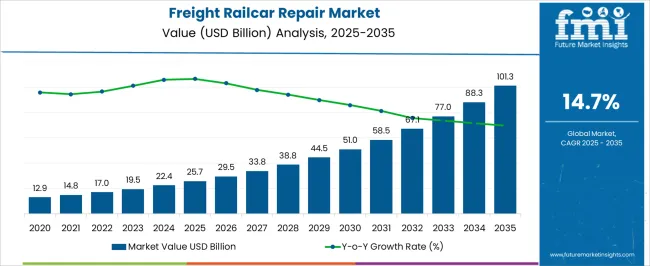

The freight railcar repair market is estimated to reach 25.7 billion dollars in 2025 and USD 101.3 billion in 2035, growing at a CAGR of 14.7%. During the early adoption phase from 2020 to 2024, demand was primarily driven by fleet operators conducting pilot repairs and preventive maintenance on limited railcar fleets. Entering the scaling phase in 2025, adoption expands as rail operators invest in larger-scale repair programs to reduce downtime and improve operational efficiency.

Service providers increase capacity, standardize repair processes, and expand regional presence. Growing freight volumes and aging rail infrastructure contribute to steady revenue growth, supporting broader adoption across North America, Europe, and Asia-Pacific. From 2030 to 2035, the market is expected to reach 101.3 billion dollars, maintaining a CAGR of 14.7%. In the consolidation phase, leading repair service providers strengthen market share through mergers, strategic alliances, and nationwide service networks. Smaller players either specialize in niche repairs or exit the market. Adoption stabilizes as most rail operators have established repair contracts.

Companies focus on process efficiency, cost optimization, and long-term service agreements. By 2035, the market will exhibit mature competition, predictable growth, and standardized repair protocols, creating a stable and well-established industry environment.

| Metric | Value |

|---|---|

| Freight Railcar Repair Market Estimated Value in (2025 E) | USD 25.7 billion |

| Freight Railcar Repair Market Forecast Value in (2035 F) | USD 101.3 billion |

| Forecast CAGR (2025 to 2035) | 14.7% |

The freight railcar repair market serves a diverse set of end users, each with distinct requirements. Large Class I railroads dominate, representing roughly 40% of demand, driven by extensive fleets requiring both scheduled preventive maintenance and major overhauls. Regional and shortline railroads contribute about 20%, relying on outsourced repair services to maintain older or smaller fleets efficiently. Private freight operators account for 15%, balancing in-house repair capabilities with third-party workshops to minimize downtime. Intermodal and container transport firms make up 10%, focusing on rapid turnaround for specialized container cars to ensure smooth supply chain operations. Mining and bulk commodity operators represent 8%, where heavy-duty railcars transporting coal, grain, or ores require frequent refurbishment.

Industrial logistics and railcar leasing companies collectively contribute 7%, emphasizing fleet reliability for leased or internal-use railcars. Government and military operations comprise the remaining 1–2%, handling specialized or armored railcars. Service types, including wheelset replacement, braking system repair, and structural refurbishment, significantly affect market share across segments.

Regional differences also influence adoption patterns, with North America and Europe accounting for a larger proportion due to higher freight volumes. Revenue grows from 12.9 billion dollars in 2020 to 25.7 billion in 2025 and is projected to reach 101.3 billion by 2035, reflecting a CAGR of 14.7%, driven by fleet modernization, increased freight traffic, and stricter regulatory maintenance standards.

The freight railcar repair market is experiencing steady expansion driven by the rising need to maintain operational efficiency, safety compliance, and asset longevity in the rail transport sector. Increasing freight volumes across industrial goods, energy products, and bulk commodities have intensified the demand for timely and high quality maintenance services.

Aging railcar fleets in key markets are further propelling repair and refurbishment activities, while regulatory mandates regarding safety inspections and component standards are ensuring consistent service requirements. Technological upgrades in diagnostic equipment and predictive maintenance systems are improving repair turnaround times and cost efficiency.

As rail operators continue to focus on minimizing downtime and extending asset life cycles, the market is expected to maintain positive growth momentum supported by both scheduled and demand driven repair services.

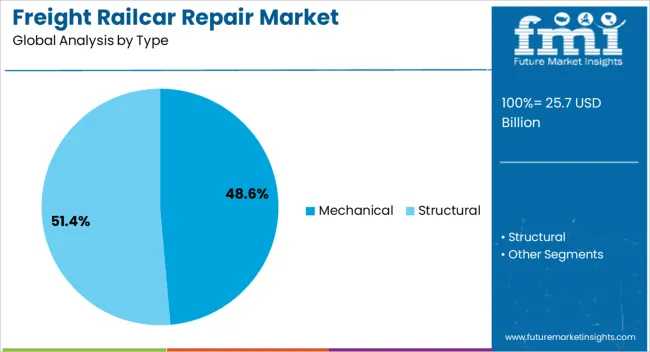

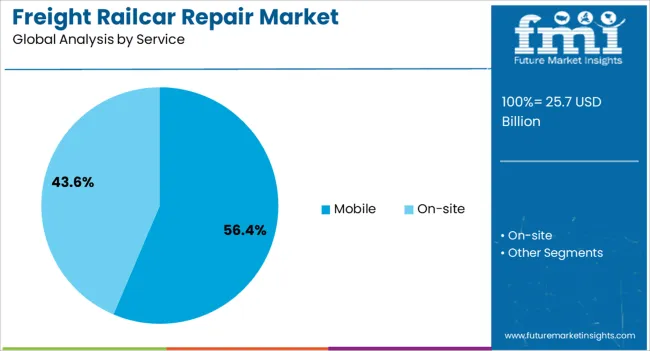

The freight railcar repair market is segmented by type, service, and geographic regions. By type, freight railcar repair market is divided into Mechanical, Structural, Interiors, and Other. In terms of service, freight railcar repair market is classified into Mobile and On-site. Regionally, the freight railcar repair industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The mechanical segment is anticipated to hold 48.60% of the total market revenue by 2025 within the type category, making it the leading segment. This dominance is driven by the necessity for regular inspection, maintenance, and replacement of critical railcar components such as brakes, couplers, and wheelsets to ensure operational safety.

Mechanical repairs are integral to meeting compliance requirements and preventing costly service disruptions. The segment’s growth is also supported by the increased complexity of railcar systems, which demands skilled labor and specialized tools.

As fleet sizes expand and operational intensity increases, mechanical repairs remain a core service ensuring reliability and regulatory adherence.

The mobile service segment is projected to account for 56.40% of total market revenue by 2025 within the service category, positioning it as the dominant service type. This growth is attributed to the operational benefits of on site repairs, which minimize downtime by eliminating the need to transport railcars to fixed repair facilities.

Mobile services enhance flexibility, improve scheduling efficiency, and reduce logistical costs for rail operators. Additionally, advances in mobile diagnostic and repair equipment have enabled service teams to address a broader range of issues directly in the field.

The convenience, speed, and cost savings associated with mobile repair solutions have solidified their position as the preferred choice for many rail operators, ensuring this segment’s sustained market leadership.

The freight railcar repair market is growing due to increasing freight traffic, aging rail fleets, and demand for safe, reliable rail transport. North America and Europe lead with advanced repair facilities, predictive maintenance, and high-quality replacement parts, while Asia-Pacific shows rapid growth driven by rail network expansion and industrial logistics. Manufacturers differentiate through rapid turnaround, modular repair systems, and mobile repair units. Regional variations in fleet age, maintenance standards, and regulatory oversight strongly influence adoption, operational efficiency, and competitiveness globally.

Aging freight rail fleets are a primary driver for railcar repair services. North America and Europe focus on scheduled overhauls, component replacement, and retrofitting of older railcars to meet safety and efficiency standards. Asia-Pacific markets face growth in railcar volumes, increasing demand for timely maintenance and repair to prevent operational downtime. Differences in fleet age, repair frequency, and operational intensity affect service demand and procurement cycles. Leading repair providers offer predictive maintenance, modular repair kits, and automated diagnostics, while regional operators deliver cost-effective, practical solutions. Fleet age and maintenance contrasts shape adoption, operational reliability, and competitive positioning in the global freight railcar repair market.

Strict safety standards and regulatory oversight strongly affect the freight railcar repair market. North America and Europe enforce stringent maintenance, inspection, and certification protocols to ensure operational safety and regulatory compliance. Asia-Pacific regulations vary; developed regions follow international norms, while emerging economies implement localized guidelines focusing on cost-effective compliance. Differences in regulatory rigor, inspection frequency, and certification requirements influence repair timelines, operational planning, and service adoption. Leading repair providers maintain compliance through certified processes, quality assurance, and standardized documentation, while regional operators focus on practical, regulation-aligned practices. Regulatory and safety contrasts shape adoption, operational assurance, and market competitiveness globally.

Integration of advanced technologies, such as predictive analytics, IoT sensors, and automated repair equipment, is transforming railcar maintenance and repair. North America and Europe adopt condition-based monitoring, robotic systems, and real-time diagnostics to reduce downtime and improve repair accuracy. Asia-Pacific markets emphasize scalable technology solutions compatible with high-volume operations and budget constraints. Differences in technological adoption affect repair quality, turnaround time, and cost-effectiveness. Leading service providers invest in IoT-enabled monitoring, advanced welding, and automated inspection systems, while regional operators rely on conventional methods optimized for efficiency. Technology integration contrasts shape adoption, operational performance, and competitiveness in the freight railcar repair market.

Timely access to spare parts, components, and specialized materials is critical for repair operations. North America and Europe maintain robust supply chains, ensuring quick availability of high-quality replacement parts for diverse freight railcar types. Asia-Pacific markets face longer lead times, variable quality, and dependence on regional suppliers for repair components. Differences in supply chain reliability, inventory management, and logistics affect repair turnaround, costs, and operational continuity. Leading providers invest in strategic sourcing, regional warehouses, and standardized parts, while regional operators optimize local procurement and maintenance schedules. Supply chain contrasts shape adoption, service efficiency, and competitive positioning in global freight railcar repair operations.

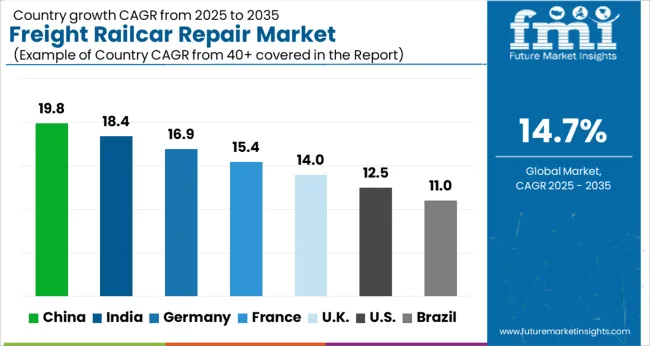

| Country | CAGR |

|---|---|

| China | 19.8% |

| India | 18.4% |

| Germany | 16.9% |

| France | 15.4% |

| UK | 14.0% |

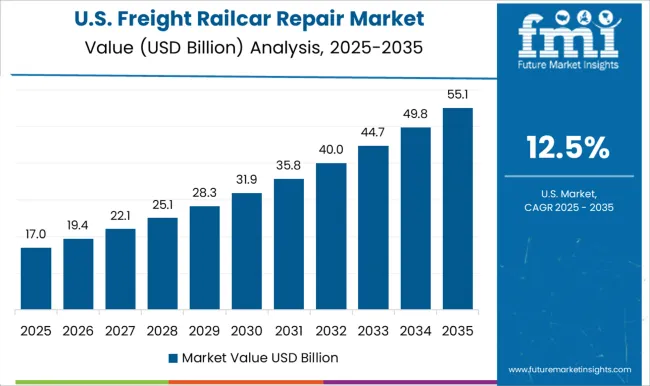

| USA | 12.5% |

| Brazil | 11.0% |

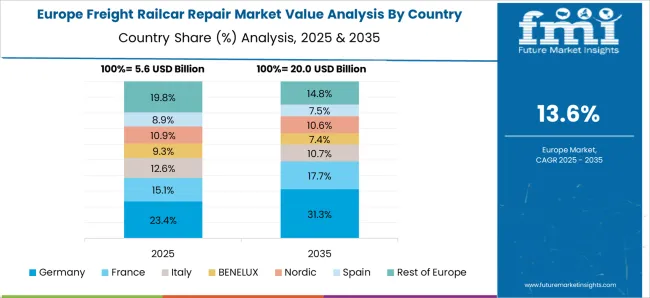

The global freight railcar repair market is projected to grow at a 14.7% CAGR through 2035, driven by demand in logistics, rail transport maintenance, and industrial shipping sectors. Among BRICS nations, China led with 19.8% growth as repair and maintenance facilities were commissioned and compliance with safety and operational standards was enforced, while India at 18.4% growth expanded service networks to meet increasing regional rail traffic. In the OECD region, Germany at 16.9% sustained output under stringent regulatory frameworks, while the United Kingdom at 14.0% operated moderate-scale repair units for commercial and freight applications. The USA, growing at 12.5%, supported steady maintenance demand across logistics and industrial transport, adhering to federal and state-level quality and safety regulations. This report includes insights on 40+ countries; the top five markets are shown here for reference.

The freight railcar repair market in China is projected to grow at a CAGR of 19.8% due to increasing rail freight volumes and the need for maintenance of expanding cargo networks. Adoption is being driven by repair services that ensure operational efficiency, extend railcar lifespan, and reduce downtime. Manufacturers and service providers are being encouraged to supply high quality, reliable, and cost effective repair solutions. Distribution through railway operators, authorized maintenance centers, and logistics companies is being strengthened. Research into advanced repair techniques, predictive maintenance, and component upgrades is being conducted. Expansion of industrial logistics, growing freight demand, and modernization of rail infrastructure are considered key factors supporting growth of the freight railcar repair market in China.

The freight railcar repair market in India is expected to grow at a CAGR of 18.4%, driven by rising cargo volumes and expansion of railway infrastructure. Adoption is being strengthened by repair services that ensure safety, operational efficiency, and longer railcar lifespans. Service providers are being encouraged to deliver cost effective, durable, and reliable solutions. Distribution through railway maintenance depots, authorized repair centers, and logistics operators is being expanded. Technical workshops and training programs are being conducted to improve repair quality and skills. Growth in freight transport, modernization of rail networks, and increased industrial activity are recognized as primary drivers of the freight railcar repair market in India.

Germany is experiencing growth in the freight railcar repair market at a CAGR of 16.9%, supported by high rail freight usage and strict maintenance standards. Adoption is being strengthened by repair services that improve safety, efficiency, and operational continuity. Service providers are being encouraged to supply high quality, technologically advanced, and reliable solutions. Distribution through railway operators, maintenance depots, and authorized service centers is being maintained. Research into predictive maintenance, component refurbishment, and faster repair techniques is being conducted. Rising freight volumes, regulatory compliance, and demand for efficient rail transport are considered key growth drivers for the freight railcar repair market in Germany.

The freight railcar repair market in the United Kingdom is expected to grow at a CAGR of 14.0%, supported by increasing rail freight activities and the need for timely maintenance. Adoption is being emphasized for services that extend railcar life, enhance operational reliability, and reduce downtime. Service providers are being encouraged to deliver cost effective, reliable, and durable solutions. Distribution through railway depots, logistics operators, and authorized repair centers is being strengthened. Awareness campaigns and technical training programs are being conducted to ensure quality maintenance. Expansion of freight networks, increased industrial shipments, and modernization of rail assets are recognized as key contributors to the freight railcar repair market in the United Kingdom.

The freight railcar repair market in the United States is projected to grow at a CAGR of 12.5%, driven by rising cargo transport and the need for effective railcar maintenance. Adoption is being supported by repair services that reduce operational downtime, extend railcar life, and ensure safety standards. Service providers are being encouraged to provide high quality, durable, and efficient repair solutions. Distribution through railway operators, authorized maintenance centers, and logistics companies is being maintained. Research in faster repair methods, predictive maintenance, and advanced refurbishment techniques is being conducted. Expansion of freight volumes, modernization of rail infrastructure, and increased industrial activity are considered key drivers of growth for the freight railcar repair market in the United States.

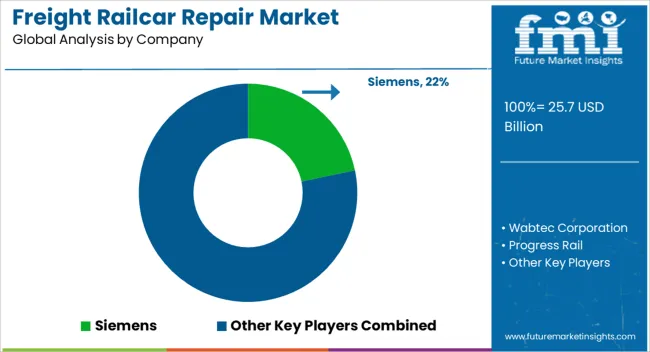

The freight railcar repair market has been experiencing steady growth due to the rising demand for freight transportation and the need to maintain the efficiency and longevity of railcar fleets worldwide. Key suppliers in this market, including Siemens, Wabtec Corporation, Progress Rail, Alstom, TTX, Union Tank Car Company (UTLX), Trinity Industries, Watco Companies, The Greenbrier Companies, and Cathcart Rail, have established themselves as leaders by providing comprehensive repair, refurbishment, and maintenance services. These companies cater to diverse types of freight railcars, including tank cars, hopper cars, flatcars, and boxcars, ensuring operational reliability, safety compliance, and reduced downtime for operators. Innovation and technological integration are central to the strategies of these leading suppliers. Companies are increasingly employing predictive maintenance techniques, automated inspection systems, and advanced diagnostics to enhance repair efficiency and minimize operational disruptions. Siemens and Wabtec Corporation, for example, leverage digital tools and IoT-enabled solutions to monitor railcar conditions in real time, allowing for timely intervention and reduced repair costs. Additionally, suppliers focus on providing customized solutions tailored to the specific requirements of railway operators, ranging from minor part replacements to complete structural refurbishments, ensuring prolonged asset life and adherence to stringent safety standards.

| Item | Value |

|---|---|

| Quantitative Units | USD 25.7 Billion |

| Type | Mechanical, Structural, Interiors, and Other |

| Service | Mobile and On-site |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Siemens, Wabtec Corporation, Progress Rail, Alstom, TTX, Union Tank Car Company (UTLX), Trinity Industries, Watco Companies, The Greenbrier Companies, and Cathcart Rail |

| Additional Attributes | Dollar sales vary by repair type, including wheelset repair, body repair, brake system maintenance, and coupling system repair; by railcar type, spanning boxcars, tank cars, flatcars, and hopper cars; by end-use, covering freight operators, logistics companies, and industrial shippers; by region, led by North America, Europe, and Asia-Pacific. Growth is driven by rising freight transport demand, aging railcar fleets, and emphasis on safety and operational efficiency. |

The global freight railcar repair market is estimated to be valued at USD 25.7 billion in 2025.

The market size for the freight railcar repair market is projected to reach USD 101.3 billion by 2035.

The freight railcar repair market is expected to grow at a 14.7% CAGR between 2025 and 2035.

The key product types in freight railcar repair market are mechanical, _brake systems, _couplers & draft gears, _bearings & axles, _wheels & wheelsets, _doors & hatches, _pneumatic systems, _others, structural, _body & frame repairs, _welding & metalwork, _corrosion prevention and repair, _roof, sides, and underbody repairs, _others, interiors, _flooring & subflooring, _interior lining & insulation, _lighting & electrical systems, _others and other.

In terms of service, mobile segment to command 56.4% share in the freight railcar repair market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Freight Transport Management Market Size and Share Forecast Outlook 2025 to 2035

Freight Trucking Market Size and Share Forecast Outlook 2025 to 2035

Freight Forwarding Software Market Size and Share Forecast Outlook 2025 to 2035

Freight Management Software Market Insights - Growth & Forecast through 2034

Freight Car Market

Freight Railcar Parts Market Size and Share Forecast Outlook 2025 to 2035

Air Freight Forwarding Market Size and Share Forecast Outlook 2025 to 2035

Air Freight Forwarding System Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Rail Freight Market Size and Share Forecast Outlook 2025 to 2035

Rail Freight Digital Transformation Market Size and Share Forecast Outlook 2025 to 2035

Ocean Freight Forwarding Market Size and Share Forecast Outlook 2025 to 2035

Digital Freight Matching Market Size and Share Forecast Outlook 2025 to 2035

Digital Freight Management Market Size and Share Forecast Outlook 2025 to 2035

International Freight Forwarding Market Size and Share Forecast Outlook 2025 to 2035

Railcar Unloader Market Growth – Trends & Forecast 2025 to 2035

DNA-Repair Enzymes Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Ship Repair and Maintenance Service Market Size and Share Forecast Outlook 2025 to 2035

Self-repairing Polymers Market Size and Share Forecast Outlook 2025 to 2035

Wall Repair Roller Paint Market Size and Share Forecast Outlook 2025 to 2035

Tire Repair Patch Market Analysis By Type, Application, and Region Through 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA