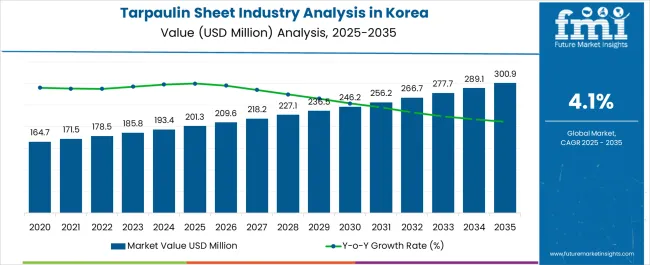

The Tarpaulin Sheet Industry Analysis in Korea is estimated to be valued at USD 201.3 million in 2025 and is projected to reach USD 300.9 million by 2035, registering a compound annual growth rate (CAGR) of 4.1% over the forecast period.

| Metric | Value |

|---|---|

| Tarpaulin Sheet Industry Analysis in Korea Estimated Value in (2025 E) | USD 201.3 million |

| Tarpaulin Sheet Industry Analysis in Korea Forecast Value in (2035 F) | USD 300.9 million |

| Forecast CAGR (2025 to 2035) | 4.1% |

The tarpaulin sheet industry in Korea is experiencing steady growth. Market expansion is being driven by increasing use in construction, logistics, agriculture, and industrial storage. Demand is being reinforced by urban development, infrastructure upgrades, and the growing need for durable protective coverings in commercial and residential projects.

Current dynamics are influenced by technological improvements in manufacturing processes that enhance product durability, UV resistance, and waterproofing performance. Material innovations and greater customization options are supporting adoption across diverse end-use industries. The future outlook is shaped by sustainable production initiatives, rising demand for eco-friendly and recyclable materials, and stricter regulations on product quality standards.

Import substitution policies and the development of domestic production capacity are further strengthening local supply chains Growth rationale is founded on expanding application areas, increased demand from seasonal storage and transportation, and product versatility, positioning the Korean tarpaulin sheet market for long-term development and stable revenue generation.

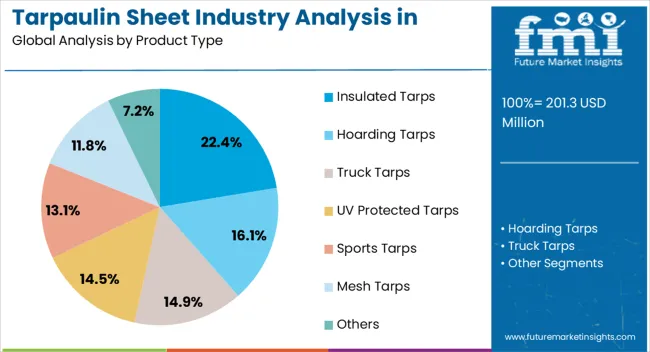

The insulated tarps segment, holding 22.4% of the product type category, is leading due to its suitability for temperature-sensitive applications such as food storage, construction, and logistics. Market dominance has been reinforced by the ability of insulated tarps to maintain consistent thermal conditions, reduce spoilage, and protect sensitive goods from extreme weather.

Demand has been supported by adoption in the cold chain industry and agricultural exports. Enhanced insulation technologies and lightweight yet durable construction have further improved their performance and portability.

Domestic manufacturers have invested in expanding production capacity to meet rising demand As the food and pharmaceutical sectors expand, insulated tarps are expected to maintain their strong market share and drive innovation within the broader product type segment.

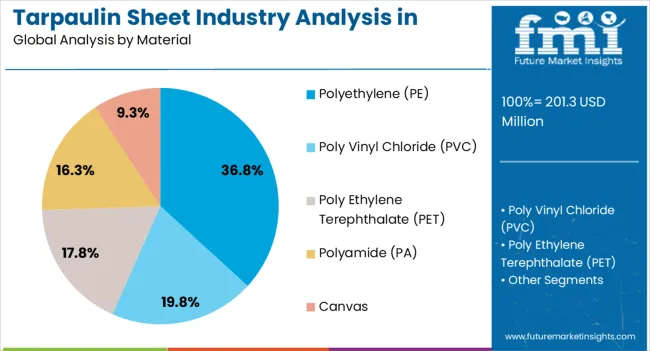

The polyethylene (PE) segment, accounting for 36.8% of the material category, has maintained its leadership due to its durability, flexibility, and cost-effectiveness. PE tarpaulins are widely adopted in construction, agriculture, and logistics, where strength and weather resistance are critical.

The material’s adaptability to various coatings and treatments enhances its waterproofing and UV resistance, ensuring long service life. Growing preference for recyclable and eco-friendly materials has also supported the PE segment, as it aligns with regulatory requirements and sustainability initiatives.

Manufacturers are increasingly focused on quality control and advanced extrusion technologies to improve tensile strength and reduce environmental impact PE’s competitive pricing and versatility are expected to sustain its dominance in the material segment.

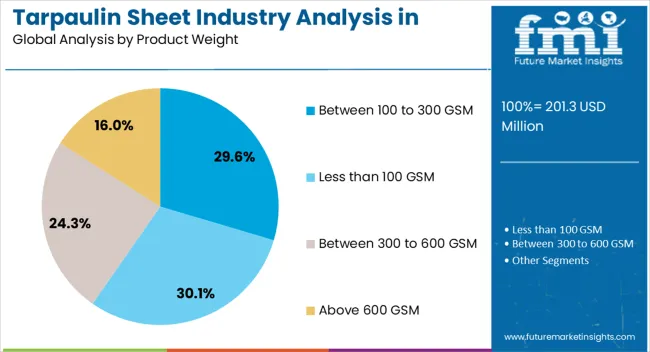

The segment between 100 to 300 GSM, representing 29.6% of the product weight category, has emerged as the leading weight range owing to its balance of durability, affordability, and ease of handling. This range is particularly suitable for medium-duty applications such as covering construction materials, agricultural products, and vehicles.

Demand stability has been supported by consistent use across small and medium businesses, households, and commercial sectors. The weight category offers versatility, as it provides adequate protection without being excessively heavy, making it easier for frequent handling and transport.

Technological improvements in lamination and reinforcement techniques have further enhanced strength within this GSM range Continued demand from urban and rural applications is expected to sustain the prominence of this weight category in Korea’s tarpaulin sheet market.

The agriculture sector in South Korea is heavily investing in tarpaulin sheets to protect crops from hail, rain, sunlight, and wind, as the country observes a humid subtropical climate with four different seasons.

| Leading End Use | Agriculture |

|---|---|

| Industry Share % (2025) | 26.1% |

Other factors that are augmenting the adoption of tarpaulin sheets in the agriculture sector include:

Hoarding tarps are expected to occupy a 34.9% share of the tarpaulin sheet industry. Its demand is increasing for the development of temporary enclosures on smaller construction sites.

This demand is driven by the shortage of space caused by rising urbanization. Hoarding tarps are also used to safeguard construction sites from any impairment caused by adverse weather events. As climate change results in more weather conditions like typhoons and hurricanes, the prospects for tarpaulin sheets remain positive.

| Leading Product Type | Hoarding Tarps |

|---|---|

| Industry Share % (2025) | 34.9% |

Key players are also improving the durability and performance of hoarding tarps for improved functionality, thus boosting its adoption among end users. Another factor that is propelling the use of hoarding tarps is the implementation of strict government regulations related to noise and air pollution. This is because it helps lower noise pollution and stops pollutants like dust from fleeing into the environment.

Key providers of tarpaulin sheet in South Korea are focusing on extending their distribution channels by way of partnering with distributors and opening new branches to reach more customers in Korea.

Apart from this, key players are concentrating on delivering outstanding customer service. This includes assisting customers, offering technical support, and providing extensive options for payment and delivery.

Growing concern over sustainability propels key players to use recycled materials in their products and develop new products offering more sustainability quotient. Additionally, key players can be seen investing in building brand image to develop a strong identity and a means to differentiate from the crowd. In tandem with this, providers are turning to eCommerce to increase their reach among target customers.

Profiling of Leading Companies Offering Tarpaulin Sheets in Korea

| Leading Companies | Details |

|---|---|

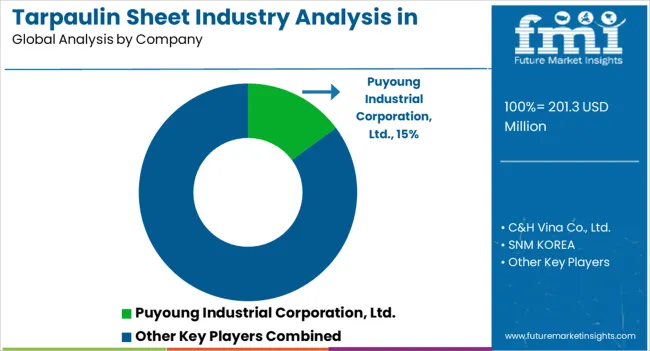

| Puyoung Industrial Corporation, Ltd. | A South Korean firm that develops and sells tarpaulin sheets and other industrial products. The company manufactures an extensive range of tarpaulin sheets, such as PVC tarpaulin sheets, PE tarpaulin sheets, and canvas tarpaulin sheets. These sheets are in high demand in the agriculture, construction, and manufacturing industries. |

| C&H Vina Co., Ltd. | It is a division of C&H Group (Korean), which had entered the P.E tarpaulin industry way back in 2004. The company develops a range of tarpaulin sheets to cater to different industries. |

| SNM KOREA | The firm originated in 1998 and its headquarters is in Seoul, South Korea. The company manufactures tarpaulin sheets as per the specifications of different industries. |

| DongAh Tarpaulin Co., Ltd. | The company is headquartered in Seoul, South Korea. It develops high-quality tarpaulin sheets at competitive pricing. Along with this, the company maintains strong customer service. Further, the company plans to extend in domestic as well as international markets. |

| Attribute | Details |

|---|---|

| Estimated Industry Size in 2025 | USD 201.3 million |

| Projected Industry Size in 2035 | USD 300.9 million |

| Anticipated CAGR between 2025 to 2035 | 4.1% CAGR |

| Historical Analysis of Demand for Tarpaulin Sheet in Korea | 2020 to 2025 |

| Demand Forecast for Tarpaulin Sheet in Korea | 2025 to 2035 |

| Report Coverage | Industry Size, Industry Trends, Analysis of Key Factors Influencing Tarpaulin Sheet Adoption in Korea, Insights on Korea Industry Players and their Industry Strategy in Korea, Ecosystem Analysis of Local and Regional Korea Providers |

| Key Cities Profiled | South Gyeongsang, North Jeolla, South Jeolla, Jeju |

| Key Companies Profiled | Puyoung Industrial Corporation, Ltd.; C&H Vina Co., Ltd.; SNM KOREA; DongAh Tarpaulin Co., Ltd.; Samhwa Tarpaulin Co., Ltd.; Daesung Tarpaulin Co., Ltd.; Sungwon Tarpaulin Co., Ltd.; Ilsung Tarpaulin Co., Ltd.; Woojin Tarpaulin Co., Ltd.; Hanil Tarpaulin Co., Ltd.; Jeil Tarpaulin Co., Ltd.; Sejong Tarpaulin Co., Ltd.; Ssangyong Tarpaulin Co., Ltd.; Namyang Tarpaulin Co., Ltd.; Shinhan Tarpaulin Co., Ltd.; Others |

The global tarpaulin sheet industry analysis in korea is estimated to be valued at USD 201.3 million in 2025.

The market size for the tarpaulin sheet industry analysis in korea is projected to reach USD 300.9 million by 2035.

The tarpaulin sheet industry analysis in korea is expected to grow at a 4.1% CAGR between 2025 and 2035.

The key product types in tarpaulin sheet industry analysis in korea are insulated tarps, hoarding tarps, truck tarps, uv protected tarps, sports tarps, mesh tarps and others.

In terms of material, polyethylene (pe) segment to command 36.8% share in the tarpaulin sheet industry analysis in korea in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Tarpaulin Sheets Market Size and Share Forecast Outlook 2025 to 2035

Evaluating Tarpaulin Sheets Market Share & Provider Insights

Tarpaulin Sheet Industry Analysis in Western Europe Size and Share Forecast Outlook 2025 to 2035

Tarpaulin Sheet Industry Analysis in Japan Size and Share Forecast Outlook 2025 to 2035

Mesh Tarpaulin Sheets Market Size and Share Forecast Outlook 2025 to 2035

Hoarding tarpaulin Market

UV Protected Tarpaulin Sheets Market Size and Share Forecast Outlook 2025 to 2035

Asia Pacific and Europe Tarpaulin Sheets Market Size and Share Forecast Outlook 2025 to 2035

Sheeted Labels Market Size and Share Forecast Outlook 2025 to 2035

Sheet Metal Market Size, Growth, and Forecast 2025 to 2035

Sheet Pan Racks Market

Slip Sheets Market Insights – Growth & Demand 2025 to 2035

Dryer Sheets Market Size and Share Forecast Outlook 2025 to 2035

Metal Sheet Bending Machine Market Size, Growth, and Forecast 2025 to 2035

Veneer Sheets Market Size and Share Forecast Outlook 2025 to 2035

Mirror Sheets Market Size and Share Forecast Outlook 2025 to 2035

Balance Sheet Management Software Market Size and Share Forecast Outlook 2025 to 2035

Bonding Sheet Market Forecast and Outlook 2025 to 2035

Aluminum Sheets and Coils Market Size and Share Forecast Outlook 2025 to 2035

Baby Crib Sheet Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA