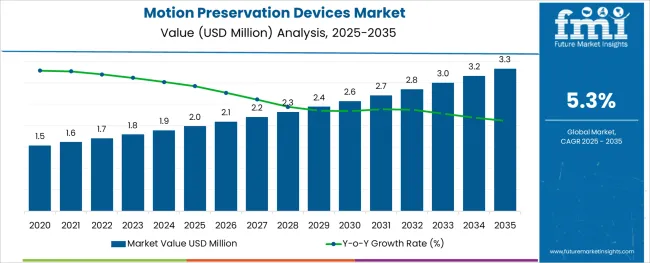

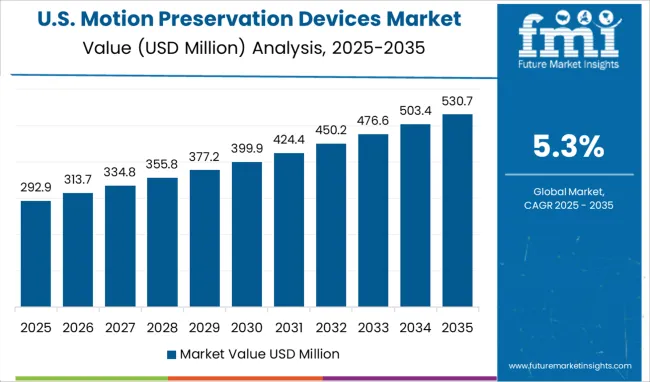

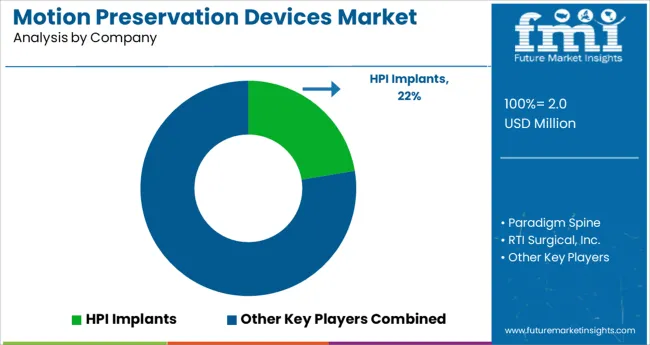

The Motion Preservation Devices Market is estimated to be valued at USD 2.0 million in 2025 and is projected to reach USD 3.3 million by 2035, registering a compound annual growth rate (CAGR) of 5.3% over the forecast period.

The motion preservation devices market is expanding, driven by the rising preference for surgical solutions that maintain spinal mobility while addressing degenerative spine conditions. Advancements in surgical techniques and increasing adoption of minimally invasive spine surgeries have contributed to market growth. Surgeons and healthcare providers are increasingly focusing on treatments that reduce recovery time and improve patient quality of life.

Growing awareness about alternatives to spinal fusion procedures has supported demand for motion preservation devices. Additionally, investments in healthcare infrastructure and rising incidences of spine-related disorders globally have expanded the patient pool.

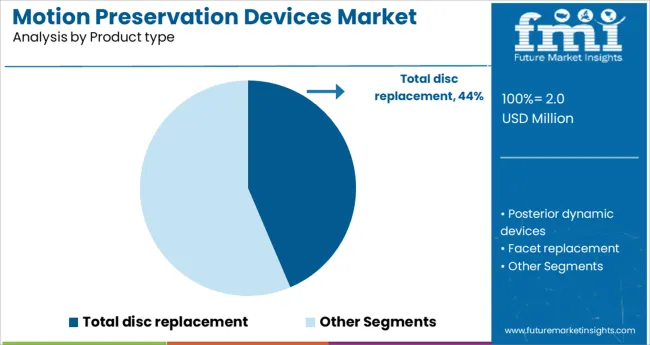

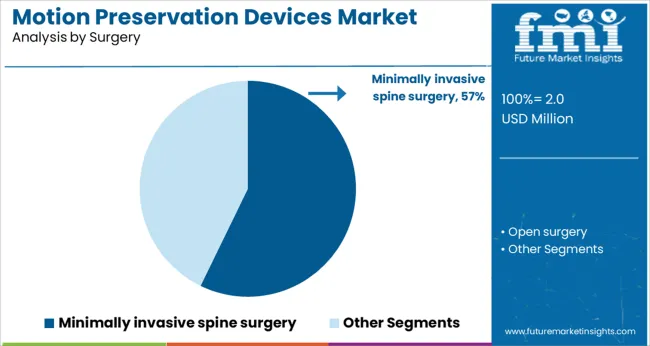

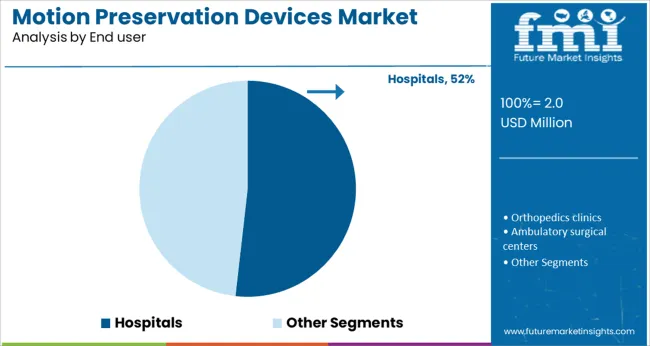

As technological innovations continue in device materials and designs, the market outlook remains positive. Segmental growth is expected to be led by total disc replacement as the dominant product type, minimally invasive spine surgery as the leading surgery method, and hospitals as the primary end user.

The market is segmented by Product type, Surgery, and End user and region. By Product type, the market is divided into Total disc replacement, Posterior dynamic devices, Facet replacement, and Prosthetic nucleus replacement. In terms of Surgery, the market is classified into Minimally invasive spine surgery and Open surgery.

Based on End user, the market is segmented into Hospitals, Orthopedics clinics, Ambulatory surgical centers, and Specialty clinics. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The total disc replacement segment is projected to hold 43.6% of the motion preservation devices market revenue in 2025, positioning it as the leading product type. This segment’s growth is supported by the clinical benefits of preserving natural spinal movement while alleviating pain. Total disc replacement devices have been increasingly preferred over traditional fusion procedures due to their potential to reduce adjacent segment degeneration.

Surgeons value these devices for their ability to restore normal spinal biomechanics. Patient outcomes showing improved mobility and faster rehabilitation have encouraged adoption.

The segment has also benefited from advancements in biomaterials and implant design, enhancing device durability and biocompatibility. With growing preference for motion-preserving treatments, total disc replacement is expected to maintain its market leadership.

The minimally invasive spine surgery segment is anticipated to contribute 57.2% of the market revenue in 2025, holding the largest share among surgical approaches. This segment’s growth is driven by the advantages of reduced tissue damage, shorter hospital stays, and quicker recovery compared to open surgeries.

The evolution of surgical instruments and imaging techniques has enabled precise device implantation with minimal disruption to surrounding tissues. Surgeons and patients increasingly prefer minimally invasive methods for their safety profile and improved postoperative outcomes.

Additionally, healthcare systems benefit from cost savings associated with shorter hospitalizations. These factors have propelled the adoption of minimally invasive spine surgery, making it the dominant surgical approach in motion preservation device implantation.

The hospitals segment is expected to hold 51.8% of the motion preservation devices market revenue in 2025, sustaining its position as the primary end user. Hospitals provide the necessary infrastructure, multidisciplinary surgical teams, and postoperative care facilities required for motion preservation procedures.

Increasing investments in spine surgery centers and enhanced surgical suites have facilitated device adoption. Hospitals remain the preferred setting due to the complexity of procedures and need for advanced monitoring.

Moreover, growing patient inflow and demand for specialized spine care have reinforced hospital dominance. As healthcare facilities continue to improve surgical capabilities, hospitals are projected to maintain their leading role in device utilization.

The preference for minimally invasive spine surgery over traditional open surge treatment procedures is driving the demand for motion Preservation devices globally.

Moreover, there is a very low cost involved in minimally invasive surgical procedures as compared to the previous traditional means of surgeries. There is also a rise in the geriatric population, which is fueling the growth of the global motion Preservation devices market.

In addition to that, an increase in technological advancement and development in bone graft products will boost the overall market for motion preservation devices. Due to the increase in popularity, other motion preservation products will have a significant portion of the motion preservation devices market.

It is projected that artificial disc replacement devices dominate the market due to the adoption of the same, and motion Preservation surgeries help in restoring motion that is leading to increased adoption of surgical procedures.

Furthermore, the main purpose of motion preservation devices is to provide better treatment than spine fusion with pain for the patient and loss of function caused in spines such as lumbar spinal stenosis, degenerative disc disease, and facet pain, therefore, the motion preservation devices market is gaining traction globally.

On the other hand, incidences of diseases such as spinal disorders & neurological disorders and advancements in surgical techniques create new opportunities in the coming years.

It is anticipated that the motion Preservation devices involve expensive implants and the high procedure cost associated with the plantation is likely to restrain the growth of the motion preservation devices market.

Furthermore, there are stringent regulatory approvals and unfavorable reimbursement scenarios, which is likely to inhibit the growth of the motion preservation devices market.

At present, the North American region is accountable for 33.1% of the total motion preservation devices market share.

Due to the adoption of several motion preservation techniques and the usage of cervical artificial disc replacement which allows for decompression of the spinal cord and nerve roots and maintains natural movement in the neck that is usually indicated for patients with stenosis and disc herniation, the market demand is being driven in North America.

Additionally, lumbar artificial disc replacement in this region for spine disorder patients is allowing the decomposition of the nerve roots and spinal canal and is maintaining the natural movement of the back for the geriatric population, fuelling the market size of motion Preservation devices.

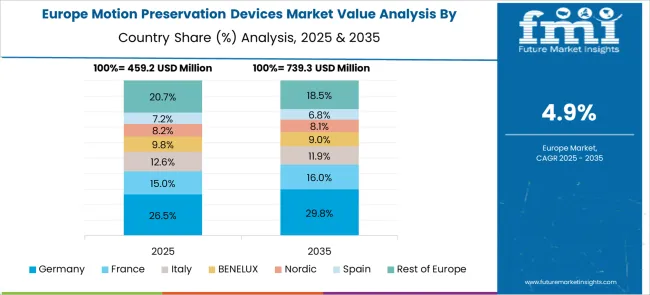

Europe is currently accountable for a 29.1% share of the total motion Preservation devices market.

In this region, there is an increase in preference for motion Preservation devices. This is due to the presence of major companies and vendors that have focused on product development to serve dual procedures and mitigation of the disability rate caused by spinal injuries.

How are New Entrants Revolutionizing the Motion Preservation Devices Market?

The start-up ecosystem in the motion Preservation devices market is intense with frequent innovations being made. Start-ups in the motion Preservation devices market are focusing on improvising the devices for better implementation in surgical procedures.

ZygoFix develops a miniature implant that achieves spinal fusion and stability without screws. The medical device is called zLOCK and its unique design allows it to adjust to the joint’s natural geometry and provide stabilization. The zLOCK is made from rigid titanium with a porous texture and the minimal invasiveness required to place the implant is yet another essential benefit. Some of the other start-ups include TracInnovations, ABLE, and other.

Who are some of the Key Market Players in the Motion Preservation Devices Market?

Some of the key players in the Motion Preservation Devices Market are HPI Implants, Paradigm Spine, RTI Surgical, Inc., B. Braun Melsungen AG, Depuy Synthes, Globus Medical, Inc, Spinal Kinetics, Zimmer Biomet Holdings, Inc., Ulrich GmbH & Co. KG.

The key market players have adopted product development strategies such as approvals, product launches, and clinical trials. Constant efforts are being made in improvising the techniques of surgical procedures.

| Report Attribute | Details |

|---|---|

| Growth Rate | CAGR of 5.3% from 2025 to 2035 |

| Base Year for Estimation | 2024 |

| Historical Data | 2020 to 2024 |

| Forecast Period | 2025 to 2035 |

| Quantitative Units | Revenue in million and CAGR from 2025 to 2035 |

| Report Coverage | Revenue Forecast, Volume Forecast, Company Ranking, Competitive Landscape, Growth Factors, Trends and Pricing Analysis |

| Segments Covered | Type, Design, Region |

| Regions Covered | North America; Latin America; Europe; East Asia; South Asia; Oceania; Middle East and Africa |

| Key Countries Profiled | USA, Canada, Brazil, Argentina, Germany, UK, France, Spain, Italy, Nordics, BENELUX, Australia & New Zealand, China, India, ASEAN, GCC, South Africa |

| Key Companies Profiled | HPI Implants; Paradigm Spine; RTI Surgical, Inc.; B. Braun Melsungen AG; Depuy Synthes; Globus Medical, Inc; Spinal Kinetics; Zimmer Biomet Holdings, Inc.; Ulrich GmbH & Co. KG. |

| Customization | Available Upon Request |

The global motion preservation devices market is estimated to be valued at USD 2.0 million in 2025.

It is projected to reach USD 3.3 million by 2035.

The market is expected to grow at a 5.3% CAGR between 2025 and 2035.

The key product types are total disc replacement, posterior dynamic devices, facet replacement and prosthetic nucleus replacement.

minimally invasive spine surgery segment is expected to dominate with a 57.2% industry share in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Spinal Motion-Preservation Devices Market

Motion Control Software in Robotics Market Size and Share Forecast Outlook 2025 to 2035

Motion Simulation Market Size and Share Forecast Outlook 2025 to 2035

Motion Control Centers Market by Component, Deployment Mode, Mode & Region Forecast till 2025 to 2035

Motion Stimulation Therapy Market Trends – Growth & Forecast 2024-2034

Motion Controllers Market

Motion Sensors Market

Emotion Detection and Recognition Market

In Motion Dimensioning Systems Market Analysis Size and Share Forecast Outlook 2025 to 2035

Promotional Packaging Market Size and Share Forecast Outlook 2025 to 2035

3D Motion Capture Market by System, Component, Application & Region Forecast till 2035

Competitive Overview of Promotional Packaging Market Share

Promotion Bins Market

Safety Motion Control System Market

Weigh in Motion System Market - Trends & Forecast 2025 to 2035

Continuous Motion Cartoner Market Size and Share Forecast Outlook 2025 to 2035

Multi-axis Motion Controller Market Size and Share Forecast Outlook 2025 to 2035

Social and Emotional Learning Market Forecast Outlook 2025 to 2035

Radiotherapy Motion Management Market

Automotive Weigh-In Motion Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA