dominant functional category. This is driven by ongoing consumer demand for wrinkle reduction, collagen protection, and prevention of oxidative stress caused by lifestyle and environmental factors. Tocopherol’s synergistic role with vitamin C and hyaluronic acid has amplified its relevance in age-defense formulations. The segment’s growth is also supported by early adoption trends among younger consumers who seek preventative anti-aging care.

As dermatologist endorsements and clinical trial-backed efficacy continue to influence purchase decisions, the anti-aging segment is expected to remain the backbone of the tocopherol-rich antioxidants industry.

| Product Type Segment | Market Value Share, 2025 |

|---|---|

| Serums | 43.9% |

| Others | 56.1% |

The serum segment is forecasted to hold 43.9% of the market share in 2025, led by its application in targeted antioxidant delivery. Serums are favored for their fast absorption, lightweight texture, and ability to deliver high concentrations of tocopherol directly into the skin. These products are ideal for premium skincare consumers seeking visible results and scientifically proven formulations.

Their rising popularity in Asia-Pacific and Europe is driven by K-beauty, J-beauty, and clean-label skincare trends. The segment’s growth is further bolstered by e-commerce platforms where serums dominate bestseller lists. With increasing digital marketing, influencer endorsements, and subscription models, serums are expected to continue their dominance in the market.

| Channel Segment | Market Value Share, 2025 |

|---|---|

| E-commerce | 39.6% |

| Others | 60.4% |

The e-commerce segment is projected to account for 39.6% of the Tocopherol-Rich Antioxidants Market revenue in 2025, establishing it as the fastest-growing distribution channel. Online platforms are preferred for their convenience, transparency, and access to product reviews, influencer recommendations, and subscription services.

Global players like L’Oréal and Estée Lauder have accelerated their digital-first strategies, while indie brands such as The Ordinary and Paula’s Choice rely heavily on direct-to-consumer and marketplace platforms. As consumer purchasing shifts increasingly toward mobile apps and online-exclusive launches, e-commerce is expected to maintain its upward trajectory, surpassing several offline channels by 2035.

Drivers

Rising Preventive Skincare Adoption Among Gen Z and Millennials

Younger consumers are entering the anti-aging market earlier than previous generations. In the USA, nearly 42% of Gen Z women under 25 already use antioxidant serums, with tocopherol (vitamin E) ranking as one of the most trusted ingredients due to its long history in dermatology. Unlike collagen or retinol, which are often associated with corrective skincare, tocopherol is positioned as a preventive solution that shields skin from oxidative stress caused by urban pollution, blue light exposure, and UV damage.

This driver is especially strong in East Asia, where beauty routines emphasize “prevention before cure.” Korean and Japanese skincare brands are amplifying tocopherol usage in hybrid products for example, sunscreens and brightening masks that integrate vitamin E as a daily-use staple. This generational shift ensures a longer consumer lifecycle for tocopherol-rich products, sustaining demand well beyond the luxury anti-aging demographic.

Expansion of E-commerce Subscriptions and D2C Personalization

Tocopherol-rich antioxidant products are benefiting from the rise of subscription-based beauty models, especially in North America and Europe. Platforms such as SkinCeuticals’ subscription refills and Paula’s Choice auto-delivery serums are reshaping consumer retention strategies. Tocopherol’s stable shelf life compared to some volatile actives makes it particularly well-suited for recurring delivery. In parallel, AI-driven skin diagnostics offered by brands like L’Oréal’s Perso enable personalized antioxidant routines where tocopherol is frequently recommended as a base-layer antioxidant. This blend of personalization with automated delivery is not only locking in brand loyalty but also raising the average order value as tocopherol-rich products are often positioned as “core routine essentials.”

Restraints

Supply Chain Volatility of Natural Tocopherol Sources

A large share of tocopherol is derived from soybean oil distillates, sunflower, and palm oil. In recent years, supply chain disruptions from South American soybean export restrictions to EU regulations on palm oil imports have created price volatility for natural tocopherol. While synthetic tocopherol is available, consumers increasingly prefer “plant-derived” labels, especially in Europe where over 55% of consumers check origin claims. This dependence on agricultural inputs exposes manufacturers to commodity price fluctuations, climate change impacts, and geopolitical instability, all of which can significantly raise raw material costs and compress margins.

High Competition from Emerging Antioxidant Actives

Although tocopherol is an established antioxidant, it faces stiff competition from newer antioxidant technologies such as resveratrol, astaxanthin, and niacinamide. Many premium brands are reformulating to showcase these “novel actives” in their marketing, often relegating tocopherol to a secondary role. For instance, in Japan, astaxanthin-based products are now outselling vitamin E oils in certain retail chains due to stronger redox claims. In the USA, niacinamide serums have surged to the top of Amazon’s skincare sales rankings, overshadowing tocopherol-based equivalents. This creates a perception risk where consumers may consider tocopherol “old-fashioned,” forcing brands to innovate with tocopherol blends or risk losing relevance.

Key Trends

Hybrid Formulations with Tocopherol Synergies

A major trend shaping the market is the formulation of tocopherol with synergistic antioxidants, especially vitamin C and ferulic acid. This “antioxidant triad” not only enhances stability but also provides broad-spectrum protection against UV and pollution damage, a claim increasingly demanded by urban consumers. Brands like SkinCeuticals popularized this format with their C E Ferulic Serum, which now represents one of the highest-selling tocopherol-based products globally. The trend is expanding into mass retail and indie brands, leading to a wave of “multi-antioxidant blends” marketed for daily defense. By 2030, formulations with tocopherol as part of a multi-active complex are expected to account for over 60% of total serum launches.

Growth of Vegan and Upcycled Tocopherol Ingredients

Sustainability concerns are transforming tocopherol sourcing. Instead of petrochemical or palm oil derivatives, brands are turning toward upcycled tocopherol from wheat germ oil waste, grape seeds, and sunflower by-products. Indie labels such as Derma E are already marketing tocopherol-rich products sourced exclusively from non-GMO, plant-based inputs. Meanwhile, European consumers increasingly demand vegan-certified antioxidants, with the vegan skincare market projected to grow at 15% CAGR outpacing the overall category. The combination of vegan, upcycled, and clean-label claims is elevating tocopherol’s image from a “basic antioxidant” to a sustainable hero ingredient, particularly appealing to Gen Z and millennial consumers who link skincare purchases with ethical values.

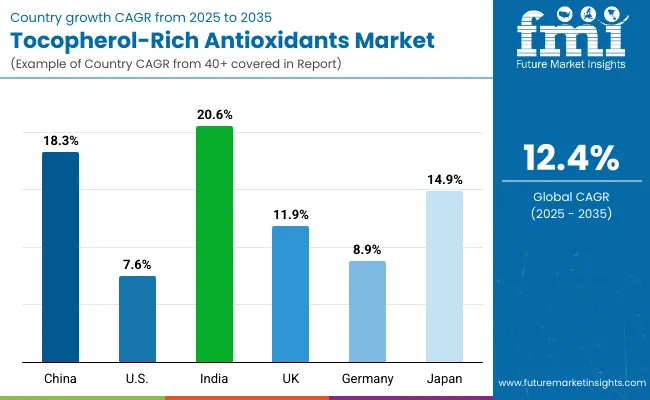

| Countries | Estimated CAGR (2025 to 2035) |

|---|---|

| China | 18.3% |

| USA | 7.6% |

| India | 20.6% |

| UK | 11.9% |

| Germany | 8.9% |

| Japan | 14.9% |

The Tocopherol-Rich Antioxidants Market shows strong geographic variation in growth rates, reflecting differences in consumer behavior, economic dynamics, and skincare adoption patterns. India (20.6% CAGR) and China (18.3% CAGR) are projected to be the fastest-growing markets, fueled by rising disposable incomes, expanding middle-class demographics, and the rapid urbanization that intensifies concerns over pollution and UV exposure.

In these countries, e-commerce is enabling access to premium international brands while local players are launching affordable tocopherol-rich serums and oils, making the ingredient accessible across income brackets. Japan (14.9% CAGR) also stands out, driven by its advanced beauty culture and high adoption of antioxidant serums within J-beauty routines. The emphasis on long-term skin health and scientific efficacy is pushing tocopherol demand into both premium and mass segments, especially as hybrid vitamin E + vitamin C formulations gain popularity.

By contrast, mature markets like the USA (7.6% CAGR), Germany (8.9% CAGR), and the UK (11.9% CAGR) are expected to record slower yet steady growth, constrained by high competitive saturation and established consumer routines. However, even within these developed regions, tocopherol continues to benefit from clean-label, vegan, and dermatologist-tested positioning, which appeals to health-conscious and sustainability-driven consumers.

In Europe, regulatory support for natural and non-synthetic formulations is shaping product pipelines, while in the USA, subscription-driven e-commerce and clinical positioning are sustaining momentum. The UK’s relatively higher growth compared to Germany and the USA highlights the strong role of digital-first beauty retail and influencer-driven marketing in shaping consumer choices. Together, these dynamics indicate that Asia-Pacific will be the growth engine, while North America and Europe will serve as steady-value anchors for the tocopherol-rich antioxidants industry.

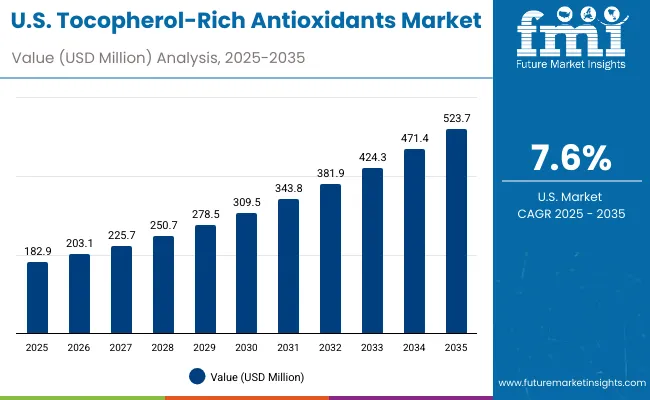

| Year | USA Tocopherol-Rich Antioxidants Market (USD Million) |

|---|---|

| 2025 | 182.9 |

| 2026 | 203.1 |

| 2027 | 225.7 |

| 2028 | 250.7 |

| 2029 | 278.5 |

| 2030 | 309.5 |

| 2031 | 343.8 |

| 2032 | 381.9 |

| 2033 | 424.3 |

| 2034 | 471.4 |

| 2035 | 523.7 |

The Tocopherol-Rich Antioxidants Market in the United States is projected to grow at a CAGR of 7.6%, led by strong adoption of anti-aging serums, dermatologist-tested formulations, and subscription-based e-commerce models. Clinical positioning remains a core driver, with dermatologists and skincare professionals recommending tocopherol-rich products as foundational antioxidants. Growth is also supported by premium and mid-tier consumers demanding multifunctional solutions that combine tocopherol with vitamin C and ferulic acid for UV protection and free radical defense. Clean-label and vegan claims are gaining traction in retail chains, while digital-first brands are using influencer-driven campaigns to capture younger demographics. The integration of refillable packaging and hybrid formulations is creating opportunities for hardware-software-like bundling models, where product + subscription services fuel long-term loyalty.

The Tocopherol-Rich Antioxidants Market in the United Kingdom is expected to grow at a CAGR of 11.9%, supported by strong adoption of e-commerce skincare sales, vegan formulations, and heritage beauty retailing. Premium brands are expanding their tocopherol portfolios with dermatologist-tested serums and creams designed to address both oxidative stress and pollution-induced skin aging. Digital beauty retailers and department stores are prioritizing clean-label tocopherol serums as part of their sustainability and transparency agendas. Heritage-focused British brands are blending tocopherol with botanicals, positioning them as eco-luxury skincare solutions. Public-private innovation programs around sustainable sourcing and consumer education are fueling growth.

India is witnessing rapid growth in the Tocopherol-Rich Antioxidants Market, which is forecast to expand at a CAGR of 20.6% through 2035, the highest globally. A sharp increase in serum and oil launches is being driven by tier-2 and tier-3 city adoption, where affordability and natural sourcing are major consumer priorities. Indian consumers are embracing tocopherol-rich products as part of preventive skincare regimens, particularly for UV and pollution defense. Domestic beauty brands are leveraging Ayurveda-inspired clean-label storytelling to integrate tocopherol into creams and brightening masks. Rising disposable incomes and social media influence are fueling awareness, while cross-border e-commerce imports from global brands further expand consumer choice.

| Countries | 2025 Share (%) |

|---|---|

| USA | 21.2% |

| China | 10.8% |

| Japan | 6.3% |

| Germany | 13.9% |

| UK | 7.3% |

| India | 4.4% |

| Countries | 2035 Share (%) |

|---|---|

| USA | 18.8% |

| China | 11.7% |

| Japan | 7.6% |

| Germany | 12.1% |

| UK | 6.6% |

| India | 5.4% |

The Tocopherol-Rich Antioxidants Market in China is expected to grow at a CAGR of 18.3%, among the highest globally. This momentum is driven by urban pollution concerns, smart retail channels, and competitive innovation from domestic and K-beauty inspired brands. Tocopherol-rich serums are gaining traction in Tier 1 and Tier 2 cities, where consumers demand multifunctional brightening and anti-aging solutions. Local beauty firms are producing affordable tocopherol formulations, fueling mass adoption, while global players focus on premium hybrid products that combine tocopherol with vitamin C for enhanced efficacy. Municipal support for clean-label cosmetics, alongside livestream e-commerce channels, is accelerating product uptake across the middle class.

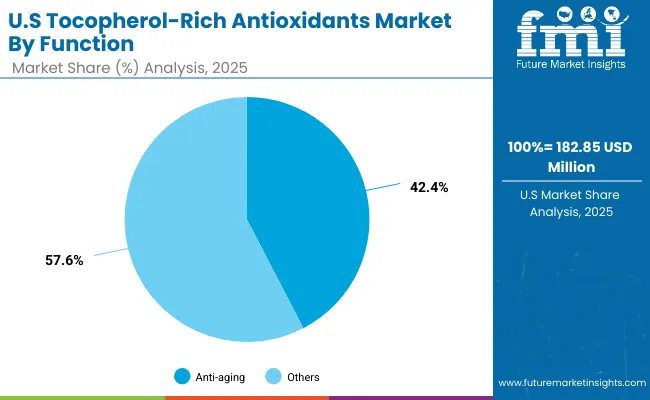

| Function Segment | Market Value Share, 2025 |

|---|---|

| Anti-aging | 42.4% |

| Others | 57.6% |

The Tocopherol-Rich Antioxidants Market in the United States is valued at USD 182.85 million in 2025, with anti-aging products leading at 42.4%, followed by other functions at 57.6%. The dominance of anti-aging is closely tied to the maturity of the USA skincare industry, where clinical positioning, dermatologist endorsements, and strong consumer demand for wrinkle-prevention serums drive adoption. High penetration of subscription-based e-commerce, combined with clean-label and dermatologist-tested claims, has made tocopherol a household name across premium and mid-tier brands. The presence of major players such as SkinCeuticals, Estée Lauder, and Paula’s Choice reinforces this dominance by promoting vitamin E as a clinically validated, essential antioxidant for preventative skincare.

This advantage positions anti-aging tocopherol serums and creams as essential products in USA daily skincare regimens, particularly among millennials and Gen Z consumers who are embracing “early anti-aging.” Other functions such as UV protection and skin brightening remain important but secondary, often positioned as multi-benefit add-ons rather than primary purchase drivers. As subscription models expand and dermatologist-tested claims continue to dominate brand marketing, the anti-aging segment will solidify its role as the anchor of tocopherol adoption in the United States.

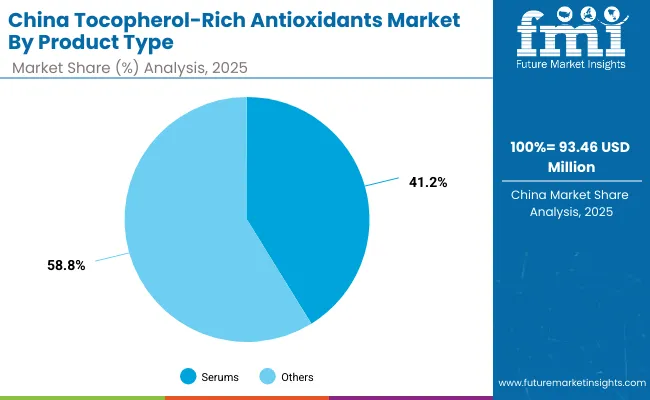

| Product Type Segment | Market Value Share, 2025 |

|---|---|

| Serums | 41.2% |

| Others | 58.8% |

The Tocopherol-Rich Antioxidants Market in China is valued at USD 93.46 million in 2025, with serums leading at 41.2%, followed by other product types at 58.8%. The strong dominance of serums reflects China’s fast-growing urban middle class, where consumers seek lightweight, fast-absorbing, and multifunctional products that combine tocopherol with vitamin C or niacinamide. The rise of K-beauty and J-beauty influences has fueled demand for targeted formulations, making serums the entry point for antioxidant-based skincare. Affordable tocopherol-rich serums from domestic brands are complementing premium imports, creating a wide spectrum of choices across e-commerce platforms such as Tmall and JD.com.

Serums’ dominance is reinforced by livestream e-commerce, influencer campaigns, and AI-powered digital retail platforms that prioritize serums as bestsellers in beauty categories. Oils and masks are also emerging but remain secondary, appealing primarily to natural/organic and wellness-driven consumers. As government support for clean-label beauty grows and consumer awareness of urban pollution-related skin stress intensifies, serums will continue to dominate as the core vehicle for tocopherol delivery in China’s skincare market.

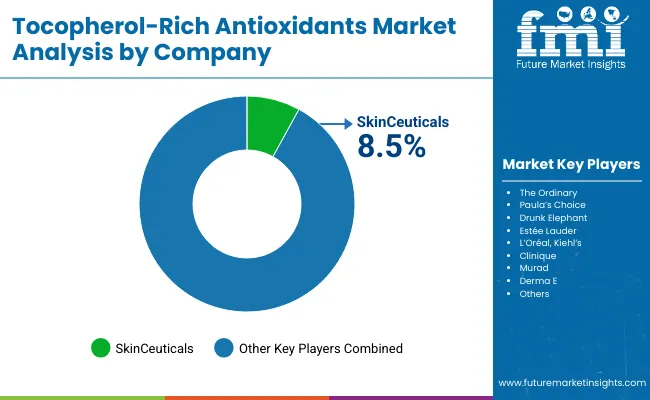

The Tocopherol-Rich Antioxidants Market is moderately fragmented, with global leaders, regional specialists, and indie digital-first brands competing across multiple skincare categories. Prestige skincare leaders such as SkinCeuticals, Estée Lauder, and L’Oréal hold significant share, driven by advanced tocopherol-serum formulations, clinical validation, and strong penetration in dermatology-backed retail channels. Their strategies increasingly emphasize multi-antioxidant blends, clinical trial-backed claims, and subscription-based e-commerce expansion to maintain consumer trust and loyalty.

Mid-sized innovators, including Paula’s Choice, Drunk Elephant, and The Ordinary, are capturing younger demographics through vegan, clean-label, and affordable serum launches. Their rise is supported by influencer-driven marketing, D2C strategies, and transparent ingredient labeling, which have made them highly competitive in both mature and emerging markets. Indie and natural-focused players such as Derma E and Murad specialize in plant-derived tocopherol oils and eco-friendly packaging, positioning themselves in the sustainability-driven segment of the market.

Competitive differentiation is shifting away from single-ingredient formulations toward ecosystem strength, where AI-powered personalization, hybrid product bundles, and clean-label sourcing narratives define consumer preference. By 2030, global leaders are expected to rely less on hardware-like “hero serums” and more on integrated systems combining tocopherol-based skincare, refillable packaging, and subscription models as the foundation of competitive advantage.

Key Developments in Tocopherol-Rich Antioxidants Market

| Item | Value |

|---|---|

| Quantitative Units | USD 863.2 million |

| Function | Anti-aging, Free radical protection, Skin brightening, and UV damage repair |

| Product Type | Creams/lotions, Serums, Oils, and Masks |

| Channel | E-commerce, Pharmacies, Specialty beauty stores, and Mass retail |

| Claim | Natural/organic, Vegan, Dermatologist-tested, and Clean-label |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | The Ordinary, SkinCeuticals, Paula’s Choice, Drunk Elephant, Estée Lauder, L’Oréal, Kiehl’s, Clinique, Murad, and Derma E |

| Additional Attributes | Dollar sales by function, product type, and channel, adoption trends in anti-aging and brightening skincare, rising demand for vegan and dermatologist-tested claims, segment-specific growth in serums and e-commerce, integration of tocopherol with other antioxidants (vitamin C and ferulic acid), regional trends influenced by K-beauty and clean-label movements, and innovations in upcycled and biotech-derived tocopherol sourcing. |

The Tocopherol-Rich Antioxidants Market is estimated to be valued at USD 863.2 million in 2025.

The market size for the Tocopherol-Rich Antioxidants Market is projected to reach USD 2,781.3 million by 2035.

The Tocopherol-Rich Antioxidants Market is expected to grow at a 12.4% CAGR between 2025 and 2035.

The key product types in the Tocopherol-Rich Antioxidants Market are creams/lotions, serums, oils, and masks.

In terms of function, the anti-aging segment is projected to command 47.3% share in the Tocopherol-Rich Antioxidants Market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Antioxidants Cosmetic Market (Personal Care Actives) Analysis - Size and Share Forecast Outlook 2025 to 2035

Antioxidants Market Size, Growth, and Forecast for 2025 to 2035

Antioxidants Reagent Market Analysis – Trends & Future Outlook 2024-2034

Food Antioxidants Market Analysis by Product, Application and Form Through 2035

Phenolic Antioxidants Market Size and Share Forecast Outlook 2025 to 2035

Pet Food Antioxidants Market Size and Share Forecast Outlook 2025 to 2035

Moringa Oil Antioxidants Market Size and Share Forecast Outlook 2025 to 2035

Animal Feed Antioxidants Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Blueberry Extract Antioxidants Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA