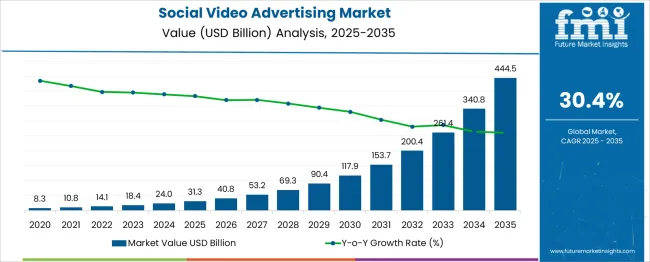

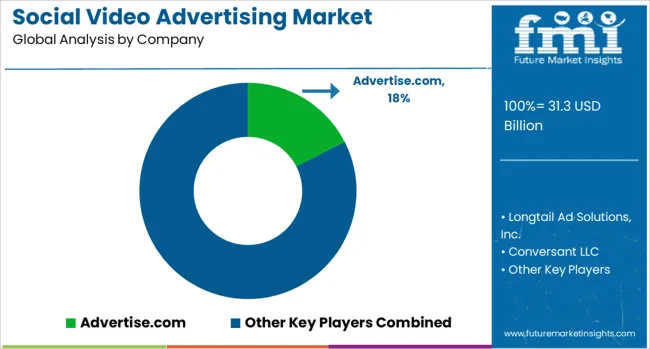

The Social Video Advertising Market is estimated to be valued at USD 31.3 billion in 2025 and is projected to reach USD 444.5 billion by 2035, registering a compound annual growth rate (CAGR) of 30.4% over the forecast period.

| Metric | Value |

|---|---|

| Social Video Advertising Market Estimated Value in (2025 E) | USD 31.3 billion |

| Social Video Advertising Market Forecast Value in (2035 F) | USD 444.5 billion |

| Forecast CAGR (2025 to 2035) | 30.4% |

The demand for social video advertising is on the rise as advertisers are increasingly turning to social video advertising due to technological improvements and changing customer behavior.

Individuals are increasingly adopting visual media via venues other than traditional cable and satellite TVs. Furthermore, as per social media video statistics in 2025, the adoption of social video advertising is projected to rise throughout 2035.

Non-traditional platforms, such as computers, mobile phones, OTT media platforms, and social media applications, are allowing social media advertisers to improve their service delivery methodology and open up new social video advertising market revenue streams for marketers and broadcasters.

Furthermore, these digital video contents are designed to run on a variety of platforms and in a variety of formats to ensure maximum reach and, as a result, a higher rate of interaction.

The introduction of the latest social video advertising market trends like vertical filming and 360° digital videos has created considerable growth opportunities for the social video advertising market. In comparison to old methods, these current videography techniques provide a different perception of the subject being advertised, enticing new clients.

These methods enable advertisers to develop and create more successful advertising campaigns, increasing the use of social video advertising strategies by brands.

Advances in video filmmaking technology have also resulted in the development of newer and better-recording equipment, allowing videographers to create high-quality, detailed movies with shorter lengths, which are more successful in communicating businesses' messages to viewers.

Individuals' increasing adoption of linked TVs is encouraging firms and marketers to adopt social video advertising strategies. Brands and marketers may give relevant adverts to individuals thanks to the ability to access an individual's social media accounts, evaluate viewing behaviors, and use effective search engine optimization.

Connected TV allows for the delivery of highly tailored, targeted, and HD-quality advertisements, which increase brand awareness and loyalty. Furthermore, the continuous trend among individuals to avoid skipping commercials on television allows advertisers to convey brand messaging more effectively, boosting social video advertising market growth.

The increased use of OTT platforms by an increasing number of people around the world has given advertisers a better opportunity to get into the social video advertising market.

However, during the forecast period, the impact of GDPR and other privacy rules on the usage of internet data is projected to act as limitation of the social video advertising market.

The retail and CPG segment had the highest share of 35 percent. Cookies can be used by brands and marketers to identify and assess search results in social video advertising on mobile and desktop platforms, allowing retailers to gain a better understanding of their customers' needs.

Offline stores can improve their consumers' in-store experiences by selling products that match their needs by understanding their needs.

Furthermore, social video advertising may be used in businesses to create interactive customer experiences, boosting the effectiveness of social media marketing campaigns and ensuring efficient consumer acquisition.

By end user, the brands/companies segment is gaining traction and dominating the social video advertising market. During the forecast period 2025-2035, the brands/companies are expected to increase at a stunning 14.2% CAGR.

Advertisers are adopting this platform to contact their targeted clients as it is less expensive than traditional advertising strategies such as television commercials, and it also allows them to reach a wider audience.

According to a study, mobile advertising or short video advertising generates money for 70-80% of social video advertising companies. In 2024, approximately 8.3 billion monthly active users accessed social networking sites such as Facebook, YouTube, LinkedIn, and others, up 14% from 2020 due to Covid-19.

The social ad services are expected to dominate the social video advertising market due to advertising businesses' increasing use of social media platforms to reach targeted clients, as well as the high use of smartphones rather than PCs for social media platforms.

During the forecast period, the social video advertising market in the Asia Pacific is expected to grow at a quick rate.

China is the most lucrative market for social video advertising, with the highest CAGR of 33.4% through 2035.

This growth can be attributed to telecommunication companies increasing their investments in high-speed internet services, which increases the adoption of smart devices, OTT platforms, social media platforms, and other social video advertising platforms.

Furthermore, India's social video advertising market is also anticipated to grow at a CAGR of 30.8% throughout the forecast period.

As a result, these factors are anticipated to indirectly propel the social video advertising market growth in the Asia Pacific during the forecast period.

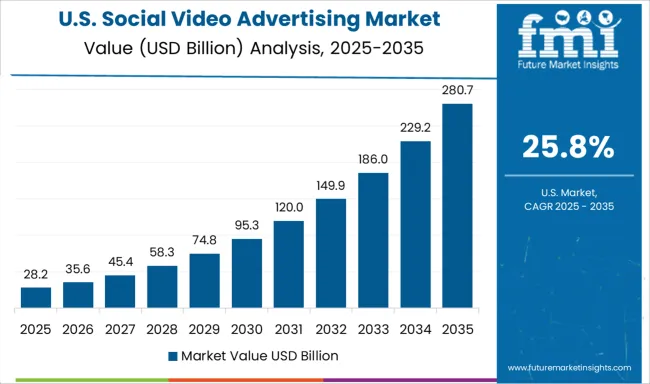

On the other hand, the USA is expected to develop at a 26.9% compound annual growth rate (CAGR) in the global social video advertising market from 2025 to 2035.

The growing popularity of social media platforms such as Facebook, Snapchat, and others, as well as the increasing use of smartphones, have aided in boosting the market demand for social video advertising in the United States.

Furthermore, the expanding dominance of OTT platforms, as well as massive corporate investments in research and development, are driving significant market growth in social video advertising.

Some companies, such as Interactive Advertising Bureau, Buzzfeed Inc., and Verizon Media, have been important drivers of the social video advertising market's growth.

Advertising companies all around the world have begun to engage in social video advertising in order to provide better ad content to their audiences. To recruit better talent and allow effective corporate growth, companies have begun investing in new development centers and operating bases.

In addition, established businesses are forming alliances with data analytics firms to assess the success and engagement rates of their advertising efforts. This enables social video advertising companies to take appropriate action as needed.

Recent Developments in the Social Video Advertising Market

The global social video advertising market is estimated to be valued at USD 31.3 billion in 2025.

The market size for the social video advertising market is projected to reach USD 444.5 billion by 2035.

The social video advertising market is expected to grow at a 30.4% CAGR between 2025 and 2035.

The key product types in social video advertising market are social ad platform, social ad services, _social advertising consulting, _implementation & integration and _support and maintenance.

In terms of vertical, retail & cpg segment to command 28.9% share in the social video advertising market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Social and Emotional Learning Market Forecast Outlook 2025 to 2035

Social Tourism Market Forecast and Outlook 2025 to 2035

Social Publishing Application Market Size and Share Forecast Outlook 2025 to 2035

Social Media Records Management Market Size and Share Forecast Outlook 2025 to 2035

Social Media Engagement Applications Market Size and Share Forecast Outlook 2025 to 2035

Social TV Market Size and Share Forecast Outlook 2025 to 2035

Social Commerce Market Size and Share Forecast Outlook 2025 to 2035

Social Employee Recognition System Market Size, Growth, and Forecast for 2025 to 2035

Social Media Content Creation Market Size and Share Forecast Outlook 2025 to 2035

Social Employee Recognition System Market in Korea – Industry Outlook & Forecast 2025 to 2035

Evaluating Social Media and Destination Market Share & Provider Insights

Social Media and Destination Market Analysis by Platform, by Destination Type, by Region - Forecast for 2025 to 2035

Social Business Intelligence Market Growth – Trends & Forecast 2024-2034

Social Media Content Creator Market

Social Media Analytics Market

Social Software As A Collaborative ERP Tool Market

Social Advertising Tools Market Size and Share Forecast Outlook 2025 to 2035

Social Employee Recognition System Market in Japan - Growth & Forecast 2025 to 2035

Mobile Social Networks Market Size and Share Forecast Outlook 2025 to 2035

Enterprise Social Graph Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA