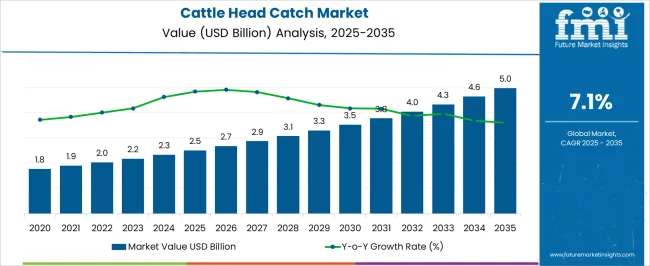

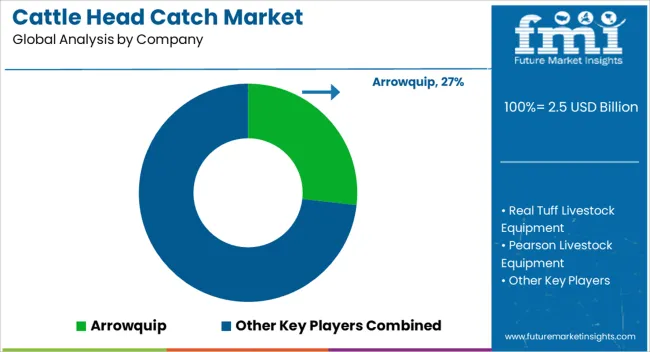

The Cattle Head Catch Market is estimated to be valued at USD 2.5 billion in 2025 and is projected to reach USD 5.0 billion by 2035, registering a compound annual growth rate (CAGR) of 7.1% over the forecast period.

| Metric | Value |

|---|---|

| Cattle Head Catch Market Estimated Value in (2025 E) | USD 2.5 billion |

| Cattle Head Catch Market Forecast Value in (2035 F) | USD 5.0 billion |

| Forecast CAGR (2025 to 2035) | 7.1% |

The cattle head catch market is expanding steadily as livestock management practices increasingly prioritize animal safety, handler efficiency, and operational productivity. Growing demand for durable and reliable equipment in cattle handling facilities has enhanced the adoption of advanced head catch systems.

Regulatory emphasis on animal welfare standards and the need to minimize stress during veterinary examinations, feeding, and routine health checks are contributing significantly to market growth. Manufacturers are focusing on ergonomically designed, adjustable, and easy to operate systems that ensure both safety and efficiency.

Furthermore, the rise in organized livestock farming and large scale dairy operations is reinforcing the importance of effective handling infrastructure. The outlook remains positive as the livestock industry continues to invest in equipment that enhances productivity, ensures compliance with welfare norms, and reduces labor intensity.

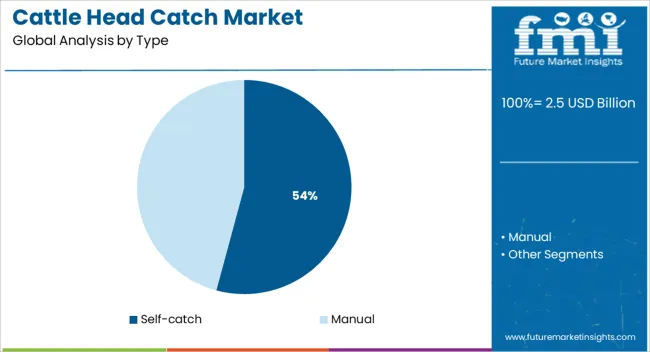

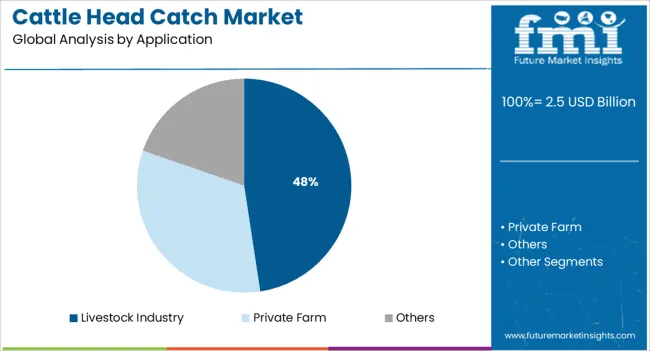

The market is segmented by Type and Application and region. By Type, the market is divided into Self-catch and Manual. In terms of Application, the market is classified into Livestock Industry, Private Farm, and Others. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The self catch type segment is projected to represent 54.20% of the total market revenue by 2025, positioning it as the leading type segment. Its growth is attributed to ease of use, reduced need for additional manpower, and improved safety for both animals and handlers.

Self catch systems automatically secure cattle once they enter the chute, enabling faster operations and lowering stress on livestock. Their adaptability to different cattle sizes and suitability for both small and large scale farms have reinforced widespread acceptance.

Enhanced durability and low maintenance requirements have further supported their dominance, making self catch systems the preferred choice for modern livestock operations.

The livestock industry application segment is expected to account for 47.60% of overall market revenue by 2025, making it the most prominent application. This dominance is being driven by the expansion of commercial dairy and beef production, which requires efficient handling systems to ensure productivity and compliance with animal welfare regulations.

Increasing herd sizes and the need for regular veterinary care and health monitoring have intensified the demand for cattle head catches in this sector. Moreover, the focus on reducing labor costs and improving operational safety has encouraged farms to integrate advanced handling equipment.

The livestock industry continues to serve as the key growth driver, underpinning consistent demand for cattle head catch systems in both developed and emerging markets.

The market is projected to register a CAGR of 7.1% between 2025 and 2035. Historically, the market presented moderate growth from 2020 to 2025, exhibiting a CAGR of 6.4%.

Short Term (2025 to 2029): The mechanization of the dairy farming market is a crucial topic for agricultural research and development. As a result, sales of cattle head catches are likely to be influenced by the agriculture industry altogether.

Medium Term (2029 to 2035): This period is expected to see a surge in demand for cattle head catches, which is likely to benefit manufacturers. This popularity is probably being fueled by the tendency toward making meaningful changes to cattle husbandry to provide top-notch care.

Long Term (2035 to 2035): Advanced devices like self-head catches have already been shaped by several manufacturers. During this period, manufacturers are likely to invest more money in better-quality product development that incorporates up-to-date pioneering technology.

These factors are anticipated to support a 2X increase in the market between 2025 and 2035. The market is projected to be worth USD 5 billion by the end of 2035, according to FMI analysts.

| 2020 | USD 1.40 billion |

|---|---|

| 2024 | USD 1.91 billion |

| 2025 | USD 2.03 billion |

| 2025 | USD 2.18 billion |

| 2035 | USD 5 billion |

Recent developments in livestock management are facilitating relatively high efficiency and reduced prices. Growing dairy and beef consumption, as well as the appeal of clean and pasture products, are important growth factors.

Increasing government funding for dairy farm efficiency programs and expansions are also likely to help the industry grow. Mechanization of the dairy farming sector is being promoted to increase output, reduce costs, and improve the quality of the products.

The use of technology in the cattle handling system is anticipated to open up new economic prospects. Market participants are taking note of this attention and profiting from it by offering cattle head catches. These are complemented by several applications for managing livestock. During the forecast period, this phenomenon is projected to prove to be crucial to market growth.

Online stores for livestock farming products have proliferated in recent years. Customers now have access to a greater variety of products. As a result, convenience for consumers has improved, and small-scale manufacturers, therefore, have multiple opportunities.

Auto-adjusting cattle head catches, commonly referred to as self-catch, are being developed by manufacturers. Cattle are intended to self-capture by hitting their shoulders on the head catch, which activates a device that wraps around their neck.

| Countries | Market Value (2025) |

|---|---|

| United States | USD 534.6 million |

| Germany | USD 393 million |

| United Kingdom | USD 199.4 million |

| China | USD 191.07 million |

| Japan | USD 87.3 million |

| India | USD 78.9 million |

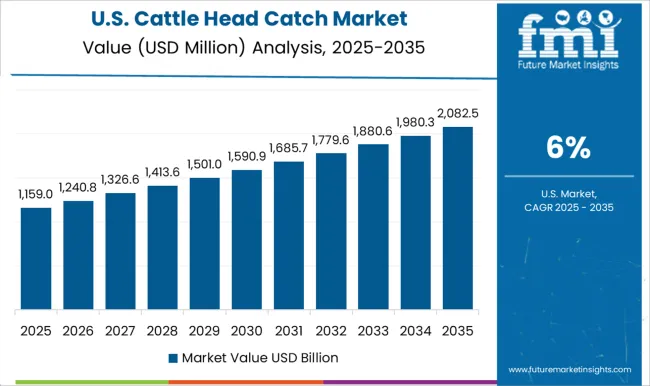

Cattle production is a significant agricultural sector in the United States. This typically accounts for the main bulk of overall cash revenues for agricultural commodities. Ranchers rank cattle health as their top priority, according to research commissioned by The National Cattlemen's Beef Association (NCBA). The management techniques they use include low-stress methods of handling cattle.

| Country | Market Share (2025) |

|---|---|

| United States | 26.3% |

During the forecast period, the United States is anticipated to contribute a sizable portion of the cattle head catches to the market in North America. The primary causes of the large contribution are the expanding role of the dairy sector. Moreover, the dairy cattle population is immensely increasing in the country to meet the demand from the dairy farming industry. With the help of more hands-on experience recently, the nation's awareness regarding the application of advanced cattle management practices has swiftly improved. Therefore, the United States cattle head catch market offers enormous opportunities for market players.

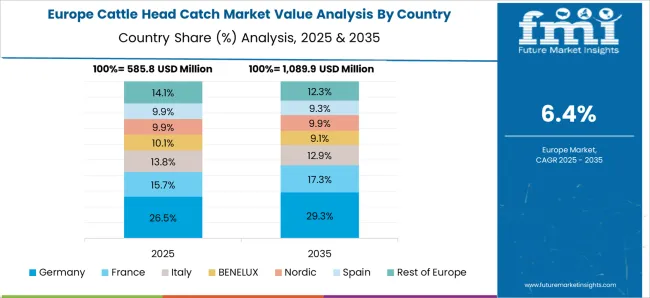

Europe also owns a sizable portion of the market after North America since advanced dairy farming practices are becoming popular there. Germany has a sizable pasture of dairy cattle, making it an important cattle head catch to market in Europe. Around one in four farms in this nation grow dairy cattle. In Germany, livestock farming is the mainstay of the economy. The sale of products from livestock operations generates 60% of the agricultural income in Germany.

| Country | Market Share (2025) |

|---|---|

| Germany | 19.3% |

In Germany, cattle breeding is a thriving industry with a long history, excellent management, and a depth of expertise. The demand for meat and dairy items in the country is growing. The reason for the significant spike in consumption is customer demand for a diet rich in protein. Farmers are compelled by this enormous dairy product demand to import farming equipment from abroad to boost domestic produces. As a result, market participants are likely to benefit from the German cattle head catch to market.

In the UK, mixed agriculture is prevalent. It can be either extensive or intense and involves both crops and livestock. The nation is densely populated overall and has a significant demand for foods like meat and proteins. Ranchers are increasing their cattle production to meet the demand. Therefore, to handle these huge herds of cattle, farms in the UK utilize innovative modern infrastructure.

| Country | United Kingdom |

|---|---|

| CAGR (2025 to 2035) | 7.6% |

| Market Share (2025) | 9.8% |

| Market Value (2035) | USD 415.4 million |

Several large-scale industrial raising facilities are currently located here. The UK cattle head catch market is projected to expand significantly. The primary reason behind this is the presence of large enterprises and rising volumes of farm equipment imports and export. Manufacturers in the country are focusing on recent finds to establish a substantial footprint.

Many nations in the Asia Pacific region are recognized for having common agricultural economies and have recently boosted their cattle farming. China has profited from the very profitable sector in the same way as other developing countries. This is mainly because industrialized agriculture methods are used in the country to enhance productivity. Milk and other dairy products seem to have firmly carved out a place for themselves in the local cuisine.

| Country | China |

|---|---|

| CAGR (2025 to 2035) | 5.7% |

| Market Share (2025) | 9.4% |

| Market Value (2035) | USD 332.3 million |

China has seen a substantial improvement in the cattle industry. This development is positively impacted by government backing, cattle supply, and demand, as well as advancement in technology. Farmers and agricultural professionals in the nation focus on careful and controlled management. Along with the management or essential Key performance indicators, they concentrate on prospective handling process enhancements. As a result, China offers a wealth of chances for market players.

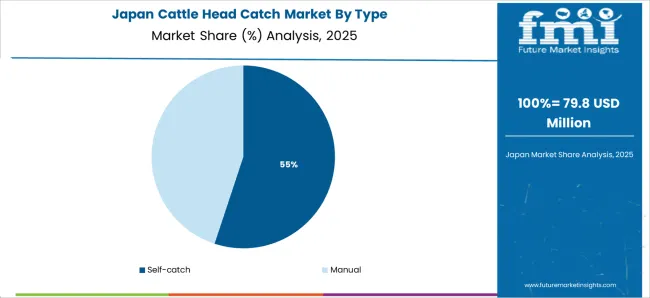

To encourage the development of local cattle farming, the Japanese government has put in place several initiatives. These include increased funding for the industry's research and development efforts in addition to incentives for cattle producers. The government has also put in place a system of cattle farming transparency to ensure animal care and safety.

| Country | Market Share (2025) |

|---|---|

| Japan | 4.3% |

During the forecast period, market growth in Japan is predicted due to the growing demand for beef. The adoption of cattle farming tools by farm owners is predicted to rise as a result. Furthermore, the government's actions to support domestic cattle production and ensure food safety and quality are likely to remain beneficial to the industry.

The world's substantial milk producer at the moment, India is essential to the supply chains of its neighbors who have milk scarcities. This makes the industry important from an economic and cultural standpoint. The Rashtriya Gokul Mission and The National Livestock Mission are two examples of the government of India's numerous programs for farmers. Consequently, the Indian cattle head catch market is a profitable venture for producers and suppliers.

| Country | India |

|---|---|

| CAGR (2025 to 2035) | 8.3% |

| Market Share (2025) | 3.9% |

| Market Value (2035) | USD 175.8 million |

The global market is segmented based on type, application, and region.

It's a widespread misconception that self-catch head gates are easy to use. Self-catch head gates are popular. However recent research has shown that they can be more difficult for handlers to use than manual head gates. Cattle that have a bad experience with a self-catch head gate could be extremely challenging to handle in the future. Moreover, chute shyness is a common problem cattle handlers have in their ranching operations.

The word "Manual" is frequently misused about head gates. However, new developments by revolutionary manufacturers have significantly reduced the labor-intensiveness that manual head gates once required. In addition to being far simpler to operate than its counterparts, the new generation manual head gates bring self-catch head gates to disgrace.

Based on application, the livestock industry is anticipated to be a significant source of revenue for the global market. This share can be attributed to their capacity to use cutting-edge farming equipment since they have sufficient capital on hand. In general, the livestock industry generates profits that are far above its total operating expenses.

Compared to private farms, the livestock business often incurs far lower expenses. Until the economies of scale are maintained, these advantages are spread throughout a broad range of herd sizes. Moreover, large herd sizes in the livestock industry are expected to cut operational costs in half. With growing herd sizes, the price is projected to continue to decrease.

The market is fiercely competitive, and the leading rivals often modify their tactics. Businesses are focusing on creating cutting-edge products and growing their distribution channels in an attempt to expand their customer base.

Real Tuff Livestock Equipment

Since its establishment in 1994, REAL-TUFF, Inc. has placed a strong emphasis on providing affordable, high-quality cattle equipment. The business continues to create different products and enhance its portfolio as an outcome of using the machinery on its own farms.

Arrowquip

The business launched its first livestock chute project in North America in 2003. It started making cutting-edge cattle chutes and handling machinery for trade. The Arrowquip team relocated to a cutting-edge production facility and office space in December 2020 to better serve the market and its manufacturing procedures.

Pearson Livestock Equipment

Since the firm itself is a rancher, it designs each piece of livestock handling equipment with the rancher in mind. It considers that the operator and the animal must come first while dealing with animals. Given this, it continues to set the standard for the sector with cutting-edge machinery made to be less stressful for farmers and animals while standing up to use, cattle, and time.

Recent Developments

The global cattle head catch market is estimated to be valued at USD 2.5 billion in 2025.

The market size for the cattle head catch market is projected to reach USD 5.0 billion by 2035.

The cattle head catch market is expected to grow at a 7.1% CAGR between 2025 and 2035.

The key product types in cattle head catch market are self-catch and manual.

In terms of application, livestock industry segment to command 47.6% share in the cattle head catch market in 2025.

The global cattle head catch market is estimated to be valued at USD 2.5 billion in 2025.

The market size for the cattle head catch market is projected to reach USD 5.0 billion by 2035.

The cattle head catch market is expected to grow at a 7.1% CAGR between 2025 and 2035.

The key product types in cattle head catch market are self-catch and manual.

In terms of application, livestock industry segment to command 47.6% share in the cattle head catch market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Cattle and Sheep Disease Diagnostic Kits Market Size and Share Forecast Outlook 2025 to 2035

Cattle Feed Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Cattle Squeeze Market Size and Share Forecast Outlook 2025 to 2035

Cattle Feeder Panels Market Size and Share Forecast Outlook 2025 to 2035

Cattle Grooming Chute Market Size and Share Forecast Outlook 2025 to 2035

Cattle Handling Systems Market Size and Share Forecast Outlook 2025 to 2035

Cattle Blower Market Size and Share Forecast Outlook 2025 to 2035

Cattle Mineral Feeder Market Size and Share Forecast Outlook 2025 to 2035

Cattle Feeder Market Size and Share Forecast Outlook 2025 to 2035

Cattle Management Software Market Size and Share Forecast Outlook 2025 to 2035

Cattle Supplies Market Analysis & Forecast for 2025 to 2035

Cattle Nutrition Market Analysis by Cattle Type, Nutrition Type, Application, Life Stage Through 2025 to 2035

Smart Cattle Market

Dairy Cattle Feed Market

Automatic Cattle Waterer Market – Trends & Growth Forecast 2025 to 2035

Head Protection Equipment Market Forecast Outlook 2025 to 2035

Head-up Display Market Size and Share Forecast Outlook 2025 to 2035

Head Band Ophthalmoscopes Market Size and Share Forecast Outlook 2025 to 2035

Head and Neck Cancer (HNC) Therapeutics Market - Growth & Drug Developments 2025 to 2035

Headspace Gas Analyzers Market - Trends & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA