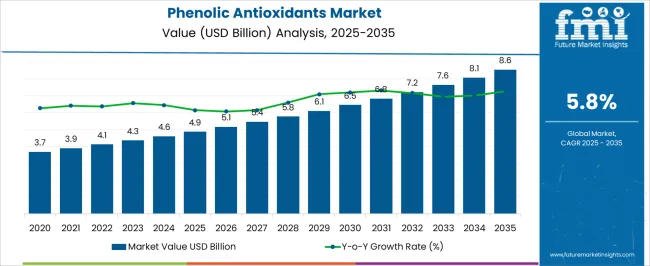

The phenolic antioxidants market is estimated to be valued at USD 4.9 billion in 2025 and is projected to reach USD 8.6 billion by 2035, registering a compound annual growth rate (CAGR) of 5.8% over the forecast period. Regulatory agencies in major markets, including the USA Environmental Protection Agency, the European Chemicals Agency, and Asian regulatory bodies, impose strict guidelines on the production, handling, and application of phenolic antioxidants due to their chemical reactivity and potential environmental impact. Compliance with these regulations requires manufacturers to implement robust monitoring, documentation, and quality assurance protocols, which increases operational complexity and associated costs.

Regulatory mandates also influence product formulation, particularly in the food, packaging, and polymer sectors, where migration limits, residual content restrictions, and permissible concentration levels dictate the choice of specific phenolic antioxidants. The evolving regulations aimed at reducing hazardous substances and enhancing sustainability are prompting innovation toward bio-based or low-toxicity alternatives, which may offer competitive advantages but require additional R&D investment. The market trajectory from USD 4.9 billion in 2025 to USD 8.6 billion in 2035 reflects the capacity of manufacturers to navigate regulatory environments while scaling production to meet growing demand in industrial and consumer applications.

Regulatory oversight, therefore, shapes not only market entry and pricing strategies but also long-term growth prospects, compelling companies to prioritize compliance, sustainability, and continuous innovation throughout the value chain to maintain market competitiveness and ensure safe, standardized product delivery.

| Metric | Value |

|---|---|

| Phenolic Antioxidants Market Estimated Value in (2025 E) | USD 4.9 billion |

| Phenolic Antioxidants Market Forecast Value in (2035 F) | USD 8.6 billion |

| Forecast CAGR (2025 to 2035) | 5.8% |

The phenolic antioxidants market represents a specialized segment within the global chemical additives and polymer stabilization industry, emphasizing thermal stability, oxidative protection, and product longevity. Within the broader antioxidant additives sector, it accounts for about 5.4%, driven by demand in plastics, rubber, lubricants, and industrial polymers. In the polymer processing and stabilization segment, its share is approximately 6.1%, reflecting adoption in polyethylene, polypropylene, and other thermoplastics to prevent degradation during processing and use.

Across the lubricants and metalworking fluids market, it contributes around 4.3%, supporting oxidation resistance and enhanced performance. Within the specialty chemicals and functional additives category, it represents 3.8%, highlighting the need for tailored stabilization solutions. In the overall industrial additives ecosystem, the market contributes about 4.9%, emphasizing protection, performance, and extended product life in diverse applications. Recent developments in the phenolic antioxidants market have focused on formulation efficiency, sustainability, and regulatory compliance. Groundbreaking trends include the development of high-performance, low-odor, and low-migration antioxidants for food-contact polymers and medical-grade plastics.

Key players are collaborating with polymer manufacturers, lubricant producers, and chemical innovators to optimize stabilization performance while minimizing environmental impact. Adoption of multifunctional antioxidants, synergistic blends, and bio-based phenolic compounds is gaining traction to enhance efficacy and meet evolving regulations. The digital formulation tools and predictive aging studies are being introduced to ensure consistent quality and reliability.

The phenolic antioxidants market is witnessing steady expansion, supported by their critical role in enhancing product stability and extending shelf life across multiple industries, including food, plastics, rubber, and cosmetics. Increasing demand for long-lasting and high-performance materials has driven adoption, particularly in regions experiencing rapid industrialization. Regulatory emphasis on food safety, polymer stability, and oxidation control has strengthened the market’s value proposition.

Shifts toward sustainable and bio-based solutions are influencing sourcing strategies, with manufacturers increasingly exploring natural phenolic antioxidants to meet clean-label and eco-friendly demands. The market's growth is also reinforced by technological advancements in formulation techniques, enabling more efficient dispersion and compatibility across diverse matrices.

Rising consumer awareness about oxidative degradation and its impact on quality has further accelerated the shift toward antioxidant inclusion in everyday products. Over the forecast period, the market is expected to benefit from both regulatory compliance requirements and the rising incorporation of these compounds into next-generation materials, positioning phenolic antioxidants as indispensable additives in modern manufacturing and food preservation.

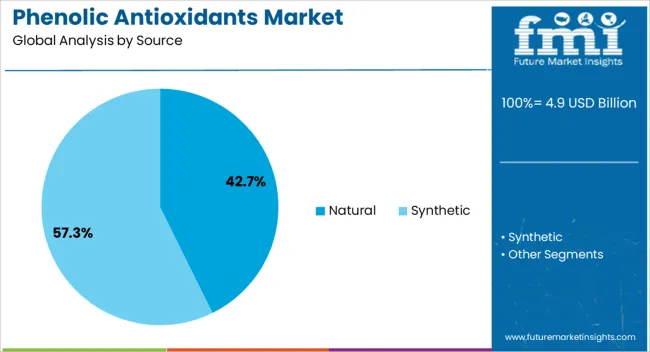

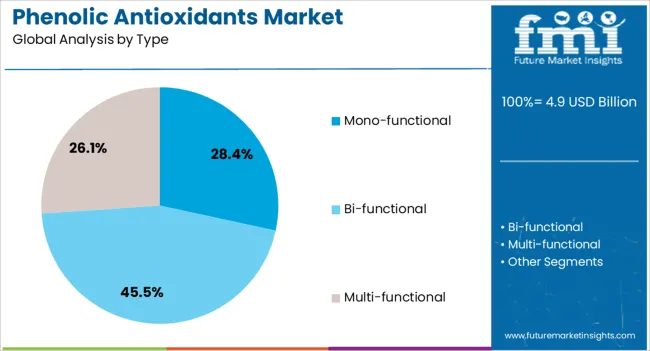

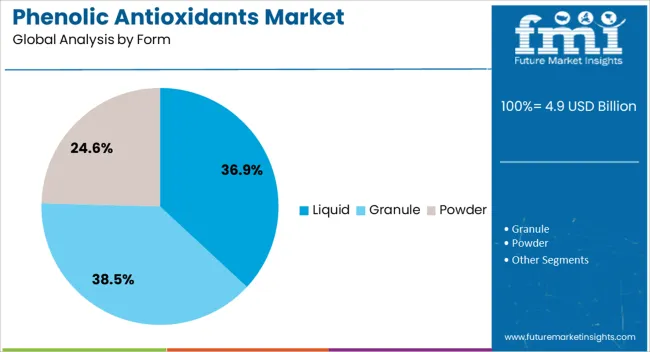

The phenolic antioxidants market is segmented by source, type, form, application, and geographic regions. By source, phenolic antioxidants market is divided into Natural and Synthetic. In terms of type, phenolic antioxidants market is classified into Mono-functional, Bi-functional, and Multi-functional. Based on form, phenolic antioxidants market is segmented into Liquid, Granule, and Powder.

By application, phenolic antioxidants market is segmented into Plastic & rubber, Fuel & lubricants, Cosmetic & personal care, Food & feed additive, and Others. Regionally, the phenolic antioxidants industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The natural segment, representing approximately 42.7% of the phenolic antioxidants market by source, has secured its leadership due to growing consumer and industrial preference for bio-based and sustainable ingredients. Adoption has been bolstered by regulatory encouragement for clean-label formulations, especially in food and beverage applications where synthetic additives face stricter scrutiny. Natural phenolic antioxidants are derived from plant-based sources, offering perceived health benefits and lower environmental impact, which resonate with global sustainability trends.

The segment’s growth has been further propelled by advancements in extraction technologies that enhance yield and functional performance without compromising purity. Market uptake in premium food categories, nutraceuticals, and personal care formulations has solidified its share.

Additionally, manufacturers are investing in research to improve the stability and cost-efficiency of natural antioxidants, allowing them to compete more effectively with synthetic counterparts. This combination of consumer pull, regulatory push, and technological innovation positions the natural segment for sustained leadership over the forecast period.

The mono-functional segment, holding about 28.4% share by type, has established its market position due to its targeted performance in specific oxidation control applications. These antioxidants are designed to address singular functional needs, making them cost-effective for industries where specialized, predictable performance is prioritized over multi-functional versatility. Adoption has been supported by their ease of formulation, compatibility with various substrates, and proven stability under controlled conditions.

The segment has maintained relevance in polymer processing, lubricants, and certain food preservation uses where narrowly defined antioxidant properties meet operational requirements efficiently. Growth is reinforced by their lower cost relative to multi-functional counterparts, enabling broad utilization in price-sensitive sectors.

Technological improvements in synthesis and quality control have enhanced product reliability, ensuring consistent performance and reinforcing customer confidence. As industries continue to demand dependable oxidation inhibitors without the added expense of multi-functionality, the mono-functional segment is expected to remain a steady contributor to market revenues.

The liquid segment, comprising around 36.9% of the phenolic antioxidants market by form, leads due to its superior dispersion, ease of incorporation, and rapid reaction kinetics in preventing oxidation. Liquid formulations are favored in applications requiring homogeneous blending, such as liquid food systems, coatings, and polymer emulsions. The segment’s share is further supported by manufacturing convenience, as liquid antioxidants can be directly integrated into production lines without the additional processing required for solids.

Improved solubility profiles have widened their use across diverse matrices, ensuring efficient antioxidant distribution and functional consistency. The segment also benefits from compatibility with automated dosing systems, reducing waste and enhancing operational efficiency in large-scale production.

Furthermore, liquid forms enable higher bioavailability in nutraceutical and cosmetic applications, aligning with functional performance requirements. With ongoing innovation in stabilizing agents and solvent systems, the liquid segment is expected to maintain its competitive edge and strengthen its position in the phenolic antioxidants market throughout the forecast period.

The market has been experiencing steady growth due to rising demand for polymer stabilization, fuel preservation, and food product shelf-life extension. Phenolic antioxidants are employed to prevent oxidative degradation in plastics, rubbers, lubricants, and edible oils, ensuring prolonged material integrity and functional performance. Increasing applications in industrial lubricants, packaging materials, and cosmetics have expanded market reach. Advances in synthetic and natural phenolic compounds, along with research into high-performance stabilizers, have enhanced their effectiveness in preventing free radical-induced degradation. Regulatory support for antioxidants in food, pharmaceutical, and personal care sectors further stimulates adoption.

The demand for phenolic antioxidants has been significantly driven by polymer and lubricant applications. In plastics and rubber industries, these antioxidants inhibit oxidative degradation during processing and product lifecycle, maintaining tensile strength, elasticity, and color stability. Lubricant formulations utilize phenolic antioxidants to prevent oil breakdown under high temperatures and mechanical stress, extending machinery lifespan and reducing maintenance costs. Automotive, construction, and electronics sectors rely on high-performance polymers and lubricants stabilized with phenolic antioxidants for operational efficiency. Research into multifunctional antioxidants capable of scavenging multiple radical species has further increased adoption rates. The integration of phenolic antioxidants in industrial materials ensures improved durability, operational reliability, and product consistency, reinforcing their critical role in manufacturing and performance-critical applications worldwide.

Food and personal care industries are emerging as major consumers of phenolic antioxidants due to their natural and synthetic variants’ ability to prevent oxidation in oils, fats, and active ingredients. In edible oils, snacks, and packaged foods, antioxidants help extend shelf life, maintain flavor, and prevent nutrient degradation. Cosmetic products, including creams, lotions, and hair care formulations, benefit from phenolic antioxidants’ ability to stabilize sensitive bioactive compounds and prevent discoloration. Regulatory acceptance and consumer preference for natural antioxidants derived from plant phenols have further encouraged market expansion. Companies are increasingly formulating hybrid antioxidant blends that meet performance, safety, and sustainability criteria. The convergence of food safety regulations, consumer awareness, and product quality demands has stimulated the wider adoption of phenolic antioxidants globally.

Technological innovation has improved the efficiency and versatility of phenolic antioxidants, enabling their use in high-performance and specialized applications. Novel synthesis methods allow precise control over molecular structures, enhancing radical-scavenging activity and thermal stability. Encapsulation techniques, co-additive formulations, and polymer-compatible delivery systems ensure uniform distribution in matrices, improving antioxidant performance and product consistency. Analytical methods for real-time monitoring of oxidation levels in industrial processes have increased reliability in additive selection. Enhanced formulations have allowed adoption in high-temperature plastics, automotive lubricants, and specialty chemicals without compromising performance. Continuous research into bio-based and renewable phenolic antioxidants is expanding environmentally responsible alternatives. Technological improvements have thus strengthened product effectiveness, widened application scope, and driven the growth of the phenolic antioxidants market globally.

Sustainability and regulatory considerations have become significant drivers in the phenolic antioxidants market. Industrial and consumer product manufacturers are increasingly seeking antioxidants that comply with environmental, safety, and food-grade regulations. Bio-based and naturally derived phenolic antioxidants are gaining traction as environmentally responsible alternatives to synthetic compounds. Regulations on food additives, polymer stabilizers, and industrial chemical emissions have encouraged manufacturers to adopt compliant antioxidant solutions.

Lifecycle analysis and eco-friendly production methods are being prioritized to reduce environmental impact and waste generation. As companies aim to meet sustainability goals while maintaining product quality, phenolic antioxidants that combine regulatory compliance, safety, and functional performance have become essential, supporting market growth and long-term adoption across industrial, food, and cosmetic sectors.

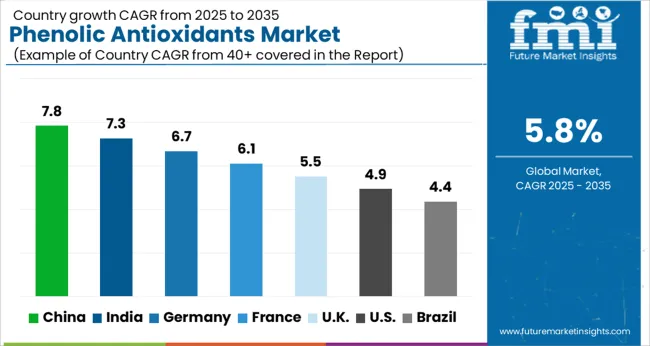

| Country | CAGR |

|---|---|

| China | 7.8% |

| India | 7.3% |

| Germany | 6.7% |

| France | 6.1% |

| UK | 5.5% |

| USA | 4.9% |

| Brazil | 4.4% |

The market is expected to expand at a CAGR of 5.8% from 2025 to 2035, driven by applications in polymers, lubricants, and food preservation. China leads with 7.8%, supported by strong chemical manufacturing capabilities and growing industrial demand. India follows at 7.3%, reflecting growth in polymer processing and lubricant industries. Germany holds 6.7%, emphasizing high-quality production standards and innovation in antioxidant formulations. The UK records 5.5%, benefiting from technological research and niche chemical applications. The USA reaches 4.9%, influenced by demand in food and industrial sectors and investment in advanced chemical processing. Growth is supported by the increasing need for stability and longevity in materials across multiple industries. This report includes insights on 40+ countries; the top markets are shown here for reference.

China recorded a 7.8% CAGR, driven by rising demand in plastics, rubber, and food industries to enhance product stability and shelf life. Domestic manufacturers invested in high purity phenolic antioxidants and specialized formulations to meet industrial requirements. Research and development focused on thermal stability, oxidative resistance, and compatibility with diverse polymer and lubricant systems. Competitive strategies included regional production expansion, strategic collaborations with chemical distributors, and customized solutions for industrial clients. Adoption was particularly high in automotive, packaging, and construction sectors, where material longevity, heat resistance, and anti-aging properties were critical. Environmental regulations also prompted innovation toward safer, low emission antioxidant formulations.

India demonstrated a 7.3% CAGR, supported by growth in polymer processing, lubricants, and packaging industries. Manufacturers invested in high performance and specialty antioxidants tailored for heat and oxidative resistance. Competitive strategies emphasized partnerships with chemical distributors, localized production, and application specific solutions. Adoption was high in automotive components, industrial lubricants, and polymer-based packaging materials. Industrial R&D focused on enhancing product durability, long term stability, and environmental compliance. Government regulations on chemical safety and emission standards further encouraged manufacturers to develop low toxicity and eco-friendly antioxidant solutions. Regional supply chain development improved accessibility and reliability for industrial consumers.

Germany advanced at a 6.7% CAGR, influenced by the demand for high quality and specialty antioxidants in polymers, rubber, and lubricants. Manufacturers prioritized thermal stability, oxidative resistance, and compliance with EU chemical regulations. Adoption was particularly strong in automotive, industrial equipment, and construction materials requiring long term durability and heat tolerance. Competitive advantage was achieved through product innovation, certification compliance, and close collaboration with industrial users. Export potential to other European markets influenced production and quality standards. Continuous R&D in low toxicity, high efficiency formulations reinforced Germany’s position as a key market for phenolic antioxidants with stringent performance requirements.

The United Kingdom progressed at a 5.5% CAGR, driven by polymer processing, lubricant formulations, and packaging industry demand. Manufacturers focused on high performance, low toxicity, and environmentally safe phenolic antioxidants. Adoption was concentrated in automotive components, industrial lubricants, and polymer based packaging requiring long term stability and heat resistance. Competitive strategies emphasized product innovation, application specific solutions, and collaborations with chemical distributors. Industrial R&D also targeted improved oxidative resistance, thermal stability, and compatibility across diverse material systems. Regulatory compliance and quality certifications reinforced consumer confidence and encouraged adoption in specialty and high performance applications.

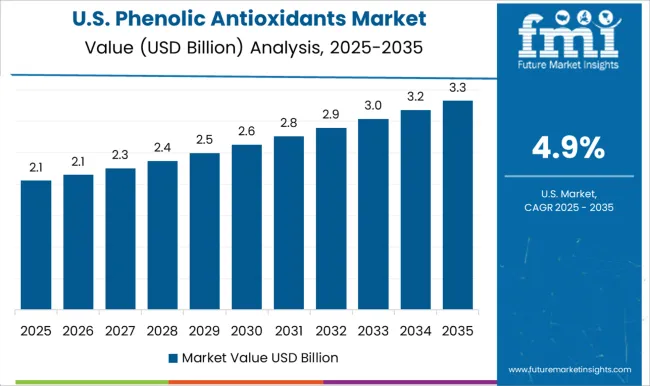

The United States expanded at a 4.9% CAGR, influenced by demand in automotive, polymer, lubricant, and packaging applications. Manufacturers invested in specialty phenolic antioxidants with high oxidative resistance, thermal stability, and compatibility with diverse materials. Competitive strategies included R&D for advanced formulations, partnerships with chemical distributors, and application specific product development. Adoption was strong in automotive parts, industrial lubricants, and packaging materials requiring long term performance. Regulatory standards for chemical safety, environmental compliance, and product certifications reinforced market growth. Innovation in low emission and high efficiency formulations enhanced reliability, and manufacturers leveraged regional supply chains to ensure consistent availability and timely support for industrial users.

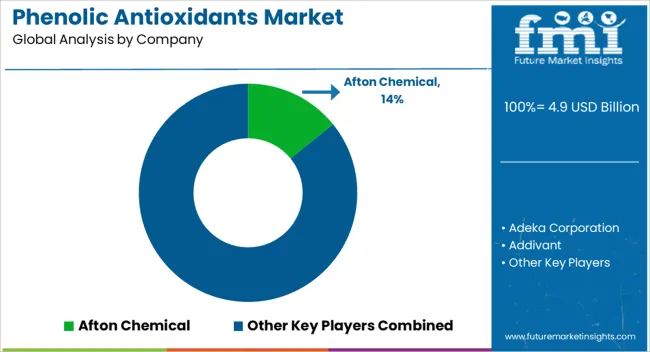

The market has been shaped by chemical innovators and global specialty additives providers. BASF SE, Eastman Chemical Company, and Lanxess AG have focused on high performance formulations for polymers, fuels, and lubricants, emphasizing thermal stability, oxidation prevention, and long service life. Afton Chemical, Addivant, and Lubrizol Corporation have targeted automotive and industrial applications, promoting efficiency enhancement and material protection under extreme operating conditions.

Regional and niche players such as Adeka Corporation, Chitec, Dorf Ketal, Dover Chem, Mayzo Inc., OXIRIS, SI Group, and Songwon Industrial have differentiated themselves through specialized phenolic blends and customized antioxidant solutions. Product brochures highlight thermal resistance, low volatility, and compatibility with diverse polymer matrices. Emphasis is placed on oxidative stability, reduced degradation, and extended product life. BASF and Eastman emphasize broad application versatility, while Adeka and Chitec promote specialty solutions for plastics, coatings, and elastomers. Competition revolves around performance consistency, application breadth, and regulatory compliance.

| Item | Value |

|---|---|

| Quantitative Units | USD 4.9 Billion |

| Source | Natural and Synthetic |

| Type | Mono-functional, Bi-functional, and Multi-functional |

| Form | Liquid, Granule, and Powder |

| Application | Plastic & rubber, Fuel & lubricants, Cosmetic & personal care, Food & feed additive, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Afton Chemical, Adeka Corporation, Addivant, BASF SE, Chitec, Clariant International AG, Dorf Ketal, Dover Chem, Eastman Chemical Company, Lanxess AG, Lubrizol Corporation, Mayzo Inc, OXIRIS, SI Group, and Songwon Industrial |

| Additional Attributes | Dollar sales by antioxidant type and application, demand dynamics across polymers, lubricants, and food sectors, regional trends in additive adoption, innovation in thermal stability, oxidative resistance, and formulation efficiency, environmental impact of chemical production and disposal, and emerging use cases in high-performance plastics, bio-based lubricants, and food preservation. |

The global phenolic antioxidants market is estimated to be valued at USD 4.9 billion in 2025.

The market size for the phenolic antioxidants market is projected to reach USD 8.6 billion by 2035.

The phenolic antioxidants market is expected to grow at a 5.8% CAGR between 2025 and 2035.

The key product types in phenolic antioxidants market are natural and synthetic.

In terms of type, mono-functional segment to command 28.4% share in the phenolic antioxidants market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Phenolic Tackifying Resin Market Size and Share Forecast Outlook 2025 to 2035

Phenolic Adhesive Resin Market Size and Share Forecast Outlook 2025 to 2035

Phenolic Resins Market Size and Share Forecast Outlook 2025 to 2035

Phenolic Board Market Growth – Trends & Forecast 2024-2034

Ribbed Phenolic Caps Market

Antioxidants Cosmetic Market (Personal Care Actives) Analysis - Size and Share Forecast Outlook 2025 to 2035

Antioxidants Market Size, Growth, and Forecast for 2025 to 2035

Antioxidants Reagent Market Analysis – Trends & Future Outlook 2024-2034

Food Antioxidants Market Analysis by Product, Application and Form Through 2035

Pet Food Antioxidants Market Size and Share Forecast Outlook 2025 to 2035

Moringa Oil Antioxidants Market Size and Share Forecast Outlook 2025 to 2035

Animal Feed Antioxidants Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Tocopherol-Rich Antioxidants Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Blueberry Extract Antioxidants Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA