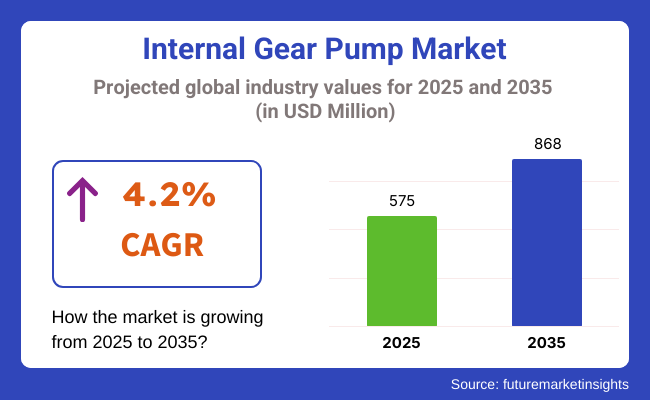

The global internal gear pump market is projected to expand from USD 575 million in 2025 to USD 868 million by 2035, growing at a CAGR of 4.2% over the forecast period. This growth is supported by rising demand across core sectors like oil & gas, chemicals, and increasingly, food processing-where hygiene, precision, and reliability are critical.

In 2024, manufacturers prioritized engineering advancements that reduce cavitation, enhance longevity, and deliver low-maintenance performance. The Asia-Pacific region, particularly China and India, led in volume growth, while Germany and the United States maintained dominance in high-performance and smart pump technologies.

Key growth drivers include rising investments in automated fluid-handling systems, increased emphasis on energy efficiency, and the integration of IoT and predictive maintenance capabilities. Industry stakeholders across North America and Europe are investing in smart pump systems with embedded sensors for real-time diagnostics and remote performance tracking.

In contrast, Japan and South Korea are leaning toward compact, space-saving pump formats for high-density industrial spaces. The transition to low-emission fuels and renewable energy sources is also reshaping demand patterns, particularly in marine, chemical, and hydrogen-processing applications.

Looking ahead, the market will continue evolving toward intelligent, eco-friendly, and custom-engineered gear pumps. Manufacturers are aligning their product designs with regional regulatory demands-ranging from OSHA and NFPA in the USA to CE and ATEX compliance in Europe.

The food & beverage sector is projected to be the fastest-growing application, driven by CIP-compliant hygienic designs and strict safety certifications. Meanwhile, niche sectors like battery cooling, biofuels, and pharmaceuticals are emerging as lucrative areas. With digital transformation sweeping the industrial landscape, companies that invest in modular, IoT-enabled, and regulation-compliant gear pumps are best positioned to capture long-term value.

Steel pumps continue to dominate the global internal gear pump market due to their chemical resistance, mechanical strength, and suitability for aggressive fluids across chemical, oil & gas, and food applications. Cast iron pumps also hold a notable share, favored in cost-sensitive sectors like marine and industrial lubrication.

However, the heavy-duty pump segment is witnessing the fastest growth, driven by demand from offshore drilling, hydrogen refining, and high-pressure chemical injection systems. These pumps often comply with ATEX and other explosion-proof certifications.

Additionally, pumps made from hybrid and specialty materials are carving a niche in sectors requiring lightweight and corrosion-resistant designs. As industries move toward extreme environments and safety-critical systems, heavy-duty variants will remain the most lucrative segment.

The chemical industry remains the largest end-user of internal gear pumps, owing to its need for precision dosing, chemical resistance, and adherence to stringent safety norms. Gear pumps are integral in handling solvents, acids, and caustic mixtures in processing facilities. The marine industry also contributes significantly to the market, using gear pumps for fuel transfer, lubrication, and ballast control.

However, the food & beverage industry is the fastest-growing end-use segment, with rising demand for stainless-steel, hygienic, and energy-efficient CIP-compatible pumps. Regulatory compliance (FDA, EHEDG) and process automation in beverage filling and dairy processing lines are driving this trend. Furthermore, renewable energy, hydrogen, and battery manufacturing are emerging sectors rapidly integrating advanced gear pump systems.

Introduction

FMI conducted a detailed study of 450 industry stakeholders, including manufacturers, distributors, industrial operators, and regulators in key industries, including the USA, Western Europe, Japan, and South Korea, in Q4 2024. The study aimed to analyze emerging industry dynamics, key priorities, and global investment trends in gear pumps. The survey uncovered key insights regarding regulatory impact, technology adoption, material preferences, and industry challenges.

Global Trends

Regional Variance

High Variance in Adoption

73% of USA stakeholders considered automation a beneficial investment, whereas 35% of Japanese stakeholders preferred cost-effective, standalone models.

Material Preferences

Regional Preferences

Global

Regional Differences

Manufacturers

Distributors

End-User Industry

Global Alignment

Regional Investment Focus

USA

OSHA and NFPA regulations are a strong driver of safety technology adoption, according to 65% of respondents.

Western Europe

83% said that the EU Workplace Safety Directive was a strong sales driver for premium products.

Japan/South Korea

Just 35% felt regulations had a strong effect on purchasing decisions, as compliance was weaker.

Key Takeaways

Worldwide concerns about safety compliance, durability, and pressure on costs persist.

Adoption and pricing strategies vary widely

The global gear pump industry cannot be tackled using a “one-size-fits-all” approach. To ensure optimal industry penetration and sustainable growth, companies must tailor tactics to suit regional needs-IoT-oriented solutions in the USA; eco-friendly solutions in Europe; and cost-effective, small-footprint designs across Asia.

| Country | Regulatory Impact & Mandatory Certifications |

|---|---|

| United States |

|

| United Kingdom |

|

| France |

|

| Germany |

|

| Italy |

|

| South Korea |

|

| Japan |

|

| China |

|

| Australia & New Zealand |

|

| India |

|

The gear pump industry in the United States will see 4.5% CAGR growth on the back of increasing demand from the oil & gas, chemical, and food & beverage industries. The Industrial Internet of Things (IIoT) is driving growth, with original equipment manufacturers embedding smart sensors for predictive maintenance. Regulatory systems like OSHA and EPA are encouraging the use of energy-efficient & low-emission gear pumps by the manufacturers.

Problems include semiconductor shortages and rising raw material prices, but opportunities in automation, hydrogen, and biofuels remain solid. Transferring well as domestic production that promotes innovation has also boosted growth.

The UK gear pump industry is projected to grow at a 3.8% CAGR, lower than the global average due to post-Brexit trade barriers and economic ambiguity. But demand from the pharmaceutical, water treatment, and industrial automation sectors is solid. The transition from CE marking to UKCA certification initially caused compliance issues, but the industry is now stabilizing.

Energy efficiency policies lead to the adoption of energy-efficient pumps. Although IoT adoption lags behind the USA and Germany, it is expected to drive industry growth in the coming years, with smart manufacturing and Industry 4.0 driving increased investments.

The demand for chemicals, cosmetics, and pharmaceuticals will be the key driver for the growth of France's gear pump industry, which is projected to grow at a 3.9% CAGR through 2023. Strict environmental regulations, such as ICPE laws, are driving manufacturers toward low-emission, energy-efficient pumps. The installation of gear pumps in explosive environments such as petrochemicals and power generation requires ATEX directive compliance.

Smart pumps with predictive maintenance are gaining ground here, but more slowly than in Germany. The supply chain is being disrupted by Asia, regulatory complexity in the EU, and potential battles for intellectual property in China, but there are also opportunities in some biotech, water purification, and alternative energy applications.

Germany, the industry with the highest revenues, continues to see growth of 4.6% CAGR. Strong demand for high-performance gear pumps thanks to strengths in industrial segments like automobiles, chemicals, and heavy equipment. Germany is at the forefront, with over 50% of manufacturers integrating IoT-enabled pumps for real-time monitoring and efficiency improvements.

Demand for green gear pumps gains momentum as the TA Luft regulations apply stringent emission controls. Biofuels and hydrogen usage are growth drivers for the renewable energy industry. Even though labour expenses and regulatory restrictions can impose barriers, Germany's focus on pursuing automated processes and a sustainable future ensures that they will thrive.

Projections indicate a CAGR of 3.7% for the Italian gear pump industry, with the food processing, textiles, and chemicals industries contributing the most. Italy is known for precision engineering and is a huge producer of custom-built and high-speed gear pumps. Moreover, compliance with IMQ Certification, CE Marking, and ISO Standards provides tremendous export potential.

Hybrid gear pumps are in vogue currently, as they are more cost-effective and energy-efficient. Economic instability and shifting industrial investments may dampen growth, but growing adoption of automated fluid-handling technologies and energy-efficient designs will underpin long-run demand.

In South Korea, the gear pump industry is anticipated to grow at a 4.0% CAGR, primarily driven by electronics, shipbuilding, and semiconductor production. If manufacturers need certifications for KOSHA and KC, they have to adhere to strict safety and performance controls. One of the key drivers has been smart factories and automation, with over 40% of the manufacturing base outfitted with IoT-ready gear pumps.

The government’s Green New Deal is pushing energy-efficient industrial equipment and driving growth for low-carbon gear pumps. High manufacturing costs and dependency on imported raw materials pose challenges, while advancements in robotics and automation provide ample growth prospects.

The gear pump industry in Japan will expand at a 3.6% CAGR, lower than the global average, as consumers prefer traditional machinery. Still, the automotive, robotics, and precision manufacturing industries are still key drivers of demand. The sector in Japan meet JIS, METI, and PSE standards to deliver high-quality products to our customers.

Due to the cost factor, 25% of industrial operators in Japan lack the implementation of smart pumps and are unavailable for IoT-based solutions. However, the significantly greater investments in wireless and compact fluid-handling solutions for space-limited facilities will present new avenues for growth.

Demand in China is expected to grow at the fastest pace among all leading industries, registering a 5.0% CAGR in the gear pump industry. Robust industrialization in the country, infrastructure development, and leadership in chemical processing and manufacturing generate demand. Product quality and safety are regulated by CCC certification and GB standards.

Demand for high-efficiency fluid-handling systems is being further accelerated by massive government investments in renewable energy and electric vehicles. China enjoys a comparative advantage in labour-intensive, low-cost production and demand-led growth, but it still suffers from higher labour costs, regulatory scrutiny, and supply chain disruptions. The industry is rapidly moving toward automated and intelligent fluid-handling systems.

Booming industrialization, urbanization, and infrastructure development are upholding the gear pump industry in India, which is anticipated to grow at a CAGR of 4.9% during 2025 to 2035. Oil & gas, water treatment, and food processing require more gear pumps. Granting BIS certification and compliance with CPCB environment norms is essential for entry into the industry.

Government initiatives such as “Make in India” as well as an investment in clean energy and smart manufacturing are driving growth. While price sensitivity remains prevalent, soaring demand for automated and high-efficiency fluid-handling products offers promising new opportunities. New investments overseas in the automotive, chemical and power industries would also complement the industry demand.

| 2020 to 2024 | 2025 to 2035 |

|---|---|

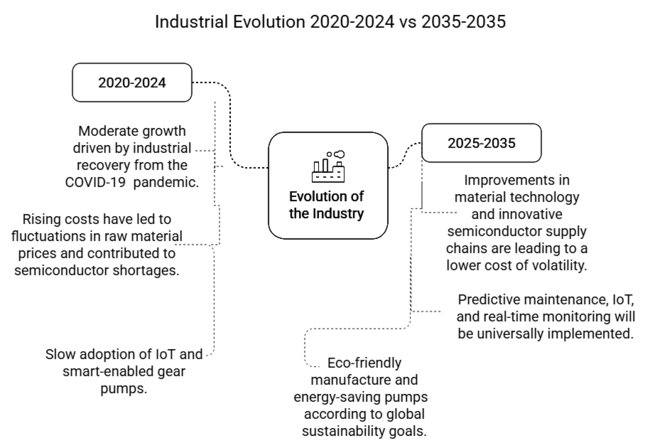

| Moderate growth driven by industrial recovery from the COVID-19 pandemic. | There is a positive matrix effect from automation, digitalization, and sustainability trends. |

| Supply chain shutdowns impacted raw material supply and production. | Localized manufacturing and strategic alliances lead to stable supply chains. |

| Rising costs have led to fluctuations in raw material prices and contributed to semiconductor shortages. | Improvements in material technology and innovative semiconductor supply chains are leading to a lower cost of volatility. |

| Slow adoption of IoT and smart-enabled gear pumps. | Predictive maintenance, IoT, and real-time monitoring will be universally implemented. |

| This growth is supported by the oil & gas, chemicals, and shipping sectors. | The food & beverage, pharmaceutical, and renewable energy sectors have boosted demand. |

| Tougher safety and emissions rules increased compliance costs. | Eco-friendly manufacture and energy-saving pumps according to global sustainability goals. |

| Traditional mechanical pumps dominate the industry. | There has been an increase in the adoption of hybrid and also smart gear pumps. |

The various players in the gear pump industry compete regarding price, technology, innovation, partnerships, and geography. Some are competing on the basis of cost leadership, while others are competing on the basis of high-performance, energy-efficient, and intelligent gear pumps. Key enablers include materials innovation, IoT-based monitoring, and predictive maintenance technology. Key players forge strategic partnerships with OEMs, industrial operators, and distributors to enhance their industry presence.

Common growth strategies include mergers, acquisitions, and the establishment or expansion of manufacturing facilities in rapidly growing regions like Asia-Pacific. In addition, organizations emphasize adherence to regulations (API, ATEX, FDA) and personalization for target industries to strengthen their industry sovereignty as well as address potential prospects in the industry.

Bosch Rexroth AG announced a new series of its energy-efficient internal gear pumps designed to reduce carbon emissions in various industrial processes. The pumps use IoT-enabled sensors to enable predictive maintenance and real-time monitoring, which is in response to the growing need for smart manufacturing solutions.

Viking Pump, Inc. launched corrosion-resistant internal gear pumps for the chemical process industry to expand its product line. This innovation addresses the increased demand for durable and reliable pumping solutions in extreme conditions. Viking Pump further gained share in the industry by forming a partnership with a large European chemical manufacturer to co-engineer tailored pumping systems.

Tuthill Corporation One news snippet did involve the acquisition of a smaller pump manufacturer, one who works with renewable energy users. In March 2024, Industry Today reported Tuthill's key role in enhancing capacity to deliver sustainable pumping solutions for hydrogen production and biofuels. Tuthill predicts the acquisition will strengthen its presence in the renewable energy sector.

PSG, a division of Dover Corporation, focused on digital transformation by embedding advanced analytics and AI into its internal gear pumps. Announced in early 2024, this project provides customers the ability to maximize pumping potential while minimizing operational expenses. PSG also added to its in-region channel in Asia-Pacific to take advantage of the industrial areas’ growing sector.

Similarly, Colfax Corporation introduced a third-generation internal gear pump with energy-efficient performance and reduced noise levels. The pumps are aimed at marine applications and tap into an increasing interest in environmentally friendly solutions in the shipping sector. Colfax also collaborated with a leading shipbuilding entity to design exclusive pumping systems for next-generation vessels.

Iwaki CO., Ltd. made giant investments for R&D to manufacture internal gear pumps regarding pharmaceutical and food & beverage industries with improved sealing technologies. IWAKI also announced plans to build a new plant in India to support rising demand in the Asia-Pacific region.

In aerospace, Sumitomo Precision Products Co., Ltd. focused on innovation, launching internal gear pumps for lightweight designs. These pumps are purpose-built to deliver premium performance and safety, thereby enhancing Sumitomo's foothold in the aerospace space, as it were.

The adoption of Industry 4.0 and greener regulations will accelerate the demand for gear pumps that are intelligent, energy-saving, and environmentally friendly. As industrial operators demand real-time monitoring and efficiency in operations, investors must invest in IoT-based, predictive maintenance technologies.

Two key industries are Asia-Pacific and the Middle East, where industrialization and infrastructure investments are exploding. With governments around the world promoting environmentally friendly technologies, firms should also develop specialized gear pumps for emerging industries, like hydrogen fuel processing, biofuels, and cooling systems for electric vehicles.

TGTs will strengthen the competitive position and win new business as producers expect integrated, plug-and-play pump systems through strategic alliances with industrial automation companies. Even partnerships with OEMs can help pump vendors grow their business and become the preferred supplier of heavy machinery and process equipment manufacturers.

In addition, companies must navigate regional regulation schemes-adopting ATEX and CE marking in Europe, API certification in the US, and energy-saving designs in Asia-to gain traction in new industries.

The industry is segmented into steel pumps, cast iron pumps, heavy-duty pumps and others.

The Industry is segmented into chemical industry, marine industry, oil & gas sector, food & beverage companies and other End-use Applications

It is fragmented North America, Latin America, Europe, East Asia, South Asia and Pacific, Middle East and Africa (MEA)

Table 1: Global Market Value (US$ Million) Forecast by Region, 2019 to 2034

Table 2: Global Market Volume (Units) Forecast by Region, 2019 to 2034

Table 3: Global Market Value (US$ Million) Forecast by Type, 2019 to 2034

Table 4: Global Market Volume (Units) Forecast by Type, 2019 to 2034

Table 5: Global Market Value (US$ Million) Forecast by Application, 2019 to 2034

Table 6: Global Market Volume (Units) Forecast by Application, 2019 to 2034

Table 7: North America Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 8: North America Market Volume (Units) Forecast by Country, 2019 to 2034

Table 9: North America Market Value (US$ Million) Forecast by Type, 2019 to 2034

Table 10: North America Market Volume (Units) Forecast by Type, 2019 to 2034

Table 11: North America Market Value (US$ Million) Forecast by Application, 2019 to 2034

Table 12: North America Market Volume (Units) Forecast by Application, 2019 to 2034

Table 13: Latin America Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 14: Latin America Market Volume (Units) Forecast by Country, 2019 to 2034

Table 15: Latin America Market Value (US$ Million) Forecast by Type, 2019 to 2034

Table 16: Latin America Market Volume (Units) Forecast by Type, 2019 to 2034

Table 17: Latin America Market Value (US$ Million) Forecast by Application, 2019 to 2034

Table 18: Latin America Market Volume (Units) Forecast by Application, 2019 to 2034

Table 19: Western Europe Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 20: Western Europe Market Volume (Units) Forecast by Country, 2019 to 2034

Table 21: Western Europe Market Value (US$ Million) Forecast by Type, 2019 to 2034

Table 22: Western Europe Market Volume (Units) Forecast by Type, 2019 to 2034

Table 23: Western Europe Market Value (US$ Million) Forecast by Application, 2019 to 2034

Table 24: Western Europe Market Volume (Units) Forecast by Application, 2019 to 2034

Table 25: Eastern Europe Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 26: Eastern Europe Market Volume (Units) Forecast by Country, 2019 to 2034

Table 27: Eastern Europe Market Value (US$ Million) Forecast by Type, 2019 to 2034

Table 28: Eastern Europe Market Volume (Units) Forecast by Type, 2019 to 2034

Table 29: Eastern Europe Market Value (US$ Million) Forecast by Application, 2019 to 2034

Table 30: Eastern Europe Market Volume (Units) Forecast by Application, 2019 to 2034

Table 31: South Asia and Pacific Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 32: South Asia and Pacific Market Volume (Units) Forecast by Country, 2019 to 2034

Table 33: South Asia and Pacific Market Value (US$ Million) Forecast by Type, 2019 to 2034

Table 34: South Asia and Pacific Market Volume (Units) Forecast by Type, 2019 to 2034

Table 35: South Asia and Pacific Market Value (US$ Million) Forecast by Application, 2019 to 2034

Table 36: South Asia and Pacific Market Volume (Units) Forecast by Application, 2019 to 2034

Table 37: East Asia Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 38: East Asia Market Volume (Units) Forecast by Country, 2019 to 2034

Table 39: East Asia Market Value (US$ Million) Forecast by Type, 2019 to 2034

Table 40: East Asia Market Volume (Units) Forecast by Type, 2019 to 2034

Table 41: East Asia Market Value (US$ Million) Forecast by Application, 2019 to 2034

Table 42: East Asia Market Volume (Units) Forecast by Application, 2019 to 2034

Table 43: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 44: Middle East and Africa Market Volume (Units) Forecast by Country, 2019 to 2034

Table 45: Middle East and Africa Market Value (US$ Million) Forecast by Type, 2019 to 2034

Table 46: Middle East and Africa Market Volume (Units) Forecast by Type, 2019 to 2034

Table 47: Middle East and Africa Market Value (US$ Million) Forecast by Application, 2019 to 2034

Table 48: Middle East and Africa Market Volume (Units) Forecast by Application, 2019 to 2034

Figure 1: Global Market Value (US$ Million) by Type, 2024 to 2034

Figure 2: Global Market Value (US$ Million) by Application, 2024 to 2034

Figure 3: Global Market Value (US$ Million) by Region, 2024 to 2034

Figure 4: Global Market Value (US$ Million) Analysis by Region, 2019 to 2034

Figure 5: Global Market Volume (Units) Analysis by Region, 2019 to 2034

Figure 6: Global Market Value Share (%) and BPS Analysis by Region, 2024 to 2034

Figure 7: Global Market Y-o-Y Growth (%) Projections by Region, 2024 to 2034

Figure 8: Global Market Value (US$ Million) Analysis by Type, 2019 to 2034

Figure 9: Global Market Volume (Units) Analysis by Type, 2019 to 2034

Figure 10: Global Market Value Share (%) and BPS Analysis by Type, 2024 to 2034

Figure 11: Global Market Y-o-Y Growth (%) Projections by Type, 2024 to 2034

Figure 12: Global Market Value (US$ Million) Analysis by Application, 2019 to 2034

Figure 13: Global Market Volume (Units) Analysis by Application, 2019 to 2034

Figure 14: Global Market Value Share (%) and BPS Analysis by Application, 2024 to 2034

Figure 15: Global Market Y-o-Y Growth (%) Projections by Application, 2024 to 2034

Figure 16: Global Market Attractiveness by Type, 2024 to 2034

Figure 17: Global Market Attractiveness by Application, 2024 to 2034

Figure 18: Global Market Attractiveness by Region, 2024 to 2034

Figure 19: North America Market Value (US$ Million) by Type, 2024 to 2034

Figure 20: North America Market Value (US$ Million) by Application, 2024 to 2034

Figure 21: North America Market Value (US$ Million) by Country, 2024 to 2034

Figure 22: North America Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 23: North America Market Volume (Units) Analysis by Country, 2019 to 2034

Figure 24: North America Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 25: North America Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 26: North America Market Value (US$ Million) Analysis by Type, 2019 to 2034

Figure 27: North America Market Volume (Units) Analysis by Type, 2019 to 2034

Figure 28: North America Market Value Share (%) and BPS Analysis by Type, 2024 to 2034

Figure 29: North America Market Y-o-Y Growth (%) Projections by Type, 2024 to 2034

Figure 30: North America Market Value (US$ Million) Analysis by Application, 2019 to 2034

Figure 31: North America Market Volume (Units) Analysis by Application, 2019 to 2034

Figure 32: North America Market Value Share (%) and BPS Analysis by Application, 2024 to 2034

Figure 33: North America Market Y-o-Y Growth (%) Projections by Application, 2024 to 2034

Figure 34: North America Market Attractiveness by Type, 2024 to 2034

Figure 35: North America Market Attractiveness by Application, 2024 to 2034

Figure 36: North America Market Attractiveness by Country, 2024 to 2034

Figure 37: Latin America Market Value (US$ Million) by Type, 2024 to 2034

Figure 38: Latin America Market Value (US$ Million) by Application, 2024 to 2034

Figure 39: Latin America Market Value (US$ Million) by Country, 2024 to 2034

Figure 40: Latin America Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 41: Latin America Market Volume (Units) Analysis by Country, 2019 to 2034

Figure 42: Latin America Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 43: Latin America Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 44: Latin America Market Value (US$ Million) Analysis by Type, 2019 to 2034

Figure 45: Latin America Market Volume (Units) Analysis by Type, 2019 to 2034

Figure 46: Latin America Market Value Share (%) and BPS Analysis by Type, 2024 to 2034

Figure 47: Latin America Market Y-o-Y Growth (%) Projections by Type, 2024 to 2034

Figure 48: Latin America Market Value (US$ Million) Analysis by Application, 2019 to 2034

Figure 49: Latin America Market Volume (Units) Analysis by Application, 2019 to 2034

Figure 50: Latin America Market Value Share (%) and BPS Analysis by Application, 2024 to 2034

Figure 51: Latin America Market Y-o-Y Growth (%) Projections by Application, 2024 to 2034

Figure 52: Latin America Market Attractiveness by Type, 2024 to 2034

Figure 53: Latin America Market Attractiveness by Application, 2024 to 2034

Figure 54: Latin America Market Attractiveness by Country, 2024 to 2034

Figure 55: Western Europe Market Value (US$ Million) by Type, 2024 to 2034

Figure 56: Western Europe Market Value (US$ Million) by Application, 2024 to 2034

Figure 57: Western Europe Market Value (US$ Million) by Country, 2024 to 2034

Figure 58: Western Europe Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 59: Western Europe Market Volume (Units) Analysis by Country, 2019 to 2034

Figure 60: Western Europe Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 61: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 62: Western Europe Market Value (US$ Million) Analysis by Type, 2019 to 2034

Figure 63: Western Europe Market Volume (Units) Analysis by Type, 2019 to 2034

Figure 64: Western Europe Market Value Share (%) and BPS Analysis by Type, 2024 to 2034

Figure 65: Western Europe Market Y-o-Y Growth (%) Projections by Type, 2024 to 2034

Figure 66: Western Europe Market Value (US$ Million) Analysis by Application, 2019 to 2034

Figure 67: Western Europe Market Volume (Units) Analysis by Application, 2019 to 2034

Figure 68: Western Europe Market Value Share (%) and BPS Analysis by Application, 2024 to 2034

Figure 69: Western Europe Market Y-o-Y Growth (%) Projections by Application, 2024 to 2034

Figure 70: Western Europe Market Attractiveness by Type, 2024 to 2034

Figure 71: Western Europe Market Attractiveness by Application, 2024 to 2034

Figure 72: Western Europe Market Attractiveness by Country, 2024 to 2034

Figure 73: Eastern Europe Market Value (US$ Million) by Type, 2024 to 2034

Figure 74: Eastern Europe Market Value (US$ Million) by Application, 2024 to 2034

Figure 75: Eastern Europe Market Value (US$ Million) by Country, 2024 to 2034

Figure 76: Eastern Europe Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 77: Eastern Europe Market Volume (Units) Analysis by Country, 2019 to 2034

Figure 78: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 79: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 80: Eastern Europe Market Value (US$ Million) Analysis by Type, 2019 to 2034

Figure 81: Eastern Europe Market Volume (Units) Analysis by Type, 2019 to 2034

Figure 82: Eastern Europe Market Value Share (%) and BPS Analysis by Type, 2024 to 2034

Figure 83: Eastern Europe Market Y-o-Y Growth (%) Projections by Type, 2024 to 2034

Figure 84: Eastern Europe Market Value (US$ Million) Analysis by Application, 2019 to 2034

Figure 85: Eastern Europe Market Volume (Units) Analysis by Application, 2019 to 2034

Figure 86: Eastern Europe Market Value Share (%) and BPS Analysis by Application, 2024 to 2034

Figure 87: Eastern Europe Market Y-o-Y Growth (%) Projections by Application, 2024 to 2034

Figure 88: Eastern Europe Market Attractiveness by Type, 2024 to 2034

Figure 89: Eastern Europe Market Attractiveness by Application, 2024 to 2034

Figure 90: Eastern Europe Market Attractiveness by Country, 2024 to 2034

Figure 91: South Asia and Pacific Market Value (US$ Million) by Type, 2024 to 2034

Figure 92: South Asia and Pacific Market Value (US$ Million) by Application, 2024 to 2034

Figure 93: South Asia and Pacific Market Value (US$ Million) by Country, 2024 to 2034

Figure 94: South Asia and Pacific Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 95: South Asia and Pacific Market Volume (Units) Analysis by Country, 2019 to 2034

Figure 96: South Asia and Pacific Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 97: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 98: South Asia and Pacific Market Value (US$ Million) Analysis by Type, 2019 to 2034

Figure 99: South Asia and Pacific Market Volume (Units) Analysis by Type, 2019 to 2034

Figure 100: South Asia and Pacific Market Value Share (%) and BPS Analysis by Type, 2024 to 2034

Figure 101: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Type, 2024 to 2034

Figure 102: South Asia and Pacific Market Value (US$ Million) Analysis by Application, 2019 to 2034

Figure 103: South Asia and Pacific Market Volume (Units) Analysis by Application, 2019 to 2034

Figure 104: South Asia and Pacific Market Value Share (%) and BPS Analysis by Application, 2024 to 2034

Figure 105: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Application, 2024 to 2034

Figure 106: South Asia and Pacific Market Attractiveness by Type, 2024 to 2034

Figure 107: South Asia and Pacific Market Attractiveness by Application, 2024 to 2034

Figure 108: South Asia and Pacific Market Attractiveness by Country, 2024 to 2034

Figure 109: East Asia Market Value (US$ Million) by Type, 2024 to 2034

Figure 110: East Asia Market Value (US$ Million) by Application, 2024 to 2034

Figure 111: East Asia Market Value (US$ Million) by Country, 2024 to 2034

Figure 112: East Asia Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 113: East Asia Market Volume (Units) Analysis by Country, 2019 to 2034

Figure 114: East Asia Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 115: East Asia Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 116: East Asia Market Value (US$ Million) Analysis by Type, 2019 to 2034

Figure 117: East Asia Market Volume (Units) Analysis by Type, 2019 to 2034

Figure 118: East Asia Market Value Share (%) and BPS Analysis by Type, 2024 to 2034

Figure 119: East Asia Market Y-o-Y Growth (%) Projections by Type, 2024 to 2034

Figure 120: East Asia Market Value (US$ Million) Analysis by Application, 2019 to 2034

Figure 121: East Asia Market Volume (Units) Analysis by Application, 2019 to 2034

Figure 122: East Asia Market Value Share (%) and BPS Analysis by Application, 2024 to 2034

Figure 123: East Asia Market Y-o-Y Growth (%) Projections by Application, 2024 to 2034

Figure 124: East Asia Market Attractiveness by Type, 2024 to 2034

Figure 125: East Asia Market Attractiveness by Application, 2024 to 2034

Figure 126: East Asia Market Attractiveness by Country, 2024 to 2034

Figure 127: Middle East and Africa Market Value (US$ Million) by Type, 2024 to 2034

Figure 128: Middle East and Africa Market Value (US$ Million) by Application, 2024 to 2034

Figure 129: Middle East and Africa Market Value (US$ Million) by Country, 2024 to 2034

Figure 130: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 131: Middle East and Africa Market Volume (Units) Analysis by Country, 2019 to 2034

Figure 132: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 133: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 134: Middle East and Africa Market Value (US$ Million) Analysis by Type, 2019 to 2034

Figure 135: Middle East and Africa Market Volume (Units) Analysis by Type, 2019 to 2034

Figure 136: Middle East and Africa Market Value Share (%) and BPS Analysis by Type, 2024 to 2034

Figure 137: Middle East and Africa Market Y-o-Y Growth (%) Projections by Type, 2024 to 2034

Figure 138: Middle East and Africa Market Value (US$ Million) Analysis by Application, 2019 to 2034

Figure 139: Middle East and Africa Market Volume (Units) Analysis by Application, 2019 to 2034

Figure 140: Middle East and Africa Market Value Share (%) and BPS Analysis by Application, 2024 to 2034

Figure 141: Middle East and Africa Market Y-o-Y Growth (%) Projections by Application, 2024 to 2034

Figure 142: Middle East and Africa Market Attractiveness by Type, 2024 to 2034

Figure 143: Middle East and Africa Market Attractiveness by Application, 2024 to 2034

Figure 144: Middle East and Africa Market Attractiveness by Country, 2024 to 2034

Industries such as oil and gas, chemicals, marine, food processing, and industrial manufacturing utilize gear pumps.

Real-time device monitoring, predictive maintenance, and efficiency improvement are provided by IoT-based gear pumps.

The main issues are the plummeting raw material prices, regulatory compliance, and disruption in product sourcing.

Industrialization, infrastructure, and investment in the energy sector are driving growth.

Manufacturers are prioritizing energy-saving motors, low-emission components, and recyclables.

Explore Similar Insights

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA