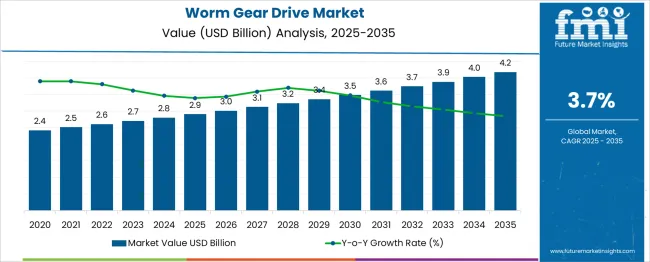

The Worm Gear Drive Market is estimated to be valued at USD 2.9 billion in 2025 and is projected to reach USD 4.2 billion by 2035, registering a compound annual growth rate (CAGR) of 3.7% over the forecast period.

| Metric | Value |

|---|---|

| Worm Gear Drive Market Estimated Value in (2025 E) | USD 2.9 billion |

| Worm Gear Drive Market Forecast Value in (2035 F) | USD 4.2 billion |

| Forecast CAGR (2025 to 2035) | 3.7% |

The worm gear drive market is expanding steadily, supported by increasing demand in industrial automation and heavy machinery applications. The growing need for compact gear solutions that offer high torque and smooth operation has driven interest in worm gear drives. Innovations in gear design and manufacturing processes have enhanced efficiency and durability, enabling their use in diverse sectors such as manufacturing, material handling, and automotive systems.

Additionally, infrastructure development and rising industrial investments globally have contributed to steady demand growth. Advancements in housing designs have improved protection and ease of installation, making these units more attractive to end users.

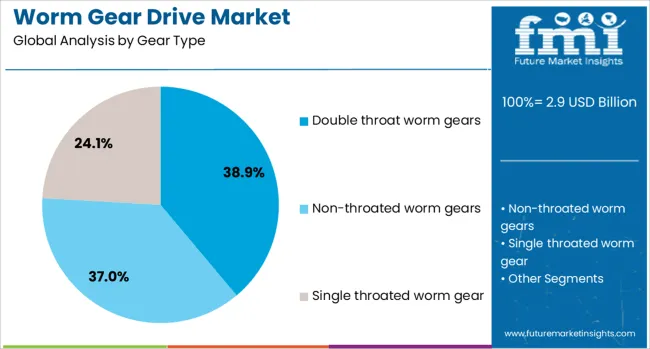

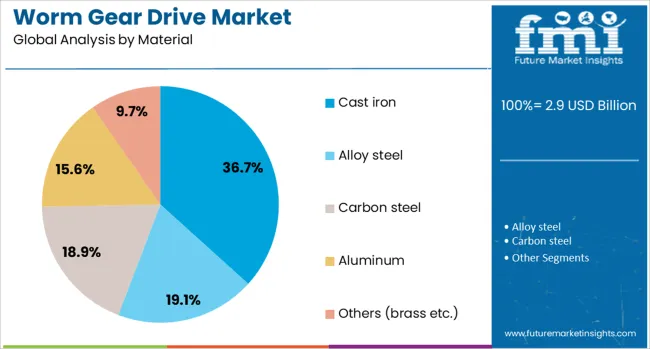

As industries focus on reliability and low maintenance in mechanical transmissions, the worm gear drive market is positioned for continued growth. Key segment drivers include the popularity of Double Throat Worm Gears, Housed Units as product types, and Cast Iron as the preferred material for their balance of strength and cost-effectiveness.

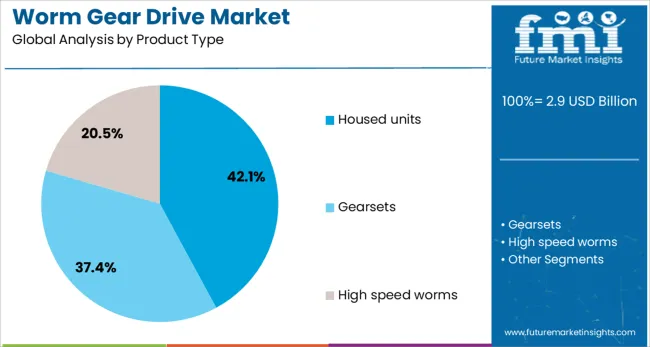

The worm gear drive market is segmented by gear type, product type, material, application, end use industry, and distribution channel and geographic regions. By gear type of the worm gear drive market is divided into Double throat worm gears, Non-throated worm gears, and Single throated worm gear. In terms of product type of the worm gear drive market is classified into Housed units, Gearsets, and High speed worms. Based on material of the worm gear drive market is segmented into Cast iron, Alloy steel, Carbon steel, Aluminum, and Others (brass etc.). By application of the worm gear drive market is segmented into Conveyors, Elevators and hoists, Automated machinery, Automotive systems, Gate controls, and Others (guitars etc.). By end use industry of the worm gear drive market is segmented into Manufacturing, Automotive, Mining, Aerospace, Construction & material handling, and Others (renewable energy etc.). By distribution channel of the worm gear drive market is segmented into Direct sales and Indirect sales. Regionally, the worm gear drive industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The Double Throat Worm Gears segment is projected to hold 38.9% of the worm gear drive market revenue in 2025, leading the gear type categories. This segment’s growth is due to its enhanced load capacity and improved contact ratio which results in smoother and quieter operation. Double throat worm gears are preferred in applications where high torque transmission and durability are essential.

Their design allows better alignment and distribution of forces, reducing wear and extending service life. These characteristics have made double throat worm gears favored in heavy-duty and precision machinery.

As the demand for reliable and efficient gear drives increases across industries, the double throat worm gear segment is expected to maintain its market leadership.

The Housed Units segment is expected to contribute 42.1% of the market revenue in 2025, securing its place as the dominant product type. These units offer integrated mounting solutions that simplify installation and protect the gear components from environmental factors such as dust and moisture. The housed design enhances the reliability and longevity of the gear drive systems, which is critical in industrial settings.

Their modular nature allows easy replacement and maintenance, reducing downtime for operations. Industries involved in material handling, conveyors, and automotive manufacturing have shown a preference for housed units due to their robust design and ease of integration.

This product type is anticipated to sustain its growth given the operational efficiencies it provides.

The Cast Iron segment is projected to hold 36.7% of the worm gear drive market revenue in 2025, remaining the leading material choice. Cast iron is favored for its excellent strength, wear resistance, and vibration damping properties which contribute to stable and durable gear performance. Its cost-effectiveness compared to other materials makes it attractive for a broad range of industrial applications.

The material’s ability to withstand harsh operating conditions and resist deformation under load has solidified its position in the market. Manufacturers prefer cast iron for its machinability and capacity to maintain precision in gear manufacturing.

As industries demand reliable gear materials that balance performance and cost, the cast iron segment is expected to sustain its leadership role.

Worm gear drives are being specified for applications requiring compactness, high torque ratio, and shock absorption in industrial, conveyor, and elevator systems. These units are installed where space constraints and noise reduction are priorities. Demand has been noted in sectors such as packaging machinery, heavy equipment, and agricultural haulers. Manufacturers are offering hardened steel worms with bronze or anti-friction alloy wheels, integrated lubrication seals, and backlash adjustment features. Load capacity has been enhanced through surface hardening techniques, while modular mountings have allowed customizable configurations for vertical and horizontal shaft arrangements.

Worm gear drives are being chosen to provide high reduction ratios within small envelope configurations, offering smooth start-stop motion in confined spaces. Self-locking characteristics have been leveraged in lifting and holding applications such as tuning mechanisms, conveyor gates, and actuator jacks, enhancing safety. Hardened worm shafts combined with anti-friction bronze or polymer wheels have reduced wear and extended gear life under continuous operation. Integrated lubrication systems with seals and reservoirs have supported maintenance-free performance over long duty cycles. Alignment features and modular bearings have simplified replacement and service across varied machinery types. As equipment designers have required reliable torque control without additional braking systems, worm gear drives have been integrated into OEM solutions and retrofit packages.

Performance of worm gear drives has been restricted by wear rates that are higher than those of spur or helical gears, and efficiency losses at high reduction ratios. Heat generation in meshing zones has required cooling methods or specialized lubricants to prevent material degradation. Load limitations have constrained usage in heavy-duty applications, where multi-stage gearing or parallel gearboxes are needed as alternatives. Precision alignment and backlash control measures have been needed to maintain position accuracy over time, increasing assembly complexity. Seal integrity has been critical to prevent lubricant contamination and gear wear, requiring robust housing designs and periodic inspections. As designers have sought higher torque and efficiency, mounting space and maintenance demands have constrained broader adoption.

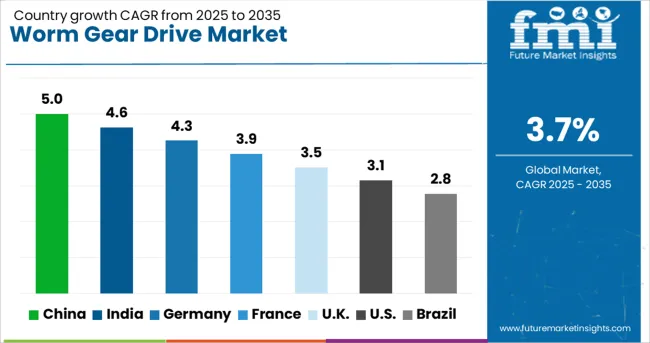

| Country | CAGR |

|---|---|

| China | 5.0% |

| India | 4.6% |

| Germany | 4.3% |

| France | 3.9% |

| UK | 3.5% |

| USA | 3.1% |

| Brazil | 2.8% |

The global worm gear drive market is expected to grow at a 3.7% CAGR from 2025 to 2035, driven by demand in material handling, packaging, and industrial automation. Of the 40 markets analyzed, China leads with 5.0%, followed by India at 4.6% and Germany at 4.3%. France posts 3.9%, and the United Kingdom records 3.5%. Growth is supported by OEM adoption in automotive production lines, conveyor systems, and precision engineering applications. BRICS nations are pushing expansion through low-cost manufacturing hubs, while OECD markets are investing in energy-efficient worm drives for robotics and high-performance machinery. The report includes an analysis of over 40 countries, with five profiled below for reference.

China is projected to grow at a 5.0% CAGR, supported by expanding applications in automotive assembly, robotics, and heavy-duty conveyors. Local manufacturers dominate by producing cost-efficient worm gears for industrial automation and high-load transmission systems. Precision gear variants are increasingly integrated into smart factories under state-led automation programs. Customized gear designs for electric vehicle assembly lines and aerospace applications are gaining traction, aided by strategic OEM partnerships. Energy efficiency standards drive the development of worm gears with improved torque output and reduced friction losses. Demand from material handling and logistics equipment adds incremental revenue streams, further fueling market penetration across Tier I industrial clusters.

India is forecast to grow at a 4.6% CAGR, fueled by automation in cement, textile, and process manufacturing sectors. Worm gear drives are widely deployed in conveyor systems for material handling in warehouses and large-scale industrial facilities. The rise of e-commerce logistics centers further boosts integration of geared conveyors for high-volume operations. Domestic manufacturers introduce cost-effective worm gears with enhanced wear resistance and heat dissipation for continuous-duty applications. Government infrastructure programs such as Make in India encourage localization of worm gear components, reducing dependency on imports. Increased penetration of worm drives in small and medium-sized manufacturing units creates additional demand across semi-urban and rural clusters.

Germany is expected to grow at a 4.3% CAGR, driven by advanced applications in automotive robotics, machine tools, and food processing lines. Worm gear drives integrated with torque sensors and smart controllers enable predictive maintenance and real-time monitoring, ensuring higher efficiency and reducing unexpected downtime. Lightweight worm gear systems are being developed for robotic arms and collaborative automation cells to improve speed and load-bearing performance. High-efficiency worm gears featuring specialized coatings gain traction in hygiene-sensitive sectors like pharmaceuticals and food. Manufacturers prioritize modular gear units for flexibility in production lines, optimizing both space and performance in constrained factory environments. Export demand from European and Asian markets reinforces Germany’s position as a leader in high-precision worm gear manufacturing.

France is forecast to grow at a 3.9% CAGR, supported by modernization in packaging machinery, renewable energy systems, and beverage processing units. Worm gear drives are integral to automated filling and bottling plants, where reliability and precision are essential. Gear systems optimized for low-noise and corrosion resistance are adopted for food-grade applications. The renewable sector creates incremental demand for worm gears in wind turbine yaw systems and small hydro plants. Local manufacturers invest in modular gear assembly lines for custom configurations in automated warehouses. Compliance with EU energy efficiency directives accelerates innovation in worm drives designed for minimal friction losses, boosting adoption in e-commerce logistics networks and automated storage systems.

The United Kingdom is expected to grow at a 3.5% CAGR, driven by upgrades in automotive assembly systems, robotics, and warehousing automation. Worm gear drives are deployed in conveyor systems for e-commerce hubs and postal distribution facilities, ensuring reliable performance under high-load conditions. Gear manufacturers focus on noise-optimized, compact designs suitable for space-constrained production environments. Partnerships between domestic firms and European suppliers support the introduction of energy-efficient worm drives aligned with UK’s industrial energy mandates. Retrofit projects in legacy automotive plants further contribute to steady adoption. The integration of worm gear solutions in robotic handling equipment enhances accuracy, making them essential for advanced motion control applications.

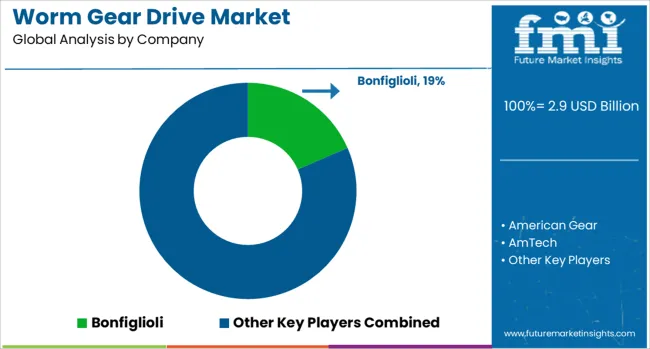

The worm gear drive market is dominated by established global and regional manufacturers focused on precision engineering, durability, and energy efficiency. Bonfiglioli and Sumitomo lead with advanced worm gear solutions optimized for automation and heavy-duty applications across industrial and automotive sectors. Flender and Rossi emphasize high-performance drives integrated with smart monitoring for predictive maintenance in critical operations. Boston Gear, Cleveland Gear, and Renold maintain strong positions in North America with robust designs suited for conveyors and material handling systems. European players such as Rhein-Getriebe and Welter Zahnrad cater to customized applications for robotics and specialized machinery. Asian manufacturers, including Shacha Technoforge and AmTech, compete on cost efficiency and scalability. Competition centers on compact design innovation, noise reduction, and compliance with energy efficiency standards.

On January 30, 2025, Sumitomo Heavy Industries, Ltd. announced the launch of its new zero-backlash DA Series gear head for servo motors, expanding its Fine CYCLO® high-precision gearbox lineup. Designed for easy mounting, the product is optimized for high-precision positioning and is suitable for applications such as machine tools, semiconductor manufacturing equipment, and other advanced industrial systems.

| Item | Value |

|---|---|

| Quantitative Units | USD 2.9 Billion |

| Gear Type | Double throat worm gears, Non-throated worm gears, and Single throated worm gear |

| Product Type | Housed units, Gearsets, and High speed worms |

| Material | Cast iron, Alloy steel, Carbon steel, Aluminum, and Others (brass etc.) |

| Application | Conveyors, Elevators and hoists, Automated machinery, Automotive systems, Gate controls, and Others (guitars etc.) |

| End Use Industry | Manufacturing, Automotive, Mining, Aerospace, Construction & material handling, and Others (renewable energy etc.) |

| Distribution Channel | Direct sales and Indirect sales |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Bonfiglioli, American Gear, AmTech, Baart, Bornemann, Boston Gear, Cleveland Gear, Dalton Gear, Flender, Renold, Rhein-Getriebe, Rossi, Shacha Technoforge, Sumitomo, and Welter Zahnrad |

| Additional Attributes | Dollar sales in the worm gear drive market are driven by their widespread use in material handling, automotive systems, and industrial automation. Growth is supported by demand for compact, high-torque solutions and energy-efficient designs. Asia-Pacific leads adoption due to expanding manufacturing, while Europe emphasizes precision engineering. Key players focus on innovation in noise reduction, durability, and smart monitoring integration. |

The global worm gear drive market is estimated to be valued at USD 2.9 billion in 2025.

The market size for the worm gear drive market is projected to reach USD 4.2 billion by 2035.

The worm gear drive market is expected to grow at a 3.7% CAGR between 2025 and 2035.

The key product types in worm gear drive market are double throat worm gears, non-throated worm gears and single throated worm gear.

In terms of product type, housed units segment to command 42.1% share in the worm gear drive market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Woodworm Treatment Service Market Size and Share Forecast Outlook 2025 to 2035

Ringworm Treatment Market - Growth & Drug Innovations 2025 to 2035

Earthworm Meal Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Pork Tapeworm Infection Treatment Market Trends – Demand & Innovations 2025 to 2035

Europe Dog Dewormers Market - Growth & Demand 2025 to 2035

Organic Gummy Worms Market Analysis by Flavors, Distribution Channel and Region from 2025 to 2035

Gearbox and Gear Motors Market Size and Share Forecast Outlook 2025 to 2035

Gear Motor Market Size and Share Forecast Outlook 2025 to 2035

Gears, Drives and Speed Changers Market Growth – Trends & Forecast 2025 to 2035

Ski Gear & Equipment Market Size and Share Forecast Outlook 2025 to 2035

Ski Gear And Equipment Market Size and Share Forecast Outlook 2025 to 2035

Rail Gearbox Market Size and Share Forecast Outlook 2025 to 2035

Open Gear Lubricants Market

Switchgear for Data Centers Market Size and Share Forecast Outlook 2025 to 2035

Switchgear Market Growth - Trends & Forecast 2025 to 2035

Motor Gear Unit Market

Roller Gear Cam Unit Market Size and Share Forecast Outlook 2025 to 2035

Timing Gear Market Size and Share Forecast Outlook 2025 to 2035

Plastic Gears Market Size and Share Forecast Outlook 2025 to 2035

Bicycle Gear Shifter Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA