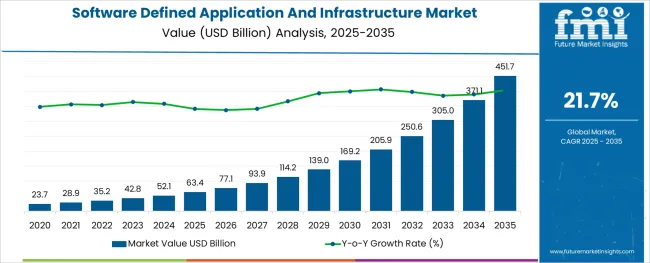

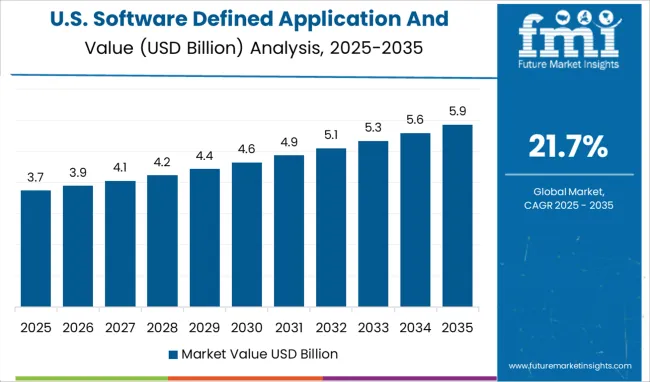

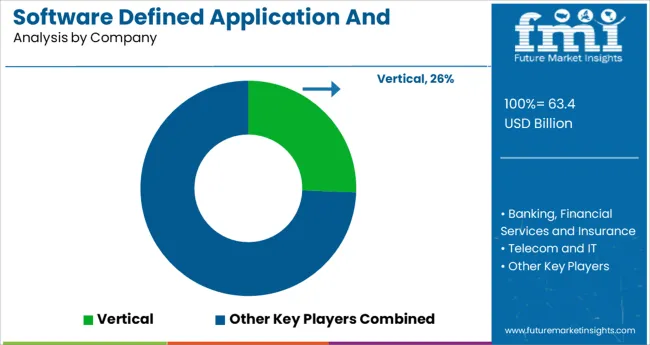

The Software Defined Application And Infrastructure Market is estimated to be valued at USD 63.4 billion in 2025 and is projected to reach USD 451.7 billion by 2035, registering a compound annual growth rate (CAGR) of 21.7% over the forecast period.

The software defined application and infrastructure market is expanding rapidly as organizations seek greater agility, scalability, and efficiency in their IT environments. Industry insights have highlighted that businesses are increasingly adopting software-defined solutions to reduce dependency on traditional hardware and to enable dynamic resource allocation.

The transition to cloud-native architectures and the rise of hybrid cloud deployments have accelerated the need for software-based management of applications and infrastructure. Large enterprises are leading this transformation by investing in flexible and automated platforms that enhance operational performance and support digital innovation initiatives.

The growing focus on security, compliance, and cost optimization further encourages adoption of software-defined solutions. Looking forward, technological advancements such as AI-driven orchestration and edge computing integration are expected to drive continued market growth. Segment growth is predicted to be led by solutions as the primary component, large enterprises as the main end users, and cloud deployment as the preferred mode.

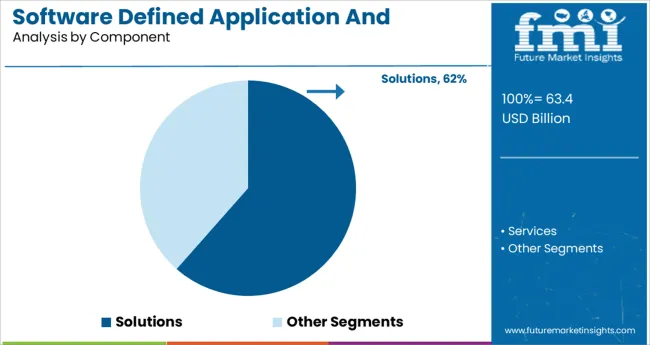

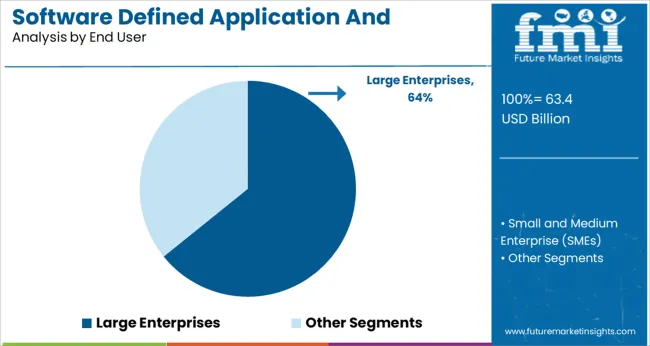

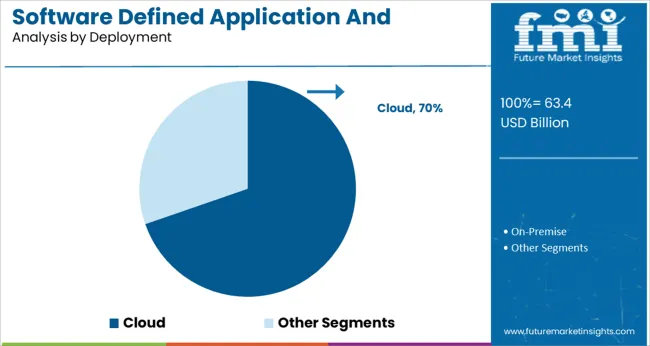

The market is segmented by Component, End User, Deployment, and Vertical and region. By Component, the market is divided into Solutions and Services. In terms of End User, the market is classified into Large Enterprises and Small and Medium Enterprise (SMEs). Based on Deployment, the market is segmented into Cloud and On-Premise.

By Vertical, the market is divided into Banking, Financial Services and Insurance, Telecom and IT, Healthcare, Retail, E-Commerce, Media and Entertainment, Transportation, and Others. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The Solutions segment is projected to capture 61.5% of the software defined application and infrastructure market revenue in 2025, sustaining its dominance. This segment benefits from the comprehensive nature of software solutions that integrate compute, storage, and networking functionalities.

Organizations favor solutions that provide centralized control, automation capabilities, and seamless scalability. The modularity and flexibility of these solutions allow rapid deployment and easier management of complex IT environments.

Growing digital transformation initiatives and the need to support hybrid workforces have driven demand for software solutions that enhance application delivery and infrastructure efficiency. As businesses continue to prioritize agility and cost-effectiveness, the Solutions segment is expected to maintain its leadership.

The Large Enterprises segment is projected to represent 64.2% of the market revenue in 2025, reflecting its leading role among end users. Larger organizations typically have more complex IT needs and the resources to invest in advanced software defined infrastructure.

They are increasingly adopting these technologies to streamline operations, improve service delivery, and enable innovation. Large enterprises are also more focused on scalability, security, and compliance, driving demand for sophisticated software-defined solutions.

The need to integrate legacy systems with modern cloud architectures has further accelerated adoption. As digital transformation strategies mature, large enterprises are expected to remain the primary drivers of market growth.

The Cloud deployment segment is expected to hold 69.7% of the market revenue in 2025, asserting its dominance in the deployment model. Cloud environments provide the flexibility and scalability required for software defined applications and infrastructure.

The shift towards public, private, and hybrid cloud models has increased reliance on software-defined technologies to manage resources efficiently and deliver applications with high performance. Cloud deployment supports remote access, rapid provisioning, and improved disaster recovery, all key considerations for modern enterprises.

Additionally, the increasing adoption of containerization and microservices architectures in cloud environments has reinforced the need for software-defined management solutions. As cloud adoption continues to accelerate globally, this deployment segment is poised to lead market expansion.

The software-defined application and infrastructure market is growing due to a number of causes. The first is that more businesses want their IT infrastructure to work together more effectively. The second factor is that far more businesses are using AI and moving to the cloud than in the past.

Traditionally, applications were thought of as a self-contained single entity, but with the development of software defined applications, this perception has shifted.

Software defined applications are a collection of self-contained microservices that connect with one another through application programming interfaces (APIs) such as the open cloud computing interface.

These interfaces allow users to make use of the immense potential of automation within and between cloud applications, thus propelling the growth of software-defined application and infrastructure market.

The software defined application and infrastructure market growth is being hampered by a lack of knowledge across industries, particularly in emerging economies such as India, China, Brazil, and Argentina, about the use of software defined applications and infrastructure.

Furthermore, security and interoperability difficulties related to the use of software defined application and infrastructure services are some of the major factors limiting the global growth of the software defined application and infrastructure market.

Also, there is a scarcity of individuals who are properly trained and skilled in the management of software-defined infrastructure. This is a significant restraint in the software defined application and infrastructure market.

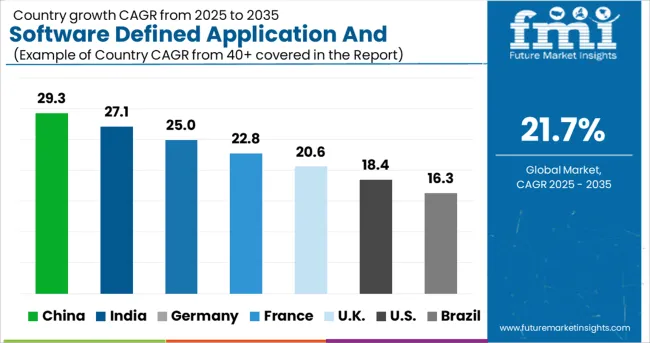

North America, Latin America, Western Europe, Eastern Europe, Japan, Asia Pacific Excluding Japan (APEJ), and the Middle East and Africa make up the global software defined application and infrastructure market.

The North America software defined application and infrastructure market holds the biggest market share in 2024.

Due to its significant concentration of large enterprises in the software defined application and infrastructure market, the North American area dominates in terms of software defined application and infrastructure market share. Companies in North America are rapidly shifting to software-defined infrastructure.

During the forecast period, the Asia Pacific region has the greatest software defined application and infrastructure market growth rate. This is due to a variety of factors. The first is that most of these countries' IT sectors are expanding at a rapid pace.

In addition, many businesses in this region are moving to the cloud and requiring software-defined infrastructure. The economy of most of the countries in this region are rising at a breakneck pace, which explains the high growth rate of software defined application and infrastructure market in APAC.

Companies in Japan, in particular, are employing Network Function Virtualization and Software Defined Networking. In the Asia-Pacific region, this is also a prominent element driving growth in the software defined application and infrastructure market.

Developing software-defined application and infrastructure that is more effective while operating at a level and in a manner that people can understand is perhaps the greatest issue that companies in the global SDI market face.

Cisco System Inc., Hewlett-Packard Co., IBM Corporation, Intel Corporation, NEC Corporation, and Dell Inc. are some of the key players in the global software defined application and infrastructure market.

To improve their products and strengthen their market position, key players in the global software defined application and infrastructure market focus on introducing improved solutions and services. Application Centric Infrastructure (ACI), for example, was introduced by Cisco System Inc. and automates end-to-end delivery, workload placement, network, and service provisioning.

| Report Attributes | Details |

|---|---|

| Growth Rate | CAGR of 21.7% from 2025 to 2035 |

| Base Year for Estimation | 2024 |

| Historical Data | 2020 to 2024 |

| Forecast Period | 2025 to 2035 |

| Quantitative Units | Revenue in USD Million and CAGR from 2025 to 2035 |

| Report Coverage | Revenue Forecast, Volume Forecast, Company Ranking, Competitive Landscape, Growth Factors, Trends and Pricing Analysis |

| Segments Covered | End-use industries, Application, Region |

| Regions Covered | North America; Latin America; Western Europe; Eastern Europe; APEJ; Japan; Middle East and Africa |

| Key Countries Profiled | USA, Canada, Brazil, Argentina, Germany, UK, France, Spain, Italy, Nordics, BENELUX, Australia & New Zealand, China, India, ASEAN, GCC, South Africa |

| Key Companies Profiled | Cisco System Inc.; Hewlett-Packard Co; IBM Corporation; Intel Corporation; NEC Corporation; Dell Inc. |

| Customization | Available Upon Request |

The global software defined application and infrastructure market is estimated to be valued at USD 63.4 billion in 2025.

It is projected to reach USD 451.7 billion by 2035.

The market is expected to grow at a 21.7% CAGR between 2025 and 2035.

The key product types are solutions and services.

large enterprises segment is expected to dominate with a 64.2% industry share in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Software License Management (SLM) Market Size and Share Forecast Outlook 2025 to 2035

Software Containers Market Size and Share Forecast Outlook 2025 to 2035

Examining Market Share Trends in the Software Distribution Industry

Software Distribution Market Analysis by Deployment Type, by Organization Size and by Industry Vertical Through 2035

Software Defined Vehicle Market Size and Share Forecast Outlook 2025 to 2035

Software Defined Perimeter (SDP) Market Size and Share Forecast Outlook 2025 to 2035

Software-Defined Wide Area Network SD-WAN Market Size and Share Forecast Outlook 2025 to 2035

Software Defined Radio (SDR) Market Size and Share Forecast Outlook 2025 to 2035

Software-Defined Networking SDN Market Size and Share Forecast Outlook 2025 to 2035

Software-Defined Anything (SDx) Market Size and Share Forecast Outlook 2025 to 2035

Software-Defined Data Center Market Size and Share Forecast Outlook 2025 to 2035

Software Defined Networking Market Size and Share Forecast Outlook 2025 to 2035

Software-Defined Camera (SDC) Market Size and Share Forecast Outlook 2025 to 2035

Software-Defined WAN Market - Growth & Forecast through 2034

Software Defined Video Networking Market

Software Defined Networking (SDN) And Network Function Virtualization (NFV) Market Size and Share Forecast Outlook 2025 to 2035

UK Software Distribution Market Analysis – Size & Industry Trends 2025-2035

VPN Software Market Size and Share Forecast Outlook 2025 to 2035

3PL Software Market Size and Share Forecast Outlook 2025 to 2035

GCC Software Distribution Market Analysis - Size, Share & Trends 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA