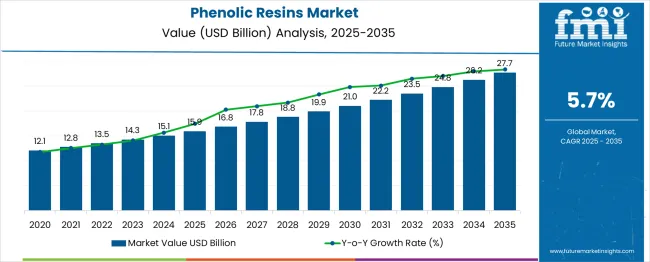

The phenolic resins market is expected to grow from USD 15.9 billion in 2025 to USD 27.7 billion in 2035 at a CAGR of 6%, but several risks may affect this trajectory. Supply chain disruptions in phenol and formaldehyde, raw material price volatility, and strict environmental regulations could increase costs and delay production. Competition from alternative adhesives may slow adoption in automotive and construction applications. Market sensitivity is high to end-use demand shifts, regulatory compliance, and regional material availability. Diversifying suppliers and end-use markets is crucial to mitigate operational and financial risks and sustain growth.

| Metric | Value |

| Estimated Value in (2025E) | USD 15.9 billion |

| Forecast Value in (2035F) | USD 27.7 billion |

| Forecast CAGR (2025 to 2035) | 6% |

The phenolic resins market demonstrates a clear pattern of proportional growth between 2025 and 2035, rising from USD 15.9 billion to USD 27.7 billion at a compound annual growth rate (CAGR) of 6%. By 2026, the market accounts for USD 16.8 billion, representing an 5.7% increase over the previous year, while 2030 sees a value of USD 19.9 billion, reflecting 12% of the total ten-year growth. By 2034, USD 26.2 billion is reached, accounting for nearly 95% of the incremental growth from 2025 to 2035.

The ratio of early-decade growth (2025–2030) to late-decade expansion (2030–2035) stands at approximately 1:1.7, highlighting accelerated adoption in industrial and construction segments in the latter years. The automotive sector is estimated to contribute nearly 35–40% of incremental market value, while construction and industrial coatings account for 30–35% and 20–25%, respectively. These ratios indicate that end-use diversification and balanced sector contributions are key to sustaining overall market growth. Careful monitoring of these proportions allows manufacturers to allocate resources efficiently and target high-growth segments for maximum return.

Market expansion is being supported by the increasing demand from automotive industry for lightweight and high-strength materials that can withstand extreme temperatures and provide excellent dimensional stability. Modern manufacturers are increasingly focused on materials that can meet stringent safety regulations while offering superior performance characteristics. Phenolic resins' proven efficacy in providing thermal resistance, electrical insulation, and mechanical strength makes them preferred materials in critical industrial applications.

The growing emphasis on fire safety regulations and building codes is driving demand for phenolic resins in construction and infrastructure projects. Consumer preference for durable materials that combine structural integrity with safety compliance is creating opportunities for innovative formulations. The rising influence of electric vehicle manufacturing and renewable energy infrastructure development is also contributing to increased product adoption across different industrial sectors and applications.

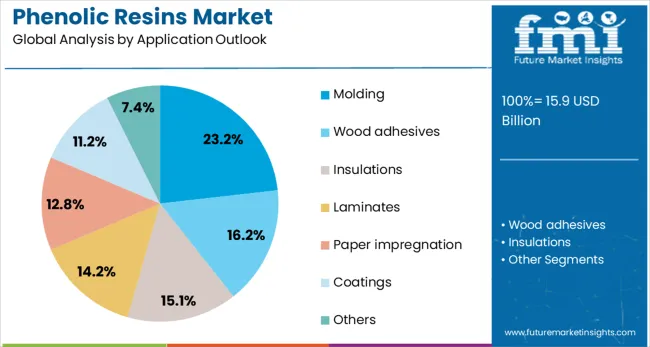

The market is segmented by product, application, and region. By product, the market is divided into novolac, resol (liquid resol resin, solid resol resin), and others. Based on application, the market is categorized into molding, molding compounds, shell molding, wood adhesives, insulations, laminates, paper impregnation, coatings, and others. Regionally, the market is divided into North America, Europe, East Asia, South Asia & Pacific, Latin America, and Middle East & Africa.

The novolac segment is projected to contribute 25% of the phenolic resins market in 2025, maintaining its position as the leading product category. Manufacturers increasingly favor novolac resins for their exceptional thermal stability, chemical resistance, and mechanical strength, which are critical for demanding industrial environments. Novolac provides superior dimensional stability under high temperatures and harsh chemical exposure, making it indispensable for applications requiring reliable, long-lasting performance. Continuous industrial testing and engineering validation reinforce confidence in novolac formulations. With industries seeking materials capable of enduring extreme conditions without compromising quality, novolac remains central to high-performance applications, driving sustained market adoption across multiple industrial sectors.

Molding applications are expected to account for 23% of phenolic resin demand in 2025, reflecting their importance in precision manufacturing. Industries increasingly utilize molding techniques for producing components with intricate geometries, consistent dimensional accuracy, and high-quality surface finishes. Phenolic resins in molding applications deliver both structural advantages, such as mechanical strength, and functional benefits, including thermal stability and electrical insulation. The segment benefits from growing demand in automotive, electrical, and industrial components, where reinforced phenolic materials are critical. Combining phenolic resins with glass fibers or carbon fibers enhances performance, meeting the requirements of industries that prioritize precision, reliability, and high-performance materials in their manufacturing processes.

The automotive and transportation industries are key drivers of the phenolic resins market. These resins are valued for their heat resistance, mechanical strength, and dimensional stability, making them suitable for brake pads, clutch facings, and under-the-hood components. As vehicles are subjected to high temperatures and friction, phenolic resins provide safety and reliability in critical applications. Their lightweight properties also support the ongoing need for fuel efficiency. Beyond cars, they are used in aerospace and heavy machinery where durability is essential. The continuous growth in vehicle production and replacement parts is fueling demand, ensuring phenolic resins remain a vital material in the global transportation sector.

The construction industry represents another strong growth area for the phenolic resins market. These resins are commonly used in laminates, insulation foams, adhesives, and coatings due to their fire resistance and thermal stability. In modern buildings, safety regulations have increased the need for fire-retardant materials, and phenolic resins meet these standards effectively. Their ability to provide long-lasting structural strength and weather resistance makes them ideal for use in both residential and commercial projects. As urban development continues in emerging economies and renovation projects rise in mature markets, demand for advanced construction materials is increasing. Phenolic resins play a crucial role in supporting safer, more durable infrastructure worldwide.

The electrical and electronics sector is another major consumer of phenolic resins. Their excellent insulation, chemical resistance, and dimensional stability make them suitable for circuit boards, switches, and other electronic components. With increasing demand for consumer electronics, home appliances, and industrial equipment, phenolic resins are being widely used to ensure performance and reliability. Their application in insulating varnishes and adhesives further strengthens their importance in this sector. As electronic devices become more compact and efficient, materials with high thermal stability are in greater demand. The widespread use of phenolic resins across electrical systems highlights their critical role in enabling reliable and safe electronic products.

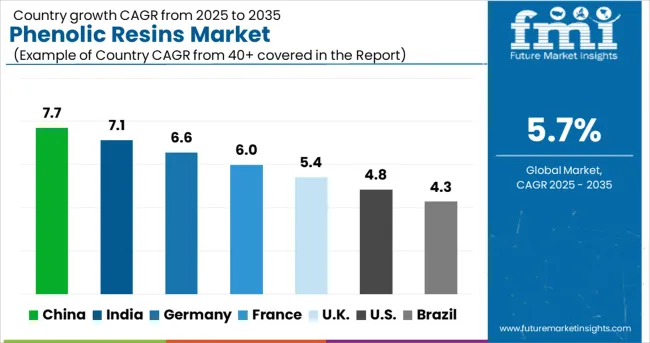

| Country | CAGR (2025-2035) |

| China | 7.7% |

| India | 7.1% |

| Germany | 6.6% |

| France | 6% |

| U.K. | 5.4% |

| U.S. | 4.8% |

The phenolic resins market is experiencing robust growth globally, with China leading at a 7.7% CAGR through 2035, driven by massive industrial expansion, automotive manufacturing growth, and increasing infrastructure development projects. India follows closely at 7.1%, supported by expanding manufacturing sector, growing automotive industry, and increasing demand for construction materials. Germany shows steady growth at 6.6%, emphasizing automotive applications and advanced manufacturing technologies. France records 6%, focusing on aerospace and defense applications and high-performance industrial materials. The UK shows 5.4% growth, prioritizing advanced composites and specialty applications.

The report covers an in-depth analysis of 40+ countries; six top-performing countries are highlighted below.

Phenolic resins in China are poised for robust growth with a projected CAGR of 7.7% through 2035, supported by expanding automotive production, growing electronics manufacturing, and increasing demand from construction projects. Domestic and international chemical providers are establishing large-scale production facilities to serve industrial manufacturers in tier-1 and tier-2 cities. Adoption surpasses India and the UK due to China’s industrial scale and government-backed initiatives in advanced materials. Investments in high-performance thermoset formulations, quality assurance programs, and industrial application-specific solutions are enhancing market penetration. Manufacturers increasingly rely on phenolic resins to ensure reliability, operational efficiency, and regulatory compliance across multiple sectors.

Phenolic resins in India are set to experience steady expansion at a CAGR of 7.1% through 2035, fueled by growing industrialization, automotive sector development, and infrastructure projects. Both domestic and international chemical manufacturers are scaling production and distribution channels to meet the increasing demand in industrial, automotive, and construction sectors. Adoption lags slightly behind China but demonstrates strong potential due to rising regulatory standards and increasing investment in manufacturing excellence. Fire-resistant and high-performance formulations are becoming standard in automotive, electrical, and building applications. Indian manufacturers increasingly rely on phenolic resins to meet quality and safety requirements while enhancing operational performance.

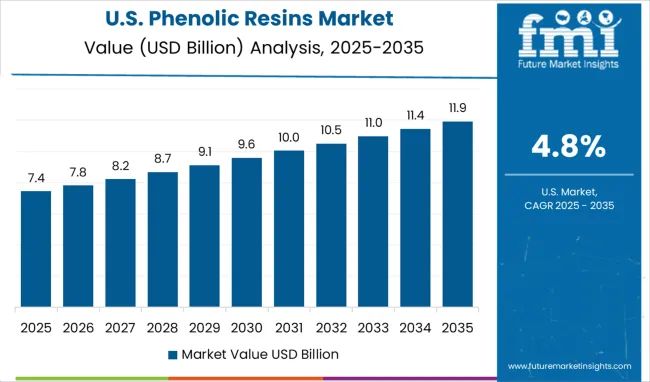

Phenolic resins in the U.S. are expected to register moderate growth at a CAGR of 4.8% through 2035, driven by specialty industrial applications requiring high-performance thermoset materials. Competition is defined by providers offering reinforced formulations and advanced processing capabilities for aerospace, defense, and automotive applications. Compared with China and India, adoption emphasizes material reliability, regulatory compliance, and precision manufacturing. Investments in lightweight automotive composites, electric vehicle components, and high-performance industrial solutions are expanding market reach. U.S. manufacturers increasingly integrate phenolic resins into aerospace, defense, and specialty industrial sectors to ensure consistent performance, compliance, and process efficiency.

Phenolic resins in Germany are anticipated to grow at a CAGR of 6.6% through 2035, supported by a robust automotive manufacturing base and demand for precision-engineered thermoset materials. Chemical providers actively collaborate with automotive and industrial manufacturers to deliver innovative and high-quality solutions. Adoption is more advanced than in India or the U.S., emphasizing regulatory compliance, reliability, and performance consistency. Investments in next-generation composites, structural reinforcement, and process optimization are driving market expansion. German manufacturers increasingly deploy phenolic resins for automotive, electrical, and industrial applications requiring validated performance, operational efficiency, and compliance with European standards.

Phenolic resins in the UK are projected to achieve steady growth at a CAGR of 5.4% through 2035, supported by demand for high-performance composites and specialized industrial applications. Competition involves providers delivering reliable, fire-resistant, and thermally stable solutions across aerospace, defense, and manufacturing sectors. Adoption is slower than China and India but emphasizes operational consistency, quality, and compliance with regulations. Investments in specialized formulations, advanced manufacturing distribution, and tailored applications are increasing market penetration. British manufacturers rely on phenolic resins to meet material performance standards while enhancing production efficiency across multiple industrial sectors.

Phenolic resins in France are expected to expand at a CAGR of 6% through 2035, driven by aerospace, defense, and advanced manufacturing sectors demanding reliable thermoset solutions. Competition is shaped by providers offering validated, high-performance formulations that prioritize compliance and operational efficiency. Adoption is moderate compared with Germany and China but focuses on quality, performance, and regulatory adherence. Investments in testing, composite integration, and distribution channels are enhancing market penetration. French manufacturers increasingly use phenolic resins for aerospace, defense, and industrial applications to ensure consistent performance, safety, and compliance with stringent operational and regulatory standards.

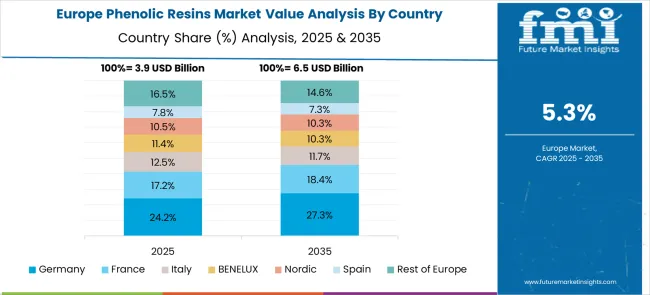

The phenolic resins market in Europe demonstrates mature development across major economies with Germany showing strong presence through its automotive manufacturing base and consumer demand for high-performance industrial materials, supported by companies leveraging advanced processing technologies to develop effective phenolic resin applications that meet stringent automotive and industrial requirements for thermal stability and mechanical performance.

France represents a significant market driven by its aerospace and defense industries and sophisticated understanding of composite materials science, with companies pioneering premium phenolic resin formulations that combine French engineering expertise with advanced manufacturing processes for enhanced structural performance and thermal resistance applications.

The UK exhibits considerable growth through its focus on advanced manufacturing and material innovation, with companies leading the development of specialized phenolic resin formulations and comprehensive industrial applications for high-performance requirements. Italy and Spain show expanding interest in construction and automotive applications, particularly in premium phenolic resin solutions targeting structural components and thermal management systems. BENELUX countries contribute through their focus on chemical processing and eco-efficient manufacturing, while Eastern Europe and Nordic regions display growing potential driven by increasing industrial development and expanding access to advanced material solutions across diverse manufacturing sectors.

Companies are allocating resources to implement advanced production technologies, optimize manufacturing efficiency, and develop eco-conscious processes while maintaining reliable and high-performance phenolic resin solutions. Distribution networks are being enhanced for timely delivery and accessibility, while technical service capabilities are being strengthened to support end users. Continuous product development, process refinement, and strategic market expansion are being pursued to broaden product portfolios, reinforce competitive positioning, and address evolving industrial requirements.

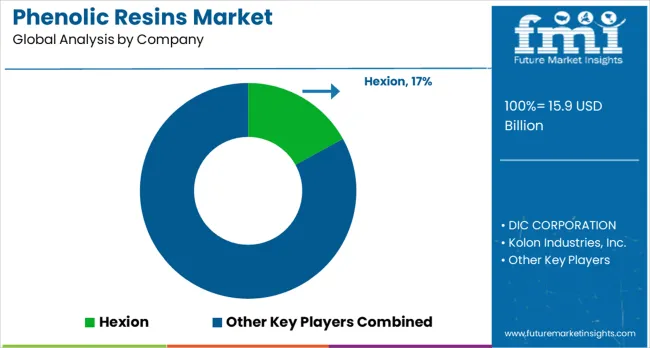

Hexion, headquartered in the U.S., holds a leading position in the global phenolic resin market with an estimated 17% share of total market value. Comprehensive solutions are provided across multiple industrial applications, with particular emphasis on technical performance, quality consistency, and large-scale manufacturing reliability. DIC Corporation of Japan delivers advanced phenolic resin technologies designed for automotive, electronics, and high-precision industrial uses. South Korea’s Kolon Industries Inc. focuses on high-performance formulations tailored to demanding industrial conditions and specialized application requirements. Sumitomo Bakelite Co. Ltd., also based in Japan, prioritizes precision applications and incorporates advanced processing technologies to enhance product reliability and functionality.

Global players such as Hexcel Corporation and Georgia-Pacific Chemicals, a division of Georgia-Pacific LLC, offer extensive phenolic resin portfolios across diverse industrial sectors, supporting a range of applications from aerospace to heavy manufacturing. Kraton Corporation, operating under DL Chemical in the U.S., emphasizes specialty applications, premium material formulations, and performance-driven positioning. Bostik Inc., a subsidiary of Arkema in France, delivers construction- and industrial-focused phenolic resin solutions with robust technical support and application guidance. SI Group Inc. provides specialized chemical offerings, concentrating on performance additives, custom formulations, and tailored solutions to meet sector-specific requirements. These market leaders compete through technological expertise, product versatility, and comprehensive service capabilities, collectively shaping the evolution of the phenolic resin industry.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD 15.9 billion |

| Product | Novolac, Resol (Liquid Resol Resin, Solid Resol Resin), Others |

| Application | Molding, Molding Compounds, Shell Molding, Wood adhesives, Insulations, Laminates, Paper impregnation, Coatings, Others |

| Regions Covered | North America, Europe, East Asia, South Asia & Pacific, Latin America, Middle East & Africa |

| Countries Covered | United States, Canada, United Kingdom, Germany, France, China, Japan, South Korea, India, Brazil, Australia and 40+ countries |

| Key Companies Profiled | Hexion, DIC Corporation, Kolon Industries Inc., Sumitomo Bakelite Co. Ltd., Hexcel Corporation, Georgia-Pacific Chemicals (a division of Georgia-Pacific LLC), Kraton Corporation (a DL Chemical company), Bostik Inc. (a subsidiary of Arkema) (a subsidiary of Arkema), and SI Group Inc. |

| Additional Attributes | Dollar sales by product type and application, regional demand trends, competitive landscape, buyer preferences for novolac versus resol formulations, integration with advanced manufacturing processes, innovations in bio-based formulations, eco-efficient production methods, and technical service capabilities |

The global phenolic resins market is estimated to be valued at USD 15.9 billion in 2025.

The market size for the phenolic resins market is projected to reach USD 27.7 billion by 2035.

The phenolic resins market is expected to grow at a 5.7% CAGR between 2025 and 2035.

The key product types in phenolic resins market are novolac, resol, _liquid resol resin, _solid resol resin and others.

In terms of application outlook, molding segment to command 23.2% share in the phenolic resins market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Phenolic Tackifying Resin Market Size and Share Forecast Outlook 2025 to 2035

Phenolic Adhesive Resin Market Size and Share Forecast Outlook 2025 to 2035

Phenolic Antioxidants Market Size and Share Forecast Outlook 2025 to 2035

Phenolic Board Market Growth – Trends & Forecast 2024-2034

Ribbed Phenolic Caps Market

PE Resins Market Size and Share Forecast Outlook 2025 to 2035

Barrier Resins Market Size and Share Forecast Outlook 2025 to 2035

Coating Resins Market Size and Share Forecast Outlook 2025 to 2035

Plastic Resins Market Size, Share & Forecast 2025 to 2035

Iodinated Resins Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Polyamide Resins Market Size and Share Forecast Outlook 2025 to 2035

Packaging Resins Market Size and Share Forecast Outlook 2025 to 2035

Protein A Resins Market Trends, Demand & Forecast 2025 to 2035

Key Companies & Market Share in the Protein A Resins Market

Wood Coating Resins Market Size and Share Forecast Outlook 2025 to 2035

Lignin Based Resins Market Size and Share Forecast Outlook 2025 to 2035

Impregnating Resins Market Size and Share Forecast Outlook 2025 to 2035

Ion Exchange Resins Market Size & Forecast 2025 to 2035

Polyurethane Resins Paints & Coatings Market Growth – Trends & Forecast 2025 to 2035

Polycarbonate Resins Market - Trends & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA