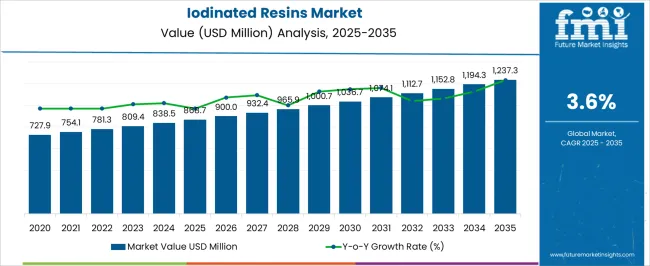

The iodinated resins market is valued at USD 868.7 million in 2025 and is anticipated to reach USD 1,239.6 million by 2035. This expansion of USD 370.9 million over the decade reflects a compound annual growth rate (CAGR) of 3.6%. The market trajectory indicates steady growth as pharmaceutical synthesis, water treatment, and specialized chemical processing applications drive sustained demand for iodine-functionalized resin technologies.

During the initial phase from 2025 to 2030, the market is forecast to advance from USD 868.7 million to USD 1,034.7 million, adding approximately USD 166.0 million, which accounts for nearly 45% of the total decade expansion. This stage is expected to be characterized by increased adoption in pharmaceutical manufacturing, where iodinated resins serve critical roles in API synthesis and intermediate processing. Macroporous resins, commanding a 40% share in 2025, are positioned to anchor growth momentum, while pharmaceutical applications maintain their lead with a 40% share.

In the latter half from 2030 to 2035, acceleration is expected as valuations rise from USD 1,034.7 million to USD 1,239.6 million, adding USD 204.9 million or 55% of total growth. This period is projected to be reinforced by expanded water treatment applications and growing demand for specialized catalysis processes. Industrial applications are anticipated to strengthen their contribution, supported by chemical processing and purification segments growing above market average.

| Metric | Value |

|---|---|

| Iodinated Resins Market Estimated Value in (2025E) | USD 868.7 Million |

| Iodinated Resins Market Forecast Value in (2035F) | USD 1,239.6 Million |

| Forecast CAGR (2025 to 2035) | 3.6% |

Between 2020 and 2024, the iodinated resins market expanded steadily, supported by pharmaceutical manufacturers adopting specialized resin technologies for complex synthesis processes. During this period, global suppliers dominated, controlling the majority of industry revenues by leveraging wide product portfolios and established distribution networks. Differentiation was largely based on resin functionality, chemical stability, and regulatory compliance, while direct applications in emerging water treatment sectors remained in their growth phase, contributing moderately to total value.

Demand is forecast to reach USD 868.7 million in 2025, and the revenue structure is expected to evolve as industrial and analytical applications accelerate. Traditional pharmaceutical leaders are projected to face rising competition from regional suppliers offering specialized formulations with cost-effective positioning. Leading incumbents are anticipated to pivot toward integrated models by expanding application-specific solutions, technical support services, and regulatory documentation platforms to retain their relevance. Emerging participants focusing on water treatment and catalysis innovations are forecast to gain share, particularly in Asia-Pacific where demand for purification technologies and specialized chemical processing is expanding rapidly.

Growth in the iodinated resins market is being supported by pharmaceutical manufacturing requirements and specialized chemical processing applications across industrial sectors. Increased demand for API synthesis and intermediate processing has translated into higher usage of iodinated resins within pharmaceutical formulations, where their selective adsorption and catalytic properties provide essential functionality.

A shift toward advanced water treatment solutions is being reinforced by regulatory requirements for contaminant removal, encouraging manufacturers to prioritize iodine-functionalized resins for specialized purification processes. Demand for analytical applications, particularly in research and laboratory environments, is accelerating the adoption of high-purity iodinated resins. Industrial sectors are integrating these materials for catalysis and adsorption processes, further supporting momentum. Technological advances in resin functionalization and manufacturing processes are enabling greater performance consistency and application versatility, ensuring long-term market viability.

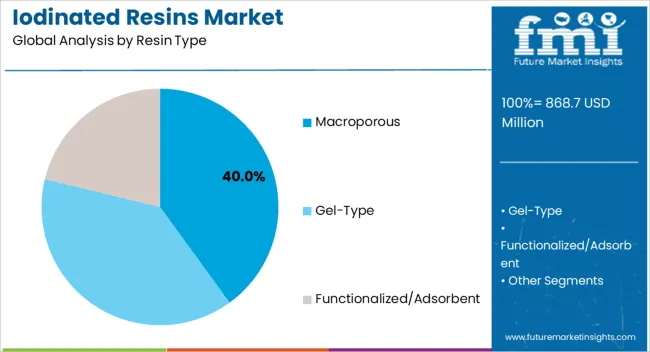

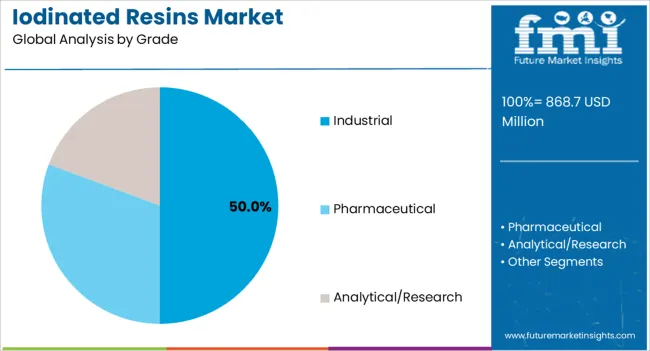

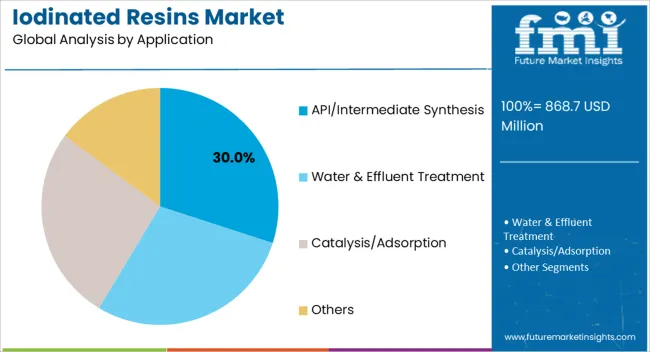

The market is segmented by resin type, grade, application, form, and region. By resin type, the market is categorized into macroporous, gel-type, and functionalized/adsorbent. Based on grade, the market is divided into pharmaceutical, industrial, and analytical/research. In terms of application, the market is classified into API/intermediate synthesis, water & effluent treatment, catalysis/adsorption, and others. By form, the market is segmented into beads/pellets, powder, and other forms. Regionally, the market is divided into North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa.

Macroporous resins are projected to dominate with a 40% share of the market in 2025, outpacing alternative formulations due to their superior porosity and chemical stability in demanding applications. Growth will be driven by pharmaceutical requirements for reliable API synthesis and water treatment applications requiring consistent performance across varied conditions. Gel-type resins, while maintaining relevance for specific applications, are also expected to contribute. As performance consistency and regulatory compliance gain importance, macroporous resins are expected to solidify their role as the backbone of specialized chemical processing, with applications extending from pharmaceuticals to advanced purification systems.

Industrial grade resins are projected to command a 50% share of the market in 2025, driven by their widespread use in chemical processing, water and effluent treatment, and environmental purification. Their durability, scalability, and cost-effectiveness position them as the preferred choice for high-volume industrial operations requiring reliable performance. While pharmaceutical and analytical grades serve specialized niches, industrial resins dominate broader applications across municipal utilities, petrochemicals, and large-scale manufacturing. As sustainability mandates and stricter treatment standards advance, industrial grade formulations are expected to strengthen their role as the backbone of mass-market adoption, ensuring both operational efficiency and regulatory compliance across diverse end-use sectors.

The API and intermediate synthesis segment is anticipated to lead with a 35% share in 2025, supported by continuous demand for pharmaceutical manufacturing and drug development processes. This leadership is reinforced by the critical role iodinated resins play in complex chemical transformations required for pharmaceutical compounds. Water and effluent treatment applications are also expected to show strong demand, particularly within industrial and municipal treatment facilities. Catalysis and adsorption applications, though smaller at 20% share, are driven by specialized chemical processing requirements. As regulatory standards for pharmaceutical manufacturing intensify and water treatment technologies advance, API synthesis applications are expected to maintain their dominant position while supporting broader market expansion across complementary sectors.

The iodinated resins market is driven by rising pharmaceutical innovation, strict regulatory standards, and growing demand for manufacturing efficiency. Key trends include increasing use in specialized applications like drug synthesis and water treatment. However, high raw material costs and technical complexity act as restraints, challenging market players. From 2025 to 2035, companies must balance compliance, innovation, and cost management to sustain growth while addressing evolving industry needs.

The iodinated resins market is being reinforced by integration into pharmaceutical manufacturing frameworks, where specialized resins enable complex chemical synthesis and purification processes. Pharmaceutical companies are increasingly incorporating iodinated resins into API production and intermediate processing, backed by their selective adsorption capabilities and chemical stability under demanding conditions. Quality assurance protocols and regulatory compliance requirements are driving adoption of pharmaceutical-grade formulations that meet stringent purity and documentation standards. As digital manufacturing platforms expand, resins with verified performance characteristics and comprehensive analytical documentation are expected to become strategic differentiators across pharmaceutical and specialty chemical portfolios.

Market growth is being constrained by volatility in iodine pricing and specialized raw materials required for resin functionalization. Supply chain dependencies on iodine sources and complex manufacturing processes elevate production costs and create pricing pressures for manufacturers. Technical complexity in resin synthesis and functionalization requires specialized expertise and advanced manufacturing capabilities, limiting market entry for smaller suppliers. Regulatory requirements for pharmaceutical and analytical grades add compliance costs and lengthy approval processes, discouraging rapid market expansion. These technical and economic barriers are anticipated to influence competitive dynamics, favoring established manufacturers with integrated supply chains and comprehensive technical capabilities.

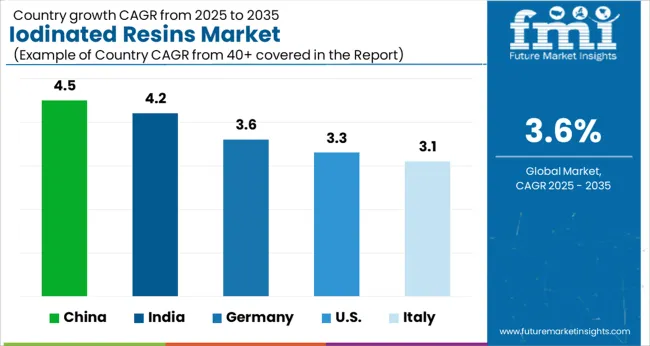

| Country | CAGR |

|---|---|

| China | 4.5% |

| India | 4.2% |

| Germany | 3.6% |

| United States | 3.3% |

| Italy | 3.1% |

A varied country trajectory is observed for the Iodinated Resins Market, reflecting pharmaceutical manufacturing capacity, industrial development, and regulatory frameworks. Asia's momentum is projected to be led by China (4.5% CAGR) and India (4.2%), where pharmaceutical manufacturing expansion and water treatment infrastructure development are expected to drive adoption under supportive industrial policies. Germany is anticipated to advance at 3.6% CAGR, with consistent uptake across pharmaceutical and chemical processing sectors as quality standards and regulatory frameworks support premium resin technologies. The United States is positioned to grow at 3.3% CAGR, driven by pharmaceutical innovation and specialized chemical applications. Italy, with 3.1% CAGR, benefits from established chemical manufacturing and pharmaceutical sectors requiring specialized resin technologies.

The report covers an in-depth analysis of 40+ countries; five top-performing OECD countries are highlighted below.

Demand for iodinated resins in China is forecasted to expand at the highest CAGR of 4.5% between 2025 and 2035, driven by pharmaceutical manufacturing growth and expanding chemical processing sectors. The country's position as a major pharmaceutical producer is expected to sustain demand for high-quality resin technologies in API synthesis and intermediate processing. Water treatment infrastructure development and industrial purification requirements are anticipated to create additional market opportunities. Government support for pharmaceutical innovation and chemical industry modernization is projected to accelerate adoption of specialized resin technologies.

China's extensive manufacturing base and established supplier networks provide competitive advantages in cost-effective production and distribution. Pharmaceutical companies are increasingly integrating iodinated resins into production processes to meet international quality standards and regulatory requirements. The combination of domestic demand growth and export market development positions China as a key growth driver in the global iodinated resins market.

Revenue from iodinated resins in India is projected to grow at a CAGR of 4.2% from 2025 to 2035, supported by pharmaceutical sector expansion and increasing water treatment requirements. The country's position as a global pharmaceutical hub is expected to drive consistent demand for pharmaceutical-grade resins in drug manufacturing and API production. Industrial development and chemical processing growth are anticipated to create additional application opportunities across manufacturing sectors.

Government initiatives supporting pharmaceutical manufacturing and water treatment infrastructure are expected to accelerate market development. India's cost-competitive manufacturing environment and growing technical expertise in specialty chemicals provide advantages for both domestic consumption and export market penetration. The combination of pharmaceutical sector strength and expanding industrial applications positions India for sustained market growth throughout the forecast period.

Sales of iodinated resins in Germany are forecast to advance at a CAGR of 3.6% between 2025 and 2035, supported by advanced pharmaceutical manufacturing and stringent quality standards. The country's leadership in chemical processing and pharmaceutical innovation drives demand for premium resin technologies meeting rigorous regulatory requirements. Industrial applications in specialized chemical processing and water treatment are expected to provide complementary growth opportunities.

Germany's emphasis on technological innovation and quality assurance positions the market for consistent expansion through advanced manufacturing processes and application development. The country's role as a regional pharmaceutical and chemical hub ensures sustained demand from both domestic producers and international companies operating in European markets. Regulatory frameworks supporting high-quality manufacturing standards reinforce market stability and growth prospects.

The United States iodinated resins market is projected to grow at a CAGR of 3.3% from 2025 to 2035, driven by pharmaceutical innovation and specialized chemical processing applications. The country's leadership in drug development and biotechnology creates consistent demand for high-performance resin technologies in complex synthesis processes. Industrial applications and water treatment requirements provide additional market support across diverse sectors.

Innovation in pharmaceutical manufacturing and regulatory requirements for quality assurance drive adoption of advanced resin technologies. The combination of domestic pharmaceutical production and research activities ensures sustained market development. Technical expertise and advanced manufacturing capabilities position the United States as a key market for premium iodinated resin products and specialized applications.

Demand of iodinated resins in Italy is expected to expand at a CAGR of 3.1% between 2025 and 2035, supported by established pharmaceutical and chemical manufacturing sectors. The country's position in European pharmaceutical production and specialty chemical processing drives consistent demand for quality resin technologies. Industrial applications and water treatment requirements provide additional market opportunities across manufacturing and municipal sectors.

Italy's manufacturing expertise and regulatory compliance capabilities support market stability and growth through established supply chains and technical knowledge. The combination of pharmaceutical manufacturing and chemical processing activities ensures diversified demand across multiple application segments. Regional market integration within Europe provides additional growth opportunities through expanded distribution and application development.

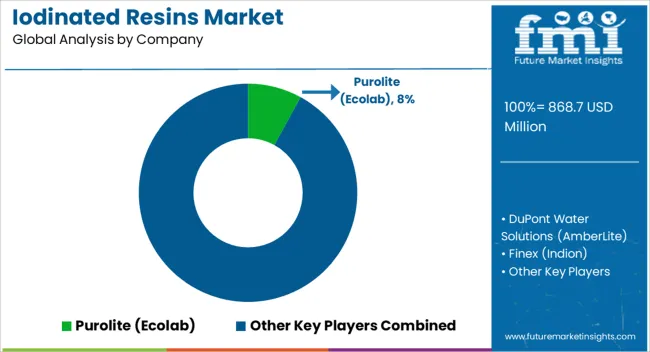

The market is moderately fragmented, with global chemical companies, specialized resin manufacturers, and regional suppliers competing across pharmaceutical, industrial, and analytical applications. Global leaders such as DuPont Water Solutions, LANXESS, and Purolite hold significant market positions, supported by comprehensive product portfolios, established distribution networks, and strong technical support capabilities. Their strategies are increasingly centered on pharmaceutical-grade formulations, regulatory compliance, and application-specific solutions aligned with quality assurance and performance requirements.

Established regional players, including Ion Exchange India, Thermax, and Finex, are actively addressing demand for cost-effective solutions tailored to local pharmaceutical and industrial applications. Their strengths are anchored in regional market knowledge, flexible manufacturing capabilities, and rapid response to evolving customer requirements. Value-added services such as technical consultation and application development are being leveraged to strengthen customer relationships and market positioning.

Specialized providers focus on high-performance formulations for analytical and research applications, serving pharmaceutical research, chemical development, and specialized processing requirements. Their competitive advantage lies in technical expertise, customized solutions, and collaborative relationships with research institutions and specialty manufacturers.

Competitive differentiation is expected to shift toward integrated solutions combining product quality, technical support, and regulatory compliance, ensuring stronger customer alignment and sustained market positioning through specialized expertise and comprehensive service capabilities.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD 868.7 million |

| Resin Type | Macroporous, Gel-Type, Functionalized/Adsorbent |

| Grade | Pharmaceutical, Industrial, Analytical/Research |

| Application | API/Intermediate Synthesis, Water & Effluent Treatment, Catalysis/Adsorption, Others |

| Form | Beads/Pellets, Powder, Other Forms |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Countries Covered | United States, Canada, United Kingdom, Germany, France, China, Japan, South Korea, Brazil, Australia and 40+ countries |

| Key Companies Profiled | DuPont Water Solutions (AmberLite), LANXESS (Lewatit), Purolite (Ecolab), Ion Exchange India, Thermax (Tulsion), Mitsubishi Chemical (Diaion), Finex (Indion), Graver Technologies, ResinTech, Sichuan Bluestar (Chengrand) |

| Additional Attributes | Dollar sales by resin type and application, adoption trends in pharmaceutical manufacturing, growing demand for water treatment applications, regulatory compliance requirements driving pharmaceutical grade adoption, regional manufacturing capabilities influencing market dynamics, technological advancement in resin functionalization improving performance characteristics |

The global iodinated resins market is estimated to be valued at USD 868.7 million in 2025.

The market size for the iodinated resins market is projected to reach USD 1,237.3 million by 2035.

The iodinated resins market is expected to grow at a 3.6% CAGR between 2025 and 2035.

The key product types in iodinated resins market are macroporous, gel-type and functionalized/adsorbent.

In terms of grade, industrial segment to command 50.0% share in the iodinated resins market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

PE Resins Market Size and Share Forecast Outlook 2025 to 2035

Barrier Resins Market Size and Share Forecast Outlook 2025 to 2035

Coating Resins Market Size and Share Forecast Outlook 2025 to 2035

Plastic Resins Market Size, Share & Forecast 2025 to 2035

Phenolic Resins Market Size and Share Forecast Outlook 2025 to 2035

Polyamide Resins Market Size and Share Forecast Outlook 2025 to 2035

Packaging Resins Market Size and Share Forecast Outlook 2025 to 2035

Protein A Resins Market Trends, Demand & Forecast 2025 to 2035

Key Companies & Market Share in the Protein A Resins Market

Wood Coating Resins Market Size and Share Forecast Outlook 2025 to 2035

Lignin Based Resins Market Size and Share Forecast Outlook 2025 to 2035

Impregnating Resins Market Size and Share Forecast Outlook 2025 to 2035

Ion Exchange Resins Market Size & Forecast 2025 to 2035

Polyurethane Resins Paints & Coatings Market Growth – Trends & Forecast 2025 to 2035

Polycarbonate Resins Market - Trends & Forecast 2025 to 2035

Cyanate Ester Resins Market

Orthophthalic Resins Market

Polybenzoxazine Resins Market Size and Share Forecast Outlook 2025 to 2035

High Purity PFA Resins Market Size and Share Forecast Outlook 2025 to 2035

India Protein A Resins Market Insights – Trends, Demand & Forecast 2025-2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA