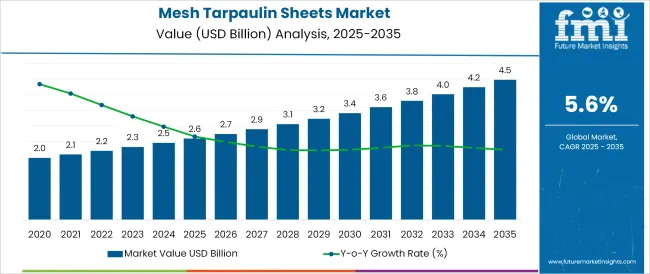

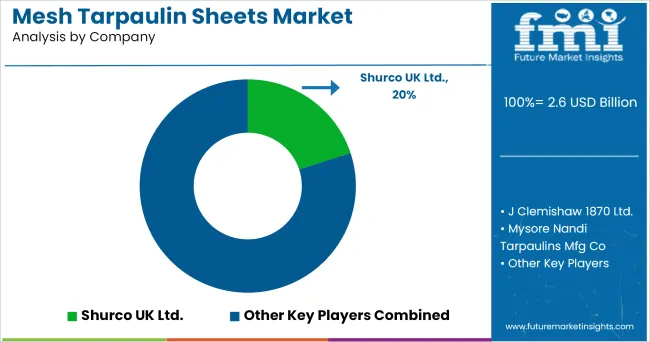

The Mesh Tarpaulin Sheets Market is estimated to be valued at USD 2.6 billion in 2025 and is projected to reach USD 4.5 billion by 2035, registering a compound annual growth rate (CAGR) of 5.6% over the forecast period.

The mesh tarpaulin sheets market is witnessing sustained growth as industries increasingly prioritize durable, lightweight, and cost efficient covering solutions for diverse applications. Rising awareness of material longevity, coupled with growing demand for protective covers in agriculture, construction, and logistics, is driving wider adoption of mesh tarpaulins.

Manufacturers are innovating with advanced polymers and weaving technologies to improve tear resistance, UV stability, and breathability, making these sheets suitable for harsh outdoor conditions. The market outlook remains positive, with growth expected to be supported by expanding agricultural activities, infrastructure development, and heightened emphasis on material recyclability.

Ongoing investments in product customization and distribution networks are paving the path for deeper market penetration and higher usage across emerging economies, where affordability and durability remain key decision drivers.

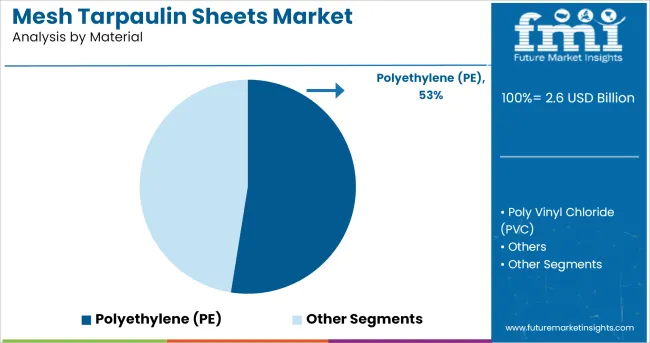

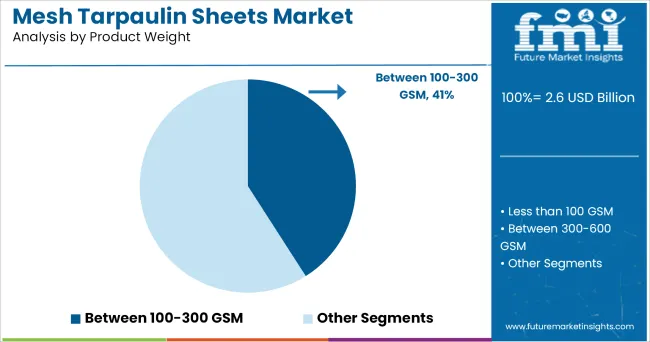

The market is segmented by Material, Product Weight, and End Use and region. By Material, the market is divided into Polyethylene (PE), Poly Vinyl Chloride (PVC), and Others. In terms of Product Weight, the market is classified into Between 100-300 GSM, Less than 100 GSM, Between 300-600 GSM, and Above 600 GSM.

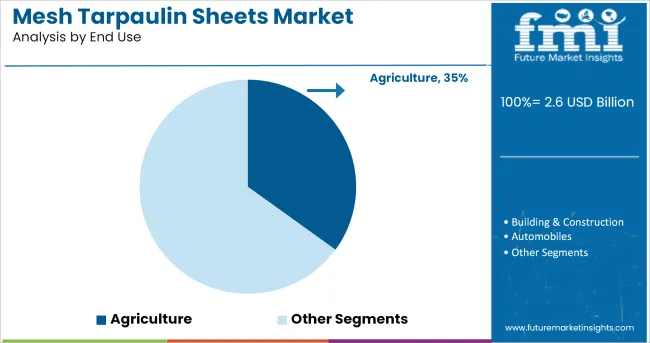

Based on End Use, the market is segmented into Agriculture, Building & Construction, Automobiles, Transportation, Storage, Warehousing & Logistics, Consumer Goods, and Other. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

When segmented by material, polyethylene (PE) is projected to hold 52.5% of the total market revenue in 2025, establishing itself as the leading material choice. This dominance is attributed to its favorable combination of strength, flexibility, and cost effectiveness, which has made it the preferred option for manufacturers and end-users alike.

Its inherent resistance to UV rays, moisture, and chemicals enhances durability, while maintaining affordability for large scale applications. Furthermore, advancements in PE manufacturing techniques have improved product quality and consistency, reinforcing its appeal across demanding environments.

The material’s recyclability and ease of fabrication into various mesh densities have allowed it to cater to a wide range of end uses, thereby solidifying its leadership position in the market.

Segmented by product weight, mesh tarpaulin sheets in the range between 100-300 GSM are expected to capture 41.0% of the total revenue in 2025, making it the leading weight category. This segment has gained prominence due to its optimal balance between strength and maneuverability, offering sufficient durability without being overly heavy or difficult to handle.

The versatility of this weight range enables its application in both temporary and semi permanent setups, where ease of installation and adequate protection are required. The ability of this segment to meet diverse customer requirements from agricultural shading to construction site covering while maintaining competitive pricing has supported its growth.

Its practicality and widespread acceptance across industries have ensured continued demand and a strong market share.

When segmented by end use, agriculture is forecast to command 35.0% of the market revenue in 2025, securing its position as the leading end use sector. This leadership is driven by the critical need for crop protection, soil moisture retention, and shading in agricultural practices.

Mesh tarpaulin sheets have become integral to safeguarding crops from excessive sunlight, wind, and pests, while also facilitating controlled growing conditions. The affordability and reusability of these sheets have made them particularly attractive to farmers operating in cost-sensitive environments.

Additionally, the growing emphasis on sustainable and efficient farming practices has encouraged wider adoption of protective coverings, reinforcing agriculture’s dominant share. Continued investments in mechanized farming and expansion of arable land usage are expected to further underpin this segment’s strong market position.

Mesh tarpaulin sheets are majorly used for the transportation and protection applications. The extraordinary tensile strength and ease, and flexibility of tarpaulin sheets, help manufacturers to store their goods/products safely and offer protection in all weather conditions despite of any damage to the goods/products.

The rise in the demand for cost-effective, easy to use materials, and better protection of goods is creating opportunities for mesh tarpaulin sheets sales.

Moreover, covering swimming pools is another use of mesh tarps. Mesh is extremely lightweight, allowing for easy setup.

It has a high resistance to UV rays and does not allow water to collect on its surface. Such features are estimated to boost the demand for mesh tarpaulin sheets during the forecast period.

During the transport of goods or products via ship, roads or railways, mesh tarpaulin sheets act as an excellent protection to the products/goods. Besides this, the rising demand from manufacturers to protect goods or products in warehouses as well as during the in-transit is the key growth driver.

Additionally, mesh tarps are perfect for covering cargo in truck beds. Since mesh tarps are constructed with small holes between the threads of fabric, they have less wind resistance than some other types of tarps.

This is an advantage when hauling sand, gravel, or other substances in a truck. Mesh tarps can be tied down over the bed of a truck securing the cargo underneath.

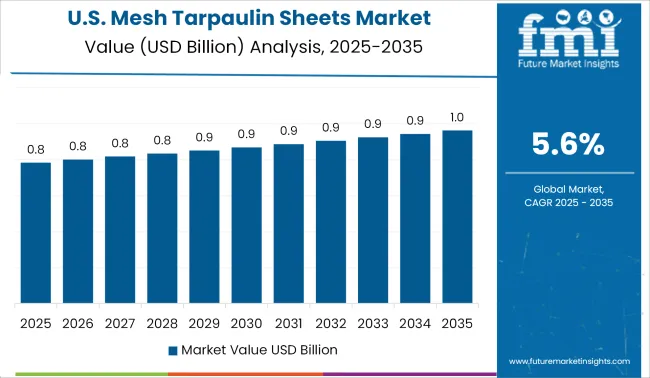

Technological advancements, increase in the trading activities, and presence of well-established industries are the key factors supporting the expansion of mesh tarpaulin sheets industry in the USA.

The expansion of the automobile industry will boost the demand for mesh tarpaulin sheets in the coming years. Also, continuous growth in the building & construction activities are anticipated to create lucrative growth opportunities for the mesh tarpaulin sheets sales in coming years.

The rapid adoption in India is projected to create lucrative growth opportunities for mesh tarpaulin sheets over the coming years. As agricultural activities are primary source of income for a majority of Indians, living across in rural areas, mesh tarpaulin sheets are witnessing a huge demand in this sector owing to several applications.

Expansion of agricultural activities will therefore create a conducive environment for mesh tarpaulin sheets sales in India. The ones used in the agriculture sector are generally made from Poly Vinyl Chloride (PVC). These sheets have anti-fungal and anti-static properties which have been aiding the increasing agricultural applications.

Also, it is a key contributor towards the country’s GDP growth. With investment in improving agricultural activities consistently increasing, the demand for mesh tarpaulin sheets will rise. Besides agriculture, the building and construction sector is also increasing with rapid increase in the population, which will act as a growth factor for the mesh tarpaulin sheets in India.

Some of the leading providers of mesh tarpaulin sheets include

Players are focusing on manufacturing the durable mesh tarpaulin sheets with strong tensile strength which will serve various applications. Also, some of the manufacturers are focusing on manufacturing the recyclable mesh tarpaulin sheets to maintain the sustainability.

The report is a compilation of first-hand information, qualitative and quantitative assessment by industry analysts, inputs from industry experts and industry participants across the value chain.

The report provides in-depth analysis of parent market trends, macro-economic indicators and governing factors along with market attractiveness as per segments. The report also maps the qualitative impact of various market factors on market segments and geographies.

The global mesh tarpaulin sheets market is estimated to be valued at USD 2.6 billion in 2025.

The market size for the mesh tarpaulin sheets market is projected to reach USD 4.5 billion by 2035.

The mesh tarpaulin sheets market is expected to grow at a 5.6% CAGR between 2025 and 2035.

The key product types in mesh tarpaulin sheets market are polyethylene (pe), poly vinyl chloride (pvc) and others.

In terms of product weight, between 100-300 gsm segment to command 41.0% share in the mesh tarpaulin sheets market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Mesh Bag Market Size and Share Forecast Outlook 2025 to 2035

Mesh Fabric Market Size and Share Forecast Outlook 2025 to 2035

Mesh Nebulizer for Kids Market Size and Share Forecast Outlook 2025 to 2035

Understanding Market Share Trends in Mesh Bags

Foam Mesh Sleeves Market Growth - Demand & Forecast 2025 to 2035

Hernia Mesh Devices Market Size and Share Forecast Outlook 2025 to 2035

Handheld Mesh Nebulizer Market Size and Share Forecast Outlook 2025 to 2035

Wireless Mesh Network Market Size and Share Forecast Outlook 2025 to 2035

Surgical Mesh Market

Monofilament Mesh Filter Bags Market Size and Share Forecast Outlook 2025 to 2035

Screen Printing Mesh Market Size and Share Forecast Outlook 2025 to 2035

Nylon Monofilament Mesh Filter Bags Market Size and Share Forecast Outlook 2025 to 2035

Breast Reconstruction Meshes Market Size and Share Forecast Outlook 2025 to 2035

Surgical Polypropylene Mesh Market

Biomaterial In Surgical Mesh Market Size and Share Forecast Outlook 2025 to 2035

Tarpaulin Sheet Industry Analysis in Western Europe Size and Share Forecast Outlook 2025 to 2035

Tarpaulin Sheet Industry Analysis in Korea Size and Share Forecast Outlook 2025 to 2035

Tarpaulin Sheet Industry Analysis in Japan Size and Share Forecast Outlook 2025 to 2035

Tarpaulin Sheets Market Size and Share Forecast Outlook 2025 to 2035

Evaluating Tarpaulin Sheets Market Share & Provider Insights

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA