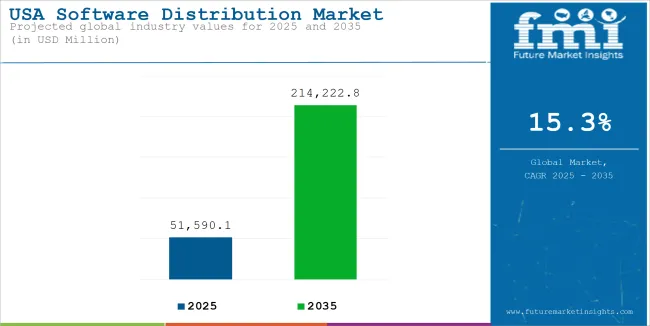

The USA software distribution market is poised for significant growth over the next decade, driven by increasing digital transformation across industries, the rising adoption of cloud-based software solutions, and the expansion of IT infrastructure. The market is projected to reach USD 51,590.1 million in 2025 and will continue expanding at a CAGR of 15.3%, reaching USD 214,222.8 million by 2035.

| Attributes | Values |

|---|---|

| Estimated USA Market Size in 2025 | USD 51,590.1 million |

| Projected USA Market Size in 2035 | USD 214,222.8 million |

| Value-based CAGR from 2025 to 2035 | 15.3% |

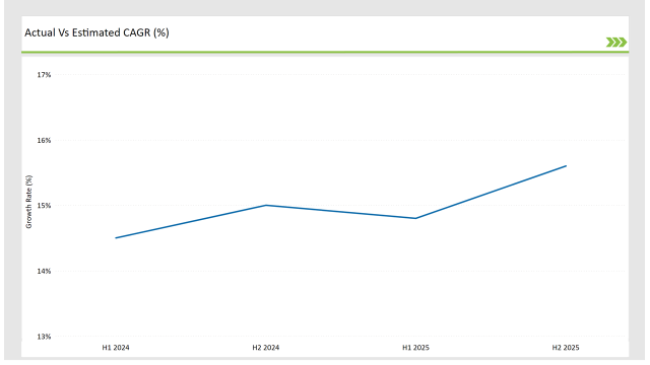

The table below outlines the semi-annual growth rate of the market, providing insights into industry trends.

| Particular | Value CAGR |

|---|---|

| H1 2024 | 14.5% (2024 to 2034) |

| H2 2024 | 15.0% (2024 to 2034) |

| H1 2025 | 14.8% (2025 to 2035) |

| H2 2025 | 15.6% (2025 to 2035) |

The software distribution industry proves to be volatile with its CAGR over half-yearly periods. Driven by strong demand for cloud-based and SaaS engagements, the H1 2024 (14.5%) brokered a 50 BPS higher on H2 2024 (15.0%) for the industry. A modest 20 BPS decrease in H1 2025 (14.8%) indicates market stabilisation prior to a rebound in H2 2025 (15.6%), signalling renewed demand driven by enterprise software adoption and industry digitisation.

| Date | Development / M&A Activity & Details |

|---|---|

| Jan-25 | Microsoft strengthens its cloud distribution network by acquiring a major USA software reseller. |

| Oct-24 | IBM launches an AI-driven software marketplace to enhance enterprise software distribution. |

| Mar-24 | Oracle partners with Amazon Web Services (AWS) to expand its cloud-based software distribution reach. |

| Sep-24 | Google Cloud expands partnerships with IT distributors to increase the availability of AI-powered software solutions. |

| Dec-23 | The USA government announces funding initiatives to support digital transformation in SMEs, boosting software adoption. |

Rise of Subscription-Based Software Licensing

In the United States, the software distribution market is gradually transitioning to subscription-based licensing models instead of one-time purchases. Microsoft, Adobe, Autodesk transitioned from traditional licensing fees to SaaS (Software-as-a-Service) models generating predictable recurring revenue and better customer retention.

Cloud-based licensing is initially more flexible, providing automatic updates and cost efficiency. Software distributors are adapting including cloud marketplaces and API based licensing capabilities in their distribution channels. In addition, the adoption of multi-cloud strategies has contributed to the demand for flexible software delivery solutions, forcing distributors to cater to cross-platform software deployment and automatic license management solutions.

Dominance of Cloud Marketplaces and Aggregators

Cloud marketplaces dominated by AWS Marketplace, Microsoft Azure Marketplace, and Google Cloud Marketplace are emerging as important distribution channels for software vendors in the USA Enterprises want to procure software through an integrated cloud platform, which also allows seamless deployment and billing as a part of their ecosystem.

This has led to lesser dependabilty on traditional resellers and VARs (Value-Added Resellers) which has forced distributors to transform towards cloud service aggregation. Big software vendors strike direct deals with cloud providers, and distributors now emphasize bundling multi-vendor SaaS applications, managed services and seamless, API-driven software distribution to keep their relevance in a cloud-first world.

Increasing Role of Managed Service Providers (MSPs) in Software Distribution

As a critical player in sofware distribution amidst the growing complexity of enterprise IT envorments, MSPs are becoming more and more prominent. This is in part because many USA companies will want to purchase software via an MSP-managed contract that ensures smooth deployment, security, and compliance.

Companies such as IBM and Cisco are tightening bonds with managed service providers (MSPs) to improve performance of software delivery through these managed cloud, security and networking services. IBM and Cisco Strengthening Partnerships with MSPs to Improve Software Delivery Distribution companies are introducing automation, AI-driven analytics, and remote monitoring tools to aid subscription management and maximize software utilization.

The trend towards co-managed IT services, in which the enterprise retains some of control while outsourcing parts specific functions, is also accelerating the MSP-centric distribution model of software.

Expansion of Cybersecurity-Focused Software Distribution

The rise of cyber threats has driven demand for security-first software distribution models in the United States, as enterprises increasingly prioritize software solutions that embed zero-trust security architectures, endpoint protection, and AI-driven threat detection. Distributors have pivoted to bundled security packages that include security configuration for places like Palo Alto Networks, Fortinet and CrowdStrike, to name a few.

Moreover, the advent of compliance-oriented distribution (e.g., in the financial, health and the public sector), has further promoted the adoption of FedRAMP approved and SOC 2 compliant software. Distributors are upgrading security validation services as per regulatory compliance.

Growing Demand for Vertical-Specific Software Solutions

Demand for industry-specific software distribution options has been growing in the USA market, especially among healthcare, retail, and manufacturing verticals. Distributors have transitioned from broad-range software portfolios to solution partnerships designed for individual industry needs.

Regulatory needs also drive software adoption between different sectors - healthcare providers want HIPAA-compliant EHR (Electronic Health Record) software computers and retail businesses want AI-powered customer engagement tools and inventory management systems.

Predictive maintenance is a type of IoT software sought after by manufacturing firms. This trend is forcing software distributors to virtualize their go-to-market, strengthening relations with vendors from their specific industry and investing in AI-based recommendation engines to facilitate more targeted software distribution.

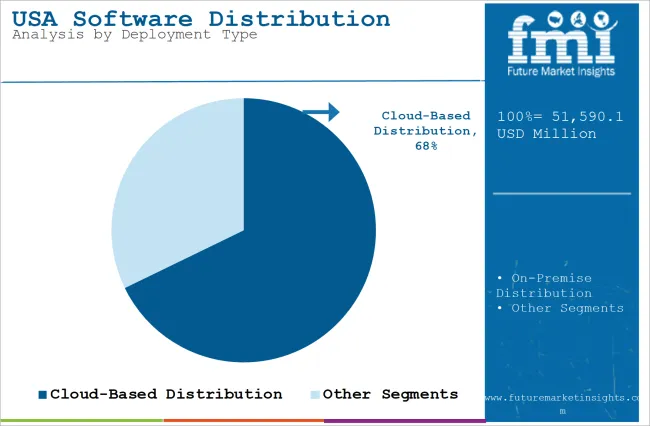

| Deployment Type | Market Share (2025) |

|---|---|

| Cloud-Based Distribution | 67.8% |

| On-Premise Distribution | 32.2% |

| Organization Size | Market Share (2025) |

|---|---|

| Small & Medium Enterprises (SMEs) | 41.3% |

| Others | 58.7% |

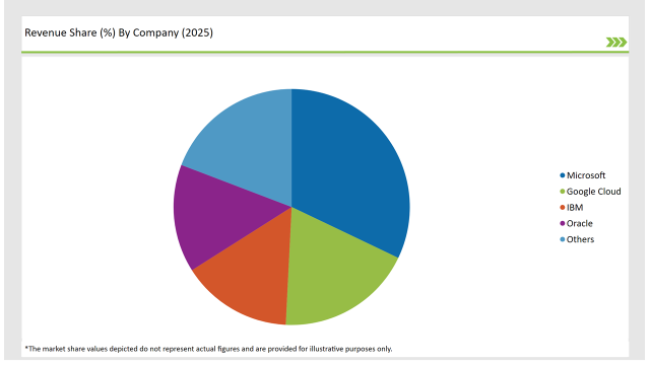

| Vendors | Market Share (2025) |

|---|---|

| Microsoft | 32.1% |

| Google Cloud | 18.7% |

| IBM | 15.2% |

| Oracle | 14.8% |

| Others | 19.2% |

The market will grow at a CAGR of 15.3% from 2025 to 2035.

The industry will reach USD 214,222.8 million by 2035.

Key players include Microsoft, Google Cloud, IBM, and Oracle.

IT & Telecom, BFSI, and Healthcare lead software distribution demand.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Examining Market Share Trends in the Software Distribution Industry

Software Distribution Market Analysis by Deployment Type, by Organization Size and by Industry Vertical Through 2035

UK Software Distribution Market Analysis – Size & Industry Trends 2025-2035

GCC Software Distribution Market Analysis - Size, Share & Trends 2025 to 2035

Japan Software Distribution Market Growth – Innovations, Trends & Forecast 2025-2035

Germany Software Distribution Market Insights – Size, Trends & Forecast 2025-2035

Content Distribution Software Market Size and Share Forecast Outlook 2025 to 2035

Demand for HVAC Software in USA Size and Share Forecast Outlook 2025 to 2035

Demand for Headless CMS Software in USA Size and Share Forecast Outlook 2025 to 2035

Demand for Trade Management Software in USA Size and Share Forecast Outlook 2025 to 2035

Demand for Food & Beverage OEE Software in USA Size and Share Forecast Outlook 2025 to 2035

Software-Defined Wide Area Network Market Size and Share Forecast Outlook 2025 to 2035

Distribution Board Market Forecast Outlook 2025 to 2035

Distribution Components Market Size and Share Forecast Outlook 2025 to 2035

USA Medical Coding Market Size and Share Forecast Outlook 2025 to 2035

Distribution Automation Market Size and Share Forecast Outlook 2025 to 2035

Software Defined Vehicle Market Size and Share Forecast Outlook 2025 to 2035

Software Defined Networking (SDN) And Network Function Virtualization (NFV) Market Size and Share Forecast Outlook 2025 to 2035

Software Defined Perimeter (SDP) Market Size and Share Forecast Outlook 2025 to 2035

USA Labels Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA