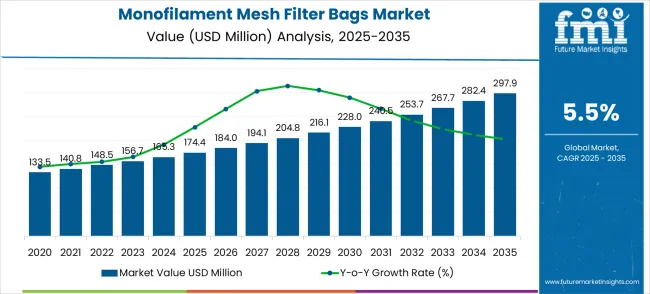

The monofilament mesh filter bags market is valued at USD 174.4 million in 2025 and is projected to reach USD 297.9 million by 2035, rising at a 5.5% CAGR and adding USD 123.5 million across the decade. Growth reflects steady replacement of conventional filtration media with durable monofilament meshes that deliver higher precision, longer service life, and better chemical resistance. From 2025 to 2030, the market rises to roughly USD 228 to 235 million, contributing close to one third of decade expansion as food processors, chemical plants, and water treatment facilities upgrade filtration systems to meet stricter purity and compliance standards. The 2030 to 2035 period accounts for the remaining growth as industrial automation, sustainability requirements, and process optimization drive deeper adoption of monofilament filtration.

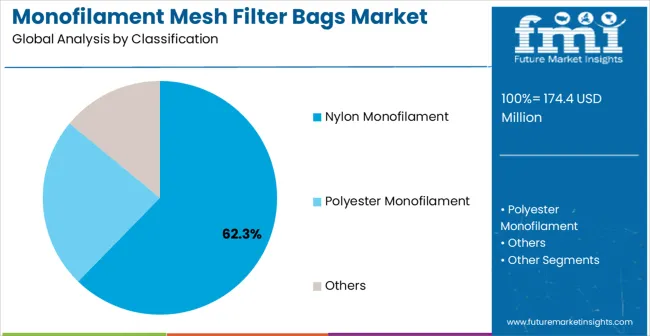

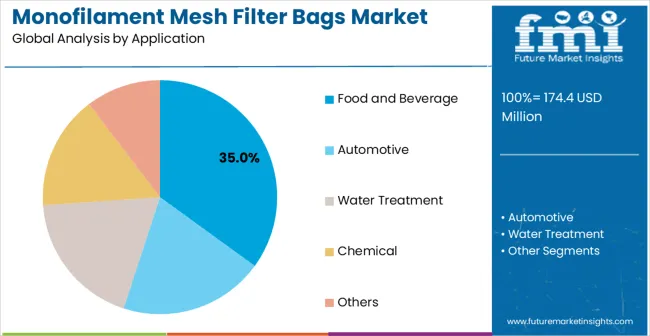

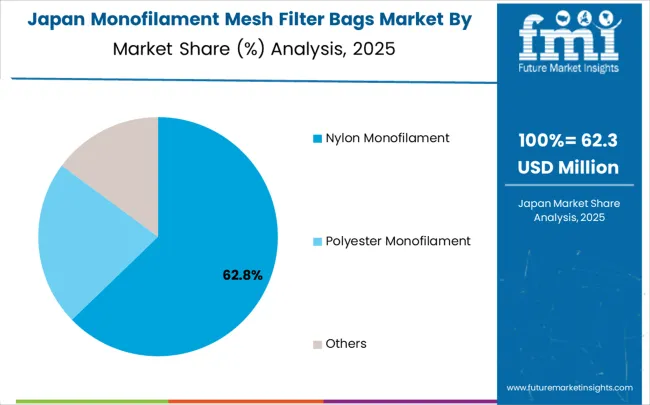

Material segmentation is led by nylon monofilament at 62.3%, supported by its consistent pore geometry, mechanical strength, and compatibility with food-grade and industrial processes. Polyester and other materials fill specialized needs where temperature or chemical tolerance is critical. By application, the food and beverage segment leads with 35.0% due to stringent hygiene requirements in dairy, beverages, edible oils, and high-purity production lines. Water treatment, chemical processing, and automotive applications follow, supported by increased demand for reliable particulate control and long-life filter media.

One of the strongest drivers of market growth is the rising focus on stringent quality standards in industrial processes. Industries dealing with sensitive materials, such as pharmaceuticals and specialty chemicals, require precise and efficient filtration systems to remove particulates without compromising product integrity. Monofilament mesh filter bags offer consistent pore size distribution and excellent mechanical stability, ensuring reliable filtration performance even under demanding operating conditions. As manufacturers across multiple sectors pursue higher productivity and reduced defect rates, the adoption of high-precision mesh filter solutions is rising rapidly.

Industrial water treatment requirements are also playing an important role in shaping market growth. With rising environmental concerns and stricter wastewater discharge norms, industries are investing heavily in filtration technologies that support efficient removal of contaminants. Monofilament mesh bags are widely used in pre-filtration, cooling water treatment, and process water purification because of their durability, chemical resistance, and ability to handle varying levels of suspended solids. As industries intensify sustainability efforts and improve water reuse practices, the demand for reliable filter bags will strengthen.

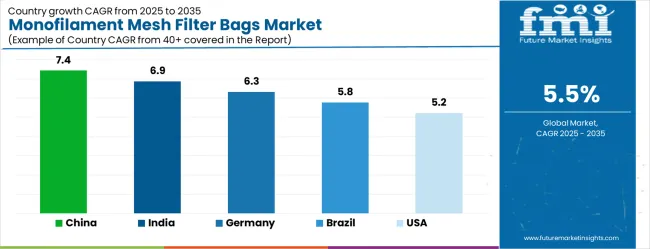

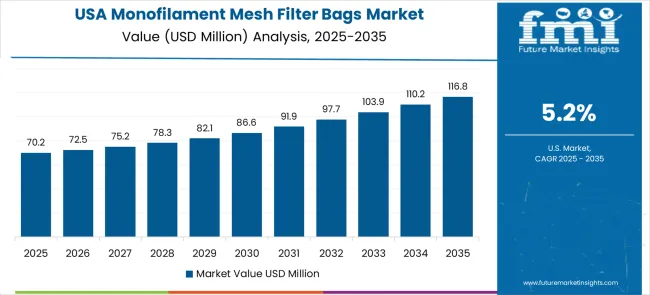

Geographically, China grows at 7.4% CAGR and India at 6.9%, driven by expanding manufacturing capacity, rising food processing output, and investment in municipal and industrial water treatment infrastructure. Germany at 6.3% and Brazil at 5.8% maintain strong demand through advanced engineering capabilities and growing industrial sectors. Mature markets such as the United States at 5.2%, United Kingdom at 4.7%, and Japan at 4.1% expand steadily through system upgrades and modernization rather than new capacity additions.

| Metric | Value |

|---|---|

| Estimated Value in (2025E) | USD 174.4 million |

| Forecast Value in (2035F) | USD 297.9 million |

| Forecast CAGR (2025 to 2035) | 5.5% |

Market expansion is being supported by the increasing global demand for industrial filtration solutions and the corresponding shift toward advanced monofilament mesh technologies that can provide superior durability and filtration efficiency while meeting industry requirements for reliable and cost-effective filtration systems. Modern food processing and water treatment facilities are increasingly focused on incorporating monofilament mesh filter bags to enhance operational efficiency while satisfying demands for consistent filtration performance and extended service life. Monofilament mesh filter bags' proven ability to deliver superior chemical resistance, mechanical strength, and filtration precision makes them essential components for industrial filtration systems and process optimization applications.

The growing focus on environmental compliance and green manufacturing processes is driving demand for high-quality monofilament mesh filter bag products that can support distinctive filtration capabilities and premium system positioning across food processing, water treatment, and chemical processing categories. Equipment manufacturer preference for filtration media that combines durability excellence with environmental compatibility is creating opportunities for innovative monofilament mesh implementations in both traditional and emerging industrial applications. The rising influence of stringent regulatory requirements and quality standards is also contributing to increased adoption of premium monofilament mesh filter bag products that can provide authentic high-performance filtration characteristics.

The market is segmented by material type, application, and region. By material type, the market is divided into nylon monofilament, polyester monofilament, and others. Based on application, the market is categorized into food and beverage, automotive, water treatment, chemical, and others. Regionally, the market is divided into North America, Europe, East Asia, South Asia & Pacific, Latin America, and the Middle East & Africa.

The nylon monofilament segment is projected to account for 62.3% of the monofilament mesh filter bags market in 2025, reaffirming its position as the leading material type category. Industrial filtration manufacturers and process equipment specialists increasingly utilize nylon monofilament mesh for its superior chemical resistance, consistent mechanical properties, and ease of integration in demanding filtration applications across diverse industrial environments. Nylon monofilament technology's standardized fiber characteristics and reliable performance directly address the industrial requirements for durable filtration media and efficient particle separation in commercial filtration operations.

This material segment forms the foundation of modern industrial filtration applications, as it represents the technology with the greatest versatility and established compatibility across multiple filtration systems. Manufacturer investments in nylon processing optimization and quality standardization continue to strengthen adoption among filtration equipment producers. With industrial facilities prioritizing operational reliability and consistent filtration performance, nylon monofilament mesh systems align with both durability objectives and cost-effectiveness requirements, making them the central component of comprehensive industrial filtration strategies.

Food and beverage applications are projected to account 35.0% share of monofilament mesh filter bags demand in 2025, highlighting their critical role as the primary application for specialized filtration solutions in food processing and beverage manufacturing operations. Equipment manufacturers prefer monofilament mesh filter bags for their exceptional hygiene standards, chemical inertness, and ability to maintain consistent filtration performance while supporting strict food safety requirements during processing operations. Positioned as essential components for high-performance food processing operations, monofilament mesh filter bags offer both regulatory compliance and operational efficiency advantages.

The segment is supported by continuous growth in food processing activities and the growing availability of food-grade monofilament materials that enable enhanced filtration precision and product quality optimization at the manufacturing level. Food and beverage manufacturers are investing in advanced filtration technologies to support premium product positioning and quality consistency. As food processing continues to expand and manufacturers seek superior filtration automation solutions, food and beverage applications will continue to dominate the application landscape while supporting technology advancement and manufacturing efficiency strategies.

The market is advancing steadily due to increasing industrial filtration investments and growing demand for durable filtration solutions that emphasize superior performance and reliability across food processing and water treatment applications. The market faces challenges, including higher material costs compared to traditional filtration alternatives, technical complexity in specialized mesh construction, and competition from alternative filtration technologies. Innovation in polymer material development and application-specific mesh design continues to influence market development and expansion patterns.

The growing adoption of monofilament mesh filter bags in eco-friendly manufacturing and green processing applications is enabling filtration manufacturers to develop products that provide distinctive environmental benefits while commanding premium positioning and enhanced performance characteristics. Advanced applications provide superior durability while allowing more sophisticated environmental compliance development across various industrial categories and regulatory segments. Manufacturers are increasingly recognizing the competitive advantages of environmentally conscious filtration positioning for premium product development and responsible market penetration.

Modern monofilament mesh filter bag suppliers are incorporating advanced polymer technologies, enhanced fiber processing techniques, and application-specific optimization to enhance filtration performance, improve durability characteristics, and meet industrial demands for specialized and reliable filtration media. These programs improve product performance while enabling new applications, including high-temperature filtration and specialized chemical processing applications. Advanced material development also allows suppliers to support premium market positioning and technology leadership beyond traditional commodity filtration products.

| Country | CAGR (2025 to 2035) |

|---|---|

| China | 7.4% |

| India | 6.9% |

| Germany | 6.3% |

| Brazil | 5.8% |

| USA | 5.2% |

| UK | 4.7% |

| Japan | 4.1% |

The market is experiencing robust growth globally, with China leading at a 7.4% CAGR through 2035, driven by the rapidly expanding manufacturing sector, massive investments in water treatment infrastructure, and increasing adoption of industrial filtration technologies. India follows at 6.9%, supported by a growing food processing industry, rising industrial development, and expanding water treatment capabilities.

Germany shows growth at 6.3%, focusing advanced engineering technology and premium filtration equipment manufacturing. Brazil records 5.8%, focusing on emerging industrial applications and water treatment development.

The USA demonstrates 5.2% growth, prioritizing advanced manufacturing automation and filtration innovation. The UK exhibits 4.7% growth, supported by specialized filtration technology development and advanced industrial capabilities. Japan shows 4.1% growth, focusing precision manufacturing excellence and high-quality filtration product development.

The report covers an in-depth analysis of 40+ countries; top-performing countries are highlighted below.

China is projected to exhibit exceptional growth with a CAGR of 7.4% through 2035, driven by the rapidly expanding manufacturing sector and massive government investments in industrial infrastructure development across major production hubs. The country's growing industrial capacity and increasing adoption of advanced filtration technologies are creating substantial demand for durable filtration solutions in both established and emerging manufacturing applications. Major filtration technology manufacturers and industrial equipment companies are establishing comprehensive production and processing capabilities to serve both domestic consumption and export markets.

India is expanding at a CAGR of 6.9%, supported by the growing food processing industry, increasing industrial development, and expanding water treatment applications. The country's developing manufacturing ecosystem and expanding infrastructure capabilities are driving demand for reliable filtration products across both food processing and industrial applications. International filtration companies and domestic manufacturing specialists are establishing comprehensive distribution and production capabilities to address growing market demand for cost-effective industrial filtration solutions.

Germany is projected to grow at a CAGR of 6.3% through 2035, driven by the country's advanced engineering technology sector, premium filtration equipment manufacturing capabilities, and leadership in precision industrial solutions. Germany's sophisticated manufacturing culture and willingness to invest in high-performance filtration technologies are creating substantial demand for both standard and specialized monofilament mesh filter bag varieties. Leading technology companies and filtration equipment manufacturers are establishing comprehensive innovation strategies to serve both European markets and growing international demand.

Brazil is projected to grow at a CAGR of 5.8% through 2035, supported by the country's expanding industrial sector, growing water treatment applications, and increasing adoption of modern filtration technologies requiring durable filtration solutions. Brazilian manufacturers and international companies consistently seek reliable filtration products that enhance operational efficiency for both domestic applications and regional markets. The country's position as a regional industrial hub continues to drive innovation in filtration technology applications and industrial standards.

The United States is projected to grow at a CAGR of 5.2% through 2035, supported by the country's advanced manufacturing sector, filtration technology innovation capabilities, and established leadership in industrial processing solutions. American manufacturing companies and equipment manufacturers prioritize performance, reliability, and regulatory compliance, making monofilament mesh filter bags essential components for both domestic production and technology-oriented manufacturing. The country's comprehensive research capabilities and technical expertise support continued market development.

The United Kingdom is projected to grow at a CAGR of 4.7% through 2035, supported by the country's specialized filtration technology sector, advanced manufacturing capabilities, and established expertise in industrial processing solutions. British manufacturers' focus on innovation, quality, and technical excellence creates steady demand for reliable monofilament mesh filtration products. The country's attention to filtration performance and application optimization drives consistent adoption across both traditional manufacturing and emerging industrial applications.

Japan is projected to grow at a CAGR of 4.1% through 2035, supported by the country's precision manufacturing excellence, advanced filtration technology expertise, and established reputation for producing superior industrial filtration products while working to enhance material processing capabilities and develop next-generation monofilament technologies. Japan's filtration industry continues to benefit from its reputation for delivering high-quality industrial products while focusing on innovation and manufacturing precision.

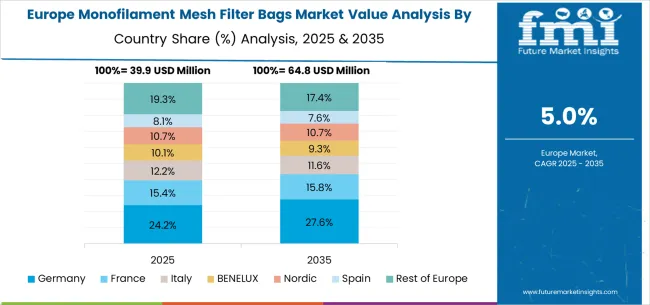

The monofilament mesh filter bags market in Europe is projected to grow from USD 45.2 million in 2025 to USD 74.1 million by 2035, registering a CAGR of 5.1% over the forecast period. Germany is expected to maintain its leadership position with a 36.8% market share in 2025, remaining stable at 36.6% by 2035, supported by its advanced engineering technology sector, precision filtration equipment manufacturing industry, and comprehensive innovation capabilities serving European and international markets.

The United Kingdom follows with a 23.4% share in 2025, projected to reach 23.7% by 2035, driven by specialized filtration technology development programs, advanced manufacturing capabilities, and a growing focus on industrial processing solutions for premium applications.

France holds an 18.1% share in 2025, expected to maintain 17.9% by 2035, supported by food processing industry demand and advanced filtration applications, but facing challenges from market competition and economic considerations. Italy commands a 12.3% share in 2025, projected to reach 12.5% by 2035, while Spain accounts for 6.2% in 2025, expected to reach 6.4% by 2035.

The Netherlands maintains a 3.2% share in 2025, growing to 3.3% by 2035. The Rest of Europe region, including Nordic countries, Eastern Europe, Belgium, Switzerland, and Austria, is anticipated to hold 16.6% in 2025, declining slightly to 16.2% by 2035, attributed to mixed growth patterns with moderate expansion in some advanced manufacturing markets balanced by slower growth in smaller countries implementing industrial filtration development programs.

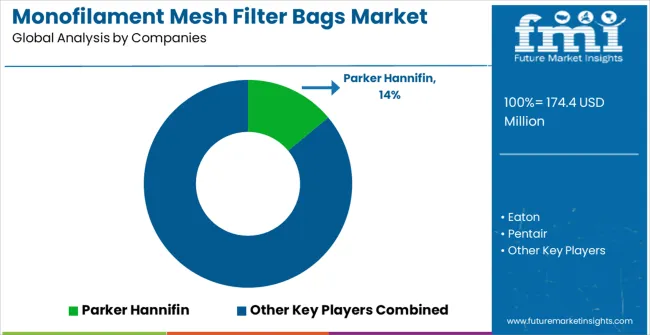

The monofilament mesh filter bags market consists of 15 to 18 key manufacturers, with the top five companies holding 57–62% of global market share. Growth is driven by expanding demand for high-precision liquid filtration in chemicals, water treatment, food and beverage, electronics, pharmaceuticals, paints and coatings, and industrial processing, where monofilament mesh provides excellent particle retention, chemical resistance, and consistent pore size. Competition focuses on filtration accuracy, mesh uniformity, stitching quality, micron rating diversity, temperature tolerance, and custom bag configurations, rather than price alone. Parker Hannifin leads the market with an 14% share, supported by its strong portfolio of engineered filtration solutions and global distribution reach.

Other major leaders such as Eaton, Pentair, 3M, and Sefar maintain significant positions with high-performance monofilament mesh bags designed for critical clarification, pre-filtration, and polishing applications. Their technical expertise and investment in advanced polymer mesh technologies reinforce their leadership across North America, Europe, and industrialized Asia.

Challengers including AJR Filtration, Amazon Filters, Filtration Group, and Knight Corporation compete through customizable mesh bags, fast lead times, and solutions tailored for specialty chemicals, process fluids, and high-flow operations.

Additional players such as Strainrite, Donaldson, Allied Filter Systems, Critical Process Filtration, Harmsco, HL Filter, Universal Filtration, Industrial Filter Manufacturing (IFM), and Farrleey expand global competition by offering cost-effective, application-specific monofilament mesh bags well suited for regional water treatment plants, mid-scale manufacturers, and industrial OEM systems, strengthening market accessibility worldwide.

Monofilament mesh filter bags are specialized industrial filtration components that provide durable, precise particle separation using single-strand synthetic fibers formed into mesh structures, essential for maintaining product quality and process efficiency across food processing, water treatment, and chemical industries. With the market projected to grow from USD 174.4 million in 2025 to USD 297.9 million by 2035 at a 5.5% CAGR, these filtration products address critical needs for chemical resistance, mechanical strength, and consistent filtration performance.

The dominance of nylon monofilament (62.3% market share) and food & beverage applications reflects the material's superior durability and food safety compliance capabilities. The market expansion faces challenges, including higher material costs compared to conventional filters, technical complexity in mesh construction optimization, and competition from alternative filtration technologies.

Maximizing growth potential requires coordinated efforts across polymer materials manufacturers and filtration specialists, end-user industries and process engineers, filtration equipment OEMs and system integrators, environmental compliance and quality assurance experts, and supply chain and market development partners.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD 174.4 Million |

| Material Type | Nylon Monofilament, Polyester Monofilament, Others |

| Application | Food and Beverage, Automotive, Water Treatment, Chemical, Others |

| Regions Covered | North America, Europe, East Asia, South Asia & Pacific, Latin America, Middle East & Africa |

| Countries Covered | United States, Canada, United Kingdom, Germany, France, China, Japan, South Korea, India, Brazil, Australia and 40+ countries |

| Key Companies Profiled | Parker Hannifin, Eaton, Pentair, 3M, Sefar, AJR Filtration, Amazon Filters, Filtration Group, Knight Corporation, Strainrite, Donaldson, Allied Filter Systems, Critical Process Filtration, Harmsco, HL Filter, Universal Filtration, Industrial Filter Manufacturing (IFM), and Farrleey |

| Additional Attributes | Dollar sales by material type and application, regional demand trends, competitive landscape, technological advancements in polymer processing, durability enhancement development initiatives, filtration efficiency optimization programs, and industrial integration strategies |

The global GLP-1 diabetes treatment drugs market is estimated to be valued at USD 6,556.5 million in 2025.

The market size for the GLP-1 diabetes treatment drugs market is projected to reach USD 62,543.2 million by 2035.

The GLP-1 diabetes treatment drugs market is expected to grow at a 25.3% CAGR between 2025 and 2035.

The key product types in GLP-1 diabetes treatment drugs market are laglutide, dulaglutide, exenatide and others.

In terms of application, online pharmacy segment to command 55.0% share in the GLP-1 diabetes treatment drugs market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Nylon Monofilament Mesh Filter Bags Market Size and Share Forecast Outlook 2025 to 2035

Homopolymer Acrylic Filter Bags Market Size and Share Forecast Outlook 2025 to 2035

Filter Bag Market Size and Share Forecast Outlook 2025 to 2035

Filter Press Solutions Market Size and Share Forecast Outlook 2025 to 2035

Mesh Bag Market Size and Share Forecast Outlook 2025 to 2035

Mesh Fabric Market Size and Share Forecast Outlook 2025 to 2035

Filter Integrity Test Systems Market Size and Share Forecast Outlook 2025 to 2035

Mesh Nebulizer for Kids Market Size and Share Forecast Outlook 2025 to 2035

Filter Coatings Market Size and Share Forecast Outlook 2025 to 2035

Mesh Tarpaulin Sheets Market Size and Share Forecast Outlook 2025 to 2035

Understanding Market Share Trends in Mesh Bags

Industry Share Analysis for Filter Paper Companies

Filter Paper Market Trends – Growth, Demand & Forecast through 2035

Monofilament Market Growth – Trends & Forecast 2024-2034

RF Filters Market Size and Share Forecast Outlook 2025 to 2035

SAW Filter Market Size and Share Forecast Outlook 2025 to 2035

Polybags Market Size and Share Forecast Outlook 2025 to 2035

Air Filters Market Growth - Trends & Forecast 2025 to 2035

Global Tea Filter Paper Market Analysis – Growth & Forecast 2024-2034

Net Bags Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA