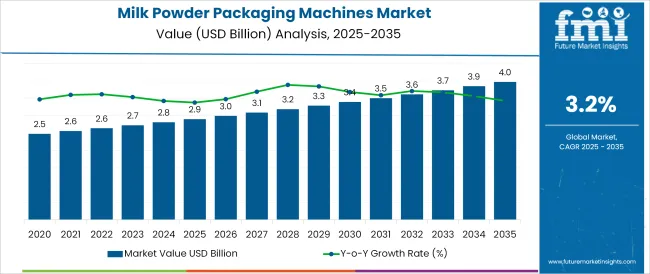

The Milk Packaging Market is estimated to be valued at USD 3.8 billion in 2025 and is projected to reach USD 6.2 billion by 2035, registering a compound annual growth rate (CAGR) of 5.0% over the forecast period. Between 2025 and 2026, the market value increases from USD 3.8 billion to USD 4.0 billion, reflecting a year-over-year (YoY) growth rate of approximately 5.3%. In the following years, the market continues this steady pace, with YoY growth rates hovering between 4.7% and 5.5%. From 2027 to 2030, the market expands from USD 4.0 billion to USD 4.6 billion, averaging around 3.8% annual growth, slightly moderating but remaining robust.

The years 2031 to 2035 see consistent growth from USD 4.9 billion to USD 6.2 billion, with YoY increases averaging about 5.5%, indicating a healthy market momentum. The milk packaging market maintains a balanced upward trajectory throughout the decade, with no major fluctuations, highlighting steady demand driven by rising consumption and evolving packaging preferences. The continuous year-on-year increase underscores the sector’s resilience and ongoing investment in packaging innovations.

| Metric | Value |

|---|---|

| Milk Packaging Market Estimated Value in (2025E) | USD 3.8 billion |

| Milk Packaging Market Forecast Value in (2035F) | USD 6.2 billion |

| Forecast CAGR (2025 to 2035) | 5.0% |

The milk packaging market is witnessing steady growth as demand for hygienic, efficient, and sustainable dairy packaging solutions continues to rise across both developed and emerging economies. A shift toward automation in dairy processing, along with rising consumption of packaged milk driven by urbanization, has reinforced the need for scalable packaging systems.

Manufacturers are focusing on lightweight, tamper-evident, and recyclable materials to meet both regulatory standards and consumer expectations for safety and sustainability. Technological advancements in filling and sealing processes have allowed greater precision, shelf-life enhancement, and operational throughput.

Additionally, retail and distribution channels are favoring formats that reduce wastage and enhance visual appeal, further accelerating innovation in packaging design and machinery. Over the forecast period, growing health awareness, cold chain expansion, and environmentally driven reforms are expected to shape strategic investments in this market.

The milk packaging market is segmented by type, end-user, and geographic regions. By type, the milk packaging market is divided into Automatic and Handheld. In terms of the milk packaging market, it is classified into Electric and Hydraulic. The end-users of the milk packaging market are segmented into Construction, Automotive, Cement, Chemical, Marine, and Metal Processing. Regionally, the milk packaging industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Automatic milk packaging systems are projected to contribute 61.70% of the market revenue in 2025, establishing them as the leading packaging type. This leadership is being driven by rising adoption of high-speed, automated filling lines that enable reduced human intervention and contamination risks.

The segment benefits from the growing need for operational efficiency, consistent sealing quality, and real-time monitoring features that manual and semi-automatic systems often lack. Integration with IoT-enabled diagnostics and smart sensors has improved machine uptime and preventive maintenance, optimizing costs for dairy producers.

As milk consumption surges in urban and institutional settings, the demand for automation in packaging to meet hygiene standards and production scalability continues to grow.

Electric hoist systems are expected to account for 66.40% of the milk packaging equipment market in 2025, making them the dominant segment under hoisting mechanisms. The preference for electric systems stems from their energy efficiency, low maintenance requirements, and precision handling capabilities.

In milk packaging plants, electric hoists enable safe and controlled movement of bulk packaging materials and equipment with reduced labor dependency. Their integration into automated lines allows synchronized operations, minimizing production downtime and material wastage.

Moreover, electric variants align well with sustainability goals due to lower emissions compared to pneumatic or hydraulic alternatives. With the dairy industry prioritizing clean, efficient, and ergonomic workflows, electric hoists have emerged as the preferred choice for lifting and handling operations.

The construction sector is projected to contribute 27.90% of the total market demand for milk packaging systems in 2025 under the end-user classification. This share is attributed to the consumption patterns within worker housing projects, labor camps, and infrastructure development zones, where bulk packaged milk is a staple supply.

The sector's requirement for high-capacity, durable, and easily transportable packaging has led to tailored solutions for on-site food service providers. Moreover, state-sponsored infrastructure initiatives and smart city developments have driven demand for robust supply chains, including essential commodities like dairy.

As construction activities expand across emerging markets, the segment's role in supporting institutional milk consumption continues to solidify its contribution to the packaging equipment ecosystem.

The milk packaging market is witnessing steady growth as consumer demand for convenience, freshness, and safety rises globally. Packaging innovations aim to extend shelf life, reduce spoilage, and improve product appeal. The shift toward eco-friendly materials and sustainable packaging solutions is reshaping industry practices. Market growth is supported by expanding dairy consumption, rising retail penetration, and advances in packaging technology. Challenges remain around balancing cost, environmental impact, and regulatory compliance. Producers focusing on innovative, user-friendly, and sustainable packaging formats are gaining competitive advantages.

Consumers increasingly seek packaging that ensures milk freshness, ease of use, and portability. Features like resealable caps, lightweight materials, and portion-controlled packs enhance convenience for on-the-go lifestyles and reduce product waste. Transparency in packaging supports consumer trust by allowing visibility of milk quality. Additionally, premium packaging designs appeal to health-conscious and premium product segments, such as organic and lactose-free milk. These consumer-driven trends are pushing manufacturers to invest in high-barrier materials that maintain product integrity while offering ergonomic designs suitable for various distribution channels.

Growing environmental concerns and regulations are pushing the milk packaging industry to adopt sustainable materials such as biodegradable plastics, recycled paperboard, and plant-based polymers. Single-use plastic reduction initiatives encourage innovation in recyclable and reusable packaging formats. However, transitioning to eco-friendly materials presents technical challenges in maintaining shelf life and protecting milk from contamination. Cost implications also influence material selection, requiring a careful balance between sustainability goals and economic feasibility. Industry stakeholders collaborate with material scientists and packaging engineers to develop solutions that meet environmental standards without compromising product safety and convenience.

Milk packaging must comply with stringent food safety regulations to ensure contamination-free storage and transport. Regulatory frameworks vary by region, affecting labeling requirements, material usage, and packaging design. Compliance with hygiene and quality standards demands rigorous testing and validation of packaging materials, especially for aseptic and extended shelf-life milk products. Additionally, anti-counterfeiting features and tamper-evident seals are becoming essential to protect brand integrity and consumer safety. Navigating these complex regulatory landscapes requires close coordination between manufacturers, suppliers, and regulatory bodies to achieve market approval and maintain consumer confidence.

Emerging markets are witnessing rapid growth in milk consumption due to rising incomes, urbanization, and increasing awareness of dairy nutrition. Expanding organized retail networks and cold chain infrastructure support wider distribution of packaged milk products, driving demand for innovative packaging solutions adapted to local needs. Small-format packaging for affordability and convenience gains traction in these regions. Furthermore, premiumization trends create opportunities for differentiated packaging in developed markets. Strategic partnerships between packaging companies and dairy producers, along with investments in local production capabilities, enable tailored solutions and quicker market penetration across diverse geographies.

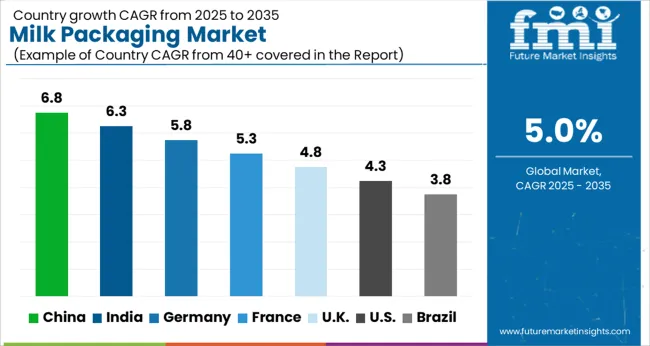

The global milk packaging market is growing at a 5.0% CAGR, driven by rising dairy consumption and demand for sustainable packaging materials. Among BRICS nations, China leads with 6.8% growth, supported by expanding dairy production and modernization of packaging technology. India follows at 6.3%, fueled by increasing milk production and retail distribution. In the OECD region, Germany records 5.8% growth, reflecting stringent quality standards and innovation in eco-friendly packaging. The United Kingdom grows at 4.8%, driven by consumer preference for convenience and sustainability. The United States, a mature market, shows 4.3% growth, shaped by regulatory compliance and advances in packaging design. These countries collectively influence market trends through technological advancements, environmental regulations, and evolving consumer demands. This report includes insights on 40+ countries; the top countries are shown here for reference.

China milk packaging market is growing at a 6.8% CAGR, driven by rising dairy consumption and modernization of packaging technologies. Increasing urbanization and changing consumer lifestyles boost demand for convenient, safe, and hygienic packaging solutions. Compared to Western countries, China’s market shows rapid adoption of innovative materials like aseptic cartons and biodegradable films. The growing middle class prefers premium milk products with attractive packaging, enhancing market growth. E-commerce platforms also expand product reach, especially in tier-2 and tier-3 cities. Domestic companies invest heavily in sustainable and smart packaging technologies to reduce waste and improve shelf life. Regulatory focus on food safety strengthens the need for reliable packaging solutions. Overall, modernization, consumer preference shifts, and environmental awareness propel China’s milk packaging market forward.

India milk packaging market is advancing at a 6.3% CAGR, supported by growing dairy consumption and increased awareness of packaging hygiene. Traditional loose milk sales are gradually replaced by packaged milk in cartons, pouches, and bottles, especially in urban areas. Compared to China, India’s market is driven by government initiatives promoting milk safety and cold chain infrastructure improvements. The rise of organized dairy players and private brands increases demand for quality packaging materials. Consumer preference for convenience and longer shelf life fuels innovation in packaging design. E-commerce and modern retail channels further enhance accessibility. Focus on sustainability leads manufacturers to adopt recyclable and eco-friendly packaging solutions. India's dairy sector transformation is a key driver of the evolving milk packaging landscape.

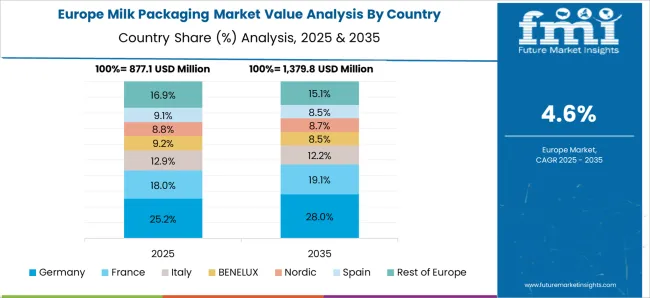

Germany milk packaging market is progressing at a 5.8% CAGR, marked by high consumer demand for sustainable and functional packaging solutions. German consumers prioritize environmental responsibility, pushing adoption of recyclable cartons, glass bottles, and biodegradable films. Compared to Asian markets, Germany’s focus is on reducing plastic waste and extending product shelf life with innovative barrier technologies. Organic and specialty milk products drive demand for premium packaging designs. Retailers and manufacturers collaborate to promote refillable and reusable packaging formats. Strict regulatory standards ensure packaging safety and environmental compliance. Technological advances in smart packaging enhance traceability and freshness monitoring. Germany’s mature dairy market combines innovation and sustainability to support steady growth in milk packaging.

United Kingdom milk packaging market is growing at a 4.8% CAGR, driven by consumer preference for convenience and sustainability. Increasing demand for plant-based milk alternatives also broadens packaging requirements. Compared to Germany, the UK market favors lightweight, recyclable cartons and PET bottles designed for easy disposal. Retailers encourage brands to adopt eco-friendly packaging to reduce plastic waste. Consumer awareness campaigns promote recycling and waste reduction behaviors. Technological innovation in packaging materials helps improve shelf life without compromising sustainability. Online grocery growth supports demand for resealable and portion-controlled milk packages. The UK market reflects balanced growth fueled by evolving consumer habits and environmental focus.

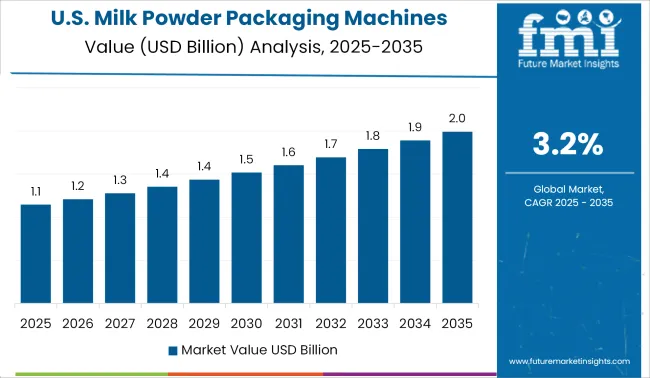

United States milk packaging market is advancing at a 4.3% CAGR, influenced by consumer demand for convenience, safety, and sustainability. The market features a mix of traditional cartons, plastic bottles, and flexible pouches. Compared to European countries, the USA shows strong interest in lightweight packaging solutions to reduce transportation costs and carbon footprint. Rising consumption of organic and specialty milk products boosts demand for premium packaging designs. Retailers and dairy companies focus on recyclable materials and reducing plastic use. The growth of online grocery channels increases demand for easy-to-handle, resealable packaging. Regulatory emphasis on food safety and environmental standards further drives innovation in materials and formats. Overall, the USA market balances convenience with environmental concerns for steady expansion.

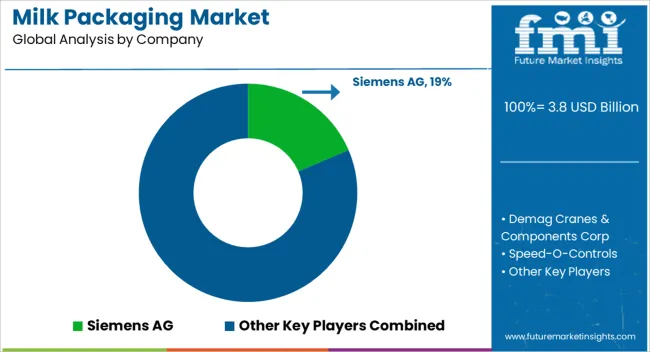

The milk packaging market is increasingly influenced by advancements in automation and material handling technologies, with suppliers focusing on enhancing efficiency, hygiene, and sustainability in packaging processes. Siemens AG stands out by providing integrated automation solutions that streamline milk packaging lines through advanced control systems and smart manufacturing technologies. Schneider Electric complements this with energy-efficient automation and digitalization tools designed to optimize packaging operations and reduce downtime. Demag Cranes & Components Corp and Uesco Cranes are key players supplying specialized crane and material handling equipment critical for bulk milk packaging and processing plants, ensuring safe and efficient movement of packaging materials.

Speed-O-Controls and Conductix-Wampfler USA focus on power transmission and energy management solutions that support packaging machinery operations, enhancing reliability and performance. Companies like The RoWLANd Company and Hoosier Crane Service Company offer tailored crane servicing and maintenance that are vital for minimizing operational disruptions in dairy packaging facilities. Eastern Electric Corporation and Magnetek Inc. contribute by providing robust electrical components and motor controls essential for precise machine operation. Together, this ecosystem of industrial automation, material handling, and electrical control suppliers drives innovation in the milk packaging market, supporting increased productivity, product safety, and sustainability goals.

Amcor has been active in developing flexible packaging solutions for milk, focusing on materials that are not only high-performing but also recyclable or compostable. They are continuously working on improving packaging designs that meet environmental regulations and consumer demand for eco-friendly products.

Alpla, a leader in plastic packaging, is focusing on reducing plastic usage by developing lightweight, recyclable bottles for liquid dairy products. They are innovating with rPET (recycled PET) packaging to meet growing demands for circular economy solutions.

| Item | Value |

|---|---|

| Quantitative Units | USD 3.8 Billion |

| Type | Automatic and Handheld |

| Hoist | Electric and Hydraulic |

| End-User | Construction, Automotive, Cement, Chemical, Marine, and Metal Processing |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Siemens AG, Demag Cranes & Components Corp, Speed-O-Controls, Schneider Electric, Conductix-Wampfler USA, Uesco Cranes, The RoWLANd Company, Hoosier Crane Service Company, Eastern Electric Corporation, and Magnetek Inc. |

| Additional Attributes | Dollar sales in the milk packaging market vary by material type (plastic, paperboard, glass, metal), packaging type (bottles, cartons, pouches), application (fresh milk, flavored milk, UHT milk), and region (North America, Europe, Asia-Pacific). Growth is driven by increasing dairy consumption, convenience demand, and sustainability trends. |

The global milk packaging market is estimated to be valued at USD 3.8 billion in 2025.

The market size for the milk packaging market is projected to reach USD 6.2 billion by 2035.

The milk packaging market is expected to grow at a 5.0% CAGR between 2025 and 2035.

The key product types in milk packaging market are automatic and handheld.

In terms of hoist, electric segment to command 66.4% share in the milk packaging market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Milk Powder Packaging Market Size and Share Forecast Outlook 2025 to 2035

Milk Powder Packaging Machines Market Size and Share Forecast Outlook 2025 to 2035

Milk Froth Thermometer Market Size and Share Forecast Outlook 2025 to 2035

Packaging Supply Market Size and Share Forecast Outlook 2025 to 2035

Packaging Testing Services Market Size and Share Forecast Outlook 2025 to 2035

Packaging Tubes Market Size and Share Forecast Outlook 2025 to 2035

Milk Carton Market Size and Share Forecast Outlook 2025 to 2035

Packaging Jar Market Forecast and Outlook 2025 to 2035

Milking Automation Market Size and Share Forecast Outlook 2025 to 2035

Packaging Barrier Film Market Size and Share Forecast Outlook 2025 to 2035

Packaging Films Market Size and Share Forecast Outlook 2025 to 2035

Packaging Laminate Market Size and Share Forecast Outlook 2025 to 2035

Packaging Burst Strength Test Market Size and Share Forecast Outlook 2025 to 2035

Packaging Tapes Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Packaging Materials Market Size and Share Forecast Outlook 2025 to 2035

Milking Robots Market Size and Share Forecast Outlook 2025 to 2035

Packaging Labels Market Size and Share Forecast Outlook 2025 to 2035

Packaging Equipment Market Size and Share Forecast Outlook 2025 to 2035

Milk Clarifier Market Size and Share Forecast Outlook 2025 to 2035

Milk Homogenizer Machine Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA