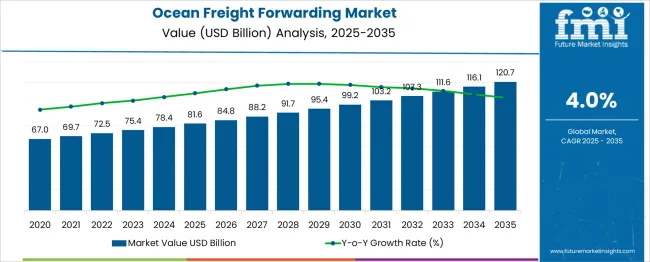

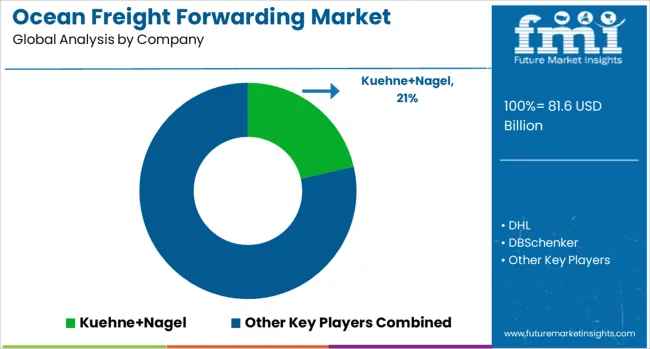

The Ocean Freight Forwarding Market is estimated to be valued at USD 81.6 billion in 2025 and is projected to reach USD 120.7 billion by 2035, registering a compound annual growth rate (CAGR) of 4.0% over the forecast period.

A five-year split analysis shows that the first phase (2025-2030) accounts for an increase from USD 81.6 billion to 99.2 billion, adding USD 17.6 billion, which represents approximately 45% of the total incremental gain.

This stage reflects stable growth influenced by recovery in global trade flows, container fleet optimization, and gradual digitization of freight operations. The second half (2030-2035) demonstrates an addition from USD 99.2 billion to 120.7 billion, contributing USD 21.5 billion, or roughly 55% of overall growth, signaling slightly stronger momentum as global supply chains become more integrated, supported by nearshoring and advanced freight visibility technologies.

The analysis indicates a balanced yet marginally back-loaded growth structure, with higher value creation expected in the later phase due to increasing trade volumes on emerging corridors and expanded use of digital freight platforms. This incremental pattern highlights strategic opportunities for logistics providers to invest in AI-based routing, automated documentation, and multimodal integration to capture share during both phases.

| Metric | Value |

|---|---|

| Ocean Freight Forwarding Market Estimated Value in (2025 E) | USD 81.6 billion |

| Ocean Freight Forwarding Market Forecast Value in (2035 F) | USD 120.7 billion |

| Forecast CAGR (2025 to 2035) | 4.0% |

The ocean freight forwarding market represents a critical segment across several large logistics and trade-related markets, though its share varies across parent categories. In the global freight and logistics market, ocean freight forwarding accounts for 18-20%, as maritime transport dominates global trade volumes by weight.

Within the maritime transportation market, its share is significant, at 25-28%, since freight forwarding forms a core service enabling cargo coordination and documentation. In the third-party logistics (3PL) services market, the contribution is estimated at 12-14%, given the inclusion of other modes such as air and road transport within this sector. For the international trade facilitation market, ocean freight forwarding represents 8-10%, as trade-related services also involve compliance, financing, and legal processes.

In the supply chain management market, its share is lower, at 4-5%, as SCM encompasses broader functions like inventory planning, procurement, and distribution. Despite these moderate shares, demand for ocean freight forwarding continues to grow due to rising global trade, containerization trends, and demand for integrated logistics solutions. Investments in digital freight platforms, predictive analytics, and blockchain-based documentation are also shaping this market, positioning ocean freight forwarding as an essential backbone for international supply chain efficiency.

The ocean freight forwarding market is experiencing sustained expansion, driven by the growing need for streamlined cross-border shipping solutions and the increasing complexity of global supply chains. As manufacturers and exporters seek to reduce costs and optimize transit time, the reliance on third-party logistics providers with digital capabilities and multimodal integration has intensified.

Advancements in maritime tracking, port digitization, and predictive analytics have enabled forwarders to offer real-time visibility, dynamic routing, and adaptive scheduling, enhancing operational resilience. Environmental regulations and sustainability goals are also prompting shifts toward consolidated shipments and fuel-efficient maritime practices, reshaping service models in ocean forwarding.

Strategic partnerships among shipping lines, freight brokers, and technology providers are further reinforcing the sector’s ability to manage rising e-commerce volumes and geopolitical trade disruptions. With capacity constraints and rate volatility influencing decisions, the role of ocean freight forwarders is evolving from transactional agents to strategic logistics partners, positioning the market for continued growth in both developed and emerging economies.

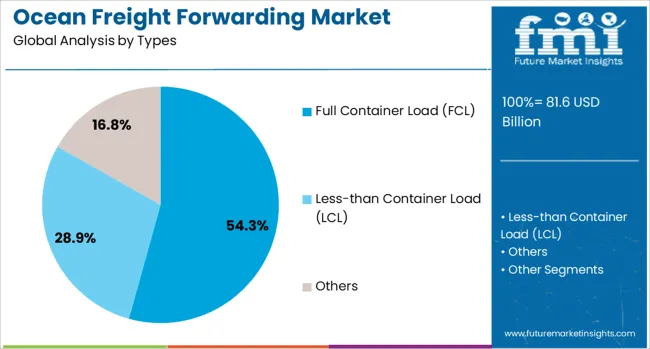

The ocean freight forwarding market is segmented by types, services, end users, and geographic regions. The ocean freight forwarding market is divided into Full Container Load (FCL), Less-than-Container Load (LCL), and Others.

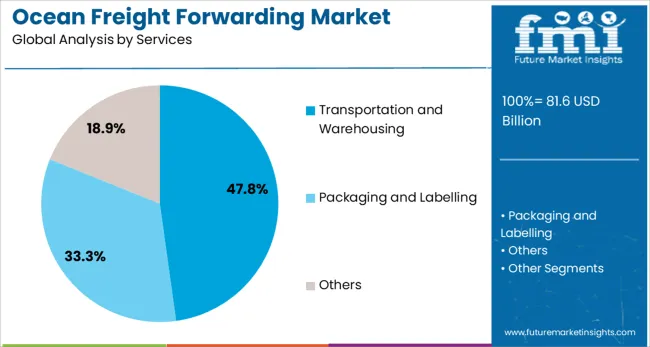

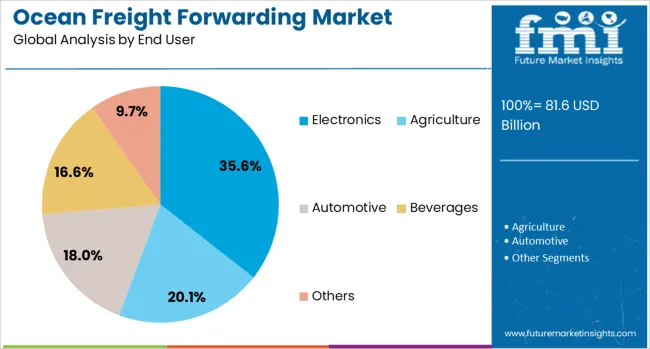

The ocean freight forwarding market is classified into Transportation and Warehousing, Packaging and Labelling, and Others. The end users of the ocean freight forwarding market are segmented into Electronics, Agriculture, Automotive, Beverages, and Others. Regionally, the ocean freight forwarding industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The full container load segment is expected to account for 54.3% of the revenue share in the ocean freight forwarding market in 2025, maintaining its position as the leading shipment type. This dominance is being driven by the cost advantages, shipment security, and operational efficiency associated with FCL services. As global trade routes become more containerized, FCL is increasingly favored for high-volume and high-value cargo that requires minimal handling and reduced transit risk.

The segment's growth is being reinforced by automation in container ports, digital booking platforms, and end-to-end tracking capabilities that provide greater control to shippers. FCL services have also benefited from carrier alliances and stable sailing schedules, enabling predictable lead times across major trade corridors.

The ability to optimize container space without cross-contamination or delays linked to shared cargo has further supported adoption. With increased emphasis on reliable delivery, streamlined documentation, and real-time container visibility, FCL continues to play a pivotal role in shaping efficient ocean freight operations.

Transportation and warehousing services are projected to hold 47.8% of the revenue share in the ocean freight forwarding market in 2025, reflecting their critical importance in the value-added service chain. This segment’s strength is being driven by the need for integrated end-to-end logistics that connect port operations with inland distribution hubs.

As businesses seek greater efficiency and cost control, forwarders are increasingly offering bundled services that include last-mile connectivity, cross-docking, inventory storage, and customs clearance. The growth of this segment is further influenced by rising demand for real-time inventory visibility, digital warehouse management systems, and multimodal transit coordination.

Technological advancements in fleet tracking, cold chain monitoring, and automated storage solutions have enabled service providers to scale operations while ensuring regulatory compliance and cargo integrity. With customer expectations shifting toward single-window logistics solutions, transportation and warehousing have become key differentiators for ocean freight forwarders aiming to deliver agility, transparency, and reliability across the supply chain.

The electronics end user segment is anticipated to contribute 35.6% of the total revenue share in the ocean freight forwarding market in 2025, marking it as the most prominent industry vertical. This dominance is being fueled by the high volume of electronic components and finished goods shipped globally through maritime routes, particularly between manufacturing hubs in Asia and consumption centers in North America and Europe.

The time-sensitive and high-value nature of electronic cargo has elevated the need for secure, traceable, and damage-minimized shipping options, which are efficiently met by ocean freight forwarders offering specialized containerization and controlled handling environments. The segment's growth is further influenced by global demand for semiconductors, consumer electronics, and industrial equipment, driving consistent freight flows.

Additionally, advancements in digital documentation, customs automation, and cargo insurance solutions have enhanced service reliability for electronics manufacturers and distributors. With increasing product miniaturization and globalization of supply chains, the electronics sector continues to leverage ocean forwarding as a cost-effective, scalable, and resilient transportation solution.

Ocean freight forwarding is essential for efficient global cargo movement, ensuring cost control and reliable delivery across major trade routes. Demand has grown for services offering real-time tracking, automated booking, and integrated customs clearance. Digital platforms providing visibility and multimodal connectivity have strengthened operational efficiency and risk management. Rising containerized trade and complex regulatory frameworks have increased the need for forwarders with strong compliance capabilities. Providers delivering optimized routing and scalable logistics solutions are positioned to capture greater market share in a competitive shipping environment.

Ocean freight forwarding is driven by increasing demand for reliable long-haul cargo movement between global trade hubs. Services with integrated port-to-door logistics coordination and advanced real-time tracking have been prioritized by exporters and importers seeking transparency across the supply chain. Forwarders offering end-to-end customs clearance support and seamless connectivity to inland transportation are being preferred for route optimization and capacity planning. Digital platforms capable of multimodal booking, vessel ETA alerts, and shipment status dashboards have enhanced visibility. This drive has been supported by demand for efficient routing in response to volatile ocean freight rates and capacity congestion around major ports. As shippers prioritize visibility, speed and compliance reliability, freight forwarders offering enhanced service orchestration are capturing growing volume flows.

Operations have been challenged by inconsistent customs regulations and screening procedures across countries which increase documentation lead times and clearance unpredictability. Port congestion at major hubs has led to vessel delays and rescheduling issues, disrupting established shipping windows. Contract complexity related to demurrage, detention charges and carrier liability terms has increased operational risk for forwarders and shippers. Data fragmentation caused by disparate terminal operating systems and lack of standardized tracking feeds has limited real-time visibility across stakeholders. Smaller forwarders have faced difficulty securing volume-based carrier contracts and negotiating competitive rates due to shifting capacity capacity and service prioritization. As global trade routes continue to evolve, consolidation and digital standard adoption have become essential to overcome inefficiencies and service delays.

Opportunities have been created through large-scale port modernization projects and the expansion of deep-water terminals in emerging economies. Increased containerization of bulk goods has driven demand for optimized forwarding solutions. Growing reliance on ocean freight for cost efficiency in long-distance trade has encouraged the development of specialized services for high-value and oversized cargo. Value-added offerings such as automated documentation, customs brokerage, and cargo insurance are being introduced to strengthen customer loyalty and revenue streams. Integration of freight forwarding with warehouse management and inland transport is unlocking prospects for end-to-end logistics solutions. Investments in digital freight platforms offering predictive pricing and route visibility are further improving market competitiveness and customer retention.

Industry trends show accelerated adoption of AI-based platforms for dynamic route planning and cost optimization, enabling enhanced operational efficiency. Blockchain technology is being implemented to improve transparency and security in documentation processes. Increased deployment of IoT-enabled containers for real-time condition monitoring has become a standard in high-value cargo shipping. Regional trade dynamics are shifting as nearshoring initiatives and bilateral agreements create alternative trade corridors. Consolidation among freight forwarders and strategic alliances with shipping carriers are reshaping competitive landscapes. Autonomous vessel trials and automation in port operations are expected to reduce turnaround times and improve reliability. Digital freight marketplaces are gaining traction as demand for faster booking and tracking solutions rises globally.

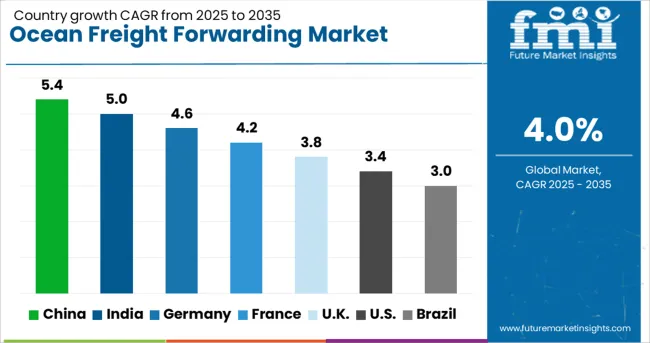

| Country | CAGR |

|---|---|

| China | 5.4% |

| India | 5.0% |

| Germany | 4.6% |

| France | 4.2% |

| UK | 3.8% |

| USA | 3.4% |

| Brazil | 3.0% |

The global ocean freight forwarding market is projected to grow at a 4.0% CAGR between 2025 and 2035, fueled by expanding global trade volumes, containerization, and digital logistics platforms. China leads with 5.4%, supported by major port infrastructure and integrated shipping hubs. India follows at 5.0%, leveraging trade facilitation programs and growing containerized exports.

Germany posts 4.6%, benefiting from advanced multimodal networks and rising demand for cross-border e-commerce freight solutions. France records 4.2%, focusing on port digitization and inland waterway connectivity. The UK grows at 3.8%, with investment in customs automation and trade corridors post-Brexit. The report includes analysis of 40+ countries, with five profiled below.

China is forecast to grow at 5.4% CAGR, driven by dominance in global maritime trade and expansion of port infrastructure. Major shipping gateways like Shanghai, Ningbo, and Shenzhen continue to handle the world’s largest container throughput, reinforcing China’s position as a freight forwarding hub. Integration of automated port systems, AI-enabled route optimization, and blockchain-based trade platforms enhances operational efficiency.

Forwarders are introducing value-added services such as bonded warehousing and temperature-controlled cargo handling to cater to pharmaceutical and food sectors. Strategic partnerships with shipping alliances strengthen competitive positioning in long-haul trade routes, particularly Asia-Europe and trans-Pacific corridors.

India is projected to expand at a 5.0% CAGR, supported by trade growth in textiles, chemicals, and automotive components. Government initiatives such as Sagarmala and Gati Shakti drive the modernization of ports and improve connectivity to industrial clusters. Rising export volumes of agricultural produce and processed foods increase demand for reefer container services. Freight forwarders are adopting digital booking platforms and offering door-to-port logistics solutions to streamline operations for SMEs. Partnerships with global carriers ensure capacity availability on high-demand trade lanes, including India-Europe and Middle East routes.

Germany is set to grow at 4.6% CAGR, benefiting from its role as a key logistics hub within Europe. Ports like Hamburg and Bremerhaven serve as major gateways for trade with Asia and North America. Adoption of IoT-based cargo tracking and automated customs clearance enhances transparency and efficiency.

Freight forwarders are offering integrated multimodal services that combine ocean shipping with rail and road transport for inland distribution. Increased demand from automotive and machinery sectors strengthens containerized freight volumes. Sustainability-linked investments in low-emission vessels and green fuel corridors are reshaping future operational models.

France is expected to grow at 4.2% CAGR, driven by expansion of its maritime trade routes and strategic investments in port digitalization. Ports such as Le Havre and Marseille are implementing smart cargo handling systems and blockchain-based documentation for enhanced trade compliance.

Freight forwarders focus on temperature-controlled cargo services to support pharmaceutical and wine exports. Collaborative projects under European logistics corridors strengthen connectivity to Central and Eastern Europe. Digital freight platforms are accelerating adoption among SMEs for simplified booking and real-time tracking.

The UK is projected to register a 3.8% CAGR, influenced by post-Brexit trade adjustments and customs automation initiatives. Ports such as Felixstowe and Southampton are upgrading digital clearance systems to manage higher documentation loads efficiently. Freight forwarders are expanding service portfolios with e-commerce-focused ocean shipping solutions, including LCL consolidation and last-mile integration.

Strong trade links with North America and Asia-Pacific sustain container throughput, while renewable energy projects increase demand for specialized breakbulk cargo services. Advanced visibility platforms and AI-based demand forecasting enhance operational agility in volatile trade environments.

The ocean freight forwarding market is highly competitive, dominated by global logistics leaders such as Kuehne+Nagel, DHL, DB Schenker, DSV A/S, Expeditors International, GEODIS, and Sinotrans, each leveraging extensive global networks, advanced digital platforms, and integrated supply chain solutions to capture market share.

The industry operates under a moderately consolidated structure with high entry barriers due to the need for international compliance, carrier partnerships, and digital freight management capabilities. Buyer power remains significant as large shippers demand competitive pricing and visibility, while supplier power, primarily from ocean carriers, is also strong given vessel capacity constraints.

Substitution risk is minimal, with air freight being an alternative only for time-sensitive cargo, which remains cost-prohibitive for most shipments. Competitive differentiation is driven by digitalization, real-time visibility tools, sustainability compliance, and value-added services such as customs clearance and inventory management. Kuehne+Nagel and DHL maintain leadership through robust technology integration, offering predictive analytics, carbon-neutral freight options, and strategic partnerships with major shipping lines.

DB Schenker and GEODIS focus on end-to-end solutions for diversified industries, while DSV A/S and Expeditors International emphasize efficiency through process automation and global consolidation services. Sinotrans strengthens its position in the Asia-Pacific region by leveraging strong regional infrastructure and partnerships.

Industry rivalry remains intense due to price sensitivity, volatile fuel costs, and regulatory pressures on emissions reduction. Future competition will hinge on AI-driven freight optimization, blockchain-enabled documentation, and expansion in emerging markets, with performance benchmarks centered on service reliability, lead time reduction, and carbon footprint minimization.

In September 2024, DSV A/S announced its acquisition of DB Schenker in a €14.3 billion (USD 15.8 billion) deal, marking one of the largest transactions in the logistics sector. The merger positions DSV among the world’s leading freight forwarding and supply chain service providers, significantly expanding its global ocean and air freight network.

| Item | Value |

|---|---|

| Quantitative Units | USD 81.6 Billion |

| Types | Full Container Load (FCL), Less-than Container Load (LCL), and Others |

| Services | Transportation and Warehousing, Packaging and Labelling, and Others |

| End User | Electronics, Agriculture, Automotive, Beverages, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Kuehne+Nagel, DHL, DBSchenker, GEODIS, Sinotrans, DSV A/S, and ExpeditorsInternational |

| Additional Attributes | Dollar sales by service type (full container load, less than container load, breakbulk) and end-use (automotive, retail, industrial), with demand driven by global trade recovery and e-commerce growth. Asia-Pacific dominates due to manufacturing exports, while North America and Europe focus on technology-enabled freight solutions. Innovations include blockchain-based documentation, real-time shipment tracking, and carbon-neutral freight programs. |

The global ocean freight forwarding market is estimated to be valued at USD 81.6 billion in 2025.

The market size for the ocean freight forwarding market is projected to reach USD 120.7 billion by 2035.

The ocean freight forwarding market is expected to grow at a 4.0% CAGR between 2025 and 2035.

The key product types in ocean freight forwarding market are full container load (fcl), less-than container load (lcl) and others.

In terms of services, transportation and warehousing segment to command 47.8% share in the ocean freight forwarding market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Oceania Digital Textile Printer Market Size and Share Forecast Outlook 2025 to 2035

Oceania Commercial Ice Machine Market Insights – Growth & Demand Forecast 2025 to 2035

Recycled Ocean Plastic Packaging Market Size and Share Forecast Outlook 2025 to 2035

Freight Management Software Market Size and Share Forecast Outlook 2025 to 2035

Freight Transport Management Market Size and Share Forecast Outlook 2025 to 2035

Freight Railcar Repair Market Size and Share Forecast Outlook 2025 to 2035

Freight Trucking Market Size and Share Forecast Outlook 2025 to 2035

Freight Railcar Parts Market Size and Share Forecast Outlook 2025 to 2035

Freight Car Market

Freight Forwarding Software Market Size and Share Forecast Outlook 2025 to 2035

Air Freight Forwarding Market Size and Share Forecast Outlook 2025 to 2035

Air Freight Forwarding System Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Rail Freight Market Size and Share Forecast Outlook 2025 to 2035

Rail Freight Digital Transformation Market Size and Share Forecast Outlook 2025 to 2035

Digital Freight Matching Market Size and Share Forecast Outlook 2025 to 2035

Digital Freight Management Market Size and Share Forecast Outlook 2025 to 2035

International Freight Forwarding Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA