The Social Tourism market is witnessing strong growth driven by increasing awareness of experiential and educational travel experiences. The future outlook for this market is shaped by the rising preference for socially responsible and culturally immersive tourism, which encourages travelers to engage in activities that combine learning with recreation. Growing access to digital platforms and online booking systems has simplified travel planning and enhanced convenience, contributing to the market expansion.

In addition, rising disposable incomes and government initiatives promoting domestic tourism are supporting the growth of socially focused travel experiences. Increasing interest among domestic tourists in exploring local culture, history, and heritage has further strengthened market demand.

Technological advancements, such as mobile applications for itinerary planning and virtual tour previews, have also facilitated the adoption of social tourism The market benefits from a combination of evolving traveler preferences, enhanced accessibility, and the desire for meaningful travel experiences, positioning it for sustained growth in both established and emerging regions.

| Metric | Value |

|---|---|

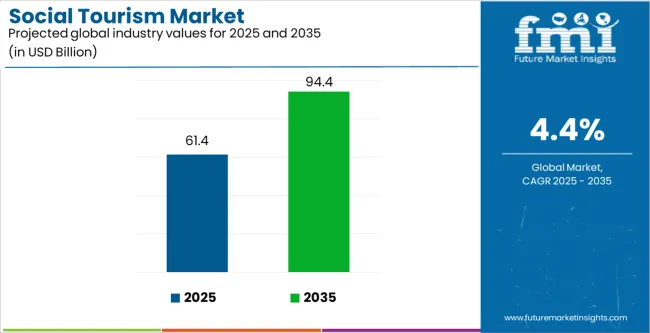

| Social Tourism Market Estimated Value in (2025 E) | USD 61.4 billion |

| Social Tourism Market Forecast Value in (2035 F) | USD 94.4 billion |

| Forecast CAGR (2025 to 2035) | 4.4% |

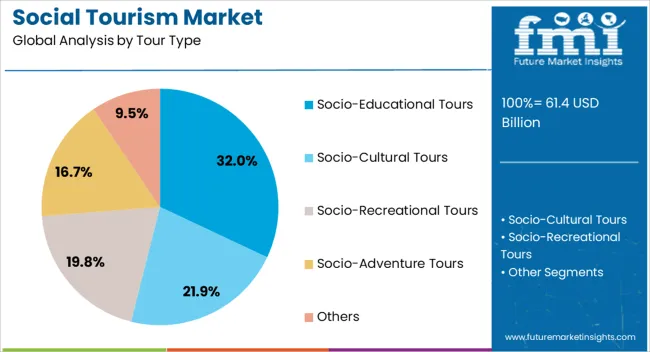

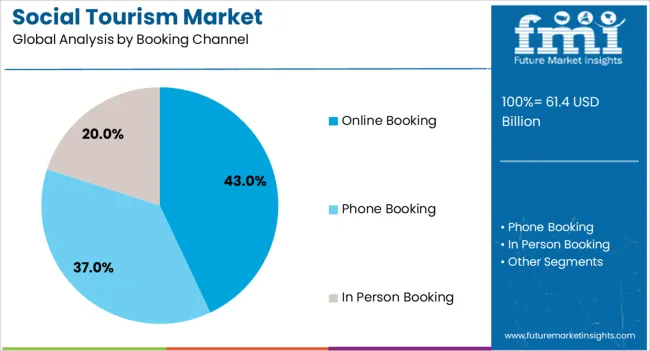

The market is segmented by Tour Type, Booking Channel, Tourist Type, and Age Group and region. By Tour Type, the market is divided into Socio-Educational Tours, Socio-Cultural Tours, Socio-Recreational Tours, Socio-Adventure Tours, and Others. In terms of Booking Channel, the market is classified into Online Booking, Phone Booking, and In Person Booking. Based on Tourist Type, the market is segmented into Domestic Tourist and International Tourist. By Age Group, the market is divided into 26-35 Years, 15-25 Years, 36-45 Years, 46-55 Years, 56-65 Years, 66-75 Years, and Above 75 Years. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The socio-educational tours segment is projected to hold 32.0% of the Social Tourism market revenue share in 2025, making it the leading tour type. This growth is driven by increasing demand for travel experiences that combine education with leisure, allowing tourists to gain cultural, historical, and social insights while traveling.

The segment benefits from collaborations with educational institutions and cultural organizations, which enhance the credibility and appeal of these tours. Additionally, the trend toward experiential learning has encouraged more travelers to participate in socially engaging tours.

The ability to provide structured, informative, and interactive itineraries has further reinforced the preference for socio-educational tours, making them a key driver of market revenue.

The online booking segment is expected to capture 43.0% of the Social Tourism market revenue share in 2025, establishing it as the leading booking channel. The growth of this segment is driven by the convenience, speed, and accessibility offered by digital platforms, enabling tourists to plan and book trips with ease.

Mobile applications and websites provide detailed itineraries, reviews, and payment options, enhancing the overall travel experience. Additionally, online booking platforms offer personalized recommendations and real-time updates, which improve customer satisfaction and encourage repeat usage.

The increasing reliance on technology for travel arrangements has accelerated the adoption of online booking, making it a dominant channel in the Social Tourism market.

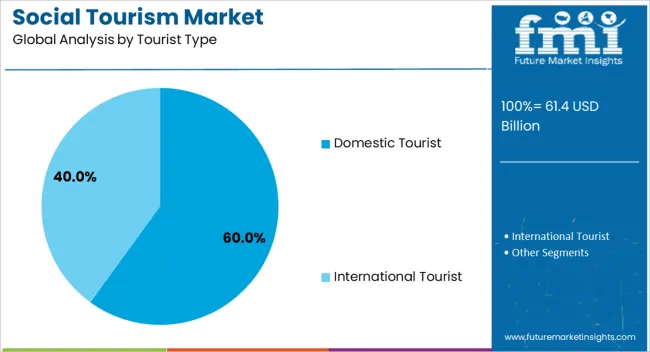

The domestic tourist segment is anticipated to account for 60.0% of the Social Tourism market revenue share in 2025, making it the leading tourist type. This growth is driven by increasing interest among local travelers in exploring regional heritage, culture, and natural attractions.

Affordability, shorter travel durations, and reduced travel risks compared to international travel have reinforced the preference for domestic tourism. The segment benefits from government initiatives promoting local tourism, enhanced infrastructure, and the proliferation of domestic travel packages.

Additionally, domestic tourists often seek socially and culturally enriching experiences, which aligns with the core offerings of social tourism The growing inclination toward domestic travel as a means of recreation, education, and cultural exploration continues to drive market revenue in this segment.

Inclusivity is a key Trend likely to Accelerate Social Tourism Market Growth

The trend of inclusion is a key factor moving the social tourism market forward. In an era defined by rising awareness of social disparities and a greater emphasis on diversity and inclusion, the tourism industry is developing to appeal to a larger range of passengers.

Social tourism programs that give economically disadvantaged persons and marginalized groups with access to travel experiences are well aligned with this trend.

As more tourists seek meaningful and genuine experiences that encourage social responsibility and cultural interaction, the need for inclusive travel alternatives grows. Social tourism promotes greater inclusion in the tourist sector by providing access to previously inaccessible places, activities, and lodgings for specific socioeconomic groups.

Digitalization to Propel Social Tourism Market Growth

Digitalization is fueling the growth of the social tourism business by changing how tourists access information, plan visits, and interact with locations. The broad availability of internet connectivity and mobile technologies has enabled travelers, particularly those from economically challenged backgrounds, to easily explore and book cheap travel alternatives.

Online platforms and social media channels are excellent resources for identifying social tourism projects, linking tourists with groups that provide subsidized tours, cheap lodging, and community based experiences.

Limited Knowledge and Comprehension of Social Tourism Projects to Stifle the Social Tourism Market Growth

Limited knowledge and comprehension of social tourism projects among both passengers and service providers impedes their broad implementation. Logistical issues, such as transportation limits and limited infrastructure in some areas, may slow down market growth.

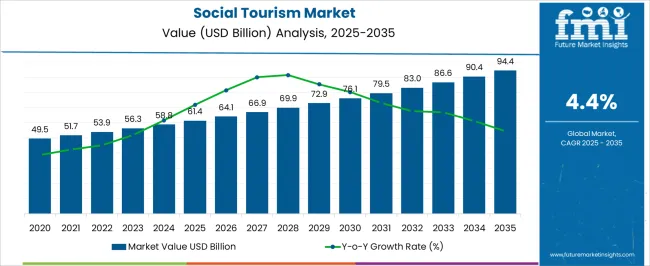

Global social tourism demand increased at a CAGR of 3.9% from 2020 to 2025. For the next ten years (2025 to 2035), projections are that expenditure on social tourism will reach a CAGR of 4.4%.

During the historical period, the global social tourism demand grew steadily, driven by a factors such as rising disposable income, more knowledge of sustainable travel practices, and increased access to cheap travel alternatives.

During this time, governments, nonprofit organizations, and private businesses worked together to promote social tourism programs that provided travel opportunities for economically poor people and marginalized communities.

Over the projection period, demand for social tourism is predicted to continue to grow rapidly. The changing consumer tastes for experiential travel and community based tourism are expected to drive demand for immersive and genuine travel experiences. Technological and digital improvements are likely to improve accessibility and convenience for social tourism participants, further driving demand.

Overall, the global social tourism market is expected to grow significantly over the forecast period, as individuals and organizations recognize the importance of inclusive and sustainable tourism practices in promoting social inclusion, economic development, and cultural exchange.

The following table shows the estimated growth rates of the top three markets. India and China are set to exhibit high social tourism market growth, recording CAGRs of 6.8% and 6.1%, respectively, through 2035.

| Countries | CAGR 2025 to 2035 |

|---|---|

| India | 6.8% |

| China | 6.1% |

| Australia | 5.2% |

| Germany | 4.6% |

| United States | 4.1% |

India is projected to ascend at a CAGR of 6.8% during the forecast period. Rising disposable income and the advent of low cost choices are driving the social tourism business in India. As the economy of India is on a surge, a rising number of people have more spare cash to spend on leisure activities like travel.

This trend has fueled demand for low cost tourist choices, particularly among sectors formerly excluded from the tourism industry owing to financial restrictions.

Budget friendly solutions, such as subsidized tours, cheap lodgings, and group travel packages, are growing more popular, making travel accessible to people from all socioeconomic situations. Government agencies and commercial corporations are all aggressively pushing social tourism programs to meet this expanding need.

China is predicted to augment at a CAGR of 6.1% during the projected period. The rich culture, historical legacy, and adorable giant pandas are significant factors driving the social tourism industry in China.

With a history spanning thousands of years, China has incredible cultural treasures, including UNESCO World Heritage Sites such as the Great Wall, Forbidden City, and Terracotta Army. The abovementioned breathtaking sites draw visitors from all over the world, eager to discover the famous past and immerse themselves in the rich legacy of the country.

The famed giant pandas in China, cherished emblems of conservation and biodiversity, amaze tourists with their cuteness. Panda conservation facilities and sanctuaries around the country provide eco conscious tourists with a once in a lifetime opportunity to view and learn about the adored species, further propelling growth of the social tourism industry.

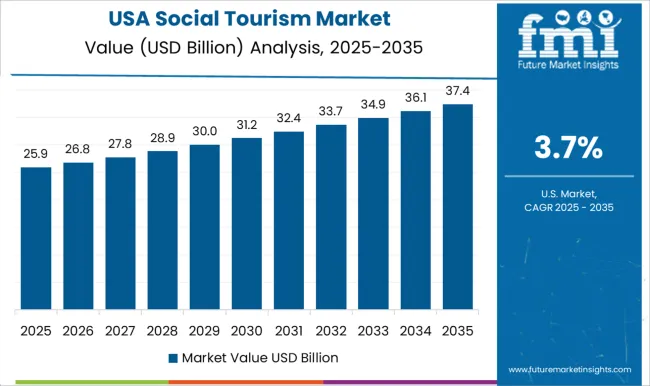

The United States is expected to thrive at a CAGR of 4.1% during the assessment period. Iconic monuments, world class museums and shopping experiences are key drivers of the social tourism industry in the United States. Owing to the rich cultural heritage and iconic attractions, the country attracts millions of local and foreign visitors looking for the memorable experiences.

Renowned sights like the Statue of Liberty, the Grand Canyon, and the Golden Gate Bridge attract tourists by capturing the spirit of American history and creativity. The abovementioned sites not only give spectacular views, but also allow for cultural enrichment and investigation.

World class museums around the country, like the Metropolitan Museum of Art, the Smithsonian Institution, and the Getty Center, fascinate visitors with their unmatched collections and immersive displays. The institutions serve as centers of learning and inspiration, drawing people from all walks of life.

Travelers are drawn to world class shopping areas such as Fifth Avenue in New York City, Rodeo Drive in Los Angeles, and the Magnificent Mile in Chicago for their unparalleled retail experiences.

From luxury shops to landmark stores, the shopping districts combine fashion, entertainment, and culinary pleasures to create remarkable experiences for tourists. All the abovementioned factors make the United States a key market for social tourism industry.

| Segment | Online Booking (Booking Channel) |

|---|---|

| Value Share (2025) | 43% |

The online booking category is projected to hold a market share of 43% in 2025. This growth is a result of factors such as the widespread use of digital platforms for travel planning and booking. Online booking systems provide economically disadvantaged people with easy access to a wide choice of cheap travel options, allowing them to explore new places and engage in recreational activities.

Technological improvements have made this possible to provide user friendly interfaces, secure payment methods, and customized recommendations, all of which improve the entire booking experience.

| Segment | Socio educational Tours (Tour Type) |

|---|---|

| Value Share (2025) | 32% |

In 2025, the socio educational tours segment is anticipated to hold a market share of 32% in the social tourism industry. This growth is a reflection of the increasing desire among economically disadvantaged people toward experiential learning and cultural immersion.

Socio educational tours cater to a wide range of interests and age groups, providing personalized experiences that promote personal growth and social involvement. As tourists seek meaningful connections and insights on their excursions, this category is poised for considerable development and impact in the changing environment of social tourism.

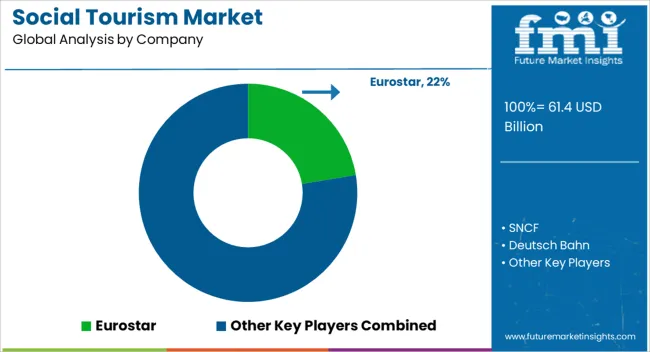

The competitive landscape of the global social tourism market is extremely fragmented with key market players and new entrants battling to strengthen their position in the market. The leading market players leverage their resources and networks to provide the consumer with the best experience.

The new entrants are leveraging latest technologies and budget friendly options to position them as a strong player in this highly competitive market. The leading market players are also focusing on profitable strategies such as travel agencies, hospitality providers, etc., in order to stay ahead of their competition.

Industry Updates

Eurostar, SNCF, Deutsch Bahn, FlixTrain, Trenitalia, Renfe, Intrepid, Explore Tours, Exodus Travels, G. adventures, On-the-go Tours and Maharashtra Tourism are some of the key players in this market.

The social tourism market is classified into socio-educational tours, socio-cultural tours, socio-recreational tours, socio-adventure tours and others.

The social tourism market is classified into phone booking, online booking and in person booking.

The social tourism market is classified into domestic tourist and international tourist.

The social tourism market is classified into 15-25 Years, 26-35 Years, 36-45 Years, 46-55 Years, 56-65 Years, 66-75 Years and Above 75 Years.

Analysis of the social tourism market has been carried out in key countries of North America, Latin America, Western Europe, South Asia, East Asia, Eastern Europe and Middle East & Africa.

The global social tourism market is estimated to be valued at USD 61.4 billion in 2025.

The market size for the social tourism market is projected to reach USD 94.4 billion by 2035.

The social tourism market is expected to grow at a 4.4% CAGR between 2025 and 2035.

The key product types in social tourism market are socio-educational tours, socio-cultural tours, socio-recreational tours, socio-adventure tours and others.

In terms of booking channel, online booking segment to command 43.0% share in the social tourism market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Social and Emotional Learning Market Forecast Outlook 2025 to 2035

Social Publishing Application Market Size and Share Forecast Outlook 2025 to 2035

Social Media Records Management Market Size and Share Forecast Outlook 2025 to 2035

Social Media Engagement Applications Market Size and Share Forecast Outlook 2025 to 2035

Social TV Market Size and Share Forecast Outlook 2025 to 2035

Social Commerce Market Size and Share Forecast Outlook 2025 to 2035

Social Video Advertising Market Size and Share Forecast Outlook 2025 to 2035

Social Employee Recognition System Market Size, Growth, and Forecast for 2025 to 2035

Social Media Content Creation Market Size and Share Forecast Outlook 2025 to 2035

Social Advertising Tools Market Size and Share Forecast Outlook 2025 to 2035

Social Employee Recognition System Market in Korea – Industry Outlook & Forecast 2025 to 2035

Evaluating Social Media and Destination Market Share & Provider Insights

Social Media and Destination Market Analysis by Platform, by Destination Type, by Region - Forecast for 2025 to 2035

Social Business Intelligence Market Growth – Trends & Forecast 2024-2034

Social Media Content Creator Market

Social Media Analytics Market

Social Software As A Collaborative ERP Tool Market

Social Employee Recognition System Market in Japan - Growth & Forecast 2025 to 2035

Mobile Social Networks Market Size and Share Forecast Outlook 2025 to 2035

Enterprise Social Graph Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA