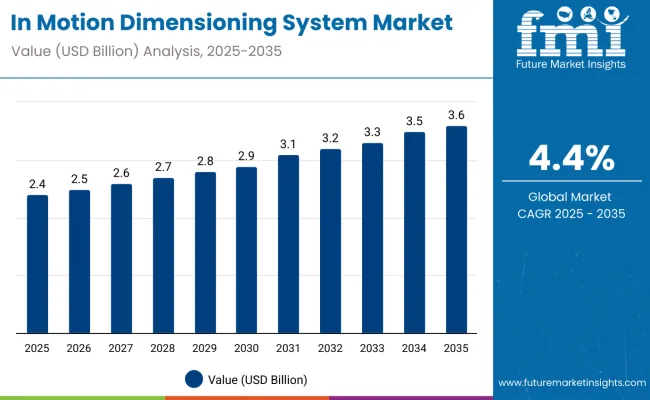

The global In Motion Dimensioning Systems market is expected to be valued at USD 2.4 billion in 2025 and is projected to reach approximately USD 3.6 billion by 2035. This reflects an absolute increase of USD 1.3 billion, equivalent to a growth of 53.4% over the forecast period. The expansion is forecast to occur at a CAGR of 4.4%, with the market size estimated to grow by nearly 1.5X by the end of the decade.

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 2.4 billion |

| Industry Value (2035F) | USD 3.6 billion |

| CAGR (2025 to 2035) | 4.4% |

Between 2025 and 2030, the market is projected to expand from USD 2.4 billion to USD 2.9 million, adding USD 554 million. Growth in this first phase is supported by network upgrades across parcel hubs and 3PL distribution centers, wider deployment of inline cubing & weighing for revenue protection (dim-weight billing), and the need to audit carrier invoices at scale. Retailers continue building micro-fulfillment and dark-store networks, pulling compact, conveyor-ready systems that can verify dimensions without slowing throughput.

From 2030 to 2035, the market is expected to grow from USD 2.9 billion to USD 3.6 billion, a further increase of USD 708.2 million. This phase is shaped by sensor fusion which involves the combined mechanism of laser, vision, and weight, edge analytics, and tighter integration with WMS/TMS/ERP for cost-to-serve analytics. Hardware refreshes emphasize safer, faster conveyors, IP-rated enclosures, and automatic calibration, while software upgrades focus on charge-back prevention, proof-of-measurement traceability, and API-first architectures.

From 2020 to 2024, the market rose from USD 2 billion to USD 2.3 billion, propelled by the surge in e-commerce parcels, reverse logistics, and contact-light operations in distribution centers. Operators prioritized in-motion systems (vs. static cubing) to avoid line slowdowns, while the need to reconcile dimensional weight with carrier invoices increased demand for audit-grade measurement accuracy. Investments in postal and express networks across North America, Europe, and East Asia laid the installed-base foundation for the 2025-2035 cycle.

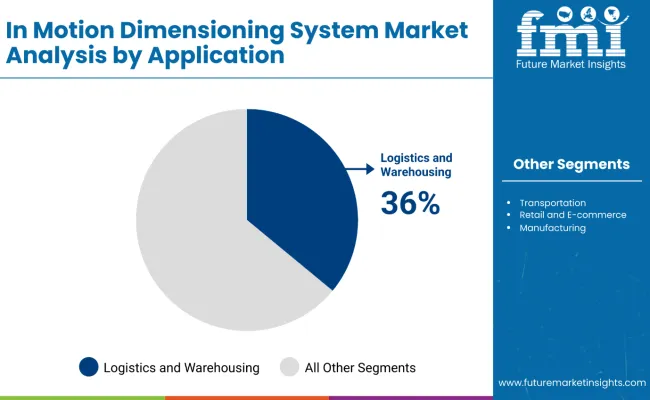

Carrier pricing has shifted decisively toward dimensional weight (DIM), making verified length-width-height as important as mass. Shippers that rely on manual or static cubing face chargebacks and billing disputes; inline systems provide audit-grade proof of measurement (time-stamp, image, barcode association) at conveyor speed. This revenue-protection motive is strongest in large CEP networks and national retailers, which explains why Logistics & Warehousing already accounts for the largest application share of 36%, with Retail & E-commerce close behind at 27%.

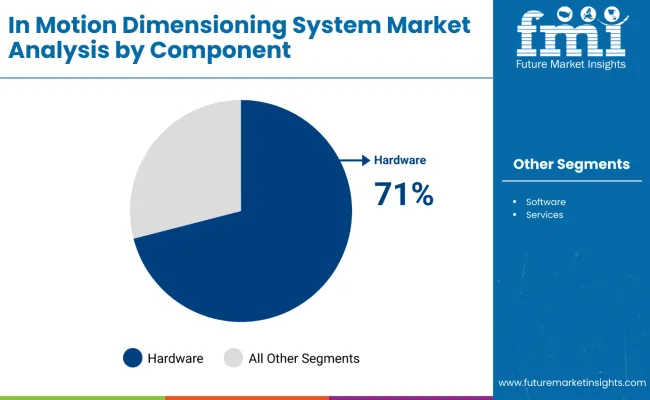

Although hardware still represents 71% of spend today, the value is increasingly unlocked by software carrier rules engines, exception workflows, image storage for disputes, and analytics that quantify cube utilization and cost-to-serve by SKU, lane, or customer. API-first platforms that plug into WMS/TMS/ERP deliver a second layer of savings: fewer manual touches, better trailer/pallet build plans, and automated packaging guidance.

Postal and trade environments demand traceable measurements that stand up to audits and customer claims. In-motion systems generate immutable records dimensions, weight, barcode, image mapped to shipment IDs. In Europe, accuracy and metrology requirements guide procurement; in the USA, large shippers insist on NTEP/MID-compliant performance and chain-of-custody for dimension data. This compliance layer turns what used to be “nice to have” into a must-have control.

Distribution centers face tight labor markets and rising wages. In-motion systems remove repetitive measuring tasks, reducing musculoskeletal strain and redeploying staff to higher-value work. Automation also lowers training time and helps standardize processes across multi-site networks important for 3PLs that ramp up seasonal capacity.

Micro-fulfillment and back-of-store operations require compact, quiet, and easily sanitized units. Vendors are responding with modular conveyor-edge dimensioners that slot into tight footprints and connect over standard fieldbuses/Ethernet. For air cargo and LTL cross-docks, high-throughput tunnel systems measure irregular freight at speed, enabling better ULD and trailer cube.

Logistics & Warehousing is the largest application at 36% of global revenue in 2025. Parcel hubs, postal centers, and 3PL campuses integrate laser tunnels and dimension-weigh-scan (DWS) stations to capture cube, weight, and barcode in a single pass. The Retail & E-commerce segment follows at 27%, where omnichannel networks deploy compact, conveyor-edge units for store-fulfillment and returns processing. Transportation (16%) includes air cargo ramps, LTL cross-docks, and port logistics; Manufacturing with 11% share uses in-motion dimensioning for inbound verification and pack-and-ship lines.

Laser-based dimensioning accounts for 48% of technology share in 2025, favored for speed, accuracy, and tolerance to varied box geometry. Infrared systems with 27% share win where cost and ease of integration matter, particularly on shorter conveyors or where safety constraints limit laser use. Ultrasonic systems with 10%share, is selected for dusty, reflective, or low-light environments, while Integrated dimensioning systems with 15% share combine laser/IR + vision + scale to deliver audit-grade records with image evidencean emerging standard for large 3PLs.

Hardware represents 71% of spend in 2025 (sensors, scanners, scales, conveyors, frames, controllers). Software with 17% share is the fastest-expanding piece as users require data orchestration, carrier rules engines, image storage, and dashboards. Services calibration, MRO, and retrofitsrise with fleet sizes and multi-site SLAs.

Demand for In Motion Dimensioning Systems is being supported by factors such as image-backed “proof of measurement” becoming mainstream, inclusion of Sensor fusion for difficult parcels and higher read rates, evolution of Edge AI and anomaly detection on the conveyor, among several others.

Image-backed “proof of measurement” becomes standard

Shippers and 3PLs are moving beyond raw L×W×H to dimension + weight + barcode + image as a single, time-stamped record. This audit-ready bundle shortens dispute cycles with carriers and customers and is increasingly written into SLAs for large parcel hubs and retailersdriving upgrades from basic sensors to integrated dimensioning systems (already 15% of tech mix).

Sensor fusion for difficult parcels and higher read rates

To handle polybags, shrink-wrap, tubes, and irregulars at speed, vendors are fusing laser with infrared, ultrasonic, and machine vision. Multi-sensor tunnels raise first-pass yield and keep conveyors at target throughput, which is critical as Logistics & Warehousing and Retail & E-commerce push peak-season volumes.

Edge AI and anomaly detection on the conveyor

New systems run on-device analytics to flag mis-measures, shadows, and occlusions in real time and auto-trigger re-measurement without stopping the line. Edge inference also identifies damaged packaging, overhanging items, and unsafe load profilesshrinking exception labor and protecting service levels.

Micro-fulfillment and back-of-store footprints

Dark stores and urban micro-DCs need compact, quiet, low-maintenancedimensioners that hug existing conveyors or sit at pack benches. Modular frames, tool-less height adjustments, and plug-and-play scales are replacing bespoke installs, allowing rollouts in hours rather than days.

Returns and reverse-logistics readiness

With returns climbing, DCs are deploying bidirectional or dedicated inbound lanes where dimensioning data feeds triage (restock, refurbish, re-pack, recycle). Image evidence shortens customer credit cycles and informs packaging redesign to reduce future damage and void.

Metrology, compliance, and chain-of-custody

Procurement specs increasingly call for NTEP/MID compliance, certified uncertainty, and encrypted data trails from sensor to host system. Regulated industries (postal, air cargo, cross-border trade) now require immutable measurement records retained for set periodspushing upgrades to integrated, calibrated systems with remote verification.

Sustainability and packaging optimization

Dimension data powers cartonization algorithms and right-sizing initiatives that cut corrugate, dunnage, and trailer count. Operators can quantify CO₂ savings per order, tying dimensioning ROI to corporate ESG goals and accelerating refresh cycles in Europe and Japan.

Service models and multi-site SLAs

As fleets scale, operators prefer calibration-as-a-service, remote health monitoring, and guaranteed uptime SLAs. Vendors win multi-year contracts by bundling commissioning, training, and periodic metrology checksturning one-off CAPEX into predictable OPEX with faster enterprise adoption.

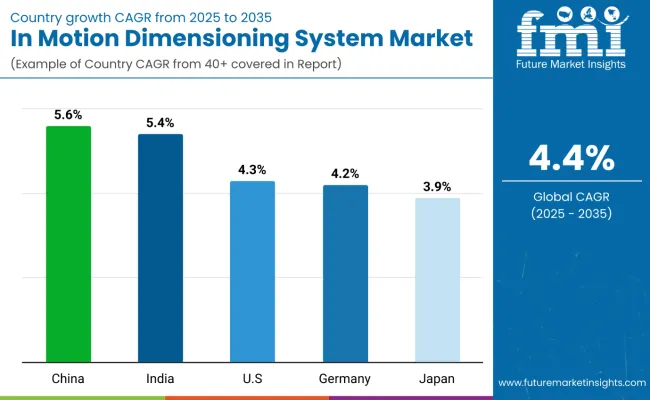

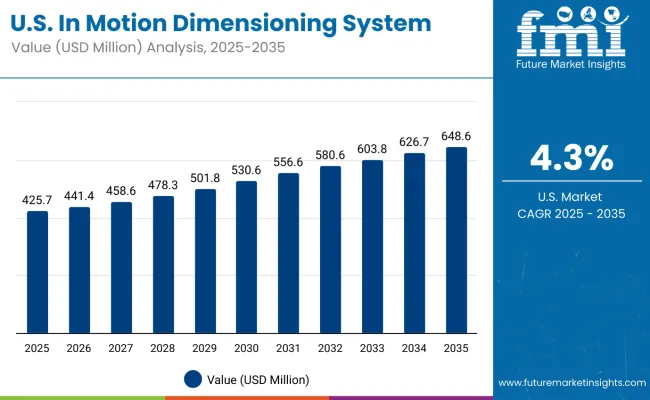

The USA in-motion dimensioning systems market is projected to grow at a CAGR of 4.3% during 2025-2035, underpinned by parcel networks’ shift to dimensional-weight billing, the build-out of micro-fulfilment and dark-store operations, and continued automation across national retailers and 3PLs. Carriers and shippers are standardizing dimension-weigh-scan (DWS) tunnels and conveyor-edge units to capture audit-grade length/width/height + weight + image without slowing throughput.

Regional clusters amplify demand: large hubs around Kentucky/Ohio, the Inland Empire (CA), and Dallas-Fort Worth are retrofitting high-speed sortation with image-backed proof of measurement, while airport and LTL cross-docks add in-motion dimensioning to streamline ULD/trailer cube. “Local-for-local” procurement favors vendors with USA assembly, calibrated service fleets, and API-first software that plugs into WMS/TMS/ERP.

China is the fastest-growing in-motion dimensioning market at 5.6% CAGR during 2025-2035, propelled by mega-hubs in Guangdong, Zhejiang, and the Yangtze River Delta, rapid growth of cross-border e-commerce, and greenfield 3PL campuses. High-throughput laser tunnels dominate parcel sortation, while cost-efficient IR/laser hybrids are deployed on short conveyors in regional DCs. Local suppliers shorten lead times with domestically sourced sensors and controllers, and software stacks expose APIs for carrier rules, image storage, and billing audit.

Germany’s market will expand at 4.2% CAGR through 2035, driven by CEP networks, automated retail DCs, and Mittelstand manufacturing that prioritizes traceable, image-backed measurement. Plants and DCs specify MID-compliant systems with certified uncertainty, integrating laser tunnels and integrated dimensioning at pack lines to support lean/OEE targets and export documentation.

Procurement favors vendors offering predictive calibration, remote health monitoring, and deterministic integration to MES/WMS. Compact, guarded frames and low-glare enclosures are preferred for operator safety in high-speed tunnels.

The market in India is projected at 5.4% CAGR, led by expansion of 3PL campuses, modernization of postal networks, and D2C brand logistics. Urban DCs with narrow conveyor footprints prefer modular, quick-install units; Tier-2/3 cities deploy IR/laser combinations that balance accuracy with budget. Software attach rates climb as operators adopt rules engines for carrier billing, image-backed dispute resolution, and packaging optimization.

In manufacturing and FMCG, in-motion dimensioning at inbound and pack-and-ship cuts mismatch errors, speeds ASN reconciliation, and informs carton selection, key to trailer cube and cost per order.

Japan’s market is expected to grow at 3.9% CAGR, reflecting dense urban DCs, convenience-store parcel flows, and high expectations for measurement fidelity and traceability. Operators prioritize compact, quiet systems that integrate cleanly with existing conveyors and maintain workplace comfort. The component mix skews toward higher software value (Hardware 65%, Software 25%, Services 10%) to support long-term record retention, image evidence, and strict host-system integration.

Manufacturers employ in-motion dimensioning on precision pack lines for export compliance, while retailers deploy conveyor-edge units at back-of-store micro-fulfilment and returns stations. Vendors win on quality, calibration stability, and responsive local service.

| Countries | 2025 |

|---|---|

| Germany | 23% |

| Italy | 9% |

| France | 14% |

| UK | 18% |

| Spain | 7% |

| BENELUX | 12% |

| Russia | 4% |

| Rest of Europe | 13% |

| Countries | 2035 |

|---|---|

| Germany | 21% |

| Italy | 9% |

| France | 14% |

| UK | 17% |

| Spain | 8% |

| BENELUX | 14% |

| Russia | 3% |

| Rest of Europe | 14% |

The European In-Motion Dimensioning Systems market is projected to grow at a CAGR of 4.1% from 2025 to 2035, reaching USD 742.3 million by 2035, up from USD 496.7 million in 2025. Growth follows sustained investment in dimension-weight (DIM) billing compliance, network upgrades across parcel/CEP hubs, and the spread of micro-fulfillment and back-of-store operations that need audit-grade measurement without slowing conveyors. Vendors that combine MID-compliant accuracy, image-backed proof of measurement, and API-first integration with WMS/TMS/ERP are winning multi-site rollouts.

Europe’s demand is anchored in replacement-led upgrades in mature Western markets and greenfield logistics capacity in Southern and parts of Central/Eastern Europe. As retailers push faster delivery and tighter cost-to-serve analytics, buyers favor IMDS platforms with sensor fusion (laser/IR + vision + scales), remote calibration, and lifecycle SLAs that guarantee uptime during peak season.

Germany with nearly 23% of the European market in 2025; easing toward remains the regional anchor. CEP networks and Mittelstand manufacturers specify laser tunnels and integrated DWS stations at pack lines to deliver traceable, image-assisted measurements that stand up in audits and export documentation. Machine-builder clusters in Baden-Württemberg and Bavaria prioritize MID-certified uncertainty, deterministic handshakes to MES/WMS, and automatic height compensation for mixed flows of cartons, polybags, and irregulars. Plants value deep diagnostics and remote health monitoring that feed TPM/OEE programs.

UK with18% of the market in Europe, together with Germany, accounts for around 40% of regional demand. UK integrators are rolling out IMDS upgrades across packaging, grocery e-commerce, and specialty retail DCs, pairing compact conveyor-edge units with image storage and rules engines to cut chargeback disputes. National parcel carriers retrofit high-speed sortation with laser tunnels and encrypted data trails, while back-of-store micro-fulfillmentfavors quiet, modular frames that fit tight footprints and install quickly in brownfield estates.

France with 14% regional share, sees demand split between Toulouse-centered air-cargo and aerospace logistics and large Île-de-France retail/omni-channel DCs. Buyers favor quiet, clean, compact IMDS units that integrate with existing conveyors and deliver proof-of-measurement (dims + weight + barcode + image) for returns triage and customer-credit acceleration. Food & beverage and cosmetics sites extend adoption on inspection/pack lines, with software features, cartonization guidance and exception workflows, tied to sustainability and service-level KPIs.

With 9% share, the market in Italy is driven by fashion/apparel, machinery exports, and 3PL campuses in Lombardy and Emilia-Romagna. Operators specify modular, quick-install dimensioners for mezzanines and narrow aisles, balancing accuracy with cost using IR/laser combinations on shorter conveyors and laser tunnels in flagship hubs. Retrofits emphasize returns handling, ASN reconciliation, and predictive calibration to minimize downtime in multi-shift operations.

Spain with nearly 7% share in 2025; is expected to gain share on the strength of logistics corridors around Zaragoza, Madrid, and Barcelona. EV-adjacent supply chains and fast-growing e-commerce programs expand IMDS use on body-shop parts logistics, retail fulfillment, and food processing. DCs adopt low-maintenance, integrated DWS systems that provide image evidence and API connections for carrier-invoice audit. Regional grants for efficiency and automation help sites migrate from static cubing to high-throughput in-motion platforms.

BENELUX accounting for 12% regional share in 2025,isbeing driven by Rotterdam/Antwerp port gateways, pharma cold-chain campuses, and dense multi-tenant logistics parks. Procurement specs emphasize hygienic, sealed IMDS enclosures, remote monitoring, and long-term data retention to meet pharma/GxP and customer-audit needs. Cold-chain and automated warehouses standardize on image-backed records and secure Industrial Ethernet, while AMR/AGV deployments drive demand for compact conveyor-edge dimensioners at induction and sort points.

Japan’s in-motion dimensioning systems market is set for steady growth through 2035, with demand concentrated in hardware, which accounts for 65% of spend in 2025. Dense, automation-heavy logistics networks, convenience-store parcels, urban micro-fulfillment, and export-grade manufacturing, prioritize compact, quiet hardware that can be dropped into existing conveyors without disturbing clean, organized workspaces.

At the same time, Japanese operators attach higher-value software with 25% for traceability, long-term record retention, and seamless WMS/TMS/ERP integration, while services (10%) cover calibration, periodic metrology checks, and uptime SLAs across multi-site fleets. Preference skews toward low-noise, cleanroom-compatible frames with image-backed proof of measurement and deterministic connectivity into host systems, features that reduce dispute cycles and support compliance in export documentation.

South Korea’s market reflects high-throughput electronics exports and multi-tenant logistics parks, with laser-based systems holding the lead at 45% in 2025. Parcel hubs around Seoul-Incheon and manufacturing corridors in Gyeonggi-Chungcheong deploy laser tunnels for speed and accuracy on cartons and mixed freight. Infrared systems (25%) gain traction in cost-sensitive, short-conveyor installations common to SME DCs and back-of-store setups.

Ultrasonic (15%) is favored where reflective films and shrink-wrap challenge optics, typical in component and display packaging, while integrated dimensioning systems (15%) combine laser/IR with machine vision and scales to deliver image-backed, audit-ready records for large 3PL campuses and cross-border operators.

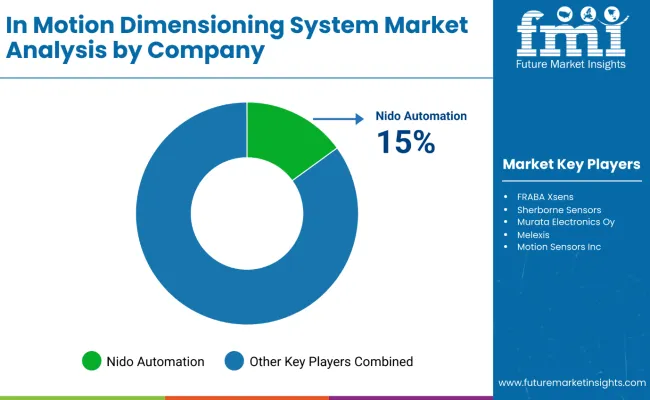

The IMDS market is intensely competitive and increasingly solution-driven. Buyers are no longer procuring a stand-alone sensor; they want a dimension-weigh-scan (DWS) stack that delivers audit-grade proof of measurement (L×W×H + weight + barcode + image), plugs cleanly into WMS/TMS/ERP, and is backed by fleet-level SLAs. That shift favors vendors that combine reliable hardware with API-first software, remote calibration, and multi-site rollout experience.

| Item | Value |

|---|---|

| Quantitative Units | USD 2.4 billion (2025) |

| Component | Hardware, Software, Services |

| Technology | Laser-Based Dimensioning Systems, Infrared Dimensioning Systems, Ultrasonic Dimensioning Systems, Integrated Dimensioning Systems |

| Application | Logistics and Warehousing, Transportation, Retail and E-commerce, Manufacturing, Automotive, Others |

| Regions Covered | North America, Europe, East Asia, South Asia & Pacific, Latin America, Middle East & Africa |

| Countries Covered | United States, Germany, United Kingdom, Japan, China, France, Italy, South Korea, Spain, BENELUX |

| Key Companies Profiled | Nido Automation, OptiSense, International Road Dynamics (IRD), FRABA, Xsens, Sherborne Sensors, Murata Electronics Oy, Melexis, Motion Sensors Inc. |

The global IMDS market is estimated at USD 2.4 billion in 2025, driven by parcel networks’ shift to dimension-weight (DIM) billing, automation in logistics hubs, and the need for audit-grade, image-backed measurements in high-throughput fulfilment.

The market is projected to reach USD 3.6 billion by 2035, reflecting wider adoption of sensor-fusion dimension-weigh-scan (DWS) tunnels and API-first software that integrates with WMS/TMS/ERP across multi-site operations.

The market is forecast to expand at a CAGR of 4.4% over 2025–2035, supported by micro-fulfillment build-outs, reverse-logistics growth, and compliance needs for traceable proof-of-measurement.

Laser-based dimensioning systems are expected to lead in 2025 with 48% share.

Logistics & Warehousing is the largest segment at 36% of 2025 revenue.

Key companies referenced in this study include Nido Automation, OptiSense, International Road Dynamics (IRD), FRABA, Xsens, Sherborne Sensors, Murata Electronics Oy, Melexis, and Motion Sensors Inc.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Infrastructure Projects Legal Services Market Size and Share Forecast Outlook 2025 to 2035

Intellectual Property Support Services Market Size and Share Forecast Outlook 2025 to 2035

Intellectual Property Legal Services Market Size and Share Forecast Outlook 2025 to 2035

Industrial Grade Electrochemical CO Sensor Market Size and Share Forecast Outlook 2025 to 2035

Interior Swinging Door Market Size and Share Forecast Outlook 2025 to 2035

Inflatable Spa Hot Tub Market Size and Share Forecast Outlook 2025 to 2035

Intelligent Touch Screen Cash Register Market Size and Share Forecast Outlook 2025 to 2035

Industrial Bench Scale Market Size and Share Forecast Outlook 2025 to 2035

Intensity Microphone Market Size and Share Forecast Outlook 2025 to 2035

Inflatable U Shaped Travel Pillow Market Size and Share Forecast Outlook 2025 to 2035

Induction Brazing Services Market Size and Share Forecast Outlook 2025 to 2035

Industrial Low Profile Floor Scale Market Size and Share Forecast Outlook 2025 to 2035

Integrated Trimming and Forming System Market Size and Share Forecast Outlook 2025 to 2035

Industrial Sand Mill Market Size and Share Forecast Outlook 2025 to 2035

Industrial Control Network Modules Market Size and Share Forecast Outlook 2025 to 2035

Incline Impact Tester Market Size and Share Forecast Outlook 2025 to 2035

In-line Emulsifier Market Size and Share Forecast Outlook 2025 to 2035

Industrial Precision Oven Market Size and Share Forecast Outlook 2025 to 2035

Industrial Water Chiller for PCB Market Size and Share Forecast Outlook 2025 to 2035

Internal Anthelmintics for Cats Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA