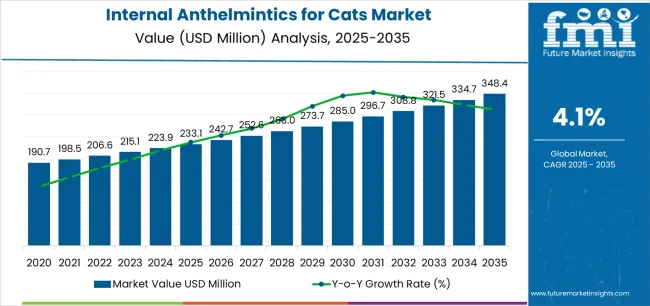

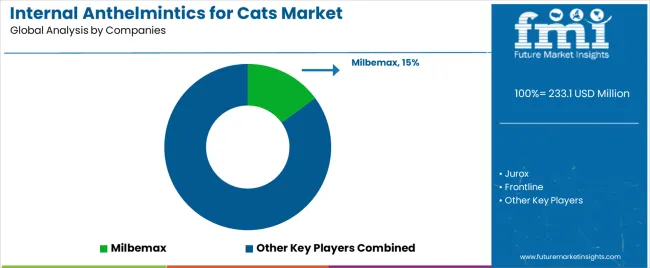

The global internal anthelmintics for cats market is valued at USD 233.1 million in 2025. It is slated to reach USD 348.3 million by 2035, recording an absolute increase of USD 115.2 million over the forecast period. This translates into a total growth of 49.4%, with the market forecast to expand at a compound annual growth rate (CAGR) of 4.1% between 2025 and 2035. The overall market size is expected to grow by nearly 1.49X during the same period, supported by increasing pet cat ownership rates, growing awareness of parasitic disease prevention, and rising emphasis on feline health and wellness across diverse veterinary care settings, pet ownership demographics, and animal welfare applications.

Between 2025 and 2030, the internal anthelmintics for cats market is projected to expand from USD 233.1 million to USD 273.7 million, resulting in a value increase of USD 40.6 million, which represents 35.2% of the total forecast growth for the decade. This phase of development will be shaped by increasing pet humanization trends and preventive healthcare adoption, rising veterinary clinic accessibility and professional service utilization, and growing demand for broad-spectrum antiparasitic solutions addressing multiple internal parasite species. Veterinary pharmaceutical companies and animal health providers are expanding their internal anthelmintics capabilities to address the growing demand for effective deworming solutions that ensure feline health and prevent zoonotic disease transmission.

From 2030 to 2035, the market is forecast to grow from USD 273.7 million to USD 348.3 million, adding another USD 74.6 million, which constitutes 64.8% of the overall ten-year expansion. This period is expected to be characterized by the expansion of combination antiparasitic products addressing both internal and external parasites, the development of novel formulation technologies improving palatability and administration convenience, and the growth of online veterinary pharmacy channels facilitating direct-to-consumer product access. The growing adoption of comprehensive feline wellness programs and integrated parasite control strategies will drive demand for internal anthelmintics with enhanced efficacy and improved owner compliance features.

Between 2020 and 2025, the internal anthelmintics for cats market experienced steady growth, driven by increasing recognition of intestinal parasite prevalence in domestic cat populations and growing acceptance of routine deworming as essential preventive care in responsible pet ownership. The market developed as veterinarians and cat owners recognized the potential for internal anthelmintics to eliminate roundworms, hookworms, tapeworms, and other gastrointestinal parasites while preventing clinical disease, supporting optimal nutrition, and reducing public health risks. Technological advancement in formulation science and palatability enhancement began emphasizing the critical importance of maintaining treatment adherence and ensuring effective parasite elimination in both indoor and outdoor cat populations.

| Metric | Value |

|---|---|

| Estimated Value in (2025E) | USD 233.1 million |

| Forecast Value in (2035F) | USD 348.3 million |

| Forecast CAGR (2025 to 2035) | 4.1% |

Market expansion is being supported by the increasing global pet cat population driven by urbanization trends and changing household demographics, alongside the corresponding need for effective parasite control products that can prevent gastrointestinal infections, support feline health and vitality, and reduce zoonotic disease transmission risks across various household, veterinary clinic, shelter, and breeding applications. Modern veterinarians and pet owners are increasingly focused on implementing internal anthelmintics solutions that can eliminate multiple parasite species, provide convenient administration options, and deliver consistent efficacy in diverse cat populations.

The growing emphasis on preventive veterinary care and pet wellness programs is driving demand for routine deworming products that can address subclinical parasitic infections, prevent disease complications, and ensure comprehensive feline health protection. Pet owners' preference for effective treatments that combine broad-spectrum parasite coverage with palatability and ease of administration is creating opportunities for innovative internal anthelmintics implementations. The rising influence of pet humanization and increased veterinary spending is also contributing to increased adoption of premium antiparasitic products that can provide superior efficacy without compromising safety or treatment compliance.

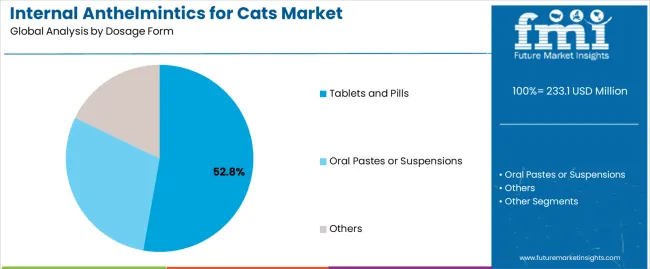

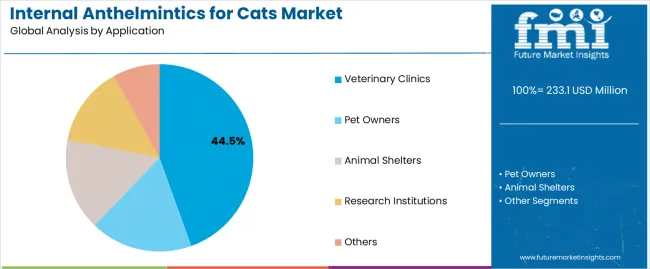

The market is segmented by dosage form, application, and region. By dosage form, the market is divided into tablets and pills, oral pastes or suspensions, and others. Based on application, the market is categorized into veterinary clinics, pet owners, animal shelters, research institutions, and others. Regionally, the market is divided into East Asia, Europe, North America, South Asia, Latin America, Middle East & Africa, and Eastern Europe.

The tablets and pills segment is projected to maintain its leading position in the internal anthelmintics for cats market in 2025 with a 52.8% market share, reaffirming its role as the preferred dosage form for routine feline deworming and parasite control applications. Veterinarians and cat owners increasingly utilize tablet formulations for their precise dosing capabilities, extended shelf life characteristics, and proven effectiveness in delivering active pharmaceutical ingredients for comprehensive internal parasite elimination. Tablet technology's proven effectiveness and handling convenience directly address the veterinary requirements for reliable anthelmintic treatment and standardized dosing protocols across diverse cat breeds and weight ranges.

This dosage form segment forms the foundation of modern feline parasite control, as it represents the format with the greatest adoption in professional veterinary settings and established efficacy record across multiple antiparasitic drug classes and parasite species. Veterinary pharmaceutical industry investments in palatability enhancement technologies and chewable formulation development continue to strengthen adoption among veterinarians and cat owners. With clinical guidelines recommending regular deworming schedules, tablets and pills align with both veterinary best practices and owner convenience requirements, making them the central component of comprehensive feline parasite management strategies.

The veterinary clinics application segment is projected to represent the largest share of internal anthelmintics for cats demand in 2025 with a 44.6% market share, underscoring its critical role as the primary driver for internal anthelmintics adoption across routine wellness examinations, diagnostic-driven treatments, and professional parasite control protocols. Veterinarians prefer prescribing internal anthelmintics through clinical settings due to their ability to provide comprehensive fecal examinations, accurate parasite identification, and appropriate product selection while ensuring proper dosing and client education. Positioned as essential healthcare providers for companion animals, veterinary clinics offer both diagnostic expertise and treatment guidance benefits.

The segment is supported by continuous growth in veterinary service utilization and the expanding availability of broad-spectrum combination products that address multiple parasite species with single administration. Additionally, veterinary practices are investing in comprehensive wellness programs incorporating routine deworming protocols to support preventive care objectives and client pet health education. As pet ownership rates increase and veterinary care standards advance, the veterinary clinics application will continue to dominate the market while supporting professional parasite management and feline health optimization strategies.

The internal anthelmintics for cats market is advancing steadily due to increasing pet cat ownership driven by urbanization and smaller household sizes requiring companion animals, and growing adoption of preventive veterinary care approaches that emphasize routine parasite control as essential component of responsible pet ownership across diverse household, shelter, and breeding applications. However, the market faces challenges, including treatment compliance difficulties with uncooperative cats and administration challenges, competition from combination products addressing multiple parasites with single formulation, and market fragmentation related to varying parasite prevalence patterns and regional treatment preferences. Innovation in palatability enhancement technologies and novel delivery systems continues to influence product development and market expansion patterns.

The growing availability of combination anthelmintic formulations addressing multiple internal parasite species and life stages is driving market transformation through improved treatment convenience, enhanced efficacy profiles, and reduced administration frequency requirements. Veterinary pharmaceutical companies are successfully developing multi-active ingredient products that eliminate roundworms, hookworms, tapeworms, and other gastrointestinal parasites with single treatment administration. Veterinarians are increasingly recognizing the clinical advantages and owner compliance benefits of broad-spectrum combination products for comprehensive parasite control, creating opportunities for market growth through simplified treatment protocols and improved therapeutic outcomes. Regulatory agencies' approval of novel combination formulations continues to expand veterinary prescribing options and strengthen preventive care capabilities.

Modern pet ownership is incorporating human-like care standards and elevated expectations for companion animal health products, including preferences for pharmaceutical-grade formulations, natural ingredient alternatives, and products with enhanced safety and palatability characteristics. Leading pet owners are demanding premium internal anthelmintics that combine clinical efficacy with superior formulation quality and minimal side effect profiles. These evolving consumer preferences drive innovation in product development while enabling market segmentation based on quality perceptions and price-value relationships, including organic formulation options and veterinary-exclusive professional products. Advanced consumer engagement through veterinary education and digital marketing also allows manufacturers to communicate product differentiation and build brand loyalty among quality-conscious pet owners.

The advancement of palatability enhancement techniques, transdermal delivery systems, and long-acting injectable formulations is driving demand for next-generation internal anthelmintics with improved owner compliance and reduced administration challenges. Pharmaceutical companies are investing in research programs exploring flavored chewable tablets, liquid suspensions with improved taste masking, and alternative delivery routes that address current product limitations related to difficult medication administration in fractious cats. These technological innovations create opportunities for differentiated product offerings with enhanced convenience features, reduced stress for both cats and owners, and improved treatment adherence that support competitive positioning in established markets while enabling expansion into underserved pet owner segments frustrated with traditional administration methods.

| Country | CAGR (2025-2035) |

|---|---|

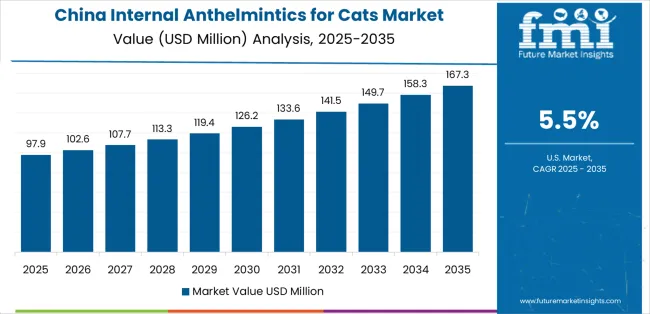

| China | 5.5% |

| India | 5.1% |

| Germany | 4.7% |

| Brazil | 4.3% |

| USA | 3.9% |

| UK | 3.5% |

| Japan | 3.1% |

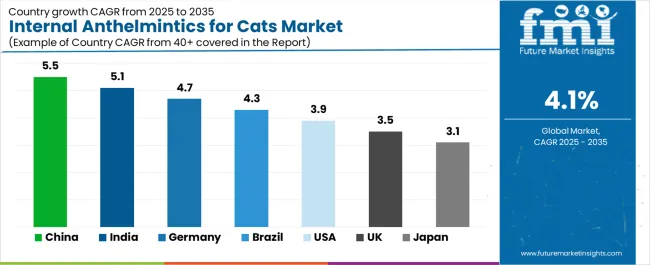

The internal anthelmintics for cats market is experiencing solid growth globally, with China leading at a 5.5% CAGR through 2035, driven by rapidly expanding pet cat ownership, increasing disposable income enabling veterinary care spending, and growing awareness of parasite control importance among urban pet owners. India follows at 5.1%, supported by rising middle-class pet adoption, expanding veterinary infrastructure, and increasing recognition of feline health needs in metropolitan areas. Germany shows growth at 4.7%, emphasizing comprehensive veterinary care standards, strong pet insurance penetration, and established preventive healthcare protocols.

Brazil demonstrates 4.3% growth, supported by growing pet ownership culture, expanding veterinary clinic networks, and increasing consumer awareness of parasite-related health risks. The USA records 3.9%, focusing on mature veterinary market infrastructure, high pet care spending levels, and widespread adoption of preventive wellness programs. The UK exhibits 3.5% growth, emphasizing established veterinary service utilization and comprehensive pet healthcare standards. Japan shows 3.1% growth, supported by high pet ownership rates in aging population and premium product preferences among quality-conscious cat owners.

The report covers an in-depth analysis of 40+ countries top-performing countries are highlighted below.

Revenue from internal anthelmintics for cats in China is projected to exhibit exceptional growth with a CAGR of 5.5% through 2035, driven by rapidly expanding pet cat ownership and increasing disposable income levels supporting veterinary care spending among urban middle-class households. The country's accelerating pet humanization trends and growing awareness of companion animal health needs are creating substantial demand for internal anthelmintics solutions. Major veterinary pharmaceutical companies and domestic animal health manufacturers are establishing comprehensive distribution capabilities to serve both metropolitan veterinary clinics and expanding pet retail channels.

Revenue from internal anthelmintics for cats in India is expanding at a CAGR of 5.1%, supported by rising pet cat ownership among urban middle-class families, expanding veterinary clinic accessibility in metropolitan areas, and increasing awareness of companion animal health needs through digital media and veterinary education initiatives. The country's growing pet care industry and evolving attitudes toward animal welfare are driving demand for quality veterinary products throughout major cities. Leading veterinary pharmaceutical companies and animal health distributors are establishing market presence through veterinary channel partnerships and pet retail expansion.

Revenue from internal anthelmintics for cats in Germany is expanding at a CAGR of 4.7%, supported by the country's comprehensive veterinary care infrastructure, high pet insurance penetration facilitating preventive care spending, and strong cultural emphasis on responsible pet ownership and animal welfare. The nation's advanced veterinary expertise and established pet healthcare standards are driving sophisticated internal anthelmintics utilization throughout professional veterinary practices. Leading veterinary pharmaceutical companies are maintaining strong market presence through established veterinary distribution networks and professional education programs.

Revenue from internal anthelmintics for cats in Brazil is expanding at a CAGR of 4.3%, supported by the country's growing pet ownership culture, expanding veterinary clinic infrastructure, and increasing consumer awareness of companion animal health needs driven by veterinary education and pet care media. The nation's large and growing pet population and evolving veterinary service landscape are driving demand for accessible internal anthelmintics products. Veterinary pharmaceutical companies and animal health distributors are investing in market development strategies addressing diverse geographic regions and socioeconomic segments.

Revenue from internal anthelmintics for cats in the USA is expanding at a CAGR of 3.9%, supported by the country's mature veterinary healthcare infrastructure, high pet care spending levels, and widespread adoption of comprehensive wellness programs incorporating routine parasite screening and prevention. The nation's established veterinary profession and sophisticated pet owner demographics are driving sustained demand for quality internal anthelmintics products. Veterinary pharmaceutical companies and animal health corporations maintain extensive distribution through veterinary clinics, online pharmacies, and retail pet specialty channels.

Revenue from internal anthelmintics for cats in the UK is expanding at a CAGR of 3.5%, supported by the country's established veterinary profession, comprehensive animal welfare standards, and strong pet ownership culture emphasizing responsible companion animal care. The UK's mature veterinary service infrastructure and sophisticated pet owner demographics are driving stable internal anthelmintics demand. Veterinary pharmaceutical companies maintain market presence through established veterinary distribution channels and professional veterinary organization partnerships.

Revenue from internal anthelmintics for cats in Japan is growing at a CAGR of 3.1%, driven by the country's high pet cat ownership rates among aging population demographics, comprehensive veterinary care standards, and strong consumer preferences for premium quality products meeting rigorous safety and efficacy standards. Japan's sophisticated pet care culture and quality-oriented consumer behavior are supporting demand for high-specification internal anthelmintics. Leading veterinary pharmaceutical companies maintain market presence through established veterinary channels and premium product positioning strategies.

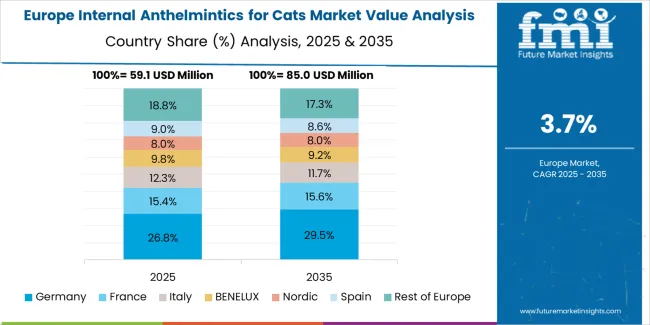

The internal anthelmintics for cats market in Europe is projected to grow from USD 68.4 million in 2025 to USD 98.2 million by 2035, registering a CAGR of 3.7% over the forecast period. Germany is expected to maintain leadership with a 24.8% market share in 2025, moderating to 24.3% by 2035, supported by comprehensive veterinary infrastructure, high pet insurance penetration, and strong preventive care culture.

France follows with 18.6% in 2025, projected at 18.9% by 2035, driven by established veterinary networks, comprehensive pet healthcare standards, and growing urban pet ownership. The UK holds 16.2% in 2025, expected to reach 16.5% by 2035 supported by mature veterinary profession and responsible pet ownership culture. Italy commands 13.7% in 2025, rising slightly to 13.9% by 2035, while Spain accounts for 11.4% in 2025, reaching 11.6% by 2035 aided by growing pet adoption and expanding veterinary service accessibility.

The Netherlands maintains 4.8% in 2025, up to 5.0% by 2035 due to advanced veterinary standards and comprehensive pet healthcare protocols. The Rest of Europe region, including Nordics, Central & Eastern Europe, and other markets, is anticipated to hold 10.5% in 2025 and 9.8% by 2035, reflecting varied pet ownership rates and veterinary infrastructure development across diverse national markets.

The internal anthelmintics for cats market is characterized by competition among established veterinary pharmaceutical companies, animal health corporations, and specialized companion animal product manufacturers. Companies are investing in formulation innovation, palatability enhancement technologies, combination product development, and veterinary channel partnerships to deliver effective, convenient, and well-accepted internal anthelmintics solutions. Innovation in broad-spectrum antiparasitic formulations, chewable delivery formats, and combination parasite control products is central to strengthening market position and competitive advantage.

Milbemax represents a leading brand in the internal anthelmintics category, offering broad-spectrum coverage against multiple internal parasite species with convenient tablet formulation designed for feline applications. Jurox provides veterinary pharmaceutical products with emphasis on companion animal health and innovative formulation technologies. Frontline offers comprehensive parasite control solutions with brand recognition spanning both external and internal parasite management. Bayer maintains strong market presence through established veterinary brands and comprehensive companion animal health portfolio. Zoetis leads the animal health industry with extensive product offerings including internal anthelmintics for small companion animals.

Elanco Animal Health delivers comprehensive companion animal healthcare solutions with focus on parasite control and preventive medicine. Zhejiang Hisun Pharmaceutical provides veterinary pharmaceutical products serving Asian and international markets. Puainta specializes in pet healthcare products with focus on parasite control and wellness support. Merck Animal Health offers established veterinary pharmaceutical brands with global distribution reach. Tianjin Ringpu Bio-technology focuses on veterinary biological products and pharmaceutical manufacturing. Ceva Santé Animale provides comprehensive veterinary pharmaceutical solutions for companion and production animals. Beaphar offers pet care products through retail channels with emphasis on owner-administered treatments. Bob Martin specializes in consumer pet healthcare products distributed through retail pet specialty and grocery channels.

Internal anthelmintics for cats represent an essential veterinary pharmaceutical segment within companion animal healthcare, projected to grow from USD 233.1 million in 2025 to USD 348.3 million by 2035 at a 4.1% CAGR. These antiparasitic products, primarily tablet formulations and oral suspensions addressing gastrointestinal parasite infections, serve as critical preventive and therapeutic medications in feline health management where elimination of roundworms, hookworms, tapeworms, and other internal parasites is essential for animal wellbeing and zoonotic disease prevention. Market expansion is driven by increasing global pet cat ownership, growing awareness of parasite control importance, expanding veterinary service accessibility, and rising emphasis on preventive healthcare approaches in responsible companion animal ownership.

How Veterinary Regulators Could Strengthen Product Standards and Animal Safety?

How Veterinary Professional Organizations Could Advance Best Practices and Clinical Standards?

How Veterinary Pharmaceutical Manufacturers Could Drive Innovation and Market Access?

How Veterinary Practices Could Optimize Parasite Control and Client Service?

How Research Institutions Could Enable Scientific Advancement?

How Pet Owners and Animal Welfare Organizations Could Support Responsible Care?

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD 233.1 million |

| Dosage Form | Tablets and Pills, Oral Pastes or Suspensions, Others |

| Application | Veterinary Clinics, Pet Owners, Animal Shelters, Research Institutions, Others |

| Regions Covered | East Asia, Europe, North America, South Asia, Latin America, Middle East & Africa, Eastern Europe |

| Countries Covered | China, India, Germany, Brazil, USA, UK, Japan, and 40+ countries |

| Key Companies Profiled | Milbemax, Jurox, Frontline, Bayer, Zoetis, Elanco Animal Health |

| Additional Attributes | Dollar sales by dosage form and application category, regional demand trends, competitive landscape, formulation innovation, palatability enhancement, parasite control protocols, and veterinary practice integration |

The global internal anthelmintics for cats market is estimated to be valued at USD 233.1 million in 2025.

The market size for the internal anthelmintics for cats market is projected to reach USD 348.4 million by 2035.

The internal anthelmintics for cats market is expected to grow at a 4.1% CAGR between 2025 and 2035.

The key product types in internal anthelmintics for cats market are tablets and pills, oral pastes or suspensions and others.

In terms of application, veterinary clinics segment to command 44.5% share in the internal anthelmintics for cats market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Internal Bifold Door Market Size and Share Forecast Outlook 2025 to 2035

Internal Olefins Market Size and Share Forecast Outlook 2025 to 2035

Internal Gear Pump Market Size, Growth, and Forecast 2025 to 2035

Internal Radiation Therapy Market Trends – Growth & Forecast 2024-2034

Formaldehyde Removal Air Purifier Market Size and Share Forecast Outlook 2025 to 2035

Fortified Dairy Products Market Size and Share Forecast Outlook 2025 to 2035

Form-Fill-Seal (FFS) Films Market Size and Share Forecast Outlook 2025 to 2035

Formable Films Market Size and Share Forecast Outlook 2025 to 2035

Forchlorfenuron Market Size and Share Forecast Outlook 2025 to 2035

Formalin Market Size and Share Forecast Outlook 2025 to 2035

Formalin Vials Market Size and Share Forecast Outlook 2025 to 2035

Foreign Trade Digital Service Market Size and Share Forecast Outlook 2025 to 2035

Forged and Casting Component Market Size and Share Forecast Outlook 2025 to 2035

Fortified Rice Market Size and Share Forecast Outlook 2025 to 2035

Fortifying Agent Market Size and Share Forecast Outlook 2025 to 2035

Forestry Equipment Market Size and Share Forecast Outlook 2025 to 2035

Forensic Imaging Market Size and Share Forecast Outlook 2025 to 2035

Forklift Battery Market Size and Share Forecast Outlook 2025 to 2035

Formulation Development Outsourcing Market Size and Share Forecast Outlook 2025 to 2035

Forskolin Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA