The social and emotional learning market is expanding rapidly due to the increasing emphasis on holistic education, student well-being, and the integration of digital learning tools. Rising awareness among educators, parents, and policymakers about the importance of emotional intelligence in academic and personal development is strengthening market adoption. The current landscape reflects growing implementation of SEL programs across K–12 and higher education institutions, supported by favorable government initiatives and institutional funding.

The future outlook remains positive as educational organizations prioritize inclusive learning environments and mental health support systems. The shift toward digital education, coupled with the integration of AI-driven personalized learning platforms, is driving continuous product innovation.

Growth rationale is grounded in the increasing demand for structured SEL frameworks that improve academic outcomes, behavioral health, and classroom engagement As education systems continue to modernize, the market is expected to witness sustained growth driven by technology adoption, policy alignment, and the expansion of service-based learning support models.

| Metric | Value |

|---|---|

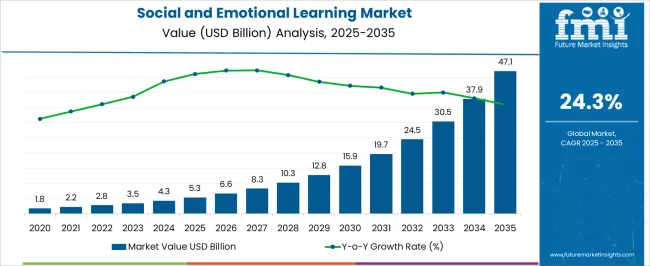

| Social and Emotional Learning Market Estimated Value in (2025 E) | USD 5.3 billion |

| Social and Emotional Learning Market Forecast Value in (2035 F) | USD 47.1 billion |

| Forecast CAGR (2025 to 2035) | 24.3% |

The market is segmented by Component, Solution, Service, User, and Type and region. By Component, the market is divided into Solutions and Services. In terms of Solution, the market is classified into Social And Emotional Learning Platform and Social And Emotional Learning Assessment Tool. Based on Service, the market is segmented into Consulting, Deployment And Integration, and Training and Support. By User, the market is divided into Elementary School, Pre-K, and Middle and High School. By Type, the market is segmented into Web Based and Application. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

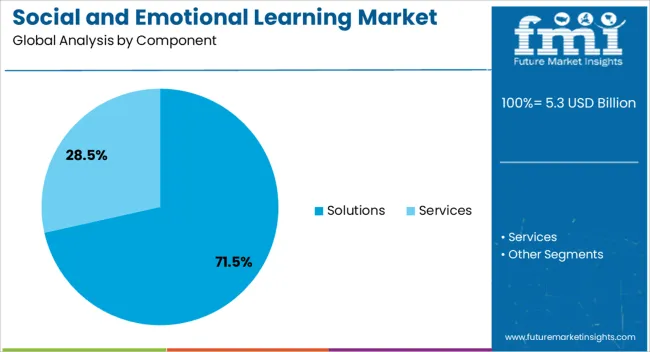

The solutions segment, accounting for 71.50% of the component category, has emerged as the dominant offering due to its wide applicability across digital education and institutional training. Its leadership is driven by the increasing use of software platforms and applications that enable interactive and measurable SEL experiences.

The segment’s growth is supported by advancements in data analytics, allowing educators to track student progress and emotional development effectively. Continuous updates in user interfaces and integration with learning management systems have enhanced accessibility and engagement.

Institutional demand for scalable and customizable SEL frameworks has reinforced the segment’s position, while collaboration between education technology providers and academic institutions continues to expand reach Over the forecast period, the solutions segment is expected to maintain its lead, supported by sustained investments in digital transformation and a growing preference for evidence-based SEL tools.

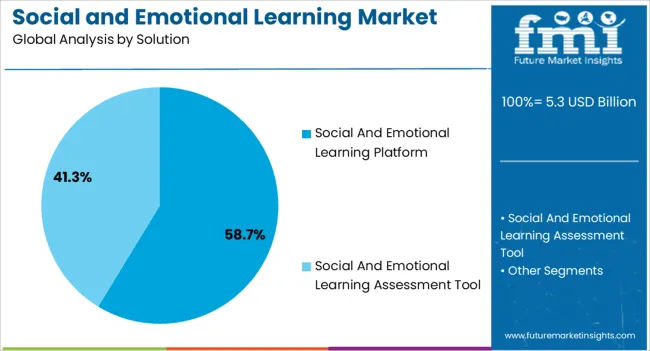

The social and emotional learning platform segment, holding 58.70% of the solution category, has maintained its leading role by offering comprehensive, technology-enabled tools that support emotional intelligence development, behavioral assessment, and interactive learning. These platforms are being increasingly adopted by schools and training organizations seeking structured SEL implementation and outcome measurement. Cloud-based deployment models and mobile accessibility have enhanced platform usability and scalability.

Integration of analytics and AI features has allowed educators to personalize learning experiences and track behavioral progress. Continuous improvement in data privacy standards and user security has also encouraged institutional adoption.

The segment’s dominance is being reinforced by increasing collaborations between EdTech firms and curriculum developers, ensuring content relevance and cultural adaptability Sustained focus on mental wellness and social skill-building is expected to drive continued growth of SEL platforms across both developed and emerging education markets.

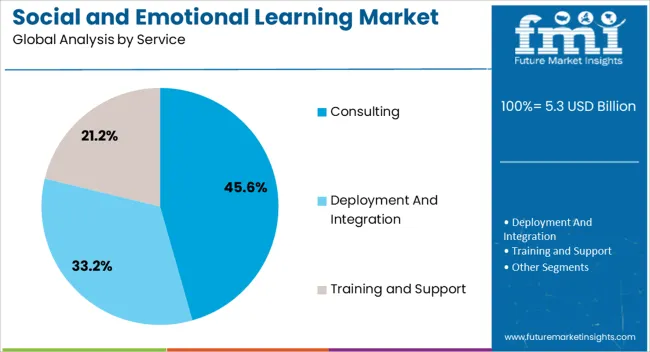

The consulting segment, representing 45.60% of the service category, has been leading due to its critical role in supporting institutions with SEL program design, implementation, and performance evaluation. Consulting services provide expertise in integrating SEL frameworks into existing curricula, aligning them with educational goals and regulatory requirements. The segment’s strength lies in its ability to deliver tailored strategies that address specific institutional challenges, ensuring measurable impact.

Increased demand for professional training and teacher capacity-building initiatives has further expanded the consulting market. Service providers are focusing on long-term partnerships with schools and districts to ensure sustainability of SEL outcomes.

Growing reliance on evidence-based assessment and outcome measurement is reinforcing the need for expert consultation As education systems evolve toward more inclusive and empathetic learning models, consulting services are expected to remain central to ensuring effective and scalable SEL adoption worldwide.

There is growing demand for evidence based social and emotional learning programs and interventions, as research continues to demonstrate the positive impact of social and emotional learning on student outcomes. Educators and policymakers are seeking validated strategies that effectively promote social and emotional skills.

The scope for social and emotional learning rose at a 28.4% CAGR between 2020 and 2025. The global market is anticipated to grow at a moderate CAGR of 24.3% over the forecast period 2025 to 2035.

There was an increasing awareness of the importance of social and emotional learning in education, during the historical period. Schools, educators, parents, and policymakers recognized the value of social and emotional learning in promoting well being, academic success, and long term outcomes of the students.

Many educational systems and jurisdictions might have integrated social and emotional learning principles and programs into their curriculum and educational policies. The integration had driven widespread adoption and implementation of social and emotional learning initiatives across diverse educational settings.

The integration of technology into education is expected to continue, offering new opportunities for delivering and enhancing social and emotional learning programs during the forecast period.

Advancements in educational technology, such as artificial intelligence, personalized learning platforms, and immersive simulations, are expected to revolutionize the way the learning is delivered and experienced.

Continued policy support and funding initiatives at the local, national, and international levels is expected to fuel the market growth.

Governments, non-profit organizations, and philanthropic foundations may invest in the initiatives as part of broader education reform efforts aimed at promoting equity, inclusion, and holistic student development.

There is a growing recognition of the importance of social and emotional skills in education and personal development. Schools, parents, and policymakers are placing greater emphasis on social and emotional learning as a crucial component of a well-rounded education.

Resistance from traditional education systems, stakeholders, and policymakers who prioritize academic achievement over social and emotional development may slow the adoption of social and emotional learning programs. Convincing stakeholders of the importance of learning and overcoming entrenched attitudes can be challenging.

The below table showcases revenues in terms of the top 5 leading countries, spearheaded by Korea and Japan. The countries are expected to lead the market through 2035.

| Countries | Forecast CAGRs from 2025 to 2035 |

|---|---|

| The United States | 24.5% |

| The United Kingdom | 25.4% |

| China | 24.9% |

| Japan | 25.6% |

| Korea | 26.0% |

The social and emotional learning market in the United States expected to expand at a CAGR of 24.5% through 2035. There is a growing recognition among educators, policymakers, and parents in the United States of the importance of social and emotional learning in supporting the overall well-being and academic success of the students.

The acknowledgment is driving increased interest and investment in the learning programs and initiatives.

There is a heightened focus on mental health awareness and support in the United States, particularly among children and adolescents. The learning programs are viewed as essential tools for addressing mental health issues, such as stress, anxiety, depression, and social isolation, and promoting resilience and coping skills.

The social and emotional learning market in the United Kingdom is anticipated to expand at a CAGR of 25.4% through 2035. The integration of social and emotional learning into educational policies and frameworks is gaining momentum in the United Kingdom.

National and local authorities are incorporating learning competencies into curriculum guidelines, educational standards, and school improvement strategies, driving the systematic implementation of the learning initiatives.

Research studies and evidence from educational research institutions highlight the positive impact of social and emotional learning on student outcomes, including academic achievement, emotional regulation, interpersonal relationships, and overall well-being.

The availability of research based evidence supports the adoption and scaling of these programs in schools and educational settings across the United Kingdom.

Social and emotional learning trends in China are taking a turn for the better. A 24.9% CAGR is forecast for the country from 2025 to 2035. Social and emotional learning programs in China are being adapted to align with Chinese cultural values, norms, and educational philosophies.

Customized social and emotional learning curricula, resources, and activities reflect the unique socio cultural context of China and resonate with the needs and preferences of Chinese students, educators, and families.

Collaboration between schools, community organizations, and mental health professionals is enhancing the delivery of social and emotional learning support to students in China.

Partnerships with community based organizations, counseling services, and youth development programs extend the reach of learning initiatives and provide additional resources and support to students and families.

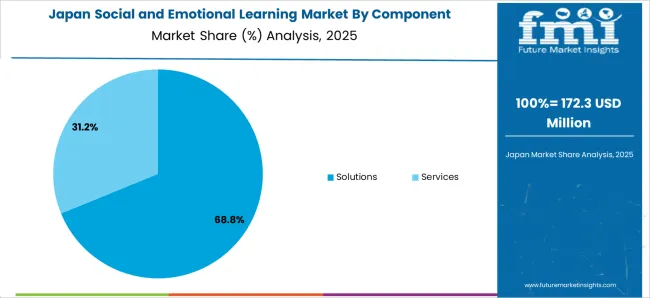

The social and emotional learning market in Japan is poised to expand at a CAGR of 25.6% through 2035. There is a shift in educational paradigm in Japan, towards holistic development and the cultivation of non-cognitive skills alongside academic achievement.

Social and emotional learning is increasingly valued as a key component of education, reflecting broader societal priorities and changing attitudes towards education.

Efforts to provide educators with training and professional development opportunities in social and emotional learning are expanding in Japan. Teacher training programs, workshops, and resources equip educators with the knowledge, skills, and strategies to integrate learning into their teaching practices and create supportive learning environments.

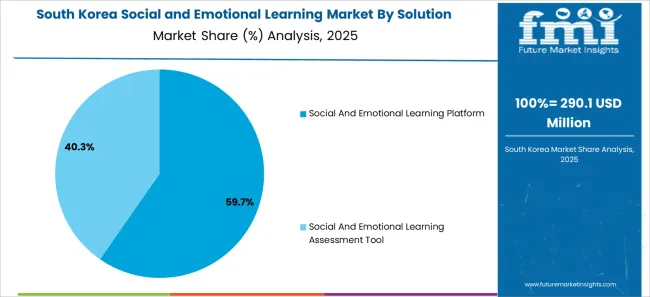

The social and emotional learning market in Korea is anticipated to expand at a CAGR of 26.0% through 2035. Involving parents, caregivers, and families in social and emotional learning initiatives is crucial for reinforcing social and emotional learning skills and promoting consistency between home and school environments.

Schools in Korea are engaging parents through workshops, family events, and communication channels to promote shared goals and reinforce the learning principles at home.

The integration of education technology and digital platforms into social and emotional learning programs is expanding in Korea. Digital resources, online platforms, and interactive tools enhance the accessibility, engagement, and effectiveness of social and emotional learning instruction, catering to diverse learning styles and preferences in the digital age.

The below table highlights how solutions segment is projected to lead the market in terms of component, and is expected to account for a CAGR of 24.1% through 2035. Based on solution, the social and emotional learning platform segment is expected to account for a CAGR of 23.8% through 2035.

| Category | CAGR through 2035 |

|---|---|

| Solutions | 24.1% |

| Social and Emotional Learning Platform | 23.8% |

Based on component, the solutions segment is expected to continue dominating the social and emotional learning market. The solutions segment encompasses a diverse range of the learning programs, platforms, and tools designed to promote social and emotional development among students.

The availability of comprehensive and customizable solutions tailored to the needs of different educational settings and student populations drives the growth of this segment.

The learning solutions are increasingly integrated into curriculum frameworks and instructional materials, offering educators structured and sequenced resources to support social and emotional learning in the classroom.

The alignment of learning solutions with academic standards and educational goals enhances their relevance and adoption within schools and districts.

In terms of solution, the social and emotional learning platform segment is expected to continue dominating the social and emotional learning market, attributed to several key factors.

The learning platforms offer comprehensive curriculum content, resources, and activities designed to promote social and emotional skills among students.

The platforms provide educators with access to a wide range of instructional materials, lesson plans, assessments, and multimedia resources aligned with social and emotional learning standards and objectives.

The platforms incorporate customization and personalization features that enable educators to tailor learning interventions to the unique needs, preferences, and developmental levels of their students.

Adaptive algorithms, content libraries, and assessment tools empower educators to create individualized learning pathways and activities that address specific social and emotional competencies.

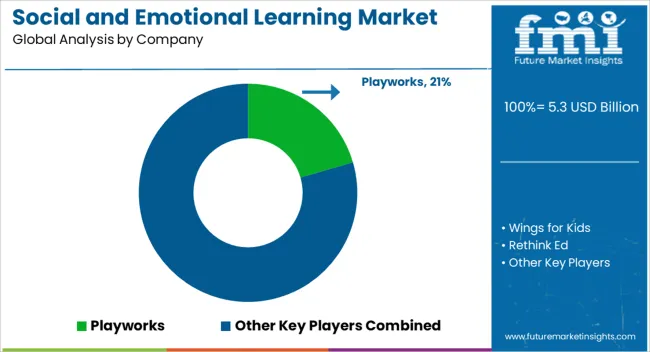

The competitive landscape of the market is characterized by a diverse array of players, including education technology companies, publishers, non-profit organizations, research institutions, and government agencies.

Company Portfolio

| Attribute | Details |

|---|---|

| Estimated Market Size in 2025 | USD 4.3 billion |

| Projected Market Valuation in 2035 | USD 38.0 billion |

| Value-based CAGR 2025 to 2035 | 24.3% |

| Forecast Period | 2025 to 2035 |

| Historical Data Available for | 2020 to 2025 |

| Market Analysis | Value in USD billion |

| Key Regions Covered | North America; Latin America; Western Europe; Eastern Europe; South Asia and Pacific; East Asia; The Middle East & Africa |

| Key Market Segments Covered | Service, User, Type, Region |

| Key Countries Profiled | The United States, Canada, Brazil, Mexico, Germany, France, France, Spain, Italy, Russia, Poland, Czech Republic, Romania, India, Bangladesh, Australia, New Zealand, China, Japan, South Korea, GCC countries, South Africa, Israel |

| Key Companies Profiled | Playworks; Wings for Kids; Rethink Ed; Move This World; Positive Action; Brighten Learning; Aperture Education; Taproot Learning; MeandMine; Everyday Speech; CASEL; PANORAMA Education |

The global social and emotional learning market is estimated to be valued at USD 5.3 billion in 2025.

The market size for the social and emotional learning market is projected to reach USD 47.1 billion by 2035.

The social and emotional learning market is expected to grow at a 24.3% CAGR between 2025 and 2035.

The key product types in social and emotional learning market are solutions and services.

In terms of solution, social and emotional learning platform segment to command 58.7% share in the social and emotional learning market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

SocialFi NFTs Market Size and Share Forecast Outlook 2025 to 2035

Social Tourism Market Forecast and Outlook 2025 to 2035

Social Publishing Application Market Size and Share Forecast Outlook 2025 to 2035

Social Media Records Management Market Size and Share Forecast Outlook 2025 to 2035

Social Media Engagement Applications Market Size and Share Forecast Outlook 2025 to 2035

Social TV Market Size and Share Forecast Outlook 2025 to 2035

Social Commerce Market Size and Share Forecast Outlook 2025 to 2035

Social Video Advertising Market Size and Share Forecast Outlook 2025 to 2035

Social Employee Recognition System Market Size, Growth, and Forecast for 2025 to 2035

Social Media Content Creation Market Size and Share Forecast Outlook 2025 to 2035

Learning Management System (LMS) Market Size and Share Forecast Outlook 2025 to 2035

Social Advertising Tools Market Size and Share Forecast Outlook 2025 to 2035

Social Employee Recognition System Market in Korea – Industry Outlook & Forecast 2025 to 2035

Evaluating Social Media and Destination Market Share & Provider Insights

Social Media and Destination Market Analysis by Platform, by Destination Type, by Region - Forecast for 2025 to 2035

Learning Analytics Solution Market Analysis by Solution, Deployment Mode, Service, End User, and Region Through 2035

Social Business Intelligence Market Growth – Trends & Forecast 2024-2034

Social Media Content Creator Market

Social Media Analytics Market

Social Software As A Collaborative ERP Tool Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA