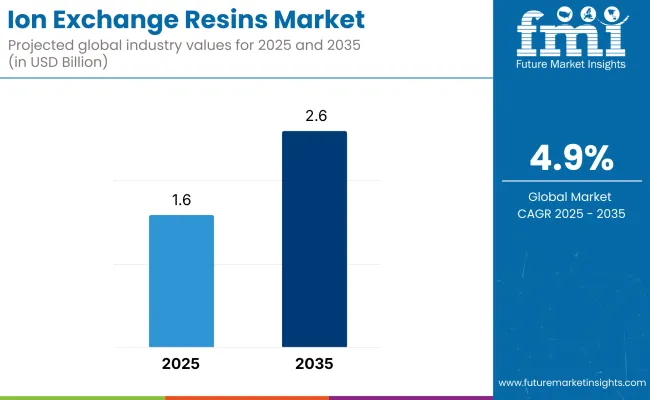

The ion exchange resins market is expected to grow from USD 1.6 billion in 2025 to USD 2.6 billion by 2035. The market is poised to expand at a 4.9% CAGR during the forecast period. Rising demand for clean water across municipal, industrial, and residential sectors is driving steady market growth. With rapid urbanization and industrial expansion, water pollution and scarcity have become critical concerns, prompting widespread adoption of advanced treatment technologies.

Ion exchange resins, valued for their ability to remove specific contaminants such as heavy metals, nitrates, and organic compounds, are playing a pivotal role in ensuring compliance with stringent water quality standards. Their application spans water treatment plants, power generation, food & beverage processing, and pharmaceutical manufacturing.

Technological advancements are further accelerating market momentum. Manufacturers are developing next-generation resins with enhanced selectivity, durability, and environmental compatibility. Innovations such as bio-based resins and low-regeneration formulations are helping industries meet evolving regulatory requirements while improving operational efficiency.

The integration of IoT-enabled monitoring systems in modern water treatment facilities is driving demand for resins that support predictive maintenance and optimized performance. Additionally, emerging applications in sectors such as semiconductors, battery manufacturing, and rare earth recovery are expanding the market scope, positioning ion exchange resins as a key component in achieving ultrapure water standards.

Government regulations are playing a crucial role in shaping the market landscape. In the United States, the Safe Drinking Water Act (SDWA) and Clean Water Act (CWA) enforced by the EPA mandate stringent water treatment standards, fostering demand for ion exchange technologies.

The European Union’s Drinking Water Directive and REACH legislation are guiding manufacturers toward safer and more sustainable solutions. In Asia-Pacific, initiatives like China’s Water Pollution Prevention Action Plan and India’s National Water Mission are accelerating investment in advanced water purification infrastructure. As industries and governments worldwide focus on water sustainability and regulatory compliance, the ion exchange resins market is likely to witness continued growth across global markets.

The market is segmented based on product type, end use, and region. By product type, the market is divided into cation exchange resins, anion exchange resins, and others (mixed-bed resins, chelating resins, specialty resins).

Based on end use, the market is categorized into power generation, chemical and fertilizer, food and beverage, electrical and electronics, pharmaceutical, domestic and waste water treatment, paper and pulp, and others (mining, textile, metal finishing, semiconductor manufacturing). Regionally, the market is classified into North America, Latin America, East Asia, South Asia, Western Europe, Eastern Europe, and the Middle East & Africa.

The anion exchange resins segment is projected to grow at the fastest CAGR of 6.7% between 2025 and 2035. This growth is being driven by increasing demand for high-purity water in industries such as pharmaceuticals, semiconductors, and power generation. Anion exchange resins play a critical role in deionization, desalination, and removal of organic contaminants from process and drinking water.

With global concerns rising around water scarcity and contaminant-free industrial processes, anion resins are seeing significant uptake. The introduction of high-capacity resins with improved durability and faster regeneration cycles is further accelerating market penetration, particularly across Asia-Pacific and Middle Eastern water treatment projects.

Meanwhile, cation exchange resins remain the dominant product type by volume and value. Their extensive use in softening, dealkalization, and industrial process water treatment ensures consistent demand across a wide range of applications. Cation resins are particularly critical in power generation and chemical processing, where scale prevention and ionic balance are essential.

The others segment including mixed-bed resins, chelating resins, and specialty resins caters to niche markets such as metal recovery, ultrapure water production, and complex separation processes. These resins are gaining traction as industries adopt advanced filtration technologies to meet stringent quality and sustainability targets.

| Product Type Segment | CAGR (2025 to 2035) |

|---|---|

| Anion Exchange Resins | 6.7% |

The domestic and waste water treatment segment is projected to register the fastest CAGR of 7.1% between 2025 and 2035. Growing regulatory emphasis on clean water standards, rising urban population, and increasing investment in municipal water treatment infrastructure across Asia-Pacific, Latin America, and Middle East & Africa are fueling this growth. Ion exchange resins are widely used in nitrate removal, hardness reduction, and heavy metal extraction, enabling compliance with stringent environmental norms.

Additionally, the rising popularity of point-of-use and point-of-entry residential water purification systems is expanding the domestic application base for ion exchange resins. The segment also benefits from ongoing upgrades to aging municipal water treatment plants in developed markets.

Meanwhile, the power generation sector continues to be a major revenue contributor, driven by the need for ultrapure boiler feed water in thermal and nuclear power plants. The chemical and fertilizer segment maintains strong demand for ion exchange resins in catalysis, separation, and purification processes.

In the food and beverage industry, ion exchange resins are crucial for sugar refining, juice decolorization, and food-grade water production. Segments such as electrical and electronics, pharmaceutical, and paper and pulp contribute stable demand, with increasing focus on process water quality and product purity.

| End Use Segment | CAGR (2025 to 2035) |

|---|---|

| Domestic and Waste Water Treatment | 7.1% |

High Raw Material Costs and Supply Chain Volatility

The ion exchange resins industry is seeing a prominent negative effect from the rising costs of raw materials like styrene, divinyl benzene, and acrylates. The supply chain interruptions that come as a result of international conflicts, sporadic crude oil-based prices, and trade prohibitions have also driven the production costs higher.

The industry's use of petrochemical-based resins has also become an issue because of sustainability, and companies are now looking for bio-based alternatives. To overcome these problems, companies are concentrating on building localized supply chains and discovering the best costs for materials and alternative resin programs. While price fluctuation and regulatory pressure still exist, the long-term market remains uncertain.

Disposal and Environmental Impact of Spent Resins

Chemicals that are produced during the regeneration of spent ion exchange resins are the main source of chemical waste, which affects the environment. With the waste-disposal issues, manufacturers have been forced to find more sustainable regeneration and recycling solutions through closed-loop production. With new programs addressing the durability and reuse of resin materials, there is a win for the environment, but these remain a challenge.

Industries that depend on large volumes of water treatment and chemical separation have environmental regulatory compliance, which makes the cost of operation increase. Apart from that, the necessity for ecological disposal and the innovation of biodegradable or recyclable resins have driven research and development at the same time. Still, the big problem is making them cost-effective and scalable enough.

Expansion in Desalination and Clean Water Technologies

The need for desalination and highly efficient water purification systems is driving the demand for these solutions, which are vital in the ongoing water scarcity crisis. Ion exchange resins are ultra-parricidal brine salt gradient chimneys in seawater treatment.

Governments across the globe are making investments in the construction of big water infrastructure projects, particularly in the Middle East, North Africa, and Asia-Pacific, thus providing resin manufacturers with work. Implementation of zero-liquid discharge (ZLD) systems and industrial wastewater recycling shard the path of innovation in designing new advanced ion exchange resins aimed at long-run sustainability and cost-effective water treatment.

Growth in Energy Storage and Lithium Extraction Applications

The development of electric vehicles (EVs) and renewable energy storage is leading the way to lithium extraction and purification technologies. Ion exchange resins are increasingly used to take out and retrieve coming lithium from brine sources, which is a significant step in the manufacture of battery-grade lithium.

To make battery materials perform better, the technology contains a good amount of ion exchange resins that are specialized for electrolyte purification, metal recovery, and energy storage. This emerging field creates actual interest in the market for the producers of such resins who are likely to benefit from the financial input of the public sector and companies in the environment-friendly technologies.

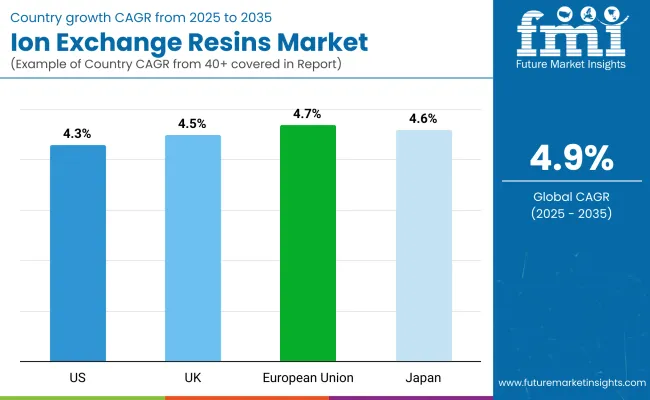

USA ion exchange resins business is on the rise owing to the enactment of environmental policies, increasing demand for water treatment, and introduction of advanced applications in industries. The EPA and Safe Drinking Water Act regulations govern the necessity of the application of high-efficiency resins to municipal water treatment.

On top of that, the growing pharmaceutical and biotechnology sectors require the use of high-purity water for the production of drugs. Yet, the increasing power generation projects, nuclear energy, and the need for nuclear-grade ion exchange resins have also resulted in the expansion of the nuclear energy sector. The after-sale segment involving the replacement of resin in industrial filtration systems is seeing an impressive surge.

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 4.3% |

The UK ion exchange resins sector is flourishing, primarily due to the establishment of water quality regulations, a surge in industrial wastewater treatment facilities, and an upsurge in pharmaceutical outlets. The UK Environment Agency implements very strict policies on wastewater discharge and chemical effluent treatment stimulating the demand for proper functioning, high-efficiency ion exchange resins ,mostly biopharmaceutical manufacturing expansion on the need for resin-based purification systems. Push for green energy and hydrogen fuel cells are the main factors of specialty ion exchange resin penetration.

| Country | CAGR (2025 to 2035) |

|---|---|

| United Kingdom | 4.5% |

The initiation of the European ion exchange resins market is attributable to the rigorous environmental regulations, the promotion of water recycling and the growth in the chemical processes observable in the region. The Mediterranean Green Deal and REACH directives prompt the configuration of ecological resin technology for use in water purification and pollution control.

The European chemical and food sector is transitioning to resin separation and purification processes for safety and energy sustainability considerations. Besides, the development of nuclear energy in France and Germany is deemed a factor behind the rise in the need for nuclear-grade ion exchange resins.

| Region | CAGR (2025 to 2035) |

|---|---|

| European Union | 4.7% |

The world of Japan's ion exchange resins is expanding at a good rate, thanks to water purification technologies, the solid pharmaceutical sector, and an uptick in nuclear power applications. Japan is renowned for high-purity production water treatment and consequently, the need for ultrapure resins in electronics and semiconductor manufacturing is growing.

What is more, Japan's deteriorating old infrastructure is causing investment to increase in municipal water treatment renovation projects. The development of the hydrogen fuel sector in Japan is also a propellant of the demand for specific ion exchange technologies.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 4.6% |

The ion exchange resins business stays at the top of the water treatment pharmaceuticals power generation, food & beverage processing, and chemical processing ladder. Particularly, the main applications of ion exchange resins are to water purification, softening, and remediation of industrial waste discharge.

Acute water recourse problems, stringent environmental directives, and the enlargement of industrial discharges promote market growth. The main companies involved are Dow Inc., DuPont de Nemours, Inc., Lanxess AG, Purolite Corporation, and Mitsubishi Chemical Corporation. This market also comprises regional makers who offer specialized applications and cheaper solutions.

Dow Inc.

As a notable supplier, Dow Inc. delivers highly effective ion exchange resins that are mainly used in water purification, chemical processing, and power generation. Its DOWEX™ and AMBERLITE™ resins are recognized for their amazing durability and ion exchange capacity, which naturally makes them the best choice for large-scale indus.

Understanding the importance of good water quality, Dow enhances the life and efficiency of resin in industries by continuous R&D investments. Resins are made from recycled or biological materials; besides, the company's emphasis on environmentally friendly water treatment leads to its position as a solid player in the fast-developing environmental field.

DuPont de Nemours, Inc.

DuPont is a key supplier of ion exchange resins used mainly in the semiconductor and medical sectors. Water treatment is the most considerable fraction of the total gas and liquid residue in the industries AmberLite™ and AmberSep™ product lines of waste management, contaminated iodine, and radioactive waste are the most popular ones.

For this reason, DuPont's industrial expertise makes it a unique solution for the electronics and pharma sectors. Together with a responsible approach to the environment, with a global supply chain and strategic alliances, the company manifests itself strongly in developed and emerging markets.

Lanxess AG

Lanxess AG is a powerhouse in the chemical processing and metal recovery industries by offering high-performance Lewatit® ion exchange resins. The strategic focus for this company is to offer high-performance resins that facilitate overall water treatment, food processing, and hydrometallurgy (metal extraction) processes.

Sustainable reality is definitely a concept Lanxess shares with other friends in the resin business, which means no excess resource flux and waste. Besides that, Lanxess is now entering the semiconductor and pharma industries where ultrapure water is required. With durability, selectivity, and regulation requirements, the company further strengthens its market position in specialized applications.

Purolite Corporation

Purolite dominates the specialty ion exchange resins market by offering products for nuclear power, food & beverage, and pharmaceutical applications. Nuclear-grade resins are manufactured by the company, and they are essential for radioactive waste treatment and decontamination. The FDA-compliant resins are successfully used in sugar refining, beverage processing, and separating pharmaceuticals.

Purolite targets at producing resins with high-purity and stronger chemical stability, which is the reason it is widely selected by critical industries. The company also pushes with an investment in both biocompatible and high-operational inks that allow them to extend their market in biotechnology and life sciences.

Mitsubishi Chemical Corporation

Mitsubishi Chemical Corporation is an ion exchange resin supplier for power plants, the electronics industry, and wastewater treatment. The company shows great strength in the Asia-Pacific market, supplying advantageous and effective resins for boiler water treatment, semiconductor processing, and environmental remediation.

The commitment to innovative technologies led the company to focus on resins developed to last longer and be regenerated more efficiently, which in turn will cut costs for the users of their products. Bio-based ion exchange materials, which are also a step forward in terms of global sustainability, are included in the company's plans. It maintains its position as a key regional player in the ion exchange resin industry.

Other Key Players

The global market is expected to reach USD 2.6 billion by 2035, growing from USD 1.6 billion in 2025, at a CAGR of 4.9% during the forecast period.

The cationic resins segment is projected to dominate the market, driven by its widespread use in water purification, power generation, and industrial processing applications requiring efficient ion exchange performance and high chemical stability.

The water treatment sector is the leading application segment, supported by rising demand for potable water, increasing industrial wastewater treatment needs, and growing implementation of stringent environmental regulations worldwide.

Key drivers include increasing demand for ultrapure water across industries, rising awareness regarding water scarcity, advancements in resin technologies, and expanding applications in pharmaceuticals, food & beverages, and chemical processing.

Top companies include DuPont de Nemours, Inc., LANXESS AG, Purolite Corporation, Mitsubishi Chemical Corporation, and Thermax Limited, recognized for their innovative resin products, strong R&D capabilities, and extensive global distribution networks.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Volume (Tons) Forecast by Region, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 4: Global Market Volume (Tons) Forecast by Product Type, 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 6: Global Market Volume (Tons) Forecast by Application, 2018 to 2033

Table 7: Global Market Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 8: Global Market Volume (Tons) Forecast by End Use, 2018 to 2033

Table 9: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 10: North America Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 11: North America Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 12: North America Market Volume (Tons) Forecast by Product Type, 2018 to 2033

Table 13: North America Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 14: North America Market Volume (Tons) Forecast by Application, 2018 to 2033

Table 15: North America Market Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 16: North America Market Volume (Tons) Forecast by End Use, 2018 to 2033

Table 17: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 18: Latin America Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 19: Latin America Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 20: Latin America Market Volume (Tons) Forecast by Product Type, 2018 to 2033

Table 21: Latin America Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 22: Latin America Market Volume (Tons) Forecast by Application, 2018 to 2033

Table 23: Latin America Market Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 24: Latin America Market Volume (Tons) Forecast by End Use, 2018 to 2033

Table 25: Western Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 26: Western Europe Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 27: Western Europe Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 28: Western Europe Market Volume (Tons) Forecast by Product Type, 2018 to 2033

Table 29: Western Europe Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 30: Western Europe Market Volume (Tons) Forecast by Application, 2018 to 2033

Table 31: Western Europe Market Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 32: Western Europe Market Volume (Tons) Forecast by End Use, 2018 to 2033

Table 33: Eastern Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 34: Eastern Europe Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 35: Eastern Europe Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 36: Eastern Europe Market Volume (Tons) Forecast by Product Type, 2018 to 2033

Table 37: Eastern Europe Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 38: Eastern Europe Market Volume (Tons) Forecast by Application, 2018 to 2033

Table 39: Eastern Europe Market Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 40: Eastern Europe Market Volume (Tons) Forecast by End Use, 2018 to 2033

Table 41: South Asia and Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 42: South Asia and Pacific Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 43: South Asia and Pacific Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 44: South Asia and Pacific Market Volume (Tons) Forecast by Product Type, 2018 to 2033

Table 45: South Asia and Pacific Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 46: South Asia and Pacific Market Volume (Tons) Forecast by Application, 2018 to 2033

Table 47: South Asia and Pacific Market Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 48: South Asia and Pacific Market Volume (Tons) Forecast by End Use, 2018 to 2033

Table 49: East Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 50: East Asia Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 51: East Asia Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 52: East Asia Market Volume (Tons) Forecast by Product Type, 2018 to 2033

Table 53: East Asia Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 54: East Asia Market Volume (Tons) Forecast by Application, 2018 to 2033

Table 55: East Asia Market Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 56: East Asia Market Volume (Tons) Forecast by End Use, 2018 to 2033

Table 57: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 58: Middle East and Africa Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 59: Middle East and Africa Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 60: Middle East and Africa Market Volume (Tons) Forecast by Product Type, 2018 to 2033

Table 61: Middle East and Africa Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 62: Middle East and Africa Market Volume (Tons) Forecast by Application, 2018 to 2033

Table 63: Middle East and Africa Market Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 64: Middle East and Africa Market Volume (Tons) Forecast by End Use, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Application, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by End Use, 2023 to 2033

Figure 4: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 5: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 6: Global Market Volume (Tons) Analysis by Region, 2018 to 2033

Figure 7: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 8: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 9: Global Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 10: Global Market Volume (Tons) Analysis by Product Type, 2018 to 2033

Figure 11: Global Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 12: Global Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 13: Global Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 14: Global Market Volume (Tons) Analysis by Application, 2018 to 2033

Figure 15: Global Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 16: Global Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 17: Global Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 18: Global Market Volume (Tons) Analysis by End Use, 2018 to 2033

Figure 19: Global Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 20: Global Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 21: Global Market Attractiveness by Product Type, 2023 to 2033

Figure 22: Global Market Attractiveness by Application, 2023 to 2033

Figure 23: Global Market Attractiveness by End Use, 2023 to 2033

Figure 24: Global Market Attractiveness by Region, 2023 to 2033

Figure 25: North America Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 26: North America Market Value (US$ Million) by Application, 2023 to 2033

Figure 27: North America Market Value (US$ Million) by End Use, 2023 to 2033

Figure 28: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 29: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 30: North America Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 31: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 32: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 33: North America Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 34: North America Market Volume (Tons) Analysis by Product Type, 2018 to 2033

Figure 35: North America Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 36: North America Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 37: North America Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 38: North America Market Volume (Tons) Analysis by Application, 2018 to 2033

Figure 39: North America Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 40: North America Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 41: North America Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 42: North America Market Volume (Tons) Analysis by End Use, 2018 to 2033

Figure 43: North America Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 44: North America Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 45: North America Market Attractiveness by Product Type, 2023 to 2033

Figure 46: North America Market Attractiveness by Application, 2023 to 2033

Figure 47: North America Market Attractiveness by End Use, 2023 to 2033

Figure 48: North America Market Attractiveness by Country, 2023 to 2033

Figure 49: Latin America Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 50: Latin America Market Value (US$ Million) by Application, 2023 to 2033

Figure 51: Latin America Market Value (US$ Million) by End Use, 2023 to 2033

Figure 52: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 53: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 54: Latin America Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 55: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 56: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 57: Latin America Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 58: Latin America Market Volume (Tons) Analysis by Product Type, 2018 to 2033

Figure 59: Latin America Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 60: Latin America Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 61: Latin America Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 62: Latin America Market Volume (Tons) Analysis by Application, 2018 to 2033

Figure 63: Latin America Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 64: Latin America Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 65: Latin America Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 66: Latin America Market Volume (Tons) Analysis by End Use, 2018 to 2033

Figure 67: Latin America Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 68: Latin America Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 69: Latin America Market Attractiveness by Product Type, 2023 to 2033

Figure 70: Latin America Market Attractiveness by Application, 2023 to 2033

Figure 71: Latin America Market Attractiveness by End Use, 2023 to 2033

Figure 72: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 73: Western Europe Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 74: Western Europe Market Value (US$ Million) by Application, 2023 to 2033

Figure 75: Western Europe Market Value (US$ Million) by End Use, 2023 to 2033

Figure 76: Western Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 77: Western Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 78: Western Europe Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 79: Western Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 80: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 81: Western Europe Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 82: Western Europe Market Volume (Tons) Analysis by Product Type, 2018 to 2033

Figure 83: Western Europe Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 84: Western Europe Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 85: Western Europe Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 86: Western Europe Market Volume (Tons) Analysis by Application, 2018 to 2033

Figure 87: Western Europe Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 88: Western Europe Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 89: Western Europe Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 90: Western Europe Market Volume (Tons) Analysis by End Use, 2018 to 2033

Figure 91: Western Europe Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 92: Western Europe Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 93: Western Europe Market Attractiveness by Product Type, 2023 to 2033

Figure 94: Western Europe Market Attractiveness by Application, 2023 to 2033

Figure 95: Western Europe Market Attractiveness by End Use, 2023 to 2033

Figure 96: Western Europe Market Attractiveness by Country, 2023 to 2033

Figure 97: Eastern Europe Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 98: Eastern Europe Market Value (US$ Million) by Application, 2023 to 2033

Figure 99: Eastern Europe Market Value (US$ Million) by End Use, 2023 to 2033

Figure 100: Eastern Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 101: Eastern Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 102: Eastern Europe Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 103: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 104: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 105: Eastern Europe Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 106: Eastern Europe Market Volume (Tons) Analysis by Product Type, 2018 to 2033

Figure 107: Eastern Europe Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 108: Eastern Europe Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 109: Eastern Europe Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 110: Eastern Europe Market Volume (Tons) Analysis by Application, 2018 to 2033

Figure 111: Eastern Europe Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 112: Eastern Europe Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 113: Eastern Europe Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 114: Eastern Europe Market Volume (Tons) Analysis by End Use, 2018 to 2033

Figure 115: Eastern Europe Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 116: Eastern Europe Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 117: Eastern Europe Market Attractiveness by Product Type, 2023 to 2033

Figure 118: Eastern Europe Market Attractiveness by Application, 2023 to 2033

Figure 119: Eastern Europe Market Attractiveness by End Use, 2023 to 2033

Figure 120: Eastern Europe Market Attractiveness by Country, 2023 to 2033

Figure 121: South Asia and Pacific Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 122: South Asia and Pacific Market Value (US$ Million) by Application, 2023 to 2033

Figure 123: South Asia and Pacific Market Value (US$ Million) by End Use, 2023 to 2033

Figure 124: South Asia and Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 125: South Asia and Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 126: South Asia and Pacific Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 127: South Asia and Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 128: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 129: South Asia and Pacific Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 130: South Asia and Pacific Market Volume (Tons) Analysis by Product Type, 2018 to 2033

Figure 131: South Asia and Pacific Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 132: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 133: South Asia and Pacific Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 134: South Asia and Pacific Market Volume (Tons) Analysis by Application, 2018 to 2033

Figure 135: South Asia and Pacific Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 136: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 137: South Asia and Pacific Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 138: South Asia and Pacific Market Volume (Tons) Analysis by End Use, 2018 to 2033

Figure 139: South Asia and Pacific Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 140: South Asia and Pacific Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 141: South Asia and Pacific Market Attractiveness by Product Type, 2023 to 2033

Figure 142: South Asia and Pacific Market Attractiveness by Application, 2023 to 2033

Figure 143: South Asia and Pacific Market Attractiveness by End Use, 2023 to 2033

Figure 144: South Asia and Pacific Market Attractiveness by Country, 2023 to 2033

Figure 145: East Asia Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 146: East Asia Market Value (US$ Million) by Application, 2023 to 2033

Figure 147: East Asia Market Value (US$ Million) by End Use, 2023 to 2033

Figure 148: East Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 149: East Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 150: East Asia Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 151: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 152: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 153: East Asia Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 154: East Asia Market Volume (Tons) Analysis by Product Type, 2018 to 2033

Figure 155: East Asia Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 156: East Asia Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 157: East Asia Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 158: East Asia Market Volume (Tons) Analysis by Application, 2018 to 2033

Figure 159: East Asia Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 160: East Asia Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 161: East Asia Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 162: East Asia Market Volume (Tons) Analysis by End Use, 2018 to 2033

Figure 163: East Asia Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 164: East Asia Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 165: East Asia Market Attractiveness by Product Type, 2023 to 2033

Figure 166: East Asia Market Attractiveness by Application, 2023 to 2033

Figure 167: East Asia Market Attractiveness by End Use, 2023 to 2033

Figure 168: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 169: Middle East and Africa Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 170: Middle East and Africa Market Value (US$ Million) by Application, 2023 to 2033

Figure 171: Middle East and Africa Market Value (US$ Million) by End Use, 2023 to 2033

Figure 172: Middle East and Africa Market Value (US$ Million) by Country, 2023 to 2033

Figure 173: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 174: Middle East and Africa Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 175: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 176: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 177: Middle East and Africa Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 178: Middle East and Africa Market Volume (Tons) Analysis by Product Type, 2018 to 2033

Figure 179: Middle East and Africa Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 180: Middle East and Africa Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 181: Middle East and Africa Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 182: Middle East and Africa Market Volume (Tons) Analysis by Application, 2018 to 2033

Figure 183: Middle East and Africa Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 184: Middle East and Africa Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 185: Middle East and Africa Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 186: Middle East and Africa Market Volume (Tons) Analysis by End Use, 2018 to 2033

Figure 187: Middle East and Africa Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 188: Middle East and Africa Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 189: Middle East and Africa Market Attractiveness by Product Type, 2023 to 2033

Figure 190: Middle East and Africa Market Attractiveness by Application, 2023 to 2033

Figure 191: Middle East and Africa Market Attractiveness by End Use, 2023 to 2033

Figure 192: Middle East and Africa Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Ionising Air Gun Market Size and Share Forecast Outlook 2025 to 2035

Ionic Liquid Market Growth – Trends & Forecast 2024-2034

Ion Mobility Spectrometry Market

Bionic Glove's Market Size and Share Forecast Outlook 2025 to 2035

Bionic Fan Market Size and Share Forecast Outlook 2025 to 2035

Bionematicides Market Size and Share Forecast Outlook 2025 to 2035

Bionic Eye Market Growth & Demand 2025 to 2035

Bionic Ears Market

Deionized Water System Market Size and Share Forecast Outlook 2025 to 2035

Thionyl Chloride Market Size and Share Forecast Outlook 2025 to 2035

Anionic Surfactants Market Size and Share Forecast Outlook 2025 to 2035

Avionics Market Growth – Trends & Forecast 2024-2034

Onion Powder Market

Onion Essential Oils Market

Vision Screener Market Size and Share Forecast Outlook 2025 to 2035

Vision Care Market Size and Share Forecast Outlook 2025 to 2035

Lotion Tubes Market Size and Share Forecast Outlook 2025 to 2035

Lotion Pump Market Size and Share Forecast Outlook 2025 to 2035

Regional Truck Market Size and Share Forecast Outlook 2025 to 2035

Fusion Beverage Market Trends - Size, Demand & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA