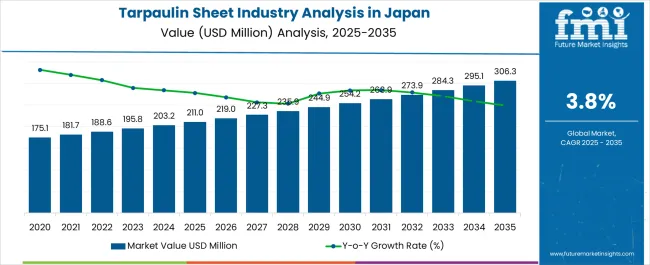

The Tarpaulin Sheet Industry Analysis in Japan is estimated to be valued at USD 211.0 million in 2025 and is projected to reach USD 306.3 million by 2035, registering a compound annual growth rate (CAGR) of 3.8% over the forecast period.

| Metric | Value |

|---|---|

| Tarpaulin Sheet Industry Analysis in Japan Estimated Value in (2025 E) | USD 211.0 million |

| Tarpaulin Sheet Industry Analysis in Japan Forecast Value in (2035 F) | USD 306.3 million |

| Forecast CAGR (2025 to 2035) | 3.8% |

The tarpaulin sheet market in Japan is experiencing steady growth driven by rising demand across construction, agriculture, logistics, and industrial sectors. Current market conditions are supported by infrastructure modernization, increased outdoor storage needs, and a focus on durable weather-resistant materials. The industry is being influenced by advancements in polymer technology, enabling enhanced strength, UV resistance, and insulation features that extend product lifespan.

Regulatory emphasis on sustainability and waste reduction is pushing manufacturers toward recyclable and eco-friendly product innovations. Future outlook remains positive as demand is expected to expand with ongoing infrastructure projects, growth in warehousing and logistics, and the agricultural sector’s reliance on protective covers.

Growth rationale is based on Japan’s strong construction pipeline, increased focus on energy-efficient building materials, and the ability of manufacturers to provide customized tarpaulin solutions Strategic investments in lightweight, insulated, and fire-retardant variants are expected to further strengthen market presence and broaden application potential across industrial and commercial use cases.

The insulated tarps segment, holding 29.4% of the product type category, has emerged as a leading segment due to its superior thermal regulation properties that make it suitable for applications requiring temperature stability. Adoption has been driven by its effectiveness in protecting goods from weather variations and minimizing energy loss in storage and transport.

Market growth is reinforced by increasing use in agriculture and industrial sectors where insulation is critical. The segment has gained further traction through technological advancements in multi-layer polymer coatings that enhance durability and performance.

Demand stability is being maintained by continuous infrastructure activities in Japan, where thermal protection and moisture resistance are essential Long-term adoption is expected to rise with growing awareness of energy-efficient construction practices, ensuring the insulated tarps segment retains its competitive edge within the Japanese tarpaulin sheet market.

The 100 to 300 GSM category, representing 41.7% of the product weight segment, has secured its leadership due to the balance it offers between durability and flexibility. This weight range is widely adopted across industries for applications that require strength without compromising ease of handling.

The segment has been supported by consistent demand from agriculture, transport, and temporary shelter uses, as it provides adequate protection against environmental factors at a cost-effective price point. Production efficiency has been improved through advancements in extrusion and weaving technologies, ensuring high-quality products at scale.

The segment’s dominance is also attributed to its suitability for both short-term and long-term applications, making it versatile across user groups With ongoing infrastructure growth and rising industrial storage needs, the 100 to 300 GSM category is expected to maintain strong adoption levels and drive further expansion in the Japanese tarpaulin sheet market.

The building and construction segment, accounting for 33.8% of the end use category, has maintained dominance due to the extensive application of tarpaulin sheets in scaffolding, site protection, and temporary coverings. Adoption is being reinforced by Japan’s robust infrastructure development and frequent use of tarpaulins to ensure safety, weather protection, and operational continuity at project sites.

Regulatory standards for workplace safety and environmental protection have further increased reliance on tarpaulin sheets in this sector. Continuous investments in commercial and residential construction projects are supporting demand growth, while the use of advanced fire-retardant and UV-resistant tarpaulins is enhancing product suitability.

As the construction industry in Japan increasingly incorporates energy-efficient and safety-compliant practices, the demand for durable and versatile tarpaulin sheets is expected to remain strong This ensures the building and construction segment continues to lead overall adoption within the Japanese tarpaulin sheet market.

Tarpaulin Sheets find their Application in Natural-disaster-prone Japan

Japan is highly susceptible to multiple natural disasters, such as typhoons, earthquakes, tsunamis, and regular landslides. In emergency situations like these, tarpaulin sheets play a significant role in covering damaged roofs, walls, and creating temporary partitions for displaced people and animals. Their demand in Japan is also driven by the fact that they provide a quick and cost-effective solution for temporary housing.

Tarpaulin sheets are also in high demand as they are used to cover essential goods and items, protecting them from heavy rains. Japan's government also strongly emphasizes disaster preparedness and often stockpiles large quantities of tarpaulin sheets in strategic areas.

Adoption Analysis of Tarpaulin Sheets in Japan:

Hoarding tarps find their prime application in commercial construction spaces. In 2025, the hoarding tarps segment accounts for a whopping 34.6% of the share.

| Product Type | Hoarding Tarps |

|---|---|

| Value share | 34.6% |

Japan has a high population density, particularly in urban areas. With limited space and close proximity to buildings, construction sites often need to use hoarding tarps to maintain privacy and safety. Therefore, local regulations and city ordinances in Japan often require construction sites to install hoarding tarps as a safety measure to protect pedestrians from construction-related hazards and debris.

Hoarding tarps are also used to help maintain a visually pleasing appearance during construction. They do this by concealing the work site and providing the building a clean, vibrant, and aesthetic look.

When it comes to end-use, the agricultural sector accounts for 26.8% share of Japan’s tarpaulin sheets industry. Tarpaulin sheets are used to create temporary partitions to segregate different groups of animals on the farm. They can also be used to store water as they stop water from sipping in the ground.

| End Use | Agriculture |

|---|---|

| Value share | 26.8% |

The demand for tarpaulin sheets in agriculture is also driven by their extensive use in curating micro-climatic conditions in horticulture. These sheets can protect plants from harmful radiation and external dust. As the agriculture sector continues to use advanced farming techniques, the demand for tarpaulin sheets in the upcoming years is set to experience a considerable surge in Japan.

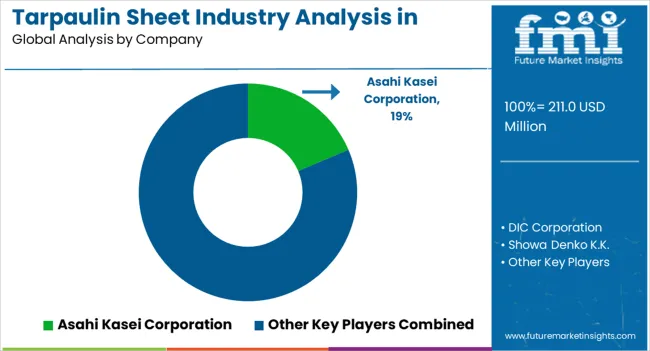

The competitive scenario of the tarpaulin sheet business in Japan has become highly saturated and predictable. There is already a presence of numerous well-established players who have built a trustworthy reputation in the minds of Japanese consumers.

The landscape has limited space for new entrants, but the situation is gradually evolving. Many smaller Japanese companies offer affordable and efficient options that cater to budget-conscious consumers. These new players are attracting consumers concerned about the ecological impacts of using conventional tarpaulin sheets made from plastic. To sum it up, the competition is a blend of old and new, local and global players, and traditional and eco-conscious consumers.

Recent Developments Tarpaulin Sheets Manufacturing in Japan

| Attribute | Details |

|---|---|

| Estimated Valuation (2025) | USD 211.0 million |

| Projected Valuation (2035) | USD 306.3 million |

| Anticipated CAGR (2025 to 2035) | 3.8% CAGR |

| Historical Analysis of Demand for Tarpaulin Sheets in Japan | 2020 to 2025 |

| Demand Forecast for Tarpaulin Sheets in Japan | 2025 to 2035 |

| Quantitative Units | Revenue in USD million and CAGR from 2025 to 2035 |

| Report Coverage | Revenue Forecast, Company Ranking, Competitive Landscape, Growth Factors, Trends and Pricing Analysis |

| Key Countries Analyzed while Studying Opportunities in Tarpaulin Sheets in Japan | Kanto, Chubu, Kinki, Kyushu & Okinawa, Tohoku, Rest of Japan |

| Key Companies Profiled | DIC Corporation; Showa Denko K.K.; Asahi Kasei Corporation; NHK Group; Gyoha Co., Ltd.; Taimatsu Tarpaulin Co., Ltd.; Tohoku Tarpaulin Co., Ltd.; Nishiki Tarpaulin Co., Ltd.; Asahi Tarpaulin Co., Ltd.; Daiwa Tarpaulin Co., Ltd.; Nippon Tarpaulin Co., Ltd. |

The global tarpaulin sheet industry analysis in japan is estimated to be valued at USD 211.0 million in 2025.

The market size for the tarpaulin sheet industry analysis in japan is projected to reach USD 306.3 million by 2035.

The tarpaulin sheet industry analysis in japan is expected to grow at a 3.8% CAGR between 2025 and 2035.

The key product types in tarpaulin sheet industry analysis in japan are insulated tarps, hoarding tarps, truck tarps, uv protected tarps, sports tarps, mesh tarps and others.

In terms of product weight, between 100 to 300 gsm segment to command 41.7% share in the tarpaulin sheet industry analysis in japan in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Tarpaulin Sheets Market Size and Share Forecast Outlook 2025 to 2035

Evaluating Tarpaulin Sheets Market Share & Provider Insights

Tarpaulin Sheet Industry Analysis in Western Europe Size and Share Forecast Outlook 2025 to 2035

Tarpaulin Sheet Industry Analysis in Korea Size and Share Forecast Outlook 2025 to 2035

Mesh Tarpaulin Sheets Market Size and Share Forecast Outlook 2025 to 2035

Hoarding tarpaulin Market

UV Protected Tarpaulin Sheets Market Size and Share Forecast Outlook 2025 to 2035

Asia Pacific and Europe Tarpaulin Sheets Market Size and Share Forecast Outlook 2025 to 2035

Sheeted Labels Market Size and Share Forecast Outlook 2025 to 2035

Sheet Metal Market Size, Growth, and Forecast 2025 to 2035

Sheet Pan Racks Market

Slip Sheets Market Insights – Growth & Demand 2025 to 2035

Dryer Sheets Market Size and Share Forecast Outlook 2025 to 2035

Metal Sheet Bending Machine Market Size, Growth, and Forecast 2025 to 2035

Veneer Sheets Market Size and Share Forecast Outlook 2025 to 2035

Mirror Sheets Market Size and Share Forecast Outlook 2025 to 2035

Balance Sheet Management Software Market Size and Share Forecast Outlook 2025 to 2035

Bonding Sheet Market Forecast and Outlook 2025 to 2035

Aluminum Sheets and Coils Market Size and Share Forecast Outlook 2025 to 2035

Baby Crib Sheet Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA