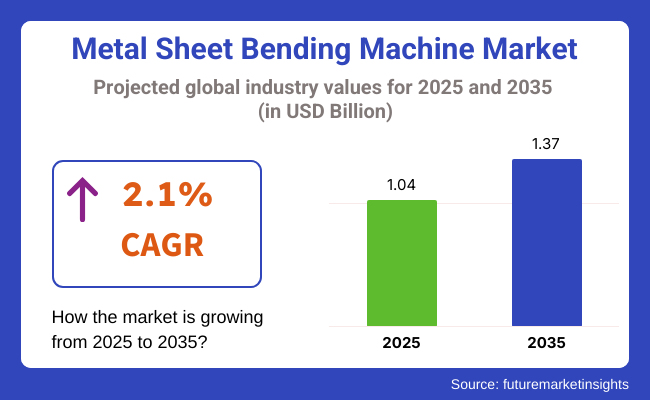

The metal sheet bending machine market is valued at USD 1.04 billion in 2025 and is expected to reach USD 1.37 billion by 2035, expanding at a 2.1% CAGR over the forecast period. In 2025, Asia Pacific dominates the market, accounting for more than 40% of global revenues, as manufacturers in China and India invest heavily in automated bending solutions.

China is poised to register the fastest national growth from 2025 to 2035, with an anticipated CAGR of 3.0%, supported by extensive infrastructure development and automotive production.

Growth in the metal sheet bending machine market is driven by the rapid adoption of CNC-controlled and fully automatic machines that enhance operational precision and minimize material waste across end-use industries. The convergence of Industry 4.0 technologies-such as robotic bending cells, IoT-enabled predictive maintenance, and digital process controls-is enabling more efficient production workflows.

However, high upfront capital expenditure and a shortage of trained operators continue to restrain small and mid-sized enterprises. Key trends shaping the market include the emergence of leasing and subscription models to lower entry barriers, the development of energy-efficient hydraulic systems, and the expansion of aftermarket service networks to maximize machine uptime.

Looking ahead to 2035, the metal sheet bending machine market will accelerate its shift toward smart factory integration, featuring real-time performance monitoring, adaptive control systems, and AI-driven process optimization. Regional production hubs in Southeast Asia are expected to expand as manufacturers diversify supply chains away from China.

Regulatory emphasis on energy efficiency and workplace safety will drive demand for CE- and ISO-certified machines. Moreover, flexible financing and subscription-based ownership models are anticipated to make advanced bending technologies accessible to a broader range of end users, sustaining long-term market growth.

The market is segmented by Product Type (Manual; Semi-Automatic; Automatic; Hydraulic) and by Application (Automobiles; Electronics; Consumer Goods; Machine Manufacturing; Metal Fabrication; Others).

Automatic bending machines-especially CNC-controlled, robotic-assisted systems-are poised for the highest growth as they deliver superior precision, repeatability, and throughput. Semi-automatic machines will retain appeal for mid-sized workshops balancing cost and control, while manual machines serve simple, low-volume needs. Hydraulic bending machines, valued for high tonnage capacity, will grow steadily in heavy-duty sectors but at a more moderate pace.

The automotive sector leads investment in advanced bending technologies as OEMs push lightweight electric-vehicle bodies and complex structural components. Electronics and consumer goods applications will grow steadily, driven by the need for compact, precision-formed parts. Machine manufacturing and metal fabrication will continue to adopt automated bending for improved efficiency and reduced labor dependency.

Surveyed Q4 2024, n=500 stakeholder participants evenly distributed across manufacturers, distributors, and end-users in North America, Europe, and Asia-Pacific

Key Market Drivers & Challenges

Adoption of Smart & Automated Bending Machines

Material Preferences & Cost Sensitivities

Supply Chain & Production Bottlenecks

Future Investment & Market Outlook

Regulatory Landscape & Compliance Challenges

Conclusion: Regional Adaptation & Market Differentiation

| Country/Region | Regulations & Policies Impacting the Industry |

|---|---|

| United States |

|

| European Union |

|

| Germany |

|

| France |

|

| United Kingdom |

|

| China |

|

| Japan |

|

| South Korea |

|

| India |

|

The USA metal sheet bending machine industry is expected to grow at a 2.5% CAGR between 2025 and 2035. The growth of the sector is driven by the increasing use of CNC and automated bending machines, with industries like aerospace, automotive, and construction requiring greater precision and efficiency.

The Buy American Act is also likely to help local manufacturers by minimizing reliance on imports. While, OSHA standards and ANSI B11.3 requirements demand rigorous safety adherence, increasing demand for machines equipped with superior safety features.

Increased labour costs and lack of skilled personnel are fuelling investments in robotic bending technologies and AI-based predictive maintenance. The demand for energy-efficient and sustainable equipment, driven by EPA regulations, is also influencing machine development.

FMI opines that the United States metal sheet bending machine sales will grow at nearly 2.5% CAGR through 2025 to 2035.

The industry for metal sheet bending machines in the UK is anticipated to have a 1.8% CAGR during the period from 2025 to 2035. The UK's manufacturing industry, particularly automotive, shipbuilding, and renewable energy is driving demand for energy-efficient and high-precision bending machines. Post-Brexit UKCA marking compliance has taken over from the EU's CE certification, prompting manufacturers to conform to separate domestic compliance regulations.

The HSE (Health and Safety Executive) regulations also focus on workplace safety, boosting the use of guarded and automatic machines. Economic volatility and changing material prices are, however, industry challenges. The UK's increasing emphasis on carbon neutrality and green production is fueling demand for hybrid and electric-driven bending machines.

FMI opines that the United Kingdom metal sheet bending machine sales will grow at nearly 1.8% CAGR through 2025 to 2035.

France is also expected to register a 2.0% CAGR in the industry for metal sheet bending machines between 2025 and 2035. The nation's industry is driven by high demand from the aerospace, rail, and renewable energy sectors. More stringent environmental regulations, like the French Energy Transition Law, are stimulating producers to embrace low-emission, energy-efficient equipment.

The INRS safety recommendations impose high standards of safety, resulting in greater demand for automated press brakes with safety sensors. Though demand for CNC-driven machines is increasing, high labour expenses and inflationary trends are likely to impede investment in new equipment.

FMI opines that France's metal sheet bending machine sales will grow at nearly 2.0% CAGR through 2025 to 2035.

Germany's metal sheet bending machine industry is forecast to grow at a 2.3% CAGR between 2025 and 2035, consistent with its dominant role as Europe's manufacturing powerhouse. The nation's automotive and industrial machinery industries are key growth drivers, with the former investing heavily in precision metal forming solutions. Strict compliance with the EU Machinery Directive and DIN safety standards fuels a trend toward sophisticated CNC and robotic bending machines.

Germany is also at the forefront of Industry 4.0 and intelligent manufacturing, with 68% of manufacturers spending money on automated bending technology. The Energy Efficiency Law (EnEfG) is encouraging companies to adopt sustainable, energy-efficient machine designs. However, growing labour costs and supply chain strain from overseas could affect production and result in less rapid take-up of new machines.

FMI opines that Germany's metal sheet bending machine sales will grow at nearly 2.3% CAGR through 2025 to 2035.

Italy's metal sheet bending machine industry is projected to expand at a 1.9% CAGR between 2025 and 2035, which is in line with the world average. Italy boasts a solid foundation of metalworking machinery manufacturers in the automotive, furniture, and industrial equipment sectors. Italy continues to be a centre for high-precision bending machines, and export demand from North America and Europe continues to drive production.

The EU Machinery Directive and CE certification requirements shape the design and safety features of domestically produced machines. Increasing energy prices and fluctuating raw material prices are, however, a challenge for machine manufacturers. Italian government initiatives in Industry 4.0, which provide incentives for tax breaks in the form of adopting automated and smart manufacturing technologies, are likely to stimulate efforts at modernization.

FMI opines that Italy's metal sheet bending machine sales will grow at nearly 1.9% CAGR through 2025 to 2035.

South Korea will experience a 2.4% CAGR in the metal sheet bending machine industry from 2025 to 2035. The automotive, shipbuilding, and electronics sectors in the country are major demand drivers for precision, compact bending machines. The KC certification system imposes stringent safety and quality regulations on imported as well as locally manufactured industrial machinery.

Government programs under South Korea's Green New Deal are promoting the use of energy-efficient and automated manufacturing systems. The nation is also experiencing a growing uptake of IoT-capable machines for production monitoring in real time.

Yet, cost-consciousness among small and mid-sized businesses (SMEs) could impede premium machine adoption. With ongoing investments in intelligent factories and industrial automation, South Korea is still a viable industry for high-tech, AI-fitted bending machines.

FMI opines that the South Korea metal sheet bending machine sales will grow at nearly 2.4% CAGR through 2025 to 2035.

The metal sheet bending machine industry in Japan is anticipated to grow at a 1.6% CAGR over the period between 2025 and 2035. The demand in the nation is driven by high-precision space-saving bending machines in the auto, robotics, and electronics industries.

Despite that, excessive automation expense and over-specification of plant equipment remain significant concerns for SMEs. The METI Machinery Safety Act and Japanese Industrial Standards (JIS) regulate the manufacturing and importing of bending machines, with rigorous safety compliance.

Although Japan has been hesitant to embrace IoT-enabled and AI-powered machines, increasing investments in predictive maintenance technologies are likely to drive industry growth. Moreover, government policies favouring energy efficiency and compact industrial designs will influence machine innovations in the future.

FMI opines that Japan's metal sheet bending machine sales will grow at nearly 1.6% CAGR through 2025 to 2035.

China's metal sheet bending machine industry is expected to expand at a 3.0% CAGR between 2025 and 2035, the fastest among major global industries. Rapid industrialization, infrastructure growth, and export-led manufacturing in the country are the major drivers of growth.

The Made in China 2025 policy promotes local production of high-tech bending machines, minimizing imports. The CCC certification is a must for industrial equipment, and compliance with safety and quality requirements is ensured. Increased labour costs and stricter environmental laws are leading to investments in automated and energy-efficient technologies by manufacturers.

FMI opines that China metal sheet bending machine sales will grow at nearly 3.0% CAGR through 2025 to 2035.

The Australia-New Zealand industry is forecast to expand at a 1.7% CAGR from 2025 through 2035, lower than the worldwide average. The industry is fueled by usage from construction, mining, and renewable power industries.

Import dependence is high, and logistical constraints affect machine availability and price. AS/NZS safety standards govern bending machine safety, while government incentives for green manufacturing and automation are encouraging the uptake of modern machines.

FMI opines that Australia-NZ metal sheet bending machine sales will grow at nearly 1.7% CAGR through 2025 to 2035.

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| Industry Growth: Moderate expansion with fluctuations due to supply chain disruptions and economic downturns post-COVID-19. Demand was driven by infrastructure projects and industrial recovery. | Industry Growth: Slower but steady growth with a focus on automation, sustainability, and material efficiency. The adoption of smart technologies will drive investments. |

| Technology Adoption: Gradual shift toward automation, with many industries still relying on manual and semi-automatic machines. | Technology Adoption: Widespread adoption of CNC and IoT-enabled bending machines, driven by Industry 4.0 and real-time production monitoring. |

| Regulatory Impact: Compliance with existing safety and environmental standards, but limited enforcement in some regions. | Regulatory Impact: Stricter regulations on energy efficiency, worker safety, and emissions, push manufacturers toward sustainable production. |

| Material Preferences: Predominantly stainless steel, with limited interest in composite or hybrid materials. | Material Preferences: Increased use of lightweight alloys, hybrid materials, and sustainable composites, particularly in Europe. |

| Regional Performance: Strong demand in North America, Europe, and China, with slow recovery in Japan and South Korea. | Regional Performance: Asia-Pacific to dominate growth, with Europe leading in sustainability-driven innovations. |

| End-User Demand: Driven by automotive, construction, and industrial machinery sectors. | End-User Demand: EV manufacturing, aerospace, and electronics will drive demand for high-precision bending machines. |

| Supply Chain Challenges: Global supply chain disruptions due to COVID-19, raw material price volatility, and logistics bottlenecks. | Supply Chain Challenges: More localized production, vertical integration, and supply chain digitalization to reduce dependency on external suppliers. |

| Investment Trends: Capital spending on automation was limited, with a focus on recovery and cost-cutting measures. | Investment Trends: Increased investments in automation, predictive maintenance, and smart bending technologies to enhance efficiency. |

The metal sheet bending machine industry comes under the industrial manufacturing equipment and machinery segment, which is directly associated with world industrial production, infrastructure growth, and construction. It depends on macroeconomic forces including GDP growth, manufacturing capital spending, trade policy, and industrial automation trends.

From 2025 to 2035, this industry will develop under a larger transformation towards smart manufacturing, sustainability, and local production. Developing economies' economic growth will propel infrastructure development, stimulating demand for heavy-duty bending machines.

Developed industries will focus on automation and energy-saving solutions, in response to labour shortages and tightening environmental legislation. Growth in electric vehicles (EVs), renewable energy initiatives, and precision engineering will lead to sustained demand for high-precision metal bending.

However, trade tensions, raw material price fluctuations, and supply chain interruptions will continue to pose challenges. State and federal incentives for advanced manufacturing and Industry 4.0 implementation will drive the move towards CNC and IoT-enabled bending machines.

Manufacturers should to the consumer's demand for precision and efficiency in bending. They should prioritise automated and CNC-enabled bending machines a priority, especially for EV manufacturing, aerospace, and high-tech industries. Investing in products with IoT-enabled predictive maintenance initiatives can establish a competitive advantage and improve downtime for the end-user.

The USA and China will drive demand for high-capacity hydraulic machines due to large-scale infrastructure and industrial development. Leasing and subscription models can be developed to lock in cost-conscious buyers, especially in Asia. Lightweight alloys and hybrid materials should also be considered to achieve sustainability goals.

Major Industry leaders in the metal sheet bending machine industry are competing based on price, innovation, strategic alliances, and expansion. While some emphasize cost-effective solutions to appeal to price-conscious customers, others are investing in high-precision, automated solutions to address high-end segments.

Businesses are using new technologies such as AI, IoT, and CNC automation to improve efficiency and reduce downtime. Greenfield innovations like energy-efficient bending systems are becoming popular, particularly in Europe.

Growth programs are focused on product differentiation, expansion in industries, and M&A programs. Industry participants are creating localized service and production centres in high-growth regions like Asia-Pacific in order to reduce supply chain risks.

Some are also venturing into strategic alliances with software firms in order to integrate smart manufacturing solutions. Leasing schemes and flexible financing options are also being made available to draw new manufacturers.

Automation, precision manufacturing, sustainability, and growth in industries like automotive, aerospace, and construction are major factors.

IoT, AI, and CNC automation are enhancing efficiency, reducing waste, and enabling predictive maintenance for minimal downtime.

Automotive (EV production), aerospace, electronics, and metal fabrication industries are leading investments in high-precision and automated solutions.

Raw material costs, regulatory compliance, supply chain disruptions, and adapting to smart manufacturing trends are key challenges.

They focus on automation, regional expansion, sustainability, and flexible pricing models like leasing and financing options.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2019 to 2034

Table 2: Global Market Volume (Units) Forecast by Region, 2019 to 2034

Table 3: Global Market Value (US$ Million) Forecast by Type, 2019 to 2034

Table 4: Global Market Volume (Units) Forecast by Type, 2019 to 2034

Table 5: Global Market Value (US$ Million) Forecast by Application, 2019 to 2034

Table 6: Global Market Volume (Units) Forecast by Application, 2019 to 2034

Table 7: North America Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 8: North America Market Volume (Units) Forecast by Country, 2019 to 2034

Table 9: North America Market Value (US$ Million) Forecast by Type, 2019 to 2034

Table 10: North America Market Volume (Units) Forecast by Type, 2019 to 2034

Table 11: North America Market Value (US$ Million) Forecast by Application, 2019 to 2034

Table 12: North America Market Volume (Units) Forecast by Application, 2019 to 2034

Table 13: Latin America Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 14: Latin America Market Volume (Units) Forecast by Country, 2019 to 2034

Table 15: Latin America Market Value (US$ Million) Forecast by Type, 2019 to 2034

Table 16: Latin America Market Volume (Units) Forecast by Type, 2019 to 2034

Table 17: Latin America Market Value (US$ Million) Forecast by Application, 2019 to 2034

Table 18: Latin America Market Volume (Units) Forecast by Application, 2019 to 2034

Table 19: Western Europe Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 20: Western Europe Market Volume (Units) Forecast by Country, 2019 to 2034

Table 21: Western Europe Market Value (US$ Million) Forecast by Type, 2019 to 2034

Table 22: Western Europe Market Volume (Units) Forecast by Type, 2019 to 2034

Table 23: Western Europe Market Value (US$ Million) Forecast by Application, 2019 to 2034

Table 24: Western Europe Market Volume (Units) Forecast by Application, 2019 to 2034

Table 25: Eastern Europe Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 26: Eastern Europe Market Volume (Units) Forecast by Country, 2019 to 2034

Table 27: Eastern Europe Market Value (US$ Million) Forecast by Type, 2019 to 2034

Table 28: Eastern Europe Market Volume (Units) Forecast by Type, 2019 to 2034

Table 29: Eastern Europe Market Value (US$ Million) Forecast by Application, 2019 to 2034

Table 30: Eastern Europe Market Volume (Units) Forecast by Application, 2019 to 2034

Table 31: South Asia and Pacific Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 32: South Asia and Pacific Market Volume (Units) Forecast by Country, 2019 to 2034

Table 33: South Asia and Pacific Market Value (US$ Million) Forecast by Type, 2019 to 2034

Table 34: South Asia and Pacific Market Volume (Units) Forecast by Type, 2019 to 2034

Table 35: South Asia and Pacific Market Value (US$ Million) Forecast by Application, 2019 to 2034

Table 36: South Asia and Pacific Market Volume (Units) Forecast by Application, 2019 to 2034

Table 37: East Asia Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 38: East Asia Market Volume (Units) Forecast by Country, 2019 to 2034

Table 39: East Asia Market Value (US$ Million) Forecast by Type, 2019 to 2034

Table 40: East Asia Market Volume (Units) Forecast by Type, 2019 to 2034

Table 41: East Asia Market Value (US$ Million) Forecast by Application, 2019 to 2034

Table 42: East Asia Market Volume (Units) Forecast by Application, 2019 to 2034

Table 43: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 44: Middle East and Africa Market Volume (Units) Forecast by Country, 2019 to 2034

Table 45: Middle East and Africa Market Value (US$ Million) Forecast by Type, 2019 to 2034

Table 46: Middle East and Africa Market Volume (Units) Forecast by Type, 2019 to 2034

Table 47: Middle East and Africa Market Value (US$ Million) Forecast by Application, 2019 to 2034

Table 48: Middle East and Africa Market Volume (Units) Forecast by Application, 2019 to 2034

Figure 1: Global Market Value (US$ Million) by Type, 2024 to 2034

Figure 2: Global Market Value (US$ Million) by Application, 2024 to 2034

Figure 3: Global Market Value (US$ Million) by Region, 2024 to 2034

Figure 4: Global Market Value (US$ Million) Analysis by Region, 2019 to 2034

Figure 5: Global Market Volume (Units) Analysis by Region, 2019 to 2034

Figure 6: Global Market Value Share (%) and BPS Analysis by Region, 2024 to 2034

Figure 7: Global Market Y-o-Y Growth (%) Projections by Region, 2024 to 2034

Figure 8: Global Market Value (US$ Million) Analysis by Type, 2019 to 2034

Figure 9: Global Market Volume (Units) Analysis by Type, 2019 to 2034

Figure 10: Global Market Value Share (%) and BPS Analysis by Type, 2024 to 2034

Figure 11: Global Market Y-o-Y Growth (%) Projections by Type, 2024 to 2034

Figure 12: Global Market Value (US$ Million) Analysis by Application, 2019 to 2034

Figure 13: Global Market Volume (Units) Analysis by Application, 2019 to 2034

Figure 14: Global Market Value Share (%) and BPS Analysis by Application, 2024 to 2034

Figure 15: Global Market Y-o-Y Growth (%) Projections by Application, 2024 to 2034

Figure 16: Global Market Attractiveness by Type, 2024 to 2034

Figure 17: Global Market Attractiveness by Application, 2024 to 2034

Figure 18: Global Market Attractiveness by Region, 2024 to 2034

Figure 19: North America Market Value (US$ Million) by Type, 2024 to 2034

Figure 20: North America Market Value (US$ Million) by Application, 2024 to 2034

Figure 21: North America Market Value (US$ Million) by Country, 2024 to 2034

Figure 22: North America Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 23: North America Market Volume (Units) Analysis by Country, 2019 to 2034

Figure 24: North America Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 25: North America Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 26: North America Market Value (US$ Million) Analysis by Type, 2019 to 2034

Figure 27: North America Market Volume (Units) Analysis by Type, 2019 to 2034

Figure 28: North America Market Value Share (%) and BPS Analysis by Type, 2024 to 2034

Figure 29: North America Market Y-o-Y Growth (%) Projections by Type, 2024 to 2034

Figure 30: North America Market Value (US$ Million) Analysis by Application, 2019 to 2034

Figure 31: North America Market Volume (Units) Analysis by Application, 2019 to 2034

Figure 32: North America Market Value Share (%) and BPS Analysis by Application, 2024 to 2034

Figure 33: North America Market Y-o-Y Growth (%) Projections by Application, 2024 to 2034

Figure 34: North America Market Attractiveness by Type, 2024 to 2034

Figure 35: North America Market Attractiveness by Application, 2024 to 2034

Figure 36: North America Market Attractiveness by Country, 2024 to 2034

Figure 37: Latin America Market Value (US$ Million) by Type, 2024 to 2034

Figure 38: Latin America Market Value (US$ Million) by Application, 2024 to 2034

Figure 39: Latin America Market Value (US$ Million) by Country, 2024 to 2034

Figure 40: Latin America Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 41: Latin America Market Volume (Units) Analysis by Country, 2019 to 2034

Figure 42: Latin America Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 43: Latin America Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 44: Latin America Market Value (US$ Million) Analysis by Type, 2019 to 2034

Figure 45: Latin America Market Volume (Units) Analysis by Type, 2019 to 2034

Figure 46: Latin America Market Value Share (%) and BPS Analysis by Type, 2024 to 2034

Figure 47: Latin America Market Y-o-Y Growth (%) Projections by Type, 2024 to 2034

Figure 48: Latin America Market Value (US$ Million) Analysis by Application, 2019 to 2034

Figure 49: Latin America Market Volume (Units) Analysis by Application, 2019 to 2034

Figure 50: Latin America Market Value Share (%) and BPS Analysis by Application, 2024 to 2034

Figure 51: Latin America Market Y-o-Y Growth (%) Projections by Application, 2024 to 2034

Figure 52: Latin America Market Attractiveness by Type, 2024 to 2034

Figure 53: Latin America Market Attractiveness by Application, 2024 to 2034

Figure 54: Latin America Market Attractiveness by Country, 2024 to 2034

Figure 55: Western Europe Market Value (US$ Million) by Type, 2024 to 2034

Figure 56: Western Europe Market Value (US$ Million) by Application, 2024 to 2034

Figure 57: Western Europe Market Value (US$ Million) by Country, 2024 to 2034

Figure 58: Western Europe Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 59: Western Europe Market Volume (Units) Analysis by Country, 2019 to 2034

Figure 60: Western Europe Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 61: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 62: Western Europe Market Value (US$ Million) Analysis by Type, 2019 to 2034

Figure 63: Western Europe Market Volume (Units) Analysis by Type, 2019 to 2034

Figure 64: Western Europe Market Value Share (%) and BPS Analysis by Type, 2024 to 2034

Figure 65: Western Europe Market Y-o-Y Growth (%) Projections by Type, 2024 to 2034

Figure 66: Western Europe Market Value (US$ Million) Analysis by Application, 2019 to 2034

Figure 67: Western Europe Market Volume (Units) Analysis by Application, 2019 to 2034

Figure 68: Western Europe Market Value Share (%) and BPS Analysis by Application, 2024 to 2034

Figure 69: Western Europe Market Y-o-Y Growth (%) Projections by Application, 2024 to 2034

Figure 70: Western Europe Market Attractiveness by Type, 2024 to 2034

Figure 71: Western Europe Market Attractiveness by Application, 2024 to 2034

Figure 72: Western Europe Market Attractiveness by Country, 2024 to 2034

Figure 73: Eastern Europe Market Value (US$ Million) by Type, 2024 to 2034

Figure 74: Eastern Europe Market Value (US$ Million) by Application, 2024 to 2034

Figure 75: Eastern Europe Market Value (US$ Million) by Country, 2024 to 2034

Figure 76: Eastern Europe Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 77: Eastern Europe Market Volume (Units) Analysis by Country, 2019 to 2034

Figure 78: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 79: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 80: Eastern Europe Market Value (US$ Million) Analysis by Type, 2019 to 2034

Figure 81: Eastern Europe Market Volume (Units) Analysis by Type, 2019 to 2034

Figure 82: Eastern Europe Market Value Share (%) and BPS Analysis by Type, 2024 to 2034

Figure 83: Eastern Europe Market Y-o-Y Growth (%) Projections by Type, 2024 to 2034

Figure 84: Eastern Europe Market Value (US$ Million) Analysis by Application, 2019 to 2034

Figure 85: Eastern Europe Market Volume (Units) Analysis by Application, 2019 to 2034

Figure 86: Eastern Europe Market Value Share (%) and BPS Analysis by Application, 2024 to 2034

Figure 87: Eastern Europe Market Y-o-Y Growth (%) Projections by Application, 2024 to 2034

Figure 88: Eastern Europe Market Attractiveness by Type, 2024 to 2034

Figure 89: Eastern Europe Market Attractiveness by Application, 2024 to 2034

Figure 90: Eastern Europe Market Attractiveness by Country, 2024 to 2034

Figure 91: South Asia and Pacific Market Value (US$ Million) by Type, 2024 to 2034

Figure 92: South Asia and Pacific Market Value (US$ Million) by Application, 2024 to 2034

Figure 93: South Asia and Pacific Market Value (US$ Million) by Country, 2024 to 2034

Figure 94: South Asia and Pacific Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 95: South Asia and Pacific Market Volume (Units) Analysis by Country, 2019 to 2034

Figure 96: South Asia and Pacific Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 97: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 98: South Asia and Pacific Market Value (US$ Million) Analysis by Type, 2019 to 2034

Figure 99: South Asia and Pacific Market Volume (Units) Analysis by Type, 2019 to 2034

Figure 100: South Asia and Pacific Market Value Share (%) and BPS Analysis by Type, 2024 to 2034

Figure 101: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Type, 2024 to 2034

Figure 102: South Asia and Pacific Market Value (US$ Million) Analysis by Application, 2019 to 2034

Figure 103: South Asia and Pacific Market Volume (Units) Analysis by Application, 2019 to 2034

Figure 104: South Asia and Pacific Market Value Share (%) and BPS Analysis by Application, 2024 to 2034

Figure 105: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Application, 2024 to 2034

Figure 106: South Asia and Pacific Market Attractiveness by Type, 2024 to 2034

Figure 107: South Asia and Pacific Market Attractiveness by Application, 2024 to 2034

Figure 108: South Asia and Pacific Market Attractiveness by Country, 2024 to 2034

Figure 109: East Asia Market Value (US$ Million) by Type, 2024 to 2034

Figure 110: East Asia Market Value (US$ Million) by Application, 2024 to 2034

Figure 111: East Asia Market Value (US$ Million) by Country, 2024 to 2034

Figure 112: East Asia Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 113: East Asia Market Volume (Units) Analysis by Country, 2019 to 2034

Figure 114: East Asia Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 115: East Asia Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 116: East Asia Market Value (US$ Million) Analysis by Type, 2019 to 2034

Figure 117: East Asia Market Volume (Units) Analysis by Type, 2019 to 2034

Figure 118: East Asia Market Value Share (%) and BPS Analysis by Type, 2024 to 2034

Figure 119: East Asia Market Y-o-Y Growth (%) Projections by Type, 2024 to 2034

Figure 120: East Asia Market Value (US$ Million) Analysis by Application, 2019 to 2034

Figure 121: East Asia Market Volume (Units) Analysis by Application, 2019 to 2034

Figure 122: East Asia Market Value Share (%) and BPS Analysis by Application, 2024 to 2034

Figure 123: East Asia Market Y-o-Y Growth (%) Projections by Application, 2024 to 2034

Figure 124: East Asia Market Attractiveness by Type, 2024 to 2034

Figure 125: East Asia Market Attractiveness by Application, 2024 to 2034

Figure 126: East Asia Market Attractiveness by Country, 2024 to 2034

Figure 127: Middle East and Africa Market Value (US$ Million) by Type, 2024 to 2034

Figure 128: Middle East and Africa Market Value (US$ Million) by Application, 2024 to 2034

Figure 129: Middle East and Africa Market Value (US$ Million) by Country, 2024 to 2034

Figure 130: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 131: Middle East and Africa Market Volume (Units) Analysis by Country, 2019 to 2034

Figure 132: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 133: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 134: Middle East and Africa Market Value (US$ Million) Analysis by Type, 2019 to 2034

Figure 135: Middle East and Africa Market Volume (Units) Analysis by Type, 2019 to 2034

Figure 136: Middle East and Africa Market Value Share (%) and BPS Analysis by Type, 2024 to 2034

Figure 137: Middle East and Africa Market Y-o-Y Growth (%) Projections by Type, 2024 to 2034

Figure 138: Middle East and Africa Market Value (US$ Million) Analysis by Application, 2019 to 2034

Figure 139: Middle East and Africa Market Volume (Units) Analysis by Application, 2019 to 2034

Figure 140: Middle East and Africa Market Value Share (%) and BPS Analysis by Application, 2024 to 2034

Figure 141: Middle East and Africa Market Y-o-Y Growth (%) Projections by Application, 2024 to 2034

Figure 142: Middle East and Africa Market Attractiveness by Type, 2024 to 2034

Figure 143: Middle East and Africa Market Attractiveness by Application, 2024 to 2034

Figure 144: Middle East and Africa Market Attractiveness by Country, 2024 to 2034

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Metal Straw Market Size and Share Forecast Outlook 2025 to 2035

Metal Can Market Size and Share Forecast Outlook 2025 to 2035

Metal IBC Market Forecast and Outlook 2025 to 2035

Metalized Barrier Film Market Forecast and Outlook 2025 to 2035

Metal Packaging Market Size and Share Forecast Outlook 2025 to 2035

Metal Bellow Market Size and Share Forecast Outlook 2025 to 2035

Metal based Safety Gratings Market Size and Share Forecast Outlook 2025 to 2035

Metal Modifiers Market Size and Share Forecast Outlook 2025 to 2035

Metallic Stearate Market Size and Share Forecast Outlook 2025 to 2035

Metallic Labels Market Size and Share Forecast Outlook 2025 to 2035

Metal Recycling Market Size and Share Forecast Outlook 2025 to 2035

Metal Forming Fluids Market Size and Share Forecast Outlook 2025 to 2035

Metal Removal Fluids Market Size and Share Forecast Outlook 2025 to 2035

Metal Deactivators Market Size and Share Forecast Outlook 2025 to 2035

Metal Film Analog Potentiometers Market Size and Share Forecast Outlook 2025 to 2035

Metal Oxide Film Fixed Resistor Market Size and Share Forecast Outlook 2025 to 2035

Metal Membrane Ammonia Cracker Market Size and Share Forecast Outlook 2025 to 2035

Metal Testing Equipment Market Size and Share Forecast Outlook 2025 to 2035

Metal Analyzers Market Size and Share Forecast Outlook 2025 to 2035

Metal Fiber Felt Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA