The filter coatings market is estimated to be valued at USD 2.3 billion in 2025 and is projected to reach USD 3.1 billion by 2035, registering a compound annual growth rate (CAGR) of 3.0% over the forecast period. The year-on-year (YoY) growth analysis shows consistent growth throughout the forecast period. From 2025 to 2029, the market gradually increases from USD 1.9 billion to USD 2.3 billion, driven by rising demand for filter coatings in sectors such as automotive, industrial filtration, and electronics. These coatings enhance the performance and longevity of filters, supporting their increased use. Between 2029 and 2031, the market continues to expand, rising from USD 2.3 billion to USD 2.5 billion, as advancements in coating technologies and a growing need for high-performance filtration systems in air and water purification, as well as HVAC applications, contribute to the demand.

The YoY growth during this phase is also supported by stricter environmental regulations, prompting industries to invest in more efficient and eco-friendly filtration solutions. From 2031 to 2035, the market shows sustained growth, reaching USD 3.1 billion, with gradual YoY increases. This period reflects the ongoing demand for filter coatings in existing markets, along with their expanding applications in new industries. Technological innovations and regulatory shifts aimed at improving filtration standards will continue to drive the market forward, supporting consistent YoY growth.

Automotive filtration manufacturing operations experience integration challenges as filter coatings must meet performance specifications for oil filtration, air intake systems, and cabin air quality while coordinating with assembly line scheduling and quality verification procedures. Production teams work with coating specialists to establish application parameters for different filter media types while managing process control requirements that address both coating uniformity and filtration efficiency across varying production volumes and substrate configurations.

Cross-functional coordination between coating development teams and filter manufacturers creates ongoing dialogue about performance optimization versus manufacturing feasibility. Materials scientists work with process engineers to evaluate new coating formulations against existing production capabilities while managing transition requirements from laboratory-scale development to commercial production that may affect both coating properties and manufacturing costs across diverse filtration applications.

HVAC system manufacturing facilities encounter operational considerations as filter coatings must integrate with existing filter production lines while maintaining antimicrobial properties, particle capture efficiency, and airflow resistance specifications. Technical teams coordinate with quality assurance departments to establish testing protocols for coating durability and filtration performance while managing production scheduling that accommodates both coated and uncoated filter variants for different market segments.

| Metric | Value |

|---|---|

| Filter Coatings Market Estimated Value in (2025 E) | USD 2.3 billion |

| Filter Coatings Market Forecast Value in (2035 F) | USD 3.1 billion |

| Forecast CAGR (2025 to 2035) | 3.0% |

The filter coatings market is gaining strong traction as industries demand higher optical performance, improved spectral control, and longer product lifespans. Rapid advances in precision manufacturing, photonics, and optical engineering are driving adoption across electronics, life sciences, and aerospace sectors. These coatings enable precise wavelength filtration, reflection, and transmission control—critical for modern imaging, sensing, and display systems.

Growth is supported by the increasing shift toward compact and high-resolution optical assemblies, where coatings must balance performance with durability under variable environmental conditions. Innovations in ion-assisted deposition, atomic layer deposition (ALD), and sputtering technologies have improved coating uniformity, adhesion, and compatibility with a broader range of materials.

Regulatory focus on optical quality, contamination control, and energy efficiency, particularly in semiconductor and medical industries, is reinforcing demand. Over the next decade, the market is expected to benefit from the miniaturization of optical components, expansion of 5G and AR infrastructure, and investments in photonic sensors, positioning filter coatings as a key enabler of next-generation optical technologies.

The filter coatings market is segmented by substrate material, end-use industry, coating type, process technology, and geographic regions. The substrate material market for filter coatings is divided into glass and quartz, ceramics, metals (steel, aluminum, titanium), and polymers and plastics. In terms of end-use industry, the filter coatings market is classified into electronics, pharmaceuticals, biotechnology, aerospace, automotive, and water and wastewater treatment.

Based on coating type, the filter coatings market is segmented into multilayer optical coatings, anti-reflective coatings, antimicrobial coatings, and ultraviolet protection coatings. The process technology of the filter coatings market is segmented into physical vapor deposition (PVD), chemical vapor deposition (CVD), solution deposition, and sputtering. Regionally, the filter coatings industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Glass and quartz are projected to hold 41.5% of total market revenue in 2025, reflecting their dominance as substrate materials. Their optical clarity, thermal stability, and chemical resistance make them indispensable in high-precision sectors such as semiconductor fabrication, biomedical imaging, and aerospace optics.

These substrates enable consistent multilayer deposition and maintain stability under UV and high-energy exposure. Compatibility with advanced coating processes allows for uniform layer formation and long-term adhesion. Their robustness under vacuum and high-temperature conditions further strengthens adoption in harsh-environment applications requiring minimal optical distortion.

The electronics sector is expected to command 29.8% of global revenue by 2025, leading overall demand. Filter coatings play a vital role in optical sensors, displays, laser modules, and imaging systems, improving signal accuracy and protecting sensitive components from infrared or UV interference.

The surge in wearable devices, autonomous systems, and LiDAR applications is accelerating the need for compact optics with precise wavelength filtering. Scalable thin-film deposition methods are supporting mass production while maintaining performance consistency. As devices shrink and integration deepens, demand for thermally stable and mechanically resilient coatings will continue to rise.

Multilayer optical coatings are projected to contribute 35.2% of total market share by 2025, owing to their ability to deliver selective reflection and transmission across narrow or broadband wavelength ranges. Built from alternating high- and low-index materials, these coatings provide fine-tuned optical behavior for telecommunications, defense, life sciences, and photonics.

Enhanced layer control and plasma-assisted deposition have improved reliability under demanding conditions. Multilayer coatings support anti-reflective, high-reflective, and bandpass filter designs, making them indispensable in the design of high-efficiency optical and photonic systems.

The market’s growth is being fueled by the rising need for high-efficiency filtration and optical performance, the adoption of nanotechnology, and expanding use across industrial, automotive, and life-science sectors. These coatings enhance filter durability, particle retention, and environmental resistance, while reducing maintenance costs.

Increasingly strict air-quality and emission standards are driving demand for advanced filtration technologies. Coated filters improve particle capture, minimize clogging, and extend filter service life.

In automotive applications, coatings enhance air and fuel filter efficiency, reducing emissions and improving engine performance. In healthcare and industrial settings, they ensure compliance with safety and environmental regulations while maintaining high throughput.

Despite technological progress, production costs remain a restraint, specially for nanocoatings and antimicrobial layers requiring complex processes. Cost sensitivity limits adoption in lower-margin sectors.

Additionally, ensuring optimal performance under varying environmental conditions (humidity, heat, or chemical exposure) remains a design challenge, necessitating continuous R&D investment to enhance coating versatility.

The filter coatings market offers significant opportunities driven by technological advancements and growing industry-specific applications. Innovations in coating materials, such as the use of nanomaterials, hydrophobic coatings, and antimicrobial agents, are expanding the functionality of filter systems and improving their performance. In the automotive industry, for instance, the development of more efficient air and fuel filters using advanced coatings is helping meet tighter emission standards. In the healthcare sector, antimicrobial coatings are becoming increasingly popular in air and water filtration systems to reduce the spread of bacteria and viruses. The development of smart coatings, which change their properties in response to environmental conditions, is also gaining attention, providing new opportunities for the filter coatings market in sectors like industrial manufacturing and environmental protection.

A key trend in the filter coatings market is the growing adoption of nanotechnology and smart coatings. Nanotechnology is enabling the development of coatings with superior filtration efficiency, offering finer filtration and enhanced particle capture. Nanocoatings are particularly useful in applications where high precision and performance are essential, such as in pharmaceutical and cleanroom environments. Additionally, the rise of smart coatings, which are capable of responding to environmental changes (e.g., adjusting their filtration capabilities based on the level of pollutants), is gaining traction in industries like automotive and air purification. These trends are driving innovation in the filter coatings market, improving both the performance and versatility of filtration systems across various industries. As these technologies evolve, they are expected to continue shaping the future of the filter coatings market.

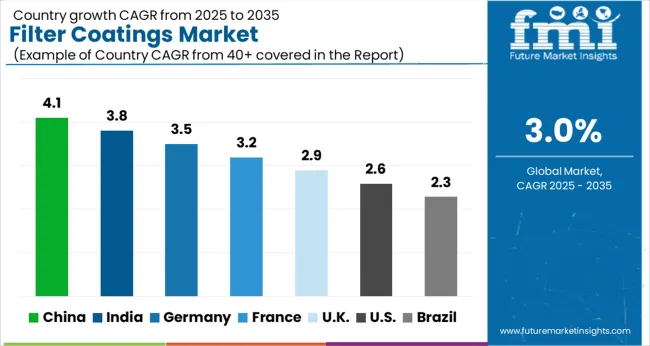

| Countries | CAGR |

|---|---|

| China | 4.1% |

| India | 3.8% |

| Germany | 3.5% |

| France | 3.2% |

| UK | 2.9% |

| USA | 2.6% |

| Brazil | 2.3% |

Global filter coatings market demand is projected to rise at a 3.0% CAGR from 2025 to 2035. China leads at 4.1%, followed by India at 3.8%, and Germany at 3.5%, while the United Kingdom records 2.9% and the United States posts 2.6%. These rates translate to a growth premium of +35% for China, +25% for India, and +5% for Germany versus the baseline, while the United States and the United Kingdom show slower growth. Divergence reflects local catalysts: rising industrial production, increasing demand for air filtration in China and India, while more mature markets like the United States and the United Kingdom experience moderate growth due to established infrastructure. The analysis includes over 40+ countries, with the leading markets detailed below.

The filter coatings market in China is expanding at a CAGR of 4.1%, driven by the country’s industrial growth and increased environmental concerns. As China’s manufacturing and automotive sectors continue to grow, the demand for air and water filtration solutions is rising, leading to a greater need for high-performance filter coatings. The Chinese government’s investments in industrial upgrades and pollution control are further boosting the demand for more effective filtration systems. The growing demand for clean air in urban areas is contributing to the market’s growth, as industries look for ways to comply with stricter environmental regulations.

The filter coatings market is projected to grow at a CAGR of 3.8%, supported by the country’s rising industrialization and urbanization. The growth in automotive production, heavy industries, and commercial establishments is creating a need for effective filtration systems. As air and water quality continue to deteriorate in many regions, the demand for filter coatings that provide better protection against contaminants is rising. The Indian government’s focus on improving infrastructure and industrial output also contributes to the increased demand for advanced filter coating technologies. Moreover, the growing awareness of health and environmental concerns is further propelling the adoption of filtration solutions across various sectors.

The filter coatings market in Germany is growing at a CAGR of 3.5%, with demand driven by the country’s strong industrial and automotive sectors. As one of the leading manufacturers in Europe, Germany’s need for efficient filtration systems is significant, particularly in industries such as automotive, manufacturing, and HVAC. The country’s emphasis on quality control and regulatory standards is pushing industries to adopt advanced filter coatings to meet stringent requirements. The rise in air and water quality concerns is increasing the need for more effective filtration solutions. Germany’s well-established infrastructure and industrial base contribute to the market’s steady growth.

The United Kingdom’s filter coatings market is growing at a CAGR of 2.9%, with steady demand from the automotive, industrial, and environmental sectors. The UK’s industrial base continues to require advanced filtration solutions, particularly in manufacturing and energy sectors. Additionally, the country’s focus on improving air quality in urban areas is driving the adoption of filter coatings in HVAC systems. Despite slower growth compared to emerging markets, the UK’s established infrastructure and industrial output continue to support a steady demand for filtration products. Increasing awareness of health and environmental impacts is fostering the market’s continued expansion.

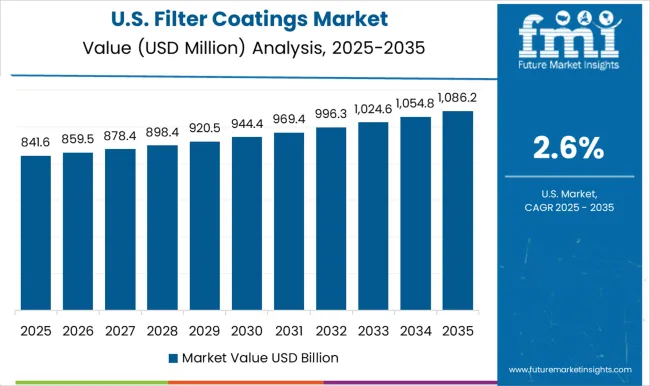

The USA filter coatings market is growing at a CAGR of 2.6%, driven by demand in industries such as automotive, manufacturing, and HVAC. While the market is mature, the increasing need for air and water filtration in various sectors is continuing to drive demand. The country’s established infrastructure and regulatory standards for air quality contribute to the adoption of more efficient filter coatings. The growing focus on reducing pollution levels and improving indoor air quality is further boosting market growth. The USA market continues to be a key player in the development and use of high-performance filtration systems.

The filter coatings market is driven by global manufacturers offering advanced thin-film coating technologies for optical, industrial, and scientific filters across telecommunications, aerospace, automotive, and electronics applications. Denton Vacuum LLC is a leading provider of precision coating equipment and solutions, specializing in customizable coatings that deliver superior durability, optical performance, and uniformity across complex substrates.

PPG Industries, Inc. supplies high-performance filter coatings for automotive, architectural, and industrial applications, focusing on durability, environmental resistance, and process efficiency. Viavi Solutions Inc. (formerly JDSU) offers optical and interference filter coatings for telecommunication and photonic systems, ensuring high light transmission and wavelength selectivity. Ophir Optronics Ltd. (an MKS Instruments company) produces precision optical and laser filter coatings used in scientific, defense, and industrial measurement systems, emphasizing accuracy and consistency.

Optical Coatings Japan Co., Ltd. specializes in high-reflectivity and anti-reflective coatings for optical filters, supporting advanced imaging and metrology applications. 3M Company delivers filter coatings for high-precision optical systems, widely used in medical imaging, automotive sensors, and consumer electronics.

Abrisa Technologies provides optical and dielectric filter coatings for aerospace, defense, and display technologies, known for reliability and precision under harsh conditions. Inrad Optics, Inc. manufactures custom optical coatings and filters for lasers, research, and medical instrumentation. Fluke Corporation (a Danaher Corporation company, incorporating Janos Technology Inc.) offers specialized optical coatings and assemblies for telecommunications, aerospace, and analytical systems.

| Item | Value |

|---|---|

| Quantitative Units | USD 2.3 Billion |

| Substrate Material | Glass and Quartz, Ceramics, Metals (Steel, Aluminum, Titanium), and Polymers and Plastics |

| End-Use Industry | Electronics, Pharmaceuticals, Biotechnology, Aerospace, Automotive, and Water and Wastewater Treatment |

| Coating Type | Multilayer Optical Coatings, Anti-Reflective Coatings, Antimicrobial Coatings, and Ultraviolet Protection Coatings |

| Process Technology | Physical Vapor Deposition (PVD), Chemical Vapor Deposition (CVD), Solution Deposition, and Sputtering |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Denton Vacuum LLC; PPG Industries, Inc.; Viavi Solutions Inc.; Ophir Optronics Ltd.; Optical Coatings Japan Co., Ltd.; 3M Company (Precision Optics Division); Abrisa Technologies; Inrad Optics, Inc.; Fluke Corporation (including Janos Technology Inc., a subsidiary of Danaher Corporation). |

| Additional Attributes | Dollar sales by product type (optical filter coatings, infrared filter coatings, UV filter coatings) and end-use segments (telecommunications, aerospace, defense, consumer electronics, medical). Demand dynamics are driven by the growing adoption of optical systems in industries such as telecommunications, defense, and healthcare, and the increasing need for high-performance filter coatings in precision instruments. Regional trends show strong growth in North America, Europe, and Asia-Pacific, with advancements in material science and rising demand for high-quality, customizable optical solutions contributing to market expansion. |

The global filter coatings market is estimated to be valued at USD 2.3 billion in 2025.

The market size for the filter coatings market is projected to reach USD 3.1 billion by 2035.

The filter coatings market is expected to grow at a 3.0% CAGR between 2025 and 2035.

The key product types in filter coatings market are glass and quartz, ceramics, metals (steel, aluminum, titanium) and polymers and plastics.

In terms of end-use industry, electronics segment to command 29.8% share in the filter coatings market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Filter Bag Market Size and Share Forecast Outlook 2025 to 2035

Filter Press Solutions Market Size and Share Forecast Outlook 2025 to 2035

Filter Integrity Test Systems Market Size and Share Forecast Outlook 2025 to 2035

Coatings and Application Technologies for Robotics Market Outlook – Trends & Innovations 2025-2035

Industry Share Analysis for Filter Paper Companies

Filter Paper Market Trends – Growth, Demand & Forecast through 2035

RF Filters Market Size and Share Forecast Outlook 2025 to 2035

UV Coatings Market Growth & Forecast 2025 to 2035

2K Coatings Market Growth – Trends & Forecast 2025 to 2035

SAW Filter Market Size and Share Forecast Outlook 2025 to 2035

Air Filters Market Growth - Trends & Forecast 2025 to 2035

Global Tea Filter Paper Market Analysis – Growth & Forecast 2024-2034

Spin Filters Market Size and Share Forecast Outlook 2025 to 2035

Coil Coatings Market Size and Share Forecast Outlook 2025 to 2035

Pipe Coatings Market Size and Share Forecast Outlook 2025 to 2035

Wood Coatings Market Size, Growth, and Forecast for 2025 to 2035

Wine Filtering Machine Market Expansion - Filtration & Winemaking Technology 2025 to 2035

Beer Filter System Market insights by Equipment Type, Type, Filtration Process, Application, and Region 2025 to 2035

EMI, Filter Kits Market

ePTFE Filter Film Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA