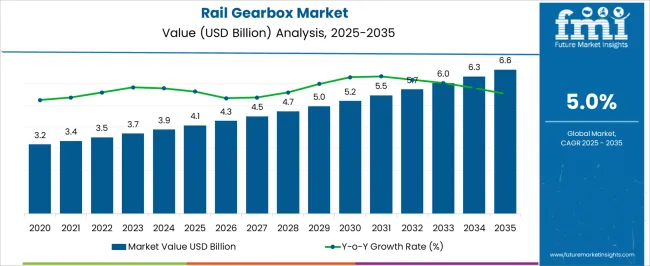

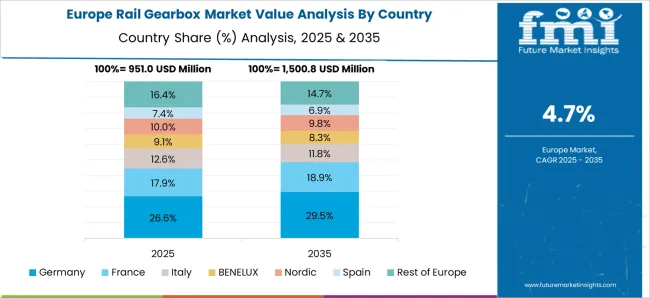

The rail gearbox market is projected to grow from USD 4.1 billion in 2025 to USD 6.6 billion by 2035, representing a CAGR of 5.0%. A regional growth imbalance is evident, shaped by differences in rail infrastructure expansion, technological adoption, and regulatory frameworks across Asia-Pacific, Europe, and North America. Asia-Pacific is expected to dominate growth during the forecast period, driven by rapid urban rail expansion, high-speed rail projects, and the modernization of existing freight networks. Investments in rail electrification and increased government funding for public transportation are creating significant demand for advanced rail gearbox solutions in this region, particularly in countries such as China, India, and Japan. Europe represents a mature market with steady growth, primarily supported by maintenance, replacement, and upgrade of aging rail systems.

Stringent safety regulations, environmental mandates, and high reliability standards are encouraging the adoption of more efficient, durable, and low-maintenance gearbox technologies. North America, while growing at a moderate pace, faces slower expansion in passenger rail infrastructure, but freight rail investments and modernization projects are sustaining demand for rail gearboxes. By 2035, the Asia-Pacific region is projected to hold the largest market share, exceeding 45% of the total market, whereas Europe and North America are expected to contribute roughly 30% and 25%, respectively. The regional disparity reflects infrastructure priorities, technological investments, and varying regulatory pressures that shape market demand across these key geographies, indicating strategic opportunities for manufacturers targeting high-growth regions.

| Metric | Value |

|---|---|

| Rail Gearbox Market Estimated Value in (2025 E) | USD 4.1 billion |

| Rail Gearbox Market Forecast Value in (2035 F) | USD 6.6 billion |

| Forecast CAGR (2025 to 2035) | 5.0% |

As governments and private operators modernize rolling stock, the need for reliable, durable, and efficient gear transmission systems has intensified. Technology providers and rolling stock manufacturers are emphasizing innovations in gear design, noise reduction, and predictive maintenance capabilities to enhance operational efficiency and meet safety standards.

The growing adoption of electric and hybrid rail systems is also influencing gearbox specifications and material selection to optimize weight and performance. Press announcements and industry briefings highlight a shift toward modular, easily maintainable gearboxes that reduce lifecycle costs.

In the coming years, further growth is expected to be supported by rising urbanization, intercity connectivity initiatives, and sustainability policies encouraging rail as a preferred mode of transport.

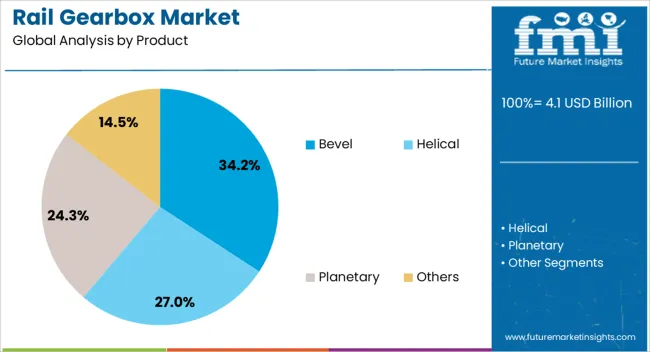

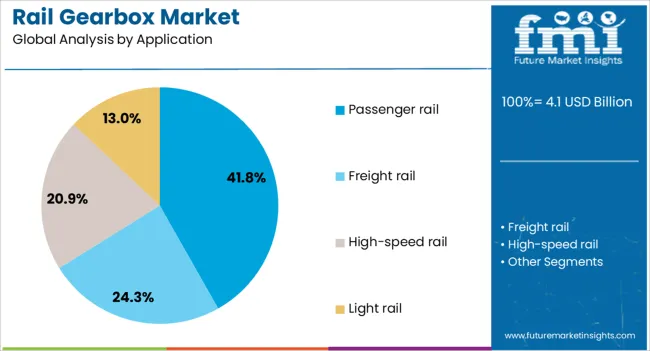

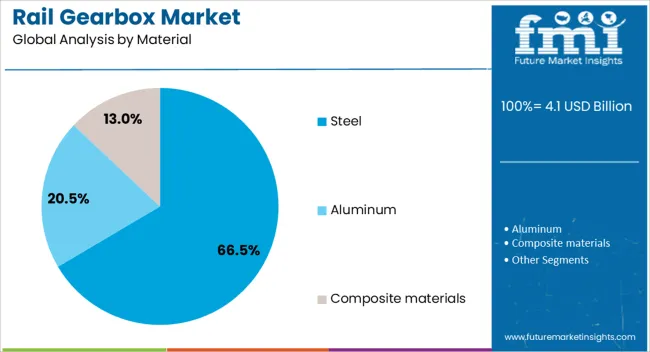

The rail gearbox market is segmented by product, application, material, and geographic regions. By product, the rail gearbox market is divided into Bevel, Helical, Planetary, and Others. In terms of application, the rail gearbox market is classified into Passenger rail, Freight rail, High-speed rail, and Light rail. Based on the material, the rail gearbox market is segmented into Steel, Aluminum, and Composite materials. Regionally, the rail gearbox industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The bevel product segment is anticipated to account for 34.2% of the Rail Gearbox market revenue share in 2025, making it the leading product category. This dominance is being attributed to its superior torque transmission capabilities and suitability for high-speed rail and urban transit systems. Bevel gearboxes have been widely integrated into railway drivetrains due to their ability to handle directional changes in power flow efficiently, contributing to smoother operations and better mechanical reliability.

It has been observed in manufacturing updates and product press statements that bevel gear systems are often engineered to minimize energy losses, reduce vibration, and extend service intervals. Their compact design allows seamless integration into varied bogie configurations, enhancing design flexibility for rolling stock manufacturers.

Demand for bevel gearboxes has also been supported by performance testing results indicating lower wear rates under high-load conditions. These combined advantages have reinforced the segment’s leadership position in the rail gearbox product landscape.

The passenger rail application segment is projected to hold 41.8% of the Rail Gearbox market revenue share in 2025, establishing it as the dominant application segment. This growth is being driven by the global increase in passenger rail networks, including metro systems, intercity rail, and high-speed trains, which require high-efficiency and low-maintenance gearbox solutions. Press briefings and technical articles have highlighted that passenger rail gearboxes are often subjected to higher usage cycles and speed demands, necessitating durable and reliable components.

Enhanced ride comfort, noise reduction, and safety compliance have emerged as priority areas, prompting the integration of advanced gearbox technologies. Operators are investing in predictive maintenance tools and condition monitoring systems embedded within the gearbox assemblies to reduce downtime and optimize fleet availability.

Furthermore, growing ridership and government subsidies for public transport infrastructure have accelerated procurement of new trains equipped with modern gearbox systems. These factors have collectively supported the segment’s market leadership in 2025.

The steel material segment is expected to contribute 66.5% of the Rail Gearbox market revenue share in 2025, maintaining its leading position. Steel has remained the material of choice for gearbox components due to its exceptional strength, fatigue resistance, and cost-effectiveness. It has been noted in production updates and supplier announcements that steel alloys are increasingly being customized with enhanced heat treatment processes to withstand extreme operational conditions in rail systems.

The material’s mechanical properties support high load transmission, which is critical in maintaining efficiency and safety in both passenger and freight applications. Additionally, steel offers long-term durability and wear resistance, which align with the railway industry’s requirements for extended service life and reduced maintenance costs.

The availability of high-grade steel at scale and its compatibility with advanced manufacturing processes such as CNC machining and surface finishing have further reinforced its dominance. These attributes have enabled the steel segment to retain a stronghold in gearbox material selection across global rail markets.

The market has expanded due to increasing demand for reliable power transmission solutions in locomotives, metro systems, and freight rail operations. Gearboxes are critical in ensuring torque conversion, speed regulation, and operational efficiency across rail propulsion systems. Growth has been driven by the modernization of rail fleets, adoption of electric and hybrid propulsion, and expansion of urban and freight rail networks. Technological advancements in materials, precision manufacturing, and lubrication systems have enhanced performance and durability, reinforcing adoption across passenger and freight rail applications globally.

Advancements in gear design and materials have strengthened the rail gearbox market by improving performance, durability, and maintenance intervals. High-strength alloys, case-hardened steel, and precision-machined components have been employed to reduce wear and extend service life under heavy load conditions. Gear geometries have been optimized for torque efficiency, noise reduction, and vibration control, while surface treatments have enhanced resistance to corrosion and fatigue. Modular designs have allowed customization for diverse locomotive and freight applications, enabling easier installation and maintenance. Lubrication technologies have been enhanced with high-performance oils and self-lubricating coatings to ensure stable operation across varying temperatures and speeds. Collectively, these advancements have positioned modern rail gearboxes as highly reliable, long-lasting, and essential components for safe and efficient rail operations globally.

The growth of electric and hybrid rail systems has driven demand for advanced gearboxes capable of handling variable torque and high-speed performance. Gearboxes in electric locomotives, metro trains, and freight units have been engineered to integrate seamlessly with electric traction motors, regenerative braking systems, and energy storage solutions. Efficiency optimization has been achieved through precision gearing, optimized gear ratios, and lightweight materials, which reduce energy consumption and operational costs. Hybrid propulsion systems have further increased adoption by requiring gearboxes capable of accommodating fluctuating power inputs and high torque variability. The rise of electrified rail networks in Europe, Asia, and North America has reinforced investment in advanced gearboxes, making them indispensable for modern, energy-efficient rail propulsion systems.

Operational reliability and maintenance considerations have significantly influenced the rail gearbox market. Long service life, low downtime, and reduced maintenance requirements have been prioritized by operators seeking consistent fleet availability. Condition monitoring systems, vibration analysis, and predictive maintenance technologies have been employed to detect gear wear and prevent unplanned failures. Modular and standardized gearbox components have facilitated quicker replacement and minimized service disruptions. Lubrication and cooling enhancements have further contributed to reduced maintenance frequency. Rail operators handling high-speed passenger and heavy freight operations have increasingly adopted gearboxes designed for robust performance, ensuring safe and uninterrupted service. Consequently, operational reliability and maintenance efficiency have become critical drivers of market adoption globally.

Rail network modernization initiatives have been central to the expansion of the rail gearbox market. Investments in high-speed rail corridors, metro systems, and freight logistics have necessitated upgrades of older rolling stock and propulsion systems. Modern gearboxes with enhanced torque handling, vibration reduction, and efficiency capabilities have been installed to support new locomotives and retrofitted fleets. Urban and regional transit expansion projects have created demand for compact, high-performance gearboxes capable of accommodating tight installation spaces. The fleet standardization programs have encouraged procurement of modular and scalable gearboxes to simplify maintenance and spare part management. Modernization of rail infrastructure, combined with the growth of passenger and freight rail services, has driven consistent global demand for advanced rail gearboxes.

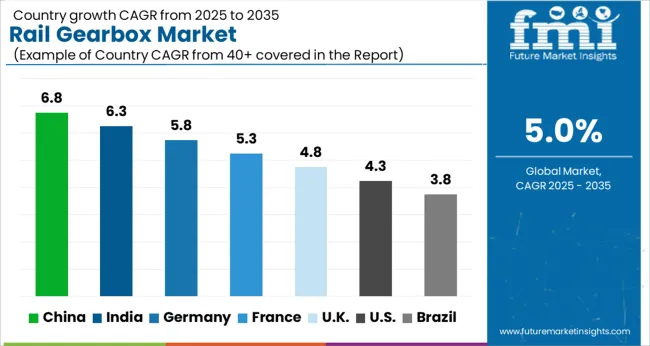

The market is projected to grow at a CAGR of 5.0% between 2025 and 2035, supported by modernization of rail systems, adoption of high-efficiency gear solutions, and investment in urban and freight rail networks. China leads with a 6.8% CAGR, driven by large-scale railway infrastructure expansion and advanced gearbox manufacturing capabilities. India follows at 6.3%, with growth fueled by railway electrification and modernization programs. Germany, at 5.8%, benefits from established precision engineering and advanced rail technologies. The UK, growing at 4.8%, focuses on upgrading regional and national rail networks. The USA, at 4.3%, experiences steady demand from freight rail modernization and high-performance gearbox adoption. This report covers 40+ countries, with the top markets highlighted here for reference.

China is expected to expand at a CAGR of 6.8% in the market from 2025 to 2035, driven by modernization of high-speed rail networks and increasing freight traffic. Domestic manufacturers are investing in advanced gearbox designs and precision manufacturing techniques to enhance efficiency and reliability. Upgrades of existing rolling stock and expansion of urban rail systems are generating strong demand for high-performance gearboxes. Strategic collaborations between railway operators and component suppliers are facilitating adoption of advanced solutions and increasing service lifespan of equipment.

India is projected to grow at a CAGR of 6.3% in the industry from 2025 to 2035, supported by increasing urban and intercity rail connectivity projects. Upgrades in locomotive efficiency and adoption of lightweight and high-torque gearbox solutions are driving growth. Domestic and international suppliers are collaborating to enhance technology transfer and reliability standards. Government programs targeting regional rail networks and freight corridors are creating sustained demand for high-quality gearboxes.

Germany is forecast to grow at a CAGR of 5.8% in the market from 2025 to 2035, driven by modernization of freight and passenger train fleets. High-speed trains and regional commuter services are demanding advanced gearbox technologies to ensure reliability and reduce maintenance intervals. Manufacturers are focusing on precision engineering, enhanced torque capacities, and vibration reduction. Research collaborations between industry and technical institutes are enhancing performance and service life.

The United Kingdom is anticipated to grow at a CAGR of 4.8% in the market from 2025 to 2035, supported by modernization of commuter and freight rail systems. Upgrades in efficiency and reliability of gearboxes for high-speed and metro services are driving demand. Strategic alliances between manufacturers and rail operators are fostering development of customized solutions for specific service requirements. Regulatory compliance and maintenance efficiency are influencing technology adoption.

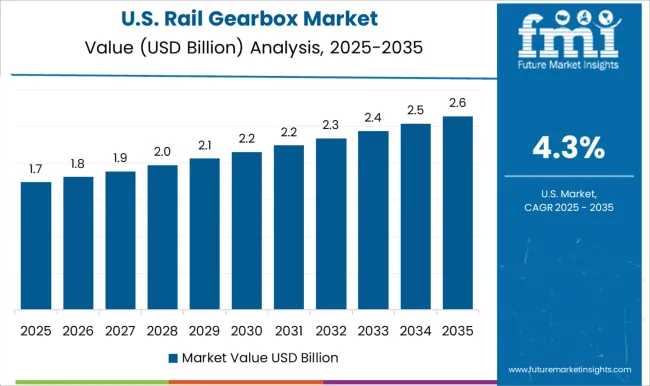

The United States is expected to expand at a CAGR of 4.3% in the market from 2025 to 2035, driven by growth in freight and passenger rail modernization initiatives. Manufacturers are emphasizing durability, high torque capacity, and reduced maintenance requirements. Public and private investments in rail infrastructure are supporting adoption of advanced gearboxes. Collaborative programs with component suppliers are ensuring consistent quality and innovation in rolling stock drivetrain systems.

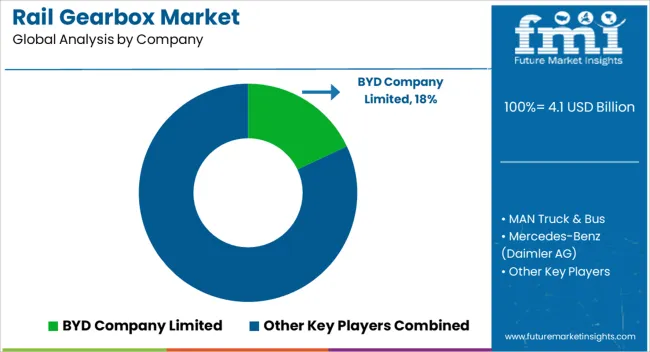

The market is shaped by manufacturers delivering high-performance transmission systems for locomotives, urban transit buses, and electric rail vehicles. BYD Company Limited and MAN Truck & Bus are recognized for integrating advanced engineering designs and durable materials to ensure reliability in heavy-duty rail applications. Mercedes-Benz (Daimler AG) and Volvo Group leverage extensive R&D capabilities to optimize gearbox efficiency, reduce noise and vibration, and enhance operational lifespan. New Flyer Industries Inc. and Nova Bus (Volvo Group) focus on lightweight, energy-efficient gearboxes tailored for electric and hybrid rail transit vehicles, supporting improved fuel efficiency and reduced maintenance requirements.

Proterra Inc. and Traton emphasize modular gearbox solutions and collaborative product development with rail operators to meet specific performance requirements. Temsa Global Sanayi Ve Ticaret A.Ş., Yutong Group, and Zhongtong Bus Holding Co., Ltd. strengthen their market position through strategic partnerships, localized manufacturing, and technology transfer agreements. Emerging players in the market are concentrating on innovations in high-torque and low-noise designs, compact configurations for electric propulsion, and enhanced durability under extreme operating conditions. Entry barriers in the market are substantial due to the requirement for specialized manufacturing expertise, stringent safety certifications, and significant capital investment in precision engineering, limiting new entrants while maintaining high competitive standards among established manufacturers.

| Item | Value |

|---|---|

| Quantitative Units | USD 4.1 Billion |

| Product | Bevel, Helical, Planetary, and Others |

| Application | Passenger rail, Freight rail, High-speed rail, and Light rail |

| Material | Steel, Aluminum, and Composite materials |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | BYD Company Limited, MAN Truck & Bus, Mercedes-Benz (Daimler AG), New Flyer Industries Inc., Nova Bus (Volvo Group), Proterra Inc., Traton, Temsa Global Sanayi Ve Ticaret A., Volvo Group, Yutong Group, and Zhongtong Bus Holding Co., Ltd. |

| Additional Attributes | Dollar sales by gearbox type and end-use application, demand dynamics across high-speed trains, metro systems, and freight locomotives, regional trends in adoption across North America, Europe, and Asia-Pacific, innovation in lightweight materials, noise reduction technologies, and maintenance-free designs, environmental impact of manufacturing emissions, lubricant usage, and energy efficiency, and emerging use cases in high-speed rail modernization, urban transit upgrades, and hybrid-electric train propulsion systems. |

The global rail gearbox market is estimated to be valued at USD 4.1 billion in 2025.

The market size for the rail gearbox market is projected to reach USD 6.6 billion by 2035.

The rail gearbox market is expected to grow at a 5.0% CAGR between 2025 and 2035.

The key product types in rail gearbox market are bevel, helical, planetary and others.

In terms of application, passenger rail segment to command 41.8% share in the rail gearbox market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Railway Communication Equipment Market Size and Share Forecast Outlook 2025 to 2035

Railway Rolling Stock Market Forecast and Outlook 2025 to 2035

Railway System Market Size and Share Forecast Outlook 2025 to 2035

Railway Air Conditioning System Market Size and Share Forecast Outlook 2025 to 2035

Railway Braking System Market Size and Share Forecast Outlook 2025 to 2035

Rail Transit Vehicle Glass Market Size and Share Forecast Outlook 2025 to 2035

Railway CNC Wheel Lathe Market Size and Share Forecast Outlook 2025 to 2035

Rail System Dryer Market Size and Share Forecast Outlook 2025 to 2035

Railway Flatcar Market Size and Share Forecast Outlook 2025 to 2035

Rail Freight Market Size and Share Forecast Outlook 2025 to 2035

Railroad Market Size and Share Forecast Outlook 2025 to 2035

Rail Car Drying System Market Size and Share Forecast Outlook 2025 to 2035

Railway Roof Switches Market Size and Share Forecast Outlook 2025 to 2035

Rail Tank Cars Market Size and Share Forecast Outlook 2025 to 2035

Railway Window Market Size and Share Forecast Outlook 2025 to 2035

Railway Maintenance Machinery Market Size and Share Forecast Outlook 2025 to 2035

Rail Freight Digital Transformation Market Size and Share Forecast Outlook 2025 to 2035

Rail Logistics Market Size and Share Forecast Outlook 2025 to 2035

Railway Control Stands Market Size and Share Forecast Outlook 2025 to 2035

Railway Horn Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA