The global rail freight sector is projected to expand from USD 370 billion in 2025 to USD 602.7 billion in 2035 at a CAGR of 5%. Yearly progression from USD 370.0 billion in 2025 to USD 388.5 billion in 2026 and USD 407.9 billion in 2027 indicates consistent demand. Growth continues as values rise to USD 428.3 billion in 2028 and USD 449.7 billion in 2029, highlighting increasing reliance on rail for bulk commodities and intermodal cargo.

Regional corridors are shaping efficiency, and this trajectory is being sustained even under pressure from competing freight modes, showing rail freight as a resilient logistics backbone. Momentum accelerates, with revenues reaching USD 472.2 billion in 2030 and USD 495.8 billion in 2031, and then further advancing to USD 520.6 billion in 2032 and USD 546.7 billion in 2033. By 2034, the industry value reaches USD 574.0 billion, closing at USD 602.7 billion in 2035, reinforcing the role of rail in freight transport. Investments in modern rolling stock, electrification, and digital tracking platforms are enhancing operational reliability across networks.

The 10-year trajectory is an indicator of long-term stability, as rail freight continues to outpace volatile air and maritime alternatives. The sector is positioned to remain a cornerstone of international and domestic supply chains.

| Metric | Value |

|---|---|

| Rail Freight Market Estimated Value in (2025 E) | USD 370.0 billion |

| Rail Freight Market Forecast Value in (2035 F) | USD 602.7 billion |

| Forecast CAGR (2025 to 2035) | 5.0% |

The rail freight segment is estimated to account for around 18% of the global freight transportation market, close to 14% of the logistics and supply chain market, nearly 21% of the intermodal transport market, about 17% of the surface transport market, and around 12% of the global freight and cargo market. When these shares are aggregated, the rail freight category contributes approximately 82% across these parent sectors. This proportion underscores the integral role rail freight occupies as a backbone within freight movement systems, balancing efficiency with large-scale cargo handling capacity.

It is considered significant in offering reliability for bulk commodities, heavy industrial goods, and cross-border trade corridors where cost control and consistency dominate decision-making. The relative strength of rail freight has been shaped by infrastructure investments, integration with ports, and its long-term contracts with sectors such as mining, manufacturing, and agriculture. It is believed that its share may not drastically shift downward as intermodal and multimodal strategies continue to rely on rail as the central spine of cargo connectivity. As such, the rail freight market is viewed not only as a sub-component but as a strategic lever that influences cost competitiveness and operational resilience across its parent markets, making it indispensable for enterprises and governments planning long-term freight strategies.

The rail freight market is experiencing sustained growth, driven by the rising demand for cost-efficient, high-capacity, and environmentally sustainable transportation solutions. Industry reports and logistics sector updates have emphasized rail freight’s role in alleviating road congestion, lowering carbon emissions, and providing reliable long-distance cargo movement.

Investments in rail infrastructure, including modernization of rolling stock, digitization of tracking systems, and expansion of intermodal terminals, have enhanced operational efficiency and service reliability. Trade growth, coupled with industrial output recovery, has boosted cargo volumes across both domestic and cross-border routes.

Additionally, rail freight has benefited from increasing fuel price volatility in road transport, making it a competitive choice for bulk and high-volume shipments. Government policies supporting modal shifts from road to rail, as part of broader sustainability agendas, are further reinforcing market expansion. Demand is expected to remain strong for containerized cargo transport, full carload services, and long-haul movements, as industries seek dependable logistics solutions that optimize costs while meeting environmental performance targets.

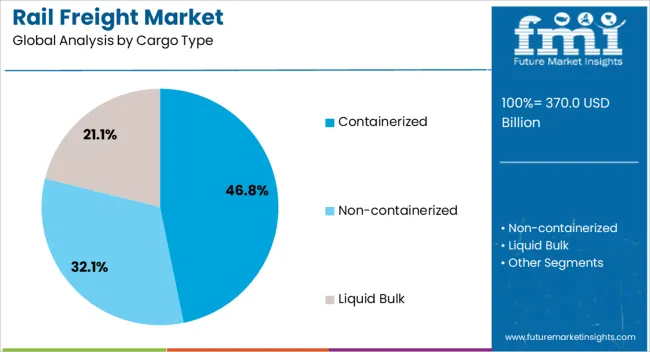

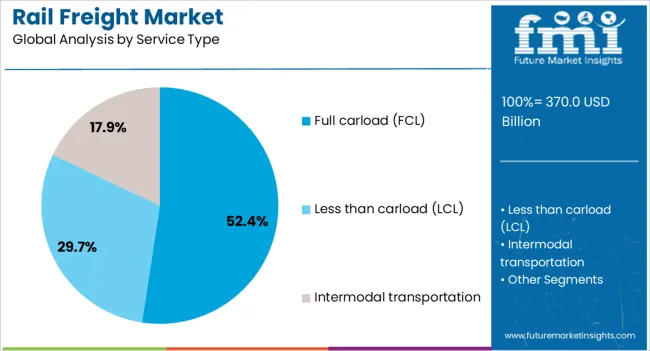

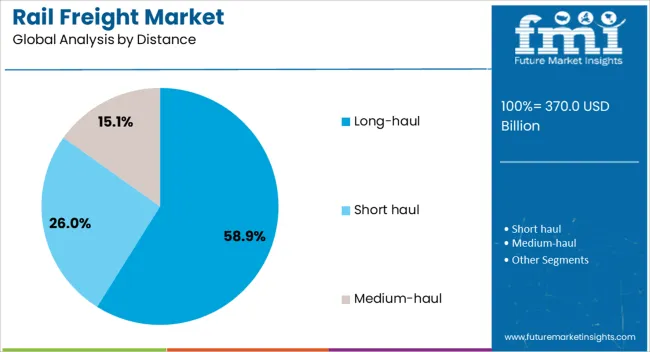

The rail freight market is segmented by cargo type, service type, distance, end-user industry, and geographic regions. By cargo type, rail freight market is divided into Containerized, Non-containerized, and Liquid Bulk. In terms of service type, rail freight market is classified into Full carload (FCL), Less than carload (LCL), and Intermodal transportation. Based on distance, rail freight market is segmented into Long-haul, Short haul, and Medium-haul. By end-user industry, rail freight market is segmented into Mining, Agriculture, Energy, Manufacturing, Construction, Retail, Automotive, Chemical, Food & beverages, and Others. Regionally, the rail freight industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The containerized segment is projected to hold 46.80% of the rail freight market revenue in 2025, maintaining its leadership due to its versatility and compatibility with intermodal logistics systems. Growth in this segment has been driven by the expansion of global trade and the widespread adoption of standardized containers, which simplify handling, improve security, and reduce transit times.

Rail operators have increasingly integrated container services with ports and inland terminals, enabling seamless transfer between sea, rail, and road transport. This multimodal connectivity has been particularly beneficial for industries requiring reliable and efficient long-distance supply chain operations.

Additionally, containerized rail freight offers flexibility for transporting a variety of goods, from consumer products to industrial machinery, without the need for cargo repackaging. As global supply chains continue to prioritize efficiency and resilience, the containerized segment is expected to retain its dominant position in the rail freight sector.

The full carload (FCL) segment is projected to contribute 52.40% of the rail freight market revenue in 2025, sustaining its position as the leading service type. This growth has been supported by the demand from industries requiring dedicated railcars for bulk shipments, ensuring consistent scheduling and minimized handling.

FCL services have been favored for commodities such as minerals, chemicals, and agricultural products, where volume and weight requirements make shared capacity impractical. Rail operators have optimized FCL networks with specialized railcars, improved loading infrastructure, and dedicated routes to meet industry-specific needs.

Furthermore, the cost advantages of FCL, particularly over long distances, have reinforced its adoption among large-scale shippers. The segment has also benefited from long-term freight contracts, which provide revenue stability for operators and predictability for customers. With continued investment in capacity and service reliability, the FCL segment is expected to remain the preferred choice for high-volume shippers.

The long-haul segment is projected to account for 58.90% of the rail freight market revenue in 2025, holding the largest share due to rail’s inherent efficiency in transporting goods over extended distances. Long-haul rail freight has been instrumental in linking major industrial hubs, ports, and inland distribution centers across national and international routes.

The segment’s growth has been underpinned by its lower per-ton-kilometer cost compared to road transport and its reduced environmental footprint, making it a preferred option for shippers aiming to meet sustainability targets.

Infrastructure upgrades, such as electrification projects and high-capacity corridors, have improved transit speeds and increased load capacity for long-haul operations. Additionally, the reliability of rail in maintaining schedules over large distances has strengthened its role in time-sensitive supply chains. As global trade flows expand and inland logistics networks become more integrated, the long-haul segment is expected to continue driving growth in the rail freight market.

The rail freight market is projected to expand steadily, shaped by shifts in trade volumes, regional connectivity, and competitive logistics models. Rising reliance on bulk commodity transport, intermodal services, and cross-border integration is driving new growth opportunities. While favorable policies and investment in corridor infrastructure enhance adoption, challenges such as operational bottlenecks and modal competition limit acceleration. Distinctive patterns emerge through evolving freight tariffs, digital scheduling platforms, and network efficiency measures, creating both prospects and obstacles for operators in this expanding global logistics ecosystem.

Global demand for rail freight has been reinforced by the rising movement of bulk commodities such as coal, minerals, and agricultural produce. Shippers have favored railways for long-haul transport as it offers a lower cost per ton-mile compared to road haulage. Cross-border corridors connecting Asia with Europe and expanding trade within North America are being leveraged to secure reliable delivery timelines. Growing intermodal traffic, driven by containerized freight, has been observed as businesses seek dependable alternatives to congested trucking networks. Industries such as automotive, chemicals, and construction materials are leaning toward rail services due to predictable transit and integrated hubs. In an opinionated view, the strategic advantage lies in cost efficiency and resilience during fuel price fluctuations. This shift is expected to stimulate stronger demand in corridors where rail infrastructure is being actively expanded.

Rail freight operators are finding opportunities in expanding intermodal services and digital platforms for scheduling and tracking. Corridors linking seaports to hinterlands have become lucrative as containerized shipments demand synchronized transport. Investment in inland dry ports and transshipment hubs has provided new access points for shippers who prioritize efficiency and cost predictability. Integration of digital platforms for real-time tracking and resource optimization has enabled operators to differentiate service offerings. From an analytical standpoint, the opportunity lies in combining rail with last-mile road delivery, a model increasingly valued by large retailers and manufacturers. Multilateral initiatives aimed at reducing border delays in Eurasian and African trade routes have also provided opportunities to expand services. This pattern positions rail freight not merely as an alternative but as a strategic backbone for regional and global trade corridors.

Key trends influencing rail freight include intermodal connectivity, competitive tariffs, and investments in energy-efficient locomotives. Shippers have increasingly demanded flexible contracts, with shorter-term arrangements gaining preference over long-term fixed models. Railways have responded by optimizing asset utilization and expanding capacity in high-volume corridors. E-commerce growth has indirectly spurred interest in rail as large-scale distribution hubs integrate with rail-linked terminals. Opinions suggest that the trend of tariff rationalization, especially in Europe and Asia, will reshape competitive positioning against trucking and inland waterways. Digital adoption in scheduling and yard management has emerged as another critical trend, with predictive analytics being incorporated into route optimization. Taken together, these trends underline a gradual repositioning of rail freight as a highly integrated pillar of multimodal logistics networks, attracting both industrial and consumer-facing supply chains.

Despite its advantages, the rail freight sector faces challenges related to infrastructure limitations, regulatory hurdles, and modal competition. Congestion on shared passenger-freight lines has been a critical constraint in both developed and emerging markets. Inconsistent regulatory frameworks across countries have complicated cross-border movement, with customs clearance delays often undermining service reliability. Rail operators also face strong competition from trucking, which provides greater route flexibility and faster door-to-door service. Rising operational costs, including labor and maintenance, have further constrained profitability in certain corridors. Industry opinions point to a structural challenge: balancing infrastructure investment with returns, especially in regions with fluctuating freight volumes. Without streamlined interoperability and dedicated freight corridors, operators risk losing ground to more agile logistics alternatives. This limitation could hinder the sector’s ability to fully capitalize on emerging trade opportunities.

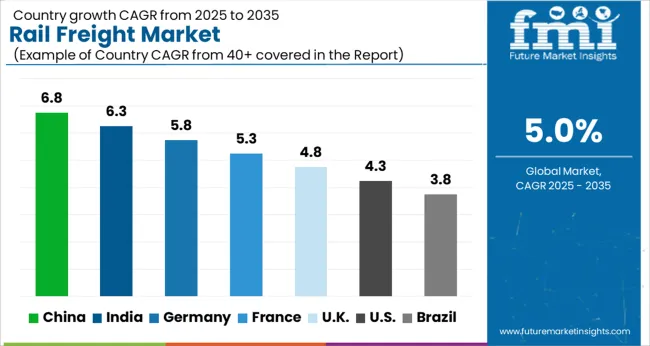

| Countries | CAGR |

|---|---|

| China | 6.8% |

| India | 6.3% |

| Germany | 5.8% |

| France | 5.3% |

| UK | 4.8% |

| USA | 4.3% |

| Brazil | 3.8% |

The global rail freight sector is projected to grow at a CAGR of 5% from 2025 to 2035, powered by increased trade flows, intermodal integration, and national investment programs. China is set to lead expansion at a CAGR of 6.8%, followed by India at 6.3% and Germany at 5.8%. The United Kingdom, with 4.8%, and the United States, with 4.3%, are expected to record slower but steady gains. Stronger growth in Asian markets is credited to large scale infrastructure programs, containerization, and government backed logistics corridors, while Western economies progress with efficiency driven upgrades and digital tracking systems. This report spans 40 plus countries, though the leading five are highlighted below.

Rail freight in China is projected to grow at a CAGR of 6.8%. Expansion is underpinned by Belt and Road corridors, domestic interprovincial cargo growth, and deeper integration of port and inland terminals. Double stack container trains and longer block train configurations are reshaping cost economics and boosting throughput. Government support for electrified lines, smart signaling, and logistics automation further strengthens competitiveness compared with trucking. Cold chain and e commerce delivery add new demand layers, ensuring freight volumes maintain momentum.

Rail freight in India is expected to expand at a CAGR of 6.3%. Growth is supported by Dedicated Freight Corridors (DFC), which shift cargo volumes from congested passenger dominated lines to high speed freight tracks. Mineral, cement, and containerized cargo benefit from reduced turnaround times and higher axle loads. State investment programs and private partnerships drive adoption of modern wagons, automated yards, and integrated logistics parks. Expansion of port connectivity further fuels growth, ensuring rail remains a viable option against road haulage.

Rail freight in Germany is forecast to grow at a CAGR of 5.8%. The network benefits from strong EU backed investment in cross border corridors such as TEN T and Rhine Alpine routes. Automotive, machinery, and chemical cargo dominate load profiles, while digital yard management and automated shunting improve network efficiency. Germany’s central role in European trade ensures steady freight flows, while green corridor projects enhance competitiveness over longer distances. Efficiency gains and regulatory pressure for modal shift sustain growth prospects.

Rail freight in the UK is projected to rise at a CAGR of 4.8%. Demand is driven by construction materials, intermodal container traffic, and energy supply movements. Growth is slower due to infrastructure bottlenecks and competition with road haulage, though terminal upgrades and digital tracking adoption improve efficiency. Policy direction supports carbon reduction targets, leading to renewed emphasis on rail over long haul trucking. Strategic ports such as Felixstowe and Southampton continue to anchor containerized volumes.

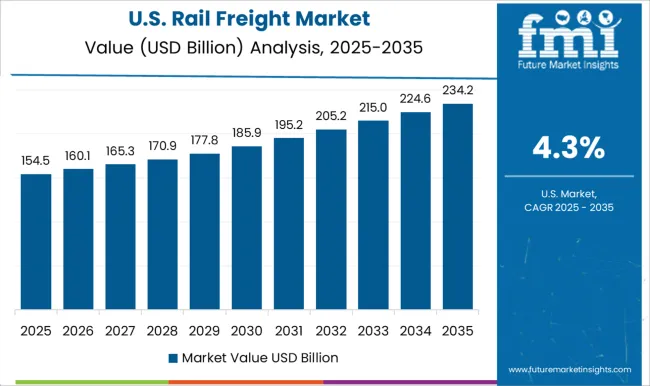

Rail freight in the US is expected to grow at a CAGR of 4.3%. Coal, agriculture, and intermodal shipments remain the backbone, with Class I operators focusing on network rationalization and service efficiency. Precision scheduled railroading continues to shape asset use and productivity, though capacity constraints in ports and yard congestion remain challenges. Investments in double track corridors, automated inspection, and smart sensors reinforce competitiveness over trucking. Growth remains steady, reflecting the maturity of freight networks but supported by new intermodal opportunities.

The rail freight market is characterized by a small number of large, vertically integrated incumbents and numerous niche or regional operators. Major players such as Union Pacific, BNSF, CSX, Norfolk Southern, DB Cargo, and Canadian National leverage their control over extensive track networks, terminal assets, and intermodal infrastructure. Their scale allows them to offer end-to-end logistics services, negotiate favorable regulatory conditions, and invest heavily in technology like predictive maintenance and digital scheduling systems.

Smaller carriers and logistics firms often compete by focusing on specialized corridors, providing last-mile connectivity, or linking under-served routes to hubs. Some act as rail haulers or forwarders without owning tracks, offering flexibility and lower capital burden. Differentiation increasingly hinges on transit speed, reliability, network coverage, and multimodal integration (road, rail, port). Environmental performance is emerging as a competitive axis, with operators investing in fuel-efficient locomotives, hybrid or electrified traction, and carbon tracking. Mergers and alliances continue to reshape market boundaries, giving stronger players broader reach and encouraging efficiency improvements across systems.

| Item | Value |

|---|---|

| Quantitative Units | USD 370.0 Billion |

| Cargo Type | Containerized, Non-containerized, and Liquid Bulk |

| Service Type | Full carload (FCL), Less than carload (LCL), and Intermodal transportation |

| Distance | Long-haul, Short haul, and Medium-haul |

| End-User Industry | Mining, Agriculture, Energy, Manufacturing, Construction, Retail, Automotive, Chemical, Food & beverages, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | BNSF Railway, Canadian National Railway, Canadian Pacific Railway, China Railway Corporation, CSX Corporation, Deutsche Bahn AG, DHL Group, Norfolk Southern Railway, SNCF Logistics, and Union Pacific Railroad |

| Additional Attributes | Dollar sales by freight type (intermodal, bulk, containerized, specialized cargo), Dollar sales by service type (domestic, cross-border, long-haul, last-mile rail-linked logistics), Trends in modal shift from road to rail and multimodal integration, Adoption of digital tracking and predictive maintenance in operations, Growth of e-commerce-driven cargo and temperature-controlled freight, Regional variations in rail infrastructure and regulatory frameworks. |

The global rail freight market is estimated to be valued at USD 370.0 billion in 2025.

The market size for the rail freight market is projected to reach USD 602.7 billion by 2035.

The rail freight market is expected to grow at a 5.0% CAGR between 2025 and 2035.

The key product types in rail freight market are containerized, non-containerized and liquid bulk.

In terms of service type, full carload (fcl) segment to command 52.4% share in the rail freight market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Rail Freight Digital Transformation Market Size and Share Forecast Outlook 2025 to 2035

Freight Railcar Repair Market Size and Share Forecast Outlook 2025 to 2035

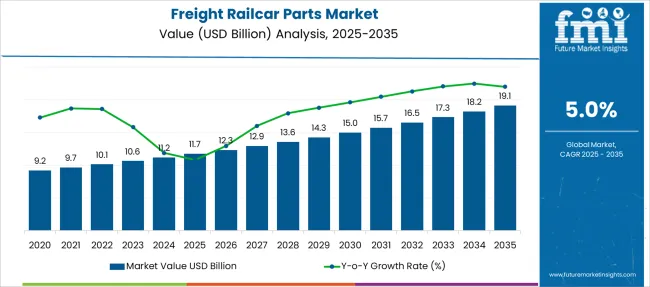

Freight Railcar Parts Market Size and Share Forecast Outlook 2025 to 2035

Railway Communication Equipment Market Size and Share Forecast Outlook 2025 to 2035

Railway Rolling Stock Market Forecast and Outlook 2025 to 2035

Railway System Market Size and Share Forecast Outlook 2025 to 2035

Railway Air Conditioning System Market Size and Share Forecast Outlook 2025 to 2035

Railway Braking System Market Size and Share Forecast Outlook 2025 to 2035

Rail Transit Vehicle Glass Market Size and Share Forecast Outlook 2025 to 2035

Railway CNC Wheel Lathe Market Size and Share Forecast Outlook 2025 to 2035

Rail System Dryer Market Size and Share Forecast Outlook 2025 to 2035

Railway Flatcar Market Size and Share Forecast Outlook 2025 to 2035

Railroad Market Size and Share Forecast Outlook 2025 to 2035

Rail Car Drying System Market Size and Share Forecast Outlook 2025 to 2035

Rail Gearbox Market Size and Share Forecast Outlook 2025 to 2035

Railway Roof Switches Market Size and Share Forecast Outlook 2025 to 2035

Rail Tank Cars Market Size and Share Forecast Outlook 2025 to 2035

Railway Window Market Size and Share Forecast Outlook 2025 to 2035

Railway Maintenance Machinery Market Size and Share Forecast Outlook 2025 to 2035

Rail Logistics Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA