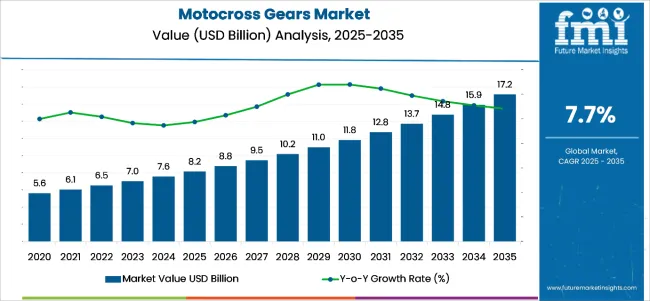

The motocross gears market is valued at USD 8.2 billion in 2025 and is expected to reach USD 17.2 billion by 2035 at a CAGR of 7.7%. The motocross gears market is evolving beyond basic protection, driven by rising consumer demand for advanced motocross safety gear, smart helmets, and impact-resistant apparel.

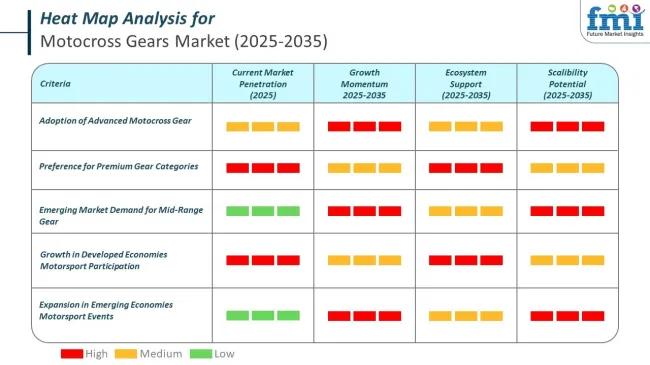

One unique insight is the growing adoption of wearable technology and sensor-embedded motocross gear that monitor rider vitals and impact forces in real-time. Industry leaders like Alpinestars and Leatt have introduced Bluetooth-enabled helmets and crash detection systems, enhancing rider safety through immediate alerts and post-crash data analysis. Motocross gear technology is expected to become standard within the next five years, particularly among professional motocross racers and enthusiasts.

The rise of electric motocross bikes (e-motocross) is shaping gear design and material innovation. E-motocross bikes generate less noise and emissions but deliver higher torque and acceleration, requiring heat-resistant motocross apparel and flexible protective gear. Manufacturers are investing in graphene-infused fabrics and advanced composites to improve durability and cooling, expanding applications in the electric off-road vehicle market.

Women’s growing participation in motocross sports, now representing about 20% of USA riders, is driving demand for female motocross gear. Brands like Fox Racing have launched women-specific gear lines focusing on ergonomic fit, lightweight materials, and style without compromising protection.

Sustainability is gaining traction in the motocross gear segment. Companies such as Alpinestars have committed to eco-friendly manufacturing and recycled fabrics, targeting a 50% carbon footprint reduction by 2030. This appeals to environmentally conscious motocross consumers. The global expansion of motocross culture into emerging markets like India and Southeast Asia is boosting demand for affordable yet certified motocross protective gear. Growth is supported by rising motorsport events and digital platforms promoting the sport.

Increased motocross participation and rising disposable incomes have elevated per-capita spending on safety and performance gear. Riders are increasingly prioritizing safety and durability, leading to a surge in demand for advanced motocross apparel such as MIPS-integrated helmets, moisture-wicking suits, reinforced boots, and gloves with improved grip technology. The growing awareness of injury prevention, along with social media influence and sponsorship by gear brands, is encouraging riders to upgrade their equipment more frequently.

Motorsport participation has surged globally due to increased sponsorships, better track accessibility, and rising interest in adventure sports and high-adrenaline recreation. Entry-level disciplines like karting and motocross are drawing younger demographics, while digital racing simulators and e-sports platforms are bridging amateur enthusiasm with professional racing careers. Additionally, social media and YouTube influencers have further popularized motocross and rally events, encouraging youth participation even in non-urban regions.

Several professional and amateur motocross racing events, a well-established sports culture, and growing off-road motorcycling activity are driving the North America high regions for the motocross gear market. In fact, there are a large number of motocross tracks, training centers, and competitive circuits in the United States and Canada, which increases the demand of heavy-duty performance features in motocross gear such as helmets, gloves, jerseys and protective helmets.

Raw Strength: The significant presence of top motocross gear manufacturers and brands further fuels market growth, which highlights lightweight, resistant, and aerodynamically high-performance gear. The growing increase in safety measures and consumer awareness of protective gear has pushed also pushed manufacturers to develop new materials with maximum shock absorption, ventilation and durability.

The motocross devices marketplace is dominated by Europe with major demands from nations including the United Kingdom, Germany, France, and Italy. National Gate also features very good access to motocross racing with a well-established culture around moto and a lot of support from the FIM Motocross World Championship and other racing events at various national level.

Mature European consumers pay much attention to the technology content and quality of the materials, so there is a growing demand for high-end products such as carbon fiber helmets and high-strength protective clothing, among others.

Riders in the region must also wear certified protective equipment under strict safety regulations, driving further market growth in the area. The European market has gradually adopted smart technology, such as impact sensors and connectivity options in helmets, since it prioritizes rider safety and technology development.

The Asia-Pacific region is expected to experience the fastest growth in the motocross gear market, driven by the rising popularity of adventure and off-road motorcycling in countries like China, India, Japan, and Australia. The increasing participation of youth in extreme sports, along with a growing number of motocross training academies and organized events, is fueling demand for motocross gear.

Additionally, rising disposable incomes and improving infrastructure for recreational motorcycling have led to a surge in premium gear sales, particularly in urban centers. While China remains a leading manufacturer of cost-effective motocross gear, Japan and Australia have a strong presence in high-quality, performance-driven gear. However, the region faces challenges in counterfeit and substandard gear flooding the market, which affects consumer confidence and safety standards.

With the market for motocross equipment being one of the major midpoint, the presence of fake or poor quality products catering to the market, especially in developing economies, remains a key challenge for the market. Consumers are attracted to less costly, non-certified equipment with marginal safety features, increasing the risk of significant injury to riders.

In some places, weak enforcement of product quality allows for the sale of unsafe protective equipment, competing with authentic manufacturers. This trend can turn further market dynamics, as price-oriented consumers may even resort to low-grade substitutes instead of purchasing high-quality, safety-certified machines.

With this growing specialization, there is a significant opportunity within the motocross gear market for rider safety. But brands are shelling out for high-tech safety solutions including MIPS (Multi-directional Impact Protection System) helmets, intelligent protective armor, breathable, lightweight materials for greater comfort and endurance.

Wearable Technology: Given the growing popularity of wearables, IoT-connected helmets offering real-time GPS tracking, emergency alerts, and communication systems are also becoming more common among professional racers and off-road enthusiasts. Additionally, eco-friendly and sustainable motocross gear made from recycled or biodegradable materials is also a key trend, heralded by global sustainability initiatives and consumer interest in green products.

Between 2020 and 2024, the motocross gears market experienced steady growth, driven by rising participation in motocross sports, increasing awareness of rider safety, and advancements in protective gear materials.

The growing popularity of off-road motorcycling, fueled by social media exposure and extreme sports sponsorships, contributed to higher demand for high-performance gear. Consumers prioritized lightweight, impact-resistant, and breathable gear, leading manufacturers to integrate advanced materials such as Kevlar, carbon fiber, and moisture-wicking fabrics.

Between 2025 and 2035, the motocross gears market will undergo a transformative shift driven by AI-driven customization, smart safety systems, and sustainable material innovations. The adoption of self-adjusting protective gear, AI-powered crash detection, and climate-adaptive riding apparel will redefine safety and performance standards. The expansion of motocross events, combined with increasing consumer spending on premium protective gear, will further propel market growth.

| Market Shift | 2020 to 2024 |

|---|---|

| Regulatory Landscape | Stricter helmet safety standards, impact resistance regulations, and environmental compliance for gear materials. |

| Technological Advancements | Smart helmets with Bluetooth communication, impact-resistant armor, and moisture-wicking fabrics. |

| Industry Applications | Recreational motocross, professional racing events, and off-road adventure sports. |

| Adoption of Smart Equipment | Bluetooth-enabled helmets, crash detection sensors, and adaptive ventilation gear. |

| Sustainability & Cost Efficiency | Eco-friendly material integration, reduced plastic usage, and energy-efficient production methods. |

| Data Analytics & Predictive Modeling | AI-driven gear customization, digital fitment analysis, and crash impact data collection. |

| Production & Supply Chain Dynamics | COVID-19 supply chain disruptions, increased material costs, and demand for lightweight protective gear. |

| Market Growth Drivers | Growth driven by increasing motocross participation, social media influence, and technological innovation in protective gear. |

| Market Shift | 2025 to 2035 |

|---|---|

| Regulatory Landscape | AI-powered safety certifications, blockchain-based gear authentication, and sustainability-driven manufacturing regulations. |

| Technological Advancements | AI-driven crash prediction gear, AR-integrated helmets, and temperature-regulating riding apparel. |

| Industry Applications | Expansion into AI-powered smart motocross gear, extreme weather riding gear, and autonomous performance monitoring. |

| Adoption of Smart Equipment | Fully automated self-adjusting protective gear, biometric performance tracking, and AI-optimized riding apparel. |

| Sustainability & Cost Efficiency | Carbon-neutral protective gear, biodegradable armor plates, and waste-free 3D-printed riding suits. |

| Data Analytics & Predictive Modeling | Quantum-assisted crash prediction modeling, decentralized AI gear diagnostics, and blockchain-secured safety data tracking. |

| Production & Supply Chain Dynamics | AI-optimized supply chains, decentralized 3D-printed protective gear production, and blockchain-enabled quality assurance. |

| Market Growth Drivers | AI-powered performance optimization, sustainable motocross gear solutions, and expansion into high-tech, climate-adaptive riding apparel. |

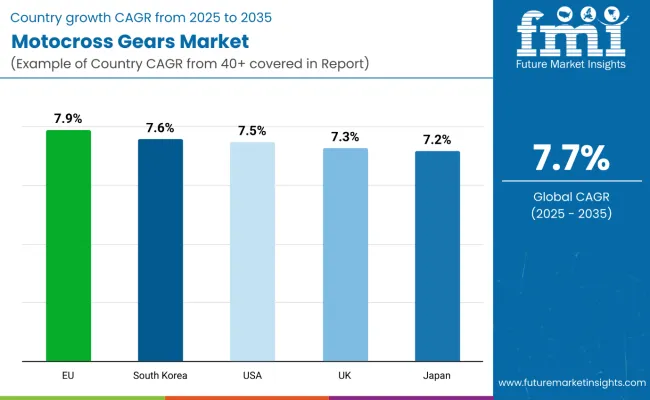

The market of motocross gears in the USA is expanding due to the increasing popularity of extreme sports, the increasing attendance to motocross racing events, and the consumer spend on high quality protection. Growth in the market is generally driven by a strong demand for a variety of high-performance helmets, boots and jerseys made from high-impact materials. Moreover, smart motocross gear technology, such as helmets embedded with communication systems, as well intricate ventilation systems are gaining ground.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 7.5% |

Across the UK motocross gears market, there is a steady growth, with increase in number of motocross tracks, dirt biking by the young generation and motorsport culture influenced. Motorcycle Rotating Saddle Muffs Market Report also mentions market share accrued by each product in the Motorcycle Rotating Saddle Muffs market, along with the production growth. There's also a growing interest in sustainable and eco-friendly motocross gear, including recyclable helmets and biodegradable jerseys.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 7.3% |

The EU motocross gears market is expected to hydrate due to rigid motorsports regulations pertaining to safety, increasing off-road racing championships, and the rising demand for advanced technology-based gear.

Germany, France and Italy are leading markets energized by the appeal of motocross racing events and the presence of leading the world motocross gears manufacturers. In addition, the increasing adoption of CE-approved protective safety gear and IoT-integrated smart protective gear are also driving the demand.

| Region | CAGR (2025 to 2035) |

|---|---|

| European Union | 7.9% |

Japan motocross gear market is growing owing to the operational enhancements in high-impact and lightweight protective gear, rising electric dirt bike sales and the developing recreation off-road biking culture. They want high-end motocross helmets, body armor, and footwear that balance down-force with enhanced shock-dispersion properties. Also be a feature of high-performance, customizable motocross equipment manufacturers in Japan, popular among professionals and enthusiasts.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 7.2% |

The South Korea motocross gears market is being driven by the increasing popularity of adventure sports, burgeoning investment in motorsports infrastructure and a rise in off-road biking events. Motor cross boot, customized-fit motocross, lightweight body protectors or anti-fog goggles with UV protection are in great demand today. Additionally, government schemes promoting motorsports tourism and collaboration among domestic and international motocross equipment manufacturers are enhancing market expansion.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 7.6% |

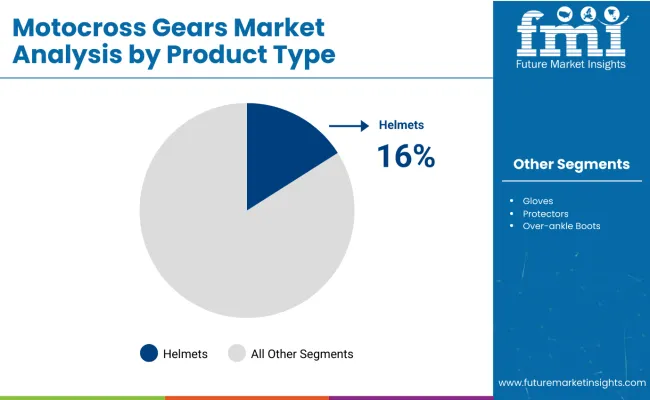

Helmets are one of the fastest expanding market segments among other motocross gears, offering ultimate head protection with the help of fortified impact-absorbing elements, high-performance ventilation systems, and integrated communication technologies. Unlike traditional motorcycle helmets, motocross helmets are designed purely for off-road conditions, with extended chin bars, visors, and featherweight build materials to maximize rider performance and safety.

Recursive advanced features in smart helmets, including heads-up display (HUDs)integrated via Bluetooth and crash detection sensors, have fueled demand in the market, ensuring more thrilling rides for motocross riders.

The integration of next-generation manufacturing technologies, including carbon fiber composites, multi-directional impact protection systems (MIPS), and rotational force reduction again, all promising to be better protective materials, and a decrease in patterns of head trauma helped further increase adoption in helmets. This segment holds 16% share.

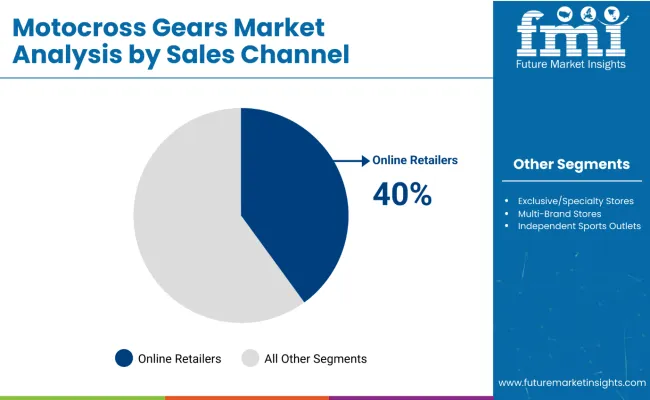

Motocross gears are sold majorly through online stores due to the convenience, variety, and competitive pricing they offer to enthusiasts and professional riders.

Online platforms provide access to a vast range of products, including helmets, jerseys, boots, gloves, and protective gear, from both global and niche brands. Riders can easily compare specifications, read reviews, and find the right fit or style without visiting multiple physical stores.

Online retailers also frequently offer discounts, seasonal deals, and easy return policies, making purchases more attractive. This segment holds 40% share.

The gloves segment has emerged as one of the most widely adopted protective gear types in the motocross market, offering riders reinforced palm grips, impact-resistant knuckle protection, and moisture-wicking materials for enhanced durability and comfort. Unlike standard motorcycle gloves, motocross gloves prioritize flexibility, breathability, and high-impact resistance, ensuring optimal control and safety.

The rising demand for high-performance motocross gloves, featuring touchscreen compatibility, gel-padded reinforcements, and abrasion-resistant fabrics, has fueled adoption of premium gloves, as riders prioritize safety and ergonomic design Despite its advantages in grip enhancement, impact protection, and weather resistance, the gloves segment faces challenges such as rapid wear and tear, counterfeit market issues, and price competition among low-cost manufacturers.

However, emerging innovations in nanotechnology-coated fabrics, AI-powered grip analysis, and biodegradable glove materials are improving durability, customization, and sustainability, ensuring continued market growth for motocross glove manufacturers worldwide.

The jerseys & jackets segment has gained strong market adoption, particularly among competitive racers, adventure riders, and recreational motocross enthusiasts, as they provide essential protection from abrasions, weather conditions, and environmental hazards. Unlike casual riding apparel, motocross jerseys & jackets feature moisture-wicking fabrics, UV-resistant coatings, and reinforced padding for enhanced rider comfort and durability.

The rising demand for breathable, lightweight motocross jerseys, featuring mesh panel ventilation, sweat-resistant fabrics, and impact-resistant padding, has driven adoption of performance-oriented motocross clothing, as riders seek comfort and protection in extreme conditions.

Despite its advantages in temperature regulation, mobility enhancement, and durability, the jerseys & jackets segment faces challenges such as high competition from unbranded manufacturers, seasonal demand fluctuations, and cost pressures in premium segments.

However, emerging innovations in smart textiles, AI-driven temperature control, and self-repairing fabric technology are improving product longevity, performance, and environmental sustainability, ensuring continued expansion for motocross apparel manufacturers worldwide.

The Motocross Gears Market is experiencing significant growth, driven by the increasing popularity of motocross racing and off-road biking activities. Rising awareness about rider safety, technological advancements in protective gear, and the growing influence of extreme sports culture are fueling demand.

Companies are focusing on material innovations, ergonomic designs, and advanced impact protection technologies to cater to both professional and amateur riders. The market is characterized by competitive product offerings, including helmets, jerseys, gloves, pants, boots, and body armor. Leading brands emphasize durability, lightweight materials, and enhanced safety standards to maintain their market positioning.

| Company Name | Estimated Market Share (%) |

|---|---|

| O’NEAL USA | 18-22% |

| Scott Sports | 14-18% |

| Aero Stitch | 10-14% |

| Fox Racing | 8-12% |

| Answer Racing | 6-10% |

| Other Companies | 30-40% |

| Company Name | Key Offerings/Activities |

|---|---|

| O’NEAL USA | Provides premium motocross gear, including helmets, jerseys, and protective equipment. Focuses on durability and impact resistance. |

| Scott Sports | Specializes in high-performance motocross goggles, apparel, and body armor with cutting-edge technology. |

| Aero Stitch | Offers durable and weather-resistant motocross clothing, known for comfort and protection. |

| Fox Racing | Develops innovative motocross gear, integrating advanced ventilation and lightweight materials for enhanced performance. |

| Answer Racing | Manufactures a wide range of motocross apparel and protective gear, targeting both professional racers and casual riders. |

O'NEAL USA is known for producing top quality protective gear and is a market leader in the motocross clothing market. With an eye focused on rider safety, the organization is always researching and developing gear with sophisticated impact protection and ventilation features. The company offers a lot of products, from helmets, jerseys, pants, gloves, and boots for professional riders and enthusiasts.

Scott Sports has a lot of presence in the motocross gear space, especially goggles and protective wear. Scott's high level lens tech and light weight armor solutions provide exceptional comfort and visibility and have made the company a hit with aggressive riders.

Well known for its durable, weather-resistant motocross wear Aero Stitch specializes in high-quality protective gear without neglecting means rider comfort. This makes their products particularly popular among adventure riders and motocross professionals as well as climbers, surfers, canyoneers and anyone else who needs gear not to fail in extreme conditions.

Fox Racing is among the most recognized line of motocross gear and manufactures products featuring advanced ventilation capabilities, lightweight structures, and stylish designs. Fox sweeps up with more products on the shelves and protection features to stay relevant in the market.

Known for offering cost-effective yet high-quality motocross apparel and protective gear, Answer Racing targets both entry-level and professional riders. The brand focuses on ergonomic designs and impact-resistant materials to enhance safety without compromising on style.

The motocross gear market is also supported by several regional and emerging players, contributing to its dynamic nature. These include:

| Report Attributes | Details |

|---|---|

| Current Total Market Size (2025) | USD 8.2billion |

| Projected Market Size (2035) | USD 17.2billion |

| CAGR (2025 to 2035) | 7.7% |

| Base Year for Estimation | 2024 |

| Historical Period | 2019 to 2024 |

| Forecast Period | 2025 to 2035 |

| Quantitative Units | Revenue in USD billion; Units of gear sets sold for volume |

| Product Types Analyzed (Segment 1) | Helmets, Jerseys, Pants, Boots, Gloves, Goggles, Chest Protectors, Knee Guards |

| Sales Channels Analyzed (Segment 2) | Franchised Stores, Specialty Stores, Direct-to-Customer Channels, Third-party Online Channels |

| Demographics Analyzed (Segment 3) | Men, Women, Kids |

| Regions Covered | North America; Latin America; Western Europe; Eastern Europe; South Asia and Pacific; East Asia; Middle East & Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, China, India, Japan, South Korea, Australia, Brazil, Mexico, South Africa |

| Key Players Influencing the Motocross Gears Market | Fox Racing; Alpinestars; Thor MX; Troy Lee Designs; Shift MX; Fly Racing; O’Neal USA; Scott Sports; Dainese; AGVSports America LLC |

| Additional Attributes | Market segmentation by product type, sales channel, and demographics; analysis of consumer preferences for protective gear; regulatory landscape overview; impact of technological advancements on market growth; regional market trends and growth opportunities |

| Customization and Pricing | Customization and Pricing Available on Request |

The overall market size for motocross gears market was USD 8.2 billion in 2025.

The motocross gears market is expected to reach USD 17.2 billion in 2035.

The rising popularity of motocross racing, adventure sports, and off-road biking fuels Motocross gears Market during the forecast period.

The top 5 countries which drives the development of Motocross gears Market are USA, UK, Europe Union, Japan and South Korea.

On the basis of product type, helmets to command significant share over the forecast period.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Volume (Units) Forecast by Region, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 4: Global Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by Size, 2018 to 2033

Table 6: Global Market Volume (Units) Forecast by Size, 2018 to 2033

Table 7: Global Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 8: Global Market Volume (Units) Forecast by End User, 2018 to 2033

Table 9: Global Market Value (US$ Million) Forecast by Rider Type, 2018 to 2033

Table 10: Global Market Volume (Units) Forecast by Rider Type, 2018 to 2033

Table 11: Global Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 12: Global Market Volume (Units) Forecast by Sales Channel, 2018 to 2033

Table 13: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 14: North America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 15: North America Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 16: North America Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 17: North America Market Value (US$ Million) Forecast by Size, 2018 to 2033

Table 18: North America Market Volume (Units) Forecast by Size, 2018 to 2033

Table 19: North America Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 20: North America Market Volume (Units) Forecast by End User, 2018 to 2033

Table 21: North America Market Value (US$ Million) Forecast by Rider Type, 2018 to 2033

Table 22: North America Market Volume (Units) Forecast by Rider Type, 2018 to 2033

Table 23: North America Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 24: North America Market Volume (Units) Forecast by Sales Channel, 2018 to 2033

Table 25: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 26: Latin America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 27: Latin America Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 28: Latin America Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 29: Latin America Market Value (US$ Million) Forecast by Size, 2018 to 2033

Table 30: Latin America Market Volume (Units) Forecast by Size, 2018 to 2033

Table 31: Latin America Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 32: Latin America Market Volume (Units) Forecast by End User, 2018 to 2033

Table 33: Latin America Market Value (US$ Million) Forecast by Rider Type, 2018 to 2033

Table 34: Latin America Market Volume (Units) Forecast by Rider Type, 2018 to 2033

Table 35: Latin America Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 36: Latin America Market Volume (Units) Forecast by Sales Channel, 2018 to 2033

Table 37: Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 38: Europe Market Volume (Units) Forecast by Country, 2018 to 2033

Table 39: Europe Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 40: Europe Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 41: Europe Market Value (US$ Million) Forecast by Size, 2018 to 2033

Table 42: Europe Market Volume (Units) Forecast by Size, 2018 to 2033

Table 43: Europe Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 44: Europe Market Volume (Units) Forecast by End User, 2018 to 2033

Table 45: Europe Market Value (US$ Million) Forecast by Rider Type, 2018 to 2033

Table 46: Europe Market Volume (Units) Forecast by Rider Type, 2018 to 2033

Table 47: Europe Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 48: Europe Market Volume (Units) Forecast by Sales Channel, 2018 to 2033

Table 49: Asia Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 50: Asia Pacific Market Volume (Units) Forecast by Country, 2018 to 2033

Table 51: Asia Pacific Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 52: Asia Pacific Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 53: Asia Pacific Market Value (US$ Million) Forecast by Size, 2018 to 2033

Table 54: Asia Pacific Market Volume (Units) Forecast by Size, 2018 to 2033

Table 55: Asia Pacific Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 56: Asia Pacific Market Volume (Units) Forecast by End User, 2018 to 2033

Table 57: Asia Pacific Market Value (US$ Million) Forecast by Rider Type, 2018 to 2033

Table 58: Asia Pacific Market Volume (Units) Forecast by Rider Type, 2018 to 2033

Table 59: Asia Pacific Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 60: Asia Pacific Market Volume (Units) Forecast by Sales Channel, 2018 to 2033

Table 61: MEA Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 62: MEA Market Volume (Units) Forecast by Country, 2018 to 2033

Table 63: MEA Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 64: MEA Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 65: MEA Market Value (US$ Million) Forecast by Size, 2018 to 2033

Table 66: MEA Market Volume (Units) Forecast by Size, 2018 to 2033

Table 67: MEA Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 68: MEA Market Volume (Units) Forecast by End User, 2018 to 2033

Table 69: MEA Market Value (US$ Million) Forecast by Rider Type, 2018 to 2033

Table 70: MEA Market Volume (Units) Forecast by Rider Type, 2018 to 2033

Table 71: MEA Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 72: MEA Market Volume (Units) Forecast by Sales Channel, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Size, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by End User, 2023 to 2033

Figure 4: Global Market Value (US$ Million) by Rider Type, 2023 to 2033

Figure 5: Global Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 6: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 7: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 8: Global Market Volume (Units) Analysis by Region, 2018 to 2033

Figure 9: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 10: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 11: Global Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 12: Global Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 13: Global Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 14: Global Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 15: Global Market Value (US$ Million) Analysis by Size, 2018 to 2033

Figure 16: Global Market Volume (Units) Analysis by Size, 2018 to 2033

Figure 17: Global Market Value Share (%) and BPS Analysis by Size, 2023 to 2033

Figure 18: Global Market Y-o-Y Growth (%) Projections by Size, 2023 to 2033

Figure 19: Global Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 20: Global Market Volume (Units) Analysis by End User, 2018 to 2033

Figure 21: Global Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 22: Global Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 23: Global Market Value (US$ Million) Analysis by Rider Type, 2018 to 2033

Figure 24: Global Market Volume (Units) Analysis by Rider Type, 2018 to 2033

Figure 25: Global Market Value Share (%) and BPS Analysis by Rider Type, 2023 to 2033

Figure 26: Global Market Y-o-Y Growth (%) Projections by Rider Type, 2023 to 2033

Figure 27: Global Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 28: Global Market Volume (Units) Analysis by Sales Channel, 2018 to 2033

Figure 29: Global Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 30: Global Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 31: Global Market Attractiveness by Product Type, 2023 to 2033

Figure 32: Global Market Attractiveness by Size, 2023 to 2033

Figure 33: Global Market Attractiveness by End User, 2023 to 2033

Figure 34: Global Market Attractiveness by Rider Type, 2023 to 2033

Figure 35: Global Market Attractiveness by Sales Channel, 2023 to 2033

Figure 36: Global Market Attractiveness by Region, 2023 to 2033

Figure 37: North America Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 38: North America Market Value (US$ Million) by Size, 2023 to 2033

Figure 39: North America Market Value (US$ Million) by End User, 2023 to 2033

Figure 40: North America Market Value (US$ Million) by Rider Type, 2023 to 2033

Figure 41: North America Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 42: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 43: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 44: North America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 45: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 46: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 47: North America Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 48: North America Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 49: North America Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 50: North America Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 51: North America Market Value (US$ Million) Analysis by Size, 2018 to 2033

Figure 52: North America Market Volume (Units) Analysis by Size, 2018 to 2033

Figure 53: North America Market Value Share (%) and BPS Analysis by Size, 2023 to 2033

Figure 54: North America Market Y-o-Y Growth (%) Projections by Size, 2023 to 2033

Figure 55: North America Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 56: North America Market Volume (Units) Analysis by End User, 2018 to 2033

Figure 57: North America Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 58: North America Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 59: North America Market Value (US$ Million) Analysis by Rider Type, 2018 to 2033

Figure 60: North America Market Volume (Units) Analysis by Rider Type, 2018 to 2033

Figure 61: North America Market Value Share (%) and BPS Analysis by Rider Type, 2023 to 2033

Figure 62: North America Market Y-o-Y Growth (%) Projections by Rider Type, 2023 to 2033

Figure 63: North America Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 64: North America Market Volume (Units) Analysis by Sales Channel, 2018 to 2033

Figure 65: North America Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 66: North America Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 67: North America Market Attractiveness by Product Type, 2023 to 2033

Figure 68: North America Market Attractiveness by Size, 2023 to 2033

Figure 69: North America Market Attractiveness by End User, 2023 to 2033

Figure 70: North America Market Attractiveness by Rider Type, 2023 to 2033

Figure 71: North America Market Attractiveness by Sales Channel, 2023 to 2033

Figure 72: North America Market Attractiveness by Country, 2023 to 2033

Figure 73: Latin America Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 74: Latin America Market Value (US$ Million) by Size, 2023 to 2033

Figure 75: Latin America Market Value (US$ Million) by End User, 2023 to 2033

Figure 76: Latin America Market Value (US$ Million) by Rider Type, 2023 to 2033

Figure 77: Latin America Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 78: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 79: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 80: Latin America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 81: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 82: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 83: Latin America Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 84: Latin America Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 85: Latin America Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 86: Latin America Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 87: Latin America Market Value (US$ Million) Analysis by Size, 2018 to 2033

Figure 88: Latin America Market Volume (Units) Analysis by Size, 2018 to 2033

Figure 89: Latin America Market Value Share (%) and BPS Analysis by Size, 2023 to 2033

Figure 90: Latin America Market Y-o-Y Growth (%) Projections by Size, 2023 to 2033

Figure 91: Latin America Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 92: Latin America Market Volume (Units) Analysis by End User, 2018 to 2033

Figure 93: Latin America Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 94: Latin America Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 95: Latin America Market Value (US$ Million) Analysis by Rider Type, 2018 to 2033

Figure 96: Latin America Market Volume (Units) Analysis by Rider Type, 2018 to 2033

Figure 97: Latin America Market Value Share (%) and BPS Analysis by Rider Type, 2023 to 2033

Figure 98: Latin America Market Y-o-Y Growth (%) Projections by Rider Type, 2023 to 2033

Figure 99: Latin America Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 100: Latin America Market Volume (Units) Analysis by Sales Channel, 2018 to 2033

Figure 101: Latin America Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 102: Latin America Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 103: Latin America Market Attractiveness by Product Type, 2023 to 2033

Figure 104: Latin America Market Attractiveness by Size, 2023 to 2033

Figure 105: Latin America Market Attractiveness by End User, 2023 to 2033

Figure 106: Latin America Market Attractiveness by Rider Type, 2023 to 2033

Figure 107: Latin America Market Attractiveness by Sales Channel, 2023 to 2033

Figure 108: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 109: Europe Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 110: Europe Market Value (US$ Million) by Size, 2023 to 2033

Figure 111: Europe Market Value (US$ Million) by End User, 2023 to 2033

Figure 112: Europe Market Value (US$ Million) by Rider Type, 2023 to 2033

Figure 113: Europe Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 114: Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 115: Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 116: Europe Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 117: Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 118: Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 119: Europe Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 120: Europe Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 121: Europe Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 122: Europe Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 123: Europe Market Value (US$ Million) Analysis by Size, 2018 to 2033

Figure 124: Europe Market Volume (Units) Analysis by Size, 2018 to 2033

Figure 125: Europe Market Value Share (%) and BPS Analysis by Size, 2023 to 2033

Figure 126: Europe Market Y-o-Y Growth (%) Projections by Size, 2023 to 2033

Figure 127: Europe Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 128: Europe Market Volume (Units) Analysis by End User, 2018 to 2033

Figure 129: Europe Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 130: Europe Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 131: Europe Market Value (US$ Million) Analysis by Rider Type, 2018 to 2033

Figure 132: Europe Market Volume (Units) Analysis by Rider Type, 2018 to 2033

Figure 133: Europe Market Value Share (%) and BPS Analysis by Rider Type, 2023 to 2033

Figure 134: Europe Market Y-o-Y Growth (%) Projections by Rider Type, 2023 to 2033

Figure 135: Europe Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 136: Europe Market Volume (Units) Analysis by Sales Channel, 2018 to 2033

Figure 137: Europe Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 138: Europe Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 139: Europe Market Attractiveness by Product Type, 2023 to 2033

Figure 140: Europe Market Attractiveness by Size, 2023 to 2033

Figure 141: Europe Market Attractiveness by End User, 2023 to 2033

Figure 142: Europe Market Attractiveness by Rider Type, 2023 to 2033

Figure 143: Europe Market Attractiveness by Sales Channel, 2023 to 2033

Figure 144: Europe Market Attractiveness by Country, 2023 to 2033

Figure 145: Asia Pacific Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 146: Asia Pacific Market Value (US$ Million) by Size, 2023 to 2033

Figure 147: Asia Pacific Market Value (US$ Million) by End User, 2023 to 2033

Figure 148: Asia Pacific Market Value (US$ Million) by Rider Type, 2023 to 2033

Figure 149: Asia Pacific Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 150: Asia Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 151: Asia Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 152: Asia Pacific Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 153: Asia Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 154: Asia Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 155: Asia Pacific Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 156: Asia Pacific Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 157: Asia Pacific Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 158: Asia Pacific Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 159: Asia Pacific Market Value (US$ Million) Analysis by Size, 2018 to 2033

Figure 160: Asia Pacific Market Volume (Units) Analysis by Size, 2018 to 2033

Figure 161: Asia Pacific Market Value Share (%) and BPS Analysis by Size, 2023 to 2033

Figure 162: Asia Pacific Market Y-o-Y Growth (%) Projections by Size, 2023 to 2033

Figure 163: Asia Pacific Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 164: Asia Pacific Market Volume (Units) Analysis by End User, 2018 to 2033

Figure 165: Asia Pacific Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 166: Asia Pacific Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 167: Asia Pacific Market Value (US$ Million) Analysis by Rider Type, 2018 to 2033

Figure 168: Asia Pacific Market Volume (Units) Analysis by Rider Type, 2018 to 2033

Figure 169: Asia Pacific Market Value Share (%) and BPS Analysis by Rider Type, 2023 to 2033

Figure 170: Asia Pacific Market Y-o-Y Growth (%) Projections by Rider Type, 2023 to 2033

Figure 171: Asia Pacific Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 172: Asia Pacific Market Volume (Units) Analysis by Sales Channel, 2018 to 2033

Figure 173: Asia Pacific Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 174: Asia Pacific Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 175: Asia Pacific Market Attractiveness by Product Type, 2023 to 2033

Figure 176: Asia Pacific Market Attractiveness by Size, 2023 to 2033

Figure 177: Asia Pacific Market Attractiveness by End User, 2023 to 2033

Figure 178: Asia Pacific Market Attractiveness by Rider Type, 2023 to 2033

Figure 179: Asia Pacific Market Attractiveness by Sales Channel, 2023 to 2033

Figure 180: Asia Pacific Market Attractiveness by Country, 2023 to 2033

Figure 181: MEA Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 182: MEA Market Value (US$ Million) by Size, 2023 to 2033

Figure 183: MEA Market Value (US$ Million) by End User, 2023 to 2033

Figure 184: MEA Market Value (US$ Million) by Rider Type, 2023 to 2033

Figure 185: MEA Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 186: MEA Market Value (US$ Million) by Country, 2023 to 2033

Figure 187: MEA Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 188: MEA Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 189: MEA Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 190: MEA Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 191: MEA Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 192: MEA Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 193: MEA Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 194: MEA Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 195: MEA Market Value (US$ Million) Analysis by Size, 2018 to 2033

Figure 196: MEA Market Volume (Units) Analysis by Size, 2018 to 2033

Figure 197: MEA Market Value Share (%) and BPS Analysis by Size, 2023 to 2033

Figure 198: MEA Market Y-o-Y Growth (%) Projections by Size, 2023 to 2033

Figure 199: MEA Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 200: MEA Market Volume (Units) Analysis by End User, 2018 to 2033

Figure 201: MEA Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 202: MEA Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 203: MEA Market Value (US$ Million) Analysis by Rider Type, 2018 to 2033

Figure 204: MEA Market Volume (Units) Analysis by Rider Type, 2018 to 2033

Figure 205: MEA Market Value Share (%) and BPS Analysis by Rider Type, 2023 to 2033

Figure 206: MEA Market Y-o-Y Growth (%) Projections by Rider Type, 2023 to 2033

Figure 207: MEA Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 208: MEA Market Volume (Units) Analysis by Sales Channel, 2018 to 2033

Figure 209: MEA Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 210: MEA Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 211: MEA Market Attractiveness by Product Type, 2023 to 2033

Figure 212: MEA Market Attractiveness by Size, 2023 to 2033

Figure 213: MEA Market Attractiveness by End User, 2023 to 2033

Figure 214: MEA Market Attractiveness by Rider Type, 2023 to 2033

Figure 215: MEA Market Attractiveness by Sales Channel, 2023 to 2033

Figure 216: MEA Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Market Share Distribution Among Motocross Gears Providers

Gears, Drives and Speed Changers Market Growth – Trends & Forecast 2025 to 2035

Plastic Gears Market Size and Share Forecast Outlook 2025 to 2035

Backpacker Gears Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Power Tool Gears Market - Growth & Demand 2025 to 2035

Railway Draft Gears Market Growth – Trends & Forecast 2025 to 2035

Gas Insulated Switchgears (GIS) Market

Data Center Automatic Transfer Switches and Switchgears Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA