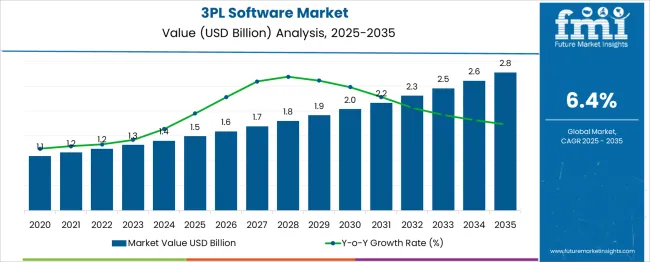

The 3PL Software Market is estimated to be valued at USD 1.5 billion in 2025 and is projected to reach USD 2.8 billion by 2035, registering a compound annual growth rate (CAGR) of 6.4% over the forecast period.

| Metric | Value |

|---|---|

| 3PL Software Market Estimated Value in (2025 E) | USD 1.5 billion |

| 3PL Software Market Forecast Value in (2035 F) | USD 2.8 billion |

| Forecast CAGR (2025 to 2035) | 6.4% |

A new era of technologies is transforming the dynamics of the third-party logistics industry. Companies are adopting an innovative, customer-centric, and agile approach to supply chain management due to advanced data collection capabilities, warehouse automation, and digitalization of the entire supply chain to the market.

Due to these developments, 3PL companies have developed technologically advanced methods to gain a competitive advantage by investing in blockchain technologies, mobile technology, and software designed for 3PL companies.

Delivery logistics businesses are in high demand in the market due to the growth of online businesses. As internet and smartphone usage continues to grow, online payment apps will grow as well, which will lead to steady growth in for 3PL software market over the next few years.

Market growth for e-commerce logistics has been further fueled by changes in consumer lifestyle, economic growth, and preferences for shopping at their fingertips has all increased 3PL software growth in the market. Further, the increased level of globalization has led to an increase in manufacturing activities around the world. 3PL services will become increasingly important in order to maintain it effectively.

The scope and market share of 3PL companies is predicted to increase, since supply chain productivity can be improved, along with cost and reliability gains, with the help of 3PL companies' expertise in management and information technology.

Moreover, the growing share of e-tailers as well as the increasing number of reverse logistics operations despite the shifting demand patterns for third-party logistics are two major factors driving the growth of this market. Despite this, the inability to directly control logistics services and the possibility of losing reputation are the major obstacles to the growth of this sector.

Regulatory issues, limited infrastructure, and a shortage of logistics experts hinder the growth of the market. Increasing chances of business downtime due to software installation problems have hampered market growth. High initial expenses and the lack of trained professionals can hinder the growth of this market. Virtualized automation is experiencing limited market growth due to insufficient tools and methods available to deal with synchronization issues.

An organization that uses third-party logistics services has to depend on the competence, honesty, and reliability of the providers. This scenario involves a manufacturer relying on a 3PL, which yields a lack of direct control over the process.

Furthermore, the manufacturer cannot monitor the activities taking place in the warehouse, which might jeopardize the quality of the products. Thus, manufacturers' inability to control logistics services hinders the growth of the 3 PL software market.

Increasing online orders as well as increasing traffic in the 3PL software industry has hindered the growth of the market. Technology advancements, the constantly changing business environment, economic pressures, and regulatory compliance are some of the challenges faced by the 3PL software market.

Among other challenges facing the market, the market is struggling with capacity constraints, a lack of understanding of energy consumption, limitations on network capacity, and budget restrictions for energy use.

The road transport market is expected to grow at the fastest rate as compared to other transport modes. With public-private partnerships and a focus on logistics infrastructure, roadways will account for the biggest share in 2025. The global market is expected to grow at a CAGR of 6.5% during the forecast period.

The roadways segment has the largest market share and is expected to keep it for the foreseeable future. As road infrastructure has improved and cross-border trade between landlocked countries has grown, so has the need for roadways in 3PL industries. Additionally, 3PL service providers provide innovative delivery solutions to first-party companies by utilizing the latest software tools such as TMS and WMS in the market.

Increasing demand for transportation route planning, contract management, and tariff surcharge management are all these factors to propel market demand for the 3PL software market.

The ability to view shipment status in real-time and the capability to synchronize your data with your ERP suite have prompted the market for three-party logistics software in the market. Moreover, the software helps workers coordinate activities like unloading and quality assurance checks with ease.

As a whole, the technological industry is seen to grow the most rapidly in the market during the forecast period. The market is expected to grow at a CAGR of 6.3% during the forecast period. Utilization of emerging new technologies that can make a positive impact on the 3PL business and establish a positive trend for market growth with greater frequency will grow the market of the 3PL software.

With the growing need for more productivity in the industry, the market for third-party logistics software is growing rapidly for these businesses as well. Using advanced technology software reduces the operating costs of a company in the market by achieving efficiencies in both the operational and financial side of the business, resulting in huge market demand for 3PL software in the market.

Technology has paved the way for 3PL software to feature end-to-end transparency throughout the process of delivering products and services to customers. Using 3PL software, customers can also record and track the entire delivery process and shipment with the help of modern technology.

As the world's population grows, the existence and further development of modern software systems have allowed the integration and automation of logistics to become easier to handle with the growth.

The North American market is expected to generate USD 976.2 Million in revenue over the forecast period due to the proliferation of highly developed IT industries and growth of economies, such as those in the United States, and Canada.

Increase in partnership among leading logistics service providers to incorporate new projects. Moreover, the establishment of a partnership and the development of new services to meet the needs of the countries further fuel the regional market growth.

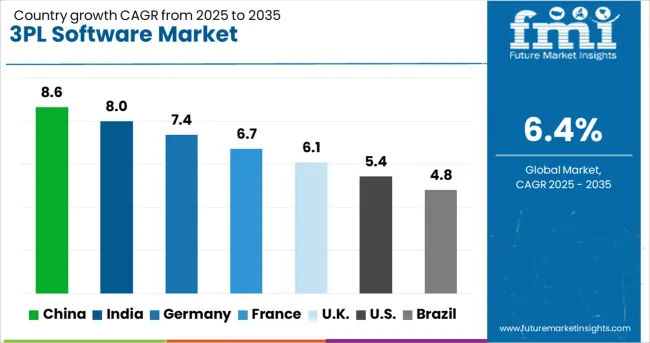

By 2035, the USA 3PL software market is expected to grow at a CAGR of 6.2% during the forecast period. With the rapid development of cloud-based solutions, the influx of IoT solutions, and the presence of a large number of companies, 3PL software has experienced positive growth in this region. Because of early adoption of software and subsequent technological advancements in warehouses, the USA 3PL software market is experiencing rapid growth in this region.

Market growth for 3PL IoT technologies is expected to be strongest in Asia-Pacific region during the forecast period. For the 3PL software development market, APAC is forecast to grow at the fastest rate during the forecast period.

China is expected to be valued at USD 174.6 Million with a CAGR of 6.1% during the forecast period. Furthermore, China accounts for 32% of revenue growth in the region. The rapid technological advancements and the increased number of retail and logistics companies in these regions has created a market for third-party logistics software in the market.

Region has seen a steady growth fueled by companies in the e-commerce industry incorporating warehouse projects and their solutions into their supply chain.

The Japanese market is expected to grow at a CAGR of 5.1% over the forecast period. South Korea's market is projected to grow at a CAGR of 4.1% during the forecast period. Having an impact on reducing operational expenses, the increasing demand for cost-savings and supply chain operations in the market is expected to grow the market in this region.

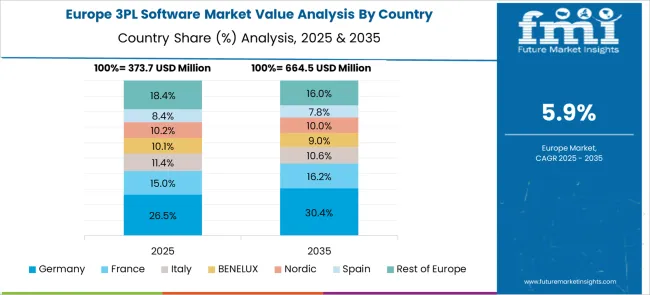

European exports are expected to increase by USD 599.8 Million during forecasted period. As global trade activity grows, companies recognize that outsourcing their logistics service to another company is an economical option, as there is a continuous pressure on travel reliability and efficiency and managing complexities of in-house logistics without increasing overhead costs.

During the forecast period, the 3PL software market in the UK is expected to grow at a compound annual growth rate of 5.6%. Warehouse expansions and global presence of logistics firms in the region will be two major factors driving the market for IoT in the logistics industry. Increasing investments for the advancement of IoT technology are helping the technology, which is widely used in logistics businesses, gain traction on the market.

Through strategic partnerships, manufacturers can increase production and meet consumer demand, increasing both their revenues and market share. The introduction of new products and technologies will allow end-users to reap the benefits of new technologies. Increasing the company's production capacity is one of the potential benefits of a strategic partnership.

The global 3pl software market is estimated to be valued at USD 1.5 billion in 2025.

The market size for the 3pl software market is projected to reach USD 2.8 billion by 2035.

The 3pl software market is expected to grow at a 6.4% CAGR between 2025 and 2035.

The key product types in 3pl software market are railways, roadways, waterways and airways.

In terms of service type, dedicated contract carriage (dcc) segment to command 28.6% share in the 3pl software market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Software-Defined Wide Area Network Market Size and Share Forecast Outlook 2025 to 2035

Software Defined Vehicle Market Size and Share Forecast Outlook 2025 to 2035

Software Defined Networking (SDN) And Network Function Virtualization (NFV) Market Size and Share Forecast Outlook 2025 to 2035

Software Defined Perimeter (SDP) Market Size and Share Forecast Outlook 2025 to 2035

Software-Defined Wide Area Network SD-WAN Market Size and Share Forecast Outlook 2025 to 2035

Software Defined Radio (SDR) Market Size and Share Forecast Outlook 2025 to 2035

Software License Management (SLM) Market Size and Share Forecast Outlook 2025 to 2035

Software-Defined Networking SDN Market Size and Share Forecast Outlook 2025 to 2035

Software-Defined Anything (SDx) Market Size and Share Forecast Outlook 2025 to 2035

Software-Defined Data Center Market Size and Share Forecast Outlook 2025 to 2035

Software Containers Market Size and Share Forecast Outlook 2025 to 2035

Software Defined Application And Infrastructure Market Size and Share Forecast Outlook 2025 to 2035

Software Defined Networking Market Size and Share Forecast Outlook 2025 to 2035

Software-Defined Camera (SDC) Market Size and Share Forecast Outlook 2025 to 2035

Examining Market Share Trends in the Software Distribution Industry

Software Distribution Market Analysis by Deployment Type, by Organization Size and by Industry Vertical Through 2035

Software Defined Video Networking Market

UK Software Distribution Market Analysis – Size & Industry Trends 2025-2035

RIP Software Market Size and Share Forecast Outlook 2025 to 2035

VPN Software Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA