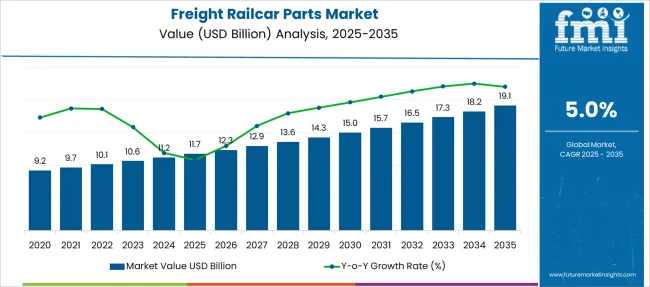

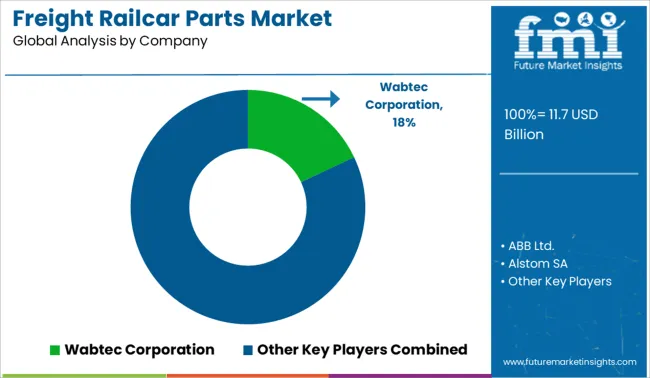

The Freight Railcar Parts Market is estimated to be valued at USD 11.7 billion in 2025 and is projected to reach USD 19.1 billion by 2035, registering a compound annual growth rate (CAGR) of 5.0% over the forecast period.

| Metric | Value |

|---|---|

| Freight Railcar Parts Market Estimated Value in (2025 E) | USD 11.7 billion |

| Freight Railcar Parts Market Forecast Value in (2035 F) | USD 19.1 billion |

| Forecast CAGR (2025 to 2035) | 5.0% |

The freight railcar parts market is advancing steadily as rail transportation remains a vital component of global logistics and supply chains. Increasing demand for efficient, durable, and cost-effective railcar components is driving the replacement and maintenance segments.

The transition toward modernized freight fleets and stricter safety regulations is further supporting growth. Industry stakeholders are focusing on enhancing component longevity and performance to reduce downtime and operational costs.

Future prospects are being shaped by investments in infrastructure upgrades, advancements in materials technology, and a rising emphasis on sustainable freight movement. Collaborative efforts between manufacturers, rail operators, and maintenance providers are fostering innovation in aftermarket services and product development, positioning the market for sustained expansion.

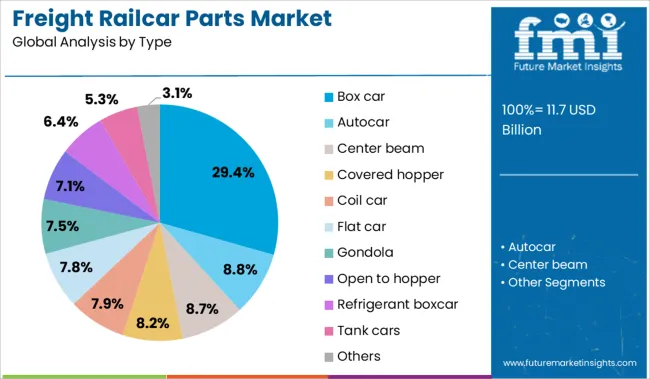

The market is segmented by Type, Component, and Distribution Channel and region. By Type, the market is divided into Box car, Autocar, Center beam, Covered hopper, Coil car, Flat car, Gondola, Open to hopper, Refrigerant boxcar, Tank cars, and Others.

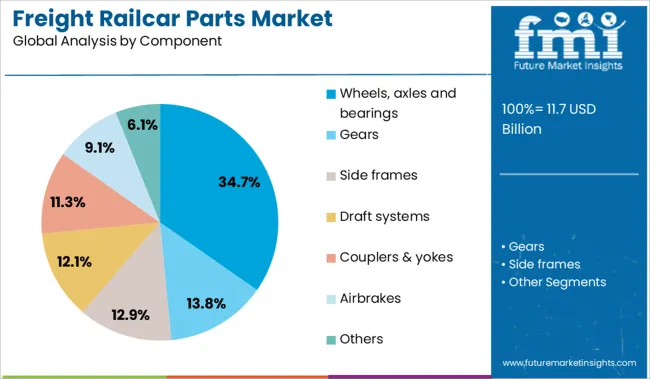

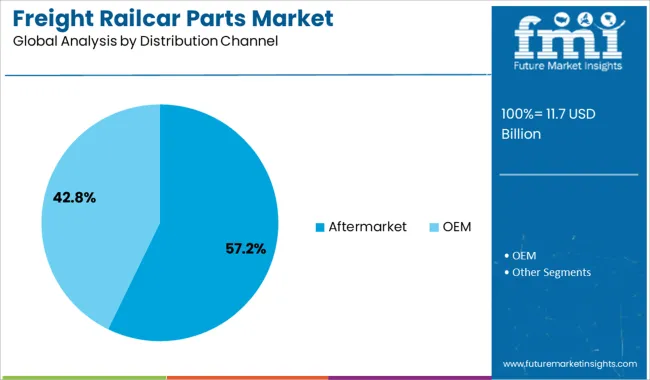

In terms of Component, the market is classified into Wheels, axles and bearings, Gears, Side frames, Draft systems, Couplers & yokes, Airbrakes, and Others. Based on Distribution Channel, the market is segmented into Aftermarket and OEM. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

When segmented by type, the box car segment is expected to hold 29.40% of the total market revenue in 2025, establishing itself as the leading type. This prominence is attributed to the versatility of box cars in transporting a wide variety of goods securely, which sustains high demand for parts servicing these railcars.

The robustness and adaptability of box cars necessitate frequent replacement of parts to maintain operational efficiency, driving continuous aftermarket activity.

Additionally, their widespread use across diverse industries supports a steady requirement for specialized components, reinforcing this segment’s dominant revenue share.

Segmenting by component, wheels axles and bearings are projected to account for 34.70% of the market revenue in 2025, securing the top position. The critical role these components play in ensuring safety, load-bearing capacity, and smooth operation has resulted in sustained investment in their maintenance and replacement.

Wear and tear due to constant use and exposure to harsh operating conditions necessitate frequent servicing.

The emphasis on minimizing downtime and improving railcar reliability has propelled the demand for high-quality wheels axles and bearings, consolidating their leadership within the component segment.

When segmented by distribution channel, the aftermarket segment is forecast to capture 57.20% of the market revenue in 2025, marking it as the leading channel. The dominance of aftermarket sales is driven by the need for ongoing maintenance and repair services across aging railcar fleets worldwide.

Operators prioritize timely availability of replacement parts to avoid operational disruptions and extend the service life of existing railcars. The aftermarket also benefits from the increasing focus on cost efficiency and inventory optimization among rail operators.

The established networks of distributors and service providers facilitate rapid parts availability and technical support, strengthening the aftermarket’s commanding revenue share.

Rising freight volumes, aging rail infrastructure, and logistics optimization spur demand for railcar parts. Opportunities include aftermarket services, digital parts tracking, local spare part manufacturing, and fleet modernization solutions.

The freight railcar parts market is expanding as rail operators seek to maintain reliable service amid increasing freight volumes. Aging railcar fleets require frequent replacement parts such as wheelsets, braking systems, couplings and suspension components to minimize delays and safety risks. Rail networks focus on maintenance strategies that reduce downtime, maintain operational schedules and support high load capacities. Parts that meet quality standards and support interoperability across railcar types are preferred by both public and private operators. Maintenance, repair and overhaul facilities are increasing their reliance on dependable suppliers as logistics demands grow. In markets experiencing expanding intermodal transport corridors, rail operators prioritize parts availability to sustain capacity and regulatory compliance.

Market opportunities include developing aftermarket service packages that bundle parts with installation support or predictive maintenance tools. Digital inventory systems using RFID or mobile apps help operators track part usage and automate reorders. Establishing localized spare parts production or distribution centers near major rail hubs reduces lead times and supply chain risk. Partnerships with railcar OEMs to offer retrofit or upgrade kits such as advanced braking modules or lightweight structural parts can extend fleet life affordably. In regions investing in rail corridor expansion and high-capacity transit, bundled modernization packages and training programs for maintenance staff create added value. Manufacturers offering modular parts, diagnostic accessories and responsive customer service stand to gain loyalty and repeat business.

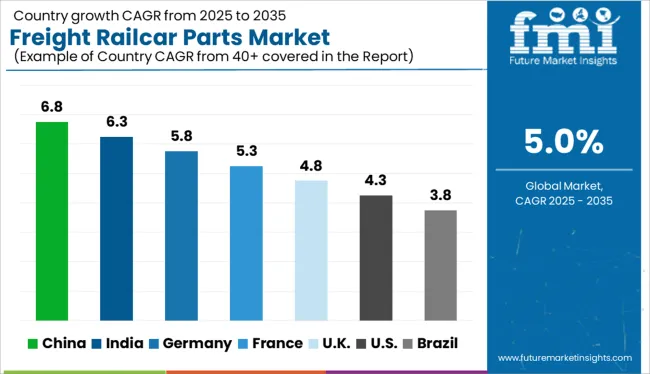

| Countries | CAGR |

|---|---|

| China | 6.8% |

| India | 6.3% |

| Germany | 5.8% |

| France | 5.3% |

| UK | 4.8% |

| USA | 4.3% |

| Brazil | 3.8% |

The global freight railcar parts market is expected to grow at a CAGR of 5.0% from 2025 to 2035, driven by rail network modernization, cross-border trade expansion, and advancements in component durability and safety. Among BRICS nations, China leads with a 6.8% CAGR, fueled by high-speed freight corridors, domestic manufacturing strength, and export-driven logistics. India follows at 6.3%, supported by public-private investment in freight corridors, wagon upgrades, and railway localization under Make in India. In the OECD region, Germany posts a 5.8% CAGR, reflecting rising maintenance needs and smart part integration in automated rail systems. The United Kingdom (4.8%) and the United States (4.3%) show steady growth driven by freight fleet refurbishment, green rail policies, and supply chain resilience. This report covers detailed analysis of 40+ countries, and the top five countries have been shared as a reference.

China is expected to maintain a leading position in the global freight railcar parts market with a CAGR of 6.8%, driven by expanding intermodal logistics and growing investments in heavy-haul freight corridors. The government's Belt and Road Initiative continues to fuel demand for railcar modernization, spare part efficiency, and longer lifecycle components. Urban-industrial corridors, especially between inland provinces and coastal ports, are prioritizing fleet upgrades with smart tracking and wear-resistant parts. Manufacturers are focusing on bulk commodity wagons, coil carriers, and brake assemblies for mineral and steel transport.

The Indian freight railcar parts market is forecast to grow at a CAGR of 6.3%, propelled by rail logistics reforms and strong demand from the steel, coal, and fertilizer sectors. The Dedicated Freight Corridor (DFC) project is increasing utilization of high-capacity wagons and driving demand for advanced bogie systems, couplers, and suspension assemblies. Private wagon operators are pushing for efficient and modular designs. Moreover, Indian Railways’ focus on transitioning from four-axle to six-axle designs is creating new avenues for specialized component manufacturers.

Germany is projected to witness a CAGR of 5.8% in the freight railcar parts sector, supported by its strong export economy and shift toward eco-friendly freight logistics. The national push to reduce highway congestion and carbon emissions is increasing rail freight utilization, especially for containerized goods. Maintenance outsourcing and lifecycle extension programs by rail operators are generating demand for precision-engineered parts such as brake pads, wheelsets, and draft gears. Investments in predictive maintenance and sensor-based diagnostics are reshaping the parts aftermarket.

The freight railcar parts market in the United Kingdom is set to grow at a CAGR of 4.8%, driven by post-Brexit logistics realignments and infrastructure upgrades in key freight corridors. Demand is rising for rail-compatible intermodal parts, especially for container wagons linking major ports and inland terminals. Fleet modernization programs by freight operating companies are increasing procurement of low-maintenance bogies, brake components, and coupler systems. Regulatory shifts toward reduced noise emissions and energy efficiency are encouraging the adoption of advanced part materials.

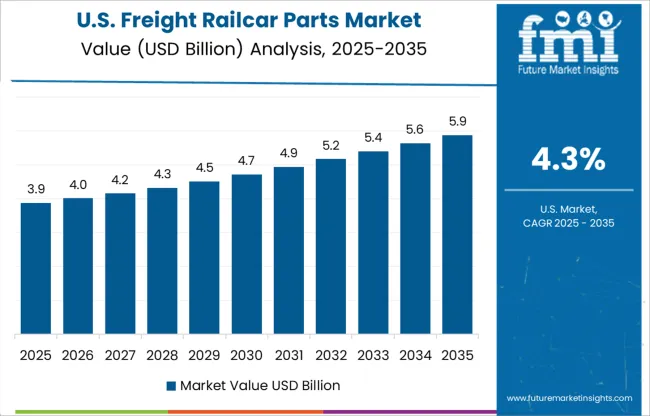

The United States is projected to expand its freight railcar parts market at a CAGR of 4.3%, with growth anchored in infrastructure revitalization and evolving fleet requirements across Class I railroads. Aging fleets, especially in bulk commodities and tank car segments, are undergoing lifecycle extensions that demand high-precision parts. The Energy Information Administration’s freight forecasts are influencing demand for tank car parts suited for LNG and oil transport. Automation in rail yard operations is also prompting investments in smart couplers and remote monitoring systems.

The freight railcar parts market is moderately consolidated, characterized by a mix of established OEMs and specialized suppliers focused on braking systems, couplers, wheelsets, and suspension components. Wabtec Corporation leads with an 18.0% market share, supported by its expansive aftermarket services, technological innovation in braking and control systems, and strong presence across North American freight networks. Tier 1 players such as Knorr-Bremse, Siemens Mobility, and Alstom offer integrated systems and digital solutions aimed at improving operational reliability and safety. Tier 2 suppliers like TrinityRail, Greenbrier Companies, and Progress Rail Services cater to specific segments including leasing, refurbishment, and fleet maintenance. Market growth is driven by rising investments in rail infrastructure, fleet modernization, and the need for enhanced supply chain efficiency.

| Item | Value |

|---|---|

| Quantitative Units | USD 11.7 Billion |

| Type | Box car, Autocar, Center beam, Covered hopper, Coil car, Flat car, Gondola, Open to hopper, Refrigerant boxcar, Tank cars, and Others |

| Component | Wheels, axles and bearings, Gears, Side frames, Draft systems, Couplers & yokes, Airbrakes, and Others |

| Distribution Channel | Aftermarket and OEM |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Wabtec Corporation, ABB Ltd., Alstom SA, Bombardier Transportation, CIMC Group Limited, Faiveley Transport, GATX Corporation, General Electric Company, Greenbrier Companies, Knorr-Bremse AG, Progress Rail Services Corporation, Siemens Mobility, TrinityRail, Union Tank Car Company, and Westinghouse Air Brake Technologies Corporation |

| Additional Attributes | Dollar sales by component type, railcar type, and maintenance cycle; regional demand driven by rail freight volumes, fleet modernization, and regulatory standards; innovation in lightweight materials, telematics integration, and wear-resistant components; cost dynamics affected by steel prices and aftermarket services; environmental impact of part remanufacturing and disposal; and emerging use cases in predictive maintenance and automated inspection systems. |

The global freight railcar parts market is estimated to be valued at USD 11.7 billion in 2025.

The market size for the freight railcar parts market is projected to reach USD 19.1 billion by 2035.

The freight railcar parts market is expected to grow at a 5.0% CAGR between 2025 and 2035.

The key product types in freight railcar parts market are box car, autocar, center beam, covered hopper, coil car, flat car, gondola, open to hopper, refrigerant boxcar, tank cars and others.

In terms of component, wheels, axles and bearings segment to command 34.7% share in the freight railcar parts market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Freight Transport Management Market Size and Share Forecast Outlook 2025 to 2035

Freight Trucking Market Size and Share Forecast Outlook 2025 to 2035

Freight Forwarding Software Market Size and Share Forecast Outlook 2025 to 2035

Freight Management Software Market Insights - Growth & Forecast through 2034

Freight Car Market

Freight Railcar Repair Market Size and Share Forecast Outlook 2025 to 2035

Air Freight Forwarding Market Size and Share Forecast Outlook 2025 to 2035

Air Freight Forwarding System Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Rail Freight Market Size and Share Forecast Outlook 2025 to 2035

Rail Freight Digital Transformation Market Size and Share Forecast Outlook 2025 to 2035

Ocean Freight Forwarding Market Size and Share Forecast Outlook 2025 to 2035

Digital Freight Matching Market Size and Share Forecast Outlook 2025 to 2035

Digital Freight Management Market Size and Share Forecast Outlook 2025 to 2035

International Freight Forwarding Market Size and Share Forecast Outlook 2025 to 2035

Railcar Unloader Market Growth – Trends & Forecast 2025 to 2035

Consumable Parts for Semiconductor Equipment Market Size and Share Forecast Outlook 2025 to 2035

Dishwashing Parts and Accessories Market - Efficient Cleaning Solutions 2025 to 2035

4X4 Vehicles Parts and Accessories Market Size and Share Forecast Outlook 2025 to 2035

Heated Shelving Parts and Accessories Market - Optimized Food Warmth 2025 to 2035

Transformer Spare Parts Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA