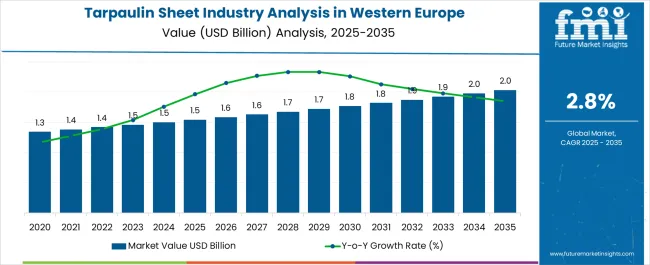

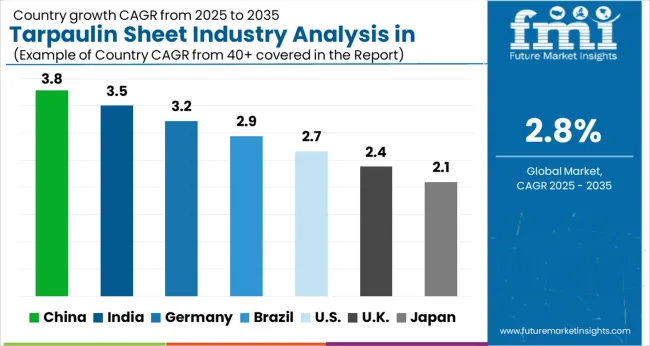

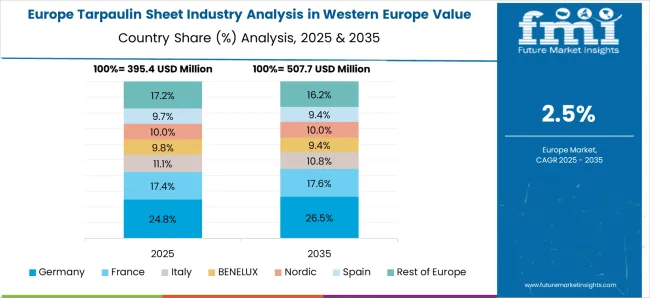

The Tarpaulin Sheet Industry Analysis in Western Europe is estimated to be valued at USD 1.5 billion in 2025 and is projected to reach USD 2.0 billion by 2035, registering a compound annual growth rate (CAGR) of 2.8% over the forecast period.

| Metric | Value |

|---|---|

| Tarpaulin Sheet Industry Analysis in Western Europe Estimated Value in (2025 E) | USD 1.5 billion |

| Tarpaulin Sheet Industry Analysis in Western Europe Forecast Value in (2035 F) | USD 2.0 billion |

| Forecast CAGR (2025 to 2035) | 2.8% |

The tarpaulin sheet industry in Western Europe is expanding steadily due to increasing applications across transportation, construction, agriculture, and industrial storage. Market growth is being supported by durable material innovations, enhanced weather resistance, and rising demand for cost-effective protective coverings. Current dynamics are defined by a strong presence of polyethylene and polyvinyl chloride-based tarpaulins, while environmental regulations are encouraging a shift toward recyclable and sustainable options.

Demand from logistics and supply chain activities remains resilient, with heightened requirements for waterproof and UV-resistant sheets in outdoor applications. Price competitiveness and product versatility are reinforcing adoption across multiple industries.

The future outlook is shaped by growth in infrastructure projects, modernization of transport fleets, and the expansion of agricultural storage systems Growth rationale is built on the segment’s adaptability to evolving end-user requirements, technological enhancements in coating and lamination processes, and the presence of a mature distribution network across Western Europe, all of which are expected to ensure sustained market penetration and revenue stability.

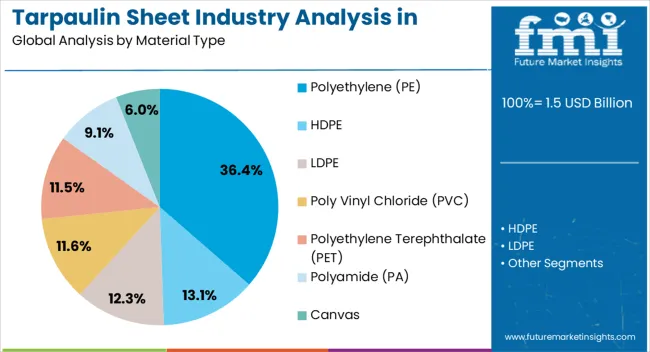

Polyethylene (PE), holding 36.4% of the material type category, has emerged as the leading choice due to its superior durability, lightweight profile, and cost-effectiveness. Its high resistance to moisture and environmental stress has strengthened its use in outdoor applications. Widespread adoption in transportation, agriculture, and temporary shelter construction has reinforced market leadership.

PE-based tarpaulins are favored for their recyclability, aligning with stringent European environmental regulations. Manufacturers have been investing in improved lamination and UV-stabilization techniques to enhance product lifespan.

Supply chain stability and strong availability across regional distributors have ensured consistent accessibility Future growth is expected to be supported by the expansion of eco-friendly variants and innovation in bio-based polymers, ensuring that polyethylene maintains its dominance in the material type segment.

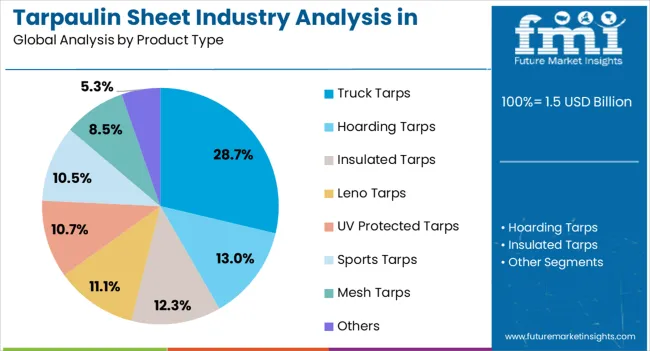

Truck tarps, accounting for 28.7% of the product type category, have maintained leadership due to their essential role in the logistics and transportation sector. Their widespread use in securing and protecting cargo across long distances has reinforced demand. Enhanced features such as reinforced stitching, heat sealing, and high tensile strength have increased product longevity.

Rising freight movement across Western Europe and growth in cross-border trade have contributed to stable adoption levels. Manufacturers are offering customized truck tarps with varying dimensions and coatings to meet industry-specific requirements.

Integration of lightweight yet strong materials has further optimized efficiency for fleet operators The segment’s dominance is expected to be sustained as logistics networks continue to expand and transport safety regulations strengthen, ensuring consistent growth.

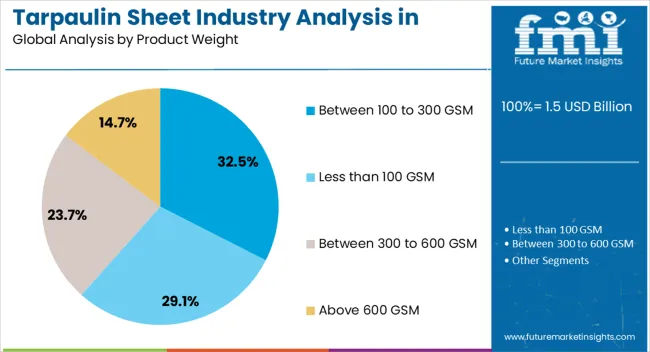

Tarpaulins with a weight range between 100 to 300 GSM, representing 32.5% of the product weight category, are leading the market due to their versatility and balance of strength with ease of handling. These sheets are widely used across agriculture, construction, and consumer applications where moderate durability and flexibility are essential. The segment has benefited from cost-efficiency, making it attractive for bulk purchases by industries and individual consumers.

Enhanced coating technologies have increased tear resistance and extended service life. Supply availability through both retail and industrial distribution channels has improved adoption.

Growth has also been supported by rising demand for portable and easy-to-install solutions across outdoor and temporary setups This weight category is expected to remain dominant as users continue to prioritize affordable, durable, and multi-purpose tarpaulin options within Western Europe.

The table below demonstrates the anticipated demand for tarpaulin sheet in Western Europe, with an eye on theFrance, United Kingdom, the Netherlands, Italy, and Germany. Based on quantitative and qualitative analysis, the United Kingdom has a lucrative opportunity with strong tarpaulin sheet producers.

Due to their adaptability and variety of uses, the hoarding tarps segment dominates the industry for tarpaulin sheet in Western Europe. Hoarding tarps are a popular choice across various industries, providing coverage and protection in event management, construction, and advertising due to their adaptability.

| Product Type | Hoarding Tarps |

|---|---|

| Share | 35.8% |

Hoarding tarps is the industry leader due to their versatility in diverse industries, as well as their strength and affordability. Hoarding tarps are a top alternative for tarpaulin sheet manufacturers looking for durable tarpaulin solutions due to their extensive usage and capacity to satisfy various purposes.

Agriculture dominates the demand for tarpaulin sheets because of their extensive use in protecting crops and equipment. The long-lasting tarpaulin sheets protect agricultural produce from bad weather, preserving its quality.

| End Use | Agriculture |

|---|---|

| Share | 27.1% |

The agriculture sector is the leading end use segment shareholder due to its high reliance on tarpaulin sheets for various uses such as crop protection, hay storage, and equipment cover. With the ongoing demand for agricultural preservation and expansion, tarpaulin sheets are essential, ensuring their industry supremacy.

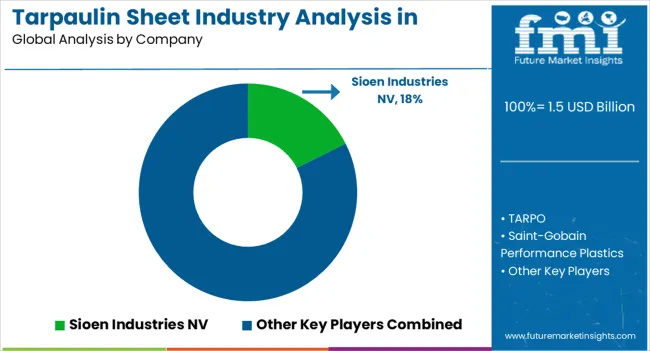

Intense competition between several key manufacturers dominates the tarpaulin sheet in Western Europe. The leading tarpaulin sheet businesses prioritize innovation, quality, and sustainability to keep their competitive edge.

Local tarpaulin sheet producers and small-scale competitors influence the diversity in Western Europe. Tarpaulin sheet demand is rising, increasing competition and propelling product development across various industries.

Key Companies Observed in Tarpaulin Sheet in Western Europe

| Company Name | Details |

|---|---|

| Sioen Industries NV | Tarpaulin sheets are one of the several technical textiles produced by Sioen Industries, a firm headquartered in Belgium. They are well-known for their high-quality items and have a significant presence in Western Europe. |

| TARPO | TARPO is a well-known producer of tarpaulin sheets and other industrial textiles. They offer a range of goods for various purposes and are well-established in Western Europe. |

| Saint-Gobain Performance Plastics | Western Europe is home to the international corporation Saint-Gobain Performance Plastics. They provide creative answers for many industries, including tarpaulin sheets used in construction and other industrial settings. |

| Sattler AG | The Sattler AG brand is well-known for its superior tarpaulin products. They are well-established in Western Europe and offer tarpaulin solutions for various uses, such as transportation and agriculture. |

| Attribute | Details |

|---|---|

| Estimated Valuation (2025) | USD 1.5 billion |

| Projected Valuation (2035) | USD 2.0 billion |

| Anticipated CAGR (2025 to 2035) | 2.8% |

| Historical Analysis of Tarpaulin Sheet in Western Europe | 2020 to 2025 |

| Demand Forecast for Tarpaulin Sheet in Western Europe | 2025 to 2035 |

| Quantitative Units | Revenue in USD million and CAGR from 2025 to 2035 |

| Report Coverage | Revenue Forecast, Company Ranking, Competitive Landscape, Growth Factors, Trends and Pricing Analysis |

| Key Countries Analyzed while Studying Opportunities in Western Europe | United Kingdom, Italy, France, Spain, Germany |

| Key Companies Profiled for Tarpaulin Sheet in Western Europe | Sioen Industries NV; TARPO; Saint-Gobain Performance Plastics; Sattler AG; Valmex (Mehler Texnologies); Low and Bonar (Now part of Freudenberg Group); Röder Zelt GmbH; Tarpaflex; Italian Technical Fabrics Srl; Döcke Extrusion GmbH and Co. KG |

The global tarpaulin sheet industry analysis in western europe is estimated to be valued at USD 1.5 billion in 2025.

The market size for the tarpaulin sheet industry analysis in western europe is projected to reach USD 2.0 billion by 2035.

The tarpaulin sheet industry analysis in western europe is expected to grow at a 2.8% CAGR between 2025 and 2035.

The key product types in tarpaulin sheet industry analysis in western europe are polyethylene (pe), hdpe, ldpe, poly vinyl chloride (PVc), polyethylene terephthalate (pet), polyamide (pa) and canvas.

In terms of product type, truck tarps segment to command 28.7% share in the tarpaulin sheet industry analysis in western europe in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Tarpaulin Sheets Market Size and Share Forecast Outlook 2025 to 2035

Evaluating Tarpaulin Sheets Market Share & Provider Insights

Tarpaulin Sheet Industry Analysis in Korea Size and Share Forecast Outlook 2025 to 2035

Tarpaulin Sheet Industry Analysis in Japan Size and Share Forecast Outlook 2025 to 2035

Mesh Tarpaulin Sheets Market Size and Share Forecast Outlook 2025 to 2035

Hoarding tarpaulin Market

UV Protected Tarpaulin Sheets Market Size and Share Forecast Outlook 2025 to 2035

Asia Pacific and Europe Tarpaulin Sheets Market Size and Share Forecast Outlook 2025 to 2035

Sheeted Labels Market Size and Share Forecast Outlook 2025 to 2035

Sheet Metal Market Size, Growth, and Forecast 2025 to 2035

Sheet Pan Racks Market

Slip Sheets Market Insights – Growth & Demand 2025 to 2035

Dryer Sheets Market Size and Share Forecast Outlook 2025 to 2035

Metal Sheet Bending Machine Market Size, Growth, and Forecast 2025 to 2035

Veneer Sheets Market Size and Share Forecast Outlook 2025 to 2035

Mirror Sheets Market Size and Share Forecast Outlook 2025 to 2035

Balance Sheet Management Software Market Size and Share Forecast Outlook 2025 to 2035

Bonding Sheet Market Forecast and Outlook 2025 to 2035

Aluminum Sheets and Coils Market Size and Share Forecast Outlook 2025 to 2035

Baby Crib Sheet Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA