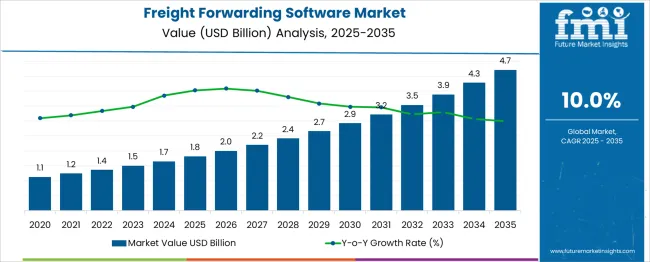

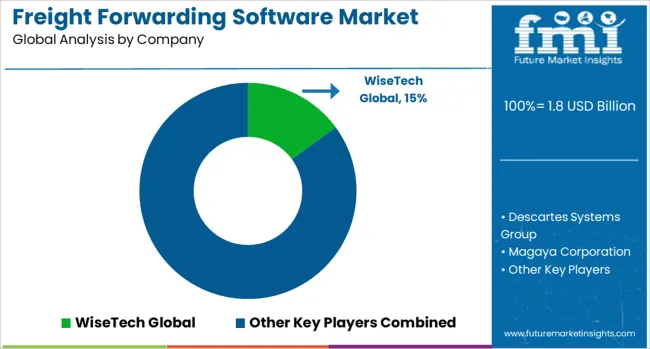

The Freight Forwarding Software Market is estimated to be valued at USD 1.8 billion in 2025 and is projected to reach USD 4.7 billion by 2035, registering a compound annual growth rate (CAGR) of 10.0% over the forecast period. The freight forwarding software market is projected to exhibit strong elasticity to macroeconomic indicators, particularly global trade volumes, logistics infrastructure investment, and technology adoption rates. A 1% increase in global trade activity can translate into an estimated 1.3–1.5% growth in freight software demand, as digitalization becomes critical to handle rising shipment complexities.

Periods of robust GDP growth in major trading economies (e.g., the USA, China, and the EU) directly enhance cross-border freight activity, driving the adoption of cloud-based and AI-powered freight management platforms. Conversely, economic downturns or trade restrictions can temporarily suppress demand; however, the need for cost optimization and route efficiency during such times often sustains software investments, indicating a relatively inelastic baseline demand.

Fuel price volatility, port congestion, and global supply chain disruptions such as those seen during the COVID-19 pandemic act as accelerators for automation adoption, boosting elasticity during operational crises. ESG-driven policies and carbon reporting requirements in logistics are expected to add regulatory elasticity, compelling faster adoption. Growth elasticity remains positively correlated with trade expansion and resiliency strategies, making this market responsive yet resilient across economic cycles.

| Metric | Value |

|---|---|

| Freight Forwarding Software Market Estimated Value in (2025 E) | USD 1.8 billion |

| Freight Forwarding Software Market Forecast Value in (2035 F) | USD 4.7 billion |

| Forecast CAGR (2025 to 2035) | 10.0% |

The Freight Forwarding Software market is undergoing accelerated transformation as global trade complexities and logistics digitization continue to intensify. A growing emphasis on real-time visibility, automation of freight processes, and centralized data management is reshaping the operational priorities of logistics service providers. Cloud-native software platforms are increasingly being adopted to support scalable, on-demand, and cost-efficient freight operations, which aligns with the industry's shift toward more agile, integrated supply chains.

Rising cross-border trade volumes and evolving compliance mandates are also encouraging the implementation of robust freight management systems. The integration of AI and machine learning into these platforms is enhancing predictive analytics, optimizing route planning, and reducing manual errors.

As businesses pursue end-to-end logistics transparency, the demand for deployment models and applications that offer both adaptability and intelligence is expected to increase. With heightened competition, freight forwarders are adopting advanced software to differentiate their services, reduce costs, and improve customer satisfaction, thereby reinforcing sustained market expansion..

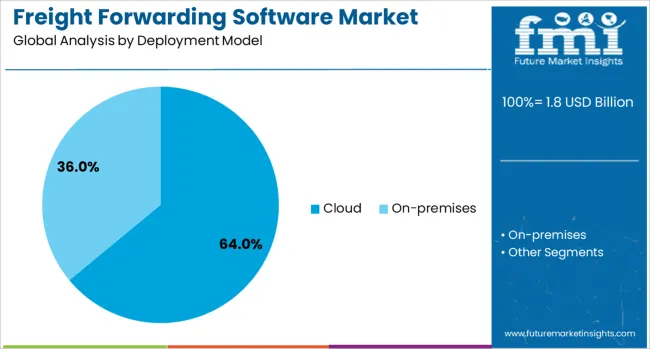

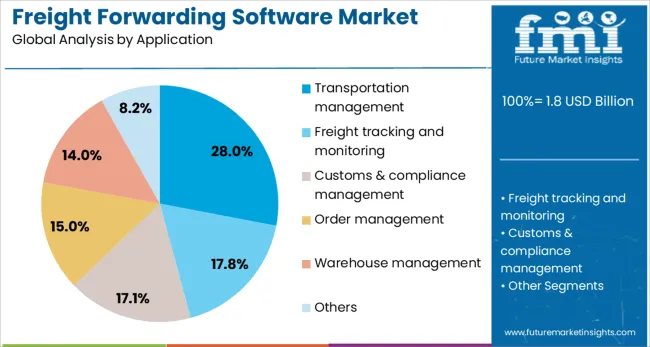

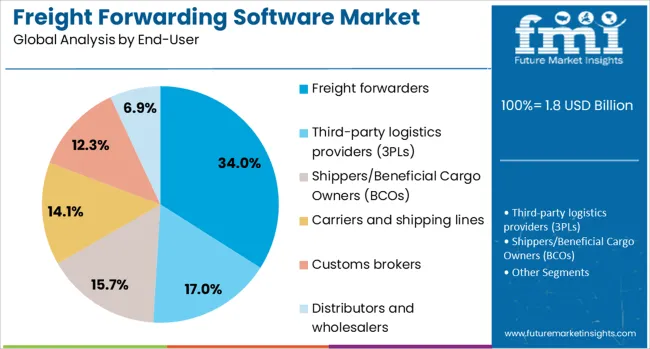

The freight forwarding software market is segmented by deployment model, application, end-user industry vertical, and geographic regions. The deployment model of the freight forwarding software market is divided into Cloud and on-premises. In terms of application, the freight forwarding software market is classified into Transportation management, Freight tracking and monitoring, Customs & compliance management, Order management, Warehouse management, and others. The end-users of the freight forwarding software market are segmented into Freight forwarders, Third-party logistics providers (3PLs), Shippers/Beneficial Cargo Owners (BCOs), Carriers and shipping lines, Customs brokers, Distributors and wholesalers. The industry vertical of the freight forwarding software market is segmented into Retail and e-commerce, Manufacturing, Oil & gas, Healthcare, Automotive, Food & beverage, and others. Regionally, the freight forwarding software industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The cloud deployment model segment is projected to hold 64% of the Freight Forwarding Software market revenue share in 2025, making it the leading model. This growth has been supported by increasing demand for flexible, cost-effective logistics software that can be accessed remotely and scaled with minimal infrastructure investment. Cloud platforms have enabled real-time collaboration, centralized data access, and seamless updates across dispersed operations.

Freight companies have shown a clear preference for cloud-based systems due to their ease of integration with third-party APIs and transportation management platforms. Enhanced data security, reduced maintenance burden, and rapid onboarding capabilities have further driven cloud adoption across both small and large logistics firms.

The ability to manage dynamic freight operations through mobile and web-based interfaces has strengthened operational responsiveness. Additionally, the low upfront capital requirement and predictable subscription-based pricing of cloud solutions have made them financially viable for organizations aiming to modernize their freight operations without long-term hardware commitments..

The transportation management application segment is expected to contribute 28% of the Freight Forwarding Software market revenue share in 2025, positioning it as the leading application. Its prominence has been driven by the growing need to optimize multi-modal transportation flows and manage complex shipping schedules across international and domestic supply chains. Software-defined transportation management systems have enabled better control over freight rates, carrier selection, route optimization, and performance tracking.

The adoption of such systems has been accelerated by rising fuel costs, capacity constraints, and increasing demand for last-mile delivery efficiency. The integration of advanced analytics and automated workflows into transportation modules has reduced operational bottlenecks and enhanced real-time decision-making.

Freight forwarders and logistics companies have relied on these solutions to ensure cost-effective, timely, and transparent freight movement. Regulatory pressures and the need for comprehensive documentation have also contributed to the growing utilization of transportation management functionalities within freight forwarding platforms..

The freight forwarders segment is projected to account for 34% of the Freight Forwarding Software market revenue share in 2025, making it the dominant end-user group. This growth has been influenced by the increasing need for freight intermediaries to streamline operations, reduce manual intervention, and improve coordination across carriers and shippers.

As intermediaries responsible for handling customs documentation, cargo tracking, and transportation arrangements, freight forwarders have turned to advanced software solutions for greater process control and efficiency. The capability to manage end-to-end shipments, automate invoicing, and access real-time visibility tools has enabled forwarders to enhance customer service and remain competitive in a digitizing logistics environment.

Additionally, the growing complexity of international trade and heightened customer expectations have necessitated the use of software that allows fast adaptation to changing logistics regulations and market dynamics. This segment’s leadership has been further supported by its pivotal role in global supply chains and its early adoption of digital freight technologies..

The freight forwarding software market is growing as logistics providers seek efficient tools to manage global shipments, documentation, and compliance. These platforms integrate functions such as booking, tracking, billing, and customs management into a centralized system. Cloud-based solutions are gaining popularity due to scalability and remote accessibility. Demand is supported by increasing cross-border trade and the need for real-time visibility. While integration with legacy systems and regulatory variations remain challenges, vendors offering user-friendly, customizable, and secure platforms are positioned for strong adoption.

Global supply chain complexities have made transparency a top priority for freight forwarders. Businesses require up-to-date information on cargo status to manage customer expectations, optimize delivery timelines, and respond quickly to disruptions. Freight forwarding software with real-time tracking capabilities allows operators to monitor shipments across multiple transport modes and regions from a single interface. This visibility not only improves operational efficiency but also strengthens client relationships by enabling proactive communication about potential delays. Real-time data sharing is becoming particularly important in sectors such as pharmaceuticals, perishable goods, and high-value commodities where timing and condition monitoring are critical. Platforms that integrate GPS tracking, IoT sensors, and automated alerts provide competitive advantages to logistics firms. As customers increasingly expect transparent updates, freight forwarders are adopting advanced tracking features as a standard service offering, driving greater investment in software with robust visibility tools.

Freight forwarding operations often involve multiple software systems for warehousing, customs clearance, accounting, and transportation management. Integrating new freight forwarding software with these existing tools can be complex due to differences in data formats, communication protocols, and process flows. Many small and mid-sized forwarders still rely on manual processes or legacy systems that lack compatibility with modern platforms. This creates delays in implementation and can reduce the return on investment if integration is incomplete. Vendors addressing this challenge by offering flexible APIs, pre-built connectors, and dedicated onboarding support can reduce friction for clients. A key factor in successful adoption is the ability of the software to synchronize data across multiple departments and external partners without duplication or errors. Streamlining integration not only saves time but also enables a more holistic view of operations, which is essential for decision-making and efficiency in a competitive logistics environment.

Cloud-based freight forwarding software offers scalability, lower upfront investment, and remote access capabilities, making it attractive to forwarders of all sizes. The ability to scale storage and processing power according to business needs allows companies to adapt quickly to fluctuations in shipment volume. Cloud solutions also enable faster updates and easier integration with third-party tools, enhancing flexibility. For forwarders with international operations, cloud platforms facilitate collaboration across multiple offices and time zones. As remote work trends persist, the appeal of web-based systems continues to grow. Vendors that can offer secure, high-availability platforms with strong data encryption are likely to capture a larger share of the market. Customization options, including configurable dashboards and automated workflows, further enhance user adoption. The shift toward digital documentation and paperless transactions also aligns with the benefits of cloud deployment, creating a strong case for migration from on-premise systems to scalable online platforms.

Freight forwarders operate in a highly regulated environment, with requirements varying across countries and transportation modes. Software must support compliance with international trade agreements, customs procedures, and security programs such as Authorized Economic Operator certification. Keeping up with regulatory changes is challenging, and failure to comply can result in fines, shipment delays, or reputational damage. Freight forwarding software that includes automated compliance checks, document validation, and tariff calculation helps reduce the risk of errors. Some platforms offer rule-based workflows that adapt to specific trade lanes or commodities, further easing the compliance burden. Integration with electronic customs submission systems streamlines border clearance and improves shipment speed. As regulations become more stringent and trade policies evolve, demand will rise for software that provides timely updates and built-in compliance features. Forwarders that adopt such systems can better navigate the complexities of global trade while maintaining operational efficiency.

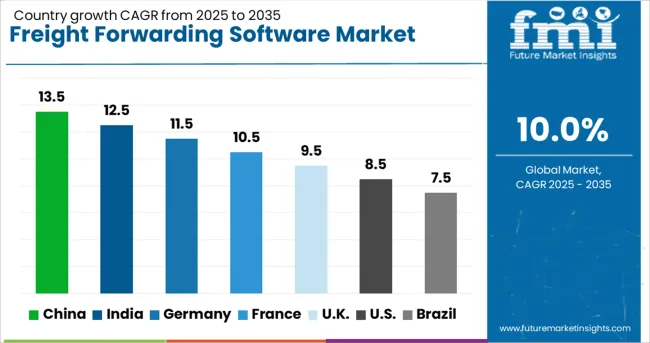

| Country | CAGR |

|---|---|

| China | 13.5% |

| India | 12.5% |

| Germany | 11.5% |

| France | 10.5% |

| UK | 9.5% |

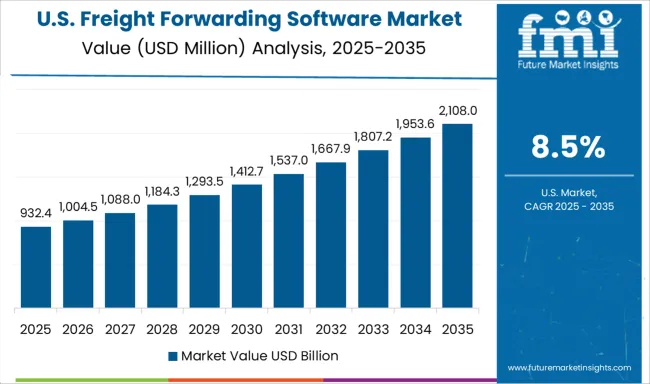

| USA | 8.5% |

| Brazil | 7.5% |

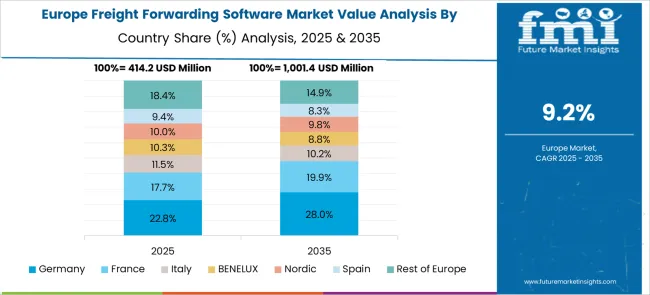

The global freight forwarding software market is expanding at a CAGR of 10.0%, driven by digitalization in logistics, demand for real-time shipment tracking, and the need for automated documentation processes. China leads with 13.5% growth, supported by its extensive export-driven economy and rapid adoption of logistics digital platforms. India follows at 12.5%, fueled by the growth of e-commerce, government initiatives for supply chain modernization, and adoption among SMEs. Germany records 11.5% growth, reflecting advanced logistics infrastructure and strong integration of freight software with multimodal transport systems. The United Kingdom grows at 9.5%, driven by the need for efficient customs management and Brexit-related trade complexities. The United States, at 8.5%, remains a major player, shaped by innovation in cloud-based freight platforms and emphasis on compliance automation. Market trends are influenced by AI-driven analytics, blockchain integration, and end-to-end supply chain visibility. This report includes insights on 40+ countries; the top countries are shown here for reference.

China is leading the freight forwarding software market with a 13.5% CAGR, fueled by its dominant role in global trade and growing demand for digital logistics solutions. Increasing export volumes and the expansion of cross-border e-commerce are driving the adoption of cloud-based freight management platforms. Logistics providers are integrating AI and big data analytics into their systems to optimize shipment tracking, customs documentation, and route planning. Government initiatives promoting smart logistics and supply chain transparency are accelerating digital transformation. Software vendors are offering localized solutions with multi-language support and integration with China’s leading payment and e-commerce platforms.

India is recording a 12.5% CAGR in the freight forwarding software market, supported by the rapid modernization of its logistics sector. Growth in manufacturing, retail, and cross-border trade is driving demand for cloud-enabled shipment management tools. Freight forwarders are adopting software with real-time tracking, automated documentation, and predictive analytics to improve efficiency. The expansion of inland freight corridors and port modernization projects is also creating opportunities for software providers. Local developers are building cost-effective solutions tailored to regional compliance needs and varying connectivity conditions.

Germany is seeing an 11.5% CAGR in the freight forwarding software market, driven by its position as a European logistics hub. Freight operators are investing in advanced platforms that integrate with warehouse management and customs clearance systems. Emphasis on sustainability is leading to the development of software that optimizes routes for fuel efficiency and carbon reduction. Integration with blockchain solutions is enhancing data security and shipment transparency. The automotive and industrial goods sectors are major users, requiring precise scheduling and tracking for just-in-time deliveries.

The United Kingdom is posting a 9.5% CAGR in the freight forwarding software market, supported by the need to streamline post-Brexit trade operations. Software solutions with enhanced customs management and compliance features are in high demand. Freight companies are adopting platforms with real-time shipment tracking, multi-carrier rate comparison, and automated invoicing. Growth in e-commerce imports and exports is further driving adoption. Cloud-based solutions that integrate with accounting and customer relationship management systems are gaining traction among small to mid-sized freight firms.

The United States is registering an 8.5% CAGR in the freight forwarding software market, driven by demand for efficiency in multimodal transportation. Software providers are focusing on platforms that handle ocean, air, and land freight within a unified interface. Integration with IoT-enabled shipment sensors is improving real-time condition monitoring for sensitive goods. The rise of domestic e-commerce fulfillment centers is creating demand for software that links directly to inventory and order management systems. Predictive analytics for demand forecasting and route planning is also gaining adoption.

The Freight Forwarding Software Market is expanding as global trade volumes grow and logistics providers seek more efficient ways to manage complex supply chain operations. These platforms enable freight forwarders to streamline booking, documentation, customs clearance, shipment tracking, and communication with carriers, helping reduce delays and improve transparency.

The push for real-time visibility, automation of manual processes, and integration with global trade compliance systems is accelerating adoption across the industry. Leading companies are driving innovation in this space. WiseTech Global offers its flagship CargoWise platform, known for end-to-end logistics management capabilities and strong global compliance tools.

Descartes Systems Group delivers cloud-based solutions that integrate transportation management, customs compliance, and security filing into a unified system. Magaya Corporation provides flexible freight management software with features like warehouse management and accounting integration tailored for small to mid-sized forwarders.

Softlink Global specializes in freight and logistics ERP solutions that support multimodal transport operations. Riege Software offers CargoWise alternatives like Scope, focusing on freight forwarding, customs, and warehousing with intuitive workflows.

BluJay Solutions (now part of E2open) combines freight forwarding capabilities with supply chain execution and optimization tools, enabling data-driven decision-making. As cross-border shipping regulations tighten and customer expectations for visibility rise, the freight forwarding software market is likely to see more AI-powered forecasting, blockchain-enabled documentation, and tighter integration with carrier and port systems.

Optimal Dynamics secured USD 40 million in Series C financing from Koch Disruptive Technologies to advance AI-driven logistics decision-making. WiseTech Global enhanced its Latin American customs software capabilities through strategic expansion. Flexport fell short of its 2024 profitability target but anticipates reaching break-even by late 2025.

| Item | Value |

|---|---|

| Quantitative Units | USD 1.8 Billion |

| Deployment Model | Cloud and On-premises |

| Application | Transportation management, Freight tracking and monitoring, Customs & compliance management, Order management, Warehouse management, and Others |

| End-User | Freight forwarders, Third-party logistics providers (3PLs), Shippers/Beneficial Cargo Owners (BCOs), Carriers and shipping lines, Customs brokers, and Distributors and wholesalers |

| Industry Vertical | Retail and e-commerce, Manufacturing, Oil & gas, Healthcare, Automotive, Food & beverage, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | WiseTech Global, Descartes Systems Group, Magaya Corporation, Softlink Global, Riege Software, and BluJay Solutions (E2open) |

| Additional Attributes | Dollar sales vary by freight mode (road, ocean, air), service model (cloud, on-premises, hybrid), enterprise type (large enterprises, SMEs), and region (North America, Asia-Pacific, Europe). Growth is driven by AI/ML automation, real-time tracking, sustainability features, and compliance tools, aligned with e-commerce expansion and digital logistics transformation. |

The global freight forwarding software market is estimated to be valued at USD 1.8 billion in 2025.

The market size for the freight forwarding software market is projected to reach USD 4.7 billion by 2035.

The freight forwarding software market is expected to grow at a 10.0% CAGR between 2025 and 2035.

The key product types in freight forwarding software market are cloud and on-premises.

In terms of application, transportation management segment to command 28.0% share in the freight forwarding software market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Air Freight Forwarding Market Size and Share Forecast Outlook 2025 to 2035

Air Freight Forwarding System Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Freight Management Software Market Size and Share Forecast Outlook 2025 to 2035

Ocean Freight Forwarding Market Size and Share Forecast Outlook 2025 to 2035

International Freight Forwarding Market Size and Share Forecast Outlook 2025 to 2035

Software-Defined Wide Area Network Market Size and Share Forecast Outlook 2025 to 2035

Software Defined Vehicle Market Size and Share Forecast Outlook 2025 to 2035

Software Defined Networking (SDN) And Network Function Virtualization (NFV) Market Size and Share Forecast Outlook 2025 to 2035

Software Defined Perimeter (SDP) Market Size and Share Forecast Outlook 2025 to 2035

Freight Transport Management Market Size and Share Forecast Outlook 2025 to 2035

Software-Defined Wide Area Network SD-WAN Market Size and Share Forecast Outlook 2025 to 2035

Freight Railcar Repair Market Size and Share Forecast Outlook 2025 to 2035

Freight Trucking Market Size and Share Forecast Outlook 2025 to 2035

Software Defined Radio (SDR) Market Size and Share Forecast Outlook 2025 to 2035

Software License Management (SLM) Market Size and Share Forecast Outlook 2025 to 2035

Software-Defined Networking SDN Market Size and Share Forecast Outlook 2025 to 2035

Freight Railcar Parts Market Size and Share Forecast Outlook 2025 to 2035

Software-Defined Anything (SDx) Market Size and Share Forecast Outlook 2025 to 2035

Software-Defined Data Center Market Size and Share Forecast Outlook 2025 to 2035

Software Containers Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA