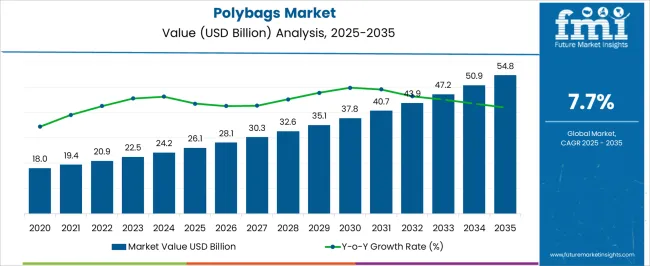

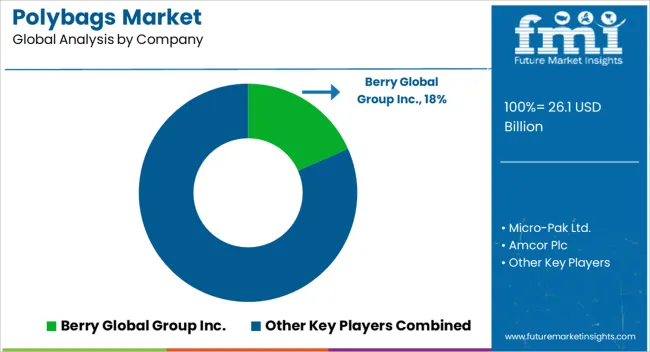

The polybags market is estimated to be valued at USD 26.1 billion in 2025 and is projected to reach USD 54.8 billion by 2035, registering a compound annual growth rate (CAGR) of 7.7% over the forecast period.

Initial adoption has been driven by industrial, retail, and e-commerce packaging needs, where standard polyethylene solutions became widely accepted due to low cost, durability, and convenience. The gradual rise in market value from 26.1 billion to 32.6 billion over the first four years highlights the steady integration of polybags across conventional packaging applications, signaling movement from early adopters to a broader user base. Mid-period growth, observed between 2029 and 2032 with values increasing from 35.1 billion to 43.9 billion, demonstrates expansion into specialized applications including biodegradable variants, high-barrier films, and printed packaging, indicating the market’s responsiveness to evolving regulatory and consumer preferences.

This stage corresponds to the late majority phase, where incremental technological enhancements and diversification strategies accelerate acceptance. By 2035, the market reaching 54.8 billion suggests the onset of full maturity, characterized by widespread penetration, standardization of production processes, and competitive pricing dynamics. At this stage, adoption lifecycle drivers shift from novelty to efficiency, quality differentiation, and sustainability considerations, establishing the market as a staple component within global packaging supply chains, while opportunities remain in premium and niche segments.

| Metric | Value |

|---|---|

| Polybags Market Estimated Value in (2025 E) | USD 26.1 billion |

| Polybags Market Forecast Value in (2035 F) | USD 54.8 billion |

| Forecast CAGR (2025 to 2035) | 7.7% |

The polybags market represents a significant segment within the global flexible packaging industry, valued for its lightweight structure, versatility, and cost effectiveness. Within the overall plastic packaging sector, it holds about 7.4%, reflecting its widespread use in retail, food, and industrial supply chains. In the e-commerce packaging industry, polybags contribute around 6.2%, driven by demand for protective and lightweight shipping solutions. Across the consumer goods packaging category, its share is about 5.1%, highlighting its role in delivering affordability and convenience. Within the agricultural and bulk packaging market, polybags account for 4.3%, supporting storage and transportation of fertilizers, grains, and seeds. In the sustainable and recyclable plastic packaging segment, they represent 3.6%, as innovation in biodegradable and recycled content-based polybags gains adoption. Recent developments in the polybags market have been shaped by sustainability, regulation, and material innovation.

Groundbreaking trends include the introduction of compostable and biodegradable polybags, as well as recycled polyethylene variants aimed at reducing plastic waste. Key players are investing in thinner yet stronger films to minimize material use while maintaining durability. The adoption of digital printing technologies is enabling customization and branding opportunities for retailers. Strategic partnerships between resin producers, recyclers, and converters are accelerating the transition toward circular packaging solutions. Regulations restricting single-use plastics have pushed companies to redesign polybags with eco-friendly alternatives. These advancements demonstrate how material science, regulatory adaptation, and innovation in recyclability are shaping the future of the market.

The polybags market is witnessing stable expansion, supported by its extensive use across retail, e-commerce, food packaging, and industrial sectors. Growing demand for cost-effective, lightweight, and versatile packaging solutions has reinforced polybags as a preferred choice among manufacturers and distributors. Current market performance is being influenced by the shift toward organized retail, increasing online sales, and rising consumer preference for convenient packaging formats.

Additionally, technological advancements in film extrusion and printing have enhanced product customization, driving adoption across branding-focused applications. While sustainability concerns are prompting regulatory interventions and development of biodegradable alternatives, conventional polybags continue to dominate due to their low production cost, durability, and broad availability.

Medium-sized formats remain especially popular in balancing storage capacity and handling convenience. Looking ahead, market growth is expected to be fueled by demand in developing economies, ongoing innovation in recyclable materials, and increased penetration in food-safe and tamper-proof packaging applications, ensuring steady relevance in the competitive packaging landscape.

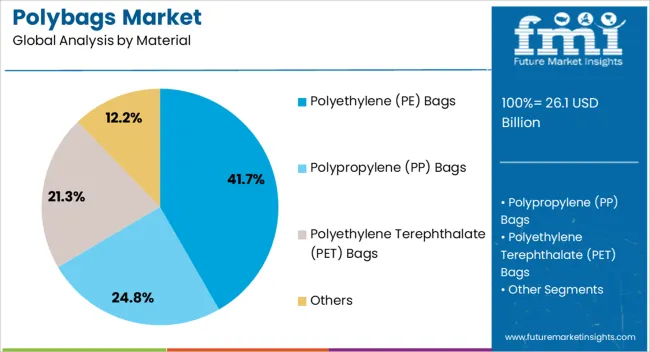

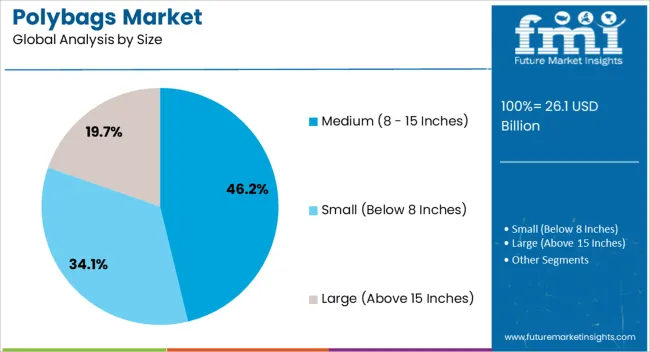

The polybags market is segmented by material, product, size, and geographic regions. By material, polybags market is divided into polyethylene (PE) bags, polypropylene (PP) bags, polyethylene terephthalate (PET) bags, and others. In terms of product, polybags market is classified into flat polybags, gusseted polybags, ziplock polybags, wicketed polybags, poly mailers, bubble mailers, and other polybags. Based on size, polybags market is segmented into medium (8 - 15 Inches), small (Below 8 Inches), and large (Above 15 Inches). Regionally, the polybags industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The polyethylene (PE) bags segment leads the material category, holding approximately 41.7% of the market share. Its dominance is attributed to the material’s versatility, cost efficiency, and excellent mechanical properties, including strength, flexibility, and resistance to moisture. PE bags are widely favored for diverse applications such as retail packaging, food containment, and industrial storage due to their compatibility with various sealing and printing methods.

The segment benefits from the established global manufacturing base and ease of recyclability, despite environmental scrutiny. Advancements in lightweight PE film production have further supported adoption by reducing material costs while maintaining performance standards.

The segment’s wide acceptance in regulated sectors, including food-grade packaging, has reinforced its market position. With consistent demand from both bulk and consumer-level packaging applications, along with integration into recyclable and bio-based PE initiatives, this segment is expected to sustain its leadership in the coming years.

The medium size segment, ranging from 8 to 15 inches, holds the highest share within the size category at approximately 46.2%. This dominance stems from its balance between storage capacity and portability, making it the most versatile choice for various applications. Medium-sized polybags are widely utilized in retail, grocery, apparel, and parcel delivery sectors, where they accommodate a broad range of product dimensions without excessive material usage.

Their practicality in both manual and automated packaging processes enhances operational efficiency for businesses. The segment also benefits from favorable cost-to-utility ratios, which appeal to high-volume users seeking functional yet economical solutions.

Its popularity is further supported by adaptability to multiple materials, including PE and biodegradable alternatives, enabling alignment with shifting sustainability requirements. Given its cross-sector utility and consistent demand from both commercial and consumer markets, the medium-sized polybag segment is expected to sustain its leadership role in the foreseeable future.

The market has been extensively utilized across retail, e-commerce, food packaging, industrial, and agricultural sectors due to their lightweight, flexible, and cost-efficient properties. Manufactured primarily from polyethylene or polypropylene, polybags are employed for storage, transportation, and product protection. Rising demand from online retail, organized distribution channels, and consumer goods sectors has strengthened market adoption. Environmental concerns and governmental regulations against single-use plastics have prompted manufacturers to innovate with recyclable, biodegradable, and reusable variants. Technological advancements in materials and production processes have enhanced durability, barrier properties, and sustainability.

Retail and e-commerce sectors have been central to polybags market expansion, as lightweight and protective packaging is critical for product distribution and storage. Online shopping has created significant demand for durable polybags to ensure secure transportation of apparel, electronics, cosmetics, and small household goods. Physical retail outlets continue to rely on polybags for customer convenience, particularly in grocery, apparel, and personal care sectors. Regulatory restrictions on single-use plastics have led retailers to adopt reusable and biodegradable options, driving innovation in material selection. Packaging manufacturers have been collaborating with e-commerce companies to ensure continuous supply, customize sizes, and enhance branding through printed polybags. This integration of convenience, compliance, and aesthetics has strengthened the polybags’ presence across the retail ecosystem, sustaining consistent market growth.

Food packaging has been a major driver for polybags, particularly in fresh produce, bakery, frozen foods, and snack items. Polybags offer moisture resistance, barrier properties, and cost-efficiency, which help maintain product freshness and extend shelf life. Quick service restaurants and food delivery services increasingly rely on polybags for takeout, delivery, and safe transport of food items. Consumer demand for sustainable packaging has led to adoption of compostable, biodegradable, and recyclable polybags within food segments. Plant-based resins and eco-friendly films are being integrated to meet both regulatory requirements and environmental expectations. With expansion of packaged food consumption and delivery services, demand for polybags in the food sector is expected to remain strong, particularly in emerging economies with growing urban populations and evolving dietary habits.

Stringent environmental regulations targeting single-use plastics have significantly influenced the polybags market. Bans, levies, and policy frameworks in Europe, North America, and Asia have compelled manufacturers to develop eco-friendly alternatives. Biodegradable, compostable, and reusable polybags have been increasingly adopted to comply with evolving regulatory landscapes. Consumer awareness regarding plastic waste and sustainability has further accelerated this transition. Industry stakeholders have been investing in circular economy initiatives, including collection, recycling, and post-consumer processing programs. The market’s ability to adapt to regulatory pressures, while maintaining product performance and cost-effectiveness, is critical to long-term growth. These sustainability efforts have positioned the polybags market toward responsible production practices and have created opportunities for innovation and differentiation among manufacturers globally.

Innovation in material science and manufacturing processes has been transforming the polybags market, improving functionality while addressing environmental concerns. Developments in bio-based polymers, oxo-biodegradable additives, and lightweighting techniques have enhanced strength, flexibility, and eco-compatibility. Recyclable polyethylene and polypropylene films allow reduced plastic consumption without compromising durability. Digital printing and customized design options have enabled retailers and e-commerce companies to increase brand visibility and customer engagement. Automation and optimized production lines have improved efficiency, lowered operational costs, and reduced material waste. As regulatory and consumer pressures continue to evolve, these technological advancements have enabled the polybags market to remain relevant, sustainable, and competitive, ensuring long-term adoption across multiple industries.

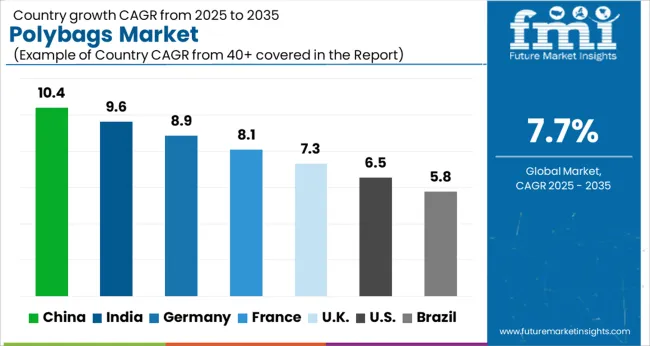

| Country | CAGR |

|---|---|

| China | 10.4% |

| India | 9.6% |

| Germany | 8.9% |

| France | 8.1% |

| UK | 7.3% |

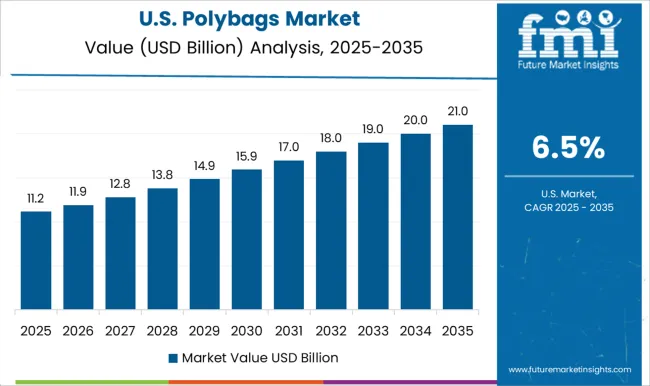

| USA | 6.5% |

| Brazil | 5.8% |

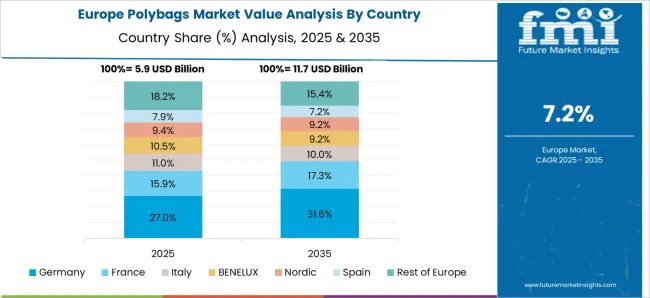

The market is anticipated to grow at a CAGR of 7.7% from 2025 to 2035, reflecting increasing demand in packaging, retail, and logistics sectors. China leads with 10.4%, supported by its large-scale manufacturing base and rising e-commerce activities. India follows at 9.6%, driven by retail expansion and packaging modernization. Germany records 8.9%, benefiting from high-quality production standards and sustainable packaging initiatives. The UK holds 7.3%, where growing retail and distribution networks boost demand. The USA posts 6.5%, fueled by packaging innovations and adoption of efficient production processes. The market trajectory is shaped by the shift toward lightweight, cost-effective, and recyclable packaging solutions across global industries. This report includes insights on 40+ countries; the top markets are shown here for reference.

China expanded at a 10.4% CAGR, driven by rapid growth in e commerce, retail packaging, and food delivery services. Large scale packaging converters invested in high speed extrusion and printing lines to meet the escalating demand for clear and printed polybags. The market was shaped by domestic manufacturers collaborating with global suppliers to introduce biodegradable and recycled polyethylene variants. Demand from logistics and courier sectors encouraged adoption of lightweight, durable, and customizable packaging. Regulatory initiatives on material efficiency and recycling were gradually influencing production processes, prompting companies to invest in sustainable polybag solutions. Competitive strategies were focused on capacity expansion, regional distribution partnerships, and cost optimized production to serve the growing consumer and industrial segments.

India recorded a 9.6% CAGR, supported by growth in retail, logistics, and food packaging sectors. Packaging converters invested in blown film extrusion and lamination technologies to enhance strength and clarity of polybags. E commerce expansion drove demand for tamper evident and reusable polybag solutions. Indian manufacturers partnered with international firms to adopt advanced production techniques, while cost efficiency and energy optimization remained central to operational strategies. The market also saw increased uptake of multi-layer and printed polybags for branding and protection during transport. Competitive positioning was achieved through faster turnaround times, regional distribution networks, and custom printing capabilities to meet diversified industrial and consumer packaging requirements.

Germany achieved an 8.9% CAGR, influenced by high standards for industrial and retail packaging quality. Industrial clients and retail chains prioritized durability, transparency, and recyclability in polybags. European manufacturers invested in energy efficient extrusion, precision cutting, and digital printing technologies to comply with strict environmental regulations. Demand from logistics, e commerce, and food sectors encouraged lightweight, reusable, and recyclable polybag formats. Competitive advantage was built on compliance with EU waste directives, process automation, and fast supply fulfillment. Collaborations between local converters and multinational brands allowed consistent supply and innovation in sustainable polyethylene production. Market expansion was supported by emphasis on product performance, long term reliability, and reduced environmental impact.

The United Kingdom progressed at a 7.3% CAGR, influenced by growth in e commerce, courier services, and consumer retail packaging. Converters emphasized lightweight polybags with enhanced tear resistance and clarity for shipping and protective applications. Regulatory frameworks on single use plastics encouraged gradual adoption of recycled and biodegradable polyethylene. Packaging suppliers collaborated with online retailers to provide custom printed and branded polybag solutions. Operational efficiency, timely delivery, and compliance with environmental standards remained critical to securing long term contracts. Competitive differentiation was achieved through digital printing capabilities, tailored designs for retail promotions, and rapid response manufacturing for short run requirements. Strategic partnerships between converters and logistic firms ensured consistent availability across multiple regions.

The United States grew at a 6.5% CAGR, with demand shaped by e commerce, retail packaging, and industrial distribution needs. Manufacturers focused on high volume extrusion lines and automated printing technologies to serve logistics, food, and consumer goods sectors. Lightweight, durable, and tamper evident polybags were widely adopted to optimize packaging costs and transport efficiency. Environmental compliance and sustainability were increasingly emphasized through recycled polyethylene and energy efficient production practices. Large converters expanded capacity through greenfield and brownfield projects near major industrial corridors. Competitive differentiation was achieved through consistent quality, fast turnaround, and regional distribution networks that ensured timely supply for national retailers and e commerce clients.

The market is highly competitive, led by global giants and regional manufacturers. Berry Global Group, Amcor, Sealed Air Corporation, and Mondi Group have focused on high volume production with consistent quality. Their strategies include advanced extrusion technologies, barrier enhancements, and scalable manufacturing lines. Micro-Pak Ltd., Arihant Packers, and A-Pac Manufacturing have concentrated on niche segments, offering custom sizes, prints, and material blends that meet diverse industrial and consumer packaging needs. Winpak, Novolex, and Printpack emphasize design efficiency and supply chain reliability to maintain a competitive edge.

Regional players such as Coveris AG, Pactiv Evergreen, Sonoco Products Company, and Huhtamaki Group have leveraged local manufacturing advantages. Product brochures consistently highlight features like tear resistance, lightweight construction, and high clarity for branding visibility. Attention is given to compatibility with automated filling systems, stackable storage, and multi-layer films that extend shelf life. The brochures present operational benefits with minimal downtime, targeting both industrial bulk users and retail packaging requirements.

Differentiation in the market is communicated through technical performance and tailored solutions. Berry Global and Sealed Air emphasize durability and chemical resistance, while Mondi and Amcor highlight recyclable or specialty films. Huhtamaki and Pactiv Evergreen showcase environmentally conscious options. Regional manufacturers promote customized printing, flexible sizing, and rapid delivery. Across the sector, brochures serve as a key tool to project reliability, efficiency, and design versatility, creating a competitive environment driven by product functionality and customer-centric innovations.

| Item | Value |

|---|---|

| Quantitative Units | USD 26.1 billion |

| Material | Polyethylene (PE) Bags, Polypropylene (PP) Bags, Polyethylene Terephthalate (PET) Bags, and Others |

| Product | Flat Polybags, Gusseted Polybags, Ziplock Polybags, Wicketed Polybags, Poly Mailers, Bubble Mailers, and Other Polybags |

| Size | Medium (8 - 15 Inches), Small (Below 8 Inches), and Large (Above 15 Inches) |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Berry Global Group Inc., Micro-Pak Ltd., Amcor Plc, Arihant Packers, Sealed Air Corporation, A-Pac Manufacturing Co., Inc., Mondi Group, Winpak Ltd., Novolex, Printpack, Inc., Coveris AG, Pactiv Evergreen Inc., Sonoco Products Company, and Huhtamaki Group |

| Additional Attributes | Dollar sales by bag type and application, demand dynamics across e-commerce, retail, and packaging sectors, regional trends in plastic and biodegradable bag adoption, innovation in material strength, transparency, and recyclability, environmental impact of single-use plastics and waste management, and emerging use cases in sustainable packaging, custom branding, and protective shipping solutions. |

The global polybags market is estimated to be valued at USD 26.1 billion in 2025.

The market size for the polybags market is projected to reach USD 54.8 billion by 2035.

The polybags market is expected to grow at a 7.7% CAGR between 2025 and 2035.

The key product types in polybags market are polyethylene (pe) bags, polypropylene (pp) bags, polyethylene terephthalate (pet) bags and others.

In terms of product, flat polybags segment to command 27.9% share in the polybags market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA