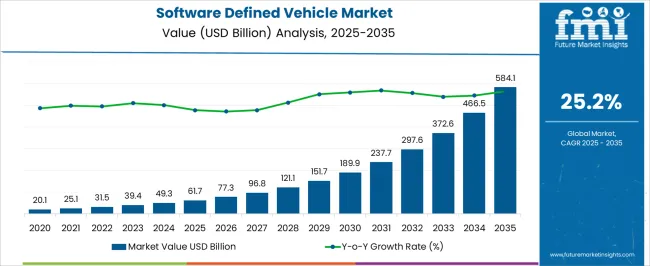

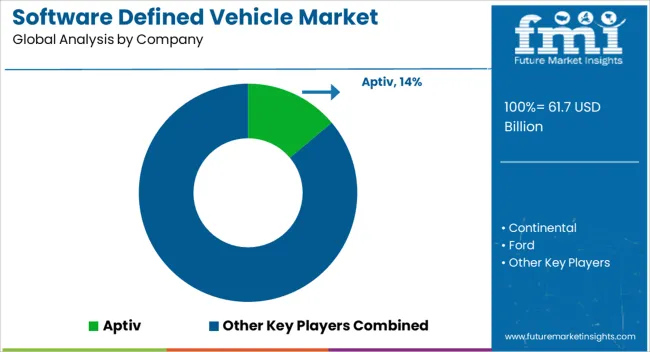

The software defined vehicle market was valued at USD 61.7 billion in 2025 and is projected to reach USD 584.1 billion by 2035, registering a CAGR of 25.2%. This exceptional growth underscores the increasing adoption of vehicles equipped with integrated software platforms that manage performance, safety, and connectivity features.

The absolute dollar opportunity is being reinforced by rising demand for vehicles that allow over-the-air updates, enhanced driver assistance, and personalized user experiences. The surge indicates a shift in automotive priorities, where software-driven functionalities are becoming central to value creation, rather than traditional mechanical features. Companies that strategically focus on software ecosystems are positioned to capture significant revenue streams, as the market is being shaped by fleet operators, automotive OEMs, and technology providers investing heavily in modular and scalable vehicle architectures.

The software defined vehicle market stood at USD 61.7 billion in 2025 and is expected to escalate to USD 584.1 billion in 2035, reflecting a CAGR of 25.2%. Year-on-year increments point to a rapidly expanding opportunity, with each year showing substantial increases in absolute dollar terms. Market growth is being influenced by the rising integration of cloud connectivity, predictive maintenance modules, and in-vehicle intelligence that enhance fleet efficiency and passenger experience. The market’s momentum signals that companies unable to adopt software-centric strategies may face declining competitiveness. The expansion trajectory also suggests that software-driven value propositions are redefining automotive revenue models, making investments in software-defined capabilities a critical lever for capturing future market share and strengthening operational control across the mobility ecosystem.

| Metric | Value |

|---|---|

| Software Defined Vehicle Market Estimated Value in (2025 E) | USD 61.7 billion |

| Software Defined Vehicle Market Forecast Value in (2035F) | USD 584.1 billion |

| Forecast CAGR (2025 to 2035) | 25.2% |

The software defined vehicle market has been increasingly acknowledged as a core segment within several larger automotive and technology-driven parent markets, each showing a distinct contribution level. Within the automotive electronics market, the share of software defined vehicles is estimated at approximately 6.2%, reflecting its integration into electronic control units, infotainment, and vehicle network architectures.

In the connected vehicle market, the penetration is observed around 7.5%, driven by the reliance on cloud connectivity, over-the-air updates, and seamless data exchange across platforms. The electric vehicle market shows a share of 5.8%, as SDV architectures have been employed to manage battery systems, powertrain controls, and digital user interfaces. The vehicle software solutions market records a 6.9% share, reflecting the demand for modular, scalable, and customizable software stacks for OEMs and tier-1 suppliers. Meanwhile, in the advanced driver assistance systems market, SDV adoption captures a 4.6% share due to its ability to centralize sensor data processing and enhance decision-making algorithms.

Combined, these segments indicate that the software defined vehicle market accounts for roughly 31% across these parent sectors, underscoring its strategic relevance in shaping modern mobility solutions. The market has been actively influencing vehicle design paradigms, operational efficiency, and fleet management strategies, while encouraging manufacturers to rethink integration, cybersecurity, and user experience. Its rising adoption signals a shift toward software-centric automotive ecosystems, positioning SDVs as a transformative force across multiple parent markets, reshaping how vehicles are designed, operated, and monetized in increasingly competitive environments.

The software defined vehicle (SDV) market is undergoing a transformative shift, driven by increasing digitization, evolving consumer preferences, and the rapid integration of advanced electronic systems across automotive platforms. OEMs are progressively transitioning toward SDV architectures to enable over-the-air updates, real-time diagnostics, and centralized computing, thereby enhancing vehicle performance, safety, and user experience.

The current scenario reflects strong momentum in passenger and commercial segments, with SDVs increasingly viewed as critical enablers of connected and autonomous mobility. Amid growing emphasis on software lifecycle management and domain controller architectures, the market is benefiting from scalable and flexible development environments.

Though adoption is still in its early phases in certain regions, future outlook remains highly favorable due to rising investments in vehicle software stacks, middleware platforms, and cross-domain integration. As electrification, autonomy, and connectivity converge, SDVs are expected to serve as foundational elements in the next-generation mobility ecosystem, offering sustained opportunities for stakeholders across hardware, software, and cloud integration layers.

The software defined vehicle market is segmented by vehicle, propulsion, level of autonomy, application, and geographic regions. By vehicle, software defined vehicle market is divided into Passenger cars and Commercial vehicles. In terms of propulsion, software defined vehicle market is classified into ICE, Electric, and Hybrid. Based on level of autonomy, software defined vehicle market is segmented into Level 1, Level 2, Level 3, and Level 4. By application, software defined vehicle market is segmented into Infotainment systems, Advanced Driver Assistance Systems (ADAS), Autonomous driving, Telematics, Powertrain control, and Others. Regionally, the software defined vehicle industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

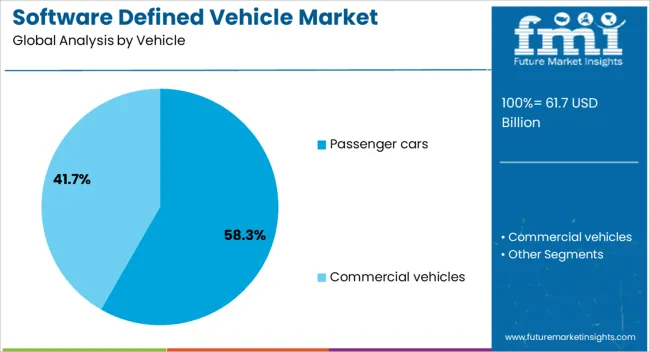

The passenger cars segment accounts for the highest share in the vehicle category, representing approximately 58.3% of the software defined vehicle market. This segment’s dominance has been attributed to the rapid adoption of advanced driver assistance systems (ADAS), infotainment upgrades, and connectivity modules tailored for individual users. As consumer expectations shift toward personalized, intelligent mobility experiences, automakers have prioritized the software transformation of passenger vehicles to support real-time services and remote feature enablement.

High-volume production, shorter model cycles, and fierce brand competition have further incentivized integration of software-centric capabilities in this segment. The segment has also benefited from early deployments of centralized computing architectures, enabling cost efficiencies and platform standardization.

With growing demand for electrification and seamless digital interfaces, software-defined architectures in passenger cars are set to expand further, particularly in premium and mid-tier offerings. As OEMs aim to differentiate through software performance, the segment is expected to sustain its leading market share throughout the forecast horizon.

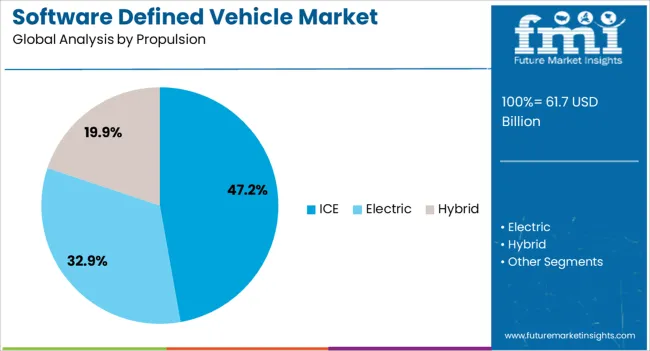

The internal combustion engine (ICE) segment currently holds the largest share in the propulsion category, accounting for approximately 47.2% of the software defined vehicle market. This leading position is largely a reflection of the extensive global ICE vehicle base, which continues to receive software-enabled upgrades through embedded systems and electronic control units (ECUs).

While electrification trends are accelerating, ICE vehicles remain a major deployment ground for SDV technologies, especially in regions where EV infrastructure is still maturing. Automakers have been actively integrating telematics, remote diagnostics, and adaptive cruise control features within ICE platforms, enabling software-defined enhancements without transitioning to full electrification.

Retrofitting capabilities and lifecycle extension strategies further support the segment’s share, allowing legacy vehicles to align with emerging digital standards. Although EVs are expected to gain momentum, ICE vehicles continue to offer a broad and cost-effective testing ground for SDV rollouts, sustaining their relevance in the medium term across both developed and developing markets.

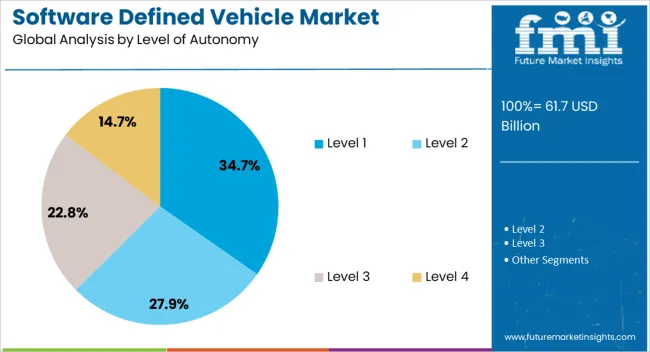

The Level 1 autonomy segment leads in terms of adoption, contributing approximately 34.7% of the software defined vehicle market. This segment’s growth has been driven by the integration of basic ADAS functionalities, including lane-keeping assistance, adaptive lighting, and forward collision warnings, which rely on software-controlled actuation and sensor fusion.

Level 1 systems serve as the foundational layer for higher autonomy, and their deployment has become widespread due to regulatory encouragement, safety mandates, and insurance incentives. Cost-effective scalability and minimal driver behavioral change requirements have enabled their mass-market penetration, particularly in compact and mid-sized passenger vehicles.

Automakers are leveraging software updates and centralized architecture to enhance Level 1 systems’ performance and extend compatibility with evolving safety protocols. As the entry point to software-defined autonomy, this segment is expected to maintain its lead while acting as a transitional platform for future upgrades to Level 2 and beyond, supported by continuous innovation in perception and control software stacks.

The software defined vehicle market has been shaped by the growing integration of in-vehicle software ecosystems, enhanced connectivity solutions, and demand for feature-rich, flexible automotive platforms. Rising consumer expectations for personalized and adaptive vehicle functionalities are driving adoption, while opportunities have been created through over-the-air updates, modular software platforms, and partnerships with cloud service providers. Noticeable trends are being observed in the convergence of mobility services with software management platforms, while challenges persist in cybersecurity risks, regulatory compliance, and interoperability issues. Market growth is expected to remain robust due to the shift toward software-centric mobility models.

The demand for software defined vehicles has been significantly influenced by the growing need for vehicles capable of delivering adaptive functionalities, over-the-air updates, and seamless connectivity across mobility platforms. Automotive manufacturers and fleet operators have been observed increasingly relying on software platforms to provide dynamic infotainment, driver assistance, and personalized user experiences. In opinion, this demand has been reinforced by consumer expectations for continuous feature upgrades without requiring physical hardware replacements. OEMs have been prioritizing software-centric vehicle architectures, where electronic control units and cloud integration play a pivotal role in vehicle performance and user experience. Fleet management and shared mobility operators have been seen adopting software defined vehicle solutions to enhance operational efficiency, predictive maintenance, and vehicle tracking. The demand trajectory has also been influenced by global automotive alliances and regional regulatory frameworks that encourage the adoption of connected, smart vehicle ecosystems, highlighting that reliance on software is gradually becoming central to automotive design strategies.

Opportunities in the software defined vehicle market have been largely defined by the development of modular platforms, cloud-enabled services, and digital vehicle management solutions. The emergence of scalable software frameworks has enabled automakers to deliver new functionalities via over-the-air updates, creating additional value propositions for vehicle owners. In opinion, the opportunities are set to grow as partnerships between automotive OEMs, software vendors, and cloud providers increase, allowing the seamless integration of vehicle data analytics, remote diagnostics, and mobility-as-a-service offerings. Tier-1 suppliers and technology providers have been observed leveraging these opportunities to create interoperable solutions for multiple vehicle models and brands. Opportunities have also been identified in aftermarket solutions, fleet telematics, and software licensing, where subscription-based models are gaining traction. Regional adoption patterns, particularly in North America, Europe, and Asia Pacific, indicate that software defined vehicle solutions are being positioned as a competitive differentiator, driving investment in scalable, flexible, and cloud-integrated vehicle architectures.

The software defined vehicle industry has been witnessing notable trends around over-the-air software updates, adaptive vehicle functionalities, and integrated mobility services. Market participants have increasingly prioritized the ability to remotely deploy new features, optimize vehicle performance, and manage diagnostics without requiring dealership visits. In opinion, trends such as predictive vehicle maintenance, driver behavior analysis, and personalized in-cabin experiences are reinforcing the centrality of software-defined strategies in modern mobility. OEMs have been observed shifting their R&D focus toward creating modular, cloud-ready platforms that support dynamic feature deployment. Mobility service providers are also exploring fleet-wide software integration, enabling real-time route optimization and energy management. These trends have been reinforced by cross-industry collaborations and standardization initiatives, making software the cornerstone of next-generation vehicle ecosystems. The convergence of vehicle connectivity, cloud services, and adaptive functionalities is expected to define competitive advantage for stakeholders moving forward.

The software defined vehicle market has faced ongoing challenges related to cybersecurity vulnerabilities, regulatory compliance, and the integration of complex software and hardware architectures. With increasing reliance on connected and remotely updatable vehicle systems, the risk of cyberattacks has been a persistent concern, requiring continuous monitoring and advanced protective measures. Compliance with regional safety and data privacy regulations has been observed to slow down deployment timelines, particularly in multi-jurisdictional markets. In opinion, system integration challenges, including harmonizing legacy vehicle platforms with modern software ecosystems, have been underestimated by some market participants. Fragmented standards and interoperability issues between OEMs, Tier-1 suppliers, and cloud providers have also created implementation complexities. These challenges suggest that successful market adoption will depend on proactive risk management, collaborative standardization, and robust integration protocols. Addressing these barriers is critical for achieving consistent growth and maintaining stakeholder confidence in software-centric vehicle solutions.

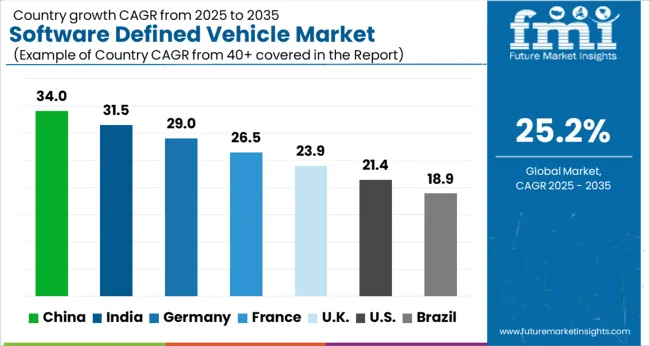

| Country | CAGR |

|---|---|

| China | 34.0% |

| India | 31.5% |

| Germany | 29.0% |

| France | 26.5% |

| UK | 23.9% |

| USA | 21.4% |

| Brazil | 18.9% |

The global software defined vehicle market is projected to rise at a CAGR of 25.2% between 2025 and 2035. China leads with 34% growth, followed by India at 31.5% and Germany at 29%. The United Kingdom records 23.9%, while the United States shows 21.4% growth. Market expansion is being shaped by the integration of software-centric architectures, rising demand for connected mobility, and increased focus on autonomous features. Emerging economies such as China and India are registering faster growth with strong EV adoption and local manufacturing, whereas developed markets like Germany, the UK, and the USA are reinforcing leadership with R&D in vehicle software, advanced driver-assistance systems, and cybersecurity frameworks. This report includes insights on 40+ countries; the top markets are shown here for reference.

The software defined vehicle market in China is advancing at 34% CAGR, fueled by the nation’s rapid EV ecosystem and strong policy backing for connected mobility. Automakers are embedding advanced software stacks to enhance over-the-air (OTA) updates, vehicle-to-everything (V2X) communication, and in-cabin digital ecosystems. Local manufacturers are benefiting from large-scale EV adoption and extensive semiconductor capacity. Partnerships between domestic automakers and global tech firms are strengthening competitiveness. Growth is also reinforced by demand for autonomous driving features in both passenger and commercial fleets.

The software defined vehicle market in India is growing at 31.5% CAGR, driven by the convergence of EV adoption, government incentives, and rising local software capabilities. Indian automakers are increasingly shifting towards centralized vehicle architectures that prioritize connectivity and digital integration. Growth is being supported by the expansion of shared mobility platforms and consumer preference for connected infotainment and driver-assist systems. Domestic IT companies are also entering collaborations with auto OEMs, further strengthening India’s role in vehicle software innovation.

The software defined vehicle market in Germany is progressing at 29% CAGR, supported by R&D leadership in vehicle software, safety systems, and integration of cybersecurity layers. German automakers are transitioning from hardware-centric to software-first architectures, embedding advanced driver-assistance systems (ADAS) and in-vehicle OS platforms. Market expansion is reinforced by partnerships with technology providers to integrate artificial intelligence into mobility platforms. With the German auto industry being heavily export-driven, adoption of software defined vehicles is creating a competitive edge in global mobility markets.

The software defined vehicle market in the United Kingdom is expanding at 23.9% CAGR, supported by digital transformation in automotive production and consumer demand for connected mobility. British automakers are investing in centralized software platforms for next-gen infotainment, driver-assist features, and autonomous capabilities. Market adoption is also driven by pilot programs in smart cities and mobility-as-a-service (MaaS) solutions, where vehicles rely on advanced connectivity. Partnerships between automakers, telecom operators, and AI firms are creating a robust ecosystem for software defined mobility.

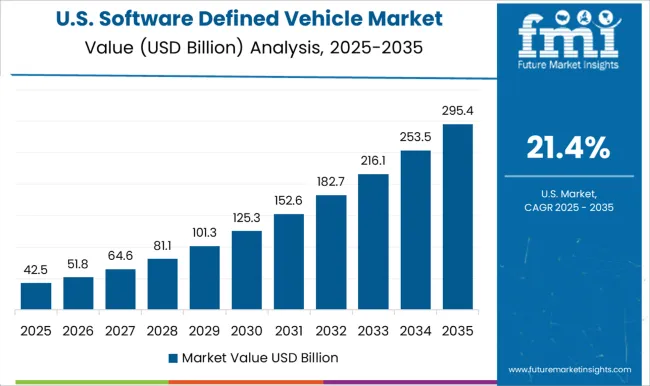

The software defined vehicle market in the United States is growing at 21.4% CAGR, led by emphasis on autonomous driving, cybersecurity, and digital services integration. USA automakers are embedding vehicle OS platforms, cloud-based data services, and software monetization strategies to strengthen long-term revenue. Adoption is also reinforced by regulatory focus on vehicle safety standards and innovation in autonomous testing programs. Technology firms are actively partnering with OEMs to integrate advanced AI-driven solutions into mobility ecosystems. While slower than Asia and Europe, USA adoption is steady and shaped by premium vehicle markets and cross-industry collaborations.

The software defined vehicle market is being steered by the combined efforts of automotive leaders and technology innovators. Tesla, Mercedes-Benz, Ford, General Motors, and Volkswagen are being positioned through proprietary in-car operating systems and over-the-air update capabilities that ensure vehicles remain adaptive beyond the showroom. Their strategy is being executed with tight integration of hardware and software, where control units and digital ecosystems are reshaping driver interaction and vehicle performance. Nvidia is being advanced as a backbone supplier, offering high-performance computing platforms that anchor autonomous features and AI-driven mobility.

Aptiv and Continental are being aligned with middleware solutions, connectivity modules, and domain controllers that give automakers the flexibility to upgrade vehicles post-production. Marelli Holdings and Robert Bosch are being viewed as tier-one suppliers bridging legacy manufacturing with software-centric architectures, focusing on scalable electronic platforms. The competition is being determined by how effectively each participant secures long-term customer lock-in through software ecosystems, service-driven models, and digital reliability. Product brochures in this market are being framed as powerful tools for influence and clarity. Tesla and Mercedes-Benz brochures are being styled as futuristic portfolios, highlighting user-centric interfaces, seamless updates, and safety benchmarks.

| Item | Value |

|---|---|

| Quantitative Units | USD 61.7 Billion |

| Vehicle | Passenger cars and Commercial vehicles |

| Propulsion | ICE, Electric, and Hybrid |

| Level of Autonomy | Level 1, Level 2, Level 3, and Level 4 |

| Application | Infotainment systems, Advanced Driver Assistance Systems (ADAS), Autonomous driving, Telematics, Powertrain control, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Aptiv, Continental, Ford, General Motors, Marelli Holdings, Mercedes-Benz, Nvidia, Robert, Tesla, and Volkswagen |

| Additional Attributes | Dollar sales by vehicle type (passenger cars, commercial vehicles, electric vehicles) and application (infotainment, ADAS, connectivity, powertrain control) are key metrics. Trends include rising demand for software-driven automotive functions, growth in connected and electric mobility, and increasing adoption of over-the-air updates. Regional adoption, regulatory standards, and technological advancements are driving market growth. |

The global software defined vehicle market is estimated to be valued at USD 61.7 billion in 2025.

The market size for the software defined vehicle market is projected to reach USD 584.1 billion by 2035.

The software defined vehicle market is expected to grow at a 25.2% CAGR between 2025 and 2035.

The key product types in software defined vehicle market are passenger cars, _sedan, _suv, _hatchback, _others, commercial vehicles, _light commercial vehicle (lcv) and _heavy commercial vehicle (hcv).

In terms of propulsion, ice segment to command 47.2% share in the software defined vehicle market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Software License Management (SLM) Market Size and Share Forecast Outlook 2025 to 2035

Software Containers Market Size and Share Forecast Outlook 2025 to 2035

Examining Market Share Trends in the Software Distribution Industry

Software Distribution Market Analysis by Deployment Type, by Organization Size and by Industry Vertical Through 2035

Software-Defined Wide Area Network Market Size and Share Forecast Outlook 2025 to 2035

Software Defined Networking (SDN) And Network Function Virtualization (NFV) Market Size and Share Forecast Outlook 2025 to 2035

Software Defined Perimeter (SDP) Market Size and Share Forecast Outlook 2025 to 2035

Software-Defined Wide Area Network SD-WAN Market Size and Share Forecast Outlook 2025 to 2035

Software Defined Radio (SDR) Market Size and Share Forecast Outlook 2025 to 2035

Software-Defined Networking SDN Market Size and Share Forecast Outlook 2025 to 2035

Software-Defined Anything (SDx) Market Size and Share Forecast Outlook 2025 to 2035

Software-Defined Data Center Market Size and Share Forecast Outlook 2025 to 2035

Software Defined Application And Infrastructure Market Size and Share Forecast Outlook 2025 to 2035

Software Defined Networking Market Size and Share Forecast Outlook 2025 to 2035

Software-Defined Camera (SDC) Market Size and Share Forecast Outlook 2025 to 2035

Software Defined Video Networking Market

UK Software Distribution Market Analysis – Size & Industry Trends 2025-2035

MES Software For Discrete Manufacturing Market Size and Share Forecast Outlook 2025 to 2035

RIP Software Market Size and Share Forecast Outlook 2025 to 2035

VPN Software Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA