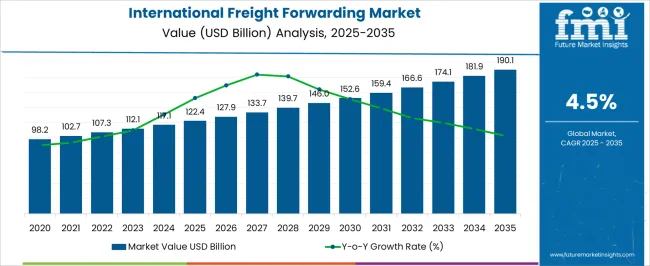

The International Freight Forwarding Market is estimated to be valued at USD 122.4 billion in 2025 and is projected to reach USD 190.1 billion by 2035, registering a compound annual growth rate (CAGR) of 4.5% over the forecast period. The market demonstrates a clear evolution through three phases of maturity and adoption. During the early adoption phase (2020–2024), the market expanded gradually from USD 98.2 billion to USD 117.1 billion. Growth in this period was fueled by increasing globalization, rising international trade, and the gradual adoption of digital freight management solutions. Early adopters focused on improving supply chain efficiency, visibility, and regulatory compliance, which laid the foundation for broader acceptance. The scaling phase (2025–2030) begins with the market crossing USD 122.4 billion in 2025, expanding to USD 152.6 billion by 2030.

This stage is characterized by accelerated adoption of integrated logistics platforms, automation, and advanced analytics. Freight forwarders increasingly invest in technology-driven services, including AI-powered route optimization, real-time tracking, and predictive risk management, driving operational efficiency and customer value. The consolidation phase (2030–2035) sees the market reaching USD 190.1 billion by 2035. Growth moderates as competition intensifies, with leading players focusing on strategic partnerships, mergers, and service differentiation. Market expansion is driven more by operational excellence, cost optimization, and sustainable logistics solutions than by rapid adoption. This lifecycle demonstrates a steady, technology-enabled transformation from early adoption to market maturity.

| Metric | Value |

|---|---|

| International Freight Forwarding Market Estimated Value in (2025 E) | USD 122.4 billion |

| International Freight Forwarding Market Forecast Value in (2035 F) | USD 190.1 billion |

| Forecast CAGR (2025 to 2035) | 4.5% |

Organizations across industries are prioritizing cost efficiency, on-time delivery, and regulatory compliance, leading to greater reliance on specialized freight forwarding services. Industry journals and investor communications have highlighted the significant impact of digital transformation, including the adoption of logistics automation, real-time shipment tracking, and integrated transportation management systems.

Press releases from logistics firms indicate strong investment momentum in digitized freight platforms that offer better route optimization and cargo visibility. Additionally, rising trade volumes, particularly in emerging economies, are contributing to long-term growth.

As businesses look to diversify sourcing and distribution strategies amid geopolitical shifts and port congestion, the demand for agile and scalable forwarding solutions is expected to rise. The market is positioned for continued growth as it becomes increasingly essential to global trade operations and just-in-time supply strategies.

The international freight forwarding market is segmented by services, mode of transportation, customer, end user, and geographic regions. By services, the international freight forwarding market is divided into Freight transportation, Warehousing and distribution, Customs brokerage, Freight consolidation, and Value-added services. In terms of mode of transportation, the international freight forwarding market is classified into Ocean, Road, Air, and Rail. Based on the customer, the international freight forwarding market is segmented into B2B and B2C.

By end user, the international freight forwarding market is segmented into Manufacturing, E-commerce & retail, Automotive, Healthcare & pharmaceuticals, Oil and gas, Food and beverage, Consumer goods, and Others. Regionally, the international freight forwarding industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

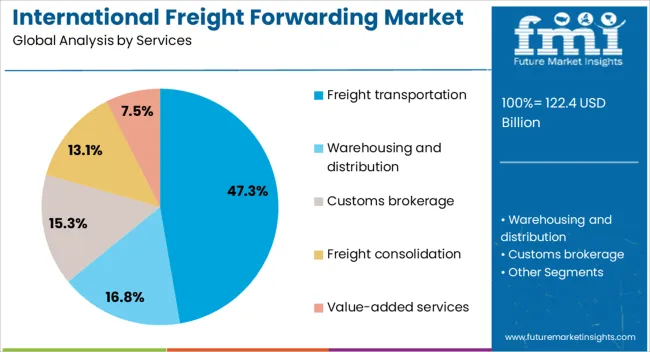

The freight transportation segment is expected to account for 47.3% of the International Freight Forwarding market revenue share in 2025, establishing it as the dominant services segment. Its leadership is being driven by the rising movement of goods across global supply chains, requiring reliable coordination across land, air, and sea routes.

Freight transportation has been preferred by enterprises due to its critical role in end-to-end logistics, enabling efficient cargo handling, customs clearance, and delivery fulfillment. It has been observed in industry updates that this segment supports both standardized and customized freight solutions, making it applicable across multiple sectors, including manufacturing, retail, and energy.

Press briefings from major logistics providers have indicated that freight transportation services are being enhanced through digital platforms and API integrations, ensuring real-time cargo visibility and route flexibility These operational advantages, coupled with a growing emphasis on on-time performance and regulatory compliance, have positioned this segment as a cornerstone in the international forwarding ecosystem.

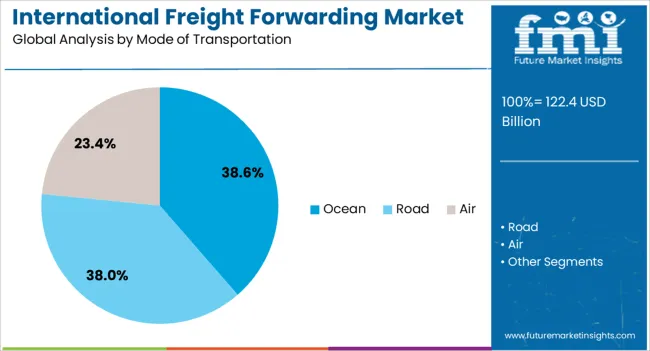

The ocean transportation segment is projected to hold 38.6% of the International Freight Forwarding market revenue share in 2025, making it the leading mode of transportation. This growth is being influenced by the increasing demand for cost-effective bulk shipping solutions over long distances, especially for commodities, industrial equipment, and consumer goods. Ocean freight has been adopted extensively due to its ability to handle large-volume shipments at relatively lower cost per unit.

Global shipping companies have reported increased investments in digital container tracking, eco-efficient vessels, and smart port operations, which are improving the reliability and sustainability of ocean freight services. Press releases from port authorities and carriers have emphasized growing capacities and infrastructure upgrades in key trade corridors.

The segment’s performance is also being supported by integration with customs and compliance platforms, which ensure smoother cross-border flow These factors have collectively led to its dominant position in the forwarding landscape, particularly for long-haul and intercontinental logistics.

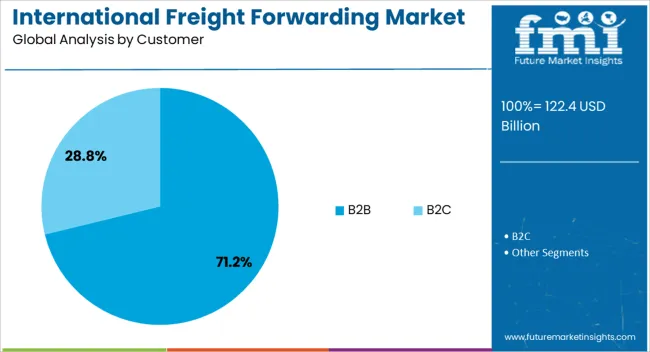

The B2B customer segment is forecasted to contribute 71.2% of the International Freight Forwarding market revenue share in 2025, reflecting its position as the largest customer group. This dominance is being driven by the strong dependency of manufacturers, distributors, and multinational enterprises on professional freight forwarding services for managing complex and high-volume shipments.

B2B clients have prioritized the use of digital freight platforms, integrated customs documentation, and multimodal logistics planning to reduce costs and improve delivery timelines. Corporate press updates have underlined a growing focus on vendor-managed inventory and global procurement strategies, both of which require reliable freight coordination.

Additionally, industry coverage has noted that B2B customers are adopting real-time shipment tracking and analytics to enhance supply chain visibility and resilience. These operational requirements and strategic priorities have continued to reinforce the demand for structured freight forwarding services among commercial clients, making the B2B segment the most influential driver of growth in the market.

The international freight forwarding market is growing steadily as global trade volumes expand and supply chains become more complex. Companies are increasingly outsourcing logistics and shipment management to specialized freight forwarders to optimize costs, ensure timely delivery, and handle regulatory compliance. Air, ocean, and land freight services are in high demand for e-commerce, industrial, and perishable goods. Rising trade agreements and cross-border commerce drive expansion, while operational efficiency, service reliability, and digital tracking solutions become key differentiators among global players.

Global trade growth, fueled by emerging economies and international e-commerce, is a primary driver for freight forwarding services. Businesses seek expertise in customs clearance, documentation, and route optimization to ensure timely delivery. Importers and exporters increasingly rely on freight forwarders to manage multi-modal logistics efficiently, reducing transit times and minimizing delays. Demand is especially high for perishable goods, pharmaceuticals, and industrial machinery. Companies offering tailored solutions for diverse cargo types gain a competitive edge, supporting continuous growth in the international freight forwarding sector.

Freight forwarding companies are investing in digital platforms to provide real-time tracking, shipment visibility, and predictive analytics. Cloud-based tools enable clients to monitor goods across multiple transport modes, optimize routes, and forecast delivery schedules. Automation of booking, customs documentation, and invoicing reduces human error while improving efficiency. Forwarders that leverage digital tools can enhance customer experience and provide transparent pricing. Integration of technology helps companies handle high shipment volumes effectively, maintain compliance with international regulations, and meet the growing expectations of global shippers.

The international freight forwarding market faces operational hurdles including fluctuating fuel prices, port congestion, and geopolitical uncertainties affecting trade routes. Regulatory compliance across different countries adds complexity to customs clearance and documentation processes. Rising labor costs and limited availability of skilled logistics personnel can hinder timely operations. Forwarders must navigate these challenges while maintaining competitive pricing. Companies adopting flexible transport solutions, strategic partnerships with carriers, and risk management strategies can mitigate operational pressures, though small and mid-sized players may struggle to balance cost and service efficiency.

Competition is intense among global freight forwarders, regional operators, and emerging logistics startups. Large international players focus on comprehensive service offerings, including end-to-end supply chain management, warehousing, and last-mile delivery, while smaller players compete on cost efficiency and niche expertise. Strategic alliances with shipping lines, airlines, and technology providers help forwarders expand their service network and enhance reliability. Companies differentiating through service quality, multi-modal capabilities, and tailored solutions for industry-specific needs are positioned to capture higher market share and retain long-term clients.

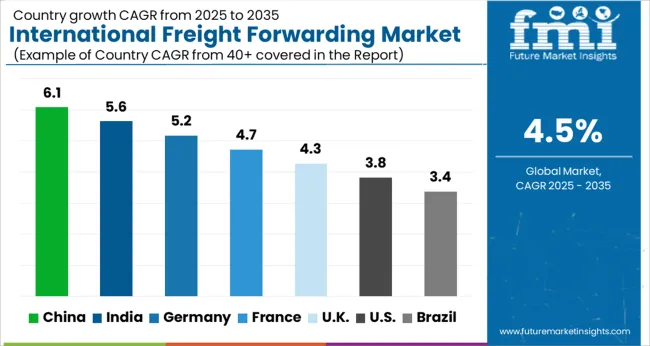

The global international freight forwarding market is projected to grow at a CAGR of 4.5%, driven by increasing global trade, e-commerce expansion, and demand for efficient supply chain solutions. China leads the market with a 6.1% growth rate, supported by its extensive manufacturing base and strong export activities. India follows at 5.6%, propelled by rising industrial production and expanding international trade networks. Germany records a steady growth of 5.2%, leveraging its robust logistics infrastructure and industrial exports. The USA grows at 4.3%, driven by trade recovery and modern logistics adoption, while the USA expands at 3.8%, reflecting stable demand in global shipping and freight management services. This report includes insights on 40+ countries; the top countries are shown here for reference.

International freight forwarding market in China is growing at 6.1%, driven by the country’s position as a global manufacturing hub and its extensive export-import activities. The rise of e-commerce, cross-border trade, and industrial production is boosting demand for reliable freight forwarding services. Logistics providers are leveraging advanced technologies, including digital tracking, warehouse automation, and supply chain optimization, to enhance service efficiency. Government initiatives, such as infrastructure investment in ports, railways, and highways, further support market growth. Additionally, the Belt and Road Initiative strengthens international trade links, increasing the need for integrated logistics solutions. As competition intensifies, forwarders are adopting value-added services, including customs clearance, insurance, and multimodal transportation, to attract clients. With China’s robust trade ecosystem and strategic global positioning, the international freight forwarding sector is poised for sustained growth.

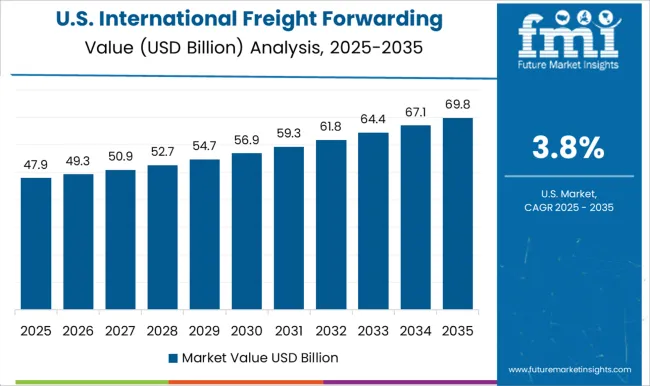

The USA market grows at 3.8%, driven by increasing global trade, e-commerce expansion, and the need for efficient supply chain solutions. Freight forwarders are adopting advanced technologies, including cloud-based tracking, predictive analytics, and route optimization, to improve efficiency. The country’s extensive infrastructure network of highways, ports, and railways enables seamless domestic and international cargo movement. Key sectors driving demand include manufacturing, retail, and technology. Environmental regulations are prompting logistics providers to integrate sustainable practices, such as electric vehicles and energy-efficient warehouses. Moreover, strategic partnerships and mergers among forwarders enhance service coverage and competitiveness. Overall, the USA international freight forwarding market continues to grow steadily, with technology adoption, regulatory compliance, and sustainability initiatives playing crucial roles.

Market in India is growing at 5.6%, fueled by the country’s expanding manufacturing sector, e-commerce boom, and growing international trade. Freight forwarders are investing in digital platforms, GPS-enabled tracking, and supply chain management software to streamline operations. Ports and logistics hubs are being upgraded to handle increasing cargo volumes, supporting faster transit times. The government’s “Make in India” initiative and reforms in logistics infrastructure, including customs simplification and GST implementation, enhance operational efficiency. Multimodal transport, combining road, rail, and sea, is gaining traction to reduce costs and improve delivery speed. Additionally, India’s strategic geographic location provides competitive advantages for trade with neighboring countries and global markets. Overall, the Indian freight forwarding market is evolving rapidly, with technology adoption and infrastructure development driving efficiency and service quality.

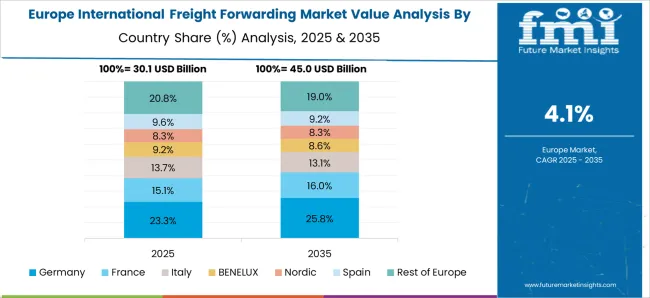

Market in Germany grows at 5.2%, supported by its position as Europe’s logistics hub and export-oriented economy. The automotive, industrial, and chemical sectors are major contributors to freight forwarding demand. German forwarders focus on digitalization, automation, and real-time tracking to optimize logistics operations. Integration of multimodal transportation, combining road, rail, and air, is increasingly adopted to improve speed and reduce carbon emissions. Sustainability regulations in Europe are prompting forwarders to implement eco-friendly solutions, such as low-emission vehicles and energy-efficient warehouses. Moreover, Germany’s advanced infrastructure, including well-connected ports and road networks, ensures efficient cargo movement. With strong government support, technological innovation, and high-quality service standards, Germany’s freight forwarding market maintains steady growth and plays a crucial role in European and global supply chains.

The UK market is expanding at 4.3%, influenced by post-Brexit trade adjustments and increased e-commerce imports and exports. Forwarders are focusing on flexible solutions to navigate new customs regulations, border checks, and trade policies. Investments in warehouse automation, tracking systems, and digital freight management platforms improve operational efficiency and customer service. The UK’s strategic location for transatlantic trade and proximity to European markets support its logistics sector. Growth in sectors like retail, pharmaceuticals, and electronics drives freight forwarding demand. Moreover, sustainability initiatives, such as the adoption of low-emission transport and green logistics, are becoming critical for competitive differentiation. Despite regulatory challenges, the UK’s freight forwarding market remains resilient and continues to attract investment in technology-driven solutions.

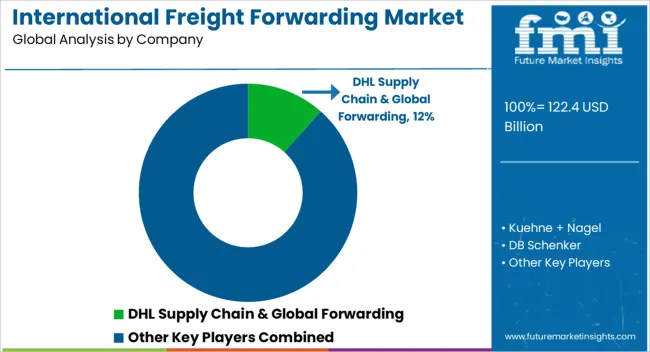

Companies are focusing on offering integrated solutions, real-time shipment tracking, and value-added services such as customs clearance, warehousing, and inventory management. DHL Supply Chain & Global Forwarding and DHL Express are prominent players, leveraging their global network and technological capabilities to provide comprehensive logistics and express delivery services. Kuehne + Nagel and DB Schenker offer specialized freight forwarding solutions, including air, ocean, and road transport, supported by advanced supply chain visibility tools. UPS Supply Chain Solutions and Expeditors International provide tailored logistics solutions for diverse industries, including automotive, pharmaceuticals, and retail. Other key players, such as C.H. Robinson and CEVA Logistics, emphasize digital freight platforms, efficiency, and cost optimization for customers.

DSV Panalpina (Panalpina) and Nippon Express are strengthening their presence with regional and global networks, ensuring seamless international operations. Sinotrans focuses on the Asia-Pacific region, integrating domestic and international logistics solutions to support cross-border trade. As businesses continue to expand globally, the international freight forwarding market is expected to witness substantial growth, driven by technological advancements, increasing e-commerce shipments, and the need for efficient, cost-effective, and reliable logistics services across multiple geographies.

| Item | Value |

|---|---|

| Quantitative Units | USD 122.4 Billion |

| Services | Freight transportation, Warehousing and distribution, Customs brokerage, Freight consolidation, and Value-added services |

| Mode of Transportation | Ocean, Road, Air, and Rail |

| Customer | B2B and B2C |

| End User | Manufacturing, E-commerce & retail, Automotive, Healthcare & pharmaceuticals, Oil and gas, Food and beverage, Consumer goods, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | DHL Supply Chain & Global Forwarding, Kuehne + Nagel, DB Schenker, UPS Supply Chain Solutions, DHL Express, Expeditors International, C.H. Robinson, CEVA Logistics, Panalpina (part of DSV Panalpina), Nippon Express, and Sinotrans |

| Additional Attributes | Dollar sales by service type including air freight, ocean freight, and road freight, application across e-commerce, automotive, and manufacturing sectors, and region covering North America, Europe, and Asia-Pacific. Growth is driven by rising global trade, expanding e-commerce, and increasing demand for efficient, reliable logistics solutions. |

The global international freight forwarding market is estimated to be valued at USD 122.4 billion in 2025.

The market size for the international freight forwarding market is projected to reach USD 190.1 billion by 2035.

The international freight forwarding market is expected to grow at a 4.5% CAGR between 2025 and 2035.

The key product types in international freight forwarding market are freight transportation, warehousing and distribution, customs brokerage, freight consolidation and value-added services.

In terms of mode of transportation, ocean segment to command 38.6% share in the international freight forwarding market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

International Wholesale Voice Carrier Market Size and Share Forecast Outlook 2025 to 2035

Freight Transport Management Market Size and Share Forecast Outlook 2025 to 2035

Freight Railcar Repair Market Size and Share Forecast Outlook 2025 to 2035

Freight Trucking Market Size and Share Forecast Outlook 2025 to 2035

Freight Railcar Parts Market Size and Share Forecast Outlook 2025 to 2035

Freight Management Software Market Insights - Growth & Forecast through 2034

Freight Car Market

Freight Forwarding Software Market Size and Share Forecast Outlook 2025 to 2035

Air Freight Forwarding Market Size and Share Forecast Outlook 2025 to 2035

Air Freight Forwarding System Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Rail Freight Market Size and Share Forecast Outlook 2025 to 2035

Rail Freight Digital Transformation Market Size and Share Forecast Outlook 2025 to 2035

Ocean Freight Forwarding Market Size and Share Forecast Outlook 2025 to 2035

Digital Freight Matching Market Size and Share Forecast Outlook 2025 to 2035

Digital Freight Management Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA