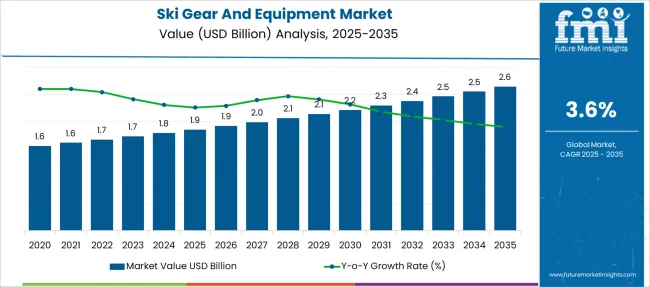

The Ski Gear And Equipment Market is estimated to be valued at USD 1.9 billion in 2025 and is projected to reach USD 2.6 billion by 2035, registering a compound annual growth rate (CAGR) of 3.6% over the forecast period.

| Metric | Value |

|---|---|

| Ski Gear And Equipment Market Estimated Value in (2025 E) | USD 1.9 billion |

| Ski Gear And Equipment Market Forecast Value in (2035 F) | USD 2.6 billion |

| Forecast CAGR (2025 to 2035) | 3.6% |

The ski gear and equipment market is gaining traction due to increased interest in winter sports tourism, growing investments in ski infrastructure, and rising participation in organized alpine activities. Expansion of ski resorts in Europe, North America, and emerging Asian destinations is stimulating demand for both recreational and professional gear.

Manufacturers are focusing on ergonomic designs, lightweight materials, and enhanced safety features to cater to evolving consumer needs. Seasonal migration trends, higher spending on outdoor experiences, and the growing influence of adventure sports on lifestyle branding have contributed to broader market visibility.

Technological improvements in wearables, smart equipment integration, and material durability have elevated product performance, attracting new segments of skiers. The market is also expected to benefit from increased promotional exposure through winter sports events and athlete endorsements, further solidifying demand in the recreational and competitive segments alike

The market is segmented by Product Type, Sport Type, End Use, and Distribution Channel and region. By Product Type, the market is divided into Ski equipment, Ski bindings, Ski boots, Ski poles, Ski helmets, Ski goggles, Ski gloves & mittens, Others (ski bags & carriers, etc), Protective gear, Helmets, Face guards, Knee pads, Others (back protectors, etc), Ski apparel, Jackets, Pants, Base layers, Ski socks, and Others (insulated gloves and mittens, etc). In terms of Sport Type, the market is classified into Alpine skiing, Cross-country skiing, Freestyle skiing, Ski touring, and Others (telemark skiing, etc). Based on End Use, the market is segmented into Men, Women, and Kids.

By Distribution Channel, the market is divided into Offline, Department stores, Specialty sports stores, Sporting goods retailers, Online, E-commerce platform, and Company websites. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

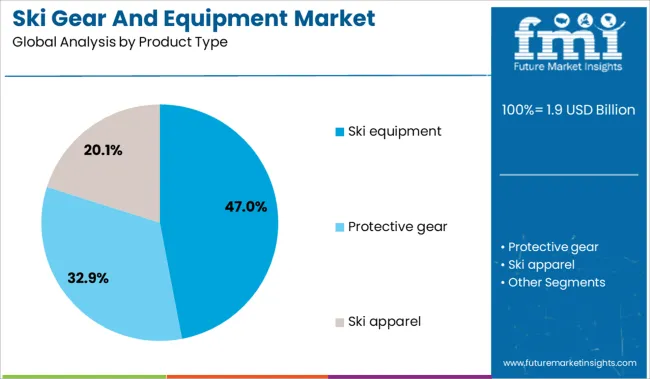

Ski equipment is projected to hold 47.0% of the total revenue share in the ski gear and equipment market by 2025, positioning it as the dominant product type. This leadership has been driven by sustained demand for essential gear including skis, bindings, and poles, which are critical across all skill levels.

The segment’s growth is further supported by increasing investments in rental infrastructure, enabling easier access to high-quality equipment without long-term ownership costs. Continuous innovation in ski technology—focusing on stability, flexibility, and edge grip-has made products more beginner-friendly and performance-enhancing, thereby broadening the user base.

Additionally, professional skiing tournaments and winter sports festivals have amplified awareness and influenced consumer preferences toward branded, high-performance equipment, sustaining segmental growth

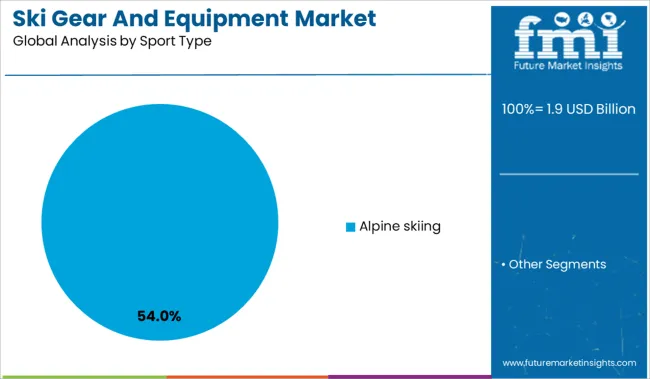

Alpine skiing is anticipated to dominate the market with a 54.0% revenue share in 2025. This segment’s leading position is attributed to its popularity across recreational and competitive user bases, supported by the global availability of alpine terrains and established resorts.

Increased media coverage and sponsorship of alpine skiing events have played a vital role in shaping consumer interest. Enhanced slope maintenance, ski pass systems, and beginner-focused training programs have also contributed to growing adoption.

Product development tailored specifically for alpine skiing, including reinforced boots, precision skis, and terrain-optimized bindings, has accelerated consumer conversion. As alpine skiing remains the most accessible entry point into winter sports, its sustained demand continues to shape equipment trends and retail strategies worldwide

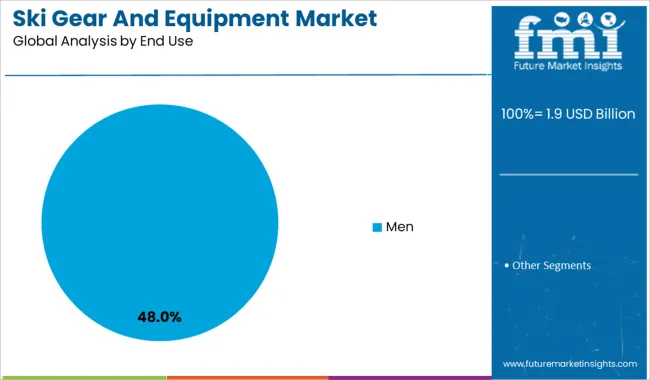

The men’s segment is forecast to account for 48.0% of the ski gear and equipment market revenue in 2025, maintaining its lead among end-user categories. This prominence is largely driven by higher participation rates among male skiers in both recreational and professional circuits.

Marketing campaigns, brand sponsorships, and athlete collaborations have traditionally targeted male demographics, reinforcing brand loyalty and seasonal purchase behaviors. Additionally, men’s ski gear often features segment-specific performance enhancements, such as greater rigidity, higher impact resistance, and customizable sizing.

While women’s and youth segments are rapidly growing, the men’s category remains dominant due to its consistent engagement across all ski sport formats and its alignment with high-expenditure consumer profiles in alpine regions

Retailers are improving off-season inventory liquidity through circular resale, modular refurbishments, and digital certification, though authenticity challenges remain. Climate-driven season disruptions are reshaping demand, pushing diversification and bundled loyalty strategies.

Retailers are streamlining off-season inventory with circular strategies and dynamic pricing tools. In 2025, ski gear resale platforms in Scandinavia and Japan reported a 41% YoY rise in refurbished equipment listings, boosting liquidity for brands and retailers. Modular component designs, especially in bindings and boots, have shortened refurbishment lead times by 28%. Digital resale certification is now bundled with over 15% of EU-listed ski gear to support second-owner confidence and warranty extensions. Despite these advances, brand integrity risks persist due to counterfeit parts entering secondary channels, particularly in Eastern Europe and Latin America. Standardized digital tagging and QR-code-based part authenticity systems remain unevenly adopted.

Unpredictable snow conditions have compressed ski seasons, disrupting demand forecasting and inventory placement. In Q4 2024, average resort opening days dropped by 11% across Central Europe, prompting regional distributors to downscale winter order volumes by 17% YoY. Retailers in alpine zones now bundle gear with flexible usage credits or loyalty points, offsetting lower footfall with ecosystem stickiness. Equipment makers are diversifying into adjacent mountain sports, e.g., splitboarding and alpine hiking, to hedge seasonal volatility. Still, reliance on snow-dependent revenue streams challenges long-term stability, especially for mid-sized brands lacking diversification capital. Insurance costs for event-based gear rental operations have surged by 19% YoY, further tightening margins.

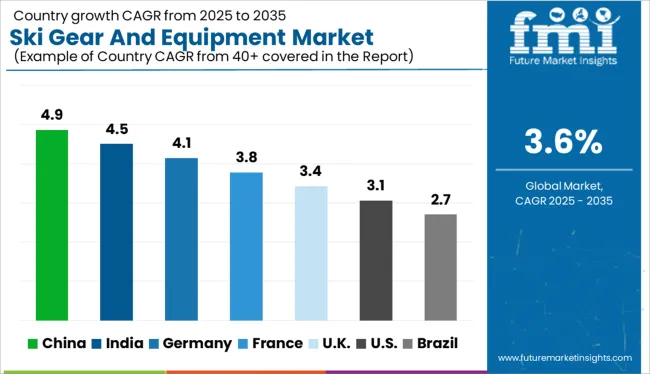

| Country | CAGR |

|---|---|

| China | 4.9% |

| India | 4.5% |

| Germany | 4.1% |

| France | 3.8% |

| UK | 3.4% |

| USA | 3.1% |

| Brazil | 2.7% |

The global ski gear and equipment market is expected to grow at a CAGR of 3.6% between 2025 and 2035, driven by rising winter tourism, vanlife trends, and demand for modular, aerodynamic carriers. BRICS nations like China and India are showing above-average growth, with CAGRs of 4.9% and 4.5% respectively. China’s growth is underpinned by increased participation in winter sports following the Beijing Winter Olympics legacy, while India’s nascent snow sport tourism in regions like Himachal and Kashmir is fueling niche demand. Among OECD economies, Germany leads with a 4.1% CAGR, supported by premium gear manufacturing and Alpine tourism infrastructure. The UK (3.4%) and the US (3.1%) are focusing on adventure-ready vehicle accessories, especially for SUVs and electric cars used in ski resorts. ASEAN countries remain marginal in demand but play a role in component manufacturing and OEM supply chains for global brands.

The CAGR for the UK ski gear and equipment market was 2.6% from 2020 to 2024, which is expected to rise to 3.4% between 2025 and 2035, surpassing pandemic-era lows and approaching the global average of 3.6%. From 2020 to 2024, sluggish growth was tied to prolonged COVID-19 travel disruptions, Brexit-related retail import complexities, and underwhelming domestic winter tourism. Consumer purchases were limited to occasional ski trips abroad, with many opting for rentals instead of investing in personal gear. However, the anticipated CAGR uplift for 2025-2035 stems from a structural rebound in outbound tourism, increased ski club memberships, and rising participation in indoor snow centres and dry slopes. Growth is further fueled by a shift toward premium and custom-fit gear, driven by rising affluence in suburban zones. Retailers are capitalizing on circular economy trends, while e-commerce and influencer-driven marketing are expanding visibility among Gen Z and millennials.

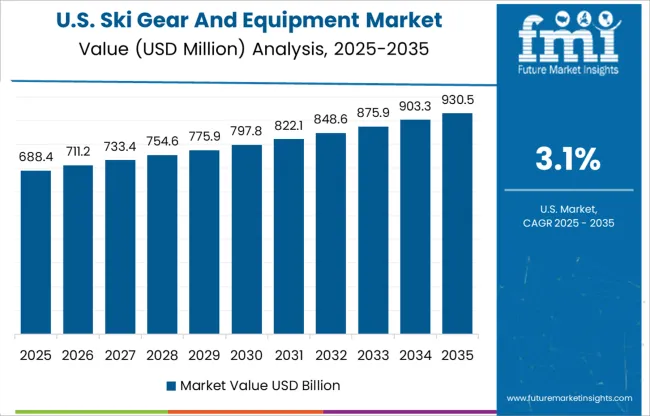

The CAGR for the USA ski gear and equipment market stood at 2.7% from 2020 to 2024, which is projected to climb to 3.1% during 2025-2035. Early decade stagnation was due to prolonged pandemic shutdowns, staffing shortages at resorts, and high inflation impacting discretionary spending. Supply chain bottlenecks for imported high-end gear further restrained sales. However, the resurgence in winter tourism, rising ski pass ownership, and growing preference for backcountry and alpine touring gear are expected to drive future growth. Resorts across Colorado, Utah, and Vermont have invested in trail expansions and infrastructure upgrades, encouraging more first-time skiers to invest in gear. The USA also leads in digital fitting and tech-enabled rentals, promoting market penetration through subscription-based models.

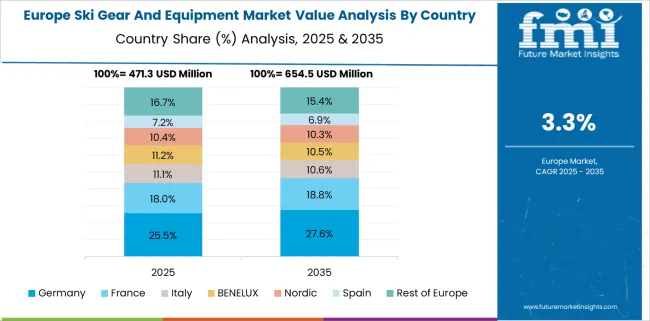

Germany’s ski gear and equipment market posted a CAGR of 3.5% from 2020 to 2024, increasing to 4.1% during 2025-2035, exceeding the global average. Between 2020 and 2024, the market demonstrated resilience due to strong domestic tourism in the Bavarian Alps and proximity to key European ski destinations. Pandemic-driven outdoor recreation trends further supported gear purchases. The transition to 2025-2035 growth is underpinned by climate adaptation strategies like artificial snowmaking and diversification into year-round alpine activities, supporting stable gear demand. Government subsidies for sports equipment in schools and youth sports programs have also increased skier participation from younger demographics. Germany’s circular economy focus has strengthened refurbishment, resale, and rental operations, increasing market turnover.

India’s ski gear and equipment market recorded a CAGR of 3.1% from 2020 to 2024, and this is expected to accelerate to 4.5% during 2025-2035, driven by infrastructure upgrades and winter tourism promotion. Early growth was constrained by limited ski infrastructure (mainly in Gulmarg and Auli), low consumer awareness, and gear availability restricted to urban Tier-1 centers. However, post-2024, significant tourism investment in Kashmir and Himachal Pradesh, including ski lift upgrades and resort privatization, has revitalized domestic interest. Influencer-driven travel, social media-fueled exposure, and a booming adventure sports market are catalyzing gear purchases. Global brands are also entering the market via omni-channel retail, while government sports initiatives are expanding youth access to skiing.

China’s ski gear and equipment market clocked a CAGR of 3.8% from 2020 to 2024, increasing to 4.9% during 2025-2035, the highest among the top five. Growth during the early period was propelled by the Beijing 2022 Winter Olympics, which catalyzed national winter sports enthusiasm, infrastructure buildouts, and government-led fitness campaigns. Between 2020 and 2024, over 300 new ski resorts and indoor centers opened across the country. For 2025-2035, the momentum continues, with focus shifting to lifestyle integration, premium product penetration, and digital customization. Middle-class aspirational spending is also lifting sales of branded ski gear, while local manufacturers are increasing exports of mid-range equipment..

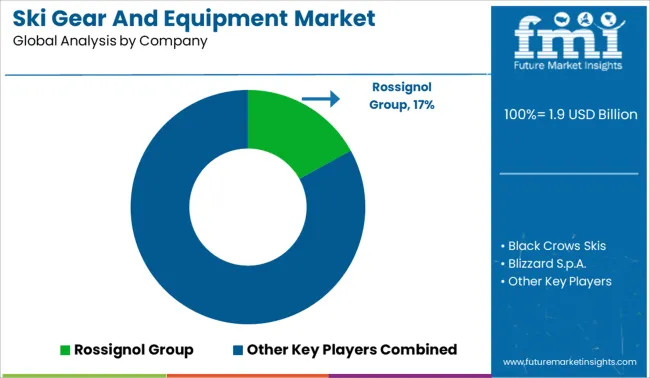

In the global ski gear and equipment market, valued between USD 9-10 billion in 2024, Rossignol Group leads with its wide alpine and Nordic gear range, combining French design precision with global brand reach. Its dominance is supported by long-standing partnerships with ski resorts and athletes. Other major players include Atomic Austria GmbH, Salomon Group, Head Sport GmbH, and Fischer Sports GmbH, each known for high-performance skis, boots, and safety gear. Black Crows Skis and Elan d.o.o. serve the premium touring and freestyle segments, while Nordica, Blizzard S.p.A., and Marker Volkl (Tecnica Group) gain traction via modular gear systems. K2 Sports, Scott Sports SA, Dynastar, and Burton Snowboards hold strong in North America, especially in the snowboarding and youth gear categories.

| Item | Value |

|---|---|

| Quantitative Units | USD 1.9 Billion |

| Product Type | Ski equipment, Ski bindings, Ski boots, Ski poles, Ski helmets, Ski goggles, Ski gloves & mittens, Others (ski bags & carriers, etc), Protective gear, Helmets, Face guards, Knee pads, Others (back protectors, etc), Ski apparel, Jackets, Pants, Base layers, Ski socks, and Others (insulated gloves and mittens, etc) |

| Sport Type | Alpine skiing, Cross-country skiing, Freestyle skiing, Ski touring, and Others (telemark skiing, etc) |

| End Use | Men, Women, and Kids |

| Distribution Channel | Offline, Department stores, Specialty sports stores, Sporting goods retailers, Online, E-commerce platform, and Company websites |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Rossignol Group, Black Crows Skis, Blizzard S.p.A., Burton Snowboards, Dynastar, Elan d.o.o., Fischer Sports GmbH, Head Sport GmbH, Atomic Austria GmbH, K2 Sports, LLC, Marker Volkl (Tecnica Group), Nordica S.p.A., Salomon Group, Scott Sports SA, and Tecnica Group S.p.A. |

| Additional Attributes | Dollar sales, share, growth by region, competitive positioning, technology trends, pricing benchmarks, policy impacts, end-user demand shifts, and channel performance. |

The global ski gear and equipment market is estimated to be valued at USD 1.9 billion in 2025.

The market size for the ski gear and equipment market is projected to reach USD 2.6 billion by 2035.

The ski gear and equipment market is expected to grow at a 3.6% CAGR between 2025 and 2035.

The key product types in ski gear and equipment market are ski equipment, ski bindings, ski boots, ski poles, ski helmets, ski goggles, ski gloves & mittens, others (ski bags & carriers, etc), protective gear, helmets, face guards, knee pads, others (back protectors, etc), ski apparel, jackets, pants, base layers, ski socks and others (insulated gloves and mittens, etc).

In terms of sport type, alpine skiing segment to command 54.0% share in the ski gear and equipment market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Skin Lightening Product Market Size and Share Forecast Outlook 2025 to 2035

Skincare Supplement Market Size and Share Forecast Outlook 2025 to 2035

Skin Tightening Device Market Size and Share Forecast Outlook 2025 to 2035

Skincare Oil Market Size and Share Forecast Outlook 2025 to 2035

Skills Management Software Market Size and Share Forecast Outlook 2025 to 2035

Skin-Barrier Strengthening Phospholipids Market Size and Share Forecast Outlook 2025 to 2035

Skin Toner Market Size and Share Forecast Outlook 2025 to 2035

Skin Cancer Detection Devices Market Size and Share Forecast Outlook 2025 to 2035

Skincare Nutritional Serum Market Size and Share Forecast Outlook 2025 to 2035

Skincare Products Market Size and Share Forecast Outlook 2025 to 2035

Skimmed Milk Powder Market Size and Share Forecast Outlook 2025 to 2035

Skin Sensors Market Size, Growth, and Forecast for 2025 to 2035

Skin Grafting System Market Size and Share Forecast Outlook 2025 to 2035

Skincare Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Ski Vacation Market Size and Share Forecast Outlook 2025 to 2035

Skincare Packaging Market Size, Share & Forecast 2025 to 2035

Skin Perfusion Pressure Testing Devices Market Size and Share Forecast Outlook 2025 to 2035

Skim Milk Powder Market Outlook – Growth, Demand & Forecast 2025 to 2035

Skin Care Devices Market Analysis - Trends & Forecast 2025 to 2035

Skin Antiseptic Market - Demand, Growth & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA