The Freight Management Software market is witnessing strong growth driven by the rapid digital transformation in global logistics and supply chain operations. The demand for real-time freight visibility, automation, and improved operational efficiency is fueling adoption across multiple industries. Businesses are increasingly integrating software-driven platforms to manage multimodal transportation, optimize routes, and reduce fuel and time costs.

The growth outlook remains promising as companies continue to invest in data analytics and cloud-based solutions for enhanced decision-making and cost control. Rising trade volumes, cross-border e-commerce, and the need for predictive logistics solutions are further strengthening market expansion.

The future trajectory of the Freight Management Software market will be shaped by increased automation, integration of artificial intelligence, and the growing emphasis on sustainability through optimized resource usage As global trade networks become more complex, the adoption of intelligent freight management systems is expected to continue expanding across both developed and emerging regions.

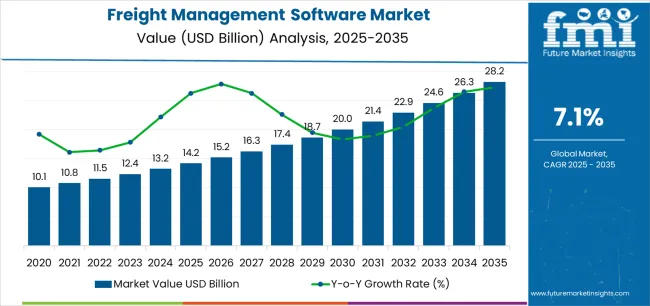

| Metric | Value |

|---|---|

| Freight Management Software Market Estimated Value in (2025E) | USD 14.2 billion |

| Freight Management Software Market Forecast Value in (2035F) | USD 28.2 billion |

| Forecast CAGR (2025 to 2035) | 7.1% |

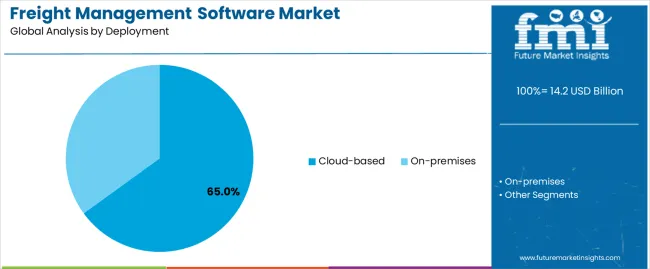

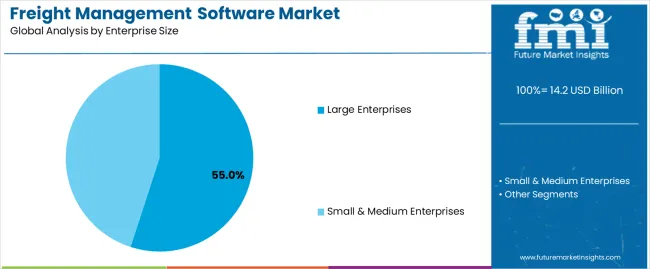

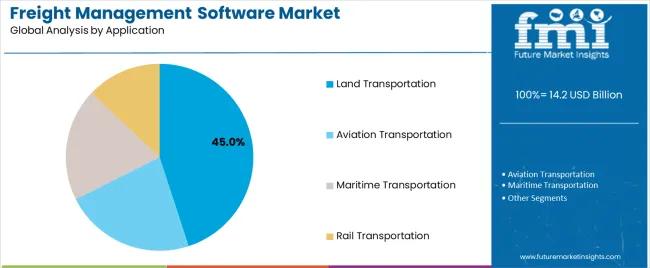

The market is segmented by Deployment, Enterprise Size, and Application and region. By Deployment, the market is divided into Cloud-based and On-premises. In terms of Enterprise Size, the market is classified into Large Enterprises and Small & Medium Enterprises. Based on Application, the market is segmented into Land Transportation, Aviation Transportation, Maritime Transportation, and Rail Transportation. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The cloud-based deployment segment is projected to hold 65.00% of the Freight Management Software market revenue share in 2025, positioning it as the leading deployment mode. The dominance of this segment has been supported by its scalability, flexibility, and cost-efficiency, which enable logistics operators to adapt quickly to changing market dynamics. Cloud deployment facilitates real-time data access and system integration across geographically distributed networks, improving coordination between shippers, carriers, and customers.

The demand for remote accessibility and seamless system upgrades without extensive infrastructure investment has further strengthened cloud adoption. Additionally, the growing preference for subscription-based models and reduced IT overheads has made cloud platforms a strategic choice for freight companies.

Enhanced data security protocols and the integration of advanced analytics tools have also contributed to segment growth As global supply chains increasingly rely on digital platforms for resilience and efficiency, cloud-based systems are expected to maintain their leadership in the deployment landscape.

The large enterprises segment is expected to account for 55.00% of the Freight Management Software market revenue share in 2025, establishing its dominance in the enterprise size category. This segment’s growth has been influenced by the extensive logistics operations and complex distribution networks managed by large corporations, requiring advanced software solutions for process optimization. Large enterprises have been at the forefront of adopting integrated platforms to gain end-to-end visibility, improve freight cost management, and enhance compliance with international shipping standards.

Their capacity to invest in digital infrastructure and implement customized freight solutions has further propelled market share. The shift toward automation and predictive analytics for demand forecasting and shipment tracking has reinforced adoption among large organizations.

Moreover, the growing need to optimize performance across multiple regions and modes of transportation has supported sustained demand from this segment As large enterprises continue prioritizing efficiency and transparency, their reliance on robust freight management software solutions is expected to deepen.

The land transportation segment is anticipated to capture 45.00% of the Freight Management Software market revenue share in 2025, making it the leading application area. This segment’s prominence has been driven by the extensive use of road and rail networks for freight movement, particularly in domestic and regional trade. The adoption of software solutions has been instrumental in improving route optimization, fleet tracking, and delivery scheduling, leading to reduced operational costs and enhanced delivery accuracy.

The growth in e-commerce logistics and last-mile delivery operations has also contributed to the segment’s expansion. Freight management software enables transportation companies to manage large fleets efficiently, monitor vehicle performance, and ensure regulatory compliance.

Moreover, the integration of GPS, telematics, and real-time data analytics has enhanced visibility across the transportation chain, supporting informed decision-making As governments invest in transportation infrastructure and logistics digitization continues, the land transportation segment is expected to sustain its leading position within the market.

The below table presents the anticipated CAGR for the global freight management software market over several semi-annual periods spanning from 2025 to 2035. This assessment outlines changes in the freight management software industry and identify revenue trends, offering key decision makers an understanding about market performance throughout the year.

H1 symbolizes first half of the year from January to June, H2 spans from July to December, which is the second half. In the first half (H1) of the year from 2025 to 2035, the business is expected to grow at a CAGR of 6.4%, followed by an increased growth rate of 7.4% in the second half (H2) of the same year.

| Particular | Value CAGR |

|---|---|

| H1, 2025 | 6.4% (2025 to 2035) |

| H2, 2025 | 7.4% (2025 to 2035) |

| H1, 2025 | 6.2% (2025 to 2035) |

| H2, 2025 | 7.9% (2025 to 2035) |

Moving into the subsequent period, from H1 2025 to H2 2035, the CAGR is projected to increase slightly to 6.2% in the first half and remain higher at 7.9% in the second half. In the first half (H1) the market witnessed a decrease of 20 BPS while in the second half (H2), the market witnessed an increase of 50 BPS.

Emergence of Cloud-based Solutions is an Escalating Trend in Freight Management Software Market

The adoption of cloud-based solutions is an important trend in the freight management software market. The demand for increased cost-effectiveness, scalability, and flexibility is driving the trend. Cloud-based platforms provide numerous benefits over traditional on-premises systems.

Firstly, they provide real-time access to data from any location, which is important for managing global supply chains and simplifying smooth collaboration among stakeholders. This competence augments decision-making, as logistics managers can monitor shipments, track performance metrics, and address to issues quickly.

In addition, cloud-based solutions reduce down on capital expenses and ongoing maintenance costs by eliminating requirement for major on-site infrastructure. Alternatively, companies might use subscription-based business models, which have reduced entry barriers and predictable costs, supporting the freight management software market growth.

Logistics services providers are establishing strategic partnerships with cloud service providers to improve their services. For instance, in July 2025, freight management company, EKA Solutions Inc. announced collaboration with Google Cloud to enhance its freight management services through the use of advanced cloud technologies.

The company will incorporate Google Cloud's data, artificial intelligence, and security solutions. This will deliver hyper automation and improved customer experiences for carriers, brokers, and shippers.

Rising Public and Private Investment in Ecommerce Sector is fueling the Freight Management Software Market Growth

Rapid expansion of ecommerce sector is driving the industry expansion remarkably. Ecommerce has transformed the landscape of logistics sector, creating need for reliable, fast, and transparent delivery services. To fulfill these expectation, freight companies are adopting freight management software to manage complex logistics needs.

E-commerce platforms majorly generates vast amount of orders. These necessitates advanced system processing shipments, managing inventory, and coordination with various carriers.

Freight management software provides tools that can handle diverse tasks efficiently, reducing the overhead costs of the freight company. This also helps companies in simplifying their business operations, minimize errors and enhance customer experience.

Moreover, the growth of e-commerce has resulted into increased rivalry among retailers, driving the need for differentiation through prominent logistics system. Companies are investing in FMS to enhance their supply chain visibility, optimize routes, and manage shipping costs effectively.

For instance, in April 2025, E-commerce courier aggregator, iThink Logistics joined Open Network for Digital Commerce (ONDC), private non-profit Section of Government of India to enhance its reach and provide logistics support to micro, small and medium enterprises (MSMEs) in the e-commerce sector.

This integration will help MSMEs benefit from cost-effective shipping solutions with multiple logistics companies available on iThink Logistics, saving shipping costs and reducing dependence on e-commerce marketplaces.

Growing Focus on Sustainability in Logistics Creates Opportunities for Freight Management Software Market

The growing focus on sustainability in logistics is creating notable opportunity for the industry, mainly for solutions that support green initiatives. As environmental concerns become more pressing, businesses and governments are highlighting sustainability, which has direct repercussions for the logistics and transportation sectors.

One key element of this opportunity is the demand for freight management software that help reduce carbon emissions. Advanced FMS platforms can improve routing & planning to lessen fuel consumption and greenhouse gas emissions.

By using real-time data and predictive analytics, these systems can locate the most effective routes, avoid traffic blocking, and reduce overall transport distances. This contributes to lower carbon footprints and helps companies meet governing requirements & sustainability goals.

The companies operating in the freight management software market are incorporating tools that are assisting companies in contributing toward establishing sustainable ecosystem for logistics sector. For instance, in March 2025, global logistics and supply chain solutions provider, FreightExchange introduced CO2 emissions reporting tool within its platform.

This advanced tool allows customers to monitor and assess the carbon emissions produced by their freight operations in real-time. This is achieved by utilizing a personalized dashboard that provides clear and actionable insights.

Integration Challenges and Data Security Concerns may affect Freight Management Software Market Growth in the Projected Timeframe

Integration challenge is one of the important factor that is affecting the industry growth. This issue arises majorly in the logistics companies with complex IT systems. Freight management software mainly need to work with multiple business software effortlessly.

However, compatibility issues can arises which results in custom solution incorporation, adding up extra costs and creating technical difficulties. This can lead to implementation delay hampering the logistics operations across the organization.

Moreover, rising cyber-attacks on connected logistics system is hampering the market growth. Cyberattacks such as Denial-of-Service (DoS), phishing, malware, and spoofing may manipulate the connected system that can result in data exploitation and loss. This growing concern makes companies hesitant to transfer their logistics operations over software.

Any security event freight management software market. The companies operating in the freight management software market should partnered with cybersecurity companies to improve the strength of their software.

The global freight management software market registered a CAGR of 6.4% during the historic period between 2020 and 2025. The growth of freight management software industry was progressive as it reached a value of USD 12,365.2 million in 2025 from USD 9,398.2 million in 2020.

The market for freight management software witnessed notable growth from 2020 to 2025. Innovations in technology and changing needs in logistics propelled the market. Businesses started to realize more and more in 2020 how important digital solutions were for streamlining logistics processes.

Companies sought to enhance visibility and augment routes to meet rising consumer expectations for fast & reliable delivery, supporting the market growth.

Outbreak of Corona virus in 2025 has noticeably obstructed the industry expansion. Primarily, global supply chain disturbance triggered some short-term setbacks. However, the pandemic also augmented the sales of digital solutions as companies adapted to remote operations and unstable demand.

Increased investments in technology to safeguard business continuousness and manage supply chain issues, further drive the market growth. Furthermore, shift towards cloud-based solutions and the incorporation of advanced technologies such as AI and machine learning became more common. Businesses invested in these technologies to improve efficacy, reduce costs, and improve supply chain flexibility.

Post pandemic, market continued its upward trajectory with emerging trends such as augmented focus on sustainability and the adoption of green logistics practices. Market growth was also driven by the expansion of logistics networks in emerging markets. The industry also saw increased adoption among small and medium-sized enterprises as costs decreased and software solutions became more accessible.

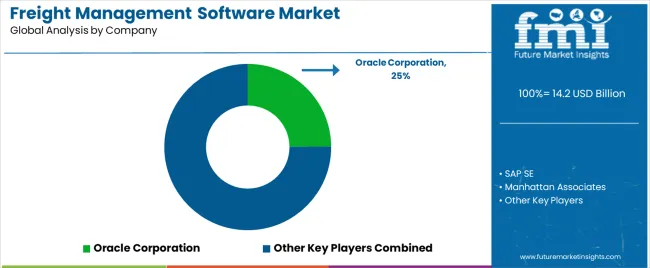

In the global freight management software market, Tier 1 companies hold a notable market share of 40% to 45%, making them the market leaders. These companies have strong R&D capabilities have established global client network.

Their solutions majorly cater to large enterprises with intricate logistics needs and notable budgets. Key companies in the tier 1 are Oracle Corporation, SAP SE, Manhattan Associates, Infor, C.H. Robinson (TMC), and MercuryGate International, Inc.

Tier 2 companies are mid-sized businesses that may not have extensive global reach as compared to tier 1 players. These companies emphasize on providing freight management software with competitive features. Tier 2 players majorly partners with technology providers to optimize their R&D cs0ts and improve overall performance of the software.

This companies provides improved customer support to increase their customer retention rate and thus revenue streams. Prominent companies in tier 2 contain E2open, Descartes Systems Group, Trimble Inc. (Transportation & Logistics Division), JDA Software (Blue Yonder), and CargoSmart Limited.

Tier 3 businesses are small sized firms and emerging startups that may lacks the global customer network as compared to tier 1 and tier 2 players. These companies focuses on developing cost-effective and advanced solutions especially for the local and regional markets. This firms possess good knowledge about the local needs and thus designs the software accordingly.

Their main clients are the small business with limited budget. Emerging startups in FMS market majorly participate in funding round to utilize the funds to improve their product portfolio and increase product sales.

The section below covers the industry analysis for the freight management software market for different countries. Market demand analysis on key countries in several regions of the globe, including the USA, Germany, China, India, Brazil, and UK is provided.

The United States is anticipated to remain at the forefront in North America, with a value share of 73.2% through 2035. In East Asia, South Korea is projected to witness a CAGR of 7.5% by 2035.

| Countries | Value CAGR (2025 to 2035) |

|---|---|

| USA | 6.5% |

| Germany | 5.8% |

| China | 7.3% |

| India | 7.9% |

| UK | 6.1% |

North America, spearheaded by the USA which currently holds around 73.2% share of the North America freight management software industry. USA freight management software market is anticipated to grow at a CAGR of 6.5% throughout the forecast period.

In USA increasing use of AI and ML in freight management software is supporting the market growth. Various logistics companies operating in air, land, or rail transportation are incorporating these solutions to enhance their logistics operations.

They are leveraging Al and ML tools to automate their daily tasks, reduce overhead costs, and optimize the route for faster delivery. Furthermore, USA government initiatives for digitization in logistics sector is expected to create favorable environment for market growth through 2035.

China’s freight management software market is poised to exhibit a CAGR of 7.3% between 2025 and 2035. Currently, it holds the significant market share in the East Asia market, and the dominance is expected to continue through the forecast period.

China’s rapid expansion of aviation freight sector is creating positive outlook for the market growth. Various logistics companies in aviation sector are partnering with market players to improve their delivery services. For instance, in February 2025, IBS Software signed an agreement with China Airlines to implement its iCargo platform as the airline's new cargo management system.

This transition aims to enhance China Airlines cargo digitization efforts by unifying various operations including air mail handling, import/export, and sales into a single platform.

India’s freight management software market is expected to witness a CAGR of 7.9% in the forecast period and hold considerable market share in South Asia & Pacific region through 2035.

Booming Indian logistics and ecommerce sector is encouraging respective companies to improve their product sales and market share. Various freight management companies are digitizing their business operations to enrich their brand identity. The market players thus are introducing innovative solutions to attract potential business clients.

For instance, in September 2025, logistics company, Delhivery Ltd. launched LocateOne, to help businesses optimize their logistics operations. The platform uses advanced algorithms to optimize delivery routes, minimizing travel distances and fuel consumption.

The section contains information about the leading segments in the industry. By deployment, cloud-based segment is estimated to grow at a CAGR of 7.5% throughout 2035. Additionally, the by application, rail transportation segment is projected to expand at 7.2% till 2035.

| Component | On-premises |

|---|---|

| Value Share (2025) | 52.3% |

On-premises segment is expected to acquire share of 52.3% in the market in terms of deployment in 2025. Most of the enterprises prefers on-premises freight management software due to enhanced data security and robust control over data.

The company do need to share their data to third party vendors, thus minimizing the risk of data leakages in on premise system. However, increasing popularity of cloud-based solution due to their scalability and cost-effectiveness may hamper the segment growth in the forecast period.

| Application | Land Transportation |

|---|---|

| Value Share (2025) | 36.1% |

The land transportation segment is expected to capture share of 36.1% in 2025. Various countries governments are strengthening their land transport to address unique challenges and complexities in road freight operations.

These systems help streamline processes like order management, route planning, contract management, and rate calculations for both full truckload (FTL) and less-than-truckload (LTL) shipments. As a result, freight management software has become an essential tool for companies engaged in land transportation.

Key players operating in the freight management software market are investing in advanced technologies and also entering into partnerships. Key freight management software providers have also been acquiring smaller players to grow their presence to further penetrate the market across multiple regions.

Recent Industry Developments in Freight Management Software Market

In terms of deployment, the industry is divided into cloud-based and on-premises.

In terms of enterprise size, the industry is divided into small & medium enterprises and large enterprises.

The application is classified by industry as aviation transportation, land transportation, maritime transportation, and rail transportation.

Key countries of North America, Latin America, East Asia, South Asia & Pacific, Western Europe, Eastern Europe, and Middle East & Africa (MEA) have been covered in the report.

The global freight management software market is estimated to be valued at USD 14.2 billion in 2025.

The market size for the freight management software market is projected to reach USD 28.2 billion by 2035.

The freight management software market is expected to grow at a 7.1% CAGR between 2025 and 2035.

The key product types in freight management software market are cloud-based and on-premises.

In terms of enterprise size, large enterprises segment to command 55.0% share in the freight management software market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Software License Management (SLM) Market Size and Share Forecast Outlook 2025 to 2035

Freight Transport Management Market Size and Share Forecast Outlook 2025 to 2035

Freight Forwarding Software Market Size and Share Forecast Outlook 2025 to 2035

Fuel Management Software Market Size and Share Forecast Outlook 2025 to 2035

Case Management Software (CMS) Market Size and Share Forecast Outlook 2025 to 2035

Farm Management Software Market Size and Share Forecast Outlook 2025 to 2035

Exam Management Software Market

Quote Management Software Market Size and Share Forecast Outlook 2025 to 2035

Trade Management Software Market Size and Share Forecast Outlook (2025 to 2035)

Event Management Software Market Analysis - Size, Share, and Forecast 2025 to 2035

Grant Management Software Market - Trends, Size & Forecast 2025 to 2035

Video Management Software Market

Digital Freight Management Market Size and Share Forecast Outlook 2025 to 2035

Server Management Software Market Size and Share Forecast Outlook 2025 to 2035

Skills Management Software Market Size and Share Forecast Outlook 2025 to 2035

Change Management Software Market Size and Share Forecast Outlook 2025 to 2035

SBOM Management and Software Supply Chain Compliance Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Church Management Software Market Size and Share Forecast Outlook 2025 to 2035

Cattle Management Software Market Size and Share Forecast Outlook 2025 to 2035

Output Management Software Market Insights – Growth & Forecast through 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA