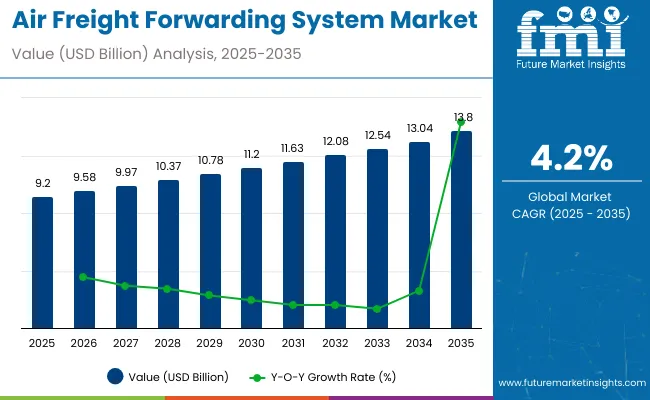

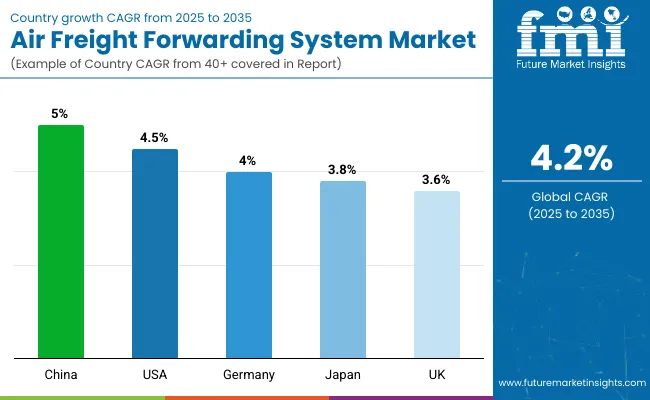

The air freight forwarding system market is valued at USD 9.2 billion in 2025 and is expected to touch USD 13.8 billion by 2035, growing at a CAGR of 4.2%.

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 9.2 billion |

| Industry Value (2035F) | USD 13.8 billion |

| CAGR (2025 to 2035) | 4.2% |

Saturation point analysis indicates that market growth will gradually decelerate as key regions reach higher levels of system adoption and process efficiency. In mature markets such as North America and Europe, air freight forwarding processes are already well established, with advanced logistics platforms, integrated IT systems, and optimized operational workflows. In these regions, further growth will primarily come from upgrades, digitalization, and incremental efficiency improvements rather than large-scale expansion.

Emerging regions, particularly Asia Pacific and the Middle East, continue to offer growth opportunities as expanding trade volumes and increased integration with global supply chains drive adoption of advanced forwarding systems. Short-term fluctuations in demand are influenced by global trade cycles, fuel costs, and regulatory changes, which can temporarily affect system utilization. Technological advancements, including AI-enabled route optimization, real-time shipment tracking, and automated documentation, allow companies to push capacity limits and sustain growth even in approaching saturation scenarios. Understanding saturation points helps service providers identify when markets are nearing maturity and focus on system enhancements, process automation, and value-added services, ensuring long-term market expansion and competitiveness across diverse regions.

The air freight forwarding system market is influenced by several interconnected sectors. Logistics and freight forwarding companies account for around 38%, managing shipment planning, customs clearance, and transportation coordination. Airline operators and cargo carriers contribute roughly 30%, providing fleet capacity, cargo handling, and route networks. Airport infrastructure and ground support services represent approximately 17%, covering warehousing, loading, and cargo management systems. Software and digital platform providers make up close to 10%, enabling automated booking, tracking, and shipment optimization. E-commerce and retail shippers comprise the remaining 5%, driving demand for express air freight and time-sensitive logistics solutions.

The market is advancing with the adoption of AI, automation, and digital freight platforms. Global air freight forwarding volumes reached over 60 million tons in 2024, marking a 5-6% increase compared to the previous year. AI-driven route optimization and predictive analytics are reducing delivery delays by 10-12%, improving overall efficiency. Cloud-based platforms for booking and tracking are increasingly deployed, supporting a 15% year-on-year growth in digital adoption. E-commerce shipments now represent nearly 28% of total air forwarding transactions, driving demand for faster processing and real-time monitoring. Strategic partnerships between forwarders, carriers, and technology providers are enhancing network scalability and operational resilience.

Growth is driven by increasing cross-border trade, rising e-commerce shipments, and demand for streamlined logistics operations. Asia Pacific accounts for roughly 38% of market share, followed by North America at 27% and Europe at 22%. Digital freight forwarding platforms, automated documentation, and real-time shipment tracking are becoming standard across freight operators. Integration with warehouse management and supply chain visibility systems enhances efficiency. Emerging regions in Latin America and Africa are adopting air freight forwarding solutions to improve connectivity, reduce delays, and support growing trade volumes.

Air freight forwarding systems are gaining traction as shippers and logistics providers increasingly adopt digital platforms for automation and operational efficiency. Automated documentation, AI-powered route optimization, and cloud-based platforms reduce manual errors and streamline customs clearance. Real-time shipment tracking improves transparency, enhances customer experience, and enables predictive analytics for better capacity planning. Airlines and freight forwarders are integrating digital solutions with ERP and warehouse management systems to optimize supply chains. In my opinion, digital air freight forwarding is becoming indispensable for global logistics, enabling faster, more reliable shipments while minimizing operational complexity and costs.

The rise of e-commerce and high-value shipments is creating strong growth opportunities for air freight forwarding systems. Platforms are being tailored for express delivery, perishable goods, and pharmaceuticals that require time-sensitive handling. Dedicated digital solutions for cold chain and high-value logistics are increasing adoption across Asia Pacific, Europe, and North America. Small and medium enterprises are also leveraging digital forwarding solutions to compete in global trade. In my view, carriers and forwarders investing in specialized software and technology-enabled operations will capture larger market share, particularly in fast-growing sectors like e-commerce, life sciences, and electronics.

AI and IoT integration is transforming air freight forwarding by enabling predictive analytics, real-time monitoring, and dynamic route planning. AI algorithms forecast demand, optimize load capacity, and enhance shipment prioritization. IoT devices track cargo conditions, monitor temperature-sensitive shipments, and provide visibility across the supply chain. Cloud-based platforms allow seamless communication between shippers, carriers, and forwarders, improving operational efficiency and reducing delays. In my view, adoption of AI and IoT in air freight forwarding is critical for competitiveness, offering actionable insights that drive faster delivery, minimize disruptions, and optimize resource utilization.

High implementation costs and regulatory requirements are major challenges in the air freight forwarding system market. Initial investment in digital platforms, IoT devices, and AI analytics is significant, particularly for SMEs. Compliance with customs, safety, and international trade regulations varies across regions, adding complexity to operations. Limited digital infrastructure in emerging markets can restrict adoption and create bottlenecks. In my opinion, forwarders must balance technology investment with regulatory compliance and workforce training to realize the full benefits of digital forwarding systems. Without addressing these challenges, growth may be slower despite rising global trade and logistics demand.

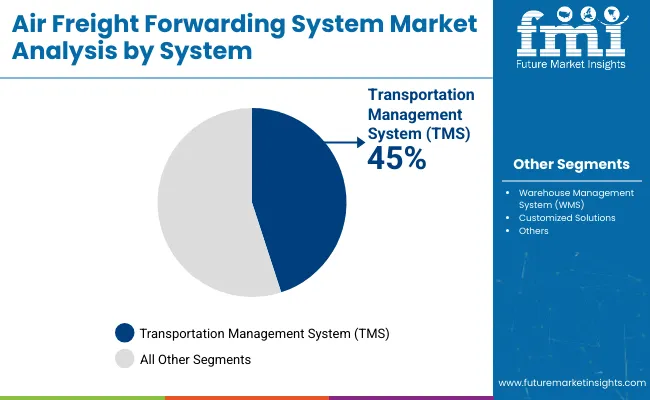

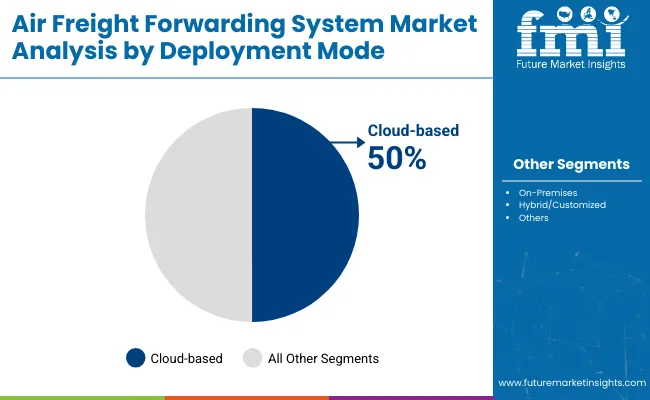

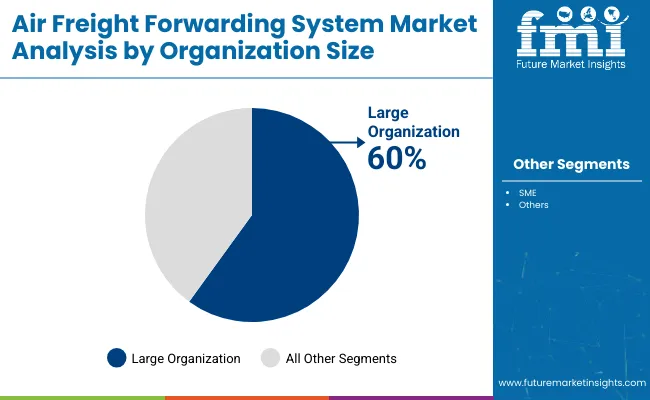

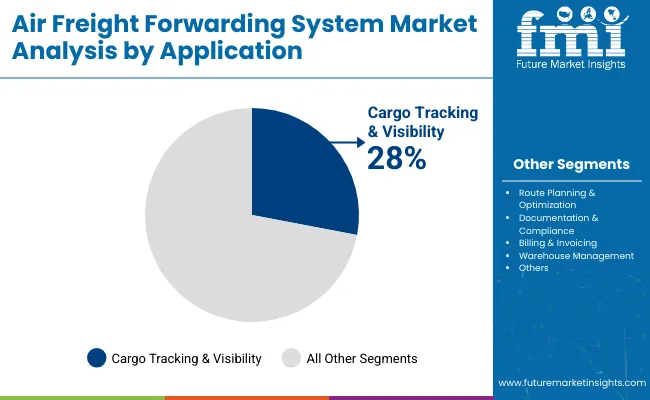

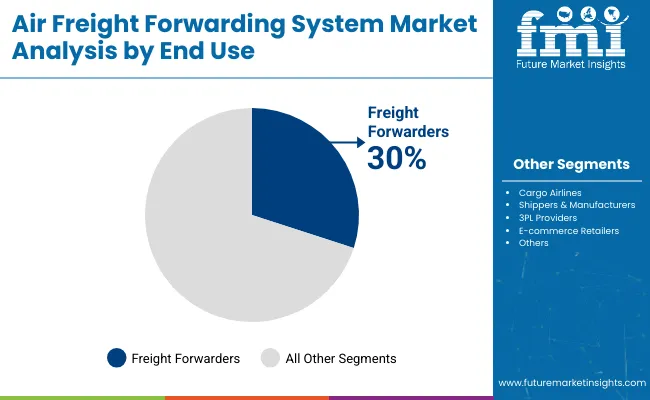

The Air Freight Forwarding System Market in 2025 is driven by global logistics digitization, real-time visibility requirements, and e-commerce expansion. Transportation Management Systems (TMS) dominate with 45% share, while Warehouse Management Systems (WMS) hold 30%, and customized solutions account for 25%. Cloud-based deployment leads with 50% share, followed by on-premises at 30%, and hybrid/customized at 20%. Large organizations hold 60% of adoption, SMEs 40%. Cargo tracking and visibility dominate applications with 28%, and freight forwarders are the leading end users at 30%.

Transportation Management Systems (TMS) capture 45% of market share, optimizing shipment planning, route allocation, and fleet management. Warehouse Management Systems (WMS) hold 30%, enabling inventory tracking, stock optimization, and seamless cargo handling. Customized solutions account for 25%, tailored to unique operational needs of large carriers or regional logistics providers. Leading vendors include SAP, Oracle, Descartes, and CargoWise, integrating predictive analytics, AI-driven route optimization, and compliance management. TMS adoption is highest among global freight forwarders and cargo airlines, WMS is critical for e-commerce retailers and 3PL providers, and customized solutions cater to specialized cargo or regional regulatory requirements. System selection impacts operational efficiency, cost reduction, and end-to-end shipment visibility.

Cloud-based deployment dominates with 50% share, offering scalable, real-time access to logistics data, predictive analytics, and remote management. On-premises solutions hold 30%, preferred by organizations with strict data security and compliance needs. Hybrid or customized deployments contribute 20%, combining cloud flexibility with localized control. Providers such as CargoWise, SAP, and Oracle support multiple deployment models, enabling freight forwarders, cargo airlines, and e-commerce logistics firms to optimize operations. Cloud adoption is driven by cost efficiency, software updates, and cross-regional visibility. On-premises is favored in highly regulated regions or for sensitive cargo, while hybrid solutions offer the best of both approaches for mid-to-large organizations.

Large organizations account for 60% of market adoption, leveraging TMS, WMS, and customized platforms for complex logistics networks, multi-country operations, and high-volume cargo management. SMEs represent 40%, increasingly adopting cloud-based solutions for affordability, scalability, and real-time operational control. Key adopters include global freight forwarders, cargo airlines, and 3PL providers. Large organizations benefit from advanced analytics, integration with ERP systems, and AI-driven route optimization. SMEs rely on intuitive interfaces, modular deployment, and cost-effective software subscriptions. Market growth is underpinned by the need for operational efficiency, risk mitigation, and digital transformation across organizations of all sizes.

Cargo tracking and visibility dominate with 28% share, providing real-time shipment status and predictive alerts. Route planning and optimization follow with 22%, minimizing transit times and operational costs. Documentation and compliance account for 18%, ensuring customs adherence and regulatory reporting. Billing and invoicing and warehouse management hold 12% each, while other applications account for 8%. Providers like Descartes, SAP, and Oracle integrate AI, IoT, and cloud connectivity for end-to-end monitoring. Adoption is strongest among freight forwarders, cargo airlines, and e-commerce retailers. Application effectiveness directly impacts operational efficiency, risk mitigation, and customer satisfaction.

Freight forwarders lead with 30% share, leveraging TMS, WMS, and cloud solutions for global and regional operations. Cargo airlines account for 25%, integrating forwarding systems for operational coordination. Shippers and manufacturers hold 20%, using platforms for inventory visibility and shipping efficiency. 3PL providers contribute 15%, while e-commerce retailers represent 10%. Key providers including SAP, Oracle, Descartes, and CargoWise serve these users with integrated software solutions supporting tracking, billing, and regulatory compliance. End-user segmentation demonstrates the centrality of forwarders and carriers in driving system adoption, with SMEs and manufacturers gradually adopting technology for operational efficiency and scalability.

China dominates the air freight forwarding system market with a CAGR of 5.0% from 2025 to 2035, +19% above the global average of 4.2%. This outperformance reflects BRICS-driven growth in e-commerce exports, cross-border trade volumes, and large-scale investment in digital logistics infrastructure. The United States follows at 4.5%, +7% over the global benchmark, benefiting from OECD-supported innovations in automated cargo management, real-time tracking, and integration of AI-enabled supply chain solutions.

Germany posts 4.0%, −5% below the global CAGR, reflecting a mature market where incremental technological adoption drives steady improvements. Japan records 3.8%, −10% under the global rate, constrained by limited expansion capacity despite advanced operational efficiency. The United Kingdom stands at 3.6%, −14% below the global average, with growth moderated by modest investment in digital freight solutions and network scalability. Data indicates BRICS economies are accelerating adoption through scale and trade demand, while OECD nations emphasize efficiency, compliance, and precision-driven technological integration to maintain steady market performance.

The air freight forwarding system market in China is projected to grow at a CAGR of 5.0%, driven by the expansion of e-commerce, industrial exports, and logistics digitization. Shanghai Pudong handled over 3.5 million tonnes of cargo in 2024, while Shenzhen and Guangzhou airports processed approximately 2.8 million and 2.1 million tonnes, respectively. Forwarders like SF Express and China Cargo Airlines integrate AI-based scheduling and automated cargo tracking to reduce turnaround times. Cold chain forwarding for pharmaceuticals and perishable goods increased by 12% in volume last year. E-commerce exports of electronics and industrial components from Guangdong and Jiangsu provinces dominate the market.

The United States market is projected to grow at a CAGR of 4.5%, with Memphis, Louisville, and Chicago airports collectively handling over 10 million tonnes of cargo annually. FedEx Express, UPS Airlines, and Expeditors deploy predictive analytics for route optimization and real-time tracking. Freight forwarding for industrial machinery, high-value electronics, and automotive parts represents over 55% of volume handled. Investment in warehouse automation has reduced cargo dwell time by up to 20%. E-commerce shipments, particularly same-day and next-day deliveries, account for roughly 30% of air forwarding volume.

The market in Germany is expected to expand at a CAGR of 4.0%, anchored by Frankfurt and Munich as leading hubs. Frankfurt Airport handled 2.2 million tonnes, while Munich processed 1.5 million tonnes in the last fiscal year. Lufthansa Cargo, DHL, and DB Schenker dominate forwarding services, transporting automotive parts, industrial machinery, and pharmaceuticals. Just-in-time supply chains in automotive production contribute significantly to air forwarding volume. Investments in automated sorting and warehouse management reduce processing time by 18%. Intra-European freight accounts for nearly 60% of forwarding operations, while intercontinental exports, especially to North America and Asia, drive high-value cargo traffic.

The air freight forwarding market in Japan is projected to grow at a CAGR of 3.8%, with Tokyo Narita, Haneda, and Kansai airports processing approximately 1.2 million, 0.9 million, and 0.6 million tonnes, respectively. ANA Cargo and Nippon Cargo Airlines focus on electronics, automotive parts, and precision machinery exports. Cold chain forwarding volumes for pharmaceuticals and perishables grew by 10% last year. AI-assisted shipment scheduling improves aircraft utilization by roughly 8%. Export demand to North America and Europe sustains growth, while warehouse automation has improved processing efficiency by 15%.

The United Kingdom market is expected to grow at a CAGR of 3.6%, with London Heathrow and East Midlands airports handling around 1.1 million and 0.7 million tonnes of cargo annually. DHL, Virgin Atlantic Cargo, and IAG Cargo lead operations, transporting high-value electronics, pharmaceuticals, and fashion goods. Warehouse automation, including robotic sorting and automated cold storage, has improved processing speed by 12%. E-commerce shipments account for 25-30% of air freight volume. Predictive analytics tools reduce routing inefficiencies by nearly 10%, while infrastructure modernization enhances handling capacity and minimizes delays.

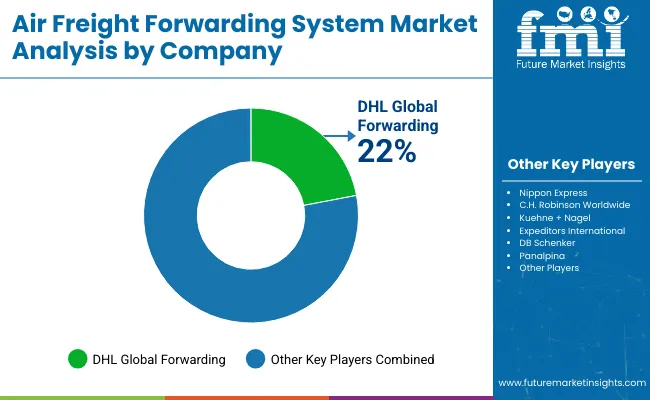

Air freight forwarding companies compete by providing efficient routing, flexible solutions, and reliable delivery across global trade lanes. Nippon Express and C.H. Robinson Worldwide optimize international supply chains, leveraging technology for shipment tracking, customs management, and multi-modal integration. DHL Global Forwarding and Kuehne + Nagel offer end-to-end logistics solutions combining air, sea, and ground transport, ensuring seamless movement of high-value cargo. Expeditors International and DB Schenker focus on time-sensitive shipments and specialized handling for electronics, perishables, and industrial goods.

Panalpina and UPS Supply Chain Solutions enhance operational efficiency through predictive analytics, warehouse management systems, and automated freight scheduling. Agility Logistics and FedEx Logistics provide temperature-controlled transport, rapid customs clearance, and tailored solutions for pharmaceuticals, e-commerce, and oversized cargo. Fleet expansion, digital freight platforms, and strategic partnerships drive competitive advantage, reducing transit times while improving capacity utilization and cargo security.

Marketing strategies rely on product brochures, digital catalogs, and interactive portals showcasing service offerings, transit routes, and cargo handling processes. Brochures highlight operational efficiency, global network coverage, and risk mitigation, allowing businesses to select solutions aligned with specific supply chain requirements. Digital presentations often include transit timelines, route comparisons, and handling protocols to simplify decision-making. Each carrier positions itself as a reliable partner for global air freight, emphasizing speed, safety, and service quality over promotional rhetoric.

| Report Attributes | Details |

|---|---|

| Market Size (2025) | USD 9.2 billion |

| Projected Market Size (2035) | USD 13.8 billion |

| CAGR (2025 to 2035) | 4.2% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projection Period | 2025 to 2035 |

| Quantitative Units | USD billion for value |

| System Segments | Transportation Management System (TMS), Warehouse Management System (WMS), Customized Solutions |

| Deployment Mode Segments | Cloud-based (TMS, WMS, Customized Solutions), On-Premises (TMS, WMS, Customized Solutions) |

| Organization Size Segments | SME, Large Organization |

| Application Segments | Cargo Tracking & Visibility, Route Planning & Optimization, Documentation & Compliance, Billing & Invoicing, Warehouse Management, Others |

| End-Use Segments | Freight Forwarders, Cargo Airlines, Shippers & Manufacturers, 3PL Providers, E-commerce Retailers |

| Regions Covered | North America, Latin America, Western Europe, Eastern Europe, Asia Pacific, Middle East & Africa |

| Countries Covered | United States, Canada, Brazil, Mexico, Germany, United Kingdom, France, Italy, China, Japan, India, UAE, Saudi Arabia, South Africa, Australia |

| Leading Players | DHL Global Forwarding, Nippon Express, C.H. Robinson Worldwide, Kuehne + Nagel, Expeditors International, DB Schenker, Panalpina, UPS Supply Chain Solutions, Agility Logistics, FedEx Logistics |

| Additional Attributes | Dollar sales by system type and deployment mode, demand dynamics across freight forwarders, cargo airlines, and e-commerce, regional adoption trends, innovation in TMS/WMS integration, cloud solutions, route optimization, and warehouse automation |

The market size is valued at USD 9.2 billion in 2025.

It is projected to reach USD 13.8 billion by 2035.

The market is expected to grow at a CAGR of 4.2% during 2025-2035.

Transportation Management System (TMS) holds the largest share with 45% in 2025.

DHL Global Forwarding is the leading player with 22% share.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Aircraft Electric Motor Market Forecast Outlook 2025 to 2035

Airborne Radar Market Size and Share Forecast Outlook 2025 to 2035

Airport Ground Transportation Market Forecast and Outlook 2025 to 2035

Airless Sprayer Accessories Market Size and Share Forecast Outlook 2025 to 2035

Air Purge Valve Market Size and Share Forecast Outlook 2025 to 2035

Air Flow Sensors Market Size and Share Forecast Outlook 2025 to 2035

Air Separation Plant Market Size and Share Forecast Outlook 2025 to 2035

Air Cooled Turbo Generators Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Cooling Turbines Market Size and Share Forecast Outlook 2025 to 2035

Air Conditioning Compressor Market Size and Share Forecast Outlook 2025 to 2035

Air Measuring Equipment Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Hose Fittings Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Cabin Interior Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Interior Lighting Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Battery Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Floor Panels Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Lubricant Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Seat Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Ground Support Equipment Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Maintenance, Repair and Overhaul Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA