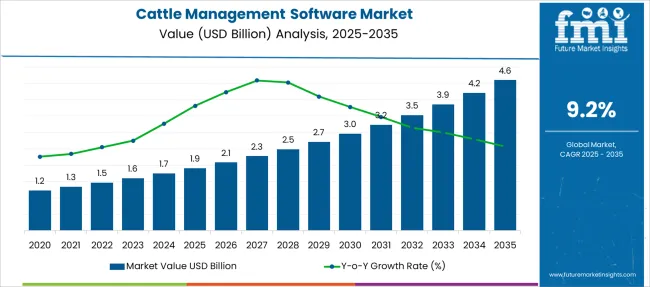

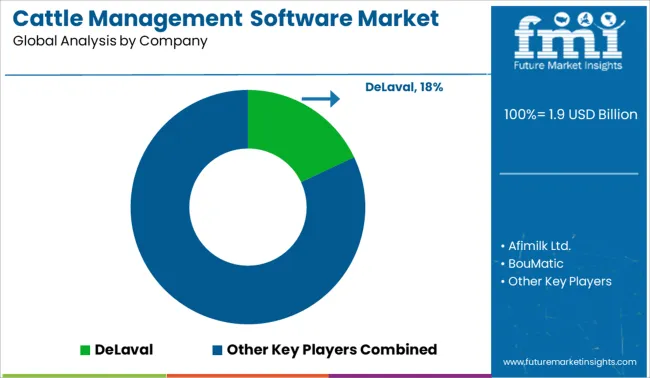

The Cattle Management Software Market is estimated to be valued at USD 1.9 billion in 2025 and is projected to reach USD 4.6 billion by 2035, registering a compound annual growth rate (CAGR) of 9.2% over the forecast period.

| Metric | Value |

|---|---|

| Cattle Management Software Market Estimated Value in (2025 E) | USD 1.9 billion |

| Cattle Management Software Market Forecast Value in (2035 F) | USD 4.6 billion |

| Forecast CAGR (2025 to 2035) | 9.2% |

The Cattle Management Software market is undergoing accelerated growth as digitization becomes increasingly critical in optimizing livestock operations. Advancements in cloud computing, real-time analytics, and mobile integration have enabled cattle owners to track animal health, breeding cycles, feeding behavior, and environmental conditions with precision. Rising global demand for dairy and beef products has prompted farms to increase productivity and operational efficiency, further fueling the adoption of intelligent management platforms.

Governments and agricultural bodies are also supporting digital transformation through funding programs, training initiatives, and regulatory modernization. In emerging markets, improved internet connectivity and smartphone penetration are facilitating access to sophisticated farm management tools.

In developed regions, focus is being placed on automation, traceability, and sustainable farming practices, which are expected to drive long-term software investment. The convergence of IoT devices with cattle management software is shaping the future of livestock technology, empowering producers with real-time insights that improve decision-making and profitability across the value chain..

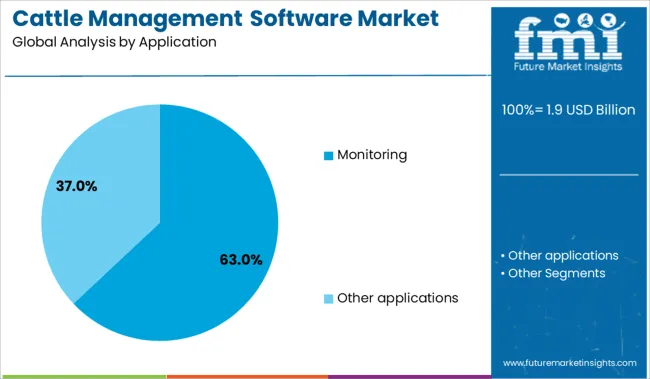

The market is segmented by Application, Sector, Deployment, and End-use and region. By Application, the market is divided into Monitoring, Milk production management, Reproduction/ breeding management, Feeding management, Health management, Other monitoring applications, and Other applications.

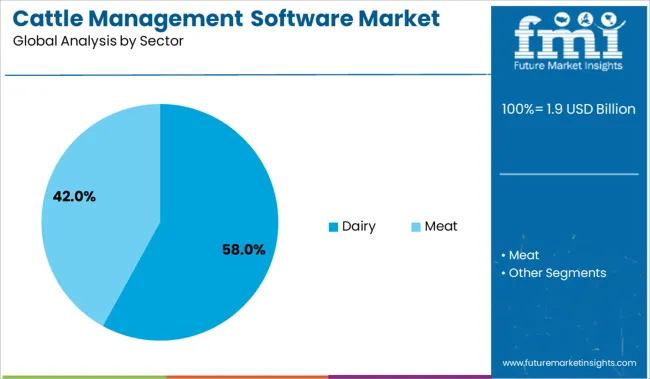

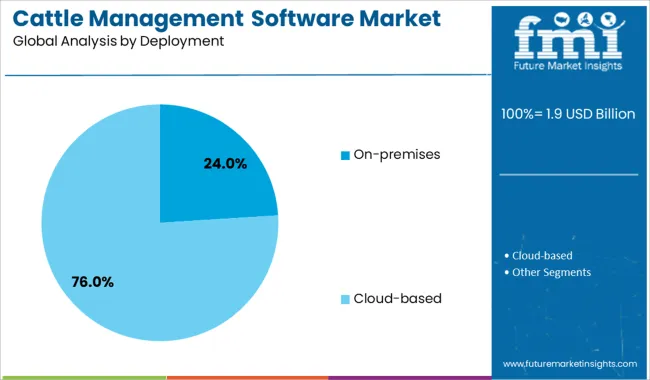

In terms of Sector, the market is classified into Dairy and Meat. Based on Deployment, the market is segmented into On-premises and Cloud-based. By End-use, the market is divided into Large farms, Small and medium-sized farms, Agricultural cooperatives, and Other end-users. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The monitoring application segment is projected to hold 63% of the Cattle Management Software market revenue share in 2025, making it the most dominant segment by application. This growth has been supported by the increasing need to track animal health metrics, reproduction cycles, movement patterns, and feed intake in real time. Monitoring solutions have been adopted widely due to their capacity to identify early signs of disease, reduce mortality rates, and optimize livestock productivity.

Software platforms with monitoring capabilities have allowed producers to detect deviations in behavior or health, enabling prompt veterinary intervention. Integration with smart tags, collars, and sensors has further enhanced accuracy and data richness.

As the cattle industry becomes more data-driven, monitoring tools have become central to preventive care, yield improvement, and cost management. Their ability to streamline operations and generate long-term performance insights has reinforced their value across farms of all sizes, supporting their dominant position in the market..

The dairy sector segment is expected to account for 58% of the Cattle Management Software market revenue share in 2025, establishing itself as the leading sector. This segment's growth has been driven by the dairy industry's reliance on high-frequency, precision-based data to maintain optimal milk yield, reproductive health, and feed efficiency.

Dairy producers have adopted software platforms to automate data collection across milking operations, breeding schedules, and nutritional management, which has significantly reduced manual effort and human error.

Demand for traceability, regulatory compliance, and herd productivity has further accelerated the adoption of digital systems in dairy farming. The increasing scale of commercial dairy farms and emphasis on sustainable practices have made software essential for maintaining profitability and compliance.

Advanced features such as milk flow tracking, somatic cell monitoring, and historical performance analytics have made these platforms indispensable in dairy operations. The need to maximize efficiency and maintain animal health under competitive pressures has supported the segment’s continued leadership..

The on-premises deployment segment has maintained a strong presence in the Cattle Management Software market due to its ability to provide localized control, enhanced data privacy, and customizability. This deployment model has been particularly favored by large farms and cooperatives that require complete autonomy over their software environment. Producers opting for on-premises solutions have been motivated by the need to store sensitive animal health and operational data securely without reliance on cloud infrastructure.

Custom software configurations tailored to specific herd sizes, species, and farming goals have made on-premises platforms more attractive for operations with complex needs. Additionally, regions with inconsistent or limited internet access have demonstrated a continued preference for locally hosted systems.

These solutions have also offered better compatibility with legacy farm hardware and equipment. As data sensitivity, operational control, and long-term infrastructure investment remain priorities for many livestock operations, on-premises deployment is expected to sustain its relevance in the evolving digital livestock ecosystem..

The cattle management software market has gained momentum through mobile-based tools and commercial system integration. From 2023 to 2025, mobile apps with real-time and offline functionality enabled on-field data entry, improving operational visibility. Simultaneously, software linked to livestock pricing and inventory tools offered ranchers market insights and predictive revenue planning. These developments suggest that user-friendly mobility and trade system compatibility are opening critical pathways for software vendors to embed deeply within livestock operations and agribusiness workflows.

The broad need for efficient herd management has accelerated procurement of cattle management software in 2023. Herd-tracking solutions were deployed to capture breeding data and manage feed regimens, improving overall output per animal. In 2024, health-monitoring tools were increasingly leveraged to identify illnesses early, reducing disease spread and treatment costs. By 2025, input optimization modules that track feed conversion and weight gain were being adopted to support economies of scale. These trends have shown that farm operators are relying on integrated herd intelligence systems to balance welfare and revenue objectives, effectively making data-driven livestock management a default strategy.

In 2023, mobile applications were introduced to enable field-based record updates and behavioral tracking for cattle managers, reducing reliance on desktop-only data entry. By 2024, these mobile modules had been enhanced to include offline capability and real-time synchronization, enabling ranch hands to record breeding or health events in real time, regardless of connectivity. In early 2025, mobile dashboards were being made available to extension agents and supply chain partners, facilitating role-based access and shared analytics across farms. These implementations demonstrate that providing intuitive, field-accessible software can elevate user adoption and improve data consistency, positioning vendors to deepen integration across the livestock value chain.

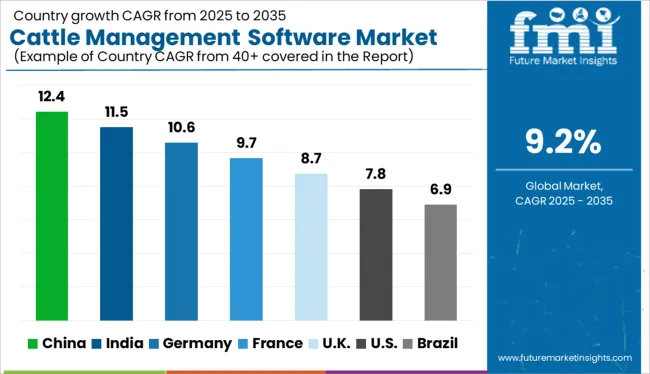

| Country | CAGR |

|---|---|

| China | 12.4% |

| India | 11.5% |

| Germany | 10.6% |

| France | 9.7% |

| UK | 8.7% |

| USA | 7.8% |

| Brazil | 6.9% |

The cattle management software market is projected to grow at a global CAGR of 9% from 2025 to 2035. China leads with a 12.4% CAGR, followed by India at 11.5% and Germany at 10.6%. France aligns with the global average at 9.7%, while the United Kingdom shows slightly slower progress at 8.7%. China and India demonstrate strong momentum due to smart farming initiatives, digitized herd tracking, and milk productivity optimization. Germany’s growth is driven by precision livestock farming and EU-backed animal welfare systems. France expands through farm-to-retail traceability tech, while the UK adopts cloud-based solutions in response to supply chain modernization.

China is expected to grow its cattle management software market at a 12.4% CAGR, led by centralized dairy integration, farm automation, and government focus on agri-digitalization. Platforms are used to track breeding cycles, monitor cattle health, and manage feed schedules in large-scale dairy operations. National policies supporting smart agriculture provide funding for IoT-integrated cattle software. Domestic firms are leveraging machine learning to detect disease risks and optimize milk yields.

India is forecast to grow its cattle management software market at an 11.5% CAGR, driven by dairy cooperative networks, private milk processors, and animal health digitization. Rural dairy centers use mobile apps for cattle history, vaccination tracking, and breed performance. Public sector undertakings promote digital herd registers and geotagging for subsidy eligibility. Regional startups are building vernacular-language dashboards for smallholder dairy farmers.

Germany is expected to expand its cattle management software market at a 10.6% CAGR, supported by precision livestock farming, traceability regulations, and sensor-based animal monitoring. Large dairy farms integrate herd software with RFID tags, feeding robots, and activity monitors. Veterinary compliance and environmental reporting are embedded into many German platforms. Farm-level productivity benchmarking is also gaining popularity.

France is projected to grow at a 9.7% CAGR in the cattle management software segment, with strong adoption in dairy cooperatives and premium beef operations. Software is used for animal identification, supply chain traceability, and automated calving alerts. National food labeling programs emphasize transparent livestock records, pushing farms to digitize operations. Cloud-based interfaces linked to local abattoirs and retailers are increasingly common.

The United Kingdom is forecast to grow at an 8.7% CAGR in the cattle management software market, driven by herd health optimization, antibiotic compliance, and agri-data consolidation. Cloud-first applications are replacing paper-based records in grazing and mixed-breed farms. Use cases include grazing rotation logs, feed efficiency analysis, and slaughter-weight prediction. Adoption remains strongest in certified organic and export-ready herds.

The cattle management software market is moderately consolidated, led by DeLaval. The company holds a dominant position through its integrated herd management platforms, combining automated milking systems, animal health tracking, and performance analytics across commercial dairy farms. Dominant player status is held exclusively by DeLaval. Key players include Afimilk Ltd., BouMatic, Fullwood Packo, GEA Group, and Sum-It Computer Systems - each offering software solutions for milk production monitoring, reproductive tracking, feed efficiency, and farm workflow optimization. Emerging player VAS (DairyComp) focuses on modular, data-driven herd intelligence platforms tailored for mid-sized farms and progressive dairy operations. Market demand is driven by increasing adoption of precision livestock farming tools, efficiency gains from digitized farm management, and the need for proactive herd health and production decisions.

| Item | Value |

|---|---|

| Quantitative Units | USD 1.9 Billion |

| Application | Monitoring, Milk production management, Reproduction/ breeding management, Feeding management, Health management, Other monitoring applications, and Other applications |

| Sector | Dairy and Meat |

| Deployment | On-premises and Cloud-based |

| End-use | Large farms, Small and medium-sized farms, Agricultural cooperatives, and Other end-users |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | DeLaval, Afimilk Ltd., BouMatic, Fullwood Packo, GEA Group, Sum-It Computer Systems, VAS (DairyComp), and Others |

| Additional Attributes | Dollar sales by software type (herd management, health tracking, breeding), regional adoption trends, competitive landscape, buyer preferences (SaaS vs on-prem), integration with IoT sensors, innovations in AI-based analytics. |

The global cattle management software market is estimated to be valued at USD 1.9 billion in 2025.

The market size for the cattle management software market is projected to reach USD 4.6 billion by 2035.

The cattle management software market is expected to grow at a 9.2% CAGR between 2025 and 2035.

The key product types in cattle management software market are monitoring, milk production management, reproduction/ breeding management, feeding management, health management, other monitoring applications and other applications.

In terms of sector, dairy segment to command 58.0% share in the cattle management software market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Cattle Feed Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Cattle Squeeze Market Size and Share Forecast Outlook 2025 to 2035

Cattle Feeder Panels Market Size and Share Forecast Outlook 2025 to 2035

Cattle Head Catch Market Size and Share Forecast Outlook 2025 to 2035

Cattle Grooming Chute Market Size and Share Forecast Outlook 2025 to 2035

Cattle Handling Systems Market Size and Share Forecast Outlook 2025 to 2035

Cattle Blower Market Size and Share Forecast Outlook 2025 to 2035

Cattle Mineral Feeder Market Size and Share Forecast Outlook 2025 to 2035

Cattle Feeder Market Size and Share Forecast Outlook 2025 to 2035

Cattle Supplies Market Analysis & Forecast for 2025 to 2035

Cattle Nutrition Market Analysis by Cattle Type, Nutrition Type, Application, Life Stage Through 2025 to 2035

Smart Cattle Market

Dairy Cattle Feed Market

Automatic Cattle Waterer Market – Trends & Growth Forecast 2025 to 2035

Tax Management Market Size and Share Forecast Outlook 2025 to 2035

Key Management as a Service Market

Cash Management Supplies Packaging Market Size and Share Forecast Outlook 2025 to 2035

Risk Management Market Size and Share Forecast Outlook 2025 to 2035

Lead Management Market Size and Share Forecast Outlook 2025 to 2035

Pain Management Devices Market Growth - Trends & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA