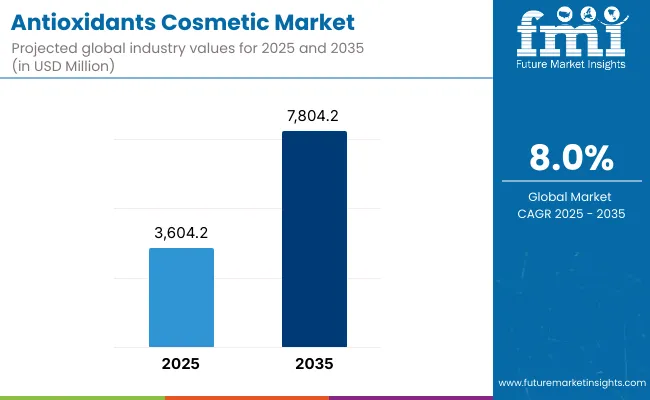

The Antioxidants Cosmetic Market (Personal Care Actives) is expected to record a valuation of USD 3,604.2 million in 2025 and USD 7,804.2 million in 2035, with an increase of USD 4,200 million, which equals a growth of 116.5% over the decade. The overall expansion represents a CAGR of 8.0% and more than a 2X increase in market size.

Antioxidants Cosmetic Market (Personal Care Actives) Key Takeaways

| Metric | Value |

|---|---|

| Antioxidants Cosmetic Market (Personal Care Actives) Estimated Value in (2025E) | USD 3,604.2 million |

| Antioxidants Cosmetic Market (Personal Care Actives) Forecast Value in (2035F) | USD 7,804.2 million |

| Forecast CAGR (2025 to 2035) | 8.0% |

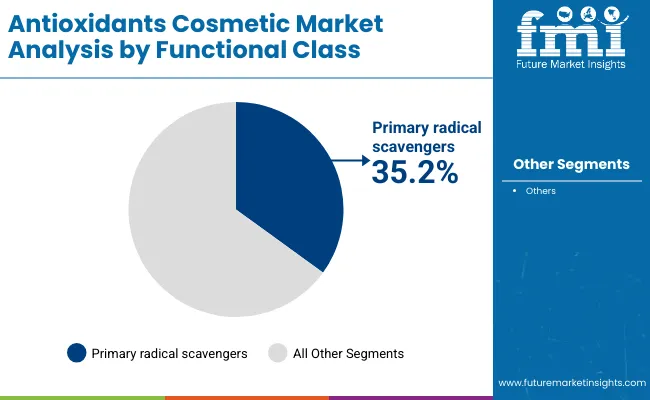

During the first five-year period from 2025 to 2030, the market increases from USD 3,604.2 million to USD 5,303.6 million, adding USD 1,699.4 million, which accounts for nearly 40% of the total decade growth. This phase records steady adoption in leave-on skincare, sun care, and premium cosmetic bases, driven by the need for photoprotection, anti-aging, and everyday oxidative stress defense. Primary radical scavengers dominate this period as they cater to over 35% of all formulations, being integral to preventing free radical damage and oxidative skin stress. Encapsulation technologies steadily scale in this period, particularly in premium sun care, to stabilize sensitive botanical and biotech-derived actives.

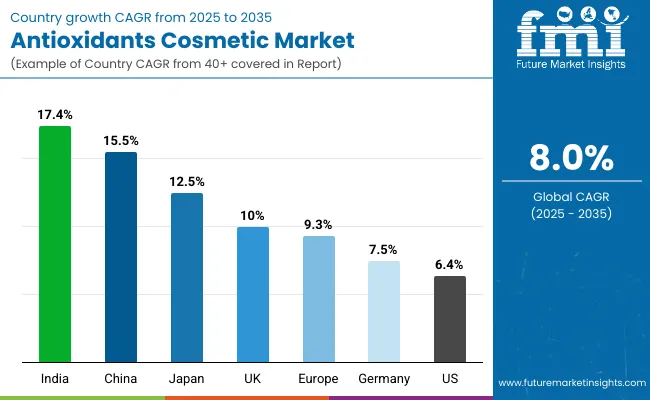

The second half from 2030 to 2035 contributes USD 2,500.6 million, equal to 60% of total growth, as the market jumps from USD 5,303.6 million to USD 7,804.2 million. This acceleration is powered by the widespread deployment of encapsulated antioxidant systems, oil-dispersed concentrates, and multifunctional blends across skincare and color cosmetics. Growth is particularly strong in Asia-Pacific, led by India (CAGR 17.4%) and China (CAGR 15.5%), where consumers demand botanical antioxidants with localized cultural resonance. Biotechnology-derived and marine actives also capture share in Japan and Europe as premium anti-glycation and photostabilizer systems gain traction.

From 2020 to 2024, the Antioxidants Cosmetic Market (Personal Care Actives) grew from hardware-centric synthetic adoption to broader botanical and encapsulated solutions, establishing a foundation for 2X expansion in the next decade. During this period, the competitive landscape was dominated by European and USA ingredient giants such as DSM-Firmenich, BASF, and Croda, who controlled nearly all supply, focusing on synthetic and semi-synthetic antioxidants for mass-market skincare and sun care. Differentiation relied on chemical stability, solubility, and regulatory compliance, while botanical and biotech-derived actives were still niche. Marine-derived antioxidants and encapsulated systems were at an early stage, contributing less than 10% of the total market value.

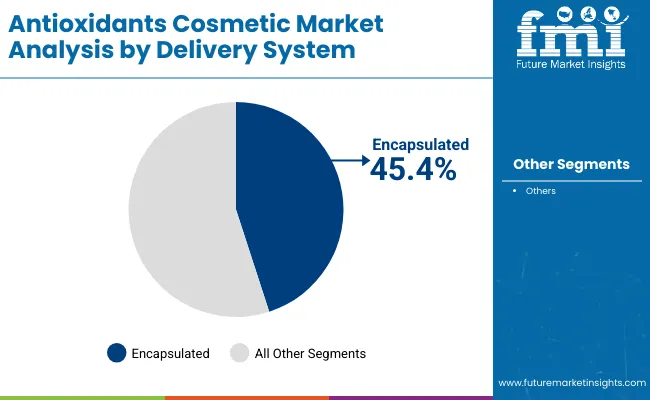

Demand for antioxidants in personal care will expand to USD 3,604.2 million in 2025, and the revenue mix will shift as botanical sourcing and encapsulated systems grow to over 45% share. Traditional synthetic antioxidant leaders face rising competition from botanical suppliers and biotech-driven startups offering microencapsulation, fermentation-based antioxidants, and marine-sourced actives. Major incumbents are pivoting to hybrid models, integrating biotechnology, controlled delivery systems, and consumer-facing transparency (traceable sourcing and clean-label claims) to retain relevance.

Emerging entrants specializing in encapsulation platforms, water-oil dispersion stability, and photostabilization synergies are gaining share. The competitive advantage is moving away from purely synthetic innovation to holistic ecosystems of natural sourcing, advanced delivery technologies, and brand-positioning with consumers who increasingly demand efficacy backed by sustainability.

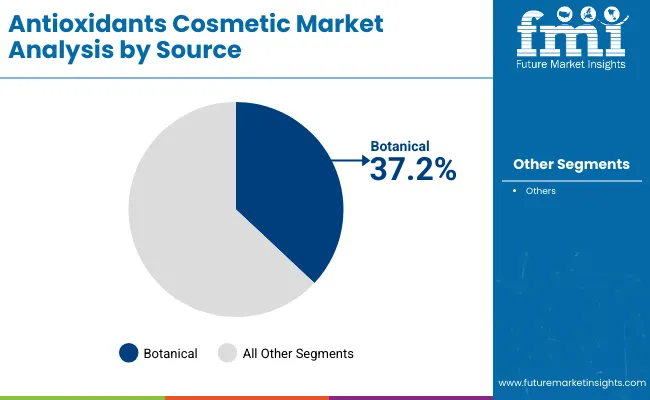

Advances in antioxidant sourcing and delivery technologies have improved stability, skin absorption, and formulation compatibility, allowing for more efficient use across personal care categories. Primary radical scavengers have gained popularity due to their critical role in neutralizing free radicals and preventing oxidative stress, which underpins skin aging, pigmentation, and sensitivity. The rise of botanical antioxidants has contributed to increased consumer trust, aligning with the global shift toward natural, plant-based, and sustainable skincare actives. Industries such as skincare, sun care, and haircare are driving demand for antioxidants that integrate seamlessly into premium cosmetic bases and multifunctional products.

Expansion of encapsulation systems and oil/water-dispersed concentrates has fueled market growth by enhancing bioavailability and prolonging antioxidant activity on the skin. Innovations in fermentation-based biotech actives, marine-derived antioxidants, and anti-glycation systems are expected to open new premium segments. Segment growth is expected to be led by primary radical scavengers, botanical antioxidants, and encapsulated delivery systems, with notable demand acceleration in India, China, and Japan due to cultural acceptance of natural remedies and premium dermocosmetic innovations.

The Antioxidants Cosmetic Market (Personal Care Actives) is segmented by functional class, source, delivery system, physical form, application, end use, and region. Functional classes include primary radical scavengers, secondary stabilizers & chelators, photostabilizers, and anti-glycation systems, highlighting the variety of antioxidant protection offered. By source, the segmentation covers synthetic, botanical, biotechnology-derived, and marine-derived, reflecting the transition from synthetic reliance to natural and biotech-based innovation.

Delivery systems include free form, encapsulated, oil-dispersed concentrates, and water-soluble concentrates, showcasing the role of controlled-release and bioavailability technologies. Physical forms are divided into solution/concentrate, powder, and emulsion concentrate, aligning with diverse formulation requirements. Applications span leave-on skincare, sun care, haircare, and color cosmetics, while end uses emphasize skincare, sun care, and premium cosmetic bases. Regionally, the scope spans North America, Europe, East Asia, South Asia & Pacific, Latin America, and the Middle East & Africa, with country-level data highlighting USA, China, India, Japan, Germany, and the UK as the key growth hubs.

| Functional Class | Value Share% 2025 |

|---|---|

| Primary radical scavengers | 35.2% |

| Others | 64.8% |

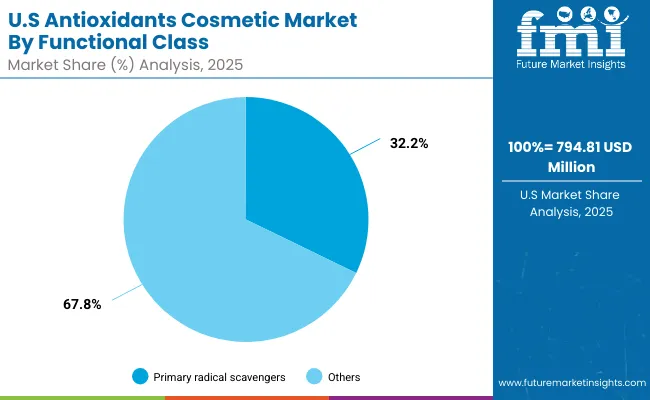

The primary radical scavengers segment is projected to contribute 35.2% of the Antioxidants Cosmetic Market (Personal Care Actives) revenue in 2025, maintaining its lead as the dominant functional class category. This dominance stems from their role as the first line of defense against oxidative stress, neutralizing free radicals that accelerate skin aging, pigmentation, and cellular damage. They are foundational in anti-aging, sun protection, and dermocosmetic products, where reliable antioxidant performance is non-negotiable.

The segment’s growth is also supported by the incorporation of synergistic blends with vitamins (C, E) and coenzyme Q10, which further boost efficacy. As encapsulation technologies and stabilized delivery formats gain adoption, primary radical scavengers are being reformulated into both mass-market and premium skincare bases. Given their broad applicability, cost-effectiveness, and proven efficacy, primary radical scavengers are expected to retain their position as the backbone of antioxidant systems in personal care actives.

| Source | Value Share% 2025 |

|---|---|

| Botanical | 37.2% |

| Others | 62.8% |

The botanical antioxidants segment is forecasted to hold 37.2% of the market share in 2025, reflecting the surging demand for plant-derived and natural actives. These antioxidants, derived from sources such as green tea, grape seed, rosemary, and turmeric, are favored for their consumer-friendly image, sustainability, and alignment with clean beauty trends. Botanical actives are particularly prominent in leave-on skincare and premium cosmetic bases, where natural claims and cultural trust drive adoption.

The segment’s expansion is further supported by regulatory encouragement for natural formulations and consumer skepticism toward synthetic additives. In fast-growing markets like India and China, botanical antioxidants are deeply tied to traditional wellness systems (Ayurveda, Traditional Chinese Medicine), which enhances consumer acceptance. With premium global brands positioning botanical antioxidants as both effective and sustainable, this segment is expected to continue leading demand and shape innovation pipelines throughout the forecast period.

| Delivery System | Value Share% 2025 |

|---|---|

| Encapsulated | 45.4% |

| Others | 54.6% |

The encapsulated delivery system segment is projected to account for 45.4% of the Antioxidants Cosmetic Market (Personal Care Actives) revenue in 2025, establishing it as the leading format. This dominance reflects the industry’s shift toward controlled-release technologies that protect sensitive antioxidant molecules from degradation while improving their skin penetration and bioavailability.

Encapsulation is increasingly preferred in sun care, anti-aging skincare, and premium cosmetic bases, where stability under light and oxygen exposure is critical. Advances in liposomal systems, polymer-based encapsulation, and nanoemulsions have enabled formulators to optimize both immediate and sustained release. These systems also allow for combining multiple antioxidants without compromising stability, making them attractive for multifunctional formulations. As personal care brands emphasize longer shelf life, consumer safety, and efficacy, encapsulated antioxidants are set to remain at the forefront of market innovation. Their balance of technical performance and consumer trust ensures that encapsulated systems will continue to dominate the delivery system landscape through 2035.

Rising dominance of encapsulated antioxidant delivery systems (45.4% share in 2025)

One of the strongest drivers for the Antioxidants Cosmetic Market is the growing adoption of encapsulated formats, which already account for nearly half of the market in 2025. Encapsulation enhances the stability, bioavailability, and controlled release of antioxidant molecules that are otherwise prone to degradation when exposed to light, heat, or oxygen. In skincare and sun care, this innovation ensures longer shelf life and sustained efficacy, aligning with consumer expectations of high-performance and clinically validated products.

The encapsulation driver is also linked to the expansion of premium cosmetic bases where delivery precision and ingredient preservation justify premium pricing. This creates not only volume demand but also significant value growth, as encapsulated actives often carry a 20-40% pricing premium compared to free-form antioxidants.

Strong consumer shift toward botanical sourcing (37.2% share in 2025)

Botanical antioxidants are becoming a critical growth lever, especially in Asia (India 17.4% CAGR, China 15.5% CAGR), where traditional systems such as Ayurveda and Traditional Chinese Medicine strongly influence consumer choices. Botanical sourcing directly responds to clean-label, sustainable, and plant-based claims, which dominate both premium dermocosmetics and mainstream skincare lines.

In Europe, where sustainability regulations are intensifying, botanical antioxidants are leveraged not only for efficacy but also for compliance with natural ingredient mandates. This driver is amplified by the fact that botanical sourcing creates differentiation in brand positioning products marketed as natural or plant-based are growing at a faster clip than synthetic-heavy formulations, which face growing skepticism in mature markets like Germany and the UK

High instability and degradation of natural antioxidants without protective systems

A critical restraint for the market lies in the inherent instability of many natural antioxidants, such as polyphenols, carotenoids, and flavonoids, when exposed to light, oxygen, or heat. Without encapsulation or stabilization technologies, these compounds lose potency quickly, limiting their application in formulations with long shelf life requirements. This restraint forces brands to either invest in costly delivery systems or risk reduced efficacy, which undermines consumer trust. Smaller companies in particular face cost challenges in adopting these advanced technologies, which slows down widespread use across mass-market formulations.

Regulatory and sourcing complexities in botanical and marine segments

While botanical antioxidants are highly desirable, their sourcing is often geographically constrained and subject to variable supply chains. Marine-derived antioxidants face even steeper regulatory barriers, with EU and USA authorities requiring extensive testing to validate safety and sustainability. These regulatory bottlenecks raise the cost of compliance and extend the time to market for innovative antioxidant systems. Moreover, as consumers increasingly demand traceability and eco-certifications, suppliers are burdened with additional costs of certification and transparent supply chain reporting, creating a restraint on scalability, especially in emerging markets.

Premiumization through anti-glycation and photostabilizer systems

While primary radical scavengers dominate in 2025 (35.2%), the fastest-moving trend is the growth of anti-glycation systems and photostabilizers. These systems appeal to premium anti-aging and sun care markets, addressing not just oxidative stress but also collagen degradation and skin yellowing caused by sugar-induced glycation. In Japan and Europe, these advanced systems are marketed as next-generation skin defense, and their demand is expected to double share by 2035 as consumers seek multi-target actives beyond traditional antioxidants.

Regional market acceleration driven by India and China’s outperformance

Unlike the slower-growing USA market (CAGR 6.4%), India (17.4% CAGR) and China (15.5% CAGR) represent a transformational trend in demand. India’s growth is anchored in Ayurveda-inspired natural antioxidants, which global brands are actively adapting into modern formats, while China’s market is heavily influenced by dermocosmetic positioning and premium botanical sourcing. Both countries are reshaping global supply chains by creating dual consumer and sourcing hubs: India as a botanical resource powerhouse and China as a manufacturing and consumption hub for antioxidant-rich personal care. This regional divergence is expected to shift global market share, with Asia’s contribution expanding from ~20% in 2025 to over 30% by 2035.

| Countries | Estimated CAGR (2025 to 2035) |

|---|---|

| China | 15.5% |

| USA | 6.4% |

| India | 17.4% |

| UK | 10.0% |

| Germany | 7.5% |

| Japan | 12.5% |

| Europe | 9.3% |

The Antioxidants Cosmetic Market (Personal Care Actives) demonstrates sharp regional contrasts in its 2025-2035 growth outlook, with India (17.4% CAGR) and China (15.5% CAGR) leading the expansion. India’s rapid acceleration is rooted in its deep consumer trust in botanical and herbal systems, where Ayurveda-inspired antioxidants are increasingly reformulated into modern dermocosmetic products. Multinational brands are localizing sourcing and product design to capture this consumer base, which is highly receptive to natural and multifunctional formulations.

China’s growth is propelled by its dermocosmetic and premium skincare segment, supported by encapsulated botanical antioxidants that appeal to urban consumers concerned with pollution, photoaging, and lifestyle-related oxidative stress. Together, India and China are reshaping the global supply chain by boosting demand for plant-based, biotech-derived, and encapsulated antioxidants, creating both consumption and production hubs in Asia.

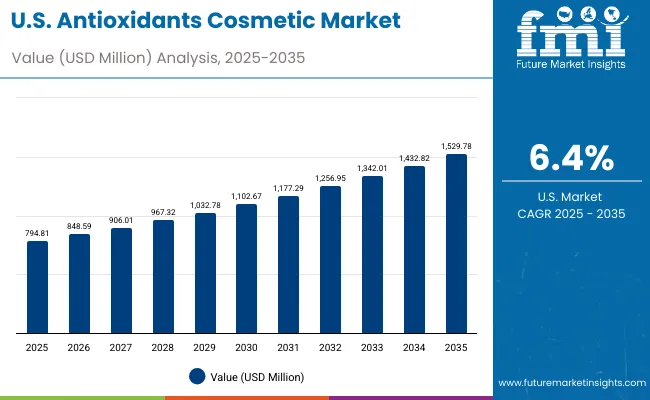

Mature markets display more moderate growth, but strategic shifts are still evident. The USA (6.4% CAGR) and Germany (7.5% CAGR) continue to expand steadily, led by primary radical scavenger systems that dominate mainstream skincare and sun care. The UK (10.0% CAGR) and Japan (12.5% CAGR) are moving faster, reflecting premiumization trends with Japan pushing biotech-derived antioxidants for anti-aging and microbiome-balancing solutions, while the UK embraces clean-label and botanical actives in both mass and prestige skincare.

Europe overall records a 9.3% CAGR, underpinned by regulatory encouragement for natural sourcing and consumer demand for sustainable, traceable actives. While the growth rates are lower than Asia, these mature markets continue to be innovation centers, setting standards for safety, efficacy, and sustainability that influence global adoption patterns.

| Year | USA Antioxidants Cosmetic Market (USD Million) |

|---|---|

| 2025 | 794.81 |

| 2026 | 848.59 |

| 2027 | 906.01 |

| 2028 | 967.32 |

| 2029 | 1032.78 |

| 2030 | 1102.67 |

| 2031 | 1177.29 |

| 2032 | 1256.95 |

| 2033 | 1342.01 |

| 2034 | 1432.82 |

| 2035 | 1529.78 |

The Antioxidants Cosmetic Market (Personal Care Actives) in the United States is projected to grow at a CAGR of 6.4%, supported by strong demand in skincare and sun care formulations. Primary radical scavengers account for 32.2% of USA revenue in 2025 (USD 255.93 Million), highlighting their role as the dominant antioxidant system in mainstream formulations. Growth is reinforced by the rising adoption of encapsulated formats in premium dermocosmetics, enabling longer shelf life and sustained release in high-value skincare products. Botanical antioxidants are gaining presence in niche clean-label launches, but synthetic and semi-synthetic antioxidants continue to dominate at scale.

The Antioxidants Cosmetic Market (Personal Care Actives) in the United Kingdom is expected to grow at a CAGR of 10.0%, supported by demand in premium skincare and clean-label formulations. Botanical antioxidants hold a particularly strong influence in the UK market, as consumers align purchases with sustainability, plant-based, and natural ingredient claims. Encapsulated delivery formats are being adopted by luxury and prestige brands, allowing stable incorporation of sensitive botanical actives like polyphenols and resveratrol. Sun care and color cosmetics are also integrating antioxidants to enhance UV and pollution defense, reflecting the market’s multifunctional positioning.

India is witnessing rapid growth in the Antioxidants Cosmetic Market (Personal Care Actives), which is forecast to expand at a CAGR of 17.4% through 2035, the highest among all tracked countries. This expansion is led by the integration of Ayurveda-inspired botanical antioxidants into modern personal care formats, fueling innovation in both mass-market and premium segments. Multinationals are collaborating with local suppliers to source turmeric, ashwagandha, neem, and green tea extracts, while encapsulation is increasingly used to stabilize these bioactive compounds. Rising middle-class purchasing power, combined with cultural affinity for herbal solutions, is accelerating adoption across skincare and sun care.

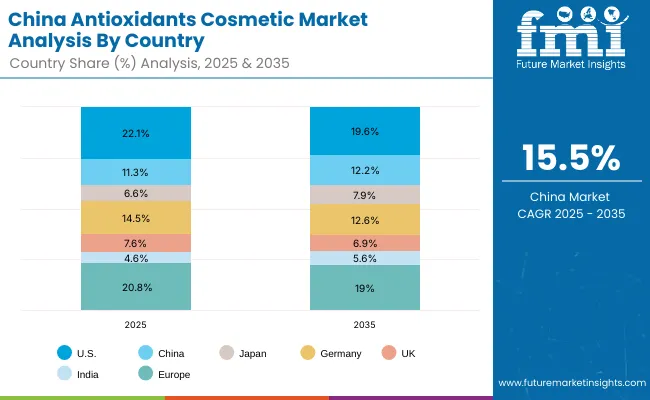

| Countries | 2025 Share (%) |

|---|---|

| USA | 22.1% |

| China | 11.3% |

| Japan | 6.6% |

| Germany | 14.5% |

| UK | 7.6% |

| India | 4.6% |

| Europe | 20.8% |

| Countries | 2035 Share (%) |

|---|---|

| USA | 19.6% |

| China | 12.2% |

| Japan | 7.9% |

| Germany | 12.6% |

| UK | 6.9% |

| India | 5.6% |

| Europe | 19.0% |

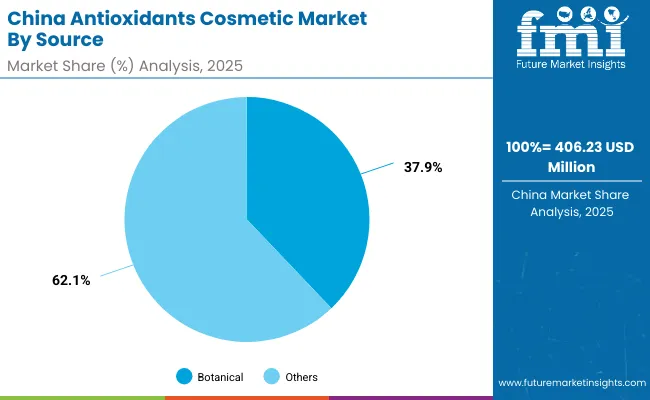

The Antioxidants Cosmetic Market (Personal Care Actives) in China is expected to grow at a CAGR of 15.5%, making it one of the fastest-growing markets worldwide. Growth is primarily driven by dermocosmetic demand in urban centers, where concerns over pollution, photoaging, and oxidative stress are boosting sales of botanical and encapsulated antioxidants. In 2025, botanical antioxidants already account for 37.9% of Chinese revenue (USD 153.96 Million), highlighting their importance in domestic formulations. Local beauty and personal care companies are rapidly incorporating fermented and biotech-derived antioxidants, often positioned alongside K-beauty and J-beauty influence.

| USA By Functional Class | Value Share% 2025 |

|---|---|

| Primary radical scavengers | 32.2% |

| Others | 67.8% |

The Antioxidants Cosmetic Market (Personal Care Actives) in the United States is projected at USD 794.81 million in 2025, recording a CAGR of 6.4% through 2035. Primary radical scavengers contribute 32.2%, equivalent to USD 255.93 million, while other antioxidant systems account for the remaining 67.8%. This indicates the continued dominance of traditional antioxidant systems that provide reliable oxidative stress protection in everyday skincare and sun care. Unlike emerging Asian markets where botanical actives dominate, the USA market relies heavily on synthetic and semi-synthetic antioxidants, favored for their regulatory familiarity, stability, and ability to perform consistently across mass-market product lines.

Growth in the USA is further driven by the uptake of encapsulated formats in premium cosmetic bases, where consumers increasingly expect longer shelf life, controlled release, and efficacy-backed claims. Botanical antioxidants are gaining traction, but primarily in niche clean-label launches, as mainstream formulations continue to balance efficacy with cost competitiveness. Rising consumer awareness of anti-pollution and anti-aging benefits, alongside stronger integration of antioxidants into multifunctional sun care, ensures steady market expansion. However, USA growth is slower compared to Asia due to its mature base and the dominance of established antioxidant technologies.

| China By Source | Value Share% 2025 |

|---|---|

| Botanical | 37.9% |

| Others | 62.1% |

The Antioxidants Cosmetic Market (Personal Care Actives) in China is valued at USD 406.23 million in 2025, expanding at a CAGR of 15.5%, making it one of the fastest-growing markets globally. Botanical antioxidants dominate with 37.9% share (USD 153.96 million), reflecting the strong preference among Chinese consumers for plant-based and natural actives. This dominance is linked to cultural familiarity with traditional Chinese medicine ingredients and a rising demand for clean-label, herbal skincare solutions. Synthetic and semi-synthetic antioxidants still contribute 62.1%, but their share is steadily declining as consumers shift toward sustainable and natural sources.

The Chinese market is further shaped by rapid expansion in urban dermocosmetics, where antioxidants are integrated into sun care, anti-pollution, and premium anti-aging solutions. Domestic beauty brands are increasingly competing with global leaders by launching encapsulated botanical antioxidants, supported by innovations in fermentation-based biotech-derived actives. Government-backed emphasis on biotechnology, combined with a booming e-commerce ecosystem, is amplifying distribution and consumer reach. China’s dual role as both a consumer hub and a manufacturing powerhouse positions it as a global influencer in antioxidant supply and demand.

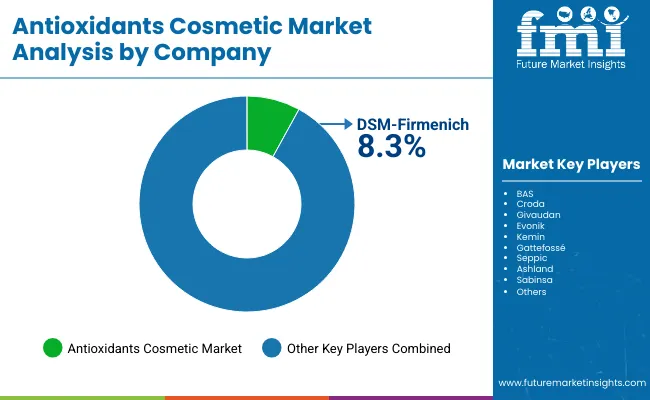

The Antioxidants Cosmetic Market (Personal Care Actives) is moderately fragmented, with a mix of multinational leaders, mid-tier European innovators, and specialized suppliers focused on botanical and biotech niches. DSM-Firmenich, with an 8.3% global value share in 2025, leads the market owing to its broad portfolio of synthetic, natural, and encapsulated antioxidant systems. Competitors such as BASF, Croda, and Evonik dominate the synthetic and semi-synthetic category, emphasizing stability, regulatory compliance, and mass-market integration, particularly in Europe and North America.

Meanwhile, botanical-focused suppliers such as Gattefossé, Sabinsa, and Seppic are carving out share in Asia and Europe by aligning portfolios with clean-label and natural ingredient trends. Companies like Ashland and Givaudan are accelerating their biotech-driven antioxidant pipelines, with emphasis on fermentation-derived actives and encapsulation technologies that meet both premium efficacy and sustainability requirements. Competitive differentiation is shifting away from simple antioxidant stability toward integrated solutions combining delivery systems, biotechnology platforms, and traceable sourcing models. Emerging players are gaining visibility through marine-derived actives and AI-driven ingredient design, further fragmenting the competitive dynamics.

Key Developments in Antioxidants Cosmetic Market

| Item | Value |

|---|---|

| Quantitative Units | USD Million |

| Functional Class | Primary radical scavengers, Secondary stabilizers & chelators, Photostabilizers, Anti-glycation systems |

| Source | Synthetic, Botanical, Biotechnology-derived, Marine-derived |

| Delivery System | Free form, Encapsulated, Oil-dispersed concentrates, Water-soluble concentrates |

| Physical Form | Solution/concentrate, Powder, Emulsion concentrate |

| Application | Leave-on skincare, Sun care, Haircare, Color cosmetics |

| End-use | Skincare, Sun care, Premium cosmetic bases |

| Regions Covered | North America, Europe, East Asia, South Asia & Pacific, Latin America, Middle East & Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | DSM-Firmenich, BASF, Croda, Givaudan, Evonik, Kemin, Gattefossé, Seppic, Ashland, Sabinsa |

| Additional Attributes | Dollar sales by functional class and source, adoption trends in encapsulated delivery systems and botanical sourcing, rising demand for antioxidants in anti-aging and sun care, sector-specific growth in dermocosmetics and premium cosmetic bases, software-enabled encapsulation and formulation platforms, integration with biotech-derived actives and marine-based innovations, regional trends influenced by clean-label and sustainability preferences, and advances in anti-glycation, photostabilization, and controlled-release systems. |

The Antioxidants Cosmetic Market (Personal Care Actives) is estimated to be valued at USD 3,604.2 million in 2025.

The market size for the Antioxidants Cosmetic Market (Personal Care Actives) is projected to reach USD 7,804.2 million by 2035.

The Antioxidants Cosmetic Market (Personal Care Actives) is expected to grow at a CAGR of 8.0% between 2025 and 2035.

The key product types in the Antioxidants Cosmetic Market (Personal Care Actives) are primary radical scavengers, secondary stabilizers & chelators, photostabilizers, and anti-glycation systems.

In terms of source, the botanical antioxidants segment is forecasted to command 37.2% share in the Antioxidants Cosmetic Market (Personal Care Actives) in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Antioxidants Market Size, Growth, and Forecast for 2025 to 2035

Antioxidants Reagent Market Analysis – Trends & Future Outlook 2024-2034

Food Antioxidants Market Analysis by Product, Application and Form Through 2035

Phenolic Antioxidants Market Size and Share Forecast Outlook 2025 to 2035

Pet Food Antioxidants Market Size and Share Forecast Outlook 2025 to 2035

Moringa Oil Antioxidants Market Size and Share Forecast Outlook 2025 to 2035

Animal Feed Antioxidants Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Tocopherol-Rich Antioxidants Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Blueberry Extract Antioxidants Market Size and Share Forecast Outlook 2025 to 2035

Cosmetic Pigment Market Forecast and Outlook 2025 to 2035

Cosmetic Product Packaging Market Size and Share Forecast Outlook 2025 to 2035

Cosmetic Dropper Market Size and Share Forecast Outlook 2025 to 2035

Cosmetic Jars Market Size and Share Forecast Outlook 2025 to 2035

Cosmetic Filling Machines Market Size and Share Forecast Outlook 2025 to 2035

Cosmetic Sucrose Cocoate Market Size and Share Forecast Outlook 2025 to 2035

Cosmetic Ingredients For Hair Removal Market Size and Share Forecast Outlook 2025 to 2035

Cosmetic Packaging Market Size and Share Forecast Outlook 2025 to 2035

Cosmetic Plastic Packaging Market Size and Share Forecast Outlook 2025 to 2035

Cosmetic Jar Industry Analysis in North America Size and Share Forecast Outlook 2025 to 2035

Cosmetic Tube Packaging Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA