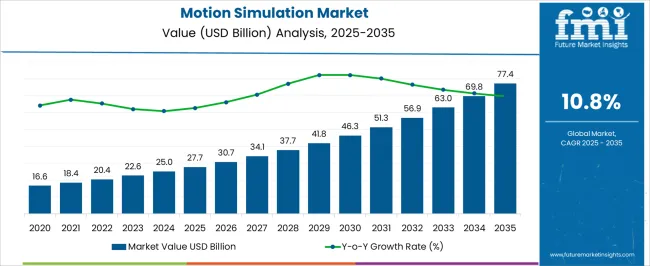

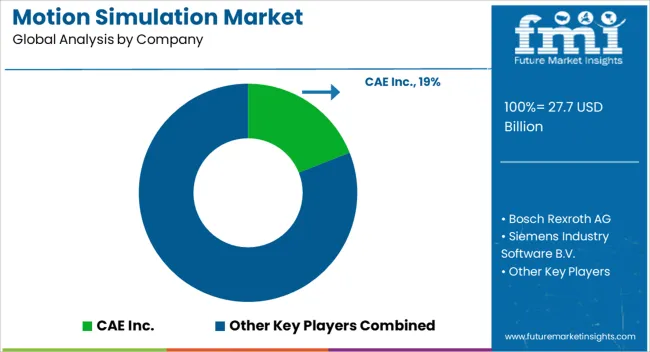

The Motion Simulation Market is estimated to be valued at USD 27.7 billion in 2025 and is projected to reach USD 77.4 billion by 2035, registering a compound annual growth rate (CAGR) of 10.8% over the forecast period.

| Metric | Value |

|---|---|

| Motion Simulation Market Estimated Value in (2025 E) | USD 27.7 billion |

| Motion Simulation Market Forecast Value in (2035 F) | USD 77.4 billion |

| Forecast CAGR (2025 to 2035) | 10.8% |

The motion simulation market is witnessing steady expansion, supported by increased demand for high-fidelity virtual training, operational cost reduction, and risk mitigation across critical sectors. Continued emphasis on safety, situational awareness, and performance optimization in environments like aerospace, defense, and automotive is fueling investments in simulation platforms.

Advancements in hardware precision, real-time response systems, and immersive feedback mechanisms have improved realism and training effectiveness. Regulatory initiatives promoting simulator-based certifications and skill development have also broadened institutional adoption.

With the integration of AI, machine learning, and sensor-based calibration, simulation systems are being tailored for real-world responsiveness and cross-domain applications. Future growth is expected to be driven by modular system design, hybrid motion cueing technologies, and the rising penetration of simulation in commercial and consumer applications.

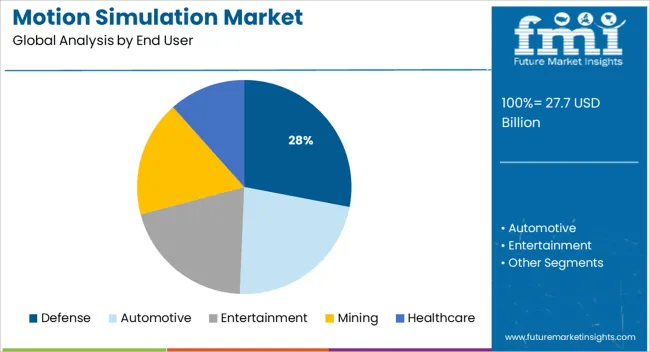

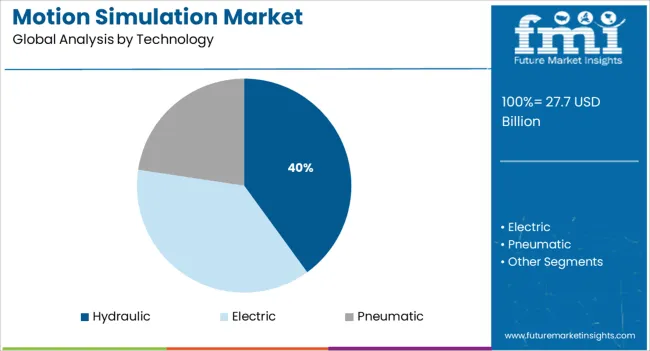

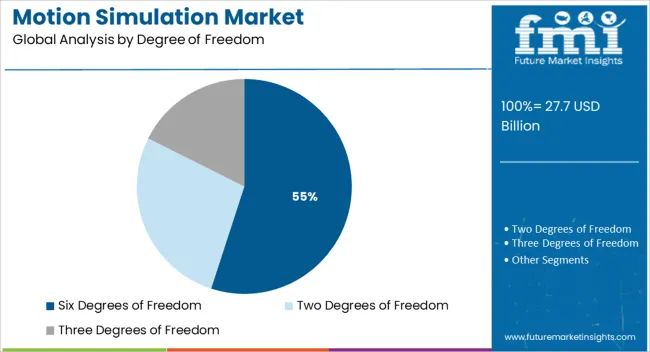

The market is segmented by End User, Technology, and Degree of Freedom and region. By End User, the market is divided into Defense, Automotive, Entertainment, Mining, and Healthcare. In terms of Technology, the market is classified into Hydraulic, Electric, and Pneumatic. Based on Degree of Freedom, the market is segmented into Six Degrees of Freedom, Two Degrees of Freedom, and Three Degrees of Freedom. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The defense segment is projected to hold 28.0% of the total market revenue in 2025, making it a key contributor to motion simulation demand. Its prominence is attributed to the growing reliance on simulation-based combat readiness, mission rehearsal, and tactical training.

Heightened geopolitical tensions and the need to optimize training costs without compromising safety have driven widespread adoption across air, land, and naval platforms. Motion simulators enable realistic combat scenario replication, equipment familiarization, and rapid response conditioning—critical for defense forces facing modern asymmetric threats.

Continued investments in joint training environments and cross-border interoperability have further reinforced the role of simulation in defense training doctrine. As governments seek to modernize legacy systems and improve troop readiness, motion simulation remains central to long-term defense infrastructure planning.

Hydraulic-based systems are expected to account for 40.0% of total market revenue in 2025, leading the technology segment. This leadership is underpinned by their superior load-bearing capabilities, responsiveness under extreme force conditions, and smooth motion translation across a range of applications.

Hydraulic motion platforms are especially valued in high-stress training environments where durability and high force feedback are essential, such as military aviation and heavy vehicle simulation. Their ability to deliver realistic acceleration and deceleration cues, along with high payload capacity, has made them a preferred choice for full-motion simulators.

While maintenance requirements remain relatively high, advancements in leak-proof sealing, noise control, and system integration have enhanced overall reliability. As mission-critical industries continue to require robust simulation fidelity, hydraulic systems are expected to retain their relevance.

Systems with six degrees of freedom are forecast to hold 55.0% of market revenue in 2025, emerging as the dominant configuration in motion simulation. This segment's growth is being driven by its ability to replicate full-range spatial movement, including roll, pitch, yaw, surge, heave, and sway, which is essential for immersive and precision-critical applications.

Such configurations allow operators to experience real-time dynamic feedback in multi-axis environments, closely mimicking real-world conditions. Industries such as aerospace, defense, and motorsport have increasingly adopted these systems for enhanced training accuracy, design validation, and operator conditioning.

The ongoing miniaturization of actuators and adoption of real-time physics engines have further improved performance and realism. With cross-sector demand for more complex simulations, systems with six degrees of freedom are expected to remain the gold standard in motion fidelity and experiential depth.

Lack of validity in some cases

In spite of all the advantages provided by motion simulation, there are a lot of cases where the outcome of the test conducted in the simulated environment was very much different from that obtained when the product/service was put into application on a real-time basis.

Works on the principle of one size fit all

When the sample test is being conducted under simulated conditions, there are chances that the outcome is entirely based only on the available samples, instead of working on the larger good. This might create complications in the process going further, and the output might not match the set standards.

The North America motion simulation market is expected to be the largest market during the forecast period. In 2024, the region held a market share of 37.6%.

The motion simulation market is mainly used in the defence sector in North America.

Based on the reports, it was found that the USA alone spent a whopping USD 801 billion to expand its defence capabilities. Additionally, the defence sector makes heavy investments in the usage of motion simulation. Apart from that, motion simulation is being increasingly implemented in the gaming sector in the region.

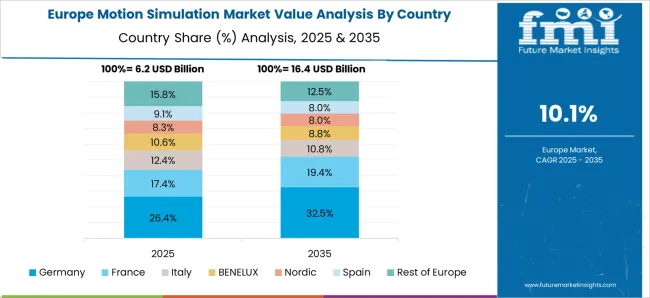

The Europe motion simulation market is expected to be one of the most critical markets for motion simulation during the forecast period. Europe had a market share of 22.3% in 2024.

In Europe as well, motion simulation is being increasingly employed for the defence sector.

However, motion simulation is being increasingly employed in the healthcare sector in the region. For example, Polhemus delivers six degrees of freedom motion measurement systems and handheld 3D laser scanners, which are used in medical simulation systems, and assist in identity simulation as well.

With developments taking place on a daily basis in the motion simulation market, start-up players are tapping into those sectors where the usage of motion simulation was never expected. The start-ups are bringing in innovative ways of making use of motion simulations.

Some of the start-ups are:

Dynisma: Dynisma is redefining automotive motion simulation. The company assists automotive manufacturers to simulate a ride in their vehicles before even building a car, allowing them to assemble the vehicle within a short span of time.

Improbable: Improbable has always believed in large and complex simulations as the next fundamental breakthrough in any technology. They are developing platforms wherein the objects in the simulations will change the response based on the environment.

Improbable is on track to raise funding of nearly USD 100 million, thereby increasing its valuation to more than USD 3 billion.

In a bid to expand the portfolio, the key players are now collaborating with microelectronics giants to develop a 3D integrated circuit hybrid bonding workflow, based on wafer-on-wafer and chip-on-wafer technologies.

Apart from that, the key players are also investing in mergers and acquisitions to reach out to new markets and expand their market share.

Some of the recent developments are:

| Report Attribute | Details |

|---|---|

| Growth Rate | CAGR of 10.8% from 2025 to 2035 |

| Base Year for Estimation | 2025 |

| Historical Data | 2020 to 2024 |

| Forecast Period | 2025 to 2035 |

| Quantitative Units | Revenue in USD Million and CAGR from 2025 to 2035 |

| Report Coverage | Revenue Forecast, Volume Forecast, Company Ranking, Competitive Landscape, Growth Factors, Trends, and Pricing Analysis |

| Segments Covered | End User, Technology, Type, Degree of Freedom, Region |

| Regions Covered | North America; Latin America; Asia Pacific; Middle East and Africa(MEA); Europe |

| Key Countries Profiled | USA, Canada, Brazil, Argentina, Germany, United Kingdom, France, Spain, Italy, Nordics, BENELUX, Australia & New Zealand, China, India, GCC Countries, South Africa |

| Key Companies Profiled | Bosch Rexroth AG; Siemens Industry Software B.V; CAE Inc. Dassault Systèmes; Laerdal Medical.; Moog Inc.; Gaumard Scientific; Cubic Corporation |

| Customization | Available Upon Request |

The global motion simulation market is estimated to be valued at USD 27.7 billion in 2025.

The market size for the motion simulation market is projected to reach USD 77.4 billion by 2035.

The motion simulation market is expected to grow at a 10.8% CAGR between 2025 and 2035.

The key product types in motion simulation market are defense, automotive, entertainment, mining and healthcare.

In terms of technology, hydraulic segment to command 40.0% share in the motion simulation market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Motion Control Software in Robotics Market Size and Share Forecast Outlook 2025 to 2035

Motion Preservation Devices Market Size and Share Forecast Outlook 2025 to 2035

Motion Control Centers Market by Component, Deployment Mode, Mode & Region Forecast till 2025 to 2035

Motion Stimulation Therapy Market Trends – Growth & Forecast 2024-2034

Motion Controllers Market

Motion Sensors Market

Emotion Detection and Recognition Market

In Motion Dimensioning Systems Market Analysis Size and Share Forecast Outlook 2025 to 2035

Promotional Packaging Market Size and Share Forecast Outlook 2025 to 2035

3D Motion Capture Market by System, Component, Application & Region Forecast till 2035

Competitive Overview of Promotional Packaging Market Share

Promotion Bins Market

Spinal Motion-Preservation Devices Market

Safety Motion Control System Market

Weigh in Motion System Market - Trends & Forecast 2025 to 2035

Continuous Motion Cartoner Market Size and Share Forecast Outlook 2025 to 2035

Multi-axis Motion Controller Market Size and Share Forecast Outlook 2025 to 2035

Social and Emotional Learning Market Forecast Outlook 2025 to 2035

Radiotherapy Motion Management Market

Automotive Weigh-In Motion Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA