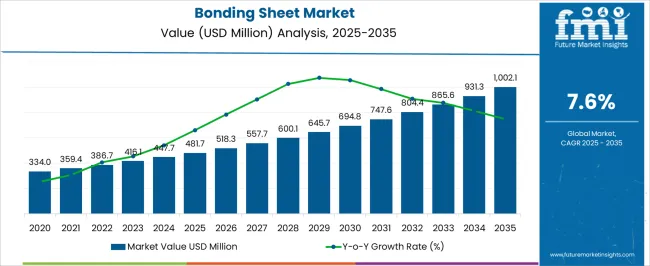

The Bonding Sheet Market is estimated to be valued at USD 481.7 million in 2025 and is projected to reach USD 1002.1 million by 2035, registering a compound annual growth rate (CAGR) of 7.6% over the forecast period.

The bonding sheet market is growing steadily, driven by increasing demand for advanced adhesive materials in electronics, automotive, and industrial applications. The shift toward lightweight, compact, and thermally stable assemblies has intensified the use of bonding sheets as substitutes for conventional fasteners.

Rising adoption in semiconductor packaging, flexible circuits, and display modules has strengthened market penetration in the electronics sector. Technological advancements in adhesive chemistry have improved thermal resistance, electrical insulation, and mechanical performance, expanding applicability across diverse substrates.

The market also benefits from the growing trend of miniaturization and high-density interconnects in electronic devices. With increasing investments in electric vehicles and 5G infrastructure, bonding sheets are expected to witness sustained demand, driven by the need for durable, high-performance bonding solutions.

| Metric | Value |

|---|---|

| Bonding Sheet Market Estimated Value in (2025 E) | USD 481.7 million |

| Bonding Sheet Market Forecast Value in (2035 F) | USD 1002.1 million |

| Forecast CAGR (2025 to 2035) | 7.6% |

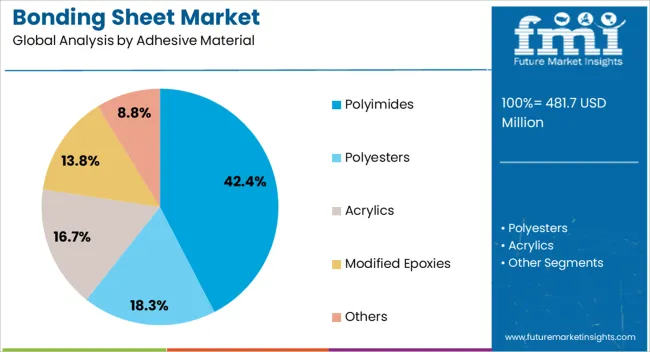

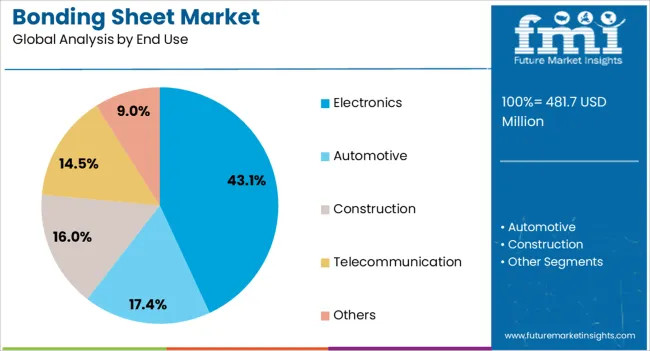

The market is segmented by Adhesive Material and End Use and region. By Adhesive Material, the market is divided into Polyimides, Polyesters, Acrylics, Modified Epoxies, and Others. In terms of End Use, the market is classified into Electronics, Automotive, Construction, Telecommunication, and Others. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The polyimides segment leads the adhesive material category with approximately 42.40% share, supported by their exceptional heat resistance, dielectric stability, and chemical durability. These properties make polyimide-based bonding sheets ideal for high-temperature and high-frequency electronic applications.

The segment benefits from increasing use in flexible printed circuits, multilayer boards, and aerospace electronics, where reliability under thermal stress is critical. Continuous advancements in polymer synthesis and film coating technologies have enhanced performance consistency, driving further adoption.

With expanding application in next-generation semiconductors and flexible electronics, the polyimides segment is projected to sustain its dominance in the foreseeable future.

The electronics segment dominates the end-use category with approximately 43.10% share, reflecting its extensive use of bonding sheets in circuit assembly, semiconductor packaging, and display module integration. The segment’s growth is propelled by the demand for compact, thermally efficient components in smartphones, wearable devices, and consumer electronics.

Manufacturers prefer bonding sheets for their uniform adhesion, reduced processing complexity, and compatibility with miniaturized designs. Rapid advancements in electronic manufacturing processes, such as surface mount technology and flexible PCB production, have reinforced segment demand.

With the proliferation of high-performance computing and connected devices, the electronics segment is expected to maintain its leading position in the bonding sheet market.

The scope for global bonding sheet market insights expanded at an 8.1% CAGR between 2020 and 2025. The market is anticipated to develop at a CAGR of 7.6% over the forecast period from 2025 to 2035.

| Historical CAGR from 2020 to 2025 | 8.1% |

|---|---|

| Forecast CAGR from 2025 to 2035 | 7.6% |

Between 2020 and 2025, the global market experienced notable growth, marked by an 8.1% CAGR. This period was characterized by increased demand driven by the expanding electronics and automotive industries. The surge in technological advancements and the growing emphasis on miniaturization in electronic devices contributed to the market upward trajectory.

Adhesive technologies also evolved during this timeframe, enhancing the performance and durability of bonding sheets. Industries increasingly recognized the critical role of these sheets in providing reliable adhesion in complex applications.

From 2025 to 2035, the market is projected to maintain a robust development pace, albeit at a slightly moderated 7.6% CAGR. The forecast reflects the industrial resilience and sustained demand. Anticipated innovations in materials and adhesive technologies, coupled with the continuous growth of the electronics and automotive sectors, are expected to be key drivers during this period.

The market expansion is likely to be further fueled by the ongoing trend towards sustainability, with eco-friendly bonding sheets gaining prominence in response to environmental considerations. The market is poised for sustained growth, underpinned by technological advancements and diverse industrial applications.

| Attributes | Details |

|---|---|

| Opportunities |

|

The provided table highlights CAGRs across five countries, focusing on the United States, Japan, China, the United Kingdom, and South Korea.

Among these nations, South Korea stands out as a dynamic and rapidly advancing market, projecting substantial growth with an 8.8% CAGR by 2035. The vibrant economic landscape of the country is marked by a proactive approach to innovation, contributing significantly to diverse industries.

The commitment to embracing and driving technological advancements positions it as a key player in the global economic arena, reflecting a thriving trajectory in its economic evolution.

| Attributes | Forecast CAGRs from 2025 to 2035 |

|---|---|

| The United States | 7.8% |

| Japan | 8.3% |

| China | 8.5% |

| The United Kingdom | 8% |

| South Korea | 8.8% |

In the United States, a CAGR of 7.8% suggests a robust demand propelled by the thriving electronics and automotive industries of the country.

The advanced technological landscape and emphasis on product design and manufacturing innovation have led to increased integration of bonding sheets for reliable adhesion in complex electronic devices and automotive assemblies.

Japan, with an 8.3% CAGR, is known for its precision manufacturing and technological prowess.

The electronics and automotive sectors are renowned for their high-quality products and heavily rely on bonding sheets to ensure the integrity of intricate components. The commitment to technological excellence fuels the adoption of advanced bonding solutions.

China, boasting an 8.5% CAGR, reflects the rapid industrialization and growth across various sectors of the country.

The manufacturing boom, especially in the electronics and automotive industries, has driven the demand for bonding sheets to meet the requirements of assembling and securing components in a cost-effective and reliable manner.

With an 8% CAGR in the United Kingdom, the adoption of bonding sheets aligns with the focus on innovation and sustainable manufacturing practices of the country.

In particular, the automotive and aerospace industries leverage bonding sheets to enhance structural integrity and reduce overall weight, contributing to more fuel-efficient and eco-friendly transportation solutions.

South Korea stands out with the highest CAGR at 8.8% due to its dynamic economic landscape and strong commitment to innovation.

The diverse industries, including electronics, automotive, and technology, extensively utilize bonding sheets to ensure the reliability and longevity of their products.

The table below provides an overview of the bonding sheet landscape on the basis of adhesive material and end-use. Polyimides are projected to lead the type of market at a 7.5% CAGR by 2035, while automotive in the end user category is likely to expand at a CAGR of 7.4% by 2035.

A key driver behind the projection of polyimides leading the bonding sheet market lies in their exceptional thermal stability and mechanical strength. The significant growth of the automotive industry can be attributed to the increasing adoption of bonding sheets to address specific challenges in modern vehicle manufacturing.

| Category | CAGR by 2035 |

|---|---|

| Polyimides | 7.5% |

| Automotive | 7.4% |

Polyimides emerge as a frontrunner in the adhesive material segment, projected to lead the market with a Compound Annual Growth Rate (CAGR) of 7.5% by 2035. This signifies a substantial demand for bonding sheets crafted from polyimide, underscoring its versatility and effectiveness across diverse industrial applications.

The prominence of polyimides reflects their exceptional adhesion properties, making them a preferred choice in addressing the intricate bonding requirements in electronics, automotive, and other sectors.

By end-use categories, the automotive sector takes center stage with a projected CAGR of 7.4% by 2035. This growth underscores the pivotal role of bonding sheets in the automotive industry, which are instrumental in ensuring structural integrity, vibration resistance, and reliability of various components.

The robust expansion is propelled by increasing demand for technologically advanced vehicles and a growing emphasis on lightweight materials, where bonding sheets play a critical role in meeting stringent performance standards. This projection highlights the sustained and significant opportunities for bonding sheets within the automotive landscape.

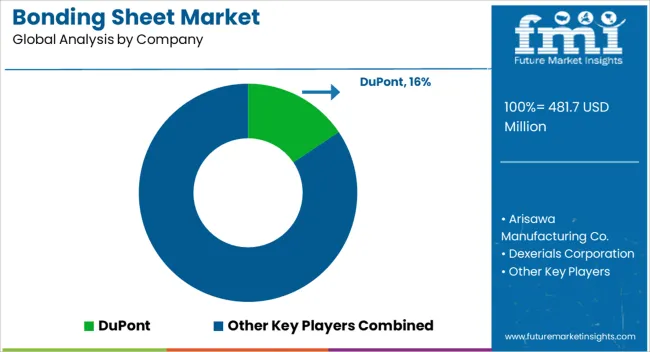

The competitive landscape of the bonding sheet market is characterized by the presence of several key players vying for market share and dominance. Major industry participants continually engage in research and development activities to introduce innovative bonding sheet solutions, often focusing on improved adhesion properties, durability, and environmental sustainability.

The companies also strategically invest in advanced manufacturing processes and technologies to stay ahead in a rapidly evolving market. Collaboration and partnerships within and outside the industry are common strategies to enhance product offerings and expand market reach.

Mergers and acquisitions significantly shape the competitive dynamics, enabling companies to consolidate their market position and capitalize on synergies. With the market poised for continued growth, competition is expected to intensify, driving further advancements and fostering a dynamic environment within the bonding sheet industry.

Some key market developments are

| Attributes | Details |

|---|---|

| Estimated Market Size in 2025 | USD 481.7 millionn |

| Projected Market Valuation in 2035 | USD 1002.1 million |

| CAGR Share from 2025 to 2035 | 7.6% |

| Forecast Period | 2025 to 2035 |

| Historical Data Available for | 2020 to 2025 |

| Market Analysis | Value in USD million |

| Key Regions Covered | North America; Latin America; Western Europe; Eastern Europe; South Asia and Pacific; East Asia; Middle East and Africa |

| Key Market Segments Covered | By Adhesive Material, By End Use, By Region |

| Key Countries Profiled | The United States, Canada, Brazil, Mexico, Germany, The United Kingdom, France, Spain, Italy, Poland, Russia, Czech Republic, Romania, India, Bangladesh, Australia, New Zealand, China, Japan, South Korea, GCC Countries, South Africa, Israel |

| Key Companies Profiled | Arisawa Manufacturing Co.; Dexerials Corporation; DuPont; Fujikura Ltd.; Hanwha Solutions Advanced Materials Division; Microcosm Technology Co. Ltd; Namics Corporation; Nikkan Industries Co.,Ltd; Nippon Mektron Ltd; Nitto Denko Corporation; Shin-Etsu Polymer Co. Ltd |

The global bonding sheet market is estimated to be valued at USD 481.7 million in 2025.

The market size for the bonding sheet market is projected to reach USD 1,002.1 million by 2035.

The bonding sheet market is expected to grow at a 7.6% CAGR between 2025 and 2035.

The key product types in bonding sheet market are polyimides, polyesters, acrylics, modified epoxies and others.

In terms of end use, electronics segment to command 43.1% share in the bonding sheet market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Bonding Honeycomb Vibration Isolation Platform Market Size and Share Forecast Outlook 2025 to 2035

Sheeted Labels Market Size and Share Forecast Outlook 2025 to 2035

Sheet Metal Market Size, Growth, and Forecast 2025 to 2035

Sheet Pan Racks Market

Slip Sheets Market Insights – Growth & Demand 2025 to 2035

Glass Bonding Adhesive Market Size and Share Forecast Outlook 2025 to 2035

Dryer Sheets Market Size and Share Forecast Outlook 2025 to 2035

Metal Sheet Bending Machine Market Size, Growth, and Forecast 2025 to 2035

Metal Bonding Adhesives Market

Veneer Sheets Market Size and Share Forecast Outlook 2025 to 2035

Mirror Sheets Market Size and Share Forecast Outlook 2025 to 2035

Balance Sheet Management Software Market Size and Share Forecast Outlook 2025 to 2035

Aluminum Sheets and Coils Market Size and Share Forecast Outlook 2025 to 2035

Concrete Bonding Agents Market Size and Share Forecast Outlook 2025 to 2035

Tarpaulin Sheets Market Size and Share Forecast Outlook 2025 to 2035

Tarpaulin Sheet Industry Analysis in Western Europe Size and Share Forecast Outlook 2025 to 2035

Tarpaulin Sheet Industry Analysis in Korea Size and Share Forecast Outlook 2025 to 2035

Tarpaulin Sheet Industry Analysis in Japan Size and Share Forecast Outlook 2025 to 2035

Temporary Bonding Adhesives Market Size and Share Forecast Outlook 2025 to 2035

Baby Crib Sheet Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA