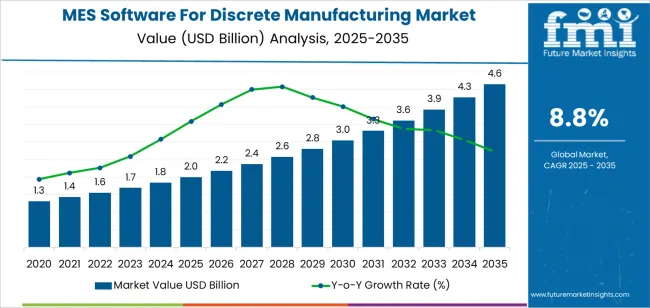

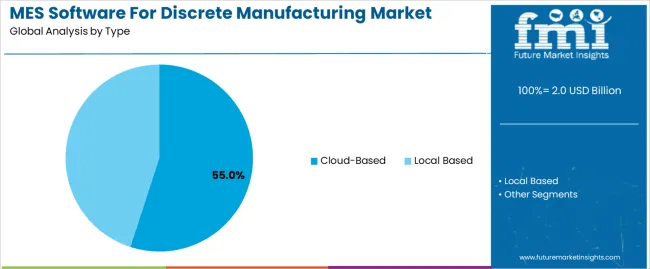

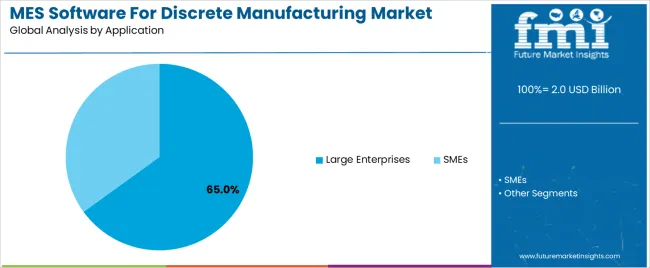

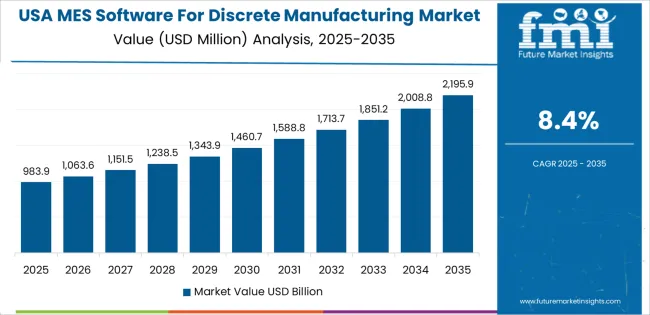

The MES software for discrete manufacturing market is valued at USD 2.0 billion in 2025 and is projected to reach USD 4.7 billion by 2035 at a CAGR of 8.8%, driven by the accelerating adoption of digital transformation across automotive, aerospace, electronics and industrial machinery sectors. Cloud based deployments are expected to capture the largest share, estimated at 55%, as scalability, remote monitoring and lower infrastructure burden are favoured by manufacturers moving toward Industry 4.0 architectures. Large enterprise implementations are anticipated to remain dominant at about 65% of revenues, since multi site operations require deep integration with ERP, PLM and shop floor automation. Between 2025 and 2030, the market is projected to advance from USD 2.0 billion to roughly USD 3.0 billion as companies prioritise production visibility, traceability and quality control.

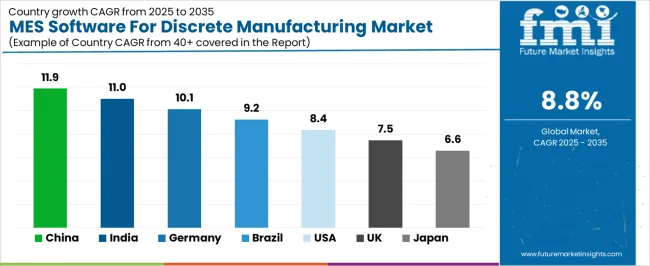

From 2030 to 2035, wider integration of AI driven analytics, predictive maintenance and edge computing is expected to underpin the rise to USD 4.7 billion, with cloud native MES platforms enabling faster rollouts and analytics scale. Regional momentum is expected to be strongest in Asia Pacific, where China is forecast at an 11.9% CAGR and India at 11.0%, while Germany is set to expand at about 10.1% as Industry 4.0 initiatives accelerate. Key vendors such as Siemens, Rockwell Automation, Tulip and Critical Manufacturing will compete on integration capability, low code configuration and data integrity.

The market for MES software is further supported by the growing complexity of global supply chains, which demand more visibility, traceability, and efficiency. With increasing regulatory requirements for product safety, quality, and traceability, manufacturers are turning to MES software to ensure compliance while maintaining operational agility. The rising focus on reducing lead times, minimizing downtime, and optimizing resource utilization are key drivers for the adoption of MES software, as these solutions offer actionable insights to enhance production efficiency.

Between 2025 and 2030, the MES software for discrete manufacturing market is projected to grow from USD 2.0 billion to approximately USD 3.0 billion, adding USD 1.0 billion. This growth, accounting for about 37% of the total forecasted increase for the decade, will be driven by increased digitalization in manufacturing. Companies will focus on modernizing their operations through the adoption of smart factories, along with the implementation of advanced Manufacturing Execution Systems (MES) that integrate seamlessly with other enterprise systems like ERP (Enterprise Resource Planning) and CRM (Customer Relationship Management). This shift will enhance the efficiency and visibility of manufacturing processes, offering real-time data to optimize operations.

From 2030 to 2035, the market is expected to expand from USD 3.0 billion to USD 4.7 billion, adding USD 1.7 billion, which constitutes about 63% of the total growth. This period will see the widespread adoption of AI and machine learning technologies within manufacturing processes, enabling predictive maintenance and process optimization. The increasing shift toward cloud-based MES solutions will provide manufacturers with scalable, cost-effective platforms for managing production. The integration of big data analytics will further boost this expansion by delivering deeper insights into production performance, reducing operational costs, and enhancing overall efficiency. These advancements in technology will drive the demand for MES software, empowering manufacturers to streamline processes, improve quality control, and achieve operational excellence.

| Metric | Value |

|---|---|

| Market Value (2025) | USD 2.0 billion |

| Market Forecast Value (2035) | USD 4.7 billion |

| Forecast CAGR (2025-2035) | 8.8% |

The MES (Manufacturing Execution System) software for discrete manufacturing market is growing as manufacturers increasingly adopt digital solutions to optimize production processes, improve product quality, and enhance operational efficiency. Discrete manufacturing, which involves the production of distinct items like automotive parts, electronics, and machinery, requires precise tracking of materials, production schedules, and equipment usage. MES software helps streamline these operations, offering real-time data on inventory, workflows, and machine performance, leading to improved decision-making and reduced downtime.

The rise of Industry 4.0 and the growing trend of smart manufacturing are significant drivers of this market. As manufacturers move toward more automated and connected systems, MES software plays a critical role in integrating various elements of the production process, from supply chain management to quality control. This integration helps improve visibility across the production line, leading to more efficient and flexible manufacturing systems that can quickly adapt to changing customer demands.

The increasing need for compliance with industry regulations and quality standards is driving the adoption of MES solutions in industries like automotive, aerospace, and electronics. The ability to trace every aspect of production and ensure product consistency is becoming increasingly important. Challenges such as the high initial implementation costs and the complexity of integrating MES software with existing systems may limit adoption in smaller manufacturing operations. Despite these barriers, the market is expected to continue growing as manufacturers seek to enhance their production capabilities.

The market is segmented by type, application, and region. By type, the market is divided into cloud-based and local-based systems, with cloud-based systems leading the market. Based on application, the market is categorized into large enterprises and SMEs, with large enterprises representing the largest segment in terms of market share.

The cloud-based segment leads the MES software for discrete manufacturing market, capturing 55% of the total market share. Cloud-based MES systems offer several advantages, such as scalability, ease of implementation, and reduced infrastructure costs, making them highly attractive to manufacturers. With the increasing adoption of Industry 4.0 practices and the rise of digitalization in manufacturing, cloud-based solutions are becoming the preferred choice for many companies seeking real-time data access, seamless integration with other systems, and enhanced collaboration across locations. Regionally, the market is divided into North America, Europe, Asia Pacific, and other key regions.

Another key factor driving the growth of the cloud-based segment is the growing trend of remote monitoring and management in manufacturing processes. Cloud-based MES systems enable manufacturers to access their data from anywhere, at any time, enhancing flexibility and decision-making. The ability to store large amounts of data securely, alongside advanced analytics capabilities, also supports the optimization of production processes, reducing operational costs and improving efficiency, thus fueling the growth of this segment.

The large enterprises segment dominates the MES software for discrete manufacturing market, holding approximately 65% of the total market share. Large enterprises require advanced, robust MES solutions that can handle complex manufacturing processes, integrate with various legacy systems, and provide scalability across multiple production sites. These enterprises are more likely to invest in comprehensive MES solutions to streamline operations, improve product quality, and enhance overall supply chain efficiency.

Large manufacturers benefit from MES systems by gaining real-time visibility into production processes, enabling faster decision-making, and ensuring compliance with industry regulations. The increasing focus on operational efficiency, coupled with the demand for innovation and automation in large-scale manufacturing, drives the adoption of MES software in this segment. As large enterprises continue to expand their digital transformation initiatives, the demand for MES software is expected to remain strong, reinforcing the segment's leadership in the market.

The market is expanding due to the increasing demand for integrated manufacturing execution systems (MES) that provide real‑time data for discrete manufacturing operations. These systems offer features like process automation, improved production visibility, and quality control. Key drivers include the rise of Industry 4.0, the adoption of IoT and AI technologies, and the growing need for operational efficiency and traceability, while restraints stem from high implementation costs and integration complexities with legacy systems.

MES software for discrete manufacturing is gaining popularity due to its ability to enhance real‑time monitoring, production efficiency, and quality control. As manufacturers look to improve workflow, reduce errors, and comply with regulations, MES systems facilitate seamless integration between shop floor and enterprise systems. These systems help in better coordination, production scheduling, and optimization of resources. As consumer demand for mass customization and on-demand production increases, manufacturers are seeking ways to meet these demands while keeping costs low.

MES software provides the necessary flexibility to manage such complex production environments efficiently. With the growing emphasis on smart factories, predictive maintenance, and digital transformation, MES software has become a crucial component in enabling connected manufacturing, driving increased productivity and operational efficiency. This combination of benefits is helping MES software become a cornerstone of modern manufacturing operations.

Technological innovations are driving the growth of the MES software market by introducing advanced tools like AI, machine learning, and predictive analytics to enhance production efficiency, minimize errors, and reduce downtime. The integration of IoT-enabled sensors enables real‑time data collection, giving manufacturers valuable insights into production processes and facilitating faster decision-making. Cloud computing and edge computing further improve scalability, flexibility, and remote monitoring capabilities, making MES systems more adaptable to evolving needs.

The rise of low‑code/no‑code MES solutions is making these systems more accessible to smaller manufacturers by simplifying implementation and customization. These innovations are not only enhancing operational efficiency but also lowering costs, improving product quality, and accelerating time-to-market, all of which are contributing to the growing adoption of MES software in the manufacturing sector.

Despite strong growth, several challenges impact the adoption of MES software in discrete manufacturing. One major barrier is the high initial costs associated with the implementation of MES systems, particularly for smaller or mid‑sized manufacturers with limited budgets. The complexity of integrating MES with legacy systems like ERP or PLM can lead to significant technical challenges, data silos, and long deployment times.

Manufacturers also face a skills gap, requiring trained personnel to operate and maintain these advanced systems, which can increase labor costs and complicate adoption. Concerns about cybersecurity and data privacy, especially in a connected manufacturing environment, further hinder full-scale adoption of MES solutions. As these challenges remain significant, manufacturers must carefully assess the costs, integration complexity, and security risks when considering MES software for their operations.

| Country | CAGR (%) |

|---|---|

| China | 11.9% |

| India | 11.0% |

| Germany | 10.1% |

| Brazil | 9.2% |

| USA | 8.4% |

| UK | 7.5% |

| Japan | 6.6% |

The global MES software for discrete manufacturing market is expanding rapidly, with China leading at an 11.9% CAGR, driven by industrial automation, digital transformation, and the adoption of smart factory technologies. India follows with an 11.0% CAGR, fueled by Industry 4.0 initiatives, government-backed manufacturing programs, and a strong push for operational efficiency in the automotive and electronics sectors.

Germany records a 10.1% CAGR, supported by its advanced manufacturing ecosystem and focus on digitalized production systems. Brazil posts a 9.2% CAGR, backed by industrial modernization and the need for real-time production control. The USA grows at an 8.4% CAGR, reflecting strong demand for automation and analytics in aerospace, automotive, and electronics manufacturing. The UK shows a 7.5% CAGR, driven by industrial digitization and smart production integration. Japan records a 6.6% CAGR, with consistent adoption of MES software to improve manufacturing precision and productivity.

China leads the MES software for discrete manufacturing sector with an impressive 11.9% CAGR, reflecting its role as a global manufacturing powerhouse. The country's ongoing investment in smart factory initiatives, industrial automation, and digital transformation is driving widespread adoption of MES solutions. As part of China’s "Made in China 2025” strategy, manufacturers are integrating MES software to optimize production efficiency, reduce downtime, and enhance data transparency across operations. Industries such as automotive, electronics, and aerospace are at the forefront of digital manufacturing, requiring advanced MES systems for process monitoring and control.

Moreover, the shift toward IoT-enabled manufacturing systems and cloud-based MES platforms has further accelerated growth. Local technology providers and collaborations between global MES vendors and Chinese manufacturers are expanding the market. The increasing focus on real-time production tracking and quality assurance across industrial facilities underscores the importance of MES solutions. As China continues to modernize its manufacturing base and adopt AI-driven automation, MES software will remain critical in achieving operational excellence and maintaining global competitiveness.

India is registering strong growth in the MES software for discrete manufacturing market, expanding at an 11.0% CAGR. The country’s rapid industrial development, coupled with the government’s "Make in India" and "Digital India" initiatives, has accelerated the adoption of smart manufacturing technologies. MES solutions are being increasingly implemented across key industries such as automotive, electronics, and defense to improve production planning, enhance visibility, and ensure compliance with global manufacturing standards. Indian manufacturers are focusing on reducing production inefficiencies through real-time data analytics and process automation, both of which are supported by MES integration.

The growing demand for traceability, quality control, and workforce productivity optimization is also driving market growth. Moreover, the rise of small and medium-sized enterprises (SMEs) in India’s manufacturing landscape is fostering the adoption of cloud-based MES platforms due to their scalability and affordability. As India continues to invest in industrial modernization, the role of MES software in streamlining production and ensuring smart factory readiness will expand significantly, supporting the country’s transformation into a global manufacturing hub.

Germany is contributing significantly to the MES software for discrete manufacturing market with a 10.1% CAGR, driven by its leadership in Industry 4.0 innovation and digital manufacturing. As Europe’s industrial center, Germany has been quick to integrate MES systems across its automotive, aerospace, and machinery sectors to ensure seamless production management and real-time operational insight. The country’s focus on high-performance manufacturing and precision engineering has created strong demand for MES solutions that enhance traceability, efficiency, and predictive maintenance.

Germany’s integration of IoT, AI, and analytics into its manufacturing workflows has accelerated the transition toward fully digitalized factories. Government programs supporting smart industry initiatives have boosted MES adoption among both large corporations and SMEs. German manufacturers prioritize MES platforms that offer interoperability with ERP and SCADA systems to create a unified digital ecosystem. As digital manufacturing continues to evolve, Germany’s advanced technological infrastructure and innovation-driven economy will sustain robust growth in MES software adoption across the discrete manufacturing landscape.

Brazil is witnessing robust growth in the MES software for discrete manufacturing market, expanding at a 9.2% CAGR, fueled by the country’s industrial modernization and increasing digital transformation in the manufacturing sector. Brazilian manufacturers are embracing MES solutions to improve production planning, quality assurance, and equipment efficiency. The automotive, aerospace, and consumer goods industries are leading adopters, driven by the need for enhanced traceability and process optimization. As Brazil’s manufacturing base diversifies, the demand for real-time data analytics and process visibility continues to rise.

Government initiatives promoting Industry 4.0 adoption and private investments in industrial automation are further accelerating MES implementation. The growing emphasis on energy efficiency, cost reduction, and sustainability in production processes is prompting companies to adopt MES platforms that provide comprehensive performance insights. With the expansion of digital manufacturing ecosystems and rising awareness of smart factory benefits, Brazil’s MES software market is positioned for continued growth, helping manufacturers improve productivity and competitiveness in global markets.

The USA is experiencing steady growth in the MES software for discrete manufacturing market, with an 8.4% CAGR, driven by advanced automation, data-driven decision-making, and a strong focus on smart manufacturing systems. MES software adoption is rising across industries such as automotive, aerospace, defense, and electronics to enhance production control and ensure compliance with strict quality standards. The integration of MES systems with IoT and AI technologies is helping American manufacturers achieve real-time visibility, predictive maintenance, and data-driven production optimization.

The USA’s focus on modernizing its industrial infrastructure and increasing productivity through digital transformation is a key growth driver. Moreover, the rise of digital twins and cloud-based MES platforms has accelerated the deployment of scalable manufacturing solutions. Government support for re-shoring manufacturing operations is also prompting companies to adopt MES software to ensure operational agility. As industries continue to invest in advanced manufacturing and automation, the USA remains one of the leading markets for MES solutions that enable smarter, more efficient production environments.

The UK’s MES software for discrete manufacturing market is growing steadily at a 7.5% CAGR, supported by increasing digitization and industrial automation across various sectors. As the UK focuses on boosting its manufacturing productivity post-industrial restructuring, MES solutions have become central to achieving operational efficiency and competitiveness. Industries such as aerospace, defense, and automotive are leading adopters of MES platforms to enhance production traceability, reduce downtime, and ensure compliance with safety and quality standards.

The UK’s strong emphasis on Industry 4.0 adoption has driven greater integration of MES with ERP, robotics, and IoT-based systems. As manufacturers focus on data-driven decision-making, the demand for MES solutions that offer real-time insights and analytics is increasing. The growing adoption of cloud-based MES systems, especially among small and mid-sized manufacturers, is further supporting market expansion. As the UK continues to modernize its industrial infrastructure, the role of MES software in enabling smart, flexible, and efficient manufacturing processes will remain crucial.

Japan is witnessing steady growth in the MES software for discrete manufacturing market with a 6.6% CAGR, driven by its focus on precision manufacturing and technological innovation. The country’s industrial sectors, including automotive, electronics, and machinery, are adopting MES solutions to streamline production processes and maintain high-quality standards. Japan’s emphasis on continuous improvement (Kaizen) and lean manufacturing aligns well with MES systems, which provide real-time monitoring, quality control, and process optimization.

The growing integration of MES software with robotics and IoT technologies enhances operational visibility and efficiency across Japanese factories. As Japan faces an aging workforce, automation and digital production management tools are becoming critical for maintaining productivity. The adoption of cloud-based MES platforms is also rising, particularly among mid-sized enterprises seeking cost-effective digital transformation. With its commitment to precision, reliability, and innovation, Japan continues to adopt MES solutions that enhance operational control and ensure long-term competitiveness in global manufacturing.

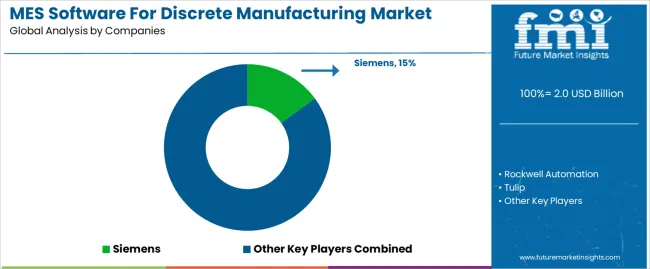

The MES (Manufacturing Execution System) software for discrete manufacturing market is highly competitive, with several key players offering robust solutions to streamline production processes, improve efficiency, and enhance real-time decision-making in manufacturing environments. Siemens leads the market with a 15% share, offering comprehensive MES solutions that are integrated with its broader digital factory offerings. Siemens' strong reputation for industrial automation and its ability to provide end-to-end solutions for discrete manufacturing make it a top contender in the market.

Other significant players in the market include Rockwell Automation, Tulip, and Critical Manufacturing. Rockwell Automation provides MES software solutions that are tightly integrated with its industrial automation and control systems, targeting manufacturers seeking seamless integration across their production lines. Tulip is known for its user-friendly, no-code platform that empowers operators to drive continuous improvement, while Critical Manufacturing focuses on offering advanced MES solutions for complex, high-tech industries, including electronics and aerospace.

Companies like Dassault Systèmes, MTEK, and Oracle offer specialized solutions in manufacturing process optimization and digital transformation. Dassault Systèmes provides a strong MES portfolio, emphasizing data integration and real-time insights, while MTEK and Oracle focus on automation and process management solutions that cater to discrete manufacturing needs.

Other players, including PSI Software, iBase-t, Mapex, Engineering Industries eXcellence, and NoMuda, are also shaping the market with their innovative software offerings, focusing on industry-specific solutions and adaptability. The competition is driven by product innovation, integration capabilities, and the increasing demand for digitized, real-time production management solutions in the discrete manufacturing sector.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD billion |

| Type | Cloud-Based, Local Based |

| Application | Large Enterprises, SMEs |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East & Africa |

| Countries Covered | China, Japan, South Korea, India, Australia & New Zealand, ASEAN, Rest of Asia Pacific, Germany, United Kingdom, France, Italy, Spain, Nordic, BENELUX, Rest of Europe, United States, Canada, Mexico, Brazil, Chile, Rest of Latin America, Kingdom of Saudi Arabia, Other GCC Countries, Turkey, South Africa, Other African Union, Rest of Middle East & Africa |

| Key Companies Profiled | Siemens, Rockwell Automation, Tulip, Critical Manufacturing, Dassault Systèmes, MTEK, Oracle, PSI Software, iBase-t, Mapex, Engineering Industries eXcellence, NoMuda, GE Vernova, SAP, Infor, MasterControl |

| Additional Attributes | Dollar sales by type and application categories, market growth trends, market adoption by classification and application segments, regional adoption trends, competitive landscape, advancements in MES software technologies, integration with manufacturing systems and automation processes. |

The global MES software for discrete manufacturing market is estimated to be valued at USD 2.0 billion in 2025.

The market size for the MES software for discrete manufacturing market is projected to reach USD 4.6 billion by 2035.

The MES software for discrete manufacturing market is expected to grow at a 8.8% CAGR between 2025 and 2035.

The key product types in MES software for discrete manufacturing market are cloud-based and local based.

In terms of application, large enterprises segment to command 65.0% share in the MES software for discrete manufacturing market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Mesquite Flour Market Size and Share Forecast Outlook 2025 to 2035

Mesh Bag Market Size and Share Forecast Outlook 2025 to 2035

Mesh Fabric Market Size and Share Forecast Outlook 2025 to 2035

Mesotherapy Market Size and Share Forecast Outlook 2025 to 2035

Mesh Tarpaulin Sheets Market Size and Share Forecast Outlook 2025 to 2035

Understanding Market Share Trends in Mesh Bags

Mesenteric Penniculitis Treatment Market

Mesh Nebulizer for Kids Market Size and Share Forecast Outlook 2025 to 2035

MES Applications For Process Manufacturing Market Size and Share Forecast Outlook 2025 to 2035

Emesis Bags Market Size and Share Forecast Outlook 2025 to 2035

Domestic Food Preparation Appliances Market Size and Share Forecast Outlook 2025 to 2035

Games and Puzzles Market is segmented by Type, Licensing, Distribution Channel and Region through 2025 to 2035.

Domestic Booster Pumps Market Growth - Trends, Demand & Innovations 2025 to 2035

A2P Messaging Market Size and Share Forecast Outlook 2025 to 2035

Enzymes Market Size and Share Forecast Outlook 2025 to 2035

Intumescent Coatings Market Size and Share Forecast Outlook 2025 to 2035

Enzymes for Laundry Detergent Market Size and Share Forecast Outlook 2025 to 2035

Enzymes for Water Treatment Market Size and Share Forecast Outlook 2025 to 2035

Exosomes Diagnostic and Therapeutic Market Size and Share Forecast Outlook 2025 to 2035

Foam Mesh Sleeves Market Growth - Demand & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA