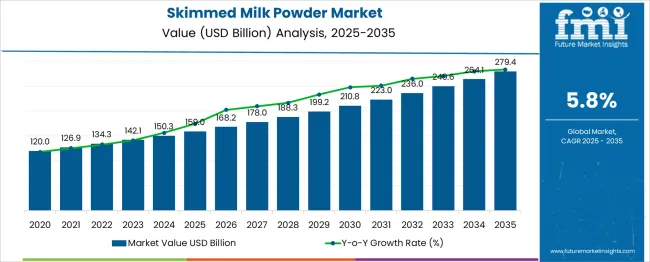

The Skimmed Milk Powder Market is estimated to be valued at USD 159.0 billion in 2025 and is projected to reach USD 279.4 billion by 2035, registering a compound annual growth rate (CAGR) of 5.8% over the forecast period.

Between 2025 and 2030, the market is expected to grow steadily from USD 159.0 billion to USD 210.8 billion, supported by rising utilization in bakery, confectionery, and nutritional products. Year-on-year analysis shows incremental gains, with the market reaching USD 168.2 billion in 2026 and USD 178.0 billion in 2027.

This progression is attributed to heightened demand for long-shelf-life dairy alternatives and cost-effective protein sources across developed and emerging economies. By 2028, the market is forecasted to reach USD 188.3 billion, followed by USD 199.2 billion in 2029 and USD 210.8 billion by 2030.

Expansion in ready-to-eat and infant nutrition products is expected to accelerate adoption, while trade liberalization in dairy commodities will further influence global supply dynamics. Manufacturers are anticipated to prioritize advanced drying technologies and clean-label formulations to meet evolving consumer expectations. These trends position skimmed milk powder as a core ingredient in both food manufacturing and functional nutrition segments, ensuring sustained market relevance over the next decade.

| Metric | Value |

|---|---|

| Skimmed Milk Powder Market Estimated Value in (2025 E) | USD 159.0 billion |

| Skimmed Milk Powder Market Forecast Value in (2035 F) | USD 279.4 billion |

| Forecast CAGR (2025 to 2035) | 5.8% |

The skimmed milk powder market holds a strong position across several dairy and ingredient-based sectors. In the dairy products market, its share is around 12–14%, as SMP is widely used in bakery, confectionery, and dairy-based formulations. Within the milk and milk derivatives market, it accounts for approximately 18–20%, given its role as a cost-effective and shelf-stable alternative to liquid milk. In the food and beverage ingredients market, its share is about 6–7%, as it competes with proteins, starches, and sweeteners in multiple applications.

The nutritional and functional foods market sees a contribution of 4–5%, driven by demand for protein-rich, low-fat formulations in health-oriented products. For the infant formula and baby food market, SMP represents nearly 8–10%, as it is a key component in milk-based infant nutrition. The increasing demand for high-protein, low-fat ingredients in ready-to-drink beverages, dietary supplements, and convenience foods supports market growth.

Advantages such as longer shelf life, ease of transport, and compatibility with fortified formulations further enhance its relevance. With rising demand from emerging economies and foodservice sectors, the skimmed milk powder market is expected to consolidate its position across these parent markets, driven by health-conscious consumption trends and evolving food manufacturing practices.

The skimmed milk powder market is advancing steadily, supported by increasing demand for low-fat dairy alternatives, rising utilization in food processing, and growing health awareness among consumers. The market has been shaped by nutritional preferences favoring high-protein, low-fat ingredients in both developed and emerging economies.

Industry developments have highlighted a shift toward functional and fortified dairy products, encouraging manufacturers to invest in higher-quality and specialized skimmed milk powders. Future growth is expected to be reinforced by technological advancements in drying processes, improved supply chain efficiencies, and heightened consumption in the bakery, confectionery, and infant nutrition sectors.

Regulatory encouragement for healthier diets and the ability of skimmed milk powder to deliver extended shelf life and versatility in formulation are paving the path for wider adoption and sustained market growth.

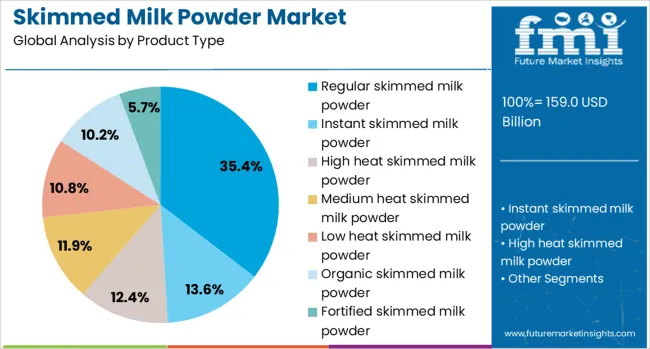

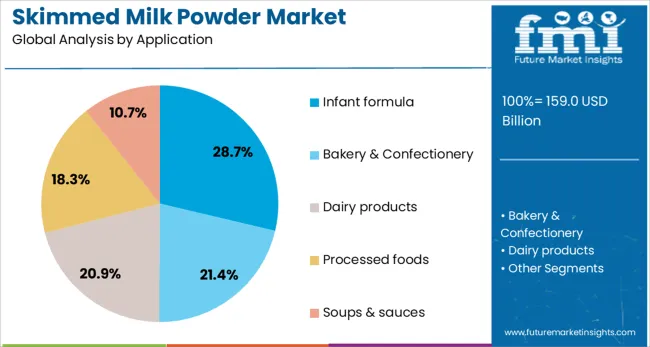

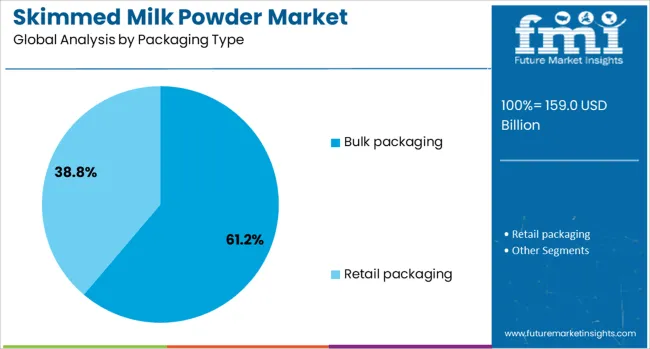

The skimmed milk powder market is segmented by product type, application, packaging type, distribution channel, nature, and geographic regions. The skimmed milk powder market is divided by product type into Regular skimmed milk powder, Instant skimmed milk powder, High heat skimmed milk powder, Medium heat skimmed milk powder, Low heat skimmed milk powder, Organic skimmed milk powder, and Fortified skimmed milk powder. The skimmed milk powder market is classified into Infant formula, Bakery & Confectionery, Dairy products, Processed foods, Soups & sauces, Beverages, Nutritional supplements, Animal feed, and Others. Based on the packaging type, the skimmed milk powder market is segmented into Bulk packaging and Retail packaging. The skimmed milk powder market distribution channel is segmented into B2B (Business-to-Business) and B2C (Business-to-Consumer). By nature, the skimmed milk powder market is segmented into Conventional and Organic. Regionally, the skimmed milk powder industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

When segmented by product type, regular skimmed milk powder is expected to hold 35.4% of the total market revenue in 2025, positioning itself as the leading product segment. This leadership is attributed to its broad applicability across diverse food manufacturing processes and its cost-effectiveness in large-scale production environments.

The consistency in quality and stability during storage and transport has enabled regular skimmed milk powder to maintain preference among industrial buyers. Its proven functionality in enhancing texture, flavor, and nutritional value in bakery, confectionery, and ready-to-eat products has reinforced its dominance.

The simplicity of processing and ability to integrate seamlessly into existing production lines have further supported its sustained adoption, ensuring its continued leadership within the product type category.

In terms of application, infant formula is projected to contribute 28.7% of the total market revenue in 2025, making it the foremost application segment. This prominence has been driven by increasing global birth rates in developing regions and heightened awareness of infant nutrition needs.

Skimmed milk powder has been widely utilized in infant formula formulations due to its balanced amino acid profile, ease of digestion, and low-fat content. Its capacity to serve as a reliable protein source while adhering to stringent safety and quality standards has made it indispensable in this segment.

The demand for premium and fortified infant formulas has also bolstered the use of high-grade skimmed milk powder, strengthening its position as the leading application. Manufacturers’ focus on meeting regulatory compliance and catering to evolving parental preferences has further solidified its share.

Segmented by packaging type, bulk packaging is anticipated to hold 61.2% of the market revenue in 2025, securing its place as the top packaging segment. This dominance is supported by the high-volume procurement patterns of industrial buyers and institutional users who prioritize cost efficiency and convenience.

Bulk packaging has been favored for its ability to reduce per-unit costs, streamline storage, and minimize material waste during large-scale operations. Its prevalence in export shipments and long-haul logistics has also reinforced its importance, as it enables manufacturers and distributors to manage inventory effectively.

The operational advantages of bulk formats, including improved handling efficiency and compatibility with automated filling and mixing systems, have further strengthened its leadership. The combination of economic, logistical, and operational benefits has made bulk packaging the preferred choice in the skimmed milk powder market.

The skimmed milk powder market is witnessing steady expansion as demand rises in food processing and dairy-based formulations. In 2024, adoption increased in bakery, confectionery, and beverage sectors for its shelf stability and versatile functionality. By 2025, nutritionally enriched variants with consistent solubility gained wider preference in developing economies and industrial-scale applications. Manufacturers offering cost-efficient, high-quality products suitable for long-term storage and diverse processing requirements are positioned to capture significant market opportunities across multiple end-use industries.

The superior shelf stability of skimmed milk powder has reinforced its importance in large-scale food production. In 2024, bakery and confectionery manufacturers relied on it as a dependable ingredient for consistent texture and flavor in packaged goods. By 2025, beverage processors and ready-to-eat meal producers continued prioritizing skimmed milk powder for its ability to deliver functionality under varying storage conditions. These developments suggest that durability in storage and formulation flexibility are shaping procurement strategies. Producers providing powders with high dispersibility and minimal fat residue are emerging as preferred suppliers for industrial buyers focused on operational efficiency.

The inclusion of fortification in skimmed milk powder is creating new prospects in value-added dairy solutions. In 2024, manufacturers introduced variants enriched with vitamins and minerals to cater to specialized nutrition products such as infant formula and dietary supplements. By 2025, fortified skimmed milk powders were increasingly adopted in clinical nutrition and sports beverage formulations to enhance protein and calcium content. This progression highlights that functional enrichment not just basic dairy processing—is enabling differentiation in competitive markets. Companies capable of delivering nutrient-enhanced powders with validated quality standards and easy solubility are positioned to capture premium segments within health-oriented product lines.

In 2024 and 2025 it was observed that sharp fluctuations in liquid milk prices imposed significant constraints on skimmed milk powder production. Manufacturers endured unpredictable input cost swings which impacted pricing flexibility and profit margins. Regions such as India and Brazil, major producers in 2024, reported sudden raw material cost surges that squeezed operational budgets. That instability caused procurement delays and reduced ordering volumes by processors and food producers in the bakery and beverage sectors. Unless pricing volatility is managed through contractual arrangements or hedging strategies, market growth remains unstable and constrained.

During 2024 and 2025 it was noted that fortified skimmed milk powders were increasingly introduced to meet diverse application needs. Nutrient-enriched variants containing added protein, minerals, and vitamins gained traction in infant formula production, nutritional mixes, and ready-to-drink beverages. Producers in Europe and Asia launched mixes tailored for bakery fillings and confectionery applications, where functional and textural benefits were required. Such enhanced formulations facilitated broader use cases beyond standard dairy inclusion, appealing to manufacturers seeking clean-label, value-added ingredients. That trend offers one clear opportunity for suppliers to diversify their product range and address expanding application segments.

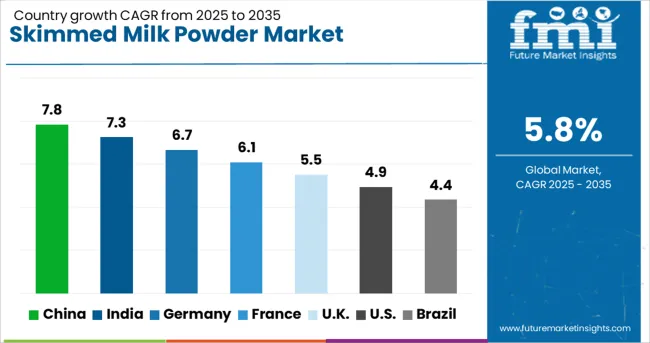

| Country | CAGR |

|---|---|

| China | 7.8% |

| India | 7.3% |

| Germany | 6.7% |

| France | 6.1% |

| UK | 5.5% |

| USA | 4.9% |

| Brazil | 4.4% |

The global skimmed milk powder market is projected to grow at a CAGR of 5.8% from 2025 to 2035. China leads with 7.8%, followed by India at 7.3% and Germany at 6.7%. France records 6.1%, while the United Kingdom posts 5.5%. Growth is driven by increasing demand for high-protein dairy products, rising use in infant nutrition, and strong applications in bakery and confectionery sectors. China and India dominate due to expanding dairy processing capacities and high domestic consumption. Germany emphasizes premium quality powders for health-based products, while France and the UK prioritize low-fat formulations aligned with nutrition-focused lifestyles.

The skimmed milk powder market in China is forecast to grow at 7.8%, driven by strong demand in infant formula production and bakery segments. Manufacturers prioritize advanced spray-drying technologies to improve powder solubility and nutrient retention. Partnerships with foodservice providers enhance product integration in beverage applications. Rising consumer preference for protein-rich dairy boosts premium powder demand.

The skimmed milk powder market in India is expected to grow at 7.3%, fueled by growing demand from confectionery and processed food manufacturers. Low-cost SMP dominates rural and semi-urban markets for dairy-based food items. Manufacturers develop fortified powders with added vitamins and minerals to meet nutritional goals. Expansion of cold-chain networks further improves distribution efficiency.

The skimmed milk powder market in Germany is forecast to grow at 6.7%, supported by strong applications in high-protein dietary products and functional beverages. Premium-quality SMP dominates exports and specialized nutrition markets. Manufacturers emphasize lactose-free and organic-certified powders to attract health-conscious consumers. Investments in sustainable dairy sourcing practices align with EU regulations.

The skimmed milk powder market in France is projected to grow at 6.1%, driven by its use in culinary preparations and infant nutrition products. Instant SMP variants dominate foodservice and retail applications for convenience-focused consumers. Manufacturers introduce clean-label formulations to meet transparency requirements. Expansion of private-label SMP brands further boosts competitiveness.

The skimmed milk powder market in the UK is expected to grow at 5.5%, supported by increasing demand in bakery, confectionery, and ready-to-drink beverages. Fat-free SMP dominates health-conscious consumer preferences. Manufacturers integrate high-heat SMP for enhanced performance in processed food applications. Strategic partnerships with nutrition brands strengthen market penetration.

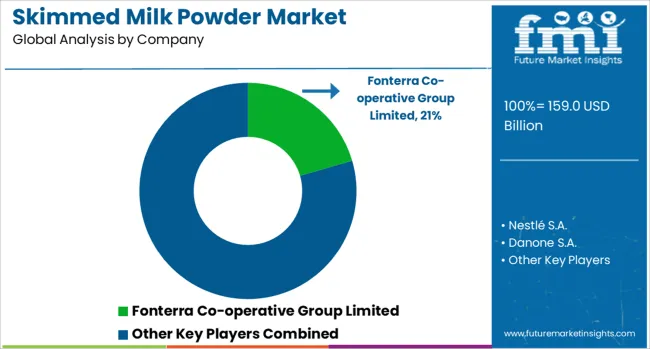

The skimmed milk powder market is moderately consolidated, with Fonterra Co-operative Group Limited holding a leading position through its extensive production capacity, global supply chain, and strong export presence in Asia-Pacific and the Middle East. The company provides high-quality milk powder for applications in dairy beverages, bakery, confectionery, and infant nutrition, reinforcing its dominance in both B2B and retail segments.

Key players include Nestlé S.A., Danone S.A., Arla Foods amba, FrieslandCampina, Lactalis Group, Dairy Farmers of America (DFA), Saputo Inc., Glanbia plc, Sodiaal Union, Hochdorf Swiss Nutrition Ltd., Euroserum, Dairygold Co‑operative Society Limited, Interfood Holding B.V., Synlait Milk Limited, Westland Milk Products, Murray Goulburn Co-operative, Amul (Gujarat Cooperative Milk Marketing Federation), Yili Group, and Mengniu Dairy Company.

These companies supply SMP in various grades to meet the needs of food processing, sports nutrition, and functional ingredient markets. Market growth is driven by increasing demand for shelf-stable dairy products, rising protein consumption, and expanding applications in processed food and nutritional formulations. Manufacturers are focusing on fortification with vitamins and minerals, improving solubility, and developing instant SMP variants to cater to consumer convenience.

Asia-Pacific is expected to dominate due to strong dairy imports by China and India, while Europe remains a key production hub. Strategic partnerships with food and beverage companies and investments in spray-drying technologies are critical factors shaping competitive advantage.

Recent advancements feature fortified, lactose-free, organic, and instant SMP variants, combined with enhanced spray-drying processes and eco-friendly packaging solutions. These innovations address consumer needs for convenience and nutritional value while supporting global trade, meeting sustainability goals, and ensuring long shelf life for diverse applications.

| Item | Value |

|---|---|

| Quantitative Units | USD 159.0 Billion |

| Product Type | Regular skimmed milk powder, Instant skimmed milk powder, High heat skimmed milk powder, Medium heat skimmed milk powder, Low heat skimmed milk powder, Organic skimmed milk powder, and Fortified skimmed milk powder |

| Application | Infant formula, Bakery & Confectionery, Dairy products, Processed foods, Soups & sauces, Beverages, Nutritional supplements, Animal feed, and Others |

| Packaging Type | Bulk packaging and Retail packaging |

| Distribution Channel | B2B (Business-to-Business) and B2C (Business-to-Consumer) |

| Nature | Conventional and Organic |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Fonterra Co-operative Group Limited, Nestlé S.A., Danone S.A., Arla Foods amba, FrieslandCampina, Lactalis Group, Dairy Farmers of America (DFA), Saputo Inc., Glanbia plc, Sodiaal Union, Hochdorf Swiss Nutrition Ltd., Euroserum, Dairygold Co‑operative Society Limited, Interfood Holding B.V., Synlait Milk Limited, Westland Milk Products, Murray Goulburn Co-operative, Amul (Gujarat Cooperative Milk Marketing Federation), Yili Group, and Mengniu Dairy Company |

| Additional Attributes | Dollar sales by product grade (organic, low-heat, lactose-free), Dollar sales by application (bakery, infant formula, sports nutrition, dairy blends), regional demand trends (North America dominant, Asia-Pacific fastest growth), competitive landscape, consumer preference for high-protein versus low-fat products, integration with clean-label and fortified ingredients, innovations in spray-drying, sustainable packaging, and nutrient-enriched formulations. |

The global skimmed milk powder market is estimated to be valued at USD 159.0 billion in 2025.

The market size for the skimmed milk powder market is projected to reach USD 279.4 billion by 2035.

The skimmed milk powder market is expected to grow at a 5.8% CAGR between 2025 and 2035.

The key product types in skimmed milk powder market are regular skimmed milk powder, instant skimmed milk powder, high heat skimmed milk powder, medium heat skimmed milk powder, low heat skimmed milk powder, organic skimmed milk powder, fortified skimmed milk powder, _vitamin fortified, _mineral fortified and _protein enriched.

In terms of application, infant formula segment to command 28.7% share in the skimmed milk powder market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Milk Froth Thermometer Market Size and Share Forecast Outlook 2025 to 2035

Milk Carton Market Size and Share Forecast Outlook 2025 to 2035

Milking Automation Market Size and Share Forecast Outlook 2025 to 2035

Milking Robots Market Size and Share Forecast Outlook 2025 to 2035

Milk Packaging Market Size and Share Forecast Outlook 2025 to 2035

Milk Clarifier Market Size and Share Forecast Outlook 2025 to 2035

Milk Homogenizer Machine Market Size and Share Forecast Outlook 2025 to 2035

Milk Pasteurization Machines Market Size and Share Forecast Outlook 2025 to 2035

Milk Sterilizer Machine Market Size and Share Forecast Outlook 2025 to 2035

Milk Protein Market - Size, Share, and Forecast 2025 to 2035

Milk Ingredients Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Milk Mineral Concentrate Market Trends-Demand, Innovations & Forecast 2025 to 2035

Milk Thistle Market Analysis by Form, Distribution Channel and Region through 2035

Milk Tank Cooling System Market Growth – Trends & Forecast 2025 to 2035

Milk Alternatives Market – Growth, Demand & Dairy-Free Trends

Milk Protein Hydrolysate Market Growth - Infant Nutrition & Functional Use 2024 to 2034

Milking Equipment Market

Milk Bottle Market Trends & Industry Growth Forecast 2024-2034

Milk Fat Fractions Market

Milk Retentate Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA