The global Headless CMS Software market is expected to expand from USD 973.8 million in 2025 to USD 7,113.6 million by 2035, reflecting a robust CAGR of 22.6%.

The headless CMS software is propelling due to the increasing adoption of omnichannel content delivery, enabling businesses to manage and distribute content in multiple platforms. The tools offer flexibility and scalability by decoupling the content repository from the front-end delivery layer. The tools help to streamline content workflows, enhance user experiences and helps to support seamless integration with various digital channels and making them very essential for modern enterprises.

Global Headless CMS Software Market Assessment

| Attributes | Description |

|---|---|

| Historical Size, 2024 | USD 816.9 million |

| Estimated Size, 2025 | USD 973.8 million |

| Projected Size, 2035 | USD 7,113.6 million |

| Value-based CAGR (2025 to 2035) | 22.6% |

The growing focus on digital transformation across industries such as retail & e-commerce, media & entertainment and IT & telecom is accelerating the demand for headless CMS solutions. The ability helps to deliver personalized and dynamic content in real time, combined with robust API-based architectures.

North America is dominating the market due to the presence of advanced technology ecosystems and early adoption of innovative content management solutions. Also, South Asia & Pacific region is witnessing rapid growth due to the rising penetration of digital platforms and focused on expanding e-commerce sectors.

The increasing adoption of cloud-based deployments, along with a shift towards micro services architecture and API-first approaches is reforming the market. The business across various verticals are prioritizing headless CMS solutions to support modular, scalable and future-proof digital strategies.

Also the rising interest in smart content management, improved developer and marketer collaboration and the integration of AI for advanced personalization are propelling the growth of headless CMS software market globally.

The below table presents the expected CAGR for the global Headless CMS Software market over several semi-annual periods spanning from 2025 to 2035. This assessment outlines changes in the Headless CMS Software industry and identify revenue trends, offering key decision makers an understanding about market performance throughout the year.

H1 represents first half of the year from January to June, H2 spans from July to December, which is the second half. In the first half (H1) of the year from 2024 to 2034, the business is predicted to surge at a CAGR of 22.1%, followed by a slightly higher growth rate of 22.9% in the second half (H2) of the same decade.

| Particular | Value CAGR |

|---|---|

| H1 | 22.1% (2024 to 2034) |

| H2 | 22.9% (2024 to 2034) |

| H1 | 21.9% (2025 to 2035) |

| H2 | 23.2% (2025 to 2035) |

Moving into the subsequent period, from H1 2025 to H2 2035, the CAGR is projected to decrease slightly to 21.9% in the first half and remain higher at 23.8% in the second half. In the first half (H1) the market witnessed a decrease of 20 BPS while in the second half (H2), the market witnessed an increase of 30 BPS.

Increased adoption of API-driven solutions to enhance integration with digital platforms

The adoption of API-driven is rapidly transforming the headless CMS software by enabling seamless integration with the diverse digital platforms. The solutions decouple content from the presentation layer, allowing businesses for delivering content dynamically across various multiple channels such as websites, mobile apps, IoT devices and social media.

The APIs help for facilitating a flexible and scalable architecture to make it easier for organizations for adopting omnichannel strategies and respond to rapidly changing market demands. The businesses are using API-first approaches report up to 40% improvement in development efficiency, reducing time-to-market for new digital experiences.

The government help to leverage API-driven headless CMS solutions for modernizing public service portals help for ensuring consistent citizen engagement across the channels. In 2023, For digital transformation projects the government of USA allocated USD 1.1 billion to emphasize API-based integrations for enhancing public accessibility.

Increasing preference for cloud-based CMS solutions to enhance accessibility and scalability

The shift towards cloud-based CMS solutions is propelling due to the need for accessible and scalable platforms. The cloud deployments allow businesses for managing content remotely, reduce infrastructure costs and help to ensure high availability. According to survey 68% of organizations prefer the cloud-based headless CMS tools due to their ability to support global teams and help for real-time collaboration.

The government agencies are also adopting cloud solutions for digital governance with the UK government G-Cloud initiative facilitating the procurement of cloud CMS services. In 2024, 75% of public sector websites in the UK are projected to transition of cloud-based CMS platforms to enhanced scalability and security.

Demand for implementation and onboarding solutions to simplify CMS deployment for enterprises

The demand for implementation and onboarding services in the headless CMS is growing as the organizations are seeking to simplify deployments and help to reduce downtime. The services help for enabling businesses to transition from traditional CMS platforms to headless architectures smoothly.

The enterprise helps to prioritize professional onboarding services for reduction in implementation time, leading to faster ROI. The government projects also benefit from such services and their initiative such as India’s Digital India and this help for utilizing and onboarding services to integrate headless CMS tools into citizen engagement platforms, enabling faster rollout of services across 27 states and help for improving user accessibility.

Integration complexities with legacy systems slow down transition to headless CMS solutions

The difficulty of integrating headless CMS solutions with existing legacy systems. Many organizations are relying on old content management systems or proprietary software that were not designed for modern, API-based architectures. The mismatch makes it challenging to connect the new headless CMS to outdated systems and it is requiring significant customization and technical expertise.

The legacy systems will store content in formats that are incompatible with APIs of headless CMS and it is causing delays in data migration. For ensuring smooth communication between the headless CMS and other enterprise tools such as CRMs or ERPs will be complex and time-consuming. Vendors are facing downtime or disruption in operations during the transition which will slows the adoption.

From the period 2020 to 2024 the global headless CMS software is experienced steady growth due to the rising adoption of omnichannel content delivery and API-based architectures. The sales were primarily concentrated in sectors such as ecommerce, IT & Telecom and Media & Entertainment was demand for flexibility and scalability in content management was high. The market size poised at a CAGR of 19.2% and the actual sale in 2024 is 816.9 Million.

Looking ahead from the period 2025 to 2035 the market is projected to expand significantly and poised at a CAGR of 22.6% from the period 2025 to 2035. The growth is propelled by the increasing digital transformation initiatives, cloud-based deployments and the adoption of micro services architecture. The global market is projected to reach a valuation of 7,113.6 Million by the end of 2035 with a strong contribution from various sectors such as retail & e-commerce and healthcare.

Tier 1 vendors are leading players with a strong presence across multiple regions and offer comprehensive headless CMS solutions and services. Vendors such as Contentful, Kentico Kontent, Strapi and Sanity are dominating the segment and caters around 50% to 55% of the global market in 2024. The vendors are benefiting robust API-driven platforms, enterprise-level scalability and wide adoption in sectors such as eCommerce and IT & telecom.

Tier 2 vendors contains mid-sized companies with a moderate regional presence and niche offerings tailored for specific industries. Vendors such as ButterCMS, Agility CMS and Prismic cater around 15% to 20% of the market. Tier 2 vendors focus on providing cost-effective solutions and catering to small and medium enterprises and this vendor rapidly gaining traction in the emerging markets.

Small-scale vendors and startups contains 20% to 25% of the market. Tier 3 vendors includes Payload CMS and Storyblok are operating regionally or in specialized sectors such as media & entertainment or government. Tier 3 vendors market share is limited and they propelled with innovation and unique features for competitive pricing strategies and it help for contributing to the dynamic growth of the market.

The section highlights the CAGRs of countries experiencing growth in the Headless CMS Software market, along with the latest advancements contributing to overall market development. Based on current estimates, USA, India and Germany are expected to see steady growth during the forecast period.

| Countries | CAGR from 2025 to 2035 |

|---|---|

| India | 26.1% |

| China | 24.7% |

| Germany | 17.8% |

| Australia & New Zealand | 23.0% |

| United States | 18.9% |

The adoption of headless CMS solutions in the USA is growing rapidly for patient education and telehealth applications. The healthcare providers are increasingly using the solutions to manage and help to distribute personalized content across websites, mobile apps and patient portals. This helps for delivering real-time educational content such as interactive guides and videos help to tailored individual patient needs.

The rise of telehealth, headless CMS supports for seamless integration with telemedicine platforms allowing for features such as virtual consultations and personalized health content delivery. The integration helps for ensuring patient will access up-to-date information on any device help for enhancing the healthcare experience.

According to government and their initiative such as 21st Century Cures Act are boosting digital health infrastructure and they are contributing to the growth of headless CMS solutions in healthcare. By the end of 2023 around 30% of the healthcare providers in USA are adopting headless CMS for telehealth and patient education projected over 16.2% for the next five years. The headless CMS software market in USA is projected to grow at CAGR of 18.9%.

The rapid growth of e-commerce and retail sectors in India are propelled by rising demand for scalable headless CMS tools. As the businesses attempt to deliver personalized, real-time content in various digital touchpoints. It offers flexibility and scalability required to manage large volumes of data and content efficiently. In India the digital economy is expanding and the shift towards online shopping in mobile e-commerce.

It allows retailers to create omnichannel experiences that will easily integrate with web, mobile and other customer-facing platforms for ensuring consistency in product information, promotions and customer interactions.

In India the e-commerce sector is rising at a rapid pace propelled by increasing internet penetration and a growing middle class and an expanding digital payment infrastructure. The government initiative such as Digital India help to enhance internet access and e-commerce capabilities and the businesses are focused on investing in advanced digital infrastructure such as content management systems. The headless CMS software market in India is expected to grow by 26.1% and valued in 2025 is 30.3 Million.

The integration of multilingual and compliant content systems is gaining momentum with the government’s digitalization under the initiatives such as Digital Strategy 2025. The headless CMS solutions are very essential to manage and distribute multilingual content while ensuring compliance with EU GDPR regulations. The systems are very crucial for public service websites that help to require content in multiple languages such as German, English and other regional languages.

The shift towards for digital public services is propelling the adoption of headless CMS, with a projected 25.3% annual increase in adoption for government portals by the end of 2026. As of 2023 around 20% of public institutions in Germany have implementing or planning to adopt multilingual content management systems. The Germany market is projected to reach 304.2 Million by 2035 and poised at a CAGR of 17.8%.

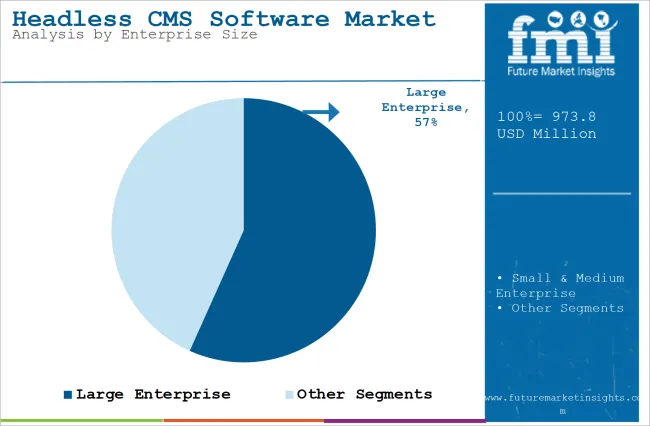

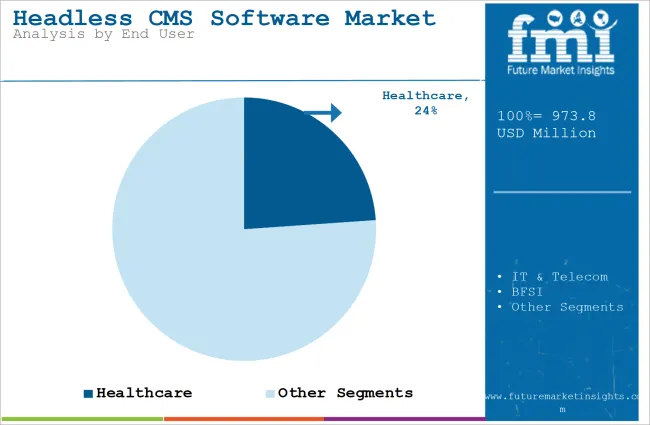

The section below offers in-depth insights into leading segments. The enterprise size category includes SMEs and Large Enterprises. Also, under end user category includes IT & Telecom, BFSI, healthcare, travel & hospitality, media & entertainment, retail & e-commerce, government and others. Among these segments, IT & Telecom gained vast popularity and experiencing a booming development, while large enterprises holds dominant market share.

Large enterprises are dominating the headless CMS software due to their complex content needs and strong digital transformation strategies. The organizations require scalable CMS solutions to manage content across websites, mobile apps and IoT devices help for ensuring consistent user experiences.

It helps to support multi-language content, integrate complex workflows and help to comply regional data regulations which is very essential for large-scale operations. According to the USA Digital Service Act help to supports businesses for improving digital accessibility. In 2025, large enterprises made up over 56.7% of the market due to ongoing government-backed digital projects.

| Segment | Value Share (2025) |

|---|---|

| Large Enterprise (Enterprise Size) | 56.7% |

The IT & Telecom sector is fueling the growth in the headless CMS software. The vendors in this sector are prioritizing the scalable, API-driven solutions for omnichannel content delivery. The rising demand for seamless integration with mobile apps, customer portals and IoT platforms is propelling the adoption of headless CMS. The solutions allow telecom and IT enterprises to deliver dynamic, personalized content across multiple touchpoints and help for enhancing customer experiences and engagement.

The platforms support automation and efficient content workflows which are vital for large-scale digital operations in the sector. According to the USA Infrastructure Investment and Jobs Act allocated USD 65 billion investment in broadband expansion help for enabling telecom companies to scale their digital services. IT & Telecom sector is projected CAGR of 23.9% from the period 2024 to 2034.

| Segment | CAGR (2025to 2035) |

|---|---|

| Healthcare (Industry) | 23.9% |

The competition in the headless CMS software market is competitive and as the various players are focused on enhancing flexibility, scalability and help for seamless content delivery across multiple digital channels. The Key players are forming strategic partnerships to broaden their capabilities and focused on various offering and more customizable solutions for diverse industries from travel to omnichannel experiences.

The market is witnessing a shift towards open-source solutions and the companies are emphasizing API-first architectures to enable smoother integrations and scalability.

Industry Update

In terms of solution, the segment is divided into Headless CMS Software Tools and Headless CMS Software Services.

In terms of enterprise size, the segment is segregated into SMEs and Large Enterprises.

In terms of end user, the industry is segregated into urban IT & Telecom, BFSI, Healthcare, Travel & Hospitality, Media & Entertainment, Retail & e-commerce, Government and Others.

A regional analysis has been carried out in key countries of North America, Latin America, East Asia, South Asia & Pacific, Western Europe, Eastern Europe and Middle East and Africa (MEA).

The Global Headless CMS Software industry is projected to witness CAGR of 22.6% between 2025 and 2035.

The Global Headless CMS Software industry stood at USD 816.9 million in 2024.

The Global Headless CMS Software industry is anticipated to reach USD 7,113.6 million by 2035 end.

South Asia & Pacific is set to record the highest CAGR of 26.1% in the assessment period.

The key players operating in the Global Headless CMS Software Industry Agility CMS, Bloomreach, Butter CMS, Cockpit, Contentful, Contentstack, Core dna and Craft CMS.

Table 1: Global Market Value (US$ Mn) Forecast by Region, 2017-2032

Table 2: Global Market Value (US$ Mn) Forecast by Deployment Type, 2017-2032

Table 3: Global Market Value (US$ Mn) Forecast by Enterprise Size, 2017-2032

Table 4: North America Market Value (US$ Mn) Forecast by Country, 2017-2032

Table 5: North America Market Value (US$ Mn) Forecast by Deployment Type, 2017-2032

Table 6: North America Market Value (US$ Mn) Forecast by Enterprise Size, 2017-2032

Table 7: Latin America Market Value (US$ Mn) Forecast by Country, 2017-2032

Table 8: Latin America Market Value (US$ Mn) Forecast by Deployment Type, 2017-2032

Table 9: Latin America Market Value (US$ Mn) Forecast by Enterprise Size, 2017-2032

Table 10: Europe Market Value (US$ Mn) Forecast by Country, 2017-2032

Table 11: Europe Market Value (US$ Mn) Forecast by Deployment Type, 2017-2032

Table 12: Europe Market Value (US$ Mn) Forecast by Enterprise Size, 2017-2032

Table 13: South Asia Market Value (US$ Mn) Forecast by Country, 2017-2032

Table 14: South Asia Market Value (US$ Mn) Forecast by Deployment Type, 2017-2032

Table 15: South Asia Market Value (US$ Mn) Forecast by Enterprise Size, 2017-2032

Table 16: East Asia Market Value (US$ Mn) Forecast by Country, 2017-2032

Table 17: East Asia Market Value (US$ Mn) Forecast by Deployment Type, 2017-2032

Table 18: East Asia Market Value (US$ Mn) Forecast by Enterprise Size, 2017-2032

Table 19: Oceania Market Value (US$ Mn) Forecast by Country, 2017-2032

Table 20: Oceania Market Value (US$ Mn) Forecast by Deployment Type, 2017-2032

Table 21: Oceania Market Value (US$ Mn) Forecast by Enterprise Size, 2017-2032

Table 22: MEA Market Value (US$ Mn) Forecast by Country, 2017-2032

Table 23: MEA Market Value (US$ Mn) Forecast by Deployment Type, 2017-2032

Table 24: MEA Market Value (US$ Mn) Forecast by Enterprise Size, 2017-2032

Figure 1: Global Market Value (US$ Mn) by Deployment Type, 2022-2032

Figure 2: Global Market Value (US$ Mn) by Enterprise Size, 2022-2032

Figure 3: Global Market Value (US$ Mn) by Region, 2022-2032

Figure 4: Global Market Value (US$ Mn) Analysis by Region, 2017-2032

Figure 5: Global Market Value Share (%) and BPS Analysis by Region, 2022-2032

Figure 6: Global Market Y-o-Y Growth (%) Projections by Region, 2022-2032

Figure 7: Global Market Value (US$ Mn) Analysis by Deployment Type, 2017-2032

Figure 8: Global Market Value Share (%) and BPS Analysis by Deployment Type, 2022-2032

Figure 9: Global Market Y-o-Y Growth (%) Projections by Deployment Type, 2022-2032

Figure 10: Global Market Value (US$ Mn) Analysis by Enterprise Size, 2017-2032

Figure 11: Global Market Value Share (%) and BPS Analysis by Enterprise Size, 2022-2032

Figure 12: Global Market Y-o-Y Growth (%) Projections by Enterprise Size, 2022-2032

Figure 13: Global Market Attractiveness by Deployment Type, 2022-2032

Figure 14: Global Market Attractiveness by Enterprise Size, 2022-2032

Figure 15: Global Market Attractiveness by Region, 2022-2032

Figure 16: North America Market Value (US$ Mn) by Deployment Type, 2022-2032

Figure 17: North America Market Value (US$ Mn) by Enterprise Size, 2022-2032

Figure 18: North America Market Value (US$ Mn) by Country, 2022-2032

Figure 19: North America Market Value (US$ Mn) Analysis by Country, 2017-2032

Figure 20: North America Market Value Share (%) and BPS Analysis by Country, 2022-2032

Figure 21: North America Market Y-o-Y Growth (%) Projections by Country, 2022-2032

Figure 22: North America Market Value (US$ Mn) Analysis by Deployment Type, 2017-2032

Figure 23: North America Market Value Share (%) and BPS Analysis by Deployment Type, 2022-2032

Figure 24: North America Market Y-o-Y Growth (%) Projections by Deployment Type, 2022-2032

Figure 25: North America Market Value (US$ Mn) Analysis by Enterprise Size, 2017-2032

Figure 26: North America Market Value Share (%) and BPS Analysis by Enterprise Size, 2022-2032

Figure 27: North America Market Y-o-Y Growth (%) Projections by Enterprise Size, 2022-2032

Figure 28: North America Market Attractiveness by Deployment Type, 2022-2032

Figure 29: North America Market Attractiveness by Enterprise Size, 2022-2032

Figure 30: North America Market Attractiveness by Country, 2022-2032

Figure 31: Latin America Market Value (US$ Mn) by Deployment Type, 2022-2032

Figure 32: Latin America Market Value (US$ Mn) by Enterprise Size, 2022-2032

Figure 33: Latin America Market Value (US$ Mn) by Country, 2022-2032

Figure 34: Latin America Market Value (US$ Mn) Analysis by Country, 2017-2032

Figure 35: Latin America Market Value Share (%) and BPS Analysis by Country, 2022-2032

Figure 36: Latin America Market Y-o-Y Growth (%) Projections by Country, 2022-2032

Figure 37: Latin America Market Value (US$ Mn) Analysis by Deployment Type, 2017-2032

Figure 38: Latin America Market Value Share (%) and BPS Analysis by Deployment Type, 2022-2032

Figure 39: Latin America Market Y-o-Y Growth (%) Projections by Deployment Type, 2022-2032

Figure 40: Latin America Market Value (US$ Mn) Analysis by Enterprise Size, 2017-2032

Figure 41: Latin America Market Value Share (%) and BPS Analysis by Enterprise Size, 2022-2032

Figure 42: Latin America Market Y-o-Y Growth (%) Projections by Enterprise Size, 2022-2032

Figure 43: Latin America Market Attractiveness by Deployment Type, 2022-2032

Figure 44: Latin America Market Attractiveness by Enterprise Size, 2022-2032

Figure 45: Latin America Market Attractiveness by Country, 2022-2032

Figure 46: Europe Market Value (US$ Mn) by Deployment Type, 2022-2032

Figure 47: Europe Market Value (US$ Mn) by Enterprise Size, 2022-2032

Figure 48: Europe Market Value (US$ Mn) by Country, 2022-2032

Figure 49: Europe Market Value (US$ Mn) Analysis by Country, 2017-2032

Figure 50: Europe Market Value Share (%) and BPS Analysis by Country, 2022-2032

Figure 51: Europe Market Y-o-Y Growth (%) Projections by Country, 2022-2032

Figure 52: Europe Market Value (US$ Mn) Analysis by Deployment Type, 2017-2032

Figure 53: Europe Market Value Share (%) and BPS Analysis by Deployment Type, 2022-2032

Figure 54: Europe Market Y-o-Y Growth (%) Projections by Deployment Type, 2022-2032

Figure 55: Europe Market Value (US$ Mn) Analysis by Enterprise Size, 2017-2032

Figure 56: Europe Market Value Share (%) and BPS Analysis by Enterprise Size, 2022-2032

Figure 57: Europe Market Y-o-Y Growth (%) Projections by Enterprise Size, 2022-2032

Figure 58: Europe Market Attractiveness by Deployment Type, 2022-2032

Figure 59: Europe Market Attractiveness by Enterprise Size, 2022-2032

Figure 60: Europe Market Attractiveness by Country, 2022-2032

Figure 61: South Asia Market Value (US$ Mn) by Deployment Type, 2022-2032

Figure 62: South Asia Market Value (US$ Mn) by Enterprise Size, 2022-2032

Figure 63: South Asia Market Value (US$ Mn) by Country, 2022-2032

Figure 64: South Asia Market Value (US$ Mn) Analysis by Country, 2017-2032

Figure 65: South Asia Market Value Share (%) and BPS Analysis by Country, 2022-2032

Figure 66: South Asia Market Y-o-Y Growth (%) Projections by Country, 2022-2032

Figure 67: South Asia Market Value (US$ Mn) Analysis by Deployment Type, 2017-2032

Figure 68: South Asia Market Value Share (%) and BPS Analysis by Deployment Type, 2022-2032

Figure 69: South Asia Market Y-o-Y Growth (%) Projections by Deployment Type, 2022-2032

Figure 70: South Asia Market Value (US$ Mn) Analysis by Enterprise Size, 2017-2032

Figure 71: South Asia Market Value Share (%) and BPS Analysis by Enterprise Size, 2022-2032

Figure 72: South Asia Market Y-o-Y Growth (%) Projections by Enterprise Size, 2022-2032

Figure 73: South Asia Market Attractiveness by Deployment Type, 2022-2032

Figure 74: South Asia Market Attractiveness by Enterprise Size, 2022-2032

Figure 75: South Asia Market Attractiveness by Country, 2022-2032

Figure 76: East Asia Market Value (US$ Mn) by Deployment Type, 2022-2032

Figure 77: East Asia Market Value (US$ Mn) by Enterprise Size, 2022-2032

Figure 78: East Asia Market Value (US$ Mn) by Country, 2022-2032

Figure 79: East Asia Market Value (US$ Mn) Analysis by Country, 2017-2032

Figure 80: East Asia Market Value Share (%) and BPS Analysis by Country, 2022-2032

Figure 81: East Asia Market Y-o-Y Growth (%) Projections by Country, 2022-2032

Figure 82: East Asia Market Value (US$ Mn) Analysis by Deployment Type, 2017-2032

Figure 83: East Asia Market Value Share (%) and BPS Analysis by Deployment Type, 2022-2032

Figure 84: East Asia Market Y-o-Y Growth (%) Projections by Deployment Type, 2022-2032

Figure 85: East Asia Market Value (US$ Mn) Analysis by Enterprise Size, 2017-2032

Figure 86: East Asia Market Value Share (%) and BPS Analysis by Enterprise Size, 2022-2032

Figure 87: East Asia Market Y-o-Y Growth (%) Projections by Enterprise Size, 2022-2032

Figure 88: East Asia Market Attractiveness by Deployment Type, 2022-2032

Figure 89: East Asia Market Attractiveness by Enterprise Size, 2022-2032

Figure 90: East Asia Market Attractiveness by Country, 2022-2032

Figure 91: Oceania Market Value (US$ Mn) by Deployment Type, 2022-2032

Figure 92: Oceania Market Value (US$ Mn) by Enterprise Size, 2022-2032

Figure 93: Oceania Market Value (US$ Mn) by Country, 2022-2032

Figure 94: Oceania Market Value (US$ Mn) Analysis by Country, 2017-2032

Figure 95: Oceania Market Value Share (%) and BPS Analysis by Country, 2022-2032

Figure 96: Oceania Market Y-o-Y Growth (%) Projections by Country, 2022-2032

Figure 97: Oceania Market Value (US$ Mn) Analysis by Deployment Type, 2017-2032

Figure 98: Oceania Market Value Share (%) and BPS Analysis by Deployment Type, 2022-2032

Figure 99: Oceania Market Y-o-Y Growth (%) Projections by Deployment Type, 2022-2032

Figure 100: Oceania Market Value (US$ Mn) Analysis by Enterprise Size, 2017-2032

Figure 101: Oceania Market Value Share (%) and BPS Analysis by Enterprise Size, 2022-2032

Figure 102: Oceania Market Y-o-Y Growth (%) Projections by Enterprise Size, 2022-2032

Figure 103: Oceania Market Attractiveness by Deployment Type, 2022-2032

Figure 104: Oceania Market Attractiveness by Enterprise Size, 2022-2032

Figure 105: Oceania Market Attractiveness by Country, 2022-2032

Figure 106: MEA Market Value (US$ Mn) by Deployment Type, 2022-2032

Figure 107: MEA Market Value (US$ Mn) by Enterprise Size, 2022-2032

Figure 108: MEA Market Value (US$ Mn) by Country, 2022-2032

Figure 109: MEA Market Value (US$ Mn) Analysis by Country, 2017-2032

Figure 110: MEA Market Value Share (%) and BPS Analysis by Country, 2022-2032

Figure 111: MEA Market Y-o-Y Growth (%) Projections by Country, 2022-2032

Figure 112: MEA Market Value (US$ Mn) Analysis by Deployment Type, 2017-2032

Figure 113: MEA Market Value Share (%) and BPS Analysis by Deployment Type, 2022-2032

Figure 114: MEA Market Y-o-Y Growth (%) Projections by Deployment Type, 2022-2032

Figure 115: MEA Market Value (US$ Mn) Analysis by Enterprise Size, 2017-2032

Figure 116: MEA Market Value Share (%) and BPS Analysis by Enterprise Size, 2022-2032

Figure 117: MEA Market Y-o-Y Growth (%) Projections by Enterprise Size, 2022-2032

Figure 118: MEA Market Attractiveness by Deployment Type, 2022-2032

Figure 119: MEA Market Attractiveness by Enterprise Size, 2022-2032

Figure 120: MEA Market Attractiveness by Country, 2022-2032

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Cash Management Services Market – Trends & Forecast 2025 to 2035

Case Management Software (CMS) Market Size and Share Forecast Outlook 2025 to 2035

Software-Defined Wide Area Network Market Size and Share Forecast Outlook 2025 to 2035

Software Defined Vehicle Market Size and Share Forecast Outlook 2025 to 2035

Software Defined Networking (SDN) And Network Function Virtualization (NFV) Market Size and Share Forecast Outlook 2025 to 2035

Software Defined Perimeter (SDP) Market Size and Share Forecast Outlook 2025 to 2035

Software-Defined Wide Area Network SD-WAN Market Size and Share Forecast Outlook 2025 to 2035

Software Defined Radio (SDR) Market Size and Share Forecast Outlook 2025 to 2035

Software License Management (SLM) Market Size and Share Forecast Outlook 2025 to 2035

Software-Defined Networking SDN Market Size and Share Forecast Outlook 2025 to 2035

Software-Defined Anything (SDx) Market Size and Share Forecast Outlook 2025 to 2035

Software-Defined Data Center Market Size and Share Forecast Outlook 2025 to 2035

Software Containers Market Size and Share Forecast Outlook 2025 to 2035

Software Defined Application And Infrastructure Market Size and Share Forecast Outlook 2025 to 2035

Software Defined Networking Market Size and Share Forecast Outlook 2025 to 2035

Software-Defined Camera (SDC) Market Size and Share Forecast Outlook 2025 to 2035

Examining Market Share Trends in the Software Distribution Industry

Software Distribution Market Analysis by Deployment Type, by Organization Size and by Industry Vertical Through 2035

Software Defined Video Networking Market

UK Software Distribution Market Analysis – Size & Industry Trends 2025-2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA